Staffing: unified form T-3

From January 1, 2013, commercial organizations are not required to draw up personnel documents according to approved forms, that is, they can use independently developed document forms.

For more information about this, see the article “Primary document: requirements for the form and the consequences of its violation” .

However, the unified T-3 form is a fairly convenient and familiar way of designing the staffing arrangement. In addition, the staffing table of the T-3 sample form contains all the necessary information, so most employers continue to use this particular form of document.

Let us remind you that the staffing table - a form of the unified form T-3 - and the procedure for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. In order for users of our site to know how to draw up a staffing table, a sample document is presented in its pure form (in this section) and in the completed state (in the last section).

Storage period and frequency of compilation

There are no rules in the legislation of the Russian Federation that would regulate the frequency of drawing up the staffing table. If the company has a high level of staff turnover, it is advisable to schedule it once a month. However, most often it is compiled once every 6 or 12 months, only making changes if necessary. This is due to the fact that such a schedule is a so-called planning document.

It is also possible to draw up a T-3 form for several years - but this can only be done by those companies that do not plan to adjust the staff, introduce new positions or remove some of the existing ones.

Therefore, this option cannot be considered as appropriate at the time of 2021 - crisis conditions force organizations to constantly change various aspects of their activities.

As for the retention period, at the moment the document must be stored in the company for 3 years. In this case, this period is calculated from the next year after the year in which the schedule lost its force. Staff arrangements (which can serve as a lightweight alternative to the paper in question) must be stored for 75 years.

What information does the unified staffing form contain?

The staffing table is one of the internal regulatory documents that every organization (or entrepreneur with employees) must have.

What other personnel documents should the employer prepare, read the article “Personnel documents that must be in the organization.”

The staffing table contains:

- list of structural divisions;

- names of positions, specialties and professions indicating qualifications;

- information on the number of staff units;

- information on salaries: tariff rates and salaries, bonuses, wage fund (payroll), including for the organization as a whole.

The main purpose of the staffing table is to determine the structure, staffing levels and size of the payroll. The document does not contain the names of employees and their staffing positions. The staffing arrangement (synonyms: staff replacement, staff list) is not established by regulatory documents. Staff replacement, unlike the staffing table, is not a mandatory document for the organization, however, it is often used. This is due to the fact that full-time replacement allows you to track vacancies, as well as the filling of staff positions when hiring a part-time employee or if the position is divided between several employees. Staff replacement is usually developed on the basis of the staffing table of the T-3 form with the addition of a column in which the last names, first names, and patronymics of employees occupying certain positions are entered. If an organization uses staff replacement in its activities, then it must be taken into account that this document must be stored for 75 years.

ConsultantPlus experts explained in detail how the staffing arrangement is drawn up. Get trial demo access to the K+ system and go to the HR Guide for free.

Read about retention periods for personnel documents here.

Important nuances: freelancers, type of work instead of position

When we draw up the school’s staffing schedule for 2021 according to all the rules, it is important to take into account the presence of “freelance staff”.

Freelance employees are persons hired by an organization to perform one-time work on the basis of a civil contract. They are not subject to labor legislation, therefore they are not included in the “staff” (Article 11 of the Labor Code of the Russian Federation). In addition, the names of the positions specified in the document must correspond to the names specified in qualification reference books or approved professional standards.

How to properly draw up a staffing schedule

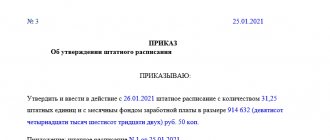

Drawing up the staffing table can be entrusted to any employee of the organization, and it must be approved by order (instruction) of the manager or other authorized person. If changes are needed to the staffing table, an order to amend the staffing table is issued. The procedure for issuing documents on approval of the staffing table must be enshrined in the constituent documents.

Read about the nuances of drawing up such orders in the material “Orders for core activities - what are these orders?”

When drawing up the staffing table for the first time, it is assigned the number 1, and subsequently continuous numbering is used. The staffing table indicates the date of preparation, as well as the date from which the staffing table comes into effect. These two dates may vary. Form T-3 provides an indication of the period of validity of the staffing table, details of the order for its approval and the number of staffing units.

What is this document for? Is it mandatory?

The staffing table is necessary so that it is possible to justify situations of dismissal of employees due to staff reduction in the event of their appeal to the court. It can also serve as a justification for refusal to hire (due to the lack of a particular position). Therefore, competent drafting of this document is the basis for legally defending the interests of the company.

In addition, inspection companies (in particular, labor inspectorates) often require its presence during inspections. The absence of a document falls under the violation of the Russian Federation law on labor protection. Accordingly, according to the Code of Administrative Offenses of the Russian Federation (Article 5.27), an organization that does not provide a schedule faces a fine ranging from 30 to 50 thousand rubles. In addition, the official will be fined (the amount varies from 1 to 5 thousand rubles).

Finally, without a staffing table, it is not possible to prove that at the time of the layoff the company did not have the opportunity to provide employees with alternative vacancies.

Thus, the presence of this paper is not mandatory from the point of view of the legislation of the Russian Federation, and in theory, the decision of the tax or labor inspectorate to levy a fine can be challenged in court. However, in practice, any company should maintain a document to prevent possible conflict situations. It is important to understand that for budgetary organizations its presence is enshrined in law.

Code of the structural unit in the staffing table and other information

The staffing table in the tabular section begins to be filled out by indicating the names and codes of structural divisions. As a rule, the department code in the staffing table is indicated in an order that allows one to determine the subordination and structure of the entire organization.

If an organization has branches and representative offices, then it must be taken into account that they are a structural unit of the organization, and accordingly, the staffing table should be drawn up for the organization as a whole. Even if the head of the branch has been given the right to independently approve the staffing table, it is still drawn up as part of a single staffing table. ConsultantPlus experts explained how the T-3 form is filled out in this case. You can get a free trial access to the system and study authoritative opinion.

Column 3 of the staffing table contains the name of the position, specialty, profession, which are indicated in the nominative case without abbreviations. The name of the position or profession is assigned by the employer, if the work is not associated with difficult working conditions and the provision of benefits, otherwise, when indicating the position in the staffing table, you need to be guided by:

- for the All-Russian Classifier of Worker Occupations, Employee Positions and Tariff Classes (OK 016-94) (approved by Resolution of the State Standard of Russia dated December 26, 1994 No. 367);

- All-Russian Classification of Occupations (OKZ) OK 010-2014 (MSKZ-08) (approved by order of Rosstandart dated December 12, 2014 No. 2020-st);

- Qualification reference book for positions of managers, specialists and other employees (approved by Resolution of the Ministry of Labor of Russia dated August 21, 1998 No. 7);

- unified tariff and qualification directories of works and professions of workers by industry;

- professional standards (paragraph 3, part 2, article 57, article 195.1 of the Labor Code of the Russian Federation).

How to bring job titles into line with professional standards, read here.

If an organization hires employees to perform a certain type of work, and not for a position (profession, specialty), then this also needs to be reflected in the staffing table.

Next, in column 4 of the staffing table, the number of staff units is indicated. Staffing units can be indicated as full or incomplete. The content of an incomplete staff unit in the staffing table is indicated in shares, for example 0.25; 0.5; 2.75, etc.

When drawing up the staffing table, special attention should be paid to column 5 “Tariff rate (salary), etc., rub.” In the simplest case, this column of the staffing table indicates a fixed monthly wage.

In practice, when drawing up a staffing table, the question often arises about the correct execution of the document in situations where there is no fixed amount of remuneration, for example, with piecework payment. In this case, it is recommended to put a dash in column 4 of the staffing table, and in column 10 indicate: “Piece-piece wages / Piece-piece bonus wages” and provide a link to the local regulatory act that defines the procedure for establishing wages, as well as its amount for a certain standard production. It is recommended to follow a similar procedure when filling out the staffing table in a situation where the employee has an hourly wage rate.

If the staffing table provides for an incomplete staffing position, then in the column “Tariff rate (salary)” the amount of the full salary for the position is still indicated.

Who does the compilation?

At the moment, the legislation does not clearly define who should develop the document.

In companies with a branched organizational structure, the responsibility for compilation may lie with employees of the following departments:

- personnel service

- accounting

- legal department (least common situation)

In small companies, this can be done by the manager or any other person authorized by him. In this case, an order is issued in the name of a specific employee who will work with this document. Another option for determining who is responsible is to indicate this fact in the job description or employment contract.

To simplify the compilation procedure, it is necessary to specify its nuances in the office work instructions:

- terms and basic rules for development/changes

- form of order for approval of schedule and changes

- responsible persons for document preparation and signing of orders

- employees with whom you need to coordinate the draft schedule or its changes

- composition of regulations that regulate all issues related to it

How to fill out a staffing table: sample and example

A sample of filling out the staffing table of Form T-3 in a situation where there is no fixed salary, and there is also an incomplete staffing position, can be found on our website.

NOTE! In Art. 22 of the Labor Code of the Russian Federation states that payment should be equal for equal work. It follows from this that the “fork” of salaries in the staffing table is a violation of the Labor Code. Rostrud, in letter No. 1111-6-1 dated April 27, 2011, recommends that the same salary amounts be indicated in the staffing table for positions of the same name, and that the possibility of paying one of the employees wages (not salary) in a larger amount should be regulated through allowances and additional payments depending on the complexity work, quantity and quality of labor.

In columns 6, 7, 8 “Additional allowances, rub.” allowances are indicated - both accepted in the organization (for long working hours, increased responsibility, knowledge of foreign languages, work experience, etc.) and established at the legislative level (for example, for work in the Far North). The staffing table of the unified form assumes that these columns are filled in in rubles. If there are not enough columns to indicate all the allowances in force in the organization in the staffing table, then their number can be increased by issuing an order to supplement the staffing table form. It is recommended to do the same if the premiums are set as a percentage.

Column 9 “Total for the month” is filled out only if the salary and allowances are indicated in rubles. The instructions for drawing up the staffing table state that “if it is impossible for an organization to fill out columns 5–9 in ruble terms... the columns are filled in in the appropriate units of measurement (percentages, coefficients, etc.).” However, it is impossible to actually formalize the staffing schedule in this way. In such a situation, you can put dashes in this column, and in column 10 “Note” indicate a link to regulations, both internal and regulatory, that establish premiums. The link in column 10 to the document allowing you to set an increase for length of service will allow you not to change the schedule when the amount of the increase changes. Column 10 also indicates any information related to the staffing table.

In some situations, an employee may need an extract from the staffing table. A sample of filling out such an extract was prepared by ConsultantPlus experts. If you do not have access to the K+ system, get a trial demo access for free.

Why make up a “staff”

First of all, the document is necessary for planning. At its core, staffing structures the entire company and the hierarchy within it. The document shows how many departments there are in the organization, what governing bodies are provided and what direction is a priority. Having the schedule form at hand, anyone can easily form an opinion about the average number of employees, the monthly payroll and the type of activity of the company.

Based on this local act, it is very convenient to form a wage fund, confirm the validity of expenses for the Federal Tax Service, draw up statistical reports and applications to the employment service and recruitment agencies. By the way, it is important to remember that if a position is designated in the SR, then it must be occupied. If there is a vacancy, but there is no employee, the employment service should know about it. Otherwise, upon learning of the violation, they will be punished. This follows from the provisions of the Law of the Russian Federation of April 19, 1991 No. 1032-1 on employment.

In practice, a staffing form is necessary in the work of not only personnel officers, but also accountants. It is one of the forms that is most often required during tax audits, as it is a primary accounting document. How to properly draw up a staffing table - take into account all the requirements of labor legislation and the internal needs of the employing organization.

ConsultantPlus experts have prepared a detailed guide to working with staffing. We figured out not only how to fill it out, but also how to store it, how to provide it to inspectors, and how to make extracts. Use these instructions for free.

Nuances of registration and changes to the staffing table

The unified form T-3 requires the signatures of the head of the personnel service and the chief accountant, but it does not contain such requisites as a seal.

The frequency and timing of approval of the staffing table are not established by law, and each employer decides this issue independently.

Familiarization with the staffing table of employees is carried out only if this obligation of the employer is secured by a collective agreement, agreement, or local regulatory act (letter of Rostrud dated May 15, 2014 No. PG/4653-6-1).

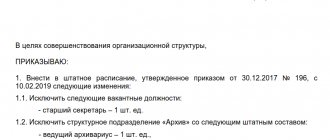

Changes may be made to the staffing table if it is necessary to supplement it with new positions and structural divisions or, conversely, to exclude them, as well as when changing salaries, renaming departments and positions. Changes in the staffing table are formalized by order. There are 2 ways to make changes to the staffing table:

1) issuing an order on the corresponding change;

2) issuance of an order approving a new staffing table.

When reducing staff or numbers, or changing salaries, changes are also made to the staffing table, but it must be taken into account that the date of entry into force of the changes cannot occur earlier than 2 months after the issuance of the order. This is due to the fact that employees must be notified 2 months in advance about the upcoming layoff (Part 2 of Article 180 of the Labor Code of the Russian Federation) or about upcoming changes in the terms of employment contracts.

The staffing table is kept permanently in the organization. Organizations carrying out control and supervisory functions (for example, the labor inspectorate, regulatory bodies of the Federal Social Insurance Fund of the Russian Federation, the Pension Fund of the Russian Federation, tax authorities) have the right to request this document when conducting inspections. In case of failure to provide the documents or copies thereof requested by the controllers, including the staffing table, the employer may be subject to a fine of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Explanatory note

This act is required when a new schedule is approved, which indicates previously unused positions. The note provides the rationale for the adoption of these changes. The same rule applies to cases where the number of employees is reduced.

Example of an explanatory note

The note is drawn up by the management of the unit where the innovations took place. The adjustments made must be justified. The document is stamped with a visa from the head of the organization, which gives reason to believe that he agrees to such adjustments.

Results

The staffing table is a mandatory document that any employer must have. An example of filling out a staffing table using Form T-3 can be found on the Internet on many accounting and legal websites, but a sample with the situations described above is rarely provided. When preparing the staffing table, form T-3, a sample of which is given in this article, can be a good help for both experienced and novice personnel officers.

To learn how to properly organize personnel records, read the article “Personnel records management from scratch - step-by-step instructions.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.