28 January 2020

Peasant farming is the same taxpayer as any other commercial organization. The specifics of the activity certainly influence the choice of taxation system and accounting.

In 2021, OSNO, simplified tax system and the profile mode of unified agricultural tax are available for peasant farms. The latter is relevant for commodity producers. In general, a peasant farm can be called an organization whose activities are related to the production, processing, and sale of agricultural and livestock products.

What are the benefits of using unified agricultural tax?

If we talk about the tax burden, then until 2021 the Unified Agricultural Tax was superior to both the OSNO and the simplified tax system. Let's compare the tax base and tax rate of systems whose object of taxation is received income (we remind you that for UTII neither income nor expenses are taken into account):

| Element of the tax system | Unified agricultural tax | BASIC | USN Income | USN Income minus expenses |

| The tax base | Monetary value of income reduced by expenses | Monetary expression of profit, that is, the difference between income and expenses | Monetary expression of income | Monetary value of income reduced by expenses |

| Tax rate | 6% | 20% (in general) | 6% | From 5% to 15% (depending on the size of the differentiated rate accepted in the region) |

As you can see, although the tax rate for the Unified Agricultural Tax and the simplified tax system for Income is the same, the tax base for the simplified tax system for Income is larger, since it does not take into account expenses incurred, which means that the tax payable will be higher.

It was possible to compare the Unified Agricultural Tax in terms of the tax burden only with the simplified tax system Income minus expenses (subject to the minimum possible rate of 5%, which is not applied in all regions). However, since 2019, agricultural tax payers, as well as those who work for OSNO, began to pay VAT. You can be exempt from paying this tax if the agricultural producer’s income in 2021 did not exceed 90 million rubles.

Who can be a payer of the Unified Agricultural Tax

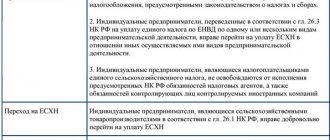

A full description of taxpayers entitled to the Unified Agricultural Tax is given in Art. 346.2. Tax Code of the Russian Federation. They can only be:

- Organizations and individual entrepreneurs, as well as agricultural consumer cooperatives that produce, process and sell agricultural products. This condition must be considered comprehensively, that is, all these requirements must be taken into account. It’s just that processors and sellers of agricultural products do not have the right to the Unified Agricultural Tax.

- City-forming and village-forming Russian fishery organizations, provided that the number of workers in them, taking into account family members living with them, is at least 50% of the population of this locality. This also includes fishing cooperatives (collective farms). In this case, fishing must be carried out on fishing fleet vessels owned by right of ownership or on the basis of charter agreements.

- Organizations and individual entrepreneurs that provide services to agricultural producers in the field of crop and livestock production.

Specific primary

Accounting in a farm involves processing primary documents, reflecting financial and economic transactions in the database, maintaining registers, making entries, generating and submitting reports. It’s worth looking at the primary in more detail.

The use of a number of documents is due to the peculiarities of farming activities. Thus, a peasant farm accountant has to deal with waybills F412 of the agro-industrial complex, registers for sending grain from the field, accumulative statements of harvest receipts, records of the movement of raw materials, acts for sorting, drying, etc. Limit-fence cards, acts of write-off of materials, acts of posting of offspring (relevant for livestock farming) are also accepted for accounting.

A peasant farm accountant must have the appropriate competencies and experience in accounting for an agricultural producer. Otherwise, serious mistakes and associated tax, financial, legal and reputational consequences cannot be avoided.

Restrictions for Unified Agricultural Tax

Additional restrictions for using this mode look like this:

- Manufacturers of excisable goods (alcohol, tobacco, etc.), as well as those involved in the gambling business, cannot work for the Unified Agricultural Tax.

- In order to be able to switch (for already operating business entities) or retain the right to unified agricultural tax, the taxpayer must fulfill the condition that the share of income from the sale of agricultural products or fishing catch is at least 70% of his total income.

- If the average annual number of fishery organizations and individual entrepreneurs using the Unified Agricultural Tax does not exceed 300 people. There is no such requirement for agricultural organizations.

- There are no restrictions on the amount of income received, provided that the requirement for a share of income of at least 70% is met.

Start of work on Unified Agricultural Tax

Individual entrepreneurs and firms operating under a general or simplified taxation system switch to the Unified Agricultural Tax starting on January 1 of the year following the year in which the notification was submitted. Those who received the status of an individual entrepreneur or a legal entity and immediately declared their intention to apply the Unified Agricultural Tax, use this regime from the beginning of production activities.

When the right to use the unified agricultural tax is lost

Loss of the status of an agricultural producer and, accordingly, the right to apply a preferential agricultural special regime is possible in the following cases:

- reducing the mandatory 70% barrier to the share of sold agricultural products in gross income;

- violation of requirements for agricultural producers entitled to apply a special regime;

- termination of activities that give the right to apply the Unified Agricultural Tax;

- transition to another form of taxation.

Since the tax period for agricultural tax is a calendar year, all decisions regarding the loss of the right to use the Unified Agricultural Tax are made after December 31. If you refuse to further apply the special regime (regardless of the circumstances), the business entity is obliged to notify the fiscal service about this as follows:

- in case of violation of the criteria of the Unified Agricultural Tax payer - by submitting an application for loss of the right to a special tax in form No. 26.1-2;

- if you wish to use a general or simplified taxation system - according to form No. 26.1-3;

- when interrupting activities related to agriculture - according to form No. 26.1-7.

Information on the given forms must be submitted to the tax authority for a limited period - from January 1 to January 15 of the new calendar year.

How to fill out and submit a tax return under the Unified Agricultural Tax?

An individual entrepreneur must submit a declaration for the single agricultural tax to the Federal Tax Service inspectorate at the place of residence no later than March 31 of the year following the expired tax period.

The prescribed declaration form can be filled out by hand or on a computer and then:

- either submit in person or through a representative with a notarized power of attorney (you can make an appointment with the inspectorate on the Federal Tax Service website>);

- or send by mail in a valuable letter with a list of the contents;

- or transfer online using a special service on the Federal Tax Service website (a qualified electronic signature is required).

Elements of the Unified Agricultural Tax system

The Unified Agricultural Tax can be called a taxation system that is easy to understand. What do you need to know about this system?

- The tax period, that is, the period of time at the end of which the amount of tax payable is calculated, is a calendar year.

- The reporting period based on the results of which the advance tax payment must be calculated and paid is six months. The declaration at the end of the reporting period is not submitted, but by July 25 an advance payment must be made based on the income received in the first half of the year.

- The object of taxation for the Unified Agricultural Tax is income reduced by the amount of expenses, and the tax base is the monetary value of such income. The rules for recognizing income and expenses for calculating agricultural tax are very similar to those that apply when calculating the tax base when calculating the simplified tax system Income minus expenses.

- The tax rate is 6%, and has no regional specifics, and local authorities cannot limit the operation of the Unified Agricultural Tax on their territory.

We draw the attention of all LLCs to the Unified Agricultural Tax - organizations can pay taxes only by non-cash transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the organization’s obligation to pay tax is considered fulfilled only after presentation of a payment order to the bank. The Ministry of Finance prohibits paying LLC taxes in cash. We recommend that you open a current account on favorable terms.

How to switch to Unified Agricultural Tax

The transition to paying agricultural tax is voluntary and is possible both when registering a business entity, and if an LLC or individual entrepreneur is already operating under some kind of regime. The notification is submitted to the registering tax authority in form No. 26.1-1.

- Newly registered individual entrepreneurs and legal entities must submit a notification within 30 days after registration to switch to the Unified Agricultural Tax.

- Already operating business entities can submit a notification no later than December 31 of the current year in order to switch to paying agricultural tax from the beginning of the new year. At the same time, they must indicate in the notification data on the share of income from the sale of agricultural products or fishing catch. This share must be at least 70% of total income.

Current accounting nuances

Now is the time to understand the specifics of accounting. Let's start with property. If a peasant farm operates on a single social tax or unified agricultural tax, the obligation to take into account property data in separate registers does not arise. For OSNO users, such accounting remains relevant.

Forms of internal accounting of property of peasant farms are determined independently. Books of the 1-KX form are most often used. Separate sections take into account data on plots, perennial plantings, fixed assets, equipment, machinery, transport, and working capital. Also a separate type of property is productive, draft and fattening livestock.

Intangible assets are also subject to mandatory registration. Their cost is formed in the same order as the OS. The initial cost is determined based on actual acquisition costs. Intangible assets of a farm include copyrights, breeding innovations for production, processing of products, licenses (including software), patents for plant varieties, rights to use natural resources.

Intangible assets are included in expenses by depreciation. The period of their use is determined by the period of expected receipt of economic benefits.

Another mandatory accounting item is wages for farm workers. Labor relations are formalized in accordance with the Labor Code. For salary accounting, such primary documents as time sheets, work orders, travel tickets, accounting sheets, registers and payroll sheets are important.

KF X has the status of a legal entity or individual entrepreneur with the right to hire employees. In wage accounting, primary documents are used to record personnel and their labor:

- Time sheets.

- Work orders for piecework work.

- Vehicle waybills.

- Registers and accounting sheets.

- Sheets for calculating and issuing wages.

Amounts received by employees for wages are subject to income tax. The peasant farm acts as a tax agent in relation to the staff and has the obligation to withhold tax and pay it to the budget.

Loss of the right or refusal to apply the unified agricultural tax

If at the end of the year it turns out that the requirements for the application of this regime have been violated (for example, the share of income from the sale of agricultural products or fishing catch is at least 70% of the total income), then the Unified Agricultural Tax payer must report this in Form No. 26.1-2. In this case, the tax for the past year will be recalculated based on the requirements of OSNO, and the arrears will have to be paid in January of the new year.

You can also refuse to apply this preferential treatment on a voluntary basis; this is reported in Form No. 26.1-3. This can be done only at the end of the tax period, that is, the calendar year, in the period from January 1 to January 15.

Finally, the fact that the Unified Agricultural Tax payer has ceased the activities of the agricultural producer must be reported within 15 days from the date of termination of such activities in Form No. 26.1-7.

Questions and answers

- We are producers of agricultural products. Our assortment includes berries, jam, honey. We use small retail kiosks to sell manufactured products. Will we have to pay property taxes on these kiosks? In our work we use Unified Agricultural Tax.

Answer: Considering the fact that trade pavilions are used for selling agricultural products, you will not pay property tax on these objects in 2021, because By law, from January 1, 2021, business entities using the Unified Agricultural Tax are exempt from paying property tax on facilities used for primary and subsequent industrial processing and sale of agricultural products.

- Our organization discovered distributed and unclaimed dividends. How should we deal with them in terms of calculating and paying income taxes?

Answer: According to Federal Law No. 286-FZ of September 30, 2021, dividends or part of distributed profits not claimed by participants of a business company or partnership, restored as part of the retained earnings of a business company or partnership, are not subject to income tax.

Reporting, accounting and payment of tax on unified agricultural tax

Agricultural tax payers submit one declaration per year, completed in the prescribed manner, no later than March 31 of the year following the reporting year. If the activity is terminated before the end of the tax period, then the declaration must be submitted no later than the 25th day of the month following the month of termination of the activity.

Individual entrepreneurs at the Unified Agricultural Tax maintain a special Book of Income and Expenses designed for this regime; organizations maintain only accounting registers.

If you did not manage to pay taxes or contributions on time, then in addition to the tax itself, you will also have to pay a penalty in the form of a penalty, which can be calculated using our calculator:

So that you can try outsourcing accounting without any material risks and decide whether it suits you, we, together with the 1C company, are ready to provide our users with a month of free accounting services :

Get free accounting services

Agricultural tax is paid twice a year: once in the form of an advance payment at the end of the half-year no later than July 25, and a second time at the end of the year, inclusive until March 31 of the next year, taking into account the advance payment already made.

In addition, if the agricultural tax payer has not received an exemption from paying VAT in accordance with the provisions of Article 145 of the Tax Code of the Russian Federation, then he must pay value added tax and submit the corresponding declarations.

Use of a special tax regime for peasant farms under the simplified tax system

The simplified taxation system is considered the most beneficial for small businesses in comparison with the general taxation procedure. Farmers using the simplified regime have the right to choose one of the tax calculation systems:

- for income with a maximum rate of 6%: amount of profit * current rate;

- for expenses with a maximum rate of 15%: established rate * (amount of profit - expenses incurred).

Obviously, if expenses are minimal or absent, then it is not advisable to choose the second calculation option at a rate of 15%. Maximum rates can be lowered by constituent entities of the Russian Federation to 1% for income and 5% for expenses, respectively. Tax payments are made quarterly by the 25th of the month following the quarter, and for the year - by April 30.

Under the simplified tax system, simplified accounting is carried out using the “cash” method. The main reporting of a farm is a declaration according to the simplified tax system (submitted annually before April 30) and an accounting book for profits and expenses (submitted to the tax authorities upon request).

The legislative basis for peasant farms on the simplified tax system is determined by the Tax Code of the Russian Federation (Chapter 26.2) and Federal Law No. 402 “On Accounting” dated December 6, 2011, as amended on May 23, 2016. If during the reporting period the farm’s profit exceeds the maximum amount established by law, then the right to apply the simplified tax system is lost.

Example #1. Application of the simplified tax system in farming

A newly created peasant farm (as an individual entrepreneur) has been using the simplified tax system for six months since registration (during registration, an application for the use of the simplified tax system was simultaneously submitted with a package of documents). The number of employees is 10 people, profits significantly exceed expenses. There are no restrictions on use or type of activity.

To calculate the tax, the simplified tax system (STS) was chosen. Accordingly, tax is calculated at a maximum rate of 6%. Tax calculation formula: profit * 6%. Taxes are paid at the end of each quarter no later than the following 25th day.

Accounting is carried out using the “cash” method. The head of the household fills out an accounting book for expenses and profits. At the end of the year, a declaration under the simplified tax system will be submitted and the annual tax will be paid until April 30. If the annual income does not exceed the limit established by law, the peasant farm will remain on the simplified tax system. If the conditions are violated at the end of the year, the farm will automatically switch to OSNO. The figure below discusses in the infographic the requirements for the transition to the simplified tax system, interest rates, advantages and disadvantages for peasant farms ⇓

What problems may the Unified Agricultural Tax payer encounter?

Since in this regime the tax base is calculated taking into account the expenses incurred, the same problem arises of recognizing them for tax purposes as for payers of the simplified tax system Income minus expenses, that is, documentary evidence and economic justification for expenses. The procedure for determining and recognizing income and expenses for the Unified Agricultural Tax, as well as a specific list of expenses, is given in Article 346.5 of the Tax Code of the Russian Federation.

But, unlike the simplified tax, the Unified Agricultural Tax payer does not have the obligation to pay the minimum tax (1% of income received) if at the end of the year the activity turned out to be unprofitable. Moreover, the resulting loss can be carried forward to future tax periods for 10 years.

What liability is provided for tax violations?

| Violation | Punishment |

| Delay in filing a declaration for more than 10 working days | A fine of 5% to 30% of the amount of unpaid tax for each full or partial month of delay, but not less than 1000 rubles |

| Delay in payment | Penalties for each day of delay. The amount of the penalty is calculated as a percentage, which is equal to 1/300 of the refinancing rate of the contribution amount or tax transferred incompletely or partially |

| Non-payment of tax | A fine of 20% to 40% of the amount of unpaid tax |

In addition, if at the end of the year it turns out that income from the sale of agricultural products grown or agricultural services provided accounted for less than 70% of the total income, you will have to pay taxes on a general basis.

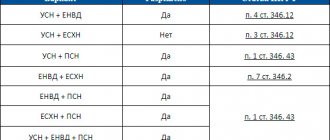

Combining the Unified Agricultural Tax with other tax regimes

Organizations can combine Unified Agricultural Tax with UTII, and individual entrepreneurs with both UTII and PSN, but they will need to keep separate records of income and expenses. When combining regimes, the total income for determining the share from the sale of agricultural products of at least 70% will be calculated for all regimes. In addition, it will not be possible to use UTII for the sale of agricultural products through your own stores and catering outlets. Unified agricultural taxation is not combined with the simplified taxation system and OSNO modes.

Thus, we can conclude that the Unified Agricultural Tax is a gentle special regime, and if an agricultural producer (or fishing organization) can meet all the specified requirements, then the tax burden for them will be minimal.