Employer reporting

Natalya Vasilyeva

Certified Tax Advisor

Current as of November 20, 2019

One of the forms of reporting by employers for employees is SZV-STAZH. It is rented out for employees registered under employment or civil law contracts. Let's figure out whether it is necessary to take SZV-STAZH if there are no employees at all, and what to do if the company only has a founder who is also a director.

Who should take SZV-STAZH: what the law says

The obligation of policyholders to submit an annual report on the length of service of employees to the territorial bodies of the Pension Fund of the Russian Federation is provided for in paragraph 2 of Article 11 of Federal Law No. 27-FZ of April 1, 1996. It is stipulated that such a report must be submitted to the Pension Fund no later than March 1 of the year following the reporting year. That is, the work experience report for 2021 must be submitted to the Pension Fund no later than March 1, 2021.

Insureds must submit an annual report on work experience to the departments, namely:

- organizations, including foreign ones, operating in Russia, and their separate divisions;

- entrepreneurs, lawyers, notaries, private detectives.

Reporting to the Pension Fund of Russia as part of the year-end work experience report is required for all employees who perform work under an employment or civil contract. This follows from Article 1, paragraph 1 of Article 8 and Article 15 of the Federal Law of April 1, 1996 No. 27-FZ.

Thus, in order for there to be a legal basis for submitting a report on work experience, employment or civil law contracts must be concluded in the reporting period (year).

How to fill out correctly if there is no salary

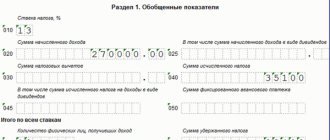

In order for the zero reporting form to be generated correctly, when filling it out, it is recommended to follow the instructions:

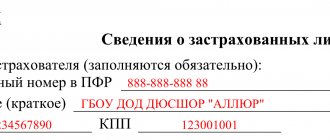

- The introductory part contains all organizational information about the institution - full (short) name, TIN, KPP, registration number in the Pension Fund. Also in the header is the number of pages and information about zero content.

- It is worth noting that in the previous version of the form, the registration data of the organization (TIN/KPP and registration number in the Pension Fund) were duplicated - in the header of the document and in the water part. Now such information is recorded only once. Also, the “Page” symbol and, accordingly, the page number are no longer written.

- Next, the reporting period is indicated - year.

- The tabular part contains information about the business activities of the insured persons. Information is entered for each employee. If a zero form is submitted for the founder, then the table shows his business activity only within the given organization.

- Next, accrued and paid pension contributions (contribution period) are noted. The fact of payment is reflected in yes/no points.

After filling out all the necessary lines, the reporting is certified by the signature of the head of the institution.

What does the procedure for filling out the report say?

The form of the SZV-STAZH report and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. At the same time, in accordance with clause 1.5 of the Procedure, the SZV-STAZH report is filled out and submitted by the insured for all insured persons who are in an employment relationship with the insured (including with whom employment contracts have been concluded) or who have concluded civil contracts with him, the subject of which is the performance of work, provision of services under copyright contracts in favor of authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including remunerations accrued organizations for managing rights on a collective basis in favor of authors of works under agreements concluded with users, or who have concluded employment contracts and (or) civil law contracts.

It turns out that the obligation to fill out and submit a report in the SZV-STAZH form arises for policyholders only if there is an employment or civil law relationship under the contracts listed above.

Let's look at the SZV-STAZH report form. First of all, we are interested in section 3 of this form

As you can see, in this section of the report you need to provide a list of insured persons indicating, in particular, full name, SNILS, periods of work in the reporting period, working conditions and information about dismissal. That is, if, suppose, in 2021 the organization had an employment relationship with one employee, then this section will contain a record with one line.

How to fill out

The reporting procedure is established by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p in Appendix 5. The form is filled out both in paper and electronic versions. Corrections and blots are not allowed. The pages must be numbered in order. The reporting is signed by management and certified by a seal (if used by the institution). In this article we will look at a special case - the regulations for filing SZV-STAZH without calculating wages. We talked in detail about filling out the regular SZV-STAZH form in a special material.

Is it possible to submit a zero form?

Some policyholders do not have an employment relationship with any individuals. Also, many do not enter into any civil contracts and have no movements on their current accounts at all. In such situations, is it necessary to fill out and submit a zero report SZV-STAZH? To answer these questions, let’s turn to the format required for submitting the report electronically. This format was also approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. Also see “New forms of personalized accounting: SZV-STAZH, ODV-1, SZV-KORR AND SZV-ISKH”.

The format stipulates that the SZV-STAZH report must have at least one entry containing, among other things, full name, SNILS and period of work. Accordingly, if there is no such (at least one) record, then the empty report simply will not pass the format-logical control and cannot be accepted. Consequently, submitting a “zero” SZV-STAZH report simply does not make any sense. Moreover, we note that on the basis of the SZV-STAZH report, the territorial bodies of the Pension Fund of the Russian Federation must distribute information about periods of service and insurance premiums paid for these periods to the individual personal accounts of insured persons. If such information is not included in the report, then its presentation becomes meaningless. Thus, we can say with confidence that there is no need to submit the “zero” form of SZV-STAZH.

At the same time, we note that if in the reporting period (for example, in 2017) there were no payments in favor of individuals, but employment or civil law contracts were concluded with them, then the SZV-STAZH experience report must be filled out and submitted. The fact that there was no payment does not relieve the policyholder of the obligation to submit a report on the periods of service. Also see “Form SZV-STAZH: how to fill out and submit a new form for annual reporting to the Pension Fund of Russia.”

Mandatory reports to the Pension Fund of Russia

Key changes in terms of insurance coverage for citizens, which were carried out back in 2021, significantly reduced the composition of the forms required to be submitted to the Pension Fund of the Russian Federation.

Now policyholders fill out only two mandatory reports - SZV-M and SZV-STAZH. In addition to mandatory reporting, representatives of the Pension Fund have the right to request other information. For example, information about the insurance experience of specialists for past periods. The forms and deadlines for providing such data are usually reflected in a written request for information.

Russian organizations are subject to significant fines for failure to submit mandatory forms. Thus, for untimely submission of SZV-M, Pension Fund employees will fine the company 500 rubles. And not for the entire report, but for each insured person, which must be reflected in this form. That is, if there are 10 people in the company, you will have to pay 5,000 rubles for late SZV-M.

The form is monthly, so if the deadlines are violated several times, the amount of penalties becomes increasingly significant. Many companies, fearing fines, do not take risks and submit zero reports to the Pension Fund in 2021. To figure out whether it is worth sending zero reports, let us recall the conditions for filling them out.

What to do with the CEO - the only founder

Some policyholders may be faced with the question of the need to fill out the SZV-STAZH form for the general director, the only founder, with whom an employment contract has not been concluded and who has not received any payments from the organization in the reporting period. The controversy of this situation lies in the particularity of the legal status of the head of the organization: he is subject to the norms of labor law, as an employee who has entered into labor relations with an employer - a legal entity on the basis of an employment contract, as well as the norms of civil legislation and laws on legal entities, as executive body of a legal entity (part 1 of article 273, article 274 of the Labor Code of the Russian Federation, paragraph 4 of article 53 of the Civil Code of the Russian Federation).

When a similar issue was considered in relation to the SVZ-M form, it was not possible to finally reach a consensus. So, for example, Letter No. LCH-08-19/10581 dated July 27, 2016 stated that if an organization does not have insured persons with whom an employment contract or a civil law contract has been concluded, for the benefits for which insurance premiums are calculated, then the obligation to submit a form SZV-M is missing.

However, from the explanations of the Pension Fund of the Russian Federation, given in Letter No. 08-22/6356 dated May 6, 2016, we can conclude that information must be submitted to the manager in the SZV-M form, even if there is no employment contract with him.

What to do with the SZV-STAZH form? Should the founding director be included? We will consider this issue in a separate article.

Read also

28.02.2017

Legislative basis

Policyholders throughout the country must submit reports to the Pension Fund with information about the length of service of hired employees. Depending on whether the activity was carried out or not, it is necessary to generate SZV-experience zero reporting or provide full information. The legal basis is Art. 11 Federal Law-27 of April 1996. The deadlines are also indicated there - in 2021, accountants need to hurry to submit this report before the first of March.

Considering the fact that the report must contain information about employees, the question arises as to whether it needs to be submitted in their absence. These and other reporting provisions are detailed in the law.

The SZV report is required for the following business entities:

- Domestic enterprises created and operating in the Russian Federation.

- Enterprises created by foreign founders, but operating in Russia;

- Entrepreneurs;

- Companies and individuals providing legal services;

- Notary offices;

- Private detectives.

Each hired employee must be involved in work on the basis of a civil contract (CLA) or under an employment contract. The report is generated only for officially employed employees. The absence of contracts of this kind means the absence of a legal basis for the formation of a zero SZV-experience report.

What does “zero” SZV-M mean in the Pension Fund of Russia

SZV-M is a form of personalized accounting. It is intended to reflect data about the insured employees of an organization or individual entrepreneur. Roughly, this designation stands for: Information about the Insured Incoming for the Month. The preparation of this report is carried out by the responsible person appointed by the manager.

As a general rule, if there are no employees at the enterprise and an employment agreement has not been signed between the manager and the organization itself, then we are talking about zero forms of SZV-M. At least, that's what accountants call these monthly reports.

Who submits the report and where?

Organizations must report under SZV-STAZH for their employees hired under labor and civil law contracts. In addition, the Pension Fund requires that the form be submitted for managers who are the sole founders.

Individual entrepreneurs who attract hired labor also submit the SZV-STAGE form. But individual entrepreneurs without employees do not fill out this report. Self-employed persons also do not apply.

The SZV-STAZH form must be sent to your territorial division of the Pension Fund: for entrepreneurs - at the place of residence, for organizations - at the place of registration. If the company has separate divisions that are registered as policyholders, then the form is sent to the branch at the location of such OPs. If they are not policyholders, then the necessary information is submitted to the parent organization as part of its report.

The standard deadline for submitting the form is March 1 of the year following the reporting year. If it is a weekend, the deadline is traditionally postponed to the next working day. As you know, the deadlines for many reports in 2021 were postponed due to coronavirus. But this did not affect SZV-STAZH - by the time it was rescheduled, it already had to be passed (the deadline was March 2, postponed due to a day off).

In addition, there are special deadlines for sending SZV-STAZH:

- when an employee applies for a form - within 5 working days;

- upon dismissal of an employee - on the last day of work;

- when assigning a pension - within 3 calendar days from the date of the employee’s application;

- in case of liquidation/reorganization of a company - within a month from the date of approval of the interim/separation balance sheet, but no later than the day of submitting documents to the tax office;

- when deregistering an individual entrepreneur - within a month from the date of the decision to terminate activities;

- in case of bankruptcy - before submitting the manager’s report to the arbitration court.

.

Free accounting services from 1C

Do individual entrepreneurs submit a zero form?

A separate question is whether or not to hand over zero SZV-M to entrepreneurs. So: businessmen submit the report in question to the Pension Fund only when they act as policyholders. This requirement follows from clause 2.2 of Art. 11 of Law No. 27-FZ “On accounting in the OPS system.” And this is only possible using hired labor.

When all employees are fired or are absent altogether, and the entrepreneur independently conducts his activities, the report in question is not submitted. In this case, filling in a zero SZV-M does not make sense.

How to act

Today it is impossible to say unequivocally that policyholders are finally relieved of the fine for a zero SZV-M - failure to submit this form.

We discussed above that the zero report without a list of insured persons has been cancelled. Insurers must submit only SZV-M with information about employees.

ADVICE

Letters from the Ministry of Labor and the Pension Fund of the Russian Federation do not yet provide clear answers to controversial questions about reporting in the SZV-M form. Therefore, we recommend that policyholders, if any problems arise, seek written responses from the Pension Fund divisions. This way you minimize the risk of being held accountable for an offense.

Also see “Fine for failure to submit SZV-M in 2021.”

Read also

23.11.2017

Reporting to the Pension Fund of the Russian Federation using the SZV-STAZh form in 2021

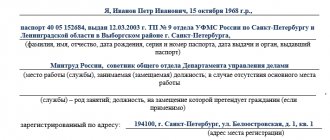

note

that the data in the specified section is filled in the nominative case.

In the columns “Name”, “Last name” and “Patronymic”

The full names of the insured persons for whom the report is being submitted are indicated accordingly. In this case, the columns “Last name” and “First name” are required to be filled out.

In the "SNILS" column

the insurance numbers of the individual personal accounts of each of the insured persons on which the report is submitted are indicated.

In the column "Operation period"

dates are indicated within the year (reporting period) for which the report is submitted, and are reflected in the format: “from (dd.mm.yyyy.)” to “to (dd.mm.yyyy.)”. If it is necessary to reflect several periods of work for a specific employee, then each period is indicated on a separate line, and there is no need to refill the columns “Last name”, “First name”, “Patronymic name”, “SNILS”.

Note

: for forms with the “Pension assignment” type, the “Period of work” column is filled in until the date of expected retirement. The period of work of the insured person under a civil contract is filled in with the codes “AGREEMENT”, “NEOPLDOG” or “NEOPLAVT” reflected in column 11. If payment under the agreement was made during the reporting period, the code “AGREEMENT” is indicated. If there is no payment for work under the contract, the code “NEOPLDOG” or “NEOPLAVT” is indicated.

In column 8 “Territorial conditions (code)”

it is necessary to indicate the code of territorial conditions, in accordance with the “Classifier of parameters used when filling out information for maintaining individual (personalized) records” (see Appendix 1).

In column 9 “Special working conditions (code)”

the code of working conditions giving the right to early assignment of a pension is indicated (see Appendix 2).

Note

: codes of special conditions are indicated in accordance with the section “Codes of special working conditions used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH)”, “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR )”, forms “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)” of the Classifier. The code for special working conditions or conditions for early assignment of a pension is indicated only if, during the period of work in conditions that give the right to early assignment of a pension, insurance contributions at an additional rate or pension contributions were paid in accordance with pension agreements for early non-state pension provision. When an employee performs types of work that give the insured person the right to early assignment of an old-age insurance pension in accordance with Art. 30 Federal Law dated December 28, 2013 N 400-FZ and with Lists 1 and 2 of production, work, professions, positions and indicators giving the right to preferential security, approved. By Resolution of the Cabinet of Ministers of the USSR No. 10 dated January 26, 1991, the code of the employee’s profession is indicated in accordance with the Classifier, in the next line, starting with the column “Special working conditions”. Writing code is not limited by the width of the column.

Boxes 9, 12 and 13

sections are not filled out if special working conditions are not documented, or when the employee’s employment in these conditions does not meet the requirements of current regulatory documents, or there is no payment of insurance contributions at an additional rate or pension contributions in accordance with pension agreements for early non-state pension provision.

Features of filling out columns 10, 11, 12:

- The code “SEASON” is entered in column 10 only if a full season has been worked in the work provided for in the list of seasonal work, or a full navigation period on water transport.

- The code “FIELD” in column 10 is indicated if in the column “Special working conditions (code)” the code “27-6” is indicated and only on the condition that work in expeditions, parties, detachments, in areas and in brigades on field work ( geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey) was carried out directly in the field.

- The number of months accepted for credit towards length of service in the relevant types of work is determined by dividing the total number of full days actually worked by the number of working days in a month, calculated on average for the year, 21.2 - with a five-day working week; 25.4 - with a six-day work week. The number obtained after this action is rounded to two digits if necessary. The integer part of the resulting number is the number of calendar months. For the final calculation, the fractional part of the number is converted into calendar days on the basis that 1 calendar month is equal to 30 days. When translating, the whole part of the number is taken into account; rounding is not allowed.

- For the corresponding periods of work, limited by the dates specified in columns 6 and 7, in column 11 “Calculation of the insurance period, additional information”, working time is reflected in the calendar calculation translated in the specified order (month, day).

- When filling out the period of work of convicted persons, column 11 indicates the number of calendar months and days of work of the convicted insured person included in the insurance period.

- The time spent under water (hours, minutes) is filled in only for divers and other insured persons working under water.

- Data on the flight hours of insured persons - civil aviation flight personnel (hours, minutes) are filled in only if one of the codes is indicated in column 12 “ground (code)”: “PLANE”, “SPECIAL”.

- Data on the flight hours of insured persons, participants in test flights (hours, minutes) are filled in if column 12 “base (code)” indicates one of the codes “ITSISP”, “ITSMAV”, “INSPECT”, “LETISP”.

- The scope of work (share of the rate) for the position performed by medical workers is filled in simultaneously with the indication in column 12 “base (code)” of one of the codes: “27-SM”, “27-GD”, “27-SMHR”, “ 27-GDHR".

- The rate (share of the rate) and the number of teaching hours worked by teachers in schools and other institutions for children are filled in simultaneously with the indication in column 12 “base (code)” of one of the values “27-PD”, “27-PDRK”.

- Moreover, if in column 12 “ground (code)” the value “27-PD” is indicated, indicating the number of training hours is not necessary, including for positions and institutions provided for in clause 6 of the Rules for calculating periods of work giving the right to early assignment of a retirement pension for old age in accordance with Art. 27 Federal Law “On Labor Pensions in the Russian Federation” (work as a primary school teacher in general education institutions specified in paragraph 1.1 of the section “Name of Institutions” of the list, teachers of general education schools of all names located in rural areas (except for evening (shift) and open (shift) general education schools) is included in the length of service regardless of the volume of the teaching load performed).

- If in column 12 “ground (code)” the value “27-PDRK” is indicated, the indication of the rate and number of training hours is mandatory for positions and institutions provided for in paragraphs. “a” clause 8 of the Rules approved by Decree of the Government of the Russian Federation dated October 29, 2002 N 781 (work as a director (chief, manager) of institutions specified in clauses 1.1, 1.2 and 1.3 (except for orphanages, including including sanatoriums, special (correctional) for children with developmental disabilities) and paragraphs 1.4 - 1.7, 1.9 and 1.10 of the section “Name of institutions” of the list, for the period from September 1, 2000 is counted towards work experience, subject to teaching work in the same or in another institution for children in an amount of at least 6 hours per week (240 hours per year), and in institutions of secondary vocational education specified in paragraph 1.10 of the section “Name of institutions” of the list, subject to teaching work in an amount of at least 360 hours per year).

- If in column 12 “ground (code)” the code “27-PDRK” is indicated, the rate must be indicated; indication of the number of training hours is optional for positions and institutions provided for in paragraphs. “b” clause 8 of the Rules approved by Decree of the Government of the Russian Federation of October 29, 2002 N 781 (work performed during normal or reduced working hours provided for by labor legislation, work in the positions of director (chief, manager) of orphanages is counted as work experience , including sanatorium, special (correctional) for children with developmental disabilities, as well as deputy director (chief, manager) for educational, educational, educational, production, educational and other work directly related to educational ) process, institutions specified in paragraphs 1.1 - 1.7, 1.9 and 1.10 of the “Name of Institutions” section of the list, regardless of the time when this work was performed, as well as teaching work).

For insured persons working in territorial working conditions or in types of work that give the right to early assignment of an old-age insurance pension, the code of territorial working conditions or the code of special working conditions and conditions for early assignment of an old-age insurance pension is not indicated if, when reflecting information in column 11 The form contains the following additional information:

- parental leave – “CHILDREN”

. - leave without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work), unpaid leave of up to one year provided to teaching staff, one additional day off per month without pay provided to women working in rural areas localities, unpaid time of participation in a strike and other unpaid periods - “NEOPL”

. - off-the-job training – “QUALIF”

. - performance of state or public duties - “SOCIETY”

. - days of donating blood and its components and days of rest provided in connection with this - “SDKROV”

. - suspension from work (preclusion from work) through no fault of the employee - “SUSPENDED”

. - additional holidays for employees combining work with training - “UCHOTPUSK”

. - parental leave for children from 1.5 to 3 years - “CHILDREN”

. - additional leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant - “Chernobyl Nuclear Power Plant”

. - additional days off for persons caring for disabled children - “DOPVIKH”

.

Code "CHILDREN"

in column 11 “additional information” is indicated if the child’s parent is granted leave to care for a child under the age of one and a half years.

Code "DLDETI"

is indicated in the case of granting the parent of a child leave to care for a child aged from one and a half to three years.

Code "DETIPRL"

is indicated in the case of granting parental leave until the child reaches the age of three to grandparents, other relatives or guardians actually caring for the child.

Code "ZGDS"

indicated in the case of a person holding a government position in a constituent entity of the Russian Federation, replaced on a permanent basis.

Code "ZGD"

indicated if a person holds a government position in the Russian Federation.

Code "ZGGS"

indicated if a person holds a position in the state civil service of the Russian Federation.

Code "ZMS"

indicated if a person holds a municipal service position.

Code "ZMD"

indicated if a person holds a municipal position replaced on a permanent basis.

If it is necessary to reflect simultaneously more than one code specified in the section Codes “Calculation of insurance experience: additional information”, used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH), “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR), forms “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance length of the insured person (SZV-ISKH)” of the Classifier , codes are indicated in two lines. The first line reflects the period with one of the codes “ZGDS”, “ZGD”, “ZGGS”, “ZMS”, “ZMD”, the entire period within the reporting period is indicated. The second line reflects the period with a different code of additional information for calculating the insurance period (for example, “VRNETRUD”). In this case, the period with a different code of additional information for calculating the insurance period is within the period or equal to the period indicated in the first line.

For insured persons who voluntarily entered into legal relations under compulsory pension insurance, the column “Period of work” of the section indicates the period of their registration with the Pension Fund of Russia, limited to the reporting period, subject to payment of insurance contributions for compulsory pension insurance for this period.

Box 14

“Information about the dismissal of the insured person/information about the periods counted in the insurance period of the unemployed” is filled in with the value “12/31/yyyy.” only for insured persons whose dismissal date falls on December 31 of the calendar year for which the SZV-STAGE form is being submitted.

For an insured person who has a period of receiving unemployment benefits, a period of participation in paid public works and a period of moving or relocating in the direction of the state employment service to another area for employment in accordance with clause 4, part 1, article 12 of the law of December 28, 2013 N 400-FZ in column 14 “Information about the dismissal of the insured person/information about the periods counted in the insurance period of the unemployed” the value “BEZR” is indicated.

Purpose and types

SZV-STAZH informs the Pension Fund about insured persons who are assigned to the employer. As part of the report on each of them, the following information is sent to the fund: full name, SNILS, periods of work, existence of grounds for early accrual of pensions, information about special working conditions (harmfulness, danger). This information is necessary for the subsequent assignment of pension benefits.

The SZV-STAZH form comes in several varieties:

- initial – filled out if the policyholder submits personalized reporting for the first time during the reporting period;

- supplementary – filled in if you need to enter information that is not in the original report;

- assignment of pension – filled in if the employee needs to take into account the periods of the current year to calculate the pension.

It is important to know that SZV-STAZH of any type is submitted together with the EDV-1 form. This is not an independent report, but an inventory, but without it the basic form will not be taken.

Results

Submission of the zero form SZV-M is not provided for by current legislation. Therefore, the question of how to fill out the SZV-M zero report is not relevant.

If there are no accruals and full-time employees in the reporting month, the company still needs to submit the SZV-M. But it will not be considered zero, since it will contain information about the director (sole founder).

Sources:

- Tax Code of the Russian Federation

- Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.