26.11.2020

Here you will find an application for the distribution of property tax deductions between the owners of an apartment (room, residential building, land plot). It is issued when several people (for example, husband and wife) purchase real estate as joint or shared ownership. Samples of other statements can be found at the following links:

- application for property deduction (when purchasing an apartment or other real estate);

- application for social benefits (training);

- application for social deduction (treatment).

How is the deduction distributed between spouses when purchasing a home in common shared ownership?

If, when purchasing a home, the spouses chose the “common shared ownership” form, then the shares are determined in advance and are indicated in the Certificate of Registration of Ownership (extract from the Unified State Register of Real Estate from July 15, 2016). Despite this, as of January 1, 2014, the property deduction of spouses is not tied to the share of property.

Spouses can distribute the tax benefit at their own discretion: either arbitrarily or depending on each person’s contribution to the payment of the apartment.

This is stated in the Letter of the Federal Tax Service of Russia dated March 30, 2021 No. BS-3-11/ [email protected] , Letter of the Ministry of Finance of Russia dated June 29, 2015 No. 03-04-05/37360, June 01, 2015 No. 03-04-05/31428 , March 10, 2015 No. 03-04-05/12335.

To receive a property deduction and determine the shares of each spouse, you must contact the Federal Tax Service at your place of residence.

A package of documents is submitted to the tax authority, including 3-NDFL declarations and payment documents for the purchase of an apartment. If you decide to redistribute expenses, an application for distribution of deductions is additionally attached.

Let's consider the possible options:

1. Each of the spouses independently paid their share and has supporting documents on hand. This is the simplest case when the benefit is calculated in full accordance with the expenses incurred. To do this, you do not need to write a distribution application.

Example:

In 2021, a husband and wife bought an apartment for 3 million rubles and registered it as common shared ownership. Everyone paid their share independently, which is confirmed by payment documents. The shares were distributed as follows: 990 thousand were paid by the wife (1/3) and 2.1 million by the husband (2/3).

The tax deduction for the wife will be 990 thousand and she will receive 13% of this amount into her account: 128.7 thousand. Despite the fact that the husband’s contribution was 2.1 million, he will receive a tax deduction in the amount of 2 million, since this is the maximum amount established by law. 260 thousand rubles of overpaid personal income tax will be returned to the husband’s account.

2. Each of the spouses independently paid their share and has supporting documents on hand. But the spouses decided to distribute the actual expenses in other proportions, since, according to Art. 34 of the Family Code of the Russian Federation, property acquired during marriage is considered common.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Example:

In 2021, a husband and wife bought an apartment in common shared ownership. The cost of housing is 4 million rubles. Everyone paid their share independently, which is confirmed by payment documents. The shares were distributed as follows: 25% was paid by the husband, 75% by the wife.

In this case, it is more profitable to issue tax deductions not for payments, but to redistribute expenses equally. Then each spouse will receive 2 million, and 260 thousand rubles of overpaid income tax will be returned to their accounts (520 thousand in total).

3. One of the spouses paid for the housing. A married couple can write an application to the Federal Tax Service and distribute the shares at their own discretion. As we said above, the basis is the new edition of the Tax Code, Art. 34 of the Family Code of the Russian Federation, Letters of the Federal Tax Service of the Russian Federation and the Ministry of Finance.

Example:

In 2021, a husband and wife bought an apartment in common shared ownership and distributed the shares equally. The cost of the apartment is 5 million rubles, all payment documents are issued in the name of the husband. In order for both husband and wife to receive the maximum deduction, a package of documents must be provided to the Federal Tax Service, including payment documents and an application for the distribution of expenses.

In this situation, costs can be divided in half. In any case, the maximum tax deduction will be 2 million for each person, which means that 260 thousand of overpaid personal income tax will be credited to the accounts.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

Why do you need an Agreement on the distribution of costs for purchasing an apartment?

An application for redistribution need not be submitted if the spouses have not previously returned income tax on real estate, and the cost of the current purchase is 4 million rubles or more. In this case, there is no point in notifying the Federal Tax Service about anything; the tax authorities will automatically, without an application, provide each spouse with the full amount of benefits of 2 million rubles.

We recommend reading: Child Rights Documents International Russian Federation

What form should I use for separation?

To add this page to your browser's favorites (software for browsing the Internet), please click the "Add to Favorites" link below. You can also use the buttons to the right of the Share link below to share this page on your social network.

While you are still deciding whether you need to receive a tax refund separately, or whether it is better to submit a single application, we would like to warn you that your initial decision regarding the distribution of shares cannot be changed in the future .

How is the deduction distributed between spouses when purchasing a home in common joint ownership?

Since 01/01/2014, the procedure for obtaining a property deduction when purchasing in joint ownership is practically no different from the procedure for obtaining a property deduction when purchasing in shared ownership.

You have the right to distribute the tax benefit at your discretion in any proportion of shares. In order to receive equal shares, no additional actions are needed - you create a package of documents, including 3-NDFL declarations and applications for deductions, and submit it to the Federal Tax Service at your place of residence.

If you want to assign an individual share to each spouse, then you need to attach an application for distribution of expenses to the general package of documents. In this case, the inspector will take into account your wishes and calculate the deduction in the proportion that you indicated.

Basis - new edition of the Tax Code of the Russian Federation, Family Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated September 18, 2013 No. BS-4-11 / [email protected] , Letters of the Ministry of Finance of the Russian Federation dated March 29, 2021 No. 03-04-05/18320, April 20, 2015 No. 03-04-05/22246, April 08, 2015 No. 03-04-05/19849.

If your home is more expensive than 4 million rubles, then each spouse receives a deduction of 2 million rubles. In this case, you do not need to write a statement about the distribution of expenses.

Example:

While married, you bought a house for 6 million rubles and registered it as joint property. Since the value of the home exceeds the two maximum allowable deductions, both you and your spouse will receive $260,000 in excess income taxes. Total for a family is 520 thousand rubles.

Find out what documents need to be submitted in your case!

To get a consultation

In the article “Tax deduction when purchasing an apartment, house, plot of land” we described all the nuances, so we will only recall the basic requirements for obtaining a property deduction:

- you are a tax resident of the Russian Federation;

- you have documents confirming the purchase;

- there are documents confirming ownership;

- you did not purchase the apartment from related parties;

- you have not previously used the right to deduct;

- the amount of property deduction cannot exceed 2 million rubles, so the maximum amount you can receive is 260 thousand rubles (13% of 2 million);

- the amount of the deduction cannot be greater than the cost of the purchased property.

Please note an important point:

Shares of the main property deduction can be distributed only once upon application to the Federal Tax Service. Therefore, weigh the pros and cons - you will not be able to change your decision later.

Reason: Letters of the Ministry of Finance of the Russian Federation dated September 7, 2012 No. 03-04-05/7-1090, August 28, 2012 No. 03-04-05/7-1012, July 20, 2012 No. 03-04-05/9-890, May 18 2012 No. 03-04-05/7-647.

Example:

In 2021, a married couple bought a room as joint property. Since the wife is on maternity leave and has no income, the couple decided to distribute the entire tax benefit to the husband. The wife still has the right to deduction, so when buying a new apartment she will be able to receive an income tax refund.

Example:

In 2021, a married couple purchased an apartment as joint property for 3 million rubles. The husband’s salary is higher, so they distributed the deduction in a 2/1 ratio. That is, the husband will receive a property deduction in full and return 260 thousand, and the wife will receive 130 thousand rubles.

Since the amount of the property deduction is not tied to the property, when purchasing a new home, the wife will receive the rest of the deduction.

Tax concierge - consultations with a tax expert for only 42 rubles per month!

Order service

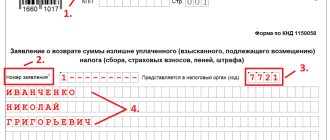

Sample application

- Taxpayer identification number. Every law-abiding citizen of the Russian Federation has a TIN assigned to him by the Federal Tax Service. But due to certain circumstances, one of the spouses or both may not have such a document. In this case, a dash is placed in the corresponding column of the application, but the document does not lose its validity.

- Residence address. The registration address, which is recorded in the applicants’ passport, must be indicated here.

- The location of the residential property for which the spouses want a tax refund and the amount of the refund. Since the application must be submitted to the Federal Tax Service together with other necessary documentation, some of the data that is written in it must be in accordance with the information presented in the 3-NDFL declaration.

Is there a generally accepted application form?

Information about the spouses (full name, passport details) is required. The property must be described and its location indicated. Next, you need to indicate the percentage of compensation that each spouse claims after submitting the paper. It can only be submitted upon a personal visit to the Federal Tax Service. The second spouse may not be present. It is possible to send documents by registered mail by making a list of the attached papers.

On the Taxation website you will find everything you need to get a deduction in any part of Russia. Tax will help you not just prepare and submit documents, but also maximize the amount of your refund, prepare the documents correctly and make the refund process as simple as possible for you.

How is the property tax deduction distributed when registering housing for one of the spouses?

Regardless of which of the spouses the housing is registered in and who paid for it, a married couple has the right to distribute shares of the property deduction at their own discretion.

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation and Art. Art. 33, 34 of the RF IC, property acquired during an official marriage is common property managed by both spouses. Even if an apartment or other real estate is registered in the name of only one person, the tax authority will calculate the property benefit in the proportion that you indicate in the application.

Reason: Letters of the Ministry of Finance of the Russian Federation dated April 20, 2015 No. 03-04-05/22246, March 18, 2015 No. 03-04-05/14480, March 26, 2014 No. 03-04-05/13204.

Example:

In 2021, a married couple purchased an apartment for 1.5 million rubles and registered it in the husband’s name. The couple decided not to distribute expenses and apply for a tax deduction for the husband.

In this situation, there is no need to write an application to the Federal Tax Service about distribution. The wife retains the right to receive a deduction for housing purchased in the future.

It is established by law that the maximum amount of property deduction is 2 million rubles, but not more than the cost of the purchased housing. In our example, the apartment costs 1.5 million rubles, and the husband received a deduction for this amount (195 thousand to be returned).

This means that the husband has the right to take up the lost part of the deduction from housing purchased in the future.

Attention! Even if the apartment costs 4 million rubles or more and is registered in the name of one of the spouses, the spouses are required to submit an application to the Federal Tax Service to distribute the deduction.

Example:

The apartment for 4 million rubles was registered in the name of the wife, but the spouses decided to both receive tax deductions. They wrote an application to the tax authority and received 260 thousand personal income tax refunds.

Example:

The apartment is registered in the name of the husband, but the couple decided to distribute the entire tax deduction to the wife. They wrote a statement to the Federal Tax Service, where they indicated the wife’s 100% share. The husband still has the right to receive a property deduction for housing purchased in the future.

You can distribute the property deduction even after the spouse for whom the housing is registered has already begun to receive the deduction.

The Supreme Court, in paragraph 18 of the Review of Court Case Practices dated October 21, 2015, ruled that a tax deduction can be distributed to the other spouse at any time without a time limit, but only if the spouses have not previously submitted an application to the Federal Tax Service for distribution .

To do this, you need to submit updated 3-NDFL declarations and write an application to the Federal Tax Service.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Features when filling

There are some peculiarities when obtaining a property tax deduction in the case of the purchase of housing by spouses. When buying a home, spouses themselves choose the type of ownership: common shared (divided into shares), common joint (without division into shares) or individual (property is registered in the name of one of the spouses).

This will determine how they will be able to receive deductions in the future. It is also very important when exactly the spouses acquired the right to deduct: the year of signing the act of acceptance and transfer of the apartment, if the apartment was purchased under an equity participation agreement, or the year of receiving a certificate of state registration of ownership of the property, if the housing was purchased under a purchase and sale agreement or a residential building was built before January 1, 2014 or after.

It is also very important when exactly the spouses acquired the right to deduct: the year of signing the act of acceptance and transfer of the apartment, if the apartment was purchased under an equity participation agreement, or the year of receiving a certificate of state registration of ownership of the property, if the housing was purchased under a purchase and sale agreement or a residential building was built before January 1, 2014 or after.

How is the property deduction distributed if the housing is registered as common property with children?

If you register an apartment, house or land plot as joint property with your children, you can receive a tax deduction for their shares. We described all cases in detail in the article “Tax deduction for children when purchasing an apartment, house, or land.”

If you have not yet purchased a home, we recommend our partner’s site-guide APARTMENT-Bez-AGENTA.ru

Look

Why do you need an Agreement on the distribution of costs for purchasing an apartment?

- name of the document (agreement on the distribution of costs for the purchase of an apartment);

- Full name and passport details of each spouse;

- details of the transaction agreement, as a result of which the spouses became the owners of the apartment;

- apartment address;

- the total cost of the apartment in accordance with the transaction agreement;

- the proportions according to which the costs of the purchase are distributed between the spouses;

- Date of preparation;

- signatures and their decoding.

How to make an application correctly?

Taxpayers have the right to take advantage of property deductions when purchasing an apartment. If housing was purchased by spouses, then each of them can receive such a deduction, but within the limits of the costs that they determine by agreement on the distribution of expenses.

The deduction provided for the main expenses for the purchase and sale of housing is distributed based on the application of the spouses only once. Then you cannot change it. As for percentages, you can change the proportions every year.

Important advice!

When distributing shares between spouses, I advise you to take into account who earned how much over the past year, and paid taxes accordingly. My husband and I wrote in a statement about dividing our shares in half, although his income significantly exceeds mine. And it would be wiser to give him a larger share of the return than I have. Then he would be able to receive a larger tax deduction than he received this year. But we can return the rest of the funds next year.

It is important to remember that this application is completed when jointly owning real estate. Because when registering shares for each spouse, he can return the tax only to the extent of the value of his share. And as part of my article, I recommend you watch this video. In it you will learn how joint property of spouses differs from shared property.