Individual entrepreneurs (IP) often carry out their business activities using non-cash payments.

However, many of them also practice cash transactions. Until 2014, individuals operating as individual entrepreneurs and working with cash were required to regularly maintain a special register - a cash book (CC).

This obligation applied to any individual entrepreneur – regardless of the taxation system used. Directive of the Central Bank of the Russian Federation No. 3210-U, issued on March 11, 2014, radically changed this situation.

This regulatory act provides for an exemption from filling out the CC for those individual entrepreneurs who already take into account income, income/expenses, other objects of taxation or, alternatively, physical indicators of their business activities (clause 4.6).

What is cash discipline

The current regulations for conducting cash transactions by legal entities/individual entrepreneurs were approved by the Bank of Russia in Instructions No. 3210-U dated March 11, 2014. Current regulations establish the rules for working with cash, including accepting and issuing money, and calculating the cash balance limit. According to clause 4.6 of the Instructions for individual entrepreneurs, there is no need to maintain a cash book if accounting of income and expense transactions or physical indicators (objects of taxation) is organized according to the Tax Code of the Russian Federation. Due to the fact that any entrepreneur, regardless of the taxation system used, keeps tax records in one way or another, we can conclude that all individual entrepreneurs may not keep a cash book.

However, in some cases it will still be necessary to organize cash document flow. First of all, an entrepreneur can independently decide to maintain cash forms to strengthen control and increase transparency of employees’ work. Secondly, the need for filling arises when:

- Availability of accountable settlements between individual entrepreneurs and personnel.

- Issuance of PCO (cash receipt orders) as confirmation of payment for the services offered to customers.

- Cash payments to personnel for salaries.

- Cash issuance of various social benefits to employees - copies of documents for reimbursement of expenses must be submitted to the Social Insurance Fund.

Therefore, the answer to the question: Should an individual entrepreneur keep a cash book? will be negative. At the moment, entrepreneurs are given the opportunity to choose - to draw up cash documents in the general manner with the formation of a cash book and receipt and expenditure orders. Or apply simplified regulations by recording income and expenses in KUDiR or recording physical indicators. The nuances depend on the tax regime used - simplified tax system, PSN, UTII, OSNO or Unified Agricultural Tax.

Cash

The current legislation establishes a list of purposes for spending cash received at the cash desk (clause 2 of Directive No. 3073-U dated October 7, 2013). Cash proceeds are spent on the following purposes:

- payment for goods (works, services);

- issuance of cash for personal needs of individual entrepreneurs not related to their business activities;

- payment of wages to employees;

- social payments (for example, financial assistance, benefits, etc.);

- payment of insurance compensation under insurance contracts to individuals who previously paid insurance premiums in cash;

- issuing cash to employees on account;

- refund for previously paid in cash and returned goods, work not performed, services not rendered.

Attention! Cash payments within the framework of one agreement are allowed in an amount not exceeding 100 thousand rubles (clause 6 of Directive No. 3073-U).

Is an individual entrepreneur required to keep a cash book?

We figured out that according to clause 4.6 of Instructions No. 3210-U, entrepreneurs have the right not to maintain a generally accepted cash book, and also according to clause 2 they may not calculate the cash balance limit. But despite the existing legislative norm, before completely abandoning the cash management regulations, it is necessary to assess the consequences of not accounting for cash. And this is not a matter of responsibility to state control authorities - we have already found out that individual entrepreneurs are not required to maintain cash documents.

The task of any business is to make a profit and ensure the safety of assets, including cash and non-cash funds. And in the case where an individual entrepreneur is distinguished by a large scale of activity, regular cash turnover and a large staff of hired employees, the human factor comes to the fore, which an experienced manager cannot neglect. Correctly establishing accounting for cash transactions will significantly simplify control over the state of finances and help evaluate the work of individual specialists, including responsible cashiers. It’s not for nothing that cash discipline is called that - maintaining unified forms is carried out according to clearly developed regulations and allows you to accurately calculate how much money came in, went out and for what purposes.

A little about the balance limit

Since an entrepreneur has the right not to register a book, but can do so at will, it should be noted that in this case he must do this in accordance with all established rules. One of these rules is setting a balance limit. All business entities must do this except:

- Individual entrepreneurs;

- Small businesses (remember that this includes organizations with fewer than one hundred employees and revenue of no more than eight hundred million per year).

Important! Thus, if an entrepreneur decides to maintain a cash register, then he is not obliged to set a limit on the remaining money in the cash register, that is, any amount can be stored in the cash register.

Individual entrepreneur cash book - how to fill it out

Competently filling out an individual entrepreneur's cash book does not depend on the fact of using a cash register or the use of special modes. The rules for entering data are the same for all business entities; standard forms are approved by the State Statistics Committee in Resolution No. 88 of August 18, 1998. What documents are required to be kept for the general accounting of cash?

Cash document flow includes the preparation of the following forms:

- Cash book KO-4.

- Receipt orders KO-1.

- Expense orders KO-2.

- Sheets – settlement and payment f. T-49, settlement T-51, payment T-53. They are used optionally for payroll settlements with personnel.

The listed documents form the backbone of accounting for cash transactions, and the cash book is a consolidated journal that displays the movement of cash inflows and outflows. The document is opened for the calendar year and maintained in chronological order. Format – electronic or paper. The first is printed at the end of the period, the second is issued for each cash day. The individual entrepreneur’s cashier is appointed as the responsible employee for filling out KO-4; certification of the document is entrusted to the entrepreneur. Let's talk about the rules for filling out the journal.

The procedure for creating an individual entrepreneur's cash book:

- Title page – details of the entrepreneur are given: full name, codes, reporting period.

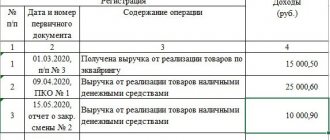

- Internal sheets - one page is allocated for each cash day, where they indicate data on incoming transactions (by entering PKO numbers/dates) and outgoing transactions (by displaying data on cash register numbers/dates). At the end of the day, the totals for income and expenses are compiled, and the balance in the cash register is calculated. The cashier checks documentary data and actual cash.

- The last sheet is where the book is certified: the magazine is stitched, the pages are pre-numbered, and the number of pages and a signature with the date are indicated on the outside of the document. This norm, according to Instructions No. 3210-U, is no longer mandatory; the lack of firmware and certification is not considered a violation.

The cash book must be filled out without errors, corrections or omissions. If an inaccuracy has been made, the correction is made according to the correction rules - by crossing out the incorrect entry, entering the correct one, and certifying it with the signature of the individual entrepreneur. If no transactions were carried out at the entrepreneur’s cash desk during the day, make entries in f. KO-4 is not required.

Sample of a standard cash book form f. KO-4 is possible.

Innovations for 2021 on accountable transactions of individual entrepreneurs

Starting from July 2021, mainly electronic cash receipts are used in circulation. Accountable persons purchasing goods or services for cash in the interests of the enterprise must attach printed electronic cash documents to the report. The authenticity of checks is verified. If in doubt, the official website of the Federal Tax Service allows you to use the “Check Check” service.

The procedure for maintaining electronic and other document flow is determined by the enterprise. Features of the design of reporting forms are provided.

| Condition | Description of application | Add-ons |

| Details required when issuing an electronic receipt for the purchase of goods | The seller of goods is obliged to indicate in the receipt the buyer’s details (name and tax identification number), country of origin of the goods, customs declaration number, excise tax amount | Details are provided if the buyer has a power of attorney from the company confirming the competence to represent interests |

| Confirmation of completeness of product information | Some individual entrepreneurs working in a special mode provide checks without deciphering the nomenclature and quantity of goods | When receiving a check without highlighting the name of the product, you must provide an additional document with a breakdown of the data |

| Possibility of receiving a check from self-employed persons | Self-employed citizens must also provide information about the services provided | When receiving services from self-employed persons, a check is printed from the “My Tax” mobile application. |

| Receiving services with registration of BSO (for example, when receiving hotel accommodation while on a business trip) | The BSO indicating the services received must meet the requirements in terms of form and set of details. The new form of BSO practically corresponds to an electronic cash receipt | The accountable person as part of the supporting documents after 07/01/2021 does not have the right to provide the BSO in the typographic form adopted earlier |

The remaining requirements for registration of accountable transactions have not changed. The issuance of funds is carried out by order of the manager. If the accountable amount is used by the entrepreneur himself, orders and an expense cash order are not required. To provide a report on the funds spent, the employee is given the period allotted by the accounting policy.

How to maintain a cash book in 1C

Often, many entrepreneurs use the capabilities of accounting programs such as 1C to keep daily records of business operations. Such developments are aimed more at enterprises, so the movement of funds in them is displayed by entering data through incoming and outgoing orders. That is, without even resorting to special efforts, the individual entrepreneur receives ready-made cash documents, including a cash book. All that remains is to print the documents, sign and store them among other forms.

In this case, you need to pay attention to this aspect. In accordance with Instructions No. 3210-U, individual entrepreneurs may not prepare a cash book, provided they maintain tax records. But he has the right to fill out receipts and expenditure orders. This means that even if there are PKOs and RKOs, it is allowed not to maintain a cash book and limit oneself to the presence of orders in order to reflect transactions in KUDiR. This will not be considered a violation.

Conclusion - in this article we examined whether an individual entrepreneur can not keep a cash book and in what situations it is still more advisable not to deviate from the generally accepted cash accounting regulations. If an entrepreneur decides to fill out the standard KO-4 form, this must be done in compliance with the current regulations according to Directions No. 3210-U dated March 11, 2014.

This might also be useful:

- Application for registration of individual entrepreneurs (form No. P21001)

- Documents for closing an individual entrepreneur

- Documents for registration of individual entrepreneurs

- Rules for filling out the 2-NDFL certificate

- Certificate of state registration of individual entrepreneurs

- Strict reporting form for individual entrepreneurs

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Tax deduction for the purchase of cash registers

Even at the stage of introducing new innovative cash registers, officials promised small businesses to reimburse the costs of purchasing cash registers. The corresponding bill No. 18416-7 was adopted by the State Duma in the third reading on November 15, 2017.

But there are also limitations here:

- Only entrepreneurs on UTII and PSN can receive a deduction;

- the amount of deduction for each unit of cash register equipment for UTII cannot exceed 18 thousand rubles;

- in order to count on the deduction, an individual entrepreneur engaged in retail trade or catering and having employees must register a cash register before July 1, 2021;

- entrepreneurs engaged in other types of activities have the right to claim a deduction if they register a cash register before July 1, 2021.

Prepare a UTII declaration for only 149 rubles