Initial stage of joining

A merger is a form of reorganization in which one or more organizations cease to exist as separate legal entities and become part of another company.

In what follows, for simplicity, we will refer to the affiliating organization as the “main” organization. The starting point is for the owners to make an appropriate decision. It must be sent to the “registering” Federal Tax Service within three working days, along with a written message about the start of the accession. Having received these papers, inspectors must make an entry in the state register stating that the companies are in the process of reorganization. Officials are given three working days for this.

In addition, companies are required to inform the Pension Fund and the Social Insurance Fund office in writing about the upcoming accession. This should also be done within three working days (clause 3 of part 3 of article 28 of the Federal Law of July 24, 2009 No. 212-FZ).

Then twice, at intervals of a month, a notice of the reorganization is supposed to be published in special publications. And also, within five working days from the date of filing the application with the Federal Tax Service, notify all known creditors about the initiated process (Article 13.1 of the Federal Law of 08.08.01 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

Next, you should prepare a new version of the constituent documents of the company, which is being joined by another legal entity. At this stage, it is also necessary to conduct an inventory of the property and obligations of all participants - and the joining organization. This is stated in paragraph 2 of Article 12 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

Typical mistakes during reorganization

Mistake #1. Accounting during reorganization in the form of separating the difference between the amount of the value of property rights contributed as payment for property and the nominal value of the received shares, shares or shares as profit/loss.

For accounting purposes, the difference between these indicators is not recognized as profit or loss of the legal entity.

Mistake #2. Failure to reflect business transactions in the period of time between the preparation of the separation balance sheet for the purpose of reorganization and the date of making the corresponding entry in the Unified Register.

It is the responsibility of the reorganized company to reflect all business transactions in a given period of time, since legal entities participating in the reorganization are required to know about the changes that have occurred in the enterprise.

Transfer deed

After the steps described above, accountants must draw up a transfer deed. The date of this document can be any at the discretion of the founders. However, it is better to date the transfer act at the end of the quarter or year - this is precisely the recommendation contained in paragraph 6 of the Instructions for the preparation of accounting records during reorganization*.

There are no restrictions on the form of the transfer deed (an example of a transfer deed can be found here). In terms of content, there is only one indication - the act must include “provisions on legal succession” (Article 59 of the Civil Code of the Russian Federation). This is information about the amount of receivables and payables and about the property that goes to the “main” company. It is permissible to reflect property either at market or at residual value (clause 7 of the Instructions for the formation of accounting records during reorganization).

In practice, the deed of transfer is most often drawn up in the form of an ordinary balance sheet and transcripts are attached for each line. Inventory sheets can be used as transcripts. There is another option: abandon the balance sheet form, and simply list all types of assets and liabilities (fixed assets, intangible assets, accounts receivable, etc.) and indicate their value. And in separate appendices, provide lists of objects, debtors, etc.

Valuation of assets and liabilities during reorganization

The value of the property recorded in the separation balance sheet or deed of transfer must agree with that listed in the inventory or transcript thereof. The assessment of the property of the transferring and receiving parties is carried out:

- at residual value,

- at the current market price,

- at the actual cost of inventories,

- at the original cost of the cash investment,

- by another method.

The transfer of property according to the rules of universal legal succession is not accepted as its sale or as a gratuitous transfer when maintaining accounting (no entries are made). The obligations of the reorganized LLC are shown in the amount reflected in the accounting records of the loan debt (including losses reimbursed to borrowers).

Accounting must contain separate documentation:

- intermediate (drawn up between the day of alienation of the property and obligations of the reorganized LLC and the day of making entries in the Unified State Register of Legal Entities) and

- final reporting (with closing accounts for losses and profits, reflecting the distribution of net profit for the implementation of tasks approved by the founders in the agreement).

If during the period of writing the interim reports the value of the property being surrendered has changed, this must be indicated in the explanatory paper to the report or in a clarification to the separation balance sheet or transfer deed, since the information contained in them will become the basis for entering data on property, obligations and other indicators in introductory note report of the newly created legal entity (the final accounting report will also be considered).

Period until completion of accession

Next you need to collect a package of documents. It consists of a deed of transfer, an application for state registration of the acquiring legal entity, a decision on reorganization, a document on payment of state duty and other papers. The full list is given in paragraph 1 of Article 14 of the Federal Law of 08.08.01 No. 129-FZ.

The package of documents must be submitted to the “registering” tax office and wait for it to make an entry in the Unified State Register of Legal Entities. The appearance of such a record will mean that the company being merged has ceased to exist, and the “main” has begun to operate in a new capacity.

While the waiting period lasts, the joining organization continues to operate. In particular, it calculates wages, depreciation, issues invoices and issues invoices and invoices.

Required documents

The legislation establishes a list of documentation required for submission to the tax service. To register the transformation, the following documents of the liquidated enterprise must be submitted:

- Application on form P12001. The document must be signed by the applicant. Provided for each emerging company.

- A set of documents of the reorganized organization. It includes:

- TIN;

- charter;

- extract from the Unified State Register of Legal Entities;

- OGRN certificate.

statistics codes;

Originals or notarized copies are submitted to the Federal Tax Service. Documents are provided in two copies.

For a newly created company, the following information is needed:

- full and abbreviated name;

- activity codes;

- legal address;

- size of the authorized capital indicating the form of payment;

- details of the manager, name of his position;

- data of the chief accountant;

- data of the founders indicating their shares in the authorized capital;

- information about the bank in which the account will be opened;

- The contact person.

If these documents and information are available, the tax authorities register the reorganization of the enterprise.

Final financial statements of the acquired company

The organization that joins is required to prepare final accounting reports. Its date is the day preceding the date of entry into the unified state register of the reorganization entry. The reporting includes a balance sheet, profit and loss account, statements of changes in capital and cash flows, explanations and an auditor's report (if the company was subject to a statutory audit).

The final statements will reflect transactions completed during the period from the signing of the transfer deed to the closure of the predecessor organization. In particular, writing off deferred expenses that cannot be transferred to the successor (for example, the cost of a license). As a result of these transactions, the figures in the final balance sheet will differ from the figures in the transfer deed.

Finally, the accountant of the acquiring company needs to close account 99 “Profits and losses”. Profits can be distributed according to the decision of the founders.

After the final reporting, the affiliated organization does not have to submit balance sheets and other documents, because the last reporting period for it is the time from the beginning of the year to the date of reorganization.

As for the “main” organization, it has no obligation to prepare and submit final reports.

Reorganization in the form of transformation

The conditions and scheme of reorganization into the appropriate legal form are approved by the founders and formalized in a decision on transformation. A deed of transfer is necessary, despite the fact that the owner of the property and the debtor of the obligations remain the same. If the organizational and legal form changes, the details of the transfer of property are prescribed in the transfer deed.

The work of a company in the process of transformation may not stop during the period of reorganization, as of the state date. Upon registration, the amount of net profit must be indicated, and the profit must be distributed among the participants or spent. Such measures are necessary because assets may not change, but liabilities are likely to change.

| Operation | DEBIT | CREDIT |

| by the amount of profit from core activities | 90 s/ac “Profit/loss from sales” | 99 |

| or | ||

| for the amount of loss from core activities | 99 | 90 |

| for the amount of other profit of the company | 91 s/account “Balance of other income and expenses” | 99 |

| or | ||

| for the amount of loss from non-core activities and from non-operating expenses minus received non-operating income | 99 | 91 |

| for the amount of unforeseen expenses | 99 | 99 |

| for the amount of income tax (before the date of state registration) | 99 | 68 |

| for the amount of permanent tax liabilities | 99 | 68 s/ch “Income tax” |

| by the amount of net profit (which will be divided between the participants or spent) | 99 | 84 |

| by the amount of net loss (attributable to the decrease in net profit of previous periods) | 84 | 99 |

| for the amount of accrued dividends | 84 | 75 |

| the amount of accrued dividends (if they are accrued to company employees) | 84 | 70 |

Accounting statements of the “main” company

An organization that merges another legal entity does not have to submit its opening balance sheet. Instead, the successor will have to prepare interim accounts as of the date of termination of the predecessor company's operations. This follows from paragraph 23 of the Instructions for the formation of accounting records during reorganization.

The lines of the interim balance sheet will contain the sum of the indicators of the final balance sheet of the affiliated organization and the balance sheet of the “main” company as of the date of making an entry in the Unified State Register of Legal Entities. The exception is mutual settlements between the predecessor and the successor - for example, when one of them was a borrower and the other a lender. Such indicators are not summed up, since if the debtor and creditor coincide, the obligation terminates.

In the interim income statement, the successor does not need to combine its data with that of its predecessor. The explanation is simple: these figures refer to the period before the reorganization, and then there were two (or more) legal entities independent from each other.

Particular attention should be paid to the authorized capital of the successor organization. If it is less than the sum of the capitals of the “main” and acquired companies, then the difference is reflected in the balance sheet in the line “Retained earnings (uncovered loss).” If the legal successor’s capital is greater than the amount of capital before the reorganization, such a difference does not need to be shown in the balance sheet. In both cases, the accountant does not make any entries.

The introductory reporting must be submitted to the Federal Tax Service either immediately after registration or at the end of the current quarter (depending on what is more convenient for “your” inspector).

The concept of reorganization, types of reorganization

There are different types of reorganization:

- merger (creation of one LLC, termination of several LLCs);

- transformation (creation and completion of one LLC);

- spin-off (creation of one or several LLCs);

- merger (termination of activities of one or several LLCs);

- division (creation of several LLCs and closure of one LLC).

Reorganization in the form of separation and division presupposes the presence of a documented decision of the founding legal entities or the authorized body of the legal entity (the powers are confirmed in the constituent documentation); sometimes - a court decision or conclusion of government agencies. When reorganizing in the form of transformation, accession or merger, it is necessary to obtain government approval. bodies having powers, in cases approved by law.

In case of merger, spin-off, division, transformation, the reorganization process is considered completed from the date of state registration. registration of new legal entities; and upon merger - from the date of adding an entry in the Unified State Register of Legal Entities about the termination of the work of the affiliated LLC. In both cases, the final account is drawn up the day before the recordings are made. reporting.

"Primary" in the transition period

After reorganization, the successor company “inherits” the contractual relations of the joining legal entity. But the agreements themselves are still concluded on behalf of the predecessor. Is it necessary to sign additional agreements to replace parties to the transaction? Or can you simply send information letters to counterparties that indicate the name and details of the legal successor?

In our opinion, there is no need for additional agreements. Indeed, on the basis of paragraph 2 of Article 58 of the Civil Code of the Russian Federation, all rights and obligations of the affiliated company under the transfer deed are transferred to the acquiring organization. This rule also applies to contractual relationships. Thus, an extract from the Unified State Register of Legal Entities and a transfer deed are sufficient for the assignee to continue cooperation with suppliers and buyers of the affiliated organization.

However, many companies still renew contracts. This option requires additional time and labor, but allows you to prevent conflicts with both counterparties and tax authorities.

Invoices, certificates of work performed and invoices before the day of reorganization are issued on behalf of the predecessor, on the date of reorganization and further - on behalf of the successor.

Reorganization in the form of division

Costs before the date of adding the entry to the Unified State Register of Legal Entities should be taken into account as non-operating expenses of the company that is being reorganized. Upon completion of the reorganization, the costs will be taken into account by the newly created legal entities. This also applies to reorganization in the form of separation. To prepare the separation balance sheet, the accounting indicators are separated. reporting of the reorganized legal entity (except for data on profits and losses), the accounting records will not contain records about this.

According to information from the separation balance sheet and the final accounting. reporting, an introductory account is drawn up. reporting of all companies that arose after the separation and state day. registration. Two or more legal successors arise, between whom disagreements will occur due to the fact that in the period of time between the execution of the transfer deed and the entry into the Unified State Register of Legal Entities, the composition and structure of assets and obligations change, sometimes significantly. Therefore, it is customary to act according to the following scheme:

- As soon as the reorganization is planned, a list of property that will not be sold or alienated in any other way is approved, and the composition of the assets that will be transferred to each of the participating legal entities is identified.

- When the company's operations do not stop, and the division occurs on the basis of industry segments (or geographic ones), the property prepared for transfer is determined as a percentage of the total (the full amount of inventory valuation or the number of objects).

- The equity capital of the company to be divided is distributed only by decision of the meeting involved in the reorganization process. In a joint-stock company, reserve capital (intended for paying dividends) is distributed depending on the number of shares, taking into account the possibility of conversion.

- obligations are subject to division according to the principle of their ownership.

- Money and other highly liquid assets are distributed according to pre-agreed percentages.

Example of accounting for reorganization in the form of merger

Conditions:

- For clarity, let’s call the reorganized company K1, and the merged company K2.

- The authorized capital of K2 on the day of reorganization is 155 thousand rubles.

- K2 accepted an advance for the future supply of goods (266 thousand rubles), paid VAT (43 thousand rubles).

- K1 received goods worth 155 thousand rubles from K2 under the transfer deed. excluding VAT.

- K1 received accounts payable equal to the advance accepted by K2 (266 thousand rubles).

If goods are transferred from K1 under a transfer act to K2, they are accepted for accounting at the cost that was indicated in the accounting of K2, if they were valued at actual cost. When transferring goods, fixed assets, intangible assets, upon the purchase of which K1 accepted VAT for deduction, this amount of VAT will not be restored and paid to K1 and K2.

The loan debt to the purchaser of goods must be taken into account in the amount that was recorded in K2 accounting. After the goods are shipped to the buyer, K1 recognizes revenue and takes into account VAT. The legal successor is subject to deduction of VAT transferred to the budget by the reorganized enterprise from advances and other payments on account of future supplies of goods.

Proceeds from the sale of goods (minus VAT) are taken into account in sales income for the purpose of paying income tax.

For K1 and K2, expenses will be considered the residual value of property, rights that can be valued in monetary terms (determined according to the tax accounting information of K1 on the day of transition from K1 to K2), and obligations transferred by succession. K1 has the right to reduce income from the sale of goods by the cost of goods sold transferred from K2.

Accounting entries for the acquired enterprise (at the time of reorganization, K1 received an advance for the goods and paid VAT, K1 transferred goods to K2 excluding VAT and the loan debt in the amount of the advance):

| Operation | DEBIT | CREDIT | Amount (thousand rubles) |

| balances on the goods account were increased | 41 | – | 155 |

| balances on the accounts payable to customers were increased | – | 62-2 | 266 |

| VAT account balances increased | 76/AB | – | 43 |

| cash account balances increased | 51 | – | 223 |

| balances on the authorized capital account were increased | – | 80 | 155 |

| revenue from the sale of goods is recognized | 62 s/sch “Settlements with buyers and customers” | 90 s/c “Revenue” | 266 |

| written off cost of goods sold | 90 s/c “Cost of sales” | 41 | 155 |

| VAT is charged on proceeds from the sale of goods | 90 s/c “VAT” | 68 | 43 |

| accepted for deduction of VAT paid by K2 on the advance amount | 68 | 76/AB | 43 |

| the advance amount is offset against the buyer's debt for goods | 62-2 | 62 s/sch “Settlements with buyers and customers” | 266 |

Example of accounting for reorganization in the form of spin-off

Conditions:

- The OJSC is reorganizing in the form of spinning off a closed joint stock company.

- The authorized capital of the CJSC is 2,420,000 rubles.

CJSC will be transferred:

- 780 thousand rubles in cash,

- loan debt 320 thousand rubles,

- exclusive rights to a trademark (45 thousand rubles),

- debt on Debit for goods supplied (RUB 740 thousand),

- securities of OJSC (2) for 560 thousand rubles.

The rights to the assets will be transferred as a contribution by the OJSC to the authorized capital of the CJSC, 100% of which is owned by the OJSC. Reorganization in the form of a spin-off involves the purchase by the reorganized LLC of securities (shares, shares) of the spun-off legal entity, their value is considered equal to the value of the net assets of the spun-off enterprise on the state day. registration.

The transfer of property rights (the property constitutes the authorized capital of the spun-off enterprise) is carried out as a contribution to the mouth. capital of the spun-off enterprise without changing the mouth. capital of the reorganized legal entity, i.e. transfer to book. financial statements are reflected as a cash investment and accounted for at initial cost).

- Net assets:

780 thousand + 740 thousand + 560 thousand + 45 thousand – 320 thousand = 1,805,000 rubles.

- Net assets minus the amount of authorized capital:

1,805 thousand - 2,420 thousand = 615 thousand rubles - will be reflected as an uncovered loss.

Accounting entries:

| Operation | DEBIT | CREDIT | Amount (thousand rubles) |

| the transfer of money from the joint-stock company is reflected | 76 “Settlements with various debtors and creditors” | 51 “Current accounts” | 780 |

| transfer of receivables reflected | 76 | 62 “Settlements with buyers and customers” | 740 |

| transfer of shares reflected | 76 | 58 social account “Units and shares” | 560 |

| transfer of the exclusive right to the trademark is reflected | 76 | 04 | 45 |

| transfer of loan debt is reflected | 66 “Settlements for short-term loans and borrowings” | 76 | 320 |

| financial investments in shares of the company are reflected | 58 social account “Units and shares” | 76 | 1 805 |

The difference between the value of rights to property contributed as payment for property and the nominal value of the acquired securities (share, share) is not considered profit or loss.

Who submits declarations for the affiliated company

Ideally, the joining company should report all taxes before making an entry in the state register. If she doesn’t make it in time, then the very next day after the reorganization, the Federal Tax Service Inspectorate at the place of its registration will refuse to accept declarations. In this case, all tax reporting for the predecessor must be submitted by the successor organization to its inspectorate.

Accountants and inspectors often doubt: does the assignee need to combine the indicators for the last tax or reporting period into one declaration? Or submit two declarations - one for yourself, the other for the affiliated organization?

In general, indicators are not combined. This means that the legal successor should submit a separate declaration for the affiliated legal entity to its inspectorate. In the event that, after the reorganization, errors of the predecessor are discovered, the successor must pass for the annexed one.

VAT is special. Officials say that when reporting for the last quarter, the successor needs to combine the transactions that it made itself and those made by the acquired company. So, if the merger took place on December 31, and the predecessor did not report on VAT for the fourth quarter before this date, then the successor, until January 20 of the next year inclusive, submits not two, but one declaration. It reflects the indicators for both legal entities (letter of the Ministry of Finance of Russia and the Federal Tax Service of Russia dated 03/09/11 No. KE-4-3 / [email protected] ). But this conclusion seems doubtful to us, since combining indicators can lead to confusion. We believe that if the successor files two VAT returns, this will not lead to conflicts, but, on the contrary, will help to avoid troubles.

Please note: the deadline for submitting declarations will not be shifted due to the reorganization. For example, for income tax for the year, the assignee is required to report no later than March 28 of the following year. In this case, the report must be submitted both for yourself and for your predecessor.

How to start accounting in an LLC after converting from a JSC?

Reform of joint stock companies, the need to maintain a mandatory register of shareholders and legal disputes with shareholders regarding information disclosure are encouraging an increasing number of joint stock companies to transform into limited liability companies. The attractiveness of LLC is obvious - it is the smaller size of the authorized capital, and the absence of the need to report to shareholders, and the lack of publicity and the need to conduct mandatory audits.

Reorganization has its own characteristics, such as introductory and annual reporting, reporting to funds and tax authorities.

According to Art. 57 of the Civil Code of the Russian Federation, reorganization of a legal entity (merger, accession, division, separation, transformation) can be carried out by decision of its founders (participants) or a body of the legal entity authorized to do so by the constituent documents.

GOOD TO KNOW

Reorganization of a joint stock company in the form of transformation represents a change in the organizational and legal form of the company.

For accounting purposes, it is important to remember two points:

- on the transfer deed;

- on opening financial statements.

Issues related to the transfer of property and obligations to the legal successor upon change as a result of reorganization in the form of transformation of the organizational and legal form of ownership are subject to settlement in the transfer act (clause 41 of Order of the Ministry of Finance of the Russian Federation dated May 20, 2003 No. 44n “On approval of Guidelines for the preparation of financial statements when carrying out the reorganization of organizations") (hereinafter referred to as the Guidelines).

GOOD TO KNOW

The transfer act is approved by the general meeting of participants simultaneously with the approval of the decision on the reorganization of the company. The decision is made unanimously by all participants.

The opening financial statements of an organization resulting from reorganization in the form of transformation are compiled by transferring the indicators of the final accounting statements of the organization being reorganized in the form of transformation (clause 43 of the Methodological Instructions).

The reorganized organization draws up its final financial statements on the day preceding the entry into the Unified State Register of Legal Entities about the newly formed legal entity. On the specified date, it closes the profit and loss account and distributes (directs for certain purposes) net profit in accordance with the decision of the founders (clause 42 of the Methodological Instructions). On the date of state registration, the newly formed organization prepares its opening financial statements. Indicators from the final accounting statements of the reorganized organization are transferred to it (clause 43 of the Methodological Instructions). The indicators of the final financial statements of the defunct JSC are transferred to the accounting of the new legal entity. LLC has the right to independently develop a transfer methodology and consolidate it in its accounting policies (clause 7 of PBU 1/2008).

POSITION OF THE COURT

Failure to submit a deed of transfer along with the constituent documents, as well as the absence in it of provisions on succession of obligations of the reorganized company, entails a refusal of state registration of newly emerged legal entities.

— Resolution of the Eighteenth AAS dated April 20, 2012 No. 18AP-2495/12.

Let's give an example of introductory reporting. JSC "Capital" is reorganizing from 01.08.2015 into LLC "Capital".

GOOD TO KNOW

Reorganization in the form of transformation must be distinguished from transformation of the type of joint stock company. From September 1, 2014, the division of joint stock companies into open and closed was abolished, and the concept of public and non-public companies was introduced (clause 66.3 of the Civil Code of the Russian Federation). In this case, re-registration or reorganization of closed joint-stock companies and open joint-stock companies is not required (clauses 7, 10 of Law No. 99-FZ).

LLC Capital

Formation of authorized capital

If the decision of the founders provides for an increase in the authorized capital of the resulting organization compared to the authorized capital of the reorganized organization, including from its own sources (additional capital, retained earnings, etc.), then in the introductory financial statements of the organization that arose as a result reorganization in the form of transformation, the amount of the authorized capital fixed in the decision of the founders is reflected.

If the amount of the authorized capital provided for in the decision of the founders does not coincide with the value of the net assets of the emerging organization, then the numerical indicators of the “Capital and Reserves” section of the opening balance sheet are formed in the following order.

If, during the conversion of shares, the value of the net assets of the organization, which arose as a result of reorganization in the form of transformation, exceeds the amount of the authorized capital, the numerical indicators of the section “Capital and Reserves” of the opening balance sheet are formed in the amount of the value of net assets with a division into authorized capital and additional capital (excess net asset value over the total par value of shares).

In other cases, if the value of the net assets of the emerging organization turns out to be greater than the amount of the authorized capital, then the difference must be settled in the opening balance sheet in the section “Capital and reserves” with the numerical indicator “Retained earnings (uncovered loss).”

IMPORTANT IN WORK

After the reorganization of a JSC into an LLC, it is impossible to simply continue maintaining accounting records. In this case, the LLC will have its own accounting. You just need to start maintaining it not from scratch, but on the basis of the accounting data of the JSC that has ceased to operate.

Depreciation calculation

Depreciation on fixed assets, profitable investments in tangible assets and intangible assets by an organization resulting from reorganization in the form of transformation is calculated based on the useful life established by the reorganized organization (legal predecessor) when accepting these objects for accounting.

Profit generation

The reorganized company, when preparing its final financial statements on the day preceding the registration of the resulting organization, closes its profit and loss accounts and distributes (according to the decision of the founders) the amounts of net profit. Indicators from the final accounting statements of the reorganized organization are transferred to the opening financial statements of the new company.

Explanatory note

Often reorganization has a number of features that cannot be indicated in the financial statements. In this regard, it is recommended to reflect these features in the form of an explanatory note. These features include:

- expenses related to reorganization;

- formation of the authorized capital of emerging organizations;

- discrepancy (clarification) of the data of the transfer act or separation balance sheet with the numerical indicators of the final financial statements;

- discrepancy between the data in the final financial statements and the numerical indicators of the opening balance sheet;

- unfulfilled conditions and other events related to the recognized reorganization, etc.

First annual reporting after reorganization

The first thing you need to pay attention to is the question of whether it is necessary to submit annual reports at all. The answer depends on the date of registration of the company.

A legal entity created as a result of reorganization is required to prepare and submit a complete set of annual financial statements from the date of state registration to the end of the reporting period. In this case, it matters when the organization was registered - if registration occurred after September 30, the first annual reports will be submitted only at the end of the next calendar year (taking into account the period of activity in the year of formation of the legal entity). This directly follows from the norm of Part 3 of Art. 15 of the Law on Accounting, in which an exception is made only in relation to credit organizations. Let us recall that, in accordance with the new rules, an economic entity is given the right to declare a period of less than one calendar quarter (IV) as reporting and to submit annual financial statements on a general basis.

Please note: exemption from the preparation and submission of reports for the period of activity of an organization that arose after September 30 of the current year does not relieve it from the obligation to prepare reports as of the date of state registration.

In our case, such reporting is necessary.

The second point to pay attention to is the indicators that may change. In some cases, changes in the quantitative assessment of fixed assets are possible. For example, at the end of the year we carried out an inventory and did not find fixed assets that were reflected in the act and in the opening balance sheet.

Accounts receivable and payable may also change, because old debts may “resurface”, which were also not taken into account at the date of reorganization.

And the last point that often comes up is paying taxes. The legal successors of the reorganized legal entity fulfill the latter’s obligations to pay taxes, fees, penalties, and fines (clauses 1, 2 of Article 50 of the Tax Code of the Russian Federation). Reorganization of a legal entity does not change the deadlines for the fulfillment of its obligations to pay taxes by the legal successor (legal successors) (Clause 3 of Article 50 of the Tax Code of the Russian Federation). That is, if the reorganized OJSC does not fulfill its obligations to submit reports and pay taxes for the last tax period, these obligations must be fulfilled by the LLC. Recommendations for the preparation of tax returns and calculations in a situation where all reporting is submitted by the legal successor are given in the letter of the Federal Tax Service of Russia dated May 12, 2014 No. GD-4-3/ [email protected]

GOOD TO KNOW

The new legal entity resulting from the transformation must indicate the starting point of its business activities in the form of introductory statements, and at the end of the first reporting period, generate the first annual statements.

Tax period during reorganization

Since reorganization involves the transfer of rights and obligations for taxes, all rights and obligations for taxes are transferred to the new company. When a legal entity of one type is transformed into a legal entity of another type (change of organizational and legal form), the rights and obligations of the reorganized legal entity are transferred to the newly emerged legal entity in accordance with the transfer act (clause 5 of Article 58 of the Civil Code of the Russian Federation).

According to paragraph 2 of Art. 55 of the Tax Code of the Russian Federation, if an organization was created after the beginning of the calendar year, the first tax period for it is the period from the date of its creation to the end of the given year. In this case, the day of creation of the organization is recognized as the day of its state registration.

Example 1.

OJSC "Capital" was reorganized into LLC "Capital" from 01.08.2015.

Consequently, taxes are paid by OJSC Capital until July 31, 2015, including:

- tax under the simplified taxation system;

- transport tax;

- property tax.

From 01.08.2015, the above taxes are paid by Capital LLC.

The issue of recognition of losses is often controversial. Many taxpayers are familiar with the situation in which the tax authority skeptically assesses the losses received by the company and calls the taxpayer to a loss commission.

Thus, in the resolution of the Federal Antimonopoly Service of the East Siberian District dated January 30, 2014 No. A33-19851/2012, the court indicated that a reorganized organization (OJSC) has the right, when calculating income tax, to take into account the losses received by its legal predecessor, since for the organization in respect of which the decision was made on reorganization, the last tax period is the period before the completion of the reorganization process, and the first tax period for the successor organization is from the date of state registration until December 31 of the current year.

Companies using the simplified tax system can apply similar practices. A loss can be carried forward for 10 years following the year in which it was incurred. For example, the last year in which a loss incurred in 2014 can be expensed would be 2024.

Another stumbling block may be unpaid taxes.

Example 2.

Based on the results of a desk (on-site) tax audit for the six months, an arrears of tax paid in connection with the application of the simplified taxation system in the amount of 360,000 rubles were discovered. Capital LLC received a tax audit report U 3258/47.

Accordingly, as a legal successor, it is obliged to pay this arrears. If you do not agree with the inspection data, then the act and decision can be challenged, again acting as a legal successor for tax obligations.

POSITION OF THE MINISTRY OF FINANCE

The reorganization of the organization does not in any way affect the provisions established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, deadlines for submitting information on the income of individuals.

— Letter dated September 25, 2012 No. 03-02-07/1-229.

2-NDFL certificates for company reorganization

The situation regarding the submission of 2-NDFL certificates to the tax authority is debatable. On the one hand, people continue to work in the company and nothing changes; in addition, during the reorganization, all responsibilities are transferred to the legal successor (clauses 1, 2 of Article 50 of the Tax Code of the Russian Federation). But the tax authority believes that information must be submitted twice.

According to the letter of the Federal Tax Service dated October 26, 2011 No. ED-4-3/17827, information must be provided by the reorganized company for the last tax period, which, in accordance with clause 3 of Art. 55 of the Tax Code of the Russian Federation is the period of time from the beginning of the year until the day the reorganization is completed. And the second time, a company that has already been reorganized into an LLC must submit information.

If the reorganized organization fails to fulfill its obligations to submit tax returns to the tax authority and pay taxes for the last tax period, these obligations must be fulfilled by the legal successor of the reorganized organization.

As for the deadlines, information in Form 2-NDFL must be submitted to the tax authority at the place of registration of the tax agent no later than April 1 of the year following the expired tax period (clause 2 of Article 230 of the Tax Code of the Russian Federation).

You should also pay attention to the issue of providing deductions. For example, an employee purchased an apartment and has the right to take advantage of a tax deduction. The apartment was purchased in July 2015, the employee submitted documents to the tax authority in March 2016.

In this case, the taxpayer submits to the tax authority two certificates in form 2-NDFL: a certificate issued by the previous tax agent before the reorganization of the legal entity on the taxpayer’s income from the beginning of the tax period until the date of termination of the activities of this legal entity, and a certificate issued by the new tax agent on income taxpayer from the date of state registration of the newly established legal entity until the end of the tax period.

IMPORTANT IN WORK

Starting from 2021, a new reporting form 6-NDFL will be introduced by law. Quarterly calculation of personal income tax will be introduced in 2021. The inspectorate will need to provide generalized information about the earnings of individuals who received income in your company for the first quarter, half a year, 9 months and a year. However, this reporting form will not affect the issues of the reorganization carried out in 2015.

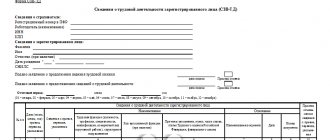

Reporting to funds

If an organization was liquidated or reorganized before the end of the calendar year, the last billing period for it is the period from the beginning of this calendar year until the day the liquidation or reorganization was completed (Part 4, Article 10 of Law No. 212-FZ).

If an organization created after the beginning of a calendar year is liquidated or reorganized before the end of this calendar year, the calculation period for it is the period from the date of creation to the day the liquidation or reorganization is completed (Part 5 of Article 10 of Law No. 212-FZ).

Example 3.

OJSC Capital calculates insurance premiums until July 31, 2015. Accordingly, RSV-1 and 4-FSS reports are submitted for the 1st, 2nd and 3rd quarters (July).

Capital LLC submits reports for the III (August, September) and IV quarters.

However, it should be noted that reorganization in the middle of the year is unprofitable from the point of view of paying insurance premiums. The fact is that insurance premiums are calculated before reaching the maximum value of the base for calculating insurance premiums, which is established by the Government of the Russian Federation, and at the same time, Law No. 212-FZ does not provide for succession in terms of the base for calculating insurance premiums during the reorganization of the payer of insurance premiums - an organization.

The letter of the Ministry of Health and Social Development of the Russian Federation dated May 28, 2010 No. 1375-19 states that when reorganizing a legal entity in the form of transformation, the newly emerged organization, when determining the base for calculating insurance contributions, does not have the right to take into account payments and other remuneration accrued in favor of employees in the reorganized organization. However, such an opinion can be argued in court, and the Supreme Arbitration Court of the Russian Federation stands in defense of insurance premium payers.

Thus, in the determination of October 16, 2013 No. VAS-14361/13, the Supreme Arbitration Court of the Russian Federation concluded that when determining the base for calculating insurance premiums, payments and other remunerations accrued in favor of employees before the exclusion of the reorganized organization from the Unified State Register of Legal Entities and the reporting of the legal predecessor were legally taken into account in terms of calculating wages to employees and insurance premiums, it is subject to transfer to the legal successor; the base for calculating insurance premiums of the predecessor is also subject to accounting when determining the base of the legal successor.

POSITION OF THE MINISTRY OF FINANCE

Considering that when a legal entity of one type is transformed into a legal entity of another type (change of organizational and legal form), a new legal entity arises, an organization reorganized by transforming a closed joint-stock company into an LLC, which used a simplified system before the reorganization, the transition to this special tax regime should carried out in the manner established by clause 2 of Art. 346.13 of the Tax Code of the Russian Federation as for a newly created organization, subject to the provisions of paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

— Letter dated February 24, 2014 No. 03-11-06/2/7608.

Where to start accounting

As we have already said, the indicators of the final accounting statements of a defunct JSC are transferred to the accounting of the new legal entity. LLC has the right to independently develop a transfer methodology and consolidate it in its accounting policies (clause 7 of PBU 1/2008).

For example, to accept assets and liabilities, you can use the subsidiary account “00” in LLC accounting. This method is quite convenient and simple.

The postings in this case will look like this:

| Debit | Credit | Operation |

| 01 | 00 | The cost of fixed assets received by the LLC as a result of reorganization is taken into account |

| 10 (41…) | 00 | Reflects the residual value of materials, goods and other assets received by the LLC as a result of the reorganization |

| 00 | 60 (76…) | Reflects the obligations received by the LLC as a result of the reorganization |

GOOD TO KNOW

When reorganizing in the form of transformation, the costs of its implementation can be repaid at the expense of the founders, without reflecting them in the company’s accounting records. In accordance with the decision of the founders on reorganization in the form of transformation, expenses associated with the re-registration of documents may be incurred at the expense of the founders.

The new LLC reflects these indicators in its accounting in the assessment reflected in the transfer act or separation balance sheet.

In accordance with the decision of the founders, reflected in the decision (agreement) on reorganization, this may be an assessment of:

- at residual value;

- at current market value;

- at a different cost (actual cost of inventories, initial cost of financial investments, etc.).

For fixed assets, profitable investments in tangible assets and intangible assets, the accountant of the new legal entity will calculate depreciation based on the useful lives established by the reorganized organization (legal predecessor) when accepting these objects for accounting in accordance with current regulations (clause 42 of the Methodological Instructions) .

Acceptance for accounting of assets and liabilities received from the transformed JSC must be documented in primary documents (Part 1, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

As such, you can use unified primary documents that are used when accepting a particular property for accounting in the event of its normal receipt by the organization. For example, when accepting fixed assets, you can use the Act in form OS-1 and the Inventory card for recording a fixed asset object OS-6 (approved by Resolution of the State Committee on Statistics of the Russian Federation dated January 21, 2003 No. 7). Instead of these forms, you can use forms that you have developed yourself.

If the debtor joined the creditor

It happens that the merged company is a debtor, and the “main” company is a creditor. Then, after the reorganization, the creditor and debtor become one, and the debts are automatically repaid.

Does the successor company have taxable income in the amount of the predecessor's debt? Two years ago, officials answered this question positively (letter of the Ministry of Finance of Russia dated 10/07/09 No. 03-03-06/1/655). But then they changed their point of view and began to argue the opposite: the assignee has no taxable income (letters from the Ministry of Finance of Russia dated July 30, 2010 No. 03-03-06/1/502 and dated November 29, 2010 No. 03-03-06/1/744 ). It is the last conclusion, in our opinion, that corresponds to the law.

The opposite situation is also possible, when the lender joins the borrower. Here, the assignee also does not have to show income in the form of former debt. The Ministry of Finance of Russia agrees with this in letter dated November 15, 2010 No. 03-11-06/2/177. True, it talks about income under a simplified system, but this does not change the essence of the matter.

Let us add that interest on the loan accrued before the reorganization does not need to be adjusted after the merger. This was reported by specialists from the financial department in a letter dated March 14, 2011 No. 03-03-06/1/135.

Does the TIN change?

From a legal point of view, during reorganization, the enterprise ceases to exist and a completely new company is created. In this regard, all company details are changing.

During the procedure, the taxpayer number of the converted company is removed from the register. In the future, this TIN will no longer be used. The newly created enterprise is assigned a different number .

If the legal form changes without reorganization, the TIN remains the same. For example, when an OJSC is transferred to a CJSC, no changes are made in the tax service register.

Accounting for property received upon annexation

The acquiring company must not include in taxable income the value of property received from the predecessor. This is directly stated in paragraph 3 of Article 251 of the Tax Code of the Russian Federation. By the way, this rule also applies to obligations, in particular accounts receivable.

The received objects must be depreciated as follows. For the period up to the month when the merger took place, and for this month itself, depreciation is calculated by the joining legal entity. From the first day of the month following the date of accession, depreciation is charged by the successor.

What it is?

Transformation is a special type of reorganization, which is a change in the organizational and legal form of a company, while another legal entity is created, and the old one ceases its activities, the constituent documents and charter are changed, but all rights and obligations are retained after the procedure.

A significant difference from other types of reorganization, that is, merger, separation, accession, is that one legal entity begins to participate in the procedure and, as a result, one company is also formed .

The process has some features:

- From an economic point of view, the transformed organization is one and the same company, which has only changed its management structure and legal status, and no changes have occurred in other areas of the company’s life.

- From a macroeconomic point of view, such a reorganization is a neutral action in relation to capital, since there is no division or merger of the authorized capital of several companies. This nuance is the most significant difference. In other cases, assets and liabilities are either combined into one fund or divided among several organizations.

- From a legal point of view, during the transformation, a completely new enterprise is created, which is a complete successor to the obligations and rights of its predecessor. The book value of the property does not change.

There are two types of transformation:

- Voluntary . Carried out only on the initiative of the company owners. For example, the procedure can be carried out if the owners or founders come to the conclusion that the enterprise will operate most effectively in a different legal form. Most often, for this reason, an LLC is transformed into a joint stock company.

- Mandatory . It is carried out upon the occurrence of certain circumstances defined by law. There are several such cases: participants in a non-profit organization intend to conduct business, and it is transformed into a partnership or society;

- the number of participants in an LLC or CJSC exceeds 50 people, and it is necessary to reorganize the enterprise into an OJSC or cooperative.

Reorganization does not include a change in the type of joint stock company, for example, a transition from an OJSC to a CJSC. This action is recorded as a name change.

Tax base for VAT

The successor can deduct the tax that the predecessor paid to its suppliers (or at customs), but did not have time to accept for deduction. To do this, standard conditions must be met. Namely, the presence of an invoice, a “primary” document and registration for use in transactions subject to VAT. In addition, there is an additional condition: the predecessor must transfer documents confirming payment (clause 5 of Article 162.1 of the Tax Code of the Russian Federation).

In addition, the acquiring company has the right to deduct VAT, which the predecessor accrued upon receipt of the advance. The assignee can do this after the sale of the prepaid goods, or after termination of the transaction and return of the advance payment. There is one limitation here - the deduction must be accepted no later than one year from the date of return (clause 4 of Article 162.1 of the Tax Code of the Russian Federation).

Particular attention should be paid to the date of the invoice issued in the name of the predecessor. If the document is dated after the accession, then inspectors will most likely not allow the deduction to be accepted. In such a situation, the accountant can only contact the supplier and ask him to correct the document.

Introductory accounting of the successor company

The newly created organization needs to draw up an opening balance sheet as of the date of transformation (that is, on the day on which the entry was made in the Unified State Register of Legal Entities). The data in the opening statements will coincide with the data in the closing balance sheet of the predecessor.

The only thing that may differ is the size of the authorized capital, because the founders have the right to either increase or decrease it.

Column 3 of the balance sheet should reflect information as of the date of reorganization. There will be dashes in columns 4 and 5, since as of December 31 of last year and the year before, the successor enterprise had not yet been created.

The opening balance is submitted to the Federal Tax Service either immediately after registration or at the end of the current quarter, depending on what is more convenient for “your” inspector.

Personal income tax reporting

Merger, like all other forms of reorganization, does not interrupt the tax period for personal income tax. This is explained by the fact that the company is not a taxpayer, but a tax agent. In addition, labor relations with personnel continue, as stated in Article 75 of the Labor Code of the Russian Federation. This means that there is no need to submit any interim reporting on personal income tax during reorganization.

There is one important nuance here: if an employee brings a notice for property deduction, where the predecessor organization is indicated as the employer, the accounting department of the successor company must refuse him. The employee will have to go to the tax office again and get another notice confirming the deduction related to the legal successor. Such clarifications were given by the Russian Ministry of Finance in letter dated August 25, 2011 No. 03-04-05/7-599. In practice, inspectors everywhere follow these clarifications and cancel the deduction provided under an “outdated” notification.

Is it possible to inherit the “simplified”

If the predecessor was on the simplified tax system, and the successor plans to remain on this special regime after the transformation, no applications need to be submitted. If all the conditions necessary for the application of the “simplified tax” are met, the right to it automatically passes to the newly formed company. And although officials do not agree with this (see letter from the Federal Tax Service for Moscow dated 10/08/10 No. 16-15/105637), judges are entirely on the side of taxpayers (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/15/10 No. 563/10).

* Full title of the document: Guidelines for the preparation of financial statements during the reorganization of organizations (approved by order of the Ministry of Finance of Russia dated May 20, 2003 No. 44n).

Insurance premiums and reporting to funds

In connection with the merger, the question inevitably arises: is the successor company obliged to calculate the taxable base for contributions of the “joined” employees from scratch? Or is it permissible to continue the countdown that began before the reorganization?

The amount of insurance premiums directly depends on the answer. If the assignee resets the base, he will automatically lose the right to exempt accruals from contributions that exceed the maximum amount (in 2011 it is equal to 463,000 rubles). If he “inherits” the base, then along with it he will receive the right not to charge contributions for the excess amount.

We believe that the database does not need to be reset, because upon merger, a new legal entity does not arise. But those who choose this route may have to contend with foundation inspectors.

In any case, paying contributions and submitting settlements for them for the predecessor is the responsibility of the successor (Part 16, Article 15 of Federal Law No. 212-FZ).

Answers to common questions

Question No. 1. In the case of reorganization according to the form of division, how should organizations resulting from the reorganization prepare opening financial statements?

Opening financial statements must be prepared, taking into account the data of the final statements and the separation balance sheet.

Question No. 2. Is it necessary to close loss and profit accounts, or can it be done without it?

No, closing loss and profit accounts cannot be avoided, since it is necessary to determine the amount of net profit of all organizations that decided to participate in the reorganization.