We already know that there are active and passive accounts. In this lesson we will look at what synthetic and analytical accounting is, as well as the concept of “subaccount”. According to the degree of detail and method of grouping, accounts are divided into synthetic and analytical. Synthetic accounts are accounting accounts designed to record information about the composition and movement of homogeneous groups, households. funds of the organization, their sources and households. processes, in a generalized form. Accounting occurs only in monetary terms. Synthetic accounts are balance sheet , i.e. According to their data, the account is filled out. balance.

Synthetic accounts provide generalized information about the accounting object.

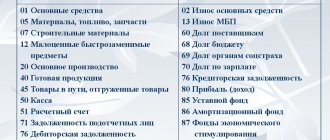

Synthetic accounts include 10 “Materials”, 01 “Fixed assets”, 80 “Authorized capital”...

Synthetic accounts are called 1st order accounts. 2nd order accounts are sub-accounts.

The concept of synthetic and analytical accounts

In accounting, the economic life of enterprises and individual entrepreneurs is reflected in certain accounts regulated by the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application” dated October 31, 2000 No. 94n.

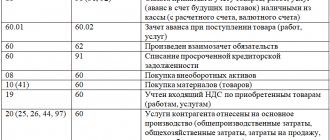

Account entries reflecting the facts of business activities are made using the double entry method. In practice, this means simultaneous entry of an identical amount into the debit of one account and the credit of another. Basic accounting accounts are called synthetic. Synthetic accounts are accounts that contain generalized data on the business activities, property of the organization, as well as on the sources of property, collected according to certain characteristics. Synthetic accounting accounts have the ability to be divided into second-order subaccounts intended for detailing the account.

IMPORTANT! Accounting in synthetic accounts is displayed exclusively in monetary terms.

Analytical accounts are intended for greater detail and analytical assessment of the economic state of the organization. Accounting for this type of account is called analytical.

Analytical accounts are accounts of the third, fourth... order, which display in detail the cost and quantitative indicators of accounting.

IMPORTANT! The evaluation of operations in analytical accounting is carried out in monetary and quantitative terms.

Based on the definition of synthetic and analytical accounting, we can say that analytical accounting is an additional decoding in detail to synthetic accounting.

about what analytical indicators synthetic accounts should have according to the chart of accounts and instructions for its use here.

What is a synthetic account?

A synthetic account is usually understood as an account on which business transactions are recorded, combined according to some characteristic. For example, account 01, approved in the Russian Chart of Accounts, which is used by private enterprises, can reflect various transactions on fixed assets. On account 50 there are cash transactions, on account 41 there are transactions showing the movement of goods.

An accounting chart of accounts is a document approved by law. All private companies in the Russian Federation are under its jurisdiction. Therefore, the synthetic accounts contained in it are mandatory for use by all Russian companies.

Synthetic accounts are used as a source of figures for filling out the most important financial reporting documents of a company - such as, for example, a balance sheet. Also, information from these accounts can be used to analyze various indicators of the company’s financial performance.

The procedure for the formation of synthetic and analytical accounting

According to the Chart of Accounts, there are a number of accounts for which it is possible to open subaccounts. Subaccounting, by its purpose, is an additional link between analytical and synthetic accounting. The subaccount, in turn, combines several analytical accounts. Grouped analytical accounting is maintained within one synthetic account, including within sub-accounts.

In practice it looks like this.

Consider account 41 “Goods”. According to the Chart of Accounts, it is divided into the following sub-accounts:

- 41.01—goods in the organization’s warehouses;

- 41.02 - goods in retail trade;

- 41.03 - containers under the goods and empty;

- 41.04 - purchased products.

Subsequently, within each sub-account there is a breakdown of analytical accounts, for example:

- 41.04 “Purchased items” - accounting subaccount;

- Cotton fabric, chintz, flannel - analytical account.

Thus, the analytical account in this case will be the characteristics and designation of the type of property. Further, its characteristics can be deepened by other parameters, for example, by color or width of the canvas.

An example of analytical accounting for account 10 “Materials”, subaccount 10-3 “Fuel” from ConsultantPlus Vostok LLC has six cars: two of them are fueled with AI-92 gasoline, two with AI-95 gasoline and two with diesel fuel .

Fuel accounting is kept on account 10 “Materials”, subaccount 10-3 “Fuel”. For intermediate grouping of data on fuel in vehicle tanks by type, second-order subaccounts are used: 10-3-1 “Gasoline” and 10-3-2 “Diesel fuel”. Analytical accounting of fuel is carried out in the balance sheet according to fuel grades and storage locations, which are considered to be vehicles. For August, the accountant filled out the balance sheet based on data from primary documents - waybills and advance reports of drivers with attached gas station receipts. You can view the entire example in K+ by getting free trial access.

Table

| Synthetic account | Analytical account |

| What do they have in common? | |

| The analytical account is located inside one of the synthetic ones (which, in turn, also contains subaccounts) | |

| The opening and closing balances for all analytical accounts located inside the synthetic account must be equal to the opening and closing balances of this account | |

| What is the difference between them? | |

| Designed to group business transactions based on the most general signs of their similarity | Designed to group business transactions based on their maximum similarity |

| Mandatory for use in the form approved by law | Can be developed by the company independently, used for ease of accounting |

Mutual relationship between synthetic and analytical accounting

Facts indicating the relationship between analytical accounting and synthetic accounting:

- The basis for records in both types of accounting is the same document.

- Analytics is an additional detailed characteristic to synthetic accounting.

- The total amount of turnover for analytical accounts is equal to the total turnover for a synthetic account that combines detailed analytics.

For example, material accounting at a sewing enterprise can be organized as follows.

Synthetic accounting

| Check | Beginning balance (rub.) | Turnover (rub.) | Balance (rub.) | |

| Dt | Dt | CT | Dt | |

| 10.1 "Raw materials" | 18 490 | 7 500 | 17 670 | 8 320 |

Analytical accounting

| Check | Nomenclature | Unit change | From-beginning | Revolutions | S-to con | |||||

| Qty | Dt (rub.) | Qty | Dt (rub) | Qty | Kt (rub) | Qty | Dt (rub) | |||

| 10.1.1 Fabrics | Pog. m | 20 | 10 000 | 12 | 6 500 | 22 | 10 800 | 10 | 5 700 | |

| silk | linear m | 5 | 3 000 | 2 | 1 200 | 4 | 2 400 | 3 | 1 800 | |

| cotton | linear m. | 10 | 1 500 | 6 | 900 | 12 | 1 800 | 4 | 600 | |

| wool | linear m. | 5 | 5 500 | 4 | 4 400 | 6 | 6 600 | 3 | 3 300 | |

| 10.1.2 Fittings | PC. | 150 | 1140 | 170 | 900 | 250 | 1 620 | 70 | 420 | |

| buttons | PC. | 120 | 240 | 150 | 300 | 210 | 420 | 60 | 120 | |

| lightning | PC. | 30 | 900 | 20 | 600 | 40 | 1 200 | 10 | 300 | |

| 10.1.3 Sewing accessories | PC. | 14 | 7 350 | 2 | 100 | 10 | 5 250 | 6 | 2 200 | |

| scissors | PC. | 7 | 7 000 | 5 | 5 000 | 2 | 2 000 | |||

| Tape measure | PC. | 7 | 350 | 2 | 100 | 5 | 250 | 4 | 200 | |

Account 10 can correspond with different accounts, for example, accounts 20, 60, 76, 91, and even with account 94. Accounting account 94 is an account for accounting for shortages and losses.

Subaccounts

Subaccounts serve as an intermediate link between synthetic and analytical accounts. They are opened for a specific synthetic account, and information from one or more analytical accounts can be combined on it. In turn, several sub-accounts can form one synthetic account. This is demonstrated by the table, which shows the structure of synthetic accounting account 90 “Sales” and its connection with analytics and subaccounts:

| Synthetic account | Subaccounts | Analytical accounting |

| 90 "Sales" | 90/1 “Revenue” | Analytics (cards, accumulative statements) for the account are maintained for each subaccount, generating data on revenue, cost, VAT, etc., as well as by type of product, sales regions, directions, based on the interests of the company, broken down by the corresponding subaccounts |

| 90/2 “Cost” | ||

| 90/3 "VAT" | ||

| 90/4 "Excise taxes" | ||

| 90/5 “Export duties” | ||

| 90/9 “Profit/loss from sales” | At the end of the year, all open subaccounts are closed with internal postings to subaccount 90/9 |

Another example is the breakdown of account 10 “Inventory and Materials” into subaccounts, where materials, fuel, packaging are taken into account separately, and cards are created in the warehouse for each type of material, the balances of which are transferred to the corresponding subaccounts of the 10th account, and subsequently the total balance is displayed according to the account.

Displaying synthetic and analytical accounting in the organization’s reporting

Maintaining accounting records by double-entrying accounts according to the approved working chart of accounts is the responsibility of the organization.

The turnover and results of synthetic accounting are reflected in the general ledger. The general ledger is the basis for the preparation of financial statements, including the balance sheet.

You can see an example of the General Ledger and other accounting registers in ConsultantPlus. Trial access to the system can be obtained for free.

Analytical accounting is reflected in a variety of accounting registers: cards on the movement of property, accumulative statements and other reporting documentation. Combining synthetic and analytical accounting in one accounting register is common.

What is an analytical account?

An analytical account reflects transactions taken individually or grouped based on exceptional similarity - much more pronounced than that which characterizes transactions that are combined within synthetic accounts.

In this case, the analytical account is always located inside one of the synthetic ones and is used for additional classification of transactions recorded on the synthetic account. The total indicators of the initial and final balance, as well as the turnover of all analytical accounts located in the synthetic account, must correspond to the figures for its initial and final balance.

In this case, we can draw some analogy with the PC file system. A synthetic account is something like a root directory, drive C. An analytical account is something like a group of files that have the same resolution - for example, DOC or JPG, or the same type (pictures, documents).

At the same time, the function of the folder, which is located between the C drive and the files, is performed by another type of accounting accounts - a subaccount.

We noted above that synthetic accounts are approved for Russian enterprises by law and must be used by firms unchanged. But a company can come up with its own analytical accounts - in any quantity and variety. They are used not because they are required by law, but for greater convenience of accounting.

Analytical accounts are useful from the point of view of checking the correctness of the figures reflecting the balances and turnover of synthetic accounts - we noted above that they must match. The correctness of the values for the second is the most important condition for drawing up reliable financial statements and conducting a qualitative analysis of the company’s economic efficiency.

Monitoring the correctness of synthetic and analytical accounting

The main document for monitoring the correct display of accounting records is the balance sheet.

For more information on the procedure for generating turnover sheets, see the material “How to fill out a turnover sheet (form, sample)?” .

This accounting register is a grouping by accounting accounts, including subaccounts, indicating their names, total balances at the beginning of the period, turnover for the period (according to the assets and liabilities of the accounts), and the total amount as of a given date.

IMPORTANT! The turnover sheet can be compiled for any time period: both per day and per month, full and partial year. To form a balance sheet, data from the turnover sheet for the reporting period is taken.

The statement must meet the main principle of equality (the final balances of the debit and credit of the accounting account must be equal to each other).

IMPORTANT! The principle of equality is regulated and characterized by the structure of financial statements (balance sheet). The debit of the accounts is responsible for the property of the business entity; the credit of the accounts reflects the sources of formation of the property. Failure to comply with equality clearly indicates a violation and incorrect reflection of the facts of the organization’s activities in accounting.

For more details on the details of drawing up a balance sheet, see the article “Filling out Form 1 of the balance sheet (sample).”

Turnover sheets for analytical accounting can take different forms. These include a variety of statements - storekeepers' reports, commodity reports, and other accounting registers. The procedure and timing for the generation of statements are regulated by the established document flow of the organization and legislative norms. Most often, for the preparation of analytical reports, this is a calendar month.

Relationship between account and balance

There is a close relationship between accounts and balance. Each balance sheet item has a corresponding account, except for individual items that reflect data from several accounts.

For example, Raw Materials and Supplies contains balances for several accounts.

Cash - this item summarizes the balances of accounts 50, 51, 52, 55.

Accounts are divided into active and passive in the same way.

The balances of assets and the sources of their formation are shown in the accounts on the same line as in the balance sheet. The sum of the balances for all active accounts is equal to the total of the assets of the balance sheet, for all passive accounts they are equal to the total of the liabilities of the balance sheet.

Drawing up a turnover sheet for synthetic accounts - an example

Due to the fact that the turnover sheet for synthetic accounts is intended to obtain aggregate accounting data, the table is compiled at the end of the time period for which financial or management reporting is generated. Before using the information, you need to check whether all current transactions are reflected in the accounting program: each missed one will require changes to the “turnover”.

How to draw up a turnover sheet for synthetic accounts - example:

| Accounting (name) | Initial balance (RUB) | Turnover (rub.) | Final balance (RUB) | |||

| D | TO | D | TO | D | TO | |

| Account 01 "Fixed assets" | 355 | 355 | ||||

| Account 02 “Depreciation of fixed assets” | 40 | 10 | 50 | |||

| Account 10 "Materials" | 55 | 120 | 45 | 130 | ||

| Account 20 "Main production" | 70 | 55 | 15 | |||

| Account 25 “General production expenses” | 25 | 25 | ||||

| Account 51 “Current account” | 250 | 140 | 275 | 115 | ||

| Account 60 “Settlements with suppliers and contractors” | 520 | 250 | 290 | 560 | ||

| Account 62 “Settlements with buyers and customers” | 100 | 240 | 165 | 25 | ||

| Account 80 “Authorized capital” | 10 | 10 | ||||

| Account 84 “Retained earnings” | 70 | 70 | ||||

| Account 90 "Sales" | 350 | 350 | ||||

| Account 91 “Other income/expenses” | 5 | 5 | ||||

| Account 99 “Profit/loss” | 80 | 70 | 50 | 100 | ||

| Total: | 740 | 740 | 1270 | 1270 | 715 | 715 |