A liability is the company’s debt existing at the reporting date, which arose as a result of accomplished events in its activities, for example, during the execution of:

- contractual terms (delivery of goods and materials);

- current legislation (calculation of mandatory payments, taxes);

- customs of business turnover (settlements on received loans and credits, other transactions).

Since liabilities are sources of acquisition of assets, they are recorded in the liabilities side of the balance sheet, dividing them into long-term and short-term liabilities. In the balance sheet, short-term liabilities are allocated to the 5th liability section - their repayment period as of the reporting date should not exceed 12 months. On the contrary, long-term liabilities include the company’s debts, the coverage of which is expected to be over a wider time range - over 12 months, and long-term liabilities are combined in the balance sheet liability in the 4th section, which is completely allocated to them.

Let's talk about how the structure of long-term liabilities is built in the balance sheet, what lines they occupy, and how the amounts in them are formed.

What are long-term liabilities on the balance sheet

Liabilities of an enterprise are debts existing at the reporting date that the company has incurred as a result of certain facts of its production activities, which will ultimately lead to the expenditure of assets to repay them. An economic entity may have obligations due to:

Take our proprietary course on choosing stocks on the stock market → training course

- business customs;

- legal norm;

- agreement.

Long-term liabilities mean debts to legal entities and individuals that must be repaid no earlier than 12 months from the reporting date . These may be, for example, estimated liabilities, deferred tax payments, and various types of debts.

It also happens that an organization attracts financing with a long repayment period, but part of the loan must be repaid in a fairly short time. Therefore, when financial experts look at existing long-term liabilities on a company's balance sheet to assess its financial condition, such debts are divided into 2 categories:

- The portion of long-term accounts payable that is due to be repaid within the next year, starting from the reporting date.

- The share of long-term accounts payable that will need to be repaid more than 1 year from the reporting date.

Credit balance of account 66 + Account balance 67

Redistribution of debt obligations

Each enterprise has the opportunity to transfer obligations that have a long maturity period to a short-term basis. This is acceptable when there are no more than 12 monthly payments remaining on the loan.

Important! Debt with a payment term exceeding 12 months cannot be included in accounts intended to reflect short-term loans and credits.

Overdue debt

When the borrower fails to repay the next payment on time, the accountant needs to transfer the remaining loan obligations to the status of overdue debt. In this case, the company may incur additional expenses:

- Paid consultations with credit experts.

- Verification of the loan agreement by third party specialists.

- Fines and penalties provided by the lender for late payments.

- Other expenses not covered by banking services.

Long-term liabilities on the balance sheet (Section IV)

Important! Liabilities (short-term and long-term) on the balance sheet are always reflected in Liabilities.

In the balance sheet, information on all long-term liabilities of the enterprise can be found in section IV, which includes the following items:

- Borrowed funds (line 1410). These are loans and borrowings issued by a legal entity, interest on the use of funds and associated costs (fees for checking a loan agreement, paid consultations, commercial information, etc.).

- Deferred tax liabilities (line 1420). This is the portion of the organization's deferred income tax, which will ultimately increase the income tax planned for transfer to the budget in the next reporting period or in later periods.

- Estimated liabilities (line 1430) . Debts of an enterprise that are planned to be repaid no earlier than in a year.

- Other obligations (line 1450) . All other debts that do not fall into any of the categories listed above.

Let's see what the mentioned section IV looks like:

Let’s look at Section IV “Long-term liabilities” line by line and see how each line of the balance sheet is filled out:

| Section IV line | Line formation order | Algorithm for calculating the indicator* *K_ – credit balance |

| 1410 "Borrowed funds" | Information on all obligations of the company taken for a long term (this is considered to be a period of time from 1 calendar year) must be reflected. Accounts payable can arise as a result of receiving a loan in cash or in kind, in the form of an obligation on a bill of exchange, or a bank loan. To form a line, you need to take the credit balance of account 67 only for debts with a long payment period. | K67 (long-term debts only) |

| 1420 “Deferred tax liabilities” | Filled out only by enterprises guided by PBU 18/02. The line is formed by indicating the credit balance of account 77. In cases where firms allow themselves to offset tax liabilities and assets and present them in a consolidated form, the line must be filled out only when the credit balance of account 77 > debit balance of account 09 (by the amount of the difference between these indicators). | K77 |

| 1430 “Estimated Liabilities” | The amount of reserves formed according to PBU 8/2010 for long-term liabilities is indicated. As an example, we can point out the reserves formed for warranty repairs. The line is created by reflecting in it the credit balance of account 96 (for debts with a repayment period of 1 year or more), which was not written off as of December 31 of the reporting period. | K96 (only estimated liabilities with a long period of fulfillment) |

| 1450 “Other obligations” | Contains information about debts to counterparties with a repayment period of 1 year. It is formed as the balance of the following accounts: – account 60 (debts to contractors and suppliers for previously received deferred payments and installment plans for payment for goods supplied, only for credit debts with a long repayment period); – account 62 (debts to customers and consumers for advances received, prepayments for future supplies of goods, commercial loans, only for long-term debts); – account 68 (accounts payable with a long repayment period that arose in connection with payments to the budget (taxes, fees), for example, upon receipt of installment plans and deferrals for federal tax collections, investment tax credit); – account 69 (debts of an enterprise for the payment of insurance premiums with a long repayment period, for example, arising due to the restructuring of debt to extra-budgetary funds); – account 76 (debts not included in other categories with a long repayment period); – account 86 (loan account 86 – targeted financing with a time period for fulfilling obligations of at least 1 year, for example, when a developer becomes obligated to transfer a finished project to investors after receiving targeted financing for construction). | K60+K62+K68+K69+K76+K86 (only long-term liabilities) |

| 1400 “Total for Section IV” | Amount of lines 1410-1450 (total liabilities of the company). |

The total for the “Long-term liabilities” section is calculated in accordance with the following formula:

Long-term liabilities: borrowed funds (line 1410)

Borrowed funds reflected in line 1410 of Section IV include all bank loans issued at the end of the reporting period for a period of 1 year or more, various loans, bonded and bill of exchange debts. Such debts accumulate in the account. 67.

The amount of the loan taken is reflected in accounting in the amount specified in the loan agreement, not exceeding the amount of finance actually taken. Such an agreement is recognized as concluded at the time of actual receipt of funds (or other assets) from the borrower.

Debt on loans and credits is shown on the balance sheet, taking into account interest on the use of funds accumulated at the end of the reporting period.

Important! In the case of receiving a credit (not a loan), the amount under the agreement is subject to reflection in the balance sheet as accounts payable, but taking into account the terms of the agreement. This is due to the fact that banks reserve the right not to issue funds (if such a condition is contained in the agreement), and that in the event of an unreasonable refusal to issue a loan, the bank will be obliged to pay compensation to the client.

Long-term liabilities: deferred tax liabilities (line 1420)

Reflected on account 77 by type of obligation. Accounting entries:

- DEBIT 68.4.2 CREDIT 77 (occurrence of deferred tax liabilities);

- DEBIT 77 CREDIT 68.4.2 (reduction of deferred non-refundable assets).

Deferred tax liabilities appear on the balance sheet because taxable temporary differences arise (in effect, they are deferred taxes that will subsequently increase income taxes payable). These are reflected in accounting taking into account all taxable differences, and such obligations are recognized precisely in the period during which they arose .

A temporary difference is income that forms profit (and expenses that form loss) within one reporting period, while the tax base is formed in another (other) periods.

Important! If a debt or an asset for which deferred tax liabilities were accrued is disposed of, the amount of IT is written off to the profit and loss accounts, which, according to the Tax Code, will not increase taxable profit.

Long-term liabilities: estimated liabilities (line 1430)

They are taken into account by accountants on account 96, recognized if 3 conditions are simultaneously met:

- The impossibility of avoiding the fulfillment of an obligation that arose earlier due to the implementation of economic activities.

- Probability of expense (reduction of economic benefits in order to fulfill an obligation).

- Possibility of a reasonable assessment of the amount of possible expenses (amount of obligation).

The listed conditions for accounting for estimated liabilities are not applicable in some cases. So, they are not taken into account when it comes to:

- amounts that are accounted for according to PBU 18/02 and affect the amount of income tax planned for transfer to the budget in the following periods or in later periods;

- valuation reserves;

- reserves that were formed from retained earnings; reserve capital;

- contracts under which at least one of the parties has not fulfilled its obligations in full as of the reporting date (with the exception of obviously unprofitable contracts, and an agreement under which a party can refuse to fulfill obligations unilaterally without any penalties is not recognized as such) .

Basic Concepts

Every legal entity, regardless of the type of activity, has obligations. They are usually divided into long-term and short-term (or current). From the name it is already clear that division is carried out on a temporary basis.

Current liabilities are those debts that the company needs to pay off within the next year. Their elimination is carried out using current resources, which include:

- Dividends intended for payment.

- Tax payments.

- Bills that are classified as short-term.

- Income received as an advance payment, but not worked out, etc.

Current resources have the main difference from long-term ones in that, theoretically, an enterprise could use them to carry out daily activities. Another distinctive feature of them is that they are converted into cash equivalent and spent in a short time. Most often this is a calendar year. If their repayment is postponed, then they become long-term. In this case, a penalty will be charged on the total amount.

This financial analysis was carried out in accordance with the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)” and the Rules for Conducting a Financial Analysis by an Arbitration Manager, approved by the Decree of the Government of the Russian Federation of June 25, 2003 N 367. The analysis was carried out on based on the financial statements of Zvezda JSC for the period from 01.01.2014 to 31.12.

2015 (8 quarters). During the analysis, the key coefficients of the financial and economic activities of Zvezda JSC were calculated (indicators of solvency, financial stability and business activity), and a final conclusion was made regarding the financial position of the debtor. The activities of Zvezda JSC are classified in the Communications industry (class according to OKVED - 64), which was taken into account in the qualitative assessment of the values of financial indicators.

The main indicators of assets and liabilities of Zvezda JSC are given according to the data contained in the financial statements (Form No. 1 “Balance Sheet”) and the debtor’s accounting registers.

| Index | Indicator value | Change during the analyzed period | ||||||

| in thousand rubles | in % to balance currency | thousand rubles (group 5-group 2) | ± % ((gr.5-gr.2) : gr.2) | |||||

| 31.12.2013 | 03/31/2014 – 06/30/2015 (on average) | 30.09.2015 | 31.12.2015 | at the beginning of the analyzed period (December 31, 2013) | at the end of the analyzed period (December 31, 2015) | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Total assets (liabilities) | 7 540 901 | 7 032 219 | 5 858 320 | 6 059 934 | 100 | 100 | -1 480 967 | -19,6 |

| Assets | ||||||||

| Adjusted non-current assets | 5 636 411 | 5 208 358 | 4 538 792 | 4 291 369 | 74,7 | 70,8 | -1 345 042 | -23,9 |

| Long-term accounts receivable | – | – | – | – | – | – | – | – |

| Short-term receivables* | 1 736 668 | 1 437 628 | 1 133 825 | 828 831 | 23 | 13,7 | -907 837 | -52,3 |

| Current assets** | 1 904 490 | 1 823 861 | 1 319 528 | 1 768 565 | 25,3 | 29,2 | -135 925 | -7,1 |

| Liquid assets | 1 763 944 | 1 719 371 | 1 231 566 | 1 699 832 | 23,4 | 28,1 | -64 112 | -3,6 |

| including: the most liquid current assets | 23 130 | 279 671 | 97 704 | 870 965 | 0,3 | 14,4 | 847 835 | 37.7 times |

| Potential current assets for return | – | – | – | – | – | – | – | – |

| Passive | ||||||||

| Own funds | 1 158 284 | 1 037 409 | 823 332 | 1 186 109 | 15,4 | 19,6 | 27 825 | 2,4 |

| Liabilities, total | 6 382 617 | 5 994 810 | 5 034 988 | 4 873 825 | 84,6 | 80,4 | -1 508 792 | -23,6 |

| including: long-term obligations of the debtor | 4 785 789 | 4 214 510 | 3 140 291 | 2 691 167 | 63,5 | 44,4 | -2 094 622 | -43,8 |

| debtor's current obligations | 1 596 828 | 1 780 300 | 1 894 697 | 2 182 658 | 21,2 | 36 | 585 830 | 36,7 |

* Including goods shipped.** Excluding goods shipped.

On the last day of the analyzed period, approximately two thirds of the organization’s assets are accounted for by their non-current part (70.8%), and a third are current assets (29.2%). Over the past two years, the value of assets has decreased significantly, decreasing to 6,059,934 thousand rubles. (-1,480,967 thousand rubles). At the same time, own funds increased by 2.4%, amounting to as of December 31.

The decrease in the total assets of Zvezda JSC occurred mainly due to a decrease in the value of the following types of assets (the amount of the change and the percentage contribution of this change to the total decrease in assets is given below):

- accounts receivable – 907,837 thousand rubles. (39%)

- other non-current assets – 819,559 thousand rubles. (35.2%)

- long-term financial investments – 323,904 thousand rubles. (13.9%)

At the same time, the largest decrease in the balance sheet liabilities occurred in the following positions (the percentage contribution to the total decrease in liabilities is indicated in parentheses):

- long-term borrowed funds – 1,948,930 thousand rubles. (92.8%)

- other long-term liabilities – 150,361 thousand rubles. (7.2%)

An even greater decrease in the value of the organization’s total assets was avoided by the increase in the values of such indicators as “cash and cash equivalents” in assets and “short-term borrowed funds” in the organization’s sources of funds (liabilities), which amounted to 611,840 thousand rubles over the last two years. and 450,802 thousand rubles. respectively.

The structure of the organization's assets by main groups is presented in the diagram below. At the same time, these assets are calculated in accordance with their definitions in clause 1 of Appendix 1 to the Rules for conducting financial analysis by arbitration managers.

The value of liquid assets as of December 31, 2015 amounted to RUB 1,699,832 thousand. Over the past two years, there has been a slight decrease in the value of liquid assets of Zvezda JSC (-64,112 thousand rubles). Over the entire period under review, the amount of short-term receivables decreased by 907,837 thousand rubles, or by 52.3%.

The change during the analyzed period in total assets (liabilities), equity and liabilities of Zvezda JSC is presented in the graph below.

During the entire analyzed period, equity capital mainly grew. The value of equity as of December 31, 2015 amounted to 1,186,109 thousand rubles.

The calculation of the value of net assets of Zvezda JSC was carried out in accordance with the Procedure for determining the value of net assets, approved by Order of the Ministry of Finance of Russia dated August 28, 2014 N 84n.

| Index | Indicator value | Change | ||||||

| in thousand rubles | in % to balance currency | thousand rubles (group 5-group 2) | ± % ((gr.5-gr.2) : gr.2) | |||||

| 31.12.2013 | 03/31/2014 – 06/30/2015 (on average) | 30.09.2015 | 31.12.2015 | at the beginning of the analyzed period (December 31, 2013) | at the end of the analyzed period (December 31, 2015) | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1. Net assets | 1 158 181 | 1 037 369 | 823 332 | 1 186 109 | 15,4 | 19,6 | 27 928 | 2,4 |

| 2. Authorized capital | 600 000 | 600 000 | 600 000 | 600 000 | 8 | 9,9 | – | – |

| 3. Excess of net assets over authorized capital (line 1-line 2) | 558 181 | 437 369 | 223 332 | 586 109 | 7,4 | 9,7 | 27 928 | 5 |

The organization's net assets as of December 31, 2015 significantly (97.7%) exceed the authorized capital. This ratio positively characterizes the financial position of Zvezda JSC, fully satisfying the requirements of regulations for the amount of net assets of the organization. Moreover, it should be noted that net assets increased by 2.4% over the last two years.

Taking into account both the excess of net assets over the authorized capital and their increase over the period, we can talk about the good financial position of the organization on this basis. A visual change in the organization’s net assets for the analyzed period (from December 31, 2013 to December 31, 2015) is presented in the following graph.

The authorized capital remained unchanged throughout the period under review.

The table below shows the main financial results of the activities of Zvezda JSC for the period under review (from 12/31/2013 to 12/31/2015) according to the accounting forms “Report on Financial Results”.

| Index | Indicator value, thousand rubles. | Change in indicator | Average monthly value, thousand rubles. | ||||

| 1st quarter 2014 | 2nd quarter 2014 – 2nd quarter 2015 (average) | 3rd quarter 2015 | 4th quarter 2015 | thousand roubles. (gr.5 – gr.2) | ± % ((5-2) : 2) | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. Net revenue | 2 934 486 | 69 122 | 760 470 | 787 651 | -2 146 835 | -73,2 | 201 176 |

| 1.1. Average monthly revenue | 978 162 | 23 041 | 253 490 | 262 550 | -715 612 | -73,2 | x |

| 2. Expenses for ordinary activities | 2 717 539 | -489 | 712 765 | 773 050 | -1 944 489 | -71,6 | 175 038 |

| 3. Profit (loss) from sales (1-2) | 216 947 | 69 611 | 47 705 | 14 601 | -202 346 | -93,3 | 26 138 |

| 4. Other income and expenses, except interest payable | 471 768 | -71 912 | 170 524 | 577 148 | 105 380 | 22,3 | 35 828 |

| 5. EBIT (earnings before interest and taxes) (3 4) | 688 715 | -2 302 | 218 229 | 591 749 | -96 966 | -14,1 | 61 966 |

| 6. Interest payable | 629 329 | -14 913 | 143 354 | 99 908 | -529 421 | -84,1 | 33 251 |

| 7. Changes in tax assets and liabilities, income tax, etc. | -31 296 | -3 407 | 22 041 | -129 064 | -97 768 | ↓ | -6 473 |

| 8. Net profit (loss) (5-6 7) | 28 090 | 9 204 | 96 916 | 362 777 | 334 687 | 12.9 times | 22 242 |

For the 4th quarter of 2015, revenue amounted to 787,651 thousand rubles. During the period under review, there was a multidirectional change in revenue (both growth and decline); the maximum value was 3,292,744 thousand rubles, the minimum – -2,512,592 thousand rubles. The graph below clearly shows the change in revenue and net profit of Zvezda JSC.

Over the last quarter, the organization not only received gross profit, but also exceeded its earnings before interest and taxes (EBIT) in the amount of 591,749 thousand rubles. The final financial result (net profit) for the period 01.10–31.12.2015 amounted to 362,777 thousand rubles.

Regulatory and legislative acts on the topic

| Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | Approval of the balance sheet form |

| clause 7.3 of the Concept approved by the Methodological Council for Accounting under the Ministry of Finance | On the grounds for the emergence of obligations |

| clause 19 PBU 4/99 | Definition of long-term liabilities |

| Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n | Algorithm for calculating indicators of items of long-term liabilities |

Organizational assets

The assets of an organization include all property owned by an economic entity. These include financial, material, and intangible resources. Conventionally, assets can be divided into several categories. For example, according to the degree of implementation and the speed of conversion into cash, they distinguish:

- assets with the highest degree of liquidity (cash, securities);

- quickly realizable assets (inventories, working capital, accounts receivable with a short maturity);

- slowly selling assets (long-term accounts receivable);

- hard-to-sell assets (fixed assets, intangible assets, other non-current assets).

Based on the period of circulation, available resources are divided into current and non-current. Negotiable assets have a short circulation period. This group includes materials, inventories, finished products, and cash directly. Non-current assets take an indirect part in the production cycle and are classified as long-term, for example, intangible assets, fixed assets.

Based on the above classifications, we can conclude that current assets are quickly realizable working capital, have a fairly high degree of liquidity, and are direct participants in the production cycle.

Answers to frequently asked questions on “Long-term liabilities on the balance sheet”

Question: Is accounts payable reduced due to the accrual of value added tax on advances received by the enterprise?

Answer: Yes, accrued VAT on advances received by the company reduces the amount of accounts payable in the balance sheet on which the tax amount was calculated. In the same way, VAT on an advance issued by an organization is not reflected in the Liability side of the balance sheet, but reduces the amount of receivables in the Asset. Regarding your question, let's give an example: on the reporting date, an advance of 118 thousand rubles was received, including the amount of VAT at a rate of 18%, in Liability we will write (118 thousand rubles - 118 thousand rubles x 18/118) = 100 thousand. R.

Question: What to do with the assessment of deferred tax liabilities if the Tax Code of the Russian Federation provides for different income tax rates for certain types of company income?

Answer: In such a situation, the tax rate must correspond to the type of income that will lead to a decrease in the amount or complete repayment of the taxable temporary difference in future years (following the reporting or subsequent periods).

Definition

Liabilities _

) are one of the three sections of the balance sheet besides assets and equity. This section reflects the company's debt obligations to its creditors that arose as a result of previous operations. By their economic essence, they, like equity capital, are a source of financing the company’s assets. In the event of default on debt obligations, creditors have the right to claim the company's assets to the extent of the outstanding debt to them.

Liabilities also include advances received that were paid for future goods, work or services. Since this amount has not yet been earned, it may be recorded as deferred income or customer deposits.

Current assets - formula

The total of current assets in the balance sheet is line 1200, but provided that there are no long-term receivables in the current resources. Current assets in the financial statements are calculated using the following formula:

TA = line 1200 - the sum of the remote data, where

line 1200 - the total amount of current assets owned by the enterprise;

DZ is the volume of receivables that are long-term in nature.

Debt of debtors with a maturity of more than 1 year cannot be classified as current assets, since this resource does not have sufficient liquidity. Information on the size of accounts receivable and its characteristics by payment period can be found based on accounting data.

Liquidity of current assets

The ability of an enterprise to pay on time, if necessary, for existing obligations is assessed as liquidity. Great importance is attached to the presence of assets that have a high degree of conversion into cash. Thus, the size of current assets affects the solvency of the organization and its investment attractiveness.

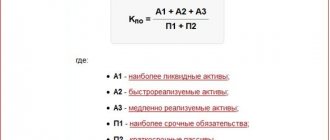

Current assets, the formula for determining which is given above, are necessary to calculate the liquidity of the enterprise. Liquidity of current assets is calculated as follows:

KTL = TA/TO, where

KTL is the value of the current liquidity ratio;

TA - current assets;

TO is the amount of current liabilities.

The TO value represents the summarized data for balance sheet lines 1510 (borrowed funds), 1520 (accounts payable) and 1550 (other current liabilities). Only short-term debt is taken into account.

To determine the quick liquidity ratio, the amount of inventory is subtracted from the TA indicator.

The value of the current liquidity ratio in the normal functioning of the organization exceeds an indicator equal to 1. A liquidity level below 1 indicates low solvency. At the same time, high ratios are also not desirable, since a decrease in turnover and ineffective use of funds do not have the best effect on the economic condition of the enterprise.

When maintaining accounting records, specialists face a number of questions related to the structure characteristic of enterprises. In particular, within the framework of the topic of current liabilities, they are interested in what line this is in the balance sheet.