When is it necessary to change the tax system?

The need to change the aid to navigation arises if the company violates the criteria established for the current special regime. Variations are possible.

- You predict that in the future you will violate the criteria for applying a special regime: for example, you are on a patent and are going to hire more than 15 employees. In this case, you can choose a “soft” transition option and choose a new profitable special regime from the new tax period.

- You suddenly violate the criteria and are forced to switch to the main system from the beginning of the period in which the violation occurred (these periods differ for different systems). For example, you did not keep track of the amount of income on the simplified tax system, and it exceeded 150 million for the year: you will have to switch to OSNO from the beginning of the quarter in which the violations were committed.

You will also have to change the aid to navigation if federal or regional laws introduce new restrictions on special regimes. For example, local authorities cancel the use of UTII for your type of activity. Another current example: you are on UTII and selling sneakers, and officials introduce a restriction on the use of UTII when selling labeled goods, which include shoes, which means you will have to switch to a different tax regime. Since innovations usually come into force from the new calendar year, the entrepreneur has time to maneuver and choose a new aid.

Application example

How to find out what taxation system an individual entrepreneur is on - is it possible to check?

Although, in essence, the application and notification have the same meaning, the form to fill out is different for all three systems.

Application for Unified Agricultural Tax

It is prohibited to make mistakes or correct anything in applications.

Application for UTII

This could create problems in the future if, for example, a mistake was made in the name of the business. It will also take more time (while the tax office will consider one application, reject it, then consider a second one, etc.). Therefore, it is best to entrust its completion to an accountant.

Application for patent

Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

How to take into account expenses for fixed assets and intangible assets when changing a simplified tax system object

Often the date of purchase of a fixed asset (FPE) item and the date of its commissioning are significantly different. The equipment needs to be installed and configured, the building needs to be repaired, etc.

If a fixed asset was acquired using the “Revenue” object, but it was put into operation after the transition to the “Revenue minus expenses” object, then the costs of purchasing this fixed asset can be included in expenses.

The fact is that, in accordance with paragraphs. 1 clause 3 art. 346.16 of the Tax Code of the Russian Federation, expenses for the acquisition of fixed assets are recognized for the simplified tax system only after the facility is put into operation. This is indicated by the Ministry of Finance with a letter dated October 18, 2017 No. 03-11-11/68187.

For intangible assets (IMA), this approach cannot be applied. Expenses for the acquisition (creation) of intangible assets must be recognized at the time the object is accepted for accounting (clause 2, clause 3, article 346.16 of the Tax Code of the Russian Federation), there is no concept of “putting into operation” in this case. Therefore, if a businessman bought (created) intangible assets and paid all the costs when using the “Income” object, then after moving to another object these expenses cannot be taken into account in any case.

Fixed assets are often expensive, and businessmen buy them in installments. If the operating system was purchased using the “Income” option, but the businessman made part of the payment after switching to “Income minus expenses,” then the cost of the operating system in this part can be taken into account in expenses (letter of the Ministry of Finance of the Russian Federation dated April 3, 2012 No. 03-11-11 /115).

Tax authorities express a similar opinion for intangible assets. For example, in a situation where a businessman, while using the “Revenue” object, entered into a license agreement for the use of software, which is valid for several years. Those license fees that were paid after the transition to “Revenue minus expenses” can be taken into account in expenses (letter of the Ministry of Finance of the Russian Federation dated May 4, 2013 No. 03-11-06/2/18966).

In the opposite situation, if OS or intangible assets were received from the supplier when using the “Revenue minus expenses” object, but it was paid for or put into operation (for OS) after the transition to the “Revenue” object, it will not be possible to take into account the costs.

Therefore, if a businessman plans to switch to the “Revenue” object, then you need to try to take into account, pay for and put into operation all acquired fixed assets and intangible assets before the transition date.

Changing the tax system voluntarily

If you voluntarily and planned change the tax system, it all depends on which SNO you leave with and which one you choose in return. First, let's look at how to abandon the current special mode, if necessary, then how to switch to a new aid to navigation.

Refusal from the simplified tax system . It will be possible to voluntarily abandon this tax regime only from the beginning of the new calendar year: submit notification 26.2-3 to the Federal Tax Service no later than January 15 of the new year. There is no need to wait for a reaction from the tax office. If you only plan to change the object of taxation (“Income” or “Income minus expenses”), this can also be done from the beginning of the calendar year: submit notification 26.2-6 to your Federal Tax Service before December 31 of the current year in order to start working in a new way from next year. In this case, also, do not expect a reaction from the tax office.

Attention! Give up the simplified tax system only if you want to switch to OSNO. If you are interested in UTII or a patent, they can be combined with the simplified tax system without giving up this regime.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Cancellation of UTII is possible at any time. Submit to the tax office an application for deregistration using the UTII-3 form (for organizations) or UTII-4 form (for individual entrepreneurs). Submit your application within 5 days from the moment you began to apply the new tax regime. It is convenient to do this at the beginning of a new tax period. The deregistration date is the date you indicate on your application. The tax office is obliged to notify you of its decision within 5 days.

to renounce a patent ; you will have to wait until its expiration date. You cannot leave a patent voluntarily, but you can “fly away”.

to refuse OSNO : this system is considered basic, and to switch to other aids you simply submit the appropriate applications.

Now we’ll tell you how to start using the new aid to navigation. Please note: some tax regimes (OSNO, simplified tax system) apply to your entire activity, and some (UTII, PSN) apply only to certain types of activities. Moreover, they can work “on top” of the basic tax system - then this is called combining tax regimes. For example, you conduct retail trade under the simplified tax system and additionally provide educational services under a patent.

The transition to the simplified tax system from the general system is possible only from the beginning of the new calendar year. Simplification will apply to all your types of activities, but for some types you will be able to additionally apply a patent or imputation. Submit form 26.2-1 to the tax office at your place of registration by December 31 of the current year. And don’t expect a response from the tax office - you just notified it about the application of the simplified tax system.

If you once switched to the simplified tax system, and then to a patent or UTII, then your “basic system” is considered a simplified one. Then you can return from additional special modes to the simplified tax system at any time.

The transition to UTII is possible at any time. This regime applies to certain types of activities that must be indicated in the application. If you are going to apply imputation from the beginning of the calendar year, submit an application for registration on UTII before January 15 (UTII-1 for organizations and UTII-2 for individual entrepreneurs). If you switch to imputation in the middle of the year, submit your application within 5 days after the start of this regime. The tax office will respond within 5 days.

The transition to PSN is possible at any time: a patent is issued for a period of 1 to 12 months, but only within a calendar year. A patent, like UTII, affects only specific types of activities. The entrepreneur submits Form 26.5-1 to the Federal Tax Service 10 or more days before the start of application of the new SNO. Within 5 days, the tax office will issue a patent or refuse the entrepreneur.

The transition to OSNO occurs if you “fell out” of the special regime or voluntarily abandoned it. There is no need to submit any application for the transition to OSNO to the tax office; this regime is considered basic; it covers all activities of a company or individual entrepreneur (except for those types of activities for which a patent or imputation is used). You can switch to OSNO from different special modes at different times:

- with the simplified tax system - voluntarily from the beginning of the new calendar year, involuntarily - from the beginning of the quarter in which the requirements for the simplified tax system were violated;

- with UTII - voluntarily at any time, involuntarily - from the beginning of the month in which the violation of the requirements for UTII occurred;

- with PSN - voluntarily only after the expiration of the patent, involuntarily - from the beginning of the patent term.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

How often can I replace it?

You can switch to the simplified tax system once during a calendar year. However, if the company previously worked on a simplified system, then changed the system, you can easily change it back even in the middle of the year. This can also be done from January 1 of the next year, but for this it is necessary to comply with the requirements of clause 291.4 of Art. 291 of the Tax Code of the Russian Federation.

Individual entrepreneur

Thus, an individual entrepreneur can use any taxation system, but for this he must comply with certain requirements. It is also very important to understand whether the chosen system meets the criteria, otherwise the company will have to pay fines and large percentages of profits.

Changing the tax system is mandatory

The need to change the AtoN appears if you violate the criteria for applying your special regime or stop a specific type of activity to which the special regime applies. Officials may also introduce new restrictions for the special regime or cancel it.

If you leave the simplified tax system , you will have to notify the tax office of the loss of the right to simplification using form 26.2-2. Do this within 15 days of the quarter in which you violated the criteria. But you lose the right to the simplified tax system from the beginning of the quarter in which you committed a violation, and you must also apply the simplified tax system from the beginning of the quarter. The last quarter on the simplified basis will be the one that preceded the quarter with a violation. For activities on the simplified tax system, you will have to pay tax and report within 25 days after the “violating” quarter.

If you are leaving UTII , submit a tax application in the form UTII-3 (for organizations) or UTII-4 (for individual entrepreneurs) within 5 days after the month when the UTII criteria were violated or within 5 days after termination of activity, taxable UTII. If before this you combined the simplified tax system and UTII, then your former imputed activity automatically switches to the simplified tax system - unless, of course, it violates its criteria. If you have not previously transferred your activity to a simplified tax system, then you have 30 days from the date of cancellation of UTII to submit an application to switch to the simplified tax system. This is a rare case when you can switch to a simplified version at the beginning of the year. If you do not apply for a simplified visa within a month, you will automatically end up on OSNO.

If you lose your patent , file an application for loss of patent rights within 10 calendar days from the date of infringement. When a patent is abandoned, it is considered that the entrepreneur was in his basic tax regime from the beginning of the patent. If you switched to the simplified tax system and combined a simplified tax system and a patent, then you will be considered a payer of the simplified tax system. If there was no transition to the simplified system, you will be considered an OSNO payer.

We have indicated the general rules for moving from one tax system to another. You may need clarification from experts: many issues of changing aids to navigation have different interpretations; there are letters and clarifications from regulatory authorities and judicial practice on this matter, all this will help you navigate a specific situation.

Transition to PSN

Conditions for using PSN

- The average number of employees is no more than 15 people;

- Income from all patent activities is no more than 60 million rubles. in year.

PSN can only be used by an individual entrepreneur and only for certain types of activities (retail, catering, transportation, repairs, hairdressing, etc.).

PSN can be combined with any taxation system. For example, buy a patent for retail, and apply the simplified tax system for the rest of your activities.

An individual entrepreneur on a patent pays insurance premiums for himself, as well as personal income tax and contributions for employees according to the general rules. The cost of a patent cannot be reduced by contributions paid for oneself and for employees.

The procedure for switching to PSN

In order to switch to the PSN, you must apply for a patent for a calendar year or for several months during the year.

Instructions for LLCs on changing the tax regime

An organization can apply OSNO, UTII and simplified tax system, combine UTII + OSNO and UTII + simplified tax system, which means it may encounter the following situations when changing regimes:

Transition from UTII to simplified tax system : in this case, follow our recommendations above and study the question of the profitability of using these special modes in our article, as well as the requirements for simplified tax payers.

Transition from UTII to OSNO : follow our recommendations above, read articles about the transition from imputation to the general regime and the features of OSNO. And remember: if you submitted an application to apply the simplified tax system, and then began working for UTII, then to switch to OSNO you will also have to abandon the simplified tax system (we wrote above how to do this).

Transition from the simplified tax system to UTII : in this case, you transfer specific types of activities to UTII, and the simplified tax system remains your “basic” tax regime. Read our article about combining the simplified tax system and UTII.

Transition from the simplified tax system to OSNO : is necessary if an organization wants to enter into transactions with large counterparties and work with VAT, or if it flies away from the simplified system. Give up the simplified tax system at the end of the calendar year voluntarily or notify the Federal Tax Service of the loss of the right to the simplified tax system according to our recommendations above.

Transition from OSNO to UTII : you transfer part or all types of activities to UTII, and OSNO remains your “basic” tax regime. Read our articles about combining UTII and OSNO and separate accounting when combined.

Transition from OSNO to simplified tax system : you change the “basic” tax regime for all your activities; this can only be done at the beginning of the calendar year. Follow our recommendations above and read the article about the transition from OSNO to the simplified tax system and the restoration of VAT.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What taxes does an individual entrepreneur pay on NAP?

Individual entrepreneur who switched to NPD:

- is not recognized as a VAT payer (except for “import” VAT) Part 9 of Art. 2 of the Law of November 27, 2018 No. 422-FZ;

- does not pay insurance premiums for himself (Part 11, Article 2 of Law No. 422-FZ dated November 27, 2018).

Thus, an individual entrepreneur applying NAP pays:

- Personal income tax as a tax agent (Part 10, Article 2 of Law No. 422-FZ dated November 27, 2018). That is, individual entrepreneurs are required to keep records of tax payments, submit reports to the tax authorities and fulfill the duties provided for in Art. 24 Tax Code of the Russian Federation. For example, if an individual entrepreneur decides to hire workers under a contract;

- tax on income received at a rate of 4 percent when working with individuals and 6 percent when working with legal entities or individual entrepreneurs. That is, the individual entrepreneur must know who his customer is - an organization or an individual.

The amount of tax, according to Art. 11 of Law No. 422-FZ, tax authorities will calculate it independently. In this case, the tax is reduced by the amount of the tax deduction provided for in Part 1 of Art. 12 of Law No. 422-FZ. Its size is 10 thousand rubles. The tax is calculated on an accrual basis. The amount of the deduction depends on the tax rate (Parts 1, 2, Article 12 of Law No. 422-FZ dated November 27, 2018):

- if the tax is calculated at a rate of 4 percent - 1 percent of income;

- if the tax is calculated at a rate of 6 percent - 2 percent of income.

The deduction is provided once, the period of its use is not limited (Part 3 of Article 12 of the Law of November 27, 2018 No. 422-FZ).

In addition, the tax paid from 07/01/2020 to 12/31/2020 is reduced by the unused deduction, increased by a tax bonus of 12,130 rubles. The government provided for such an anti-crisis measure to support the self-employed in Resolution No. 783 dated May 29, 2020. The condition for receiving it is the absence of tax arrears or arrears of penalties. At the same time, the restrictions established by Parts 1, 2 of Art. 12 of the Law of November 27, 2018 No. 422-FZ, depending on the tax rate, do not apply. If there is a debt, the deduction is counted first against it, and then against the tax paid during the specified period (Part 2.1, Article 12 of Law No. 422-FZ of November 27, 2018).

The balance of the tax deduction not used in 2021 is applied from 01/01/2021 in an amount not exceeding the balance of the deduction as of 06/01/2020 (Part 2.2 of Article 12 of the Law of November 27, 2018 No. 422-FZ).

If an individual entrepreneur registered as an NPD payer for the first time after 06/01/2020, the balance of the deduction not used in 2021 is applied from 01/01/2021 in an amount not exceeding 10 thousand rubles (Part 2.2 of Article 12 of the Law of November 27, 2018 No. 422 -FZ).

The tax is due to be transferred at the end of each month. The first tax period will be the period from the moment of registration until the end of the calendar month following the month in which registration was carried out (Parts 1, 2, Article 9 of the Law of November 27, 2018 No. 422-FZ).

If it turns out that the tax is less than 100 rubles, this amount will be added to the amount of tax payable at the end of the next month.

The Federal Tax Service will notify the taxpayer about the amount of accrued tax through the “My Tax” mobile application no later than the 12th day of the next month. In this case, the details for its transfer will be indicated.

The deadline for payment of NAP is no later than the 25th of the next month.

There are several ways to transfer taxes:

- through the “My Tax” mobile application;

- through a bank or electronic platform operator (in this case, the Federal Tax Service will send a notification to them);

- through the Federal Tax Service, authorizing it to write off tax from a bank account and transfer it to the budget through the “My Tax” application.

Violation of the procedure and deadlines for transmitting information about settlements to the Federal Tax Service threatens with the accrual of fines (Article 129.13 of the Tax Code of the Russian Federation):

- in the amount of 20 percent of the settlement amount;

- in the amount of the settlement amount in case of repeated violation within six months.

Instructions for individual entrepreneurs on changing the tax regime

An individual entrepreneur can work on OSNO, simplified tax system, UTII and patent, combine UTII + simplified tax system, UTII + OSNO, simplified tax system + patent, simplified tax system + patent + UTII, OSNO + patent, OSNO + patent + UTII. For entrepreneurs, the same regime change options are possible as for organizations (see above), and a few more situations.

Transition from a patent to OSNO : occurs upon expiration of the patent term or loss of the right to a patent, if the entrepreneur has not transferred his activities to the simplified tax system. Follow our recommendations and read the article on combining a patent and OSNO.

Transition from a patent to the simplified tax system : occurs upon expiration of the patent term or loss of the right to a patent, if the entrepreneur transferred his activities to the simplified tax system and then bought a patent. Follow our recommendations above and read articles about combining a patent and simplified tax system, as well as the profitability of a patent or simplified procedure.

Transition from a patent to UTII : possible after the expiration of the patent term or after the loss of the right to a patent, when the individual entrepreneur begins to apply UTII. Follow our recommendations above and read articles about combining a patent, simplified tax system and UTII, as well as a patent and UTII.

Transition to a patent with any SNO : possible if the type of activity meets the requirements of the PSN. In this case, it is possible to combine a patent and other tax regimes.

Does the individual entrepreneur pay insurance premiums for NAP?

One of the advantages of using NAP by an individual entrepreneur is the absence of the obligation to pay fixed insurance premiums. According to part 11 of Art. 2 of Law No. 422-FZ Individual entrepreneurs are not recognized as payers of insurance premiums for themselves for the period of application of the NAP. Thus, in a year, an individual entrepreneur can save 40,874 rubles (clauses 1, 2, clause 1 of Article 430 of the Tax Code of the Russian Federation) plus 1 percent on the amount of income exceeding 300 thousand rubles.

In this case, individual entrepreneurs have the right to pay insurance premiums on a voluntary basis:

- on OPS (letter of the Federal Social Insurance Fund of the Russian Federation dated February 28, 2020 No. 02-09-11/06-04-4346);

- on OSS (Part 3 of Article 2 of Law No. 255-FZ dated December 29, 2006, letter of the Federal Insurance Service of the Russian Federation dated February 28, 2020 No. 02-09-11/06-04-4346).

Individual entrepreneurs who have lost the right to apply NAP are required to pay insurance premiums again. The start date of the billing period for their accrual will be the date of loss of the right to use NAP. If an individual entrepreneur refuses the NAP, contributions will have to be calculated from the date of deregistration as a self-employed person (Part 1, Article 15 of Law No. 422-FZ).

Setting up cash register details when changing the tax regime

If you work with an online cash register, when you change your tax identification system, you will not have to re-register it with the Federal Tax Service and change your fiscal drive. Only when switching to OSNO there are nuances: if you have a fiscal accumulator for 36 months, you will have to change it to a “shorter” accumulator for 15 months, this is required by 54-FZ. In other cases, you will only have to change the tax regime in the cash register settings before starting work in the new mode. To do this quickly and without errors, contact your service center.

Work in different tax regimes and combine SNA in the Kontur.Accounting web service. Simple accounting, payroll, reporting and round-the-clock support from specialists. We are giving six months of work in the service to all companies and individual entrepreneurs who switch from UTII to the simplified tax system or OSNO in 2019-2020

Registration of individual entrepreneurs on NAP

Individual entrepreneurs applying one or another tax regime (STS, Unified Agricultural Tax, UTII) have the right to switch to NAP if certain requirements are met. This is stated in Part 3 of Art. 15 of the Law of November 27, 2018 No. 422-FZ.

You cannot switch to paying NAP if the individual entrepreneur (Part 2 of Article 4 of Law No. 422-FZ dated November 27, 2018):

- resells property rights and goods (except personal belongings);

- sells excisable and subject to mandatory labeling goods;

- mines or sells minerals;

- hires workers under employment contracts. At the same time, there are no restrictions on attracting employees under the GAP. Work under contract agreements is also not prohibited (clause 3 of the letter of the Federal Tax Service of the Russian Federation dated October 12, 2020 No. AB-4-20 / [email protected] );

- engages in mediation activities;

- provides services for the delivery of goods with the acceptance of payments in favor of other persons (with the exception of delivery using a cash register registered by the seller of goods).

The income of an NPD user for a calendar year cannot exceed 2.4 million rubles. If the limit is violated, the person will lose the right to apply the special regime. From the day the limit is exceeded, income will need to be subject to personal income tax, and the individual entrepreneur can return to the previous one or switch to another special regime (letter of the Federal Tax Service of the Russian Federation dated December 20, 2019 No. SD-4-3 / [email protected] ). All income to which NPA was applied before the limit was exceeded will not need to be recalculated.

An individual entrepreneur cannot combine NPD with other special regimes or OSNO.

If all the conditions for the transition to the NPD are met and the individual entrepreneur decides to use it, it is necessary to go through the registration procedure as a NPD payer (Article 5 of the Law of November 27, 2018 No. 422-FZ).

There are several ways to register with the Federal Tax Service:

- through the mobile application of the Federal Tax Service of the Russian Federation “My Tax”, which can be downloaded for the Android platform through the Google Play service, and for the iPhone OS platform through the App Store. In this case, you will need to fill out an application with passport data and photo (Part 4, Article 5 of Law No. 422-FZ dated November 27, 2018);

- through your personal account on the Federal Tax Service website. This method only involves filing an application (Part 2 of Article 5 of Law No. 422-FZ dated November 27, 2018);

- through a credit institution, if information interaction with the Federal Tax Service has been established with its help. This method will require passport data and an application using the bank’s digital signature (Part 5, Article 5 of Law No. 422-FZ of November 27, 2018).

In the event of a transition to the NAP, an individual entrepreneur, within a month after registering as a self-employed person, must submit to the inspectorate a notice of termination of the previously used taxation system (Unified Agricultural Tax, simplified tax system, UTII, part 4 of article 15 of the Law of November 27, 2018 No. 422-FZ). Failure to send a notification or failure to comply with the deadline for sending it threatens to cancel the status of an NPD payer (Part 5 of the Law of November 27, 2018 No. 422-FZ).

Notification forms have not yet been approved. The recommended forms are given in the letter of the Federal Tax Service of the Russian Federation dated January 10, 2019 No. SD-4-3/ [email protected] and in the information of the Federal Tax Service of the Russian Federation “The Federal Tax Service of Russia reminds that when switching to NAP from other special regimes, it is necessary to send a notice of termination of their use.”

Advantages of the systems

To choose the right taxation system, you need to clearly understand the specifics of the company’s work, know general indicators and be able to calculate what will be more profitable for your company. Before we talk about the transition from the simplified tax system 6 to the simplified tax system 15, let's compare how beneficial one and the other system is. First, let’s look at what advantages a tax collector who works using these systems receives:

- Maximum simplification of tax payment and reporting. Unlike the classical system, individual entrepreneurs do not need to submit tax returns every month and report for each action. The simplifier submits a declaration once a year, and in case of overpayment/underpayment of tax, he pays the difference. The only documents he needs are the Book of Income and Expenses, which is filled out in accordance with established standards.

- Ability to work at variable rates. The fact is that regional authorities can change rates, reducing them in order to reduce the burden on entrepreneurs. This is done to stimulate payers in various areas of economic activity and production. For example, in some regions there is a tax rate of 2% on income, but according to the system, income minus expenses pays not 15, but only 5 percent. If an individual entrepreneur belongs to preferential categories, then a zero rate may apply to him (for example, a disabled person or a veteran).

- Individual entrepreneurs using the simplified tax system do not pay a large number of taxes. For example, he does not need to pay property tax, profit tax, or value added tax. Of course, this is beneficial for small companies, since they will not receive claims and will not be fined for violations by tax authorities.

As you can see, these taxes have something in common. Now let's look at the difference between them. Let's make a table to make it clearer and clearer.

| For a simplified tax rate of 6% | For a simplified tax rate of 15% | ||

| Advantages | Flaws | Advantages | Flaws |

| The individual entrepreneur receives the right to issue a tax deduction. | Expenses are not included in the tax calculation, that is, even if your expenses are more than your income, you will still have to pay. | The individual entrepreneur has the opportunity to reduce the rate by subtracting from it the expenditure portion reflected in the Accounting Book. | Not all expenses are recognized by the tax authorities as expenses. Their list is spelled out in the Tax Code, everything else is cut off. |

| There is no minimum payment amount. If there is no profit at the end of the year, then you do not need to pay - just submit a zero declaration. | Carrying forward losses is prohibited. If you worked at a loss for the past year or several years, then the losses cannot be transferred to expenses. | An individual entrepreneur has the right to transfer losses to expenses, thereby reducing the tax rate for the next year for the previous year. | Mandatory payment of taxes. You will have to pay taxes in any case, even if you have no profit or are unprofitable: you will be taxed at a rate of 1% of the income received. |

STS 6% is quite profitable if you have low expenses

As you can see, it is impossible to say unequivocally what is more profitable, since everything depends on the profile of the company, the profit received, the level of expenses, the region of work, etc. In addition, according to the Tax Code, some nuances of work apply to simplified taxation system officers. For example, a simplified tax system at a rate of 6% can reduce its taxes due to the fact that it employs employees and pays appropriate contributions for them. That is, the contributions are summed up, 50% is taken from them and the resulting amount is deducted from the total tax amount. If the entrepreneur pays himself, then the entire amount can be deducted. Further, the simplified tax system of 6% does not have to pay taxes if he has not received any income at all or has incurred losses. The same nuances are present in the simplified tax system of 15%, so study the issue well before choosing one or another system, read the tax code or consult with a lawyer.

What alternatives does UTII have?

A business using imputation must choose a different tax regime by the end of 2021.

If he does not do this, he will be automatically transferred to OSN. Individual entrepreneurs have more options to choose from.

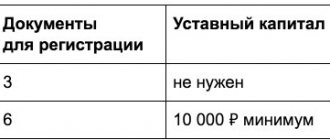

| Tax regimes | For legal entities | For individual entrepreneurs |

| OSN | + | + |

| simplified tax system | + | + |

| PSN | — | + |

| NAP | — | + |

| Unified agricultural tax | + | + |

It is important to take into account the restrictions and criteria for applying a particular tax regime.

Thus, individual entrepreneurs, unlike legal entities, can switch to using the professional income tax (PIT) if they do not have hired employees, that is, they are essentially self-employed. To switch, they will need to register in the My Tax app.

What self-employed people can count on: new opportunities in 2021

As for agricultural business, it has the right to apply the Unified Agricultural Tax.

Previously, we wrote in detail about how to choose a tax regime for 2021, taking into account various criteria.

Study the restrictions and calculate the tax burden to choose the right tax regime