How to correctly enter the required details into the delivery note in 2021

The recipient of the goods enters information on the delivery note into accounting, and not specifying the details does not affect the posting of products. Gross weight - the weight of the goods with containers or packaging - does not have to be noted as a detail when posting goods individually or by weight.

When filling out the invoice, the seller indicates the price, amount excluding VAT, calculation and amount including VAT. In cases where the goods are indicated with VAT on line 11 of the invoice, then, by decision of the tax service, it is possible to additionally charge the amount of tax to the organization. If OKDP is not indicated in the invoice, the risks of not accruing a VAT deduction are minimal.

Since the invoice is filled out by the seller, he indicates his type according to OKDP, which does not interfere with the receipt of data by the tax office about the buyer (taxpayer).

Description of the document

Purpose

When starting a conversation about TORG-12, you should understand what it is? This document is specifically designed for use in primary accounting. It was adopted by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132. Most leading accountants use this document in their practice because of its simplicity and ease of data reflection.

What is it for?

It is used in trade for dispensing products. The company that sells the goods provides this document as confirmation of the fact of the sale of goods and materials to the organization to the buyer.

When performing a transaction to transfer goods (on paper), two copies of TORG-12 are used.

The first copy is required in order to write off inventory items from the seller’s warehouse. The second is the basis for posting the received valuables to the buyer’s warehouse.

Basic details

A correctly executed document includes the following details:

- The name of the organizations concluding the transaction, the bank accounts they use to pay for the delivered goods, legal and actual address, tax identification number, checkpoint and contact telephone number.

- The document must record the date of shipment and the number assigned to the waybill accompanying the cargo, confirming the legality of this transaction.

- In the columns “release of cargo authorized” and “release of cargo carried out” the signatures of the persons responsible for the operation must be placed, always with a decoding and position. Next, the information is certified with the original seal, if any.

- It is necessary to indicate information about the power of attorney of the employee who accepted the cargo for transportation (the number is recorded, when, by whom and to whom it was issued).

- Signature of the person to whom the power of attorney was issued, its transcript and officially held position in the organization.

- The content of a business transaction, reflected in quantitative and monetary terms, is listed as a mandatory detail.

From January 1, 2013, it is possible to use an invoice that differs in form, but all of the above points must be reflected in full.

However, their own form of invoice is rarely used, because accountants are afraid that one reason or another may result in the tax service refusing to accept the package of documents provided.

If the invoices confirming the transaction are not filled out correctly or there are no invoices, VAT may not be accepted for reimbursement. The tax authority accepts only correctly completed documentation for registration.

It is important to mention that sellers working under specialized regimes, i.e. those who are exempt from paying VAT (these include UTII and the “simplified taxation system”), columns numbered 13 and 15 are left blank.

Removing any mandatory details from the unified forms is not allowed.

Which tax identification number and checkpoint to indicate in TORG-12 when working with a separate division

Since the buyer picks up the goods independently and your organization does not ship them to third parties specified by the buyer, the consignee of the goods in this case is the buyer.

The TORG-12 form does not specify the address of the consignee and the payer, so it may indicate both the legal and actual address of the buyer (warehouse address).

In our opinion, when filling out these details, you should be guided by the details of the parties specified in the supply agreement. However, taking into account the presence of a letter from the buyer clarifying his details, we believe that the seller should indicate in the appropriate lines of the TORG-12 form the address of the buyer’s separate division (address of its warehouse).

Please note that in the unified form of consignment note TORG-12 in the lines “Consignee” and “Payer” the following must be indicated: organization, address, telephone, fax and bank details.

Tax officials agreed that bank details are not required in TORG-12

Answer “...In the received delivery note in the TORG-12 form, the supplier forgot to include our bank details.

In line 4 “Consignee and his address” the seller indicates the full or abbreviated name of the consignee in accordance with his constituent documents and his postal address.

How critical is this error and does it need to be corrected? Can the tax authorities deny us VAT deductions on this basis? » From a letter from chief accountant Alexandra Pavlova, Moscow However, if the supplier for some reason does not make such corrections to the document, a refusal to recognize expenses confirmed by such a document or to withdraw a VAT deduction is unlikely. Evidence of this is the letter from the Office of the Federal Tax Service of Russia for the city.

Moscow dated April 26, 2010 No. 16-15/43834. In it, the tax authorities finally agreed that the absence of data on the buyer’s bank details in the invoice does not refute the actual delivery of the goods by the supplier.

We recommend reading: Reasons why guardianship authorities may take a child

As well as the availability of such goods and its entry into the accounting of the consignee. Have a question? Our experts will help you within 24 hours!

Get answer New

Are TIN and KPP bank details and is it mandatory to indicate them in waybills?

TIN and KPP are not bank details, since they are assigned not by the bank, but by the tax authority, and exist for the organization regardless of whether it has a bank account.

The TIN of an organization is not a bank one, but another requisite (along with the name of the organization) necessary for processing any payment document sent through a bank. Therefore, it is usually indicated along with bank account details, especially in cases where this detail was not communicated to the counterparty in any other way (for example, in an agreement). The checkpoint is used only for payments to the budget system, or for payments to budget institutions.

In other cases, it is not needed for payments through a bank. Taking into account the above, indicating these details in the form of a consignment note is not mandatory.

Is it necessary to indicate the Taxpayer Identification Number (TIN) and KPP on the delivery note?

12/18/2008 Question: If yes, then on the basis of what document and how can you “force” suppliers to change all documents from the beginning of the year if they have not provided the Taxpayer Identification Number (TIN) and KPP for 7 months.

Is it also necessary to issue a consignment note and what details are required in it? Answer: With regard to the preparation of a consignment note, the Instructions for the use and completion of forms of primary accounting documentation for recording trade operations, approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132, contain insufficient information on filling out the TORG-12 form.

It should be noted that the organization’s demands for replacing primary documents are unlawful.

The supplier does not have the right to issue new documents, since according to the opinion of the Ministry of Finance of Russia, expressed in letter dated December 8, 2004 N 03-04-11/217, organizations do not have the right to issue new invoices with the same numbers and dates in place of previously issued old invoices. In our opinion, this provision also applies to invoices. At the same time, the current legislation of the Russian Federation allows changes to be made to primary documents, in particular, in accordance with clause 5 of Article 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”, corrections can be made to primary accounting documents (except for cash and banking documents) be introduced in agreement with the participants in business transactions, which must be confirmed by the signatures of the same persons who signed the documents, indicating the date of the corrections.

Please note that corrections are made only by the persons who originally signed this document and only in agreement with the other counterparty.

At the same time, the consignment note, the form of which was approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78

“On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport”

(form N 1-T), is the main transportation document intended to record the movement of inventory items and payments for their transportation by road.

We recommend reading:

At the same time, the obligation to draw up a customs form arises for the shipper only if goods are transported by a motor transport organization under a contract for the carriage of goods (Section 2 of the Instructions for the use and completion of forms approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78, clause 2 of Article 785 Civil Code of the Russian Federation, clause 47 of the Charter of Road Transport of the RSFSR, approved by Resolution of the Council of Ministers of the RSFSR 01/08/69 N 12).

Thus, if the delivery of goods is carried out by the supplier’s or buyer’s transport (in case of self-pickup) without the involvement of a motor transport organization, drawing up a consignment note is not required. In this case, it is enough to use a consignment note, the form of which is approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132 (Form N TORG-12).

A similar point of view was expressed by arbitration courts (see, for example, resolution of the FAS North-Western District dated September 14, 2005 N A26-1530/2005-217, resolution of the FAS North-Western District dated December 28, 2006 in case No. A13-16213/2005 -19, resolution of the Federal Antimonopoly Service of the North-Western District dated December 26, 2007 in case No. A05-3299/2007). Dubinyanskaya E.N. Head of the Audit and Finance Department of United Consulting Group CJSC Answers to questions posted in the Codex Legal Reference System 12/18/2008

What mandatory details must be indicated in any technical specification?

A delivery note of any form must include the following details:

- number and date of compilation;

- the full name of the LLC or individual entrepreneur and the details of both parties - the sender and the recipient (read about why you need a TN for an individual entrepreneur and how to apply for it here);

- basis for sending products (for example, contract, invoice, etc.);

- sent item items indicating the name of goods, total quantity and cost (as a rule, drawn up in the form of a table);

- Full names, positions and signatures (with transcript) of the persons who authorized the shipment of the cargo, released it from the warehouse and received it from the buyer, respectively;

- printing on both sides (if stamps are available).

The date of drawing up the trade invoice is considered to be the day on which the purchase and sale of material assets was completed, but it does not always coincide with the date of signing the invoice. In some cases, the invoice is drawn up several days before the trade transaction takes place. Therefore, the date of delivery of the goods is considered to be the date of signing the document, and not the date indicated in the “Date of Compilation” column .

As for the column “Document number”, this column indicates the serial number of the invoice at the enterprise. There are no special requirements for numbering.

The delivery note must be prepared in 2 copies, one of which remains with the supplier, and the other is given to the buyer. Thus, both parties, based on the data in this document, will reflect the details of the transaction performed on the accounting sheet.

We talked in more detail about what a consignment note is, why it is needed, as well as when it is issued and whether it is a confirmation of payment in a separate article.

Packing list

This can be either a carrier of a third-party transport organization or a representative of the purchasing organization.

The head of the enterprise can accept the goods without a power of attorney - in this case, he signs in the line “Cargo accepted” and does not fill in the lines indicating the details of the power of attorney. At the same time, in both lines “The cargo was received by the consignee” and “The cargo was accepted” the same person can sign (if he has both a power of attorney for goods and materials and the right to sign primary documents).

In this case, the signature is placed only in the line “Cargo received”.

In the column “Consignor”, in accordance with the constituent documents, the full or abbreviated name of the consignor, legal address (possibly together with the actual one), telephone number and bank details (r./account and BIC required!) must be indicated.

Is the “base” line of the TORG-12 invoice mandatory?

For example, in the resolutions of the FAS of the Central District dated 04/09/2010 N A68-4631/09, dated 07/22/2008 N A08-8948/06-10-15, FAS of the North-Western District dated 04/30/2010 N F07-3761/2010, dated 05/04/2009 N A44-80/2008, the judges came to the conclusion that the issuance by the supplier of an invoice for payment containing the essential terms of the contract, and the payment of such an invoice by the buyer, are considered by the courts as the conclusion of an agreement by the parties in writing.

In the decisions of the Federal Antimonopoly Service of the Ural District dated 02/10/2011 N F09-250/11-S3, the Ninth Arbitration Court of Appeal dated 10/18/2010 N 09AP-24205/2010, the judges considered that the buyer’s applications and the invoices issued by the seller on their basis indicate that the parties had concluded an agreement . In this regard, we believe that in the “grounds” line, not only the details of the purchase and sale (supply) agreement can be indicated, but also, for example, the details of the buyer’s application, the supplier’s invoice for payment.

What shortcomings in the invoice can lead to additional taxes, and what not (Vightman E.)

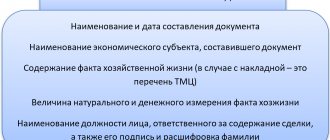

The Ministry of Finance called the details “primary”, in which it is better not to make mistakes. The details “Consignor and his address” are optional. Errors in the delivery note can be corrected. The consignment note (previously compiled according to the unified form N TORG-12) is important both for recognizing in tax accounting expenses for the purchase of assets and for deducting VAT (paragraph 2, paragraph 1, article 172 and paragraph 4, paragraph 1, article 252 Tax Code of the Russian Federation). After all, it confirms the transfer of ownership of the acquired property. If the invoice is drawn up with errors, tax authorities often deny the buyer the deduction of VAT and accounting for expenses. We will analyze judicial practice, explanations from the Russian Ministry of Finance and tax authorities in order to identify dangerous details. Let us formulate arguments that will help organizations resist unfounded claims. The controllers agree that minor errors in invoices do not prevent the accounting of expenses and the deduction of VAT. The Russian Ministry of Finance has clarified which errors in primary documents are not grounds for refusing to recognize expenses. These include shortcomings that do not prevent tax authorities from identifying the seller, buyer, name of goods, work or services and their cost during the audit (Letter dated 02/04/2015 N 03-03-10/4547). The Federal Tax Service of Russia supported this approach (Letter dated 02/12/2015 N ГД-4-3/ [email protected] ). This means that the most dangerous errors are in the following details of the consignment note (the names of the details are given in accordance with the unified form N TORG-12, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132): - supplier, his address, telephone, fax, bank details; — payer, his address, telephone, fax, bank details; — name, characteristics, grade, article number of the product (column 2 of the tabular part); — amount including VAT (column 15 of the tabular section). The absence of bank details of the supplier or buyer in the invoice does not refute the fact of purchase of the goods. The capital's tax authorities confirmed that this deficiency does not affect the recognition of expenses and the deduction of VAT (Letter of the Federal Tax Service of Russia for Moscow dated April 26, 2010 N 16-15/43834). If an organization uses an independently developed form of a consignment note, it is important that it contains all the details required for the “primary” (Clause 2, Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”, hereinafter referred to as the Law on accounting): - name and date of preparation of the document; — name of the organization or full name. the entrepreneur on whose behalf the document was drawn up; - content of the fact of economic life; - unit of measurement; — job title, surname, initials and signatures of the persons responsible for processing the transaction (read more in the box below). Note! It is risky to endorse an invoice with a facsimile signature. Tax officials say that primary documents cannot be signed using a facsimile. After all, they must bear the personal signature of the responsible person (Letters of the Federal Tax Service of Russia dated September 23, 2008 N 3-1-11 / [email protected] and the Federal Tax Service of Russia for Moscow dated January 25, 2008 N 20-12/05968). But the legislation has changed. The requirement to affix a personal signature was specified in the Federal Law of November 21, 1996 N 129-FZ “On Accounting”. This document has lost force since January 1, 2013. Now the list of mandatory details of the “primary registration” simply mentions a signature (clause 7, clause 2, article 9 of the Accounting Law). Despite this, judicial practice remains ambiguous. Many courts are still against signing the “primary document” with facsimile signatures. In their opinion, documents certified by facsimile are invalid. That is, with the help of such papers it is impossible to confirm any facts of economic activity. Including the fact of purchase of goods (Resolutions of the Far Eastern Federal Antimonopoly Service dated April 2, 2014 N F03-1016/2014, Volga District dated April 1, 2014 N A57-4665/2013 and Central District dated March 28, 2013 N A68-2818/12). Of course, the organization has the right to refer to changes in accounting legislation. But this does not guarantee her victory in the argument. Therefore, it is safer not to endorse invoices and other “primary documents” with facsimile signatures. Even if this option for signing documents is provided for in the agreement with the counterparty (clause 2 of Article 160 of the Civil Code of the Russian Federation). Failure to complete or absence of other details in the invoice is not so important. For example, the company itself decides whether or not to fill out the line “Shipping organization, address, telephone, fax, bank details.” Tax officials consider this detail of the delivery note to be optional (Letter of the Federal Tax Service of Russia dated November 25, 2014 N ED-4-15/ [email protected] ). This means that errors in it should not lead to refusal to account for expenses and deduct “input” VAT. Note. The absence of secondary details in the invoice does not refute the fact of purchase of the goods. If there is other evidence that the transaction is fictitious, errors in the delivery note will only confirm suspicions. The courts believe that the presence of errors in the delivery note does not refute the delivery of goods and their acceptance for accounting. Defects only indicate a violation of accounting rules. This means that the tax authorities’ reference only to these defects cannot be the basis for excluding the buyer’s expenses and refusing to deduct VAT (Resolutions of the Moscow Federal Antimonopoly Service dated February 26, 2014 N F05-576/2014, West Siberian Federal Antimonopoly Service dated March 1, 2012 N A75-1969/2011 , Ural dated June 30, 2011 N F09-3562/11, East Siberian dated December 20, 2007 N A19-7415/07-33-F02-9351/07 and dated December 14, 2007 N A19-8418/07-57-F02- 9192/07 districts). But if there is other evidence of the unreality of the transaction, the court can support the inspectors (Resolutions of the Federal Antimonopoly Service of the North Caucasus dated September 20, 2013 N A53-24630/2012, the Ural Federal Antimonopoly Service dated February 17, 2012 N F09-99/12 and the West Siberian Federal Antimonopoly Service dated November 6, 2009 N A27- 1367/2009 districts). What claims to the registration of invoices are successfully challenged by organizations in the courts? The date of shipment or acceptance of the goods is not indicated. According to tax authorities, the absence of this information in the invoice is evidence that the buyer did not receive the goods. This means that he does not have the right to include the cost of goods in tax expenses and deduct “input” VAT (paragraph 2, paragraph 1, article 172 and paragraph 4, paragraph 1, article 252 of the Tax Code of the Russian Federation). But the date of shipment of the goods by the supplier and the date of its receipt by the buyer are not mandatory details. These include only the date of preparation of the invoice itself (clause 2, clause 2, article 9 of the Accounting Law). Therefore, the courts believe that the absence of delivery and acceptance dates of goods in invoices does not prevent the accounting of expenses and the deduction of VAT (Determination of the Supreme Arbitration Court of the Russian Federation dated December 17, 2009 N VAS-16581/09, Resolution of the Arbitration Court of the North-Western District dated May 22, 2015 N F07-2297 /2015, FAS Moscow District dated 08/12/2011 N KA-A40/8591-11 and dated 03/12/2010 N KA-A41/1727-10). There are no details of the power of attorney of the person who signed the invoice. This defect also does not refute the fact of delivery and receipt of goods. Especially if the other details of the delivery note are filled out flawlessly. The main thing is that the person who signed the invoice has the authority to do so. Therefore, a copy of the power of attorney must be attached to the invoice. This will help deny claims. Moreover, the parties to the transaction have the right to make corrections to the invoice (Clause 7, Article 9 of the Accounting Law). That is, enter the details of the power of attorney into it. Since the invoice is prepared by the seller, he must make changes to it. Corrections must be certified by the signatures of those persons who prepared the invoice, and their surnames and initials must be indicated. You also need to put a date for making changes. Most courts allow the buyer to take into account expenses and accept VAT for deduction, even if the invoice does not contain a reference to the details of the power of attorney (Resolution of the Arbitration Court of the West Siberian dated 09.18.2014 N A03-24469/2013, FAS West Siberian dated 01.03.2012 N A75- 1969/2011, Moscow dated 02/29/2012 N A40-127306/10-90-714 and Volga region dated 05/22/2007 N A12-16921/06 districts). The arbitrators consider this defect to be minor. But only in the absence of other signs that the transaction is fictitious. The position or transcript of the signature of the person who signed the invoice is not indicated. Both of these details of the invoice are mandatory (clauses 6 and 7, clause 2, article 9 of the Accounting Law). This is what tax authorities usually refer to when deducting expenses and refusing to deduct VAT. But the courts reason differently. In their opinion, the absence of a position name and a transcript of the signature in the invoice is a minor drawback. It indicates, first of all, a violation of accounting rules. Moreover, this violation was committed by the seller. The buyer should not be responsible for the mistakes of counterparties (Definition of the Constitutional Court of the Russian Federation of October 16, 2003 N 329-O). If the facts of shipment and acceptance of goods are confirmed, the buyer has the right to take into account their value in tax accounting and accept “input” VAT for deduction even in the absence of a decryption of the signature (Resolutions of the Federal Antimonopoly Service of Povolzhsky dated May 22, 2012 N A55-5626/2010 and dated May 22, 2007 N A12 -16921/06, East Siberian from 09/22/2011 N A58-6676/2010 and Moscow from 09/14/2011 N A40-123143/10-116-503 districts). In addition to invoices, the fact of receipt of goods can be confirmed by contracts, waybills, reconciliation reports with suppliers, warehouse accounting documents, printouts of accounting account cards indicating the posting of goods and materials (for example, accounts 10 or 41). Another argument is that the absence of a transcript of the signature of the person who signed the delivery note does not prevent the identification of the supplier, buyer, name of the product, its quantity and date of release. This means that this deficiency does not lead to negative tax consequences. This is noted by some courts (Resolutions of the Federal Antimonopoly Service of the Central District dated 05/31/2011 N A35-9286/2010 and the Northwestern District dated 05/04/2011 N A13-7011/2010). Note. Courts consider many shortcomings in the preparation of invoices to be insignificant. The Russian Ministry of Finance agrees that shortcomings in the “primary”, which do not create obstacles to identifying the essential aspects of the transaction, do not entail a refusal to account for expenses (Letter dated 02/04/2015 N 03-03-10/4547). It is advisable to refer to this when disagreements arise. There is no link to the bill of lading If goods are delivered to the buyer by a third-party carrier, the supplier indicates the details of the bill of lading in the bill of lading - its number and date. Tax authorities consider the absence of this information to be a serious violation. In their opinion, this casts doubt on the reality of transporting goods. Therefore, inspectors refuse to allow the buyer to account for expenses and deduct “input” VAT. The courts note that a reference to the waybill is not a mandatory detail of the invoice. Even without this link, you can reliably establish who received what product, when and what. Lack of information about the waybill does not prevent the goods from being posted. After all, the organization accepts goods for accounting on the basis of the consignment note. There is enough data in it for this. Therefore, the courts do not see any obstacles to recognizing expenses and deducting VAT on goods, the shipment of which was registered with such a minor defect (Resolutions of the Federal Antimonopoly Service of the North-West of September 26, 2013 N A13-9242/2012 and of November 8, 2011 N A13-12880/2010, Central dated December 22, 2010 N A68-11668/09, East Siberian district dated June 24, 2008 NN A19-15326/07-57-F02-2709/08 and A19-15325/07-24-F02-2707/08 districts). The gross weight of the cargo is not indicated. In addition to the quantity of goods, the bill of lading contains a column for indicating the gross weight. That is, the weight of the goods together with containers and packaging (column 9 of the tabular part). Failure to fill out this detail, together with other shortcomings, is recognized by tax authorities as a violation, which entails a refusal to deduct VAT and account for expenses. Many organizations simply do not need information about gross weight. Especially if they accept goods for accounting individually. The courts take this circumstance into account and reject the claims of the inspectors (Resolutions of the FAS North Caucasus dated October 26, 2009 N A53-27009/2008-C5-34, Moscow dated August 21, 2008 N KA-A40/7847-08, East Siberian dated March 18, 2008 N A33-6296/07-F02-967/08 and dated 03/06/2008 N A19-11334/07-51-F02-737/08 districts). Even if the goods are by weight, the absence of data on the gross weight in the invoice does not refute the fact of purchase of the goods. This information is not required to be filled out. Therefore, the courts allow buyers to recognize the costs of purchasing weighted goods and accept the “input” VAT on them for deduction (Resolutions of the FAS Povolzhsky dated 05.05.2011 N A49-5601/2010, Uralsky dated 04.28.2011 N F09-1468/11-C2, Moscow dated 02/16/2009 N KA-A40/374-09 and West Siberian district dated 09/11/2007 N F04-6170/2007(37886-A03-29) districts).

Checkpoint in the invoice

In this case, the invoice is issued on the basis of the invoice, so the information in both documents must match - in the “Buyer” column in the invoice and in the “Payer” column in the delivery note.

If the organization does not have a separate division registered at all, and the checkpoint was assigned in connection with tax registration when applying UTII, then the name and address of the organization must be indicated in the invoices both in the “Payer” column and in the “Consignee” column. And in this case, the buyer must indicate the organization’s checkpoint in both columns in accordance with the details specified in the concluded agreement. At the same time, such details as checkpoints may not be indicated at all in the delivery note.

It is indicated only as an optional additional detail. Rationale From the recommendation In what cases should an organization register with the tax office and how to do it How to register separate divisions Based on the location of each of its organizations, the organization must register with the tax authorities ().

Instructions on how to fill out the document correctly

The unified form TORG-12 was approved by Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998. Since that time, no new versions of this simple and convenient form have been approved; it is the one that continues to be used in most organizations. A TORG-12 consignment note is issued when goods and materials are released from the warehouse, both in electronic and paper versions (read about the nuances of registering a consignment note in printed and electronic versions here).

The TORG-12 consignment note is signed by the head (manager) of the organization, the chief accountant or an authorized person (if there is a power of attorney). The question often arises: is the TORG-12 form mandatory or not? According to the law, an organization has the right to use forms developed independently .

Basic Rules

There are a number of rules that must be followed when filling out the TORG-12 form:

- The form must be filled out at the time of shipment or upon its completion, since the tax office requires that the information displayed on the invoice be accurate.

- When issuing an invoice to the recipient of the cargo, you should pay attention to the fact that the information about the sender and the items released must be similar. You can learn the difference between an invoice and a delivery note, as well as learn about the nuances of using one or another document here.

- In the columns “Consignor Organization”, “Consignee”, “Supplier” and “Payer” the name and details of the parties participating in this transaction are indicated.

There is often confusion with these concepts - whether they are different persons or not, so it is important to remember who is who:- the shipper (most often also the supplier) is the organization that sends the products to the consignee;

The consignee (in most cases, he is also the payer) is the company that receives the goods from the supplier.

- In the “Bases” column, the details of the document on the basis of which the products are shipped are indicated (as a rule, this is a contract or invoice).

- The table in the TORG-12 invoice is filled with information about the sent trade and material assets, such as:

- Name;

unique code;

- measuring units;

- weight;

- price;

- amount with/without value added tax;

- VAT amount.

- If the sender does not pay value added tax, in the column “VAT, rate, %” you should write “Without VAT”, and in the column “VAT, amount, rub.” should be set to "0". Dashes are not allowed. You will find the rules and sample for filling out TORG-12 with and without VAT in this material.

- In the TORG-12 form of the consignment note, the signatures of authorized persons are affixed and the seals of both parties are affixed (if there are seals).

- If the invoice contains additional fields (for example, a sales passport), then this is an addition. In the appropriate field you should enter the number of sheets of the application.

- Often the product is taken out by the buyer’s driver and picked up on the basis of a power of attorney. In this case, in the “Cargo accepted” column, you should indicate information about the driver, and above, write down the details of the power of attorney. In the “Cargo received” column, the buyer’s storekeeper signs when the goods have been successfully delivered to the warehouse.

The bottom line calculates the totals.

Please pay attention to how to correctly reflect the delivery cost in the invoice: you cannot indicate postal or other delivery costs as a separate line instead of the goods . It is recommended to include them in the total cost of goods.

Filling procedure

Filling out the invoice form TORG-12 should be completed by the parties participating in the shipment:

- In the “Sending organization” column, you should indicate the name of the company from which the materials are sent, its details and structural unit.

- In the “Supplier” column you should also enter information about the company that supplied the products.

- In the “Payer” and “Consignee” columns, you must fill in information about the company that received the goods.

- In the “Bases” column, you must indicate the number and date of the agreement between the parties to the transaction.

- On the right side of the form you need to fill in the codes, number and date of the waybill.

- Enter the number of the invoice itself and the date of dispatch of the products from the warehouse.

It is worth noting that the delivery note contains a column “Type of packaging”. As a rule, it remains blank: a dash is placed in place of the proposed information.

In addition, the form contains a column “Type of activity” (according to OKDP), the field of which must also be left blank - put a dash.

When filling out the tabular part of the TORG-12 consignment note, you must fill in the following:

- Enter the order number.

- Write down the full names of products and indicate their codes.

- Register the measurement units, indicate the number, cost excluding value added tax.

- Calculate the totals.

Some difficulties may arise when filling out column 3, because from the form itself it is not clear what it is - the product code and where to get it. In fact, there shouldn’t be any difficulties here, since the product identification number is advisory, but not mandatory for the TORG-12 invoice form .

As a rule, it is affixed on the basis of the all-Russian product classifier OKPD 2 (OK 034-2014). If the organization has developed its own nomenclature coding system, you can indicate the internal nomenclature number of the product.

OKUD form is a form that is assigned the code of the All-Russian OKUD classifier (for TORG-12 this is code 0330212). OKPO code is an all-Russian classifier of household facilities located on the territory of the Russian Federation.

After filling out the table in the TORG-12 sales invoice, you must indicate the number of sheets in the application and enter the number of serial entries. If necessary, you need to calculate the mass of the goods and the number of places . Then write the total amount in words.

In addition, the full name and position of the employees signing the document on the sender’s side should be specified. In the columns intended for the recipient of the cargo, write down the details of the driver’s power of attorney, and also put a signature in the column “Accepted the cargo.” After receiving the cargo, the signature is placed by the consignee or his representative who received the cargo. Prices are indicated in rubles, not in foreign currency.

As for whether the checkpoint is needed in the TORG-12 form, it is not necessary to indicate it, since its absence does not prevent the deduction of value added tax and the accounting of costs as part of the invoice expenses as a whole.

The trade invoice can contain either the legal or actual address of the consignee. Both options are valid.

In order not to get confused in the delivery note, as well as to correctly fill out all the fields and put down signatures, we recommend that you read our article.

Example for delivery of goods

So the result should be the following.

In accordance with agreement No. 123-A dated July 16, 2018, Import Furniture LLC (160000, Vologda, Leningradskaya St., 37) is obliged to supply Home Furniture LLC (150000, Yaroslavl , Krasnaya str., 19) the following products:

- Sofa “Aurora” (item number 6543), 3 pieces, price 8 / VAT 30,000 rubles.

- Office chair (item number 4231), 20 pcs., price 8 / VAT 2,500 rubles.

- Office table (item number 8093), 8 pcs., price 8 / VAT 5,250 rubles.

Products are shipped from a furniture production warehouse located at 160000, Vologda, st. Leningradskaya, 37. The driver of Home Furniture LLC arrived to pick up the goods, to whom power of attorney No. 1 dated July 16, 2018 was issued. Both parties are subject to the general tax payment regime and are VAT payers.

Since accounting registers are compiled on the basis of primary documents, in the invoice the cost of goods can be reflected as a fraction in two amounts: rubles / currency (conventional units). Therefore, if you indicate the amount not in rubles, but in foreign currency (or vice versa), the information will be incomplete.

Features of registration when transporting dangerous goods

The supplier undertakes to provide the dispatch station with a consignment note for each unit of dangerous goods. It is worth noting that the consignment note is filled out in accordance with the requirements of the Agreement on International Freight Transport by Rail .

The column “Name of cargo” implies an indication in accordance with the alphabetical index of dangerous goods. This is regulated in Appendix No. 2, attached to these rules for the transportation of dangerous goods.

In the event that dangerous goods, in accordance with the Alphabetical Index, do not have a specifically specified name, the sender of the goods undertakes to indicate in the consignment note the technical name of the product that corresponds to the standard technical conditions.

The technical name of the product (cargo) is a biological, chemical or other name that is used in scientific and technical reference books, public publications and various publications.

If column No. 2 of the Alphabetical Index of Dangerous Goods contains the technical name of a certain cargo, then its proper name is usually determined in accordance with the number established by the United Nations.

In the event that column No. 3 of the Alphabetical Index of Dangerous Goods does not contain the emergency card number, it is developed by the shipper and attached to the consignment note as an additional document - an appendix. Thus, in the column “Name of cargo” it is written about.

When transporting dangerous goods, the red stamps provided for this product are affixed at the top of the consignment note. Goods belonging to the category of dangerous goods are indicated by stamps, which are provided in column No. 10. As for the wagon sheet, the stamps are placed directly by the station from which the products are dispatched.

INN and KPP in the invoice

1016 lawyers are now on the site Good afternoon! Are suppliers required to indicate INN and KPP (their own and the buyer’s) in the delivery note?

We recommend reading: List of documents for a contractor in a construction organization to confirm a preferential pension

Where is this stated in the Laws? August 14, 2014, 14:39, question No. 530088 Julia, Moscow Collapse Victoria Dymova Support employee Pravoved.ru Try looking here: You can get an answer faster if you call the free hotline for Moscow and the Moscow region Free lawyers on the line: 7 Answers from lawyers (3)

- Padva Alexander VladimirovichLawyer, Moscow

- 931response

413 reviews

There is no unified form of TORG-12; it was canceled in 2013.

From January 1, 2013, an organization or entrepreneur can approve its own form of consignment note. The details of the Shipper, Consignee, Supplier and Payer must indicate: name of the organization or entrepreneur, address, telephone, fax, tax identification number, checkpoint, bank details, bank name, BIC, correspondent account, r/account or l/account.

Federal Law “On Accounting” and August 14, 2014, 14:48 Was the lawyer’s answer helpful? + 1 — 0 Collapse Client clarification Thank you!

The supplier claims that INN and KPP are not bank details. 14 August 2014, 14:56

All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price.

Moscow

- 931response

413 reviews

The supplier claims that INN and KPP are not bank details. Yulia Let him send an accountant for advanced training. 14 August 2014, 14:57 Was the lawyer's answer helpful? + 0 — 0 Collapse Client clarification Believe it or not, this supplier is the Metro Cash & Carry network.

)))) August 14, 2014, 14:59

- 931response

413 reviews

Believe it or not, this supplier is the Metro Cash & Carry chain. ))))Yulia-Western brand was dragged to the market, but they were not taught to work according to Russian laws... At least you will bring them a ray of light))) August 14, 2014, 15:02 Was the lawyer’s answer helpful?

+ 0 — 0 Collapse

Similar questions

- June 30, 2021, 12:39, question No. 1300431

- June 30, 2021, 12:39, question No. 1300432

- December 22, 2015, 21:04, question No. 1081066

- 07 July 2015, 15:24, question No. 896959

- 05 July 2021, 14:22, question No. 1687561

see also

Sample of filling out the unified form TORG-12

A sample of filling out the unified form TORG-12 can also be seen and downloaded on our website.

All issues related to filling out the header and tabular parts of TORG-12 are covered in detail in the Ready-made solution from ConsultantPlus. You can view the explanations by getting free trial access to K+.

Accounting and legal services

41, BC "Finlyandsky" To send a comment you need. If you need additional information, have any questions or need help, WE OFFER READY TURNKEY COMPANIES WITH OR WITHOUT AN OPEN ACCOUNT, AND WE WILL ALSO MANUFACTURE TO ORDER, FOR ANY OF YOUR REQUIREMENTS When purchasing a ready-made company from our company, you can count on comprehensive consulting assistance on all issues regarding the start of your business. Our lawyers are ready to come to your aid at any time in the formation and development of a ready-made company that you purchased from us.

Responsibility for compilation and accounting

Employees of organizations should pay attention to the details of filling out the document. This often helps to minimize the legal and tax risks of companies.

Pay attention to the seal! So, for example, a seal is not a mandatory requisite (it is not named in the list of mandatory requisites in 402-FZ). But the TORG 12 consignment note must have a stamp, since it is provided for by the form. On this issue, disagreements may arise when offsetting VAT with the tax office. On the other hand, if the consignee received the goods under a power of attorney certified by the organization’s seal, then it is not necessary to include it in the invoice. In this case, it is enough to attach a power of attorney to the invoice and ensure that these two documents are stored together.

Persons who signed the invoice on the part of the seller and the consignee bear, among other things, criminal liability in the event of, for example, theft or theft of goods. Therefore, accountants need to pay special attention to the presence of all the necessary signatures in the document when accepting it for accounting.

TORG 12 is also filled out by the buyer in case of returning the goods to the supplier. In this case, the “reverse” implementation occurs. The rules for filling out the document in this case remain unchanged.

Is it possible to give trade 12 without okpo. What information does the delivery note contain?

¦Consignee organization¦¦ L———T————¦ ¦/ delivery request /¦¦ ———-+————¬ ¦¦ ¦Employee who authorized¦ ¦¦ ¦ release of cargo, ¦ ¦¦ ¦ forms TORG-12 ¦ ¦¦ L———T———— ¦¦ ¦/ 2 copies.

¦ 1 copy¦ ———-+————¬ ¦¦ ¦ Chief accountant, ¦ ¦¦ ¦accounting employee¦ ¦¦ L———T———— ¦¦ ¦/ 2 copies. ¦¦ ———-+————¬ ¦¦ ¦ Employee, ¦ ¦¦ ¦ released the load ¦ ¦¦ L———T———— ¦¦ ¦ 2 copies.

¦¦ ¦ ————-+—————¬¦ L——————————>¦ Representative ¦L——————————————-+ consignee ¦ 1 copy

L—————————- The goods are received by a representative of the purchasing organization, vested with appropriate authority.

The fact of acceptance of the goods is recorded in the delivery note with the signature and seal of this official. If the goods are accepted by power of attorney, then its data is entered into the invoice and certified by a signature, and the signature is placed by the person indicated in the power of attorney. The power of attorney or its certified copy is attached to the return copy of the invoice.

The signatures of authorized persons on the consignment note are certified by the seals of the selling organization and the buying organization. The first copy is kept in the seller’s accounting department, the second in the buyer’s accounting department.

It should be noted that organizations under special tax regimes (simplified tax regime, UTII, unified agricultural tax) and organizations exempt from paying VAT for other reasons do not fill out columns 13 and 15. In addition, erasures and blots.

Correction of an error in the primary document must be indicated by the inscription “corrected”, confirmed by the signature of the persons who signed the document, and the date of correction must be indicated. The product data specified in the invoice must match the invoice data.

It is allowed to draw up a consignment note in a form developed by the organization independently.

In this case, it must contain the following data:

- press of organizations.

- positions of persons responsible for this business operation;

- name of the product, its quantity and cost;

- personal signatures of these persons;

- date of document preparation;

- the name of the document and the name of the organization on behalf of which the document was drawn up;

Officials authorizing the shipment of goods sign the delivery note in person. Signatures are certified by the organization's seal.

The possibility of using a facsimile must be stipulated in the supply contract.

If the transportation of goods is carried out by a third-party organization, then often, along with the bill of lading, a consignment note is also issued, confirming receipt of the goods for transportation and delivery to the recipient. Most often, the unified form N 1-T “Consignment note” is used (approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997

Moscow, st. Radio, +———-+ d. 24, t/f 778-25-32, ¦ ¦————————————————

EZh-Accountant

The accounting supplement of the newspaper “Economy and Life” is designed for practicing accountants, auditors, and tax officials. Presents current comments from experts, prompt answers to readers' questions, as well as laws, regulations, instructions, letters and clarifications from ministries and departments.

Publication frequency: weekly, 50 issues per year. Volume: 12 strips.

Packing list

- a primary accounting document used to formalize the transfer of ownership (by sale, release) of goods or other material assets from the seller to the buyer.

The invoice indicates the name (type) of the product, its price, quantity and total cost, as well as the amount of VAT.

In addition, the delivery note must contain the details of the transferring and receiving parties, handwritten signatures of authorized persons, and the seal of the organization.

How to accept or return goods using the TORG-12 invoice

Author: Alexandra Zadorozhneva June 18, 2021 The TORG-12 invoice is the primary accounting document according to which inventory items are accepted. It must be filled out at the stage of closing a government contract in order to receive payment. Before visiting the supplier, the customer must verify inventory items for compliance with the data specified in the delivery note, as well as the quantitative and qualitative characteristics specified in.

The rules for filling out TORG-12 in 2021 are regulated by regulations:

- Letter of the Federal Tax Service of Russia No. ED-4-15/ [email protected] dated November 25, 2014.

- Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998;

The document is generated in two copies, one of which the supplier keeps and the other transfers to the customer. Based on the received TORG-12, the buyer’s accounting department comes and, if necessary, writes off the received inventory items.

The filling date must strictly coincide with the delivery date, and a contract (agreement) must be indicated as the basis for the sale of inventory items. All signatures must be decrypted, and the entered data must comply. Some suppliers have automated the process of drawing up primary documentation and prefer to fill out TORG-12 online; this can be done on many accounting services.

Before signing the invoice, the accounting department needs to check it. An accountant can accept a document for accounting only if it is drawn up correctly. The delivery note can be filled out both in paper and electronic form.

If an organization draws up an invoice for goods in paper format, it is not required to use the TORG-12 form. You can use your own developed register.

The form can include the required number of columns in accordance with the needs and industry specifics of the enterprise. The decision in what form the primary documentation reflecting the supply of goods will be generated is made by the manager.

After developing and approving an independent form, it must be fixed in the accounting policies of the organization.

Include the required details in your own delivery note form:

- space for imprints of seals of the parties if they are used by organizations.

- number and date of formation;

- a table containing a list of supplied goods, unit of measurement and price characteristics;

- space for signatures of responsible persons indicating their positions;

- a document on the basis of which goods are shipped - a contract, invoice, invoice, etc.;

- name of the shipper and his details;

- name of the consignee and his details;

If the supplier uses the unified form TORG-12 from the album of unified forms of primary accounting documentation for recording trade operations, it is necessary to comply with the rules for register design. The TORG-12 invoice can be generated both in paper and electronic form, but for an electronic form you will need an electronic digital signature.