Home / Taxes / What is VAT and when does it increase to 20 percent? / VAT object

Back

Published: December 28, 2017

Reading time: 6 min

0

534

As is known, the Russian system of taxation of goods and services is regulated by the use of three VAT tax rates: basic 18%, reduced 10% and zero rate if the goods correspond to legally designated preferential categories. Let's consider in detail : which goods are included in the list of the reduced rate of 10%, and which will be subject to VAT in the amount of 18%.

- For which goods does a reduced VAT of 10% apply? Category of food products

- Product category for children

- Category of books and printed products

- Category of medical products

- Agriculture

The most important changes in VAT 2019

From 2021, the basic VAT rate has been increased to 20 percent (Federal Law No. 303-FZ dated August 3, 2018). See “ Law on increasing VAT from 18 to 20 percent .”

Story

Let us recall that a rate of 20% was in force in our country from 1994 to 2004, and in the two years preceding this period it was even higher and amounted to 28%. Since 2004, the VAT rate has been 18 percent and has not increased.

The 10% VAT rate for food and children's goods remains. In addition, until 2025, a zero VAT rate was fixed for air transportation to Crimea and Sevastopol. Also, a zero rate was provided for air transportation to the regions of the Far Eastern Federal District and the Kaliningrad region.

How to confirm your rights to a bet?

It does not matter which groups of goods are submitted for registration at a 10% VAT rate. All requirements for enterprises and the approval procedure are the same for all.

If the goods sold are from a domestic manufacturer, then you need to find out the codes according to the All-Russian Classifier of Products by Type of Economic Activities (OK 034-2014). After establishing the codes, you need to check them for presence in the list of the Tax Code of the Russian Federation for 10% VAT.

If the company sells imported products, then you need to find the HS codes, and then also confirm its presence in the list. In these cases, clearance of products is allowed at a rate of 10%.

The requirement to reconcile codes is mandatory. If you do not do this right away, you will have to pay 18% VAT in the future. This happens in two circumstances: when products are marked with codes that are not listed for the 10% rate, or when there are no codes.

All medical products undergo careful control. All products in this group must be registered and receive appropriate certificates. After verification by tax authorities, you can apply for a preferential rate.

You will find out the length of service for retirement in Russia under the new law in our article. In 2021, Russian military pensions will be increased! Find out more about this event in the article.

There are some changes to unemployment benefits in 2021. Our material has all the information you need.

2021 Betting Options

In 2021, there are several basic rates for calculating VAT - 20%, 10% and 0%, and several calculated rates - 20/120, 10/110 and 16.67%, which are used depending on the type of transaction:

Rate 20% percent

This is a general rate that applies to most transactions (clause 3 of Article 164 of the Tax Code of the Russian Federation). At this rate, tax transactions that are not specified in the Tax Code of the Russian Federation as grounds for applying other rates.

A 20% rate applies to most transactions. Until 2021, it was 18%. In this regard, transactions that were previously taxed at a rate of 18% will be taxed at a rate of 20% from 01/01/2019. There may be situations where different VAT rates will be applicable within the same transaction. In this case, it is important to correctly determine the tax rate for a specific transaction.

Rate 10 percent

The rate at which tax is calculated on the import and sale of certain goods, as well as on the sale of certain services. In paragraph 2 of Art. 164 of the Tax Code of the Russian Federation indicates goods and services, and in the lists approved by the Government of the Russian Federation - product codes. For example, this rate is applied when selling food or medical goods (clause 2 of article 164 of the Tax Code of the Russian Federation).

A rate of 10% can be called reduced. It is used for the import and sale of socially significant goods, as well as for the sale of certain services.

Rate 0% percent

Applicable for export, international transport and other operations listed in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

The 0% rate is provided mainly for export operations and for the transport of goods, passengers and luggage. Estimated rates are used for calculating VAT on prepayments, as well as for other cases when VAT is included in the tax base and needs to be extracted from there rather than charged on top of the price.

Rates 20/120 or 10/110

These are estimated rates that are used in cases where the tax base includes VAT. The main cases are listed in paragraph 4 of Art. 164 Tax Code of the Russian Federation. For example, receiving advances, withholding VAT by a tax agent. A settlement rate of 20/120 or 10/110 is applied depending on the rate at which the main transaction is taxed.

Similar rates are used if it is necessary not to calculate VAT at the rate, but, on the contrary, to isolate it from the total payment amount. They are needed, for example, if the seller receives an advance payment for future delivery of goods or provision of services. Also, these estimated rates are used when VAT is transferred to the budget by a tax agent. And another case is when there is an assignment of monetary claims by a new creditor.

And the calculated rates of 10/110 and 20/120 differ from each other in the amount of VAT that is levied on a particular product (transaction). If there was a preferential rate of 10%, then the first option is taken into account. If 20 percent, then the second one.

Rate 16.67%

A special settlement rate, which is applied only in two cases: when selling an enterprise as a whole as a property complex and when foreign companies provide services to individuals in electronic form (clause 4 of article 158, clause 5 of article 174.2 of the Tax Code of the Russian Federation).

Estimated rate increase from 2021: The estimated tax rate will increase from 15.25 percent to 16.67 percent. “Calculation method” means: 16.67 = 20/120.

List of goods subject to VAT at a rate of 10 percent

Basically, 10% VAT applies to food products included in the consumer basket. Let's take a closer look at which goods are subject to 10 percent VAT in accordance with tax legislation:

- Livestock and poultry supplied live for sale with subsequent slaughter and processing or for other needs;

- Meat products and meat with the exception of deli products, including various smoked meats, veal, cuts, deli-type preserves;

- Dairy products and pasteurized, sterilized milk - this category includes yoghurts, ice cream, fruit ice, etc.;

- Eggs and products based on them;

- Sunflower and other types of vegetable oil;

- Margarine is edible and food fats for use in confectionery production, fats for the production of chocolate, baked mixtures;

- Salt and sugar;

- Cereals in purified or processed form, grain waste;

- Combined feed based on grains, mixtures for animal feed;

- Flour, cereals;

- Pasta;

- Live fish except for rare and delicacy types. Among them are sturgeon, Far Eastern and Baltic salmon, and a number of other fish;

- Seafood, herring, chilled and frozen fish, except for rare species and caviar products, crabs and a number of other delicious seafood;

- All types of vegetables;

- Locally produced fruits.

Please note that if a manufacturing company operates for export, with a final delivery point outside the Russian Federation, then a zero rate is applied to it, since VAT is an internal tax. However, the exporter must still provide zero reporting, as well as the necessary permits from customs and other authorities to the tax office at the company's registered address.

Another product group that falls under the ten percent rate is products designed for children. In particular, it includes:

- Children's beds made of wood and woodworking products;

- Knitwear, clothing, sheepskin, rabbit fur, underwear;

- Summer, winter, special footwear;

- Bed dress;

- Diapers and a range of hygiene products;

- Sewing products;

- School supplies - notebooks, pens, pencils, paints, pencil cases, abacus, rulers, etc.

The reduced rate is necessary to ensure financially free access to goods that are socially significant. In the case of children's supplies, this rule is aimed at creating more favorable purchasing conditions for parents and special child care institutions.

In what other cases is VAT 10 percent?

There is an additional product group that is subject to a reduced tax rate. In particular, it includes medical goods and supplies, consumables, furniture and other medical products for use in specialized medical institutions or for treatment at home.

This rule also applies to printed products. Periodicals, books, magazines, etc. Exceptions include books, magazines, and newspapers containing information of an advertising or erotic nature.

A ten percent tax applies to domestic air transportation services. When providing medical and a number of other paid services of high social significance. A complete list of products and services can be clarified by contacting the Federal Tax Service office or on their website in electronic format.

Betting table 2021

The table below contains the new VAT rates that will apply from 01/01/2019:

| Bid | Application area |

| 0% | · Sale of goods intended for export, passing through customs clearance. |

| · International shipping. | |

| · Operations carried out by organizations for the transportation of oil and its products. | |

| 10% | · Sales of food products. |

| · Sales of children's goods. | |

| · Sales of medicines and medical products. | |

| · Sales of printed and periodicals related to the field of education and culture. | |

| 20% | All other transactions that do not fall into the previous two categories |

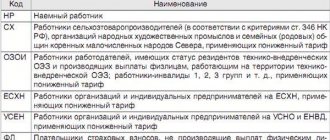

Transition from UTII to OSNO

For persons who have switched from UTII to OSNO, a deduction of input VAT if goods, work, services, property rights were acquired during the period of application of UTII or imported into the territory of the Russian Federation, but were not actually used before the transition to OSNO.

OSNO is still a complex and tax-expensive system. For small businesses, it is most likely more profitable to be simplified. We have prepared two useful materials - a digest on how to deal with payments and obligations during the transition period, as well as a checklist for changing UTII to simplified tax system.

Reflection of VAT in the invoice from 2019

When filling out an invoice in 2021, you must indicate two values:

- the total cost of goods or services;

- the required VAT rate in Russia.

If we are talking about rates of 0, 10 and 20 percent, then column No. 7 is filled out in this document. When we are dealing with calculated rates of 10/110 and 20/120, the fifth column is intended for them (see the figure below). It is only important to take into account that in the last two cases, the full amount must be indicated in the “Cost of goods and services” column. And depending on the specified rate, inspectors will understand whether it includes VAT or whether it has yet to be calculated.

From 2021, the form will remain the same, but column 7 “Tax rate” must be filled out in a new way (in accordance with the requirements of Federal Law No. 303 dated August 3, 2018). Instead of the rate of 18% there will be 20%, and instead of the calculated rate of 15.25% - 16.67% (20/120).

Read also

10.10.2018

Calculator

+ Accrue

— Select

| Price without VAT: | 0 ₽ |

| VAT 10%: | 0 ₽ |

| Value with VAT: | 0 ₽ |

VAT amount in words:

A similar VAT calculator is 20 percent on our website.

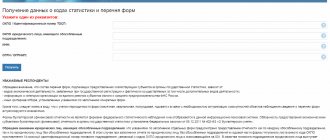

Confirmation of eligibility for a 10% rate

In order to obtain the right to work at a minimum percentage of added value, you will need to provide the Federal Tax Service with appropriate documentation confirming the company’s activities in the chosen field and containing information about the services provided or product groups sold. To do this, it is necessary to clarify the classification codes from the unified register of economic activities corresponding to the products sold by the company.

Next, these codes are entered into documents submitted to the tax office; if they fall under the rule of the minimum level of taxation, the manufacturer or seller receives the appropriate permission and further calculations are made with a 10% VAT charge. If the documents are provided after sales, then the calculation will be made based on the maximum amount of accruals - 20%, since there is no possibility of checking the sold batch of products. Be careful when preparing documents; it is advisable to double-check the data and entered codes.

Reporting must be submitted strictly before starting commercial activities. This will avoid significant unexpected expenses. We recommend contacting the Federal Tax Service department for additional advice from relevant specialists.

CONCEPT OF TAX

Hydrocarbon feedstocks include:

- dehydrated, desalted and stabilized oil;

- gas condensate that has undergone field preparation technology;

- associated gas;

- flammable natural gas, with the exception of associated gas.

Tax on additional income from the extraction of hydrocarbons (hereinafter referred to as the tax) is a direct tax that is assessed on the amount of additional income from the extraction of hydrocarbons at each subsoil site, which is calculated as the positive difference between the income and expenses received at this subsoil site.

If the amount of the minimum tax on a subsoil plot is greater than the amount of tax calculated as the difference between the income and expenses of this plot, then the tax on additional income from the extraction of hydrocarbons is recognized as a minimum tax.

The rules for taxation of additional income from the production of hydrocarbons are defined in Chapter 25.4 of the Tax Code of the Russian Federation.

Calculation of VAT in bankruptcy

From January 1, 2021, transactions for the sale of goods, works, services manufactured and (or) purchased (performed, provided) in the course of business activities after the debtors are declared bankrupt will not be recognized as subject to VAT.

In 2021, there was a moratorium on creditors filing bankruptcy applications. Over the first 9 months of 2021, 708 companies and 146 individual entrepreneurs took advantage of this right.

The moratorium has been extended until January 2021, analysts suggest, after which a surge in the number of applications is possible.

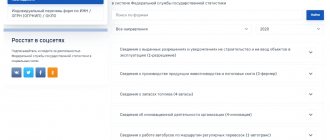

TAX RETURN

Declarations are submitted by taxpayers to the tax authorities at the place of their location, by the largest taxpayers - to the tax authority at the place of registration as the largest taxpayers.

Tax returns are submitted:

- based on the results of the reporting period - no later than the 28th day of the month following the reporting period;

- based on the results of the tax period - no later than March 28 of the year following the expired tax period.

The form, the procedure for filling it out and the format of the tax return are established by order of the Federal Tax Service of Russia dated December 20, 2018 No. ММВ-7-3/ [email protected]

Results

Having understood the questions of what a VAT rate “0” and “without VAT” is, what is the difference in the activities and status of taxpayers for which these rates may be applicable, we can draw the main conclusion:

- a 0% VAT rate applies to VAT payers carrying out certain transactions that are subject to taxation;

- the status “Without VAT” applies to persons exempt, including temporarily, from the duties of a VAT payer (for example, to entities on the simplified tax system).