Conditions for writing off and restoring VAT

Organizations purchasing goods and materials, paying for services or stages of work, receive VAT as part of their cost. Within the framework of the general taxation system, tax amounts are accepted for deduction in accordance with the rules of paragraph 1 of Art. 171 Tax Code of the Russian Federation. Namely, the amount of VAT on incoming goods and services is credited provided:

- goods are accepted for accounting;

- Inventories are used in activities subject to VAT;

- the operation has documentary confirmation: UTD, invoice, customs declaration from customs.

In practice, it looks like this: the acquisition is justified by documents that provide the right to deduction. The tax amount and the cost of the goods before tax are indicated on the invoice. The goods, intangible assets, fixed assets are credited to the balance sheet.

The goods are used in taxable transactions in the main activities of the organization: resold or released into production. If a transaction is carried out without tax (VAT is not charged), then the accounting policy must establish separate accounting for such transactions.

Possible options for taxpayer behavior

Despite the fact that officials seem to have decided on the issue of restoring VAT on write-off goods, it is impossible to completely exclude the occurrence of disagreements with inspectors during inspections. Therefore, the taxpayer still has to make his own decision about whether to restore the tax in such a situation or not, depending on his readiness for a tax dispute.

This means that a cautious taxpayer will have the following transactions on the date the goods are written off:

- regarding tax recovery:

- and by writing it off as other expenses:

The tax should be restored at the rate indicated in the supplier’s documents, applying it to the book value of the written-off product.

But we believe that it is better not to play it safe. After all, the likelihood of getting a court decision in your favor is very high.

What are the requirements for the restoration of paid VAT amounts?

Restore the amount of paid tax in the accounting records, as required by the standard of clause 3 of Art. 170 of the Tax Code of the Russian Federation is mandatory in the following situations:

- the goods are contributed to the authorized or equity capital;

- the cost of inventory items decreases;

- used in activities that are not subject to tax;

- a subsidy was received from the budget for inventory items.

When an organization contributes shares or a share in the form of goods, inventory, fixed assets, and intangible assets to the authorized capital, it will be necessary to restore part of the previously accepted tax for deduction. The transaction is reflected in the sales ledger. The amount of restored VAT is calculated in proportion to the residual value of the contribution.

Financing goods purchased with budget money implies a benefit for the organization. If a transaction is made under a subsidy program, and the VAT amount was included in the report, then it must be returned to the budget and reflected in accounting.

The law does not provide for deduction and reimbursement for goods, and, accordingly, the restoration of VAT amounts in the presence of specific conditions:

- goods, intangible assets, fixed assets are not subject to VAT;

- the transaction was completed outside the Russian Federation;

- the seller is exempt from calculating and paying tax on the basis of Art. 145 of the Tax Code of the Russian Federation.

Considering the nuance that all circumstances do not provide tax for payment, there is no need to return VAT to the treasury.

Note! Until the end of 2021, this rule applied to federal subsidies. From 01/01/2017, when financing from the local treasury, VAT amounts are restored to payment.

The position of the judiciary regarding restoration

As we said above, the judicial authorities, which are approached by taxpayers who enter into disputes with the Federal Tax Service regarding the non-compulsory restoration of VAT on a written-off product, strongly support the position of such taxpayers. Its rationale is based on the fact that in the list of situations requiring tax restoration (clause 3 of Article 170 of the Tax Code of the Russian Federation), the write-off of goods is not named. Therefore, if all the conditions for the previous deduction have been met, the reality of the existence of the product and the need to write it off are confirmed, then VAT restoration is not required. An example of such decisions can be the decisions of the FAS:

- Central District dated February 24, 2016 No. F10-43/2016;

- Ural District dated 02/08/2016 No. F09-203/16;

- North Caucasus District dated 05/07/2014 No. A32-18211/2012;

- Northwestern District dated 02/03/2014 No. A42-74/2013;

- Moscow District dated December 25, 2013 No. A40-34818/13;

- East Siberian District dated 03/05/2013 No. A19-1816/2012;

- Moscow District dated December 27, 2012 No. A40-120001/11-20-499;

- Ural District dated October 19, 2011 No. F09-6671/11.

This approach was repeatedly supported by the Supreme Arbitration Court, which was reflected in the decisions:

- dated May 19, 2011 No. 3943/11;

- dated October 21, 2009 No. VAS-13771/09;

- dated June 21, 2007 No. 7016/07;

- dated October 23, 2006 No. 10652/06.

Recover VAT if the goods are damaged

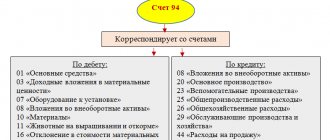

For cases of intentional or accidental damage to property, accounting provides for the following operations:

Dt 19 Kt 68/2 – for the amount of VAT that we restore for payment;

Dt 91/2 kt 19 – the amount of tax (recovered and paid) is included in other expenses;

Dt 94 Kt 41 – the cost of the goods, which is fixed in an act that indicates the volumes of broken, broken, spoiled, expired goods and materials;

Dt 44 Kt 94 – the cost of losses is included in the cost of sales.

In practice, losses in such cases are included in expenses and are repaid at the expense of the organization. Unless otherwise provided by the internal regulations document or the agreement on liability. On this basis, losses are covered by the employee.

Step-by-step instruction

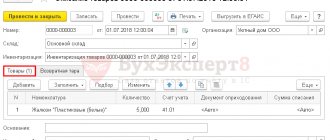

On July 1, the Organization carried out a scheduled inventory of goods in the warehouse, during which a shortage of goods was identified:

- blinds “Plastic (white)” – 5 pcs. (product cost 500 rubles/piece).

According to the manager's order, the shortage of goods was written off.

The organization decided to restore VAT, previously accepted for deduction on missing goods discovered as a result of the inventory.

Let's look at step-by-step instructions for creating an example. PDF

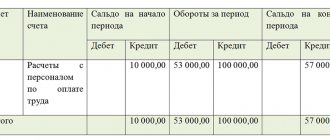

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off of shortage of goods as a result of inventory | |||||||

| July 01 | 94 | 41.01 | 2 500 | 2 500 | 2 500 | Write-off of shortage of goods at actual (book) cost | Write-off of goods |

| VAT recovery | |||||||

| July 01 | 19.03 | 68.02 | 450 | VAT recovery | VAT recovery | ||

| 91.02 | 19.03 | 450 | 450 | Write-off of VAT on other expenses | |||

Accounting for VAT in case of shortage or theft of goods

Shortages or theft of inventory items are identified during the inventory process. The actual condition of materials in the organization is entered into the comparison sheet INV - 19. The basis for checking storage locations is an order in the form INV - 22. If inventory and materials are not sufficient in accounting and in fact, the reason for this is:

- underdelivery from the counterparty (reflected in the claim to the supplier);

- established fact of theft;

- natural rates of loss of inventory items.

Based on the results, the culprit is identified, at whose expense the organization’s losses will be written off.

If the damage is compensated by the culprit, the following entries are used:

Dt 94 Kt 10, 41 – for the amount and quantity of missing inventory items;

Dt 73 Kt 94 – damage written off at the expense of the culprit;

Dt 70 Kt 73 – the amount of damage is withheld from earnings;

Dt 91/2 Kt 94 - the amount of damage is charged to other expenses (if the culprit of the theft is not identified).

The question remains: how will VAT be restored when goods are written off in such cases? Practice is not clear-cut.

The tax service inclines organizations to restore and additionally pay VAT, which was accepted for offset in previous periods on inventory and other property. This position is supported by the Ministry of Finance in letter No. 03-03-06/1/1997 dated 01/21/2016.

Based on the list of rules under which VAT must be returned to the budget (clause 3 of Article 170 of the Tax Code of the Russian Federation), we will not see theft, shortage, or damage to goods and materials. Each case is considered individually by fiscal structures. For example, the same Ministry of Finance previously clarified that writing off inventory items due to a breakdown does not entail additional VAT payment. Even if the object is damaged and disabled. This is stated in letter No. 03-07-11/15015 dated March 19, 2015.

Although the Federal Tax Service of Russia itself later stated that it is not necessary to restore VAT when damage to the organization’s property was caused in an emergency situation (theft, fire). You can find out opinions about this in letter No. GD-4-3/ [email protected]

Judicial practice is developing in favor of organizations that risk challenging the position of the financial service. The arbitration also builds its arguments on the basis of the norms named in Art. 170 Tax Code of the Russian Federation.

The behavior of organizations in such cases is divided. The safest thing to do, some believe, is to restore and pay additional tax. The rest, relying on the positive practice of the FAS, decide to argue that the need for the Federal Tax Service’s requirement to restore VAT when writing off goods is unnecessary.

Note! The reason why they are required to pay additional tax is stated as follows. If a product is written off for any reason, not counting sales, it is not used in activities subject to VAT.

Results

The issue of mandatory VAT restoration on goods written off can still be decided by controllers and courts in different ways. For taxpayers who want to avoid disputes during audits, it is safer to restore VAT when writing off goods. Those who choose not to do this have a good chance to prove their right not to restore the tax in court.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for recovered VAT amounts in the purchase ledger

The tax is entered into the purchase book when goods are received at storage locations, based on an invoice or UPD. Reflected by the “Receipt” operation, where the details of the supplier’s documents, the name of the product, its price and quantity, the amount of input tax, and the total cost are indicated.

A transaction is automatically created:

Dt 68 Kt 19 – tax credited.

1 Option for tax recovery

The goods are written off directly using the “Write-off of Inventory and Materials” document. Created on the basis of capitalization, indicating the reasons for the operation. For example, “writing off materials due to theft, wear and tear, impossibility of use or sale. VAT has been restored." The reversal entry will appear after posting the document.

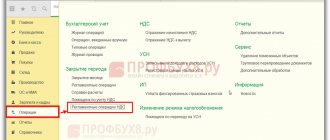

2 Tax restoration option

In the section of typical regulatory operations, you need to select “VAT recovery”. In the header, select where you want to reflect the tax amount. In our case, VAT will be reflected in the sales book. The tabular part is intended for information about the incoming document, on the basis of which the organization charges additional tax.

To write off VAT as expenses, you will need to check the box in the window; the posting of the write-off of losses will be reflected in accounting after posting the document.

This function is also used to reflect the restored VAT amount in the purchase book.

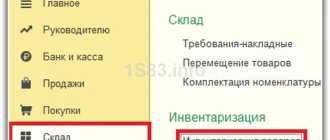

Write-off of shortages as a result of inventory

To write off actually missing property, an organization order should be issued based on the data from the matching statements and the results of identifying the circumstances of the shortage.

Write-off of missing inventory items is documented using the document Write-off of goods based on the document Inventory of goods. Goods tab Goods Write-off document will be filled in automatically with the missing inventory items from the Goods Inventory .

Find out more about writing off shortages as a result of inventory

Postings according to the document

The document generates the posting:

- Dt Kt 41.01 - write-off of shortage of goods at actual (book) cost.

Reporting on recovered VAT amounts

The restored tax itself will be reflected in an additional sheet of the sales book. The amount that is restored for payment is entered in section 3 of line 090. If the restored tax is related to real estate, you will need to draw up Appendix No. 1 in addition to section 3.

It is compiled separately for each property. It is provided to the tax office as part of the reporting for the 4th quarter of the reporting year and only once a year. This is indicated by paragraph 39 of the letter of the Federal Tax Service of Russia dated December 20, 2016 No. ММВ-7-3 / [email protected] ). The appendix contains a calculation of the amount of VAT that is restored on real estate. The total amount of tax on line 080 of Appendix No. 1 is transferred to line 090 of section 3 of the report for the year. The details of the export tax and the procedure for its restoration can be read in a separate topic.

Let's remember the basics

VAT is a mandatory tax for all Russian companies that have chosen a common taxation system.

For various types of goods and services it is 0/10/18%. The bottom line is that you already include this VAT in the price for the buyer. And he pays for it including tax. And at the end of the reporting period, all VAT must be calculated and paid to the budget. But since you also buy part or all of the goods/services in Russia and, probably, from companies that pay VAT, you pay it to them, also including tax. Therefore, part of the quarterly tax can be deducted. That is, collect primary documents (invoices) indicating the added value paid for the quarter and pay to the budget the difference between how much was sold and how much was bought during the period. This is how primitive the scheme for calculating VAT payable for a quarter looks like.

There are several points in the law when the tax that you have already accepted as a deduction (because you bought the goods) needs to be restored and paid to the budget.

Accounting entries in trade

The algorithm for writing off defective goods from a warehouse in accounting is as follows:

| Debit | Credit | Contents of operation |

| 94 | 41 | Damage to goods is reflected. |

| 44 | 94 | Losses from defects are within the limits of natural loss. |

| 19 | 68 | VAT accrued for payment to the budget has been restored. |

| 60, 73, 76 | 94 | The amount of losses from damage to goods in excess of the norms of natural loss is attributed to the perpetrators. |

| 91 | 94 | The loss from defective goods is written off to the financial results of the enterprise. |

When writing off non-conforming products, you should not forget to reflect the guilty parties (if any) in the Debit using accounting items 76, 73 or 60.

We prepare and carry out inventory

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

The obligation to conduct an annual inventory of property and financial obligations is established by the Regulations on accounting, approved by the Ministry of Finance on July 29, 1998. No. 34n.

The rules and procedure for carrying out this procedure are established by the Methodological Instructions (Order of the Ministry of Finance No. 49 of June 13, 1995), they list the composition of property and liabilities subject to audit, and the forms of documents that can be used to document the results.

The main stages of inventory are shown in the table:

| Stage | Document | Explanation |

| Preparation | Manager's order to conduct an inventory | The order indicates: the timing of the inventory, the reason for the inventory, the list of inventory property, the list of financially responsible persons and the composition of the commission |

| Carrying out | Inventory list | Members of the commission maintain an inventory (count) of property and its condition |

| Data Mapping | Collation statement | Reconciliation of the data presented in the inventory with the data in accounting. Drawing up comparison sheets to identify discrepancies. |

| Registration and approval of results | Accounting certificate | Bringing accounting data into correspondence with actual availability. Write-off of shortages or capitalization of surpluses |

Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

Get 267 video lessons on 1C for free:

To carry out an inventory at the enterprise, a commission consisting of at least three people is formed. Based on the results of the inventory, the commission draws up matching statements, inventory lists, acts:

Calculations with the budget

Reflect the transfer of VAT to the budget by posting:

Debit 68 subaccount “VAT calculations” Credit 51

– VAT paid.

In case of VAT refund from the budget, make one of two entries:

Debit 51 Credit 68 subaccount “VAT calculations”

– the amount of VAT to be reimbursed is returned to the organization’s current account;

Debit 68 Credit 68 subaccount “VAT calculations”

– VAT amounts to be refunded are offset against the organization’s payments for other taxes.

This procedure follows from the Instructions for the chart of accounts (accounts 51, 68).

The tax accounting procedure for VAT depends on the taxation system that the organization uses.