Inventory, as one of the tools for monitoring the state of material assets in an organization, allows you to immediately identify their shortages. The shortage consists in less availability of material assets than is recorded in documents and accounting registers on a certain date. There may be several reasons, and the methodology for writing off missing values in accounting depends on them. The employees who have concluded the relevant contract are financially responsible for the safety of materials, goods and objects, but they do not always bear real financial responsibility when a shortage is discovered.

How to write off the shortage of fixed assets and inventories ?

Personal accounting account to reflect shortages

To record shortages in accounting, account 94 “Shortages and losses from damage to valuables” is intended (Chart of Accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

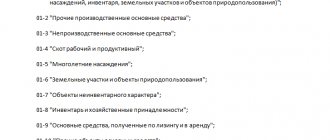

Basic information about account 94 is presented in the figure below:

What amounts are reflected in the debit and credit of this account, see below:

What needs to be taken into account when calculating the residual value of a fixed asset (FPE), see the article “How to determine the residual value of fixed assets” .

Let's figure out how account 94 is used in business activities.

Inventory: markdown and write-off

If the fact of damage to goods is detected, the organization can:

- mark down goods for further sale;

- write off goods (if they are not subject to further sale).

If an organization plans to discount (write off) a product due to damage, the head of the organization creates a commission, the composition of which is approved by order. The commission should include:

- a representative of the organization's administration (for example, a manager);

- financially responsible person;

- sanitary inspection representative (if necessary).

The commission's decision to mark down (write off) damaged goods is made in writing. For this purpose, an act is drawn up, for example in the form:

- No. TORG-15 (issued when marking down (writing off) goods as a result of damage, breakage, scrap);

- No. TORG-16 (issued when writing off goods that are not subject to further sale, for example, when their shelf life has expired).

The act in form No. TORG-15 (No. TORG-16) is drawn up in triplicate and signed by the head of the organization. One copy is transferred to the accounting department, the second remains in the department, the third - with the financially responsible person.

This procedure for registering damage to goods is established in the instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

In some industries, instead of form No. TORG-15 (No. TORG-16), other acts for write-off of goods recommended for use by the relevant departments may be used. For example, in relation to medical goods in pharmacies - an act in form No. A-2.18 (Section 4 of the Methodological Recommendations approved by the Ministry of Health of Russia on May 14, 1998 No. 98/124).

Reflection in accounting of losses confirmed by inventory results depends on:

- type of loss (shortage or damage);

- causes of occurrence (natural loss, perpetrator, force majeure).

For information on how to reflect in accounting the shortages identified during the inventory, see How to reflect the shortages identified during the inventory.

The culprits have been identified: how to write off shortages identified during inventory

Regular monitoring of the availability and condition of property, carried out through an inventory, helps the company’s management:

- promptly identify shortages and damage to property;

- deal with the culprits;

- take measures to recover shortfalls from those responsible;

- write off damaged and missing material assets from accounting accounts and generate reliable information in reporting on company property;

- take measures to strengthen control over the safety of assets, increase the level of responsibility of financially responsible persons, etc.

The following articles talk about the nuances of inventory:

- “Inventory of inventories: order and nuances”;

- “Procedure for conducting an inventory of fixed assets”;

- “The procedure for carrying out a BSO inventory (nuances).”

To understand the postings for writing off shortages during inventory, we will use the conditions of the example.

After conducting an inventory at warehouse No. 3 (the financially responsible person is storekeeper N. G. Zavyalov), a shortage of goods and materials in the amount of 8,630 rubles was revealed:

| Name | Quantity | price, rub. | Cost, rub. | ||

| Cement PC-500 | 5 bags | 290,00 | 1 450,00 | ||

| Shovel with wooden handle (rail steel) | 4 pieces | 525,00 | 2 100,00 | ||

| Rack jack | 1 piece | 5 080,00 | 5 080,00 | ||

| Total amount: | 8 630,00 | ||||

Storekeeper Zavyalov N.G. agreed to voluntarily compensate for the shortage.

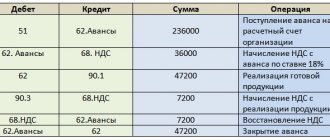

In the company's accounting, entries were made to write off the shortage to the guilty party:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 94 | 10 | 8 630,00 | The cost of missing valuables is transferred to the shortage account |

| 73 | 94 | 8 630,00 | The shortage is attributed to the person at fault |

| 70 | 73 | 8 630,00 | The shortage is withheld from the salary of the financially responsible person at his request |

How the presence of natural loss norms affects the procedure for writing off shortages is described here .

Important to consider! Recommendation from ConsultantPlus: Evaluate written-off inventory items in the manner established by the accounting policy.

In the debit of account 94, also write off the amount of deviations, including transport... (read more).

Inventory: identifying shortages and damage

Detection of the fact of shortage (damage) of goods is the basis for conducting an inventory (Part 3 of Article 11 of the Law of December 6, 2011 No. 402-FZ). An exception to this rule is the shortage (damage) of goods identified before the goods are registered. The fact of shortage (damage) can also be revealed during the inventory process carried out for other reasons.

At its discretion, the organization can conduct an inventory of goods at any time. However, there are cases when inventory must be carried out without fail:

- before preparing annual financial statements;

- when changing materially responsible persons (for example, warehouse manager, storekeeper);

- when facts of theft, abuse or damage are revealed;

- in the event of force majeure (for example, natural disasters);

- during reorganization or liquidation of the organization;

- in other cases provided for by law (for example, when selling an enterprise as a property complex) (Article 561 of the Civil Code of the Russian Federation).

Such rules are established in paragraph 27 of the Regulations on Accounting and Reporting.

For information on what conditions must be met when conducting an inventory of goods, see the table.

To document the inventory of goods, you can use the following standard forms:

- inventory list of inventory items (form No. INV-3);

- act of inventory of shipped inventory (form No. INV-4);

- inventory list of inventory items accepted for safekeeping (form No. INV-5);

- act of inventory of inventory items in transit (form No. INV-6).

When registering inventory results, the following documents must be drawn up:

- matching statement in form No. INV-19;

- statement of accounting of the results identified by the inventory, according to form No. INV-26.

This is stated in section 2 of the instructions approved by Decree of the Goskomstat of Russia dated August 18, 1998 No. 88, and in Decree of the Goskomstat of Russia dated March 27, 2000 No. 26.

For more information on filling out these forms, see the table.

There is no one to blame for the shortage: we are sorting out the wiring

Situations when there is no one to blame for a shortage often arise. Company assets can be lost as a result of force majeure (flood, drought, earthquake) or stolen by thieves who cleverly cover their tracks.

First, the property owner must understand the true reasons for the shortage and take measures to find the perpetrators, as well as evidence of their involvement in the loss of valuables. To do this, the company can conduct an internal investigation itself or file a complaint with the police.

Let's look at an example to see what kind of postings are used when writing off a shortage if the culprit is not identified.

Construction materials worth RUB 2,654,399 disappeared from the construction site. 38 kopecks In the “Construction City” accounting, after conducting an inventory and completing the necessary documents, the following entry was made:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 94 | 10 | 2 654 399,38 | There is a shortage of building materials |

The company's management contacted the police to report the theft. As a result of the investigation, the culprits of the theft were not identified. After receiving from the internal affairs bodies a document on the suspension of the case of theft of valuables due to the absence of perpetrators, the following entries were made in the accounting records of Stroyka-Gorod LLC:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 91.2 | 94 | 2 654 399,38 | The loss from the shortage was written off as other expenses due to the absence of the perpetrators |

The same entry is made in accounting if the guilt of the financially responsible person in damage or loss of valuables is not proven. The basis may be an acquittal by the court (clause 5.2 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

Learn about the nuances of using account 91 from this material.

We write off the shortage

If any fact of theft, abuse or damage to property is detected, an inventory of valuables must be carried out (clause 2 of Article 12 of Law No. 129-FZ of November 21, 1996 (hereinafter referred to as Law No. 129-FZ)). Since only an inventory will confirm the correctness and validity of the listed amount of debt for shortages.

Inventory procedure

The procedure for conducting an inventory of property and recording its results is prescribed in the “Guidelines for the inventory of property and financial obligations” established by Order of the Ministry of Finance dated June 13, 1995 No. 49 (hereinafter referred to as the Guidelines). Inventory results are reflected using unified forms approved by State Statistics Committee Resolution No. 88 dated August 18, 1998 “On approval of unified forms of primary accounting documentation for recording cash transactions and accounting for inventory results.”