Payroll calculation made easy!

Automated calculation of salaries, personal income tax and contributions in a few clicks.

The service itself will generate reports on employees. Save your time. Try for free

6-NDFL is considered a simple quarterly report - it includes only two sections. However, the variety of situations in which tax agents withhold and remit taxes raises questions about completing the report. Let's dwell on one of them: “How is salary displayed in 6-NDFL based on the payment procedure?” The question is multifaceted, so let's talk about everything in order.

Who, where and when submits the report

The Tax Code of the Russian Federation assigns the obligation to fill out and send to the Federal Tax Service at the place of registration of the 6-NDFL report to tax agents - organizations and entrepreneurs who make payments to individuals within the framework of labor relations and under GPC agreements. If there were no payments to individuals in the reporting period, the “zero” report form does not need to be submitted (Articles 24, 226, 230 of the Tax Code of the Russian Federation).

Form 6-NDFL and the procedure for filling it out were approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [email protected]

The report is submitted to the Federal Tax Service using the TKS or on paper. Tax agents paying income to 10 or more individuals must send calculations electronically from 2021; in other situations, a paper form is allowed.

The calculation is submitted by the end of the month following the reporting quarter. In 2021, due to the coronavirus pandemic, 6-EDFL for the 1st quarter was allowed to be submitted until July 30. The deadline for submitting the annual report is March 1 of the reporting year. This is a change for 2020; previously, the report could be submitted until April 1.

Non-payment of wages: legislation and business practice

The legislation provides for a whole arsenal of levers to protect an employee in cases of delay in his salary payments:

- employer's financial liability (monetary compensation for delayed payments) - Article 236 of the Labor Code of the Russian Federation;

- administrative responsibility (part 1 of article 5.27 of the Code of Administrative Offenses of the Russian Federation) for officials, individual entrepreneurs and organizations;

- criminal liability (Article 145.1 of the Criminal Code of the Russian Federation), including a fine;

- employee self-defense function: suspension of work by an employee until salary payments are made (Part 2 of Article 142, 379 of the Labor Code of the Russian Federation).

However, in the context of a deepening economic crisis, an increasing number of companies are experiencing an acute shortage of available cash. The objective financial difficulties that arise in this case carry high risks of the formation and rapid growth of wage arrears.

In this case, how should an accountant enter information into Form 6-NDFL? What if non-payments are protracted: a month, a quarter or more?

Let's look at the problem using the example of filling out a calculation taking into account clarifications issued by fiscal authorities.

General requirements for filling out the report

6-NDFL must be filled out based on accounting data for income accrued and paid to individuals, tax deductions provided to them, as well as calculated and withheld personal income tax. All this data is contained in tax registers.

Report 6-NDFL includes:

Title page - contains the details of the tax agent, the Federal Tax Service - the recipient of the calculation, as well as the calculation number and the period for which it is submitted.

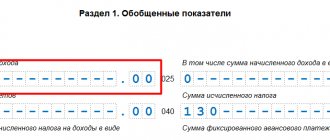

The first section reflects the total value for all individuals:

- income (on line 020), incl. dividends (on line 025);

- tax deductions (on line 030);

- taxes (on line 040), incl. from dividends (on line 045);

- fixed advances for tax on income of foreigners (on line 050).

This section is completed for each income tax rate separately (line 010) - 13, 15, 30 or 35 percent.

Lines 060-090 - the number of individuals who received income, tax withheld and not withheld, tax returned - are filled in throughout the organization, so their values are indicated only on the first sheet. The second section includes all taxable income (salaries, sick leave, vacation pay, bonuses, etc.) paid during the reporting period. This section deciphers the date of receipt of income, withholding tax and transferring it to the budget. Let's look at filling out the section line by line using the example of wages.

Line 100 is the date when the income was actually received. When paying salaries, the last day of the month is indicated.

Line 110 is the date when tax is withheld from income. According to the Tax Code of the Russian Federation, tax must be withheld on the day the income is paid, i.e. on the day the individual actually received the money. For example, if a payment for July is made on August 5, then the tax is withheld on August 5.

Line 120 is the date when the withheld tax must be transferred by the tax agent to the budget. As a general rule, no later than the day following the day of salary payment.

Lines 130 and 140 - the amount of income and the tax withheld from it, respectively.

Let's look at specific examples of how wages are reflected in 6-NDFL.

EXAMPLE No. 4.

In 2021, the employee was given a loan in the amount of 200 thousand rubles.

The amount of material benefit on a loan issued in rubles is calculated using the formula:

Amount of the loan provided x (2/3 x rate of the Central Bank of the Russian Federation -%) / 365 (366) x days, where:

rate of the Central Bank of the Russian Federation - the refinancing rate of the Central Bank of the Russian Federation, in effect on the last day of the month;

% – interest rate on the loan provided;

365 (366) – number of days in a year;

days – number of days of loan use per month.

The tax agent as of December 31, 2016 determined the material benefit in the amount of 1,129.33 rubles (200,000 rubles x 2/3 x 10%: 366 days x 31 days), personal income tax - 395.27 rubles (1,129.33 rubles x 35%).

How to reflect salary in 6-NDFL

According to the Labor Code of the Russian Federation, employers must pay their employees at least twice a month. Specific terms of payments are established in employment contracts, collective agreements and other local documents. The completion of the personal income tax calculation depends on the date of recognition of income.

Carryover income

If settlements with employees are made in the month following the month of accrual, then the amounts paid must be reflected in 6-NDFL in a special manner. For example, salaries for June are paid in July. In this situation, wages will be reflected in the half-year report in the first section, and in the 9-month report in the second section.

Example 1. In January-June 2021, 15 people worked. During the period under review, employees were only paid salaries. The collective agreement stipulates that payments are made on the 5th and 20th of the month.

Accruals to Zeus LLC for January-June 2021:

- accrued income - 3,100,000 rubles;

- provided tax deductions - 81,200 rubles;

- calculated tax - 392,444 rubles - (30) × 13%;

- tax for June 2021 - 36,520 rubles.

In the half-year report, accrued income (3,100,000) is indicated on line 020, deductions provided to employees (81,200) on line 030, calculated tax (392,444) on line 040. Next, line 060 reflects the number of employees to whom the organization accrued income (15), on line 070 - withheld tax from wages for January - May (355,924), income for June is not included, since it will be paid only in July and the tax will be withheld at the same time.

The first section of the calculation of 6-NDFL of Zeus LLC for the first half of 2021:

Let's consider how Zeus LLC will reflect the December 2020 salary in the report.

The day of final settlement with employees - the 5th - falls on the January holidays. According to the Labor Code of the Russian Federation, in this case, wages must be paid on the last working day in December - the 29th. Then the income accrued to employees will fall into the first section of the calculation for 2021 and into the second section for the first quarter of 2021. At the same time, in the second section of the report, the date of recognition of income is indicated as 12/31/2020, the date of tax withholding is 12/29/2020, and the date of tax transfer is the first working day in January 2021.

Final payment by the end of the month

If an organization pays employees before the end of the month, then filling out 6-NDFL depends on the tax withholding date. Let's assume that the salary for June 2021 is paid on the 29th. In the case of withholding tax on early payment (although this contradicts Article 223 of the Tax Code of the Russian Federation), the date of issue of income is indicated on line 110, and on line 120 - the working day following the day of issue. If tax is withheld from future payments, for example, from an advance for July, income for June is reflected on line 020 of the half-year report, and in lines 100-140 it must be indicated in the report for 9 months of 2021.

Example 2. At Mercury LLC, the payment of wages - the final payment for the month - is set for the last day of the month. The accrual amounts for April-June 2021 are shown in the table.

| Month | Payment date | Amount of charges | Amount of tax withheld |

| April | 30.04.2020 | 115 000 | 14 950 |

| May | 31.05.2020 | 120 000 | 15 600 |

| June | 28.06.2020 | 134 000 | 17 420 |

The tax was withheld on the day the income was paid. The accountant of Mercury LLC reflected the accruals in the calculation of 6-NDFL for the six months. In lines 100 he reflected the date of payroll - the last day of the month. On lines 110 - indicated the dates of payment of wages, and on lines 120 - the working day following the payment days.

Payments upon dismissal

Upon dismissal, an employee is paid his earnings for the month worked and compensation for unused vacation. In this situation, tax on monthly income and compensation is withheld on the day of payment and transferred on the next business day. If salary and compensation are paid at the same time, then in 6-NDFL they are summed up and reflected together, if on different days, then each payment is reflected separately.

Example 3. An employee of Venera LLC resigned on May 16, 2020. On the day of dismissal, May 16, he was paid wages for May (23,450 rubles) and compensation for vacation (11,710 rubles). In the calculation of 6-NDFL, payments will be reflected as follows:

Simultaneous payment of salary and sick leave

For some payments - annual leave, sick leave, etc. – there are special rules for withholding and transferring income tax. So, for sick leave and vacation payments, the day the tax is transferred is the last day of the month for which they were paid.

Example 4. On 06/05/2020, I paid an employee wages for May in the amount of 28,000 rubles and sick pay in the amount of 4,300 rubles. The tax on wages amounted to 3,744 rubles, and on sick leave - 559 rubles. Since the tax on income for the month must be transferred on the next working day after deduction, and from sick pay - on the last day of the month, payments are indicated separately in 6-NDFL.

Income accrued but not paid

In the case of the code, the organization accrued salaries to employees, but did not pay them, the following options for filling out 6-NDFL are possible:

- do not fill out the second section;

- reflect in line 100 of the second section the last day of the month of income accrual.

Example 5. Monthly accruals in favor of employees of Jupiter LLC amount to 240,000 rubles. There were no payments in May and June 2020. The accountant indicated the accrued amounts in the second section of the report.

Payment of bonuses

Regarding bonuses, there are some features of how they are reflected in the report. So, if the bonus is part of the salary and is paid monthly, then its amounts in the second section of the calculation are reflected along with the salary. And if the bonus is one-time, for example, for a holiday, then it is indicated separately, since the dates of income recognition are different.

Example 6. At LLC Saturn, the bonus regulations establish a monthly bonus of 5,000 rubles. In May 2020, the amount of income accrued to employees, taking into account bonuses, amounted to 360,000 rubles. Payments to employees are made on the 5th and 20th of the month. In May, one of the employees had an anniversary; in honor of this, on May 21, 2020, she was given a bonus of 10,000 rubles. The accountant reflected the indicated accruals in 6-NDFL for the six months.

Payment of income according to GPA

Payments under a civil contract differ from payments under an employment contract, when income is the last day of the month of accrual, and tax is not withheld from the advance and is not reflected separately in 6-NDFL. Income recognition under the GPA occurs on the day of payment to the individual, i.e. advance payment and final payment under the contract are indicated separately in the calculation, tax is withheld on the day of actual payment.

Example 7. Uran LLC paid V.V. Vasilkov according to the GPD. May 14, 2021 advance. The advance amount is 22,000 rubles, the tax on the advance is 2,860 rubles. The accountant transferred to Vasilkov V.V. advance minus tax. Amount of advance by Vasilkov V.V. will be reflected in the second section of the calculation for the half-year.

Partial income taxation

Some income received by individuals is not taxed. However, in 6-NDFL they are indicated in full. For example, gifts worth up to four thousand rubles are not subject to taxation. If the amount of the gift is more than the amount established by law, then the tax is calculated only on the excess amount. Then the first section of the calculation will reflect the entire amount of the gift - line 110, line 030 indicates the non-taxable part of the income. The second section indicates the full amount and calculated tax.

If the income is completely exempt from income tax, such as state benefits, it does not need to be reported.

Example 8. On June 3, 2021, Neptune LLC gave its employee a gift, the cost of which was 7,000 rubles. On the same day, the woman received earnings for May 2021 in the amount of 25,000 rubles, from which the accountant withheld tax on the gift. There were no further accruals during the reporting period. The 6-NDFL report for the half-year will be filled out as follows:

- In the first section, line 020 indicates the amount of income for the month and the gift - 32,000 rubles. On line 030 - the tax-free amount of the gift is 4,000 rubles. The tax on wages will be 3,250 rubles (25,000 × 13%), on a gift - 390 rubles ((7,000 - 4,000) × 13%). Since the tax is withheld, it will be reflected in lines 040 and 070.

- In the second section, the accountant will separately reflect wages and gifts, since the dates of income recognition are different.

Sick leave payment period

Temporary disability benefits are paid by the employer or directly by the social insurance fund in the regions participating in the Social Insurance Fund pilot project. However, even in those regions where direct payments are made, the employer independently pays for the first 3 days of illness.

For the payment of accrued benefits, paragraph 1 of Article 15 of Law No. 255-FZ establishes a certain period - the day closest to the date of payment of wages after the assignment of benefits.

The benefit may be paid in installments. Each of these parts has its own payment date.

In general, payments of parts of one benefit may occur in different months or quarters, and the conditions for calculating personal income tax may differ. The date of actual receipt of income in the form of temporary disability benefits is determined as the date of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Consequently, if benefits for one sick leave are paid in several parts, then each of these parts corresponds to its own payment date and the date of actual receipt of income.