Accounting for fuels and lubricants in 1C 8.3 Accounting is a set of not very complex actions in the program. True, there are some peculiarities here too. In this article we will focus on the operation of writing off fuel and lubricants in 1C without using the Waybills , and also remind you how to organize the accounting of these materials in 1C 8.3.

You will learn:

- what documents to use to register fuel and lubricants;

- how to write off gasoline, including using fuel cards in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Accounting for fuel and lubricants using fuel cards: what is a fuel card?

A fuel card is a new way to refuel vehicles without constantly paying for fuel. The convenience of cards is as follows:

- Information about gasoline consumption is stored electronically on the card chip;

- You can view data on the fuel balance and refueling time at any time;

- The card can be issued by both individuals and legal entities;

- The speed of service at the gas station increases;

- When registering a larger limit, discounts apply;

- No need to report fuel receipts to management;

- Simplification of accounting (all data is available in the cardholder’s personal account).

The disadvantage of purchasing a fuel card is that gas stations set a certain schedule for the possibility of paying for fuel with cards.

Purchase of fuels and lubricants

Typically, the scheme for purchasing fuel and lubricants using coupons looks like this.

- The organization enters into a purchase and sale agreement with a fuel and lubricants supplier.

- The fuel and lubricants supplier issues an invoice to the organization for payment of coupons.

- The organization pays the bill and issues a power of attorney to its representative to receive coupons.

- A representative of the organization receives coupons and hands them over to the employee responsible for recording coupons and issuing them to drivers. Typically, on the day the coupons are issued, the supplier issues a consignment note (transfer and acceptance certificate) and an invoice for fuel and lubricants.

- The driver who has received the coupons presents them at the gas station and refuels the car. The volume of fuel supplied must correspond to the nominal value of the coupon. The driver is given a tear-off coupon for a redeemed ticket with a gas station stamp.

Situation: is it possible to capitalize fuels and lubricants purchased with coupons on the basis of tear-off coupons attached to the coupons?

Answer: yes, it is possible, provided that the amount of fuel received corresponds to the value of the coupon.

If less fuel is dispensed according to the coupon, its actual amount can only be confirmed by a cash receipt issued by the gas station.

Purchased fuel and lubricants can be capitalized on the basis of primary documents that contain the mandatory details specified in paragraph 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. If the tear-off coupon for the coupon meets these requirements, then it can be accepted for accounting as a primary document. However, this should only be done if the driver has filled the tank with the same amount of fuel as indicated on the ticket. If less fuel is dispensed according to the coupon, its actual quantity can only be confirmed by a cash receipt issued by the gas station (letter from the Ministry of Finance of Russia dated April 3, 2007 No. 03-03-06/1/209 and the Federal Tax Service of Russia for Moscow dated June 26, 2006 No. 20-12/56636). Moreover, when dispensing fuel and lubricants using coupons, gas stations have the right to issue cash receipts, which record only the volume of fuel without indicating the price and total cost (see, for example, letters from the Federal Tax Service of Russia for the Moscow Region dated August 4, 2005 No. 22-19/0156, UMNS Russia in Moscow dated April 30, 2004 No. 29-12/29514).

Advice: if the coupons are about to expire and the car’s gas tanks are fully filled, drain the gasoline into empty fireproof containers. For example, in metal cans. By choosing fully paid for fuel, the organization will avoid financial losses.

In practice, it is better to avoid situations in which the organization receives fuel in quantities less than the nominal value of the coupon. The fact is that, regardless of the actual volume of fuel supplied, the gas station coupon presented will pay off in full. In this case, the unselected amount of gasoline cannot be reflected either in accounting or tax accounting.

How to get a fuel card?

Stages of card registration:

- Register an electronic wallet with an oil company.

- Create a personal account.

- Determine the parameters of the contract:

- set a limit on the amount of fuel;

- assign the card to a specific car (by car number - this way, if the card is stolen, the fraudster will not be able to use it);

- choose a brand of gasoline.

- Top up your account (bank transfer, payment to your current account).

Types of coupons

Coupons for fuel and lubricants can be:

- cash (issued for a certain limit on the cost of fuel and lubricants);

- liter (issued for a certain limit on the volume of fuel and lubricants).

To purchase fuel and lubricants using coupons, you need to enter into an agreement with the supplier. The supplier provides fuel and lubricants through a specific network of gas stations. The list of gas stations that dispense fuel and lubricants using coupons from a particular supplier is usually given in the contract (an appendix to it) with addresses indicated.

Attention: coupons for fuel and lubricants have a limited validity period (for example, a month or a quarter). If the agreement with the supplier does not provide for a refund for coupons not used on time, then untimely receipt of fuel and lubricants may result in financial losses for the organization.

Fuel card accounting

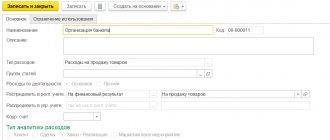

The card itself (without the cost of fuel) refers to material and production costs and is assessed at actual cost. The cost of purchasing the cards will go towards expenses for ordinary activities.

The cost of the card is recorded on the basis of the invoice in the “Other expenses” account , and at the end of the month the total cost is added to the cost of purchased fuel.

Accounting for issuing fuel cards

The issue of a fuel card to an employee is not displayed on any accounting account, and no postings are made , since funds are not actually issued.

However, the issuance of cards is recorded in a journal, the form of which must be approved by the company’s management and contain the following columns:

- Model and state the number of the transport for which the card was issued, and which is used by the employee of the enterprise on the orders of his superiors;

- Full name of the driver, his personal signature;

- Date of issue of the fuel card to the driver;

- Date by which the card must be returned.

Accounting by cards

To pay by card, the organization must enter into an agreement with the supplier, after which a special fuel card will be issued. Such a card contains information about what petroleum products can be purchased using it, in what quantities, about related services, as well as the amount of funds that can be used to purchase fuel and services.

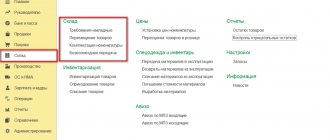

Most often, the card is provided free of charge with subsequent return. But, if a separate fee is required for it, then the capitalization of its value is formalized in the form of receipt of the service. To do this, you need to create a “Services (Act)” receipt by going through the “Purchases” and “Receipts” menus. This is shown in more detail below.

In this case, the fuel card is accounted for in off-balance account 006. It is reflected through the “Operations” menu and then “Operations entered manually.”

If you did not have to pay for the production of the card, it should still be reflected in the same off-balance sheet account; the conditional price of one ruble is simply indicated.

At the end of the month, the supplier must provide documents indicating how much fuel was purchased in liters. Based on these documents, accounting is carried out on account 10.03.1 “Fuel”. Registration is carried out in the “Purchases” menu, then “Receipt”, through “Receipt of goods (invoice)”.

You need to create a new document with the same name, specify the necessary data, and also add rows to the “Products” tabular section using the “Add” or “Selection” button. You should also indicate the type of item, that is, fuels and lubricants.

As a result, the receipt of fuel and lubricants was carried out and the Dt posting was generated. 10.3 – Kt. 60. The registration of fuel purchases using the card is completed.

Accounting for fuel costs

Fuel refers to fuels and lubricants having the following characteristics:

- standard consumption;

- actual consumption.

Fuel costs are confirmed by waybills containing information:

- about the mileage of the car;

- about the make and number of the car;

- on the amount of fuel issued using the fuel card;

- remaining fuel when the driver leaves and arrives at the company;

- comparison of standard and actual fuel consumption;

- conclusion about excess consumption or saving of gasoline.

Fuel write-off

The cost of fuel, which is written off as expenses, depends on the method of assessing fuel oil (FIFO, at average cost) (clause 16 of PBU 5/01).

When writing off fuel and lubricants in accounting, make the following entry:

Debit 20 (23, 26, 44...) Credit 10-3 (10 subaccount “Coupons in gas tanks of cars”)

– the cost of consumed fuel is written off (based on the waybill).

An example of how fuel and lubricants purchased using coupons are reflected in accounting. Ownership of fuel and lubricants passes to the organization upon receipt of coupons

On June 1, Alpha LLC purchased a cash voucher for gasoline worth 510 rubles. (including VAT - 78 rubles). The supplier issued an invoice and issued an invoice to Alpha.

On June 4, a ticket was issued to the driver of the company car, Yu.I. Kolesov. A corresponding note about this is made in the book for registering the movement of coupons. On the same day, the driver purchased 30 liters of AI-92 gasoline using a coupon at a price of 17 rubles. per liter (including VAT - 2.59 rubles). To evaluate materials in accounting, the organization's accounting policy provides for the average cost method.

According to the organization's accounting policy, waybills are prepared monthly. On June 30, Kolesov submitted his waybill to the accounting department. According to the waybill, all the gasoline received with the coupon (30 liters) was consumed within a month. Actual consumption corresponds to the standards approved by the head of the organization.

The following entries were made in the organization's records.

June 1st:

Debit 60 Credit 51 – 510 rub. – paid for a gas ticket;

Debit 10 subaccount “Coupons received for fuel and lubricants” Credit 60 – 432 rub. (510 rubles – 78 rubles) – a petrol coupon has been capitalized;

Debit 19 Credit 60 – 78 rub. – VAT is reflected on the purchased coupon.

June 4:

Debit 10 sub-account “Coupons for fuel and lubricants issued” Credit 10 sub-account “Coupons for fuel and lubricants received” – 432 rubles. – a ticket was issued to the driver (based on the ticket book);

Debit 10 subaccount “Fuels and lubricants in gas tanks of cars” Credit 10 subaccount “Coupons for fuels and lubricants issued” – 432 rubles. – gasoline filled into the tank of the car is credited (based on the gas station receipt and the tear-off coupon attached to the coupon);

Debit 68 “Calculations for VAT” Credit 19 – 78 rub. – submitted for VAT deduction.

On June 30, Alpha's accountant calculated the average cost of 1 liter of fuel. Based on the calculation, the average cost of 1 liter of gasoline turned out to be equal to its purchase price.

Based on the waybill, the cost of fuel and lubricants was written off as expenses in accounting:

Debit 26 Credit 10 subaccount “Fuels and lubricants in gas tanks of cars” – 432 rubles. – actually consumed gasoline is written off.

Accounting and transactions for the purchase and write-off of fuel and lubricants using fuel cards

In accounting, fuels and lubricants purchased using a fuel card are charged to account 10 “Materials” at actual cost and excluding VAT. The VAT allocated in the invoice is reflected independently on account 19 “VAT on purchased assets”.

Fuel will be capitalized on the same day when ownership of it was transferred to the company, since account 10 is intended to display data on the availability of materials in the company's property. This date may be specified in the contract. For example, the date of transfer of ownership rights to fuels and lubricants can be recognized as the day of actual payment - then subaccounts “fuels and lubricants in the supplier’s tanks” and “fuels and lubricants in the gas tanks of cars” are opened to account 10.

“Bonus” fuel: how to take into account

As a rule, when buying a car, the new owner receives not only the car itself, but also a certain amount of gasoline in the tank. If this is specified in the purchase and sale agreement, the accountant will be able to capitalize the fuel and lubricants without any problems. If fuel is not mentioned in the contract, then different approaches are used. When there is not very much gasoline, it is simply not taken into account, and the countdown of receipts and write-offs of fuel and lubricants begins with the first refueling.

If the tank is almost full, then first determine the volume using the same methods as for inventory. Then they arrange either a free receipt or identification of surplus.

In the case of gratuitous receipt, the cost of fuel is recorded as the debit of account 10 and the credit of account 98 “Deferred income”. Subsequently, when writing off, entries are made to the debit of the “cost” account (20, 26 or 44) and the credit of account 10 “Materials,” as well as the debit of account 98 and the credit of account 91 “Other income and expenses.”

In tax accounting, fuels and lubricants received free of charge are taxable income (subclause 8 of Article 250 of the Tax Code of the Russian Federation).

If an organization shows surpluses identified during inventory, then in accounting they should be included in income and posted as a debit to account 10 and a credit to account 91. In tax accounting, it is also necessary to generate income on the basis of subparagraph 20 of this article.

The opposite situation is also possible, when an organization sells a car, and with it the fuel in the tank. Here it is best to include a separate clause in the purchase and sale agreement, where the volume and price of gasoline should be indicated. This will make it possible to show the implementation of fuels and lubricants separately from the implementation of the machine. From a legal point of view, everything will be correct, because no license is required to sell fuel. In the absence of a special clause in the agreement, the disposal of gasoline must be carried out as a debit to account 91 and a credit to account 10. Such expenses cannot be reflected in tax accounting, since the value of gratuitously transferred property does not reduce taxable income (sub. 16, Article 270 of the Tax Code of the Russian Federation).

When renting out a car, the fuel tank is also fully or partially filled. Here, as in the situation with the purchase and sale, you have to figure out how to take such gasoline into account.

Sometimes organizations simply agree that the lessor transfers a certain amount of fuel, and the lessee, at the end of the lease period, undertakes to return the same amount along with the car. In this case, ownership of fuel and lubricants remains with the lessor, and the transfer of fuel is not reflected in the accounting records.

But this option is not entirely correct for the tenant, because in fact he uses the gasoline received and, as a result, must make certain entries in the accounting registers. For this reason, most companies still show the transfer of fuel and lubricants from the lessor to the lessee.

The most common way to reflect such a transfer is implementation. First, the lessor sells fuel to the lessee, and after the end of the contract, the lessee sells the same amount to the lessor.

Another option is a commodity loan. Here the lessor acts as a lender, and the tenant acts as a borrower. Both options are completely legal, and the accountant can only choose the one that is most convenient in a particular situation.

Tax accounting of costs for purchasing a fuel card

The type of costs for the purchase of fuel cards must be fixed by order in the company’s accounting policy:

- material and production costs;

- vehicle maintenance costs;

- other production costs not related to the production process and sales.

VAT can be deducted if:

- an invoice confirming the purchase of a fuel card has been received;

- trade transactions are carried out using the card, and their cost is subject to VAT;

- The fuel card has been registered by the accounting department.

Do I need a cash receipt and what should it be?

The question of issuing cash receipts to an accountable person—an employee of an organization at a gas station—with or without the cost of refueling does not have a clear answer. The Letter of the Federal Tax Service of Russia for the Moscow Region dated 08/04/2005 N 22-19/0156 states that with indirect non-cash payment, considered a form of payment for petroleum products at gas stations, magnetic and chip cards, coupons and other documents that are equivalent to a pre-paid certain amount of petroleum product , organizations have the right to issue a cash receipt without indicating the cost, but indicating the number of liters of petroleum product. In private explanations, specialists from the Russian Ministry of Finance agree with this approach at the present time. Indeed, indicating the cost on cash register receipts can lead to a doubling of turnover. It turns out that the cash register will duplicate previously received non-cash payment amounts. But at the same time, the Tenth Arbitration Court of Appeal, in its Resolution dated May 17, 2007, May 24, 2007 in case No. A41-K2-13402/06, rejected the tax authority’s argument that in case of indirect non-cash payment, the receipt should not indicate the cost of the petroleum products sold. Thus, this issue remains unresolved to this day. Sometimes fuel companies issue invoices for payment for information services to provide detailed calculations for the month. These costs will represent one-time expenses of the enterprise. Some experts suggest including their amount in the cost of fuel and lubricants purchased during the month. They argue this as follows: clause 6 of PBU 5/01 determines that the actual cost of inventories purchased for a fee is the amount of the organization’s actual costs for the acquisition, excluding VAT and other refundable taxes (except for cases provided for by law). The actual costs of acquiring inventories include, in particular, amounts paid to organizations for information and consulting services related to the acquisition of inventories. In our opinion, this approach is not justified and only leads to increased labor intensity of the accounting process. We believe that we should proceed from the fact that these services are not directly related to the purchase of fuel and lubricants, but are related.

Tax accounting of fuel costs

The idea of establishing a transport tax, the amount of which would be taken into account in the cost of fuel, appeared in 2010. This type of tax is regional, and therefore local authorities have the right to independently assert:

- rules for its calculation;

- machine power indicator for calculating the amount of tax at a certain rate;

- tax rate.

Today, fuel tax is a transport tax, and its amount directly depends on the vehicle’s power rating.

Accounting

The accounting procedure for coupons for fuel and lubricants depends on the terms of the contract with the supplier, as well as on the type of coupons. Fuel (coupons for fuel and lubricants) should be taken into account at the actual cost (excluding VAT) (clauses 5, 6 of PBU 5/01). The VAT allocated in the invoice should be taken into account separately on account 19 “VAT on purchased values”.

If the contract does not indicate the moment of transfer of ownership of fuel and lubricants, come to them at the time of receipt of coupons. This follows from the provisions of Articles 223 and 458 of the Civil Code of the Russian Federation.

On the date of receipt of coupons, make the following entry:

Debit 10 subaccount “Coupons for fuel and lubricants received” Credit 60

– gasoline coupons have been capitalized (based on the invoice (transfer and acceptance certificate)).

After the coupons are issued to the drivers, make the following entries in the accounting:

Debit 10 sub-account “Coupons for fuel and lubricants issued” Credit 10 sub-account “Coupons for fuel and lubricants received”

– coupons for fuel and lubricants were issued to drivers (based on the book of registration of the movement of coupons).

The amount of gasoline actually received at the gas station is reflected by wiring:

Debit 10 subaccount “Fuels and lubricants in gas tanks of cars” Credit 10 subaccount “Coupons for fuels and lubricants issued”

– gasoline filled into the tank of the car is credited (based on the tear-off coupon for the coupon and the gas station receipt).

If the contract states that ownership of fuel and lubricants passes to the organization at the time the car is refueled, then the accounting procedure depends on the type of coupons.

Take liter coupons into account in the balance on account 006 “Strict reporting forms”. Changes in prices that may occur after payment of coupons will not in any way affect the assessment of fuel and lubricants in accounting: they will be reflected at the purchase price.

When you receive the coupons, make the following entry in your accounting:

Debit 006 subaccount “Coupons for fuel and lubricants”

– gasoline coupons have been capitalized (based on the invoice (transfer and acceptance certificate)).

Reflect the issuance of coupons to drivers in accounting as follows:

Credit 006 subaccount “Coupons for fuel and lubricants”

– coupons were issued to the driver (based on the logbook for the receipt and issuance of gasoline coupons).

When registering fuel (refueling a car at a gas station), make the following entries:

Debit 10-3 Credit 60

– the fuel actually received was capitalized (based on gas station receipts, tear-off coupons for coupons).

If you purchased cash coupons, take them into account at the cash register as part of your cash documents. In accounting, reflect the receipt of coupons by posting:

Debit 50-3 Credit 60

– gasoline coupons were received (based on the invoice (acceptance certificate)).

Issue tickets to drivers upon reporting:

Debit 71 Credit 50-3

– coupons were issued to the employee (based on the book of registration of the movement of coupons).

Capitalize fuel received using coupons using the following entries:

Debit 10-3 Credit 71

– fuels and lubricants purchased using coupons are capitalized (based on a gas station receipt, tear-off coupons for coupons).

Accounting and postings for fuel and lubricants in a budgetary institution

Budgetary institutions have to justify the targeted expenditure of state budget funds. A feature of budget accounting for fuel and lubricant costs is the need to prepare special primary documentation filled out by an accountant and driver.

A fuel card serves as both a payment and accounting document. According to the law, budgetary organizations are required to place an order for fuel and lubricants through bidding or without them, but then the total amount of the order must be below 100 thousand rubles per quarter. This means that to prove the expenses incurred, you need to have bidding results or documents confirming the estimated (planned) cost of the order . The organization prepares an estimate taking into account the planned indicators used when calculating the volume of costs for fuel and lubricants, and after checking them, the main manager of funds must approve the estimate.

Fuel and lubricants must be spent within the approved standards; each budgetary enterprise must have an internal local act on fuel and lubricant consumption standards. The institution has the right to introduce separate correction factors to fuel consumption standards, justifying their use and proving the production need for their establishment.

The accounting department of a budgetary institution keeps separate records of fuels and lubricants depending on the areas of their use in a separate account 010503000 “Fuels and lubricants” . Fuel and lubricants are charged at actual cost. VAT paid on the purchase of fuel and lubricants is not included in this cost only when the fuel is paid for from income from taxable business activities of the institution and used in taxable activities.

Gasoline and diesel fuel are accounted for at a negotiated price due to some features associated with large purchases of these fuels and lubricants for cash and non-cash payments, as well as using fuel cards.

Maintaining analytical records

Analytical accounting of fuels and lubricants can be of varying detail (depending on the specifics of the enterprise, the requirements of the control system at the enterprise). It can be maintained by financially responsible persons, drivers of official vehicles, storage locations, type of fuel, vehicles, etc. In some cases, especially at large enterprises, it is advisable to introduce second-level subaccounts to control the safety and movement of fuel, for example: - subaccount 3-1 “Fuel in warehouse”; — subaccount 3-2 “Fuel in vehicle tanks”; — subaccount 3-3 “Fuel with coupons.” Acceptance of the appropriate amount of fuel must be confirmed either by the indicators of volumetric liquid meters, or based on the tank capacity and the level of the non-drainable amount available in the tank. It is advisable, especially at large enterprises, to periodically (for example, monthly) confirm the remaining fuel in the tanks of official vehicles with an act drawn up by the commission. In this case, it is important to take into account the following features of assessing fuel residues in tanks: - assessment of fuel in the tank is carried out based on the readings of the fuel level sensor; - any malfunction of this sensor will most likely lead to incorrect readings, so the sensors must be in good condition; — the correct assessment of the amount of fuel in the tank depends on the presence/absence of damage to the fuel tank. After all, dents on the tank will be a consequence of changes in its capacity, while the fuel level sensor, in accordance with its name, determines the volume of fuel by its level in the tank.

An example of accounting for fuel and lubricants using a fuel card

On June 4, the company entered into an agreement with the gas station for the use of a fuel card and immediately paid the cost of the card (118 rubles, including VAT 18 rubles). Servicing the card is free; ownership of gasoline is transferred to the company at the time the car is refueled. The card is assigned to the KamAZ-5320, which delivers goods to customers.

On June 05, the card was issued to the company and handed over to the driver.

On June 30, an advance was transferred to the card (5,900 rubles, including VAT 900 rubles).

Throughout July, the driver was issued with a card 380 liters of diesel fuel worth 15 rubles/liter, including VAT 2.29 rubles:

- 07 – 180 l for 2700 rub. (VAT – 412 rub.);

- 07 – 200 l for 3000 rub. (VAT – 458 rubles).

On the last day of July (July 31), the gas station sent the following to the company:

- invoice;

- acceptance certificate, which specifies the volume and cost of the issued fuel and lubricants;

- report on fuel card transactions.

Accounting entries

| Operation | DEBIT | CREDIT | Amount (rub.) |

| as of 04.06 | |||

| Fuel card paid | 60 | 51 | 118 |

| The cost of the fuel card was expensed | 44 | 60 | 100 (118 – 18) |

| VAT reflected on the card price | 19 | 60 | 18 |

| Card taken into account | 015 “Fuel cards” | – | 118 |

| Accepted for deduction of input VAT on the purchased card | 68 s/ch “Calculations for VAT” | 19 | 18 |

| as of 30.06 | |||

| Advance transferred | 60 s/ch “Advances issued” | 51 | 5900 |

| as of 03.07 | |||

| Fuel and lubricants were capitalized (according to gas station receipts) | 10-3 | 60 | 2288 (180 l * (15 – 2.29)) |

| Input VAT included | 19 | 60 | 412 |

| as of 17.07 | |||

| Fuel and lubricants were capitalized (according to gas station receipts) | 10-3 | 60 | 2542 (200 l * (15 – 2.29)) |

| Input VAT included | 19 | 60 | 458 |

| as of 31.07 | |||

| The previously transferred advance has been credited | 60 | 60 s/ch “Advances issued” | 5700 (2288 + 412 + 2542 + 458) |

| Accepted for deduction of VAT on fuel and lubricants (according to invoice) | 68 s/ch “Calculations for VAT” | 19 | 870 (412 + 458) |

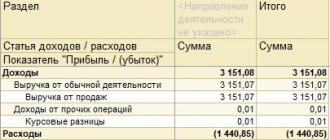

Accounting for fuels and lubricants by enterprises on OSNO

Costs for fuel and lubricants are included in:

- Material costs (when transport services are provided). Written off taking into account the material valuation method adopted by the company;

- Other costs of production and sales (when the transport is operated for the needs of the company). Written off at the actual purchase price (excluding VAT).

For the purpose of calculating profit tax, fuels and lubricants are taken into account at the purchase price excluding VAT, if it is included in the price and highlighted in a separate line in the settlement document. VAT is deductible on the invoice. The cost of fuels and lubricants is included in the costs on the day the waybill is accepted for accounting or as goods/works/services are sold, the cost of which includes fuels and lubricants, if the costs of fuels and lubricants are recognized as direct.

When waybills are accounted for (there must be receipts from the gas station), the cost of consumed fuel is included in the costs that reduce the taxable base for income tax.

The specified procedure for writing off fuel and lubricants is used in companies that calculate tax using the cash and accrual methods, since when using a fuel card, by the time the fuel is actually issued, the money for it has already been paid.

Accounting for fuel and lubricants by companies using the simplified tax system

Firms using the simplified taxation system “Income minus expenses” have the right to include the costs of fuel and lubricants as expenses , but they must be documented.

Companies using the simplified tax system “Income” (6% rate) are prohibited from reducing the tax base by the amount of costs for fuel and lubricants.

Fuel costs are written off when calculating the tax payable, just as in the case of enterprises on the OSNO, but there is one indispensable condition for recognizing costs on the simplified tax system - their payment. VAT on such costs also reduces the tax base for the simplified tax system.

Accounting for fuel and lubricants by companies on UTII

Fuel costs do not have any impact on the calculation of the taxable base for UTII due to the fact that the object of UTII taxation is imputed income.

Accounting for fuels and lubricants by organizations on OSNO/UTII

Fuel costs in companies that simultaneously use OSNO and UTII must be distributed, but costs for fuels and lubricants that relate to only one of the types of activities are not subject to distribution.

To the calculated part of the costs for the type of activity that is subject to UTII, you need to add the amount of VAT that is not allowed to be deducted.

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the document Cash withdrawal

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Fig. 10 Advance report

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report

Legislative acts on the topic

Legislative acts are represented by the following documents:

| clauses 5, 6 PBU 5/01 | About the procedure for posting fuel and lubricants |

| Art. 223 Civil Code of the Russian Federation | On the transfer of ownership rights to fuel and lubricants on the day of payment |

| Art. 458 Civil Code of the Russian Federation | On the transfer of ownership rights to fuel and lubricants at the time of actual vacation (at the time of refueling the car) |

| clause 1 art. 172 Tax Code of the Russian Federation | On the acceptance of VAT on the purchase of fuel and lubricants for deduction only after receiving the supplier’s invoice |

| Federal Law of July 21, 2005 No. 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs” | On placing an order through or without bidding for an order amount of up to 100 thousand rubles |

| Methodological recommendations “Standards for fuel and lubricant consumption in road transport” (approved by Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 No. AM-23-r) | About fuel consumption standards |

| clause 52 of the Instructions for Budget Accounting (approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 2008 No. 148n) | Composition of costs that are included in the actual cost of fuel and lubricants |

| clause 1 art. 9 of the Federal Law of December 6, 2011 No. 402-FZ, paragraph 1 of Art. 252 Tax Code of the Russian Federation | On the need for documentary evidence of consumed fuels and lubricants |

Accounting for fuel and lubricants in 1C 8.3 - step-by-step instructions

In an organization, accounting and write-off of fuel and lubricants consists of:

- receipts;

- distribution (if fuel and lubricants are purchased centrally);

- spending;

- write-offs.

Let's look at the table for reflecting these operations in 1C in the form of step-by-step instructions.

| the name of the operation | Documents (reports) in 1C |

| Purchasing fuel and lubricants centrally | |

| Acceptance of registration by invoice | Receipt (act, invoice) - Goods (invoice) |

| Purchasing fuel and lubricants through an accountant | |

| Acceptance of registration according to advance report | Advance report - Products tab |

| Distribution of fuel and lubricants among vehicles | |

| Refueling a car with fuel and lubricants using coupons, when ownership of the fuel has transferred after the advance payment | Movement of goods - Goods (fuel and lubricants in gas station tanks - Auto warehouse) |

| Refueling fuel and lubricants from the organization's warehouse | Movement of goods - Goods (fuel and lubricants in tanks - Auto warehouse) |

| Accounting for fuel consumption | |

| Travel expenses | Waybills the Waybills functionality enabled ) |

| Write-off | Requirement - waybill , waybill |

As you can see, one of the most important procedures: accounting for the consumption of fuel and lubricants is not reflected in 1C 8.3 Accounting 3.0 when the Waybills . Only the result of this operation is reflected there - writing off fuel according to waybills in 1C 8.3.

Common mistakes

Error No. 1: At an enterprise that simultaneously applies the OSNO and UTII tax regimes, VAT on expenses for fuel and lubricants was deducted in relation to the tax base for only one of the types of activity.

Comment: The amount of VAT allocated in the invoice for such an enterprise must be distributed according to the methodology described in clause 4, 4.1 of Art. 170 Tax Code of the Russian Federation.

Error No. 2: The budgetary institution accepted gasoline and diesel fuel for accounting at actual cost.

Comment: Gasoline and diesel fuel should be accounted for at a negotiated price, this is due to the large volume of their purchases for cash, non-cash payments and payment by fuel card.

Accounting for compensation for fuel and lubricants

Personal cars of employees are used quite often in organizations to perform official tasks. Labor legislation obliges the employer in this regard to pay compensation to employees, without setting restrictions on their amount.

In such situations, it is important to prepare the documentation correctly and remember that there are separate rules for tax accounting of such payments.

According to Article 188 of the Labor Code of the Russian Federation, the obligation to pay compensation arises from the employer if the employee’s property is used by the employee himself in the interests of the employer and with the consent or knowledge of the employer. It has been established that the amount of compensation, as well as the amount of reimbursable expenses, is determined by the parties to the employment contract independently and is fixed in a written agreement.

Labor legislation does not contain restrictions on the amount of payments. Therefore, theoretically, the organization can pay compensation to employees in the amounts established by the agreement. The amount of compensation must be justified.

It is recommended to draw up a bilateral written agreement as an annex to the employment contract. It should include, for example, the following points:

- an employee from ... (date) in the performance of his job duties uses for official purposes a car that belongs to him (make, engine size, year of manufacture, license plate number);

- the employer pays compensation to the employee for the use of the car;

- compensation is calculated based on the fuel consumption standard specified in the vehicle’s operating manual (specify) and the mileage traveled for business purposes.

The employee undertakes:

- keep records of business trips in travel documents;

- submit waybills and documents confirming transportation expenses for the month to the employer’s accounting department on the last working day of that month.

Compensation is paid at the end of the calendar month.

The agreement must be accompanied by a copy of the vehicle registration certificate and a copy of the vehicle's operating manual.

note

In winter, you have the right to write off more expenses for fuel and lubricants. Fuel consumption increases in the cold season due to weather conditions, use of a heater, etc. You have the right to increase the rates you use in the summer. But the algorithm of actions also depends on what standards you apply - those established by the Ministry of Transport or your own.

However, for profit tax purposes, these compensations are normalized. Subclause 11 of clause 1 of Article 264 of the Tax Code of the Russian Federation determines that the costs of paying compensation for the use of personal cars and motorcycles for business trips are taken into account in expenses only within the limits established by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92: for passenger cars with working engine capacity up to 2000 cc. cm inclusive - 1200 rubles, over 2000 cubic meters. cm - 1500 rubles.

Thus, for profit tax purposes, only an amount that does not exceed the above norms can be taken into account in expenses.

The amount of excess compensation over the legally established norm is not taken into account in expenses when calculating income tax (clause 38 of Article 270 of the Tax Code of the Russian Federation).

When establishing the amount of compensation, keep in mind that when paying such compensation, a separate reimbursement for the cost of fuel and lubricants is, for tax purposes, an excess payment that does not reduce the tax base for income tax (letter of the Ministry of Finance of Russia dated August 23, 2013 No. 03-03-06/1/39239 ).

The legality of this approach is confirmed by the courts (resolution of the Federal Antimonopoly Service of the Ural District dated December 8, 2008 No. F09-9153/08-S3, determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2009 No. VAS-495/09).

The organization's expenses in the form of compensation for the use of personal cars and motorcycles for business trips are recognized for profit tax purposes on the date of payment of this compensation to the employee, that is, until the compensation is actually paid, it cannot be taken into account as expenses.

simplified tax system

The tax base of simplified organizations that pay a single tax at a rate of 6 percent is not reduced by expenses for fuels and lubricants (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Simplified organizations that pay a single tax on the difference between income and expenses can include in the costs (other or material) documented and paid expenses for the purchase of fuels and lubricants (subclause 12, 5 clause 1, clause 2 of Article 346.16 of the Tax Code RF). The procedure for writing off such expenses when calculating a single tax is similar to the procedure that is applied in the general taxation system, taking into account the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation). This paragraph establishes a mandatory condition for the recognition of expenses during simplification - their payment. The VAT amounts on these expenses also reduce the tax base for the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).