- home

- Reference

- Insurance premiums

Private entrepreneurs are required to pay insurance premiums not only for their employees, but also for themselves. The procedure is performed annually, and also based on current details. But if an individual entrepreneur cannot or does not want to make contributions, then he becomes in debt.

Since 2021, the state has been offering businessmen a tax amnesty on fees and insurance premiums, but if an individual entrepreneur cannot take advantage of this relief for various reasons, then his debts will be collected by force.

What is written off during an amnesty: taxes or contributions?

They have been talking about an amnesty for individual entrepreneurs on contributions to the Pension Fund and taxes for the second year now.

Individual entrepreneurs have the opportunity to get rid of debts on payments to the budget and extra-budgetary funds thanks to the Law “On Amendments...” dated December 28, 2017 No. 436-FZ. This law allows amnesty of debt not only for individual entrepreneurs, but also for other categories of persons (companies, ordinary citizens - not individual entrepreneurs, private practitioners). For each group of persons, the law provides for different conditions for granting tax amnesty based on the timing of debt formation and their types. What individual entrepreneurs are written off under the tax amnesty, see below:

Law No. 436-FZ for individual entrepreneurs provides for an amnesty for both tax debt and insurance premiums. At the same time, individual entrepreneurs should not forget that timely payment of taxes is the main responsibility of the taxpayer. Forgiveness of tax debts is a one-time government measure aimed at supporting business.

Will individual entrepreneurs forgive debts on insurance premiums for injuries, as well as excise taxes and mineral extraction tax?

The tax amnesty for individual entrepreneurs does not include debt on excise taxes, mineral extraction tax and taxes payable when moving goods across the border.

Legislators also did not include insurance premiums for injuries on the list of amnestied debts. Only contributions accrued in accordance with the Law “On Insurance Contributions...” dated July 24, 2009 No. 212-FZ (currently not in force) are subject to write-off. Contributions paid by insurers as part of insurance against industrial accidents and occupational diseases (“injuries”) are regulated by another law - “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ.

Nevertheless, the individual entrepreneur was luckier than others. Among the debts subject to amnesty are both overdue tax obligations and contributions, as well as penalties and fines accrued on these amounts. Companies and private practitioners are less fortunate - they cannot count on having their tax debts written off.

If OKVED IP or LLC falls into the list of affected activities, then all taxes and contributions for the second quarter of 2020 will be written off, with some exceptions. For the list of debited payments, see the typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Bankruptcy of individual entrepreneurs

What debts are written off:

- debts to banks

- debts to counterparties

- debts of the Federal Tax Service and the Pension Fund of Russia

In case of bankruptcy of an individual entrepreneur, debts not only from business details will be taken into account, but also personal debts of individuals. faces. After completing the procedure, all debts will be written off immediately.

You can write off any amount of debt, but it is advisable to file a lawsuit starting from 350 thousand rubles.

If the debt is up to 500,000 rubles. and the debtor has no property, from September 1, 2021, you can file for out-of-court bankruptcy. In this case, the debts will be written off through the MFC, without going to court.

We advise you to close your individual entrepreneur status with the tax authorities and go through bankruptcy as an individual. Then it will be possible to continue business activities immediately after bankruptcy.

What debts cannot be written off from an individual entrepreneur?

Categories of debts that cannot be written off even through bankruptcy:

- Wage arrears.

- Liability for causing harm (injury at work).

- Vicarious liability.

If you have questions about writing off debts from individual entrepreneurs, call or leave a request in the online chat form. Our lawyers will tell you how to get rid of debts and preserve your property.

We will write off your debts through bankruptcy with a guarantee

A lawyer will call you back in 1 minute and provide advice. It's free.

Which entrepreneurs have their tax debts and contributions to the Pension Fund written off?

Tax amnesty 2021 for individual entrepreneurs is a legal opportunity to get rid of “old” debts for entrepreneurs:

- currently in force;

- who ceased their business activities, but had arrears in contributions and taxes as of a certain date.

The amnesty affects the debt of individual entrepreneurs, which is registered with them as follows:

- as of 01/01/2015 - for taxes;

- 01/01/2017 - for contributions.

This means that debts under the specified obligations of the individual entrepreneur that arose after the deadlines mentioned above are subject to payment. This applies equally to both working entrepreneurs and those who have lost their individual entrepreneur status.

"Senseless" debt

Deputies considered and approved another amendment to the Tax Code, specifically Article 217. The adjustments increase the list of income that will be exempt from taxation. It is proposed to include among these incomes that were received in the period from January 1, 2015 to December 1, 2021 (from which tax was not withheld).

Experts explain that by introducing the proposed changes, the problem of accumulated debts to the tax system will be eliminated, when collection authorities assessed personal income tax to citizens as a result of writing off their debts to banks, telecommunications companies, etc. President Vladimir Vladimirovich Putin called this practice meaningless. However, we are not talking about getting rid of it altogether. “Contingent income” that the businessman received after the period mentioned above is subject to personal income tax.

The law provides that a tax agent who has not withheld personal income tax is obliged to report this to the tax authorities. Such situations arise if a person received some economic benefit, but not with money in the physical sense. For example, if the bank wrote off the payer’s debt or the company allowed the employee not to pay for a previously taken out loan. In such situations, the citizen must send a declaration and settle accounts with the state. But not all residents of our country act according to the law, and the tax service does not always have the opportunity to collect small amounts.

The procedure and timing of the amnesty for the debts of individual entrepreneurs

Amnesty for individual entrepreneurs' debts began in 2021. The law establishes a simple mechanism for writing off debts. This should be done by tax authorities at the place of residence of the debtor entrepreneur. The law does not oblige the individual entrepreneur to perform any actions.

The deadlines for carrying out the procedure for writing off debts are not established by law, and this event may drag on indefinitely. Therefore, if an individual entrepreneur is interested in writing off debt as quickly as possible within the framework of a tax amnesty, he will still have to participate in this process. Namely, on your own initiative, reconcile existing debt with controllers.

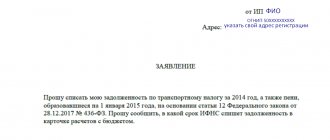

It wouldn’t hurt to inquire at the tax office about the existence of tax and insurance debts that are eligible for the amnesty. If such amounts are discovered, it is better not to leave the process of writing them off without control. Despite the fact that Law No. 436-FZ does not provide for any obligations in the tax amnesty procedure for individual entrepreneurs, write a statement in free form and submit it to the inspectors. In the application, state your request to write off debts within the framework of Law No. 436-FZ.

The Federal Tax Service recommends obtaining information about the amount of debt written off through the “Personal Account of Taxpayer-Individual Entrepreneur” service. If such information is not currently available in your personal account, please contact the tax office directly to clarify the information.

Find out more about the tax amnesty on our forum.

Writing off bad debts in 2021

Last year, the tax authorities prepared a draft Order on the procedure for writing off arrears and fines deemed uncollectible. The document allows you to write off debts in the following cases:

- When an individual or individual entrepreneur is declared bankrupt. Along the way, the procedure allows entrepreneurs to get rid of credit debts for personal and commercial purposes and debts to counterparties.

- When the court declares the period for collecting the arrears has expired. That is, when, according to the law, it is impossible to collect the debt by force or apply interim measures to the debtor to return it.

- If funds were written off from the taxpayer’s account, but were not credited to the budget account.

- In case of death of an individual and liquidation of an individual entrepreneur.

You can learn more about how to deal with debts if your solvency has decreased from our credit lawyers. Just call us by phone or ask your question online.

Law No. 436-FZ and the Ministry of Finance on writing off debts of individual entrepreneurs on contributions to the Pension Fund

The tax amnesty for individual entrepreneurs on insurance premiums provides for the following (Article 11 of Law No. 436-FZ):

The decision to write off arrears, penalties and fines is drawn up in any form and must contain the full name, TIN of the entrepreneur, and the amount of contributions to be written off.

Officials of the Ministry of Finance explained additional conditions for recognizing debt on contributions as bad and subject to write-off - the amnesty also applies to individual entrepreneurs’ contributions for themselves, accrued based on the maximum amount (8 minimum wages), for which the entrepreneur did not report (letter dated January 26, 2018 No. 03-11 -11/4394).

You will find the formula for calculating the insurance obligations of individual entrepreneurs in the material “Insurance premiums for the year - what amount to pay.”

Measures to support individual entrepreneurs during the crisis 2021

The coronavirus pandemic has affected all areas of activity, including small and medium-sized individual entrepreneurs. Due to the decline in the solvency of the population and the closure of retail outlets, many entrepreneurs did not receive any income at all for 1.5-2 months.

The state has not offered to completely write off debts incurred due to the crisis. However, already from V. Putin’s first address, measures to support citizens and businesses began to be introduced. These measures allow you to reduce the burden or receive benefits:

- a moratorium was declared on the initiation of bankruptcy cases at the initiative of creditors (an individual entrepreneur himself can file for bankruptcy according to the general rules);

- for the 2nd and 3rd quarters of 2021, tax exemption for small and medium-sized businesses was introduced (except for VAT and personal income tax for employees);

- entrepreneurs from affected industries have the right to demand a temporary reduction in rental rates for state, municipal and private property

; - introduction of a 0% insurance premium rate for employees and a reduced rate for individual entrepreneurs in the 2nd quarter of 2021;

- until the end of 2021, all control and supervisory inspections by the Federal Tax Service and other government departments are suspended;

- collection of tax debts, fines and penalties has been suspended.

If there were losses or a decrease in income by more than 10% in 2020, the individual entrepreneur received installments on tax payments for up to 6 months. If security was provided, installments were provided for a period of up to 12 months.

Also, for entrepreneurs working in the most affected industries, the state allocated a subsidy of 12,130 rubles per month for each employee and for the individual entrepreneur himself. This money can be received for the period April-June 2021, and spent not only on salaries, but also on other purposes.

Most support measures due to the coronavirus pandemic were provided without applications from entrepreneurs and organizations. However, to receive subsidies of 12,130 rubles, loans at 0% for salary payments or credit holidays before October 1, it was necessary to submit an application.

Check whether the business belongs to the affected industries on the Federal Tax Service service.

Are debts submitted for collection forgiven?

Individual entrepreneurs have the right to count on the write-off of those debts within the framework of the tax amnesty for which collection procedures have been initiated and interim measures have been taken. It doesn’t matter that the documents on these debts have already been transferred to bailiffs, courts or banks - the debts must still be written off.

The Federal Tax Service issued a special letter on this matter, in which it deciphered the actions of the inspectors (letter of the Federal Tax Service of Russia dated April 16, 2018 No. KCH-4-8/71146). After a decision is made to write off the debts of an individual entrepreneur as part of a tax amnesty, controllers are obliged to:

- revoke the order to write off the debt from the individual entrepreneur’s accounts;

- cancel the decision to suspend transactions on individual entrepreneur accounts;

- inform the bailiffs of the information from the decision made to cancel the decision to collect the tax or notify them of the updated amount of the debt (if the debt is partially written off).

We describe the method of obtaining information about tax debts, the collection of which is at the stage of enforcement proceedings, in the material “How to find out tax debts.”

Our services and prices

Check before out-of-court bankruptcy

5 000 ₽

- Debt verification: calculation of the amount, including penalties and forfeits, requests to the BKI, credit and collection organizations. We will receive a written request from creditors to fix the amount of debt

- Checking the FSSP database for completed enforcement proceedings

- Risk analysis of extrajudicial bankruptcy – final consultation with a lawyer

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 000 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,000 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details

Results

Tax amnesty for individual entrepreneurs - 2021 allows you to get rid of old debt not only for taxes, but also for insurance premiums.

Debts are written off without the participation of the entrepreneur by the tax authority at his place of residence. An individual entrepreneur can speed up this process by initiating a reconciliation with controllers and submitting an application to them with a request to write off debts as part of the amnesty. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.