You must pay tax on the market value of material assets received free of charge, including it in non-operating income. In the general system this is an income tax (clause 8 of Article 250 of the Tax Code), in the “simplified” system it is a single tax (clause 1 of Article 346.15 of the Tax Code). Only “gifts” from owners of more than half of the company’s authorized capital are not subject to taxation. Their cost is not taken into account when determining the tax base, either under the simplified tax regime or under the general taxation regime (clause 11, article 251, subclause 1, clause 1.1, article 346.15 of the Tax Code). This benefit is canceled if, within the next year, the company transfers the gift to third parties.

Upon further sale of such property or when using it for production (performing work, providing services), the tax on it actually has to be paid again, since inspectors consider it impossible to write off as expenses the value at which it was previously recognized in income. They make an exception only for fixed assets received free of charge, since the ability to depreciate their cost, previously recognized in income, is directly provided for by the Tax Code (clause 1 of Article 257 of the Tax Code). However, only those who calculate taxable income using the accrual method have this opportunity. Firms that use the cash method or the “simplified method” with the object “income minus expenses” are deprived of this, since they must write off expenses for tax purposes only after they are actually paid (clause 3 of Article 273, clause 2 of Article 346.17 of the Tax Code) . And they obviously don’t pay anything for what they receive for free. Therefore, the moment of recognizing the value of such property as expenses never comes for them.

In practice, taxpayers have developed several ways to avoid double taxation of the value of “free” property.

METHOD 1

Money instead of property

The problem of double taxation disappears if the company receives free money, not property, and then uses it to purchase what it needs.

For a long time now, tax authorities have not made any claims regarding the write-off of property acquired with gratuitous money as expenses (even if the company did not include them in income on the basis of clause 11 of Article 251 of the Tax Code; also see letter of the Ministry of Finance dated March 22, 2010 No. 03 -03-06/1/166). In addition, funds are impersonal, and in most cases it is impossible to accurately determine the source of the company’s receipt of the amount of money it paid for a particular acquisition. For funds, there is no one-year restriction on the transfer to third parties of property received free of charge; compliance with this rule in other cases is necessary to use the benefits under paragraph 11 of Article 251 of the Tax Code. Replacing property with money saves the transferring party from charging VAT, which, by the way, the tax authorities would not allow the recipient to deduct.

This is the simplest and most reliable way. But, alas, it is not always possible to transfer money instead of property. For example, often the founders, not having free funds to support their business, give the company what they themselves have - used office equipment, cars, furniture, etc. In addition, the organization does not always receive free property from the founder or friendly persons. This could be, for example, inseparable improvements to a fixed asset item being returned from lease.

METHOD 2

Details

Let's talk about the differences between the donation and donation procedures

In accordance with the gift agreement, one party transfers (or undertakes to transfer) property free of charge. The main feature of this deal is that it is free of charge. Moreover, such a transfer may include certain restrictions on the use of the donated property by the new owner. For example, this may be a requirement regarding the use of property for certain general purposes. In this case, the transfer of property will most likely be recognized as a donation.

The concept of “donation” is much narrower than the transaction of gift.

These legal relations are not typical for business. Through such transactions, property (state or municipal) is mainly transferred in favor of a specific non-profit organization. It must be said that the agreement for the transfer of property free of charge as part of a gift means that the owner of the object of the gift directly transfers to the recipient the property and a certain assignment or right (for example, the release of an existing debt). If we talk about an agreement within the framework of a donation, granting concessions, as defined by lawyers, is impossible in this case. The basis of such a transaction is only the object or the preemptive right to it.

In addition, the difference lies in the status of the subject to whom the property is transferred free of charge. The circle of persons in respect of whom a transaction is made within the framework of a donation agreement is much narrower than in another case. According to the current legislation, the main subjects of legal relations within the framework of a donation as persons accepting property are recognized only as non-profit organizations, including government agencies, to which state property is transferred. Accordingly, it is impossible to make a donation to commercial organizations.

Let's consider the nuances of taxation when transferring property free of charge

Since a participant who owns 50% of the assets of an enterprise can transfer property to his company free of charge, in this case it will not be counted as non-operating income. At the same time, assets received by an organization free of charge are still subject to taxation. In the case of a transfer in the form of a donation, the transferred assets are not subject to tax, but we must remember that this procedure only applies to non-profit organizations.

So, non-operating income does not include:

— transfer of property free of charge, provided that the founder has 50% ownership of the company;

- if the subject of the transaction is a donation, which is possible if the party receiving the property is a non-profit organization.

In other cases, tax on the received property must be paid.

It is important to note that the property of an enterprise acquired free of charge will not be taxed if the company operates under a single tax on imputed income. In this case, no income plays a role in the organization’s work - it pays fixed contributions as tax.

Russian legislation provides for such a concept as a loan (transfer of property for free use). Transferring property for rent free of charge is a very popular type of transaction in modern business. The main advantage of such legal relations is the absence of obligations to pay taxes both to the owner and to the user of property received in the form of free acquisition for rent.

"Discover" during inventory

Who doesn’t remember the old joke or true story about the report urgently drawn up before the on-site inspection: “Dt 01 Kt 91 - as a result of the inventory, a boiler room was discovered”? This joke is one of those that is only part of the joke: replacing the gratuitous transfer of property (of course, not as noticeable as a boiler room) with its “revealing” during inventory is a common way to avoid tax problems associated with a gift.

Excess material assets and other property discovered during inventory must also be included in non-operating income at market value (clause 20 of Article 250 of the Tax Code). However, inspectors can no longer argue with writing them off as expenses at the same cost, since this is directly stated in the Tax Code (clause 1 of Article 257, clause 2 of Article 254). This method relieves the donor from charging VAT, and the recipient, as in the case of a gratuitous transfer, cannot claim a deduction for this tax.

However, this method has a rather narrow scope of application. It is justified only when the property is not included in the records of the transferring party (for example, if it is transferred by an individual).

METHOD 3

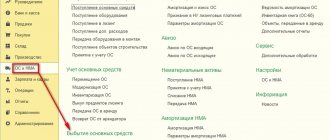

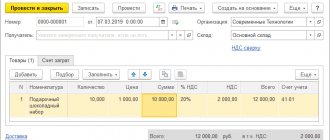

Accounting for property received free of charge

Vadim SHUSTOV Auditor, Elkod-audit LLC

Published:

Journal "Practical Accounting"

The gratuitous transfer of property in civil law is regulated by the rules on donation. Under a gift agreement, one party transfers or undertakes to transfer ownership of property to the other party free of charge (Article 572 of the Civil Code of the Russian Federation). Commercial organizations can give each other property worth no more than 5 minimum wages (clause 4 of Article 575 of the Civil Code of the Russian Federation), i.e. 500 rubles. If at least one of the parties to the gift agreement is a non-profit organization or an individual, then the value of the gift is not limited in any way. If a commercial organization nevertheless received property over 5 minimum wages free of charge from another similar company, then this transaction may be declared invalid if one of the interested parties files a claim in court. This can be done by interested parties (owners of the organization, shareholders, etc.) within 10 years from the date of gratuitous transfer of property (clause 1 of Article 181 of the Civil Code of the Russian Federation). If the transaction is declared invalid, the organization will be obliged to return to the donor all property received from him. It happens that by this time such property is no longer listed in the organization. Then the company will have to reimburse the cost of the transferred property in money (Clause 2 of Article 167 of the Civil Code of the Russian Federation). Determining the value of property When determining the value of gratuitously received property for accounting purposes, one should be guided by the norms of the Regulations on maintaining accounting and financial reporting in the Russian Federation and PBU 9/99 “Income of the organization” (approved accordingly by orders of the Ministry of Finance of Russia dated July 29, 1998 No. 34n and from 06.05.99 No. 32n). Assets received free of charge are accepted for accounting at market value. It is determined on the basis of prices in force on the date of their acceptance for accounting for this or a similar type of asset (clause 10.3 of PBU 9/99). In most cases, the value of property received free of charge when calculating income tax is recognized as non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). In this case, income is assessed based on market prices determined taking into account the provisions of Article 40 of the Tax Code of the Russian Federation. In this case, the market price must be confirmed documented or through an examination. Sources of information on market prices can be considered:

- official information on stock exchange quotations (completed transactions) on the exchange closest to the location (place of residence) of the seller (buyer), and in the absence of transactions on the specified exchange or upon sale (purchase) on another exchange - information on exchange quotations (completed transactions) on this another exchange or information on international exchange quotations, as well as the quotation of the Russian Ministry of Finance for government securities and obligations;

- information from government statistical bodies, pricing regulatory bodies and other authorized bodies;

- information published in printed publications or brought to the attention of the public by the media.

In addition, market prices can be determined by an appraiser. Valuation objects include material objects, work, services, information (Article 5 of the Federal Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation”). If the property was assessed by an expert, it is necessary to have a corresponding report with calculations determining the market value of the property. You cannot do without a copy of the license for the right to carry out appraisal activities. In tax accounting, unlike accounting, the market value of fixed assets and intangible assets received free of charge cannot be lower than their residual value. It is defined as the difference between the original cost and the amount of accrued depreciation (Article 257 of the Tax Code of the Russian Federation). Therefore, you should obtain an appropriate certificate from the donor organization regarding the above-mentioned values. For products, goods and materials, the market value should not be less than the cost of their production. Example 1

Tradecomp LLC received a computer free of charge in November 2002 from a non-profit organization.

To determine the market value of the computer, the company hired an independent appraiser, who valued it at 40,000 rubles. At this cost, the computer is capitalized in accounting. The non-profit organization - the donor subsequently submitted a certificate according to which the residual value of the computer is 48,000 rubles. Since the market value of a computer is lower than its residual value (40,000 rubles. End of example 1. Accounting for property. Assets received free of charge are reflected in accounting as part of non-operating income (clause 8 of PBU 9/99). Moreover, the cost of materials is shown as part of income at the time transferring them to production (clause 47 of the Methodological Recommendations on the procedure for forming indicators of an organization’s financial statements, approved by Order of the Ministry of Finance of Russia dated June 28, 2000 No. 60n). Free fixed assets received in accounting are depreciated. Initially, the cost of such assets is included in deferred income (loan account 98 “Deferred income”) As depreciation is calculated, their value is taken into account as part of other income (credit to account 91 “Other income and expenses” in correspondence with account 98). In accounting, depreciation is calculated in one of the possible ways: linear; reducing balance; write-off of value based on the sum of the numbers of years of useful life; write-off of cost in proportion to the volume of products (works). The use of one of the methods for calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group (clause 18 of PBU 6/01). Depreciation begins on the 1st day of the month following the month in which this object was put into operation, and stops on the 1st day of the month following the month when the cost of such an object was completely written off or when this object was removed from service fixed assets for any reason. Example 2

Let’s use the conditions of example 1. When accepting a computer for accounting purposes, its useful life is determined to be 5 years, i.e. 60 months.

(5 years x 12 months) and the straight-line depreciation method is selected. The certificate received from the non-profit organization indicates that the computer has been used for 1 year. Therefore, the remaining depreciation period will be 48 months. (60 - 12). Based on this, the monthly depreciation rate is 833.33 rubles/month. (RUB 40,000: 48 months). The following entries are made in accounting. In November: Debit 08 - 4 Credit 98 - 2 - 40,000 rubles. — received a free computer; Debit 01 Credit 08 - 4 - 40,000 rub.

— the computer was put into operation. In December (and subsequently for four years):

Debit 20 Credit 02 - 833.33 rubles. — depreciation has been calculated on the computer; Debit 98 - 2 Credit 91

- 833.33 rub. — part of the cost of a computer received free of charge is included in non-operating income. End of example 2.

The cost of property (including fixed assets) received free of charge by an organization, with the exception of those named in Article 251 of the Tax Code of the Russian Federation, for tax purposes is recognized as non-operating income at the time the parties sign the acceptance certificate (subclause 1, clause 4, article 271 of the Tax Code of the Russian Federation ). The received property is included in the depreciable property if it meets the requirements of paragraph 1 of Article 256 of the Tax Code of the Russian Federation, namely, it belongs to the organization as a property and is used to generate income. In addition, it should not be on the list of property that cannot be depreciated (clause 2 of Article 256 of the Tax Code of the Russian Federation). Tax accounting does not accrue depreciation on fixed assets received free of charge from organizations if the authorized capital of the receiving (transferring) party consists of at least 50% of the contribution of the transferring (receiving) organization. Fixed assets received free of charge from an individual are also not subject to depreciation, provided that the authorized capital of the receiving party consists of at least the same 50% of the contribution of this individual. Hence, property received free of charge is not subject to depreciation, the cost of which is not taken into account when determining the tax base for calculating income tax (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). For tax accounting purposes, depreciation can be calculated using two methods - linear or non-linear (Article 259 of the Tax Code of the Russian Federation). The linear method is necessarily applied to buildings, structures, transmission devices included in the eighth - tenth depreciation groups, regardless of the timing of commissioning of these objects. For other fixed assets, the taxpayer has the right to apply one of two methods. The selected depreciation calculation method cannot be changed during the entire period of depreciation calculation for this object. Depreciation amounts in accounting and tax accounting may differ even if the original cost is the same. To avoid this, it is necessary to use the linear depreciation method in both accounts, while establishing the same useful life of the object. Example 3

Let's use the conditions of example 1. In tax accounting, at the time of commissioning of a donated computer, a linear depreciation method and its useful life of 5 years are established (the computer according to the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, is included in the third depreciation group with a service life of 3 to 5 years).

The certificate received from the non-profit organization indicates the period of its operation before transfer - 1 year. The Tax Code of the Russian Federation allows, when purchasing used fixed assets, to reduce their useful life by the number of years (months) of operation of this property by the previous owners (Clause 12, Article 259 of the Tax Code of the Russian Federation). A reduction in the established service life by this amount for objects received free of charge may be met with hostility by tax officials. Therefore, in order to avoid disputes with them, it is advisable not to do this. The monthly depreciation amount in tax accounting will be 800 rubles/month. (RUB 48,000: 60 months). Starting from December 2002, this amount will reduce the taxable profit of the organization every month. End of example 3.

As mentioned above, in tax accounting the date of signing the act of acceptance and transfer of property transferred free of charge is recognized as the date of receipt of non-operating income. Moreover, this applies to both possible methods used in calculating income tax: both accrual and cash. Example 4

Under the donation agreement, on November 4, 2002, the construction organization Ornament CJSC received from the founder the material - construction sand in the amount of 20 tons, the market value of which was 75,000 rubles.

In the same month, 10 tons of sand were written off for production. The remaining 5 tons of sand were used in production in December 2002 and January 2003. The transfer of material is documented in a transfer and acceptance certificate. When sand arrives at the warehouse, a receipt order is issued. In this case, the following entry is made in accounting: Debit 10 Credit 98 - 2 - 75,000 rubles.

— the sand transferred free of charge was capitalized at market value. As sand is used in production, its cost is recognized as non-operating income:

Debit 20 Credit 10 - 37,500 rubles. (RUB 75,000: 20 t x 10 t) - sand was written off for production; Debit 98 - 2 Credit 91-1 - RUB 37,500.

— the cost of sand written off for production and received free of charge is taken into account in non-operating income. Similar entries are made in December and January 2003 in the amount of 18,750 rubles.

(RUB 75,000: 20 t x 5 t). In tax accounting, the total cost of sand donated free of charge is 75,000 rubles. — taken into account in non-operating income in November 2002. End of example 4.

Thus, in the case of gratuitous receipt of raw materials and materials to be used in production, organizations that use the accrual method of determining income at the end of the reporting period may have discrepancies between the accounting and tax accounting data under the item “Non-operating income” for the amount of property not used in production. In the income tax return, the value of property received free of charge is reflected on line 030 of sheet 02 as part of non-operating income. In addition, at the end of the tax period, this amount must be entered on line 070 of Appendix 6 to Sheet 02 “Non-operating income”.

Tax obligations The gratuitous transfer (receipt) of property in most cases leads to additional tax obligations of both parties.

The recipient organization's corporate property tax may increase. As is known, this tax is imposed on fixed assets, intangible assets, inventories and costs on the organization’s balance sheet. Moreover, fixed assets and intangible assets are accounted for at their residual value (Article 2 of the Law of the Russian Federation dated December 13, 1991 No. 2030-1 “On Enterprise Property Tax”). When calculating property tax, the residual value of gratuitously transferred fixed assets and intangible assets is taken into account according to accounting data (clause 4 of the instruction of the State Tax Service of Russia dated 06/08/95 No. 33 “On the procedure for calculating and paying enterprise property tax to the budget”). The cost of donated goods and materials will be taken into account in tax calculations only if they were not sold or used before the end of the reporting (tax) period. The donor also has to deal with the budget. In cases provided for by the Tax Code of the Russian Federation, the gratuitous transfer of property is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). For the purposes of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation, the transfer of ownership of goods, results of work performed, and the provision of services free of charge are recognized as the sale of goods (work, services) (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Therefore, the transferring party must pay VAT to the budget on the value of the property transferred free of charge. In this case, the tax base for VAT is its market value (clause 2 of Article 154 of the Tax Code of the Russian Federation). Example 5

The construction organization OJSC Stroyservice donates materials to a non-profit organization, the book value of which is 40,000 rubles.

The amount of VAT paid to the supplier of materials is presented for deduction when they are accepted for accounting - 8,000 rubles. The market price of the transferred materials is 48,000 rubles, including VAT - 8,000 rubles. The founders of the organization provide for the use of retained earnings from previous years for expenses associated with the gratuitous transfer of property to a non-profit organization. In the accounting records of the transaction, the transfer of materials free of charge will be reflected as follows: Debit 84 Credit 10 - 40,000 rubles. — materials donated free of charge; Debit 84 Credit 68 subaccount “VAT Calculations” - 8,000 rubles. — VAT is charged for the free transfer of materials. Debit 68 subaccount “Calculations for VAT” Credit 19 - 8000 rub. — previously deductible VAT on materials is reversed; Debit 84 Credit 19 - 8000 rub.

— VAT paid to the supplier of materials is included in profit. End of example 5.

An invoice is issued by the donor for the market value of the property in two copies. The organization will have to register its copy in the sales book. The recipient does not register this invoice in the purchase book (Clause 11 of the Government of the Russian Federation of December 2, 2000 No. 914). The recipient organization does not have the right to reimburse this amount of tax, since it does not pay for the property received. One of the mandatory conditions for deducting the amount of VAT is its payment to the supplier (Article 171 of the Tax Code of the Russian Federation). There are also exceptions. Thus, the following are not recognized as subject to VAT:

- transfer on a gratuitous basis of fixed assets to government and local government bodies, as well as budgetary institutions, state and municipal unitary enterprises;

- transfer of fixed assets, intangible assets and (or) other property to non-profit organizations for the implementation of the main statutory activities not related to business activities.

Prove the right to expenses

Such tricks are not the only remedy for double taxation. Those who are accustomed to playing fairly write off the cost of property received free of charge as expenses and are preparing to prove the legality of this in court, especially since there are plenty of arguments in favor of taxpayers.

There is no direct prohibition on the inclusion of such expenses in the calculation of taxable profit in the Tax Code. The list of expenses given in it is open - it is enough that they correspond to their general definition from Article 252.

Tax officials usually say: this is impossible, because the company did not incur any costs for the acquisition of the property received free of charge. But in fact, this fact is not yet a reason to pay tax twice on its value. The disposal of such property fully meets the concept of “expenses”. Property received free of charge becomes the property of the company, its assets. Its disposal is qualified as an expenditure of the company's own assets, that is, it means costs for it. The Ministry of Finance demonstrated this logic in relation to money received free of charge (letter of the Ministry of Finance dated June 9, 2009 No. 03-03-06/1/380). And money, from this point of view, is the same property as material assets (Article 128 of the Civil Code).

The Tax Code defines expenses accepted for profit tax purposes as economically justified and documented expenses, the assessment of which is expressed in monetary form (clause 1 of Article 252 of the Tax Code). In fact, this is not a definition of the concept of “expenses”, but of the characteristics that expenses must satisfy in order to be recognized when taxing profits.

Neither the first part of the code nor its 25th chapter defines the actual concept of “expenses”. Therefore, based on Article 11 of the Tax Code, this definition should be taken from the “core” legislation - on accounting. Paragraph 2 of PBU 10/99 refers to the reduction of economic benefits as a result of the disposal of assets (cash, other property) as expenses. Since the “free” property, upon receipt, became the property of the company and became part of its assets, its disposal as a result of the sale or sale of the products for which it was used obviously leads to a decrease in economic benefits.

Such expenses also have a monetary value - for tax purposes it was made even when the property was received free of charge (according to the rules of paragraph 8 of Article 250 of the Tax Code). Thus, the disposal of gratuitously received property fully satisfies the definition of expenses from paragraph 1 of Article 252 of the Tax Code.

The following can be cited as additional arguments.

The problem of double taxation disappears if the company receives money, not property, for free, and then uses it to purchase what it needs.

When making decisions on tax disputes in favor of the taxpayer, many courts indicate as one of the arguments that the budget was not harmed by the actions of the taxpayer (see, for example, the decision of the Supreme Arbitration Court of July 14, 2008 No. 8847/08, resolution of the Federal Antimonopoly Service of the Moscow District dated 7 September 2009 No. KA-A40/6263-09, FAS of the East Siberian District dated July 16, 2007 No. A33-674/07-F02-4300/07, FAS Volga District dated March 19, 2009 No. A55-11479 /2008).

This argument can also be used in favor of recognizing the value of property received free of charge in tax expenses. This does not cause any damage to the budget, since a double reduction in taxable profit does not occur (for the transferring party, the cost of such property is not recognized as expenses - clause 16 of Article 270 of the Tax Code). The reason for introducing this restriction is clear: the use of property for gratuitous transfer to another person does not imply a counter-obligation, the fulfillment of which will bring taxable income, therefore there is no reason to take into account the value of the property in expenses. But for the new owner of the property, its disposal will bring taxable income, so including its value in expenses will be fair. As a result, the overall result for the budget will be exactly the same as if the property had been sold by the first owner, who would have recognized its value in his expenses. It can be said that the right to recognition as an expense in this case follows the property from one owner to another until the moment when it is used in taxable activities.

We should not forget about the principle of equal taxation, which is enshrined in paragraph 1 of Article 3 of the Tax Code. It, according to the Constitutional Court, means that the same economic results of taxpayers’ activities will entail the same tax burden. This principle is violated in cases where one category of taxpayers falls into conditions that are different from those provided for others, although there are no significant differences between these taxpayers that would justify unequal legal regulation (Resolution of the Constitutional Court of March 13, 2008 No. 5-P) .

A taxpayer who does not include the cost of materials received free of charge as expenses will find himself in an unequal position with someone who received money free of charge, then bought material assets with it and wrote off their value as expenses.

Inequality exists in another aspect. Suppose two taxpayers received the same property for free, only one of them will use it as a fixed asset, and the other as a commodity. The first will be able to write it off as expenses (even if he did not include it in income on the basis of clause 11 of Article 251 of the Tax Code), but the second, according to tax authorities, will not.

And finally, those who use the cash method can also defend expenses with reference to the principle of equal taxation. Otherwise, they would have to bear an additional tax burden compared to those who determine taxable income on an accrual basis. They pay the same tax, so the composition of their income and expenses should be the same; These two methods differ only in the moment of recognition of certain amounts in expenses and income.

METHOD 4

How can a contractor take into account the gratuitous provision of services for income tax purposes?

If you provided services free of charge, then you cannot take into account the costs associated with their provision when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation).

Please note that there is widespread advice that you can take into account in your income tax expenses the amount of VAT that is accrued in connection with the gratuitous provision of services. Such advice is risky, since, according to the Russian Ministry of Finance, the amount of accrued VAT is not taken into account in expenses on the basis of clause 16 of Art. 270 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated March 11, 2010 N 03-03-06/1/123).

How can a donor take into account transactions under a gift agreement for income tax purposes?

If you transferred property (property rights) under a gift agreement, then its value and expenses associated with such transfer cannot be taken into account when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation).

Please note that there is widespread advice that you can include in your income tax expenses the amount of VAT that is accrued in connection with the gratuitous transfer. Such advice is risky, since, according to the Russian Ministry of Finance, the amount of accrued VAT is not taken into account in expenses on the basis of clause 16 of Art. 270 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated March 11, 2010 N 03-03-06/1/123).

If you transfer a fixed asset under a gift agreement, then you do not need to restore the depreciation bonus on it (Letter of the Ministry of Finance of Russia dated September 28, 2012 N 03-03-06/1/510).

How can a lender take into account the transfer of property for free use when calculating income tax?

The cost of such property, as well as the costs associated with its transfer, cannot be taken into account when calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 01.02.2013 N 03-03-06/1/2069).

Moreover, if you transfer a fixed asset for free use, then you need to stop accruing depreciation on it (clause 3 of Article 256 of the Tax Code of the Russian Federation).

This requirement does not apply to property that, according to the legislation of the Russian Federation, you must transfer for use to state authorities and authorities, local governments, state and municipal institutions, state and municipal unitary enterprises (clause 3 of Article 256 of the Tax Code of the Russian Federation).

Depreciation accrual stops from the month following the month in which you transferred the property for free use, and resumes from the month following the month when this property was returned to you (clauses 6, 7 of Article 259.1, clause 8 , 9 Article 259.2 of the Tax Code of the Russian Federation).

If you pay property tax, transport or land taxes on property transferred for free use, then you can take these taxes into account in other income tax expenses (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation).

Are charitable expenses taken into account for income tax purposes?

Charity expenses (the cost of donated property, work, services, property rights and other expenses) cannot be taken into account for the purpose of calculating income tax.

Donations are not expenses under Sec. 25 Tax Code of the Russian Federation. They must be carried out in a disinterested form (free of charge or on preferential terms). Attributing them to expenses when calculating income tax would mean carrying out charity at the expense of the budget. This opinion was expressed by the Ministry of Finance of Russia in Letters dated January 23, 2018 N 03-03-07/3443, dated April 6, 2015 N 03-03-07/19136.

If, as part of a charity, you transfer a fixed asset for which you applied a depreciation bonus, then you do not need to restore this bonus (Letter of the Ministry of Finance of Russia dated September 28, 2012 N 03-03-06/1/510).

To have income, you need expenses

Another way to avoid double taxation: when further selling property received free of charge, do not write off its value as expenses, but do not include it in income either - on the basis of paragraph 3 of Article 248 of the Tax Code. This paragraph establishes that, when determining taxable income, amounts once recognized as income are not subject to re-inclusion in income. The market value of the “gift” has already been included in income once – upon receipt. Therefore, the second time - when selling it - this cost should not be included in income. If the property is sold at a higher price, then it turns out that only the difference should be recognized in income. The final tax result, as we see, will be the same as when writing off the market value as expenses.

But what if the company does not sell the property received free of charge, but uses it to manufacture its products? After all, you cannot exclude its cost from revenue by calculation - there is no such mechanism in Chapter 25 of the Tax Code; Revenue must be recognized in full.

Perhaps that is why the courts accept the reference to paragraph 3 of Article 248 as confirmation of the organization’s right to write off the market value of something received free of charge as expenses, and not at all the right to exclude it from sales income. The Federal Arbitration Court of the Moscow District reasoned like this. Since the selling price of finished products is formed, among other things, from the cost of materials used in production, the exclusion of materials received free of charge from expenses will lead to their double taxation - both as part of non-operating income when received, and as part of revenue from the sale of finished products. And this contradicts paragraph 3 of Article 248 of the Tax Code (resolution of the Federal Antimonopoly Service of the Moscow District dated February 5, 2009 No. KA-A40/13283-08; similar conclusions are contained in the resolution of the same court dated May 7, 2008 No. KA-A40/3514- 08).

All this is true only for those who pay income tax. In Chapter 26.2 of the Tax Code regulating “simplified taxation” there is no such prohibition on repeated inclusion of the same amount in income. The ban on double taxation cannot be derived from the first part of the Tax Code. However, the Supreme Arbitration Court calls the principle of one-time taxation constitutional (decision of July 20, 2010 No. VAS-9251/10, resolution of the Supreme Arbitration Court of February 25, 2009 No. 13258/08). Therefore, one can with a high degree of probability expect that the arbitration court will not support the re-inclusion of the value of gratuitously received property in income, because judges must follow the interpretation of tax legislation given by their highest authority.

METHOD 5

General information

The fact is that, in accordance with Article 575 of the Civil Code of the Russian Federation, one commercial organization cannot give property (if its value is above 3,000 rubles) to another, as an official transaction.

At the same time, she can accept gifts from individuals, non-profit organizations, state and municipal structures.

In reality, this means that the founders of companies, who are individuals, have the right to transfer property free of charge in favor of their own commercial organizations. According to Article 251 of the Tax Code, property received by a company free of charge may not be included in unrealized income; accordingly, this type of asset does not increase the size of the tax base provided that the citizen owns more than half of the authorized capital of the enterprise. An important indicator is that the donor must have the above-mentioned share in the property of the company alone.

For example, if one citizen owns 30% of an enterprise, another – 40%, and they jointly own equipment, then the law prohibits them from donating it to their company without taxation. When drawing up a gift agreement, they need to pay income tax, in accordance with Article 250 of the Tax Code of the Russian Federation.

If the object of donation costs more than 3,000 rubles, then the receiving party is obliged to formalize the transfer of property as a purchase. In this case, the transfer of real estate free of charge is impossible, because the cost of the building cannot be less than 3,000 rubles. In fact, in the practice of doing business, there are schemes according to which it is actually possible to implement the gratuitous principle of transferring property, even if its value is greater than the established limit. For example, there is no restriction if the concern transfers property free of charge to one of its subsidiaries.

Practical significance of gratuitous transfer

In what types of civil legal relations is gratuitous transfer of property most often used? It can be noted that the range of such is very wide. However, the corresponding type of legal relationship in business has become especially popular.

The fact is that, according to Article 575 of the Civil Code of the Russian Federation, one commercial enterprise cannot give another (as part of official transactions) property whose value exceeds 3,000 rubles. However, they can receive gifts from individuals, non-profit organizations, as well as state and municipal structures. In practice, this may mean that the founders of organizations with the status of individuals can also transfer property free of charge to the benefit of commercial enterprises they own. What does this opportunity provide in practice?

Article 251 of the Tax Code states that property that an enterprise received free of charge may not be included in the category of non-operating income. That is, the tax base does not increase due to the corresponding type of assets. But under one condition - if a person owns more than 50% of the company’s authorized capital.

Free rental

Russian law provides for such a phenomenon as the transfer of property for free use. In another way, this type of legal relationship is called a loan. Free transfer of property for rent is a common type of transaction in business. At the very beginning of the article, we noted that the law provides for a limit of 3 thousand rubles on the value of transferred assets in favor of commercial organizations. As an alternative, businesses use a marked transaction type. The main advantage of such legal relations is that neither the owner of the property nor its user, as part of a free acquisition for rent, has any obligations to calculate taxes.

Actually, the aspect reflecting how taxes are calculated is also interesting. Let's consider it.

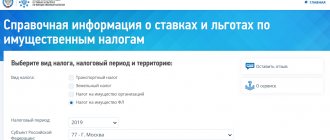

Let's talk about taxes

and property received free of charge, taxes are calculated depending on the chosen policy in the organization. So, with the general system, the rate is 20%, with the simplified taxation system there are 2 positions. The simplest formula works if the company operates on a system of paying 6% of various types of revenue, including unrealized income.

If a businessman uses a system in which 15% is paid on the difference between profits and costs, then the formula in this case becomes more complicated. The price of property acquired free of charge is added to other types of revenue. Documented costs are then deducted from the amount received and the tax is calculated based on a rate of 15%. If an organization receives property free of charge, the assessment of unrealized income is carried out based on the market value of such assets. The provisions corresponding to this procedure are prescribed in the Tax Code of the Russian Federation. In some cases, cost data must be officially confirmed (as an option for conducting an assessment when contacting independent experts).

Individuals have the right to transfer various types of property to each other, and if they do not want, then mandatory additional registration is not provided. For organizations this principle is not relevant; they are required to adhere to a regulated procedure at the legislative level.

The essence of gratuitous transfer of property

What is gratuitous transfer of property? According to a common definition, this is a procedure in which a certain subject of legal relations - an individual or an organization - assigns the rights of ownership of some property in favor of other persons, without charging payment in return and without requiring other preferences.

The subjects of the transactions in question can be both commercial enterprises and those institutions that are not related to business. At the same time, in Russian legal practice, the specifics of the participation of organizations with different statuses in procedures for the gratuitous transfer of property may differ. Later in the article we will study the relevant aspect.

The phenomenon under consideration from the point of view of legal classification can be expressed in the form of a gift or donation. It's not the same thing. Many experts believe that there is a significant difference between donation and giving. A little later we will study this aspect in more detail.