Starting from 2021, insurance premiums, including penalties and fines on them, are transferred to the Tax Service. Extra-budgetary funds no longer administer them. We will tell you what the fines for late and non-payment are, how to calculate and where to pay penalties on insurance premiums.

Fines and penalties for insurance premiums, as well as the insurance amounts themselves, must be transferred to the account of the territorial Federal Tax Service. Explanations on the procedure for transfer and payment are provided by the Ministry of Finance and the Federal Tax Service - these bodies are entrusted with the responsibility to inform payers about issues of application of legislation.

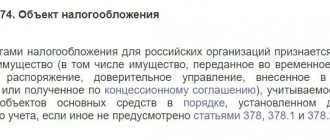

According to Chapter 34 of the Tax Code of the Russian Federation, the Tax Service controls the payment of contributions for:

- OPS (compulsory pension insurance);

- Compulsory medical insurance (compulsory health insurance);

- social insurance in connection with maternity.

The exception is deductions for injuries (insurance against industrial accidents), they are still administered by the Social Insurance Fund.

Why will penalties be charged?

According to the rules, insurance premiums, including penalties, are paid to the territorial tax office using the established details before the 15th day (inclusive) of the month following the reporting month. The exception is those months when the 15th calendar day falls on a weekend, then the deadline is the next working day. To avoid late payments, pay in advance.

To avoid sanctions, we recommend reading articles about when to pay and to whom to transfer insurance premiums.

Payment of all penalties is regulated by the Tax Code of the Russian Federation (Article 34 of the Tax Code of the Russian Federation). The policyholder bears administrative responsibility and pays penalties for non-payment of insurance premiums in 2021 for late principal payments. See the table for what else sanctions will follow:

| Violation | Fine |

| Violation of payment deadlines | Penalty 5% of the amount of unpaid contributions for each overdue month within the following limits: no less than 1000 rubles and no more than 30% of the total amount of deductions (Article 119 of the Tax Code of the Russian Federation). An additional fine for missed deadlines is 300-500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation) |

| Deliberate understatement of the tax base or erroneous calculation of mandatory payments | 20% of the unpaid amount of SV (clause 3 of article 120, clause 1 of article 122 of the Tax Code of the Russian Federation) |

| Partial payment or non-payment of contributions at all | 40% (clause 3 of article 122 of the Tax Code of the Russian Federation) |

| Deliberate violation of deadlines or complete disregard for the obligation to pay for SV in the Social Insurance Fund | From 20% to 40% of the amount of unpaid deductions (Article 19 125-FZ), an additional 300-500 rubles are collected (15.33 Code of Administrative Offenses of the Russian Federation) |

| Submitting information on paper rather than in an established electronic system | 200 rubles (clause 2 of article 26.30 125-FZ) |

| If the total number of employees is over 100 people, the report is provided on paper and not in an electronic system | 200 rubles (Article 119.1 of the Tax Code of the Russian Federation) |

| Violation of filing deadlines or provision of distorted individual information to the Pension Fund of Russia | 500 rub. for 1 employee (Article 17 27-FZ), an additional 300-500 rubles are charged (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation) |

| Submission of personalized accounting information in paper rather than electronic form when the number of employees is more than 25 people | 1000 rubles (Article 17 27-FZ) |

Tax violators for non-payment of contributions in especially large amounts (from 5 million rubles) are brought to criminal liability on the basis of Part 1 of Art. 10 of the Criminal Code of the Russian Federation. If an organization deliberately does not pay, then the Investigative Committee opens a criminal case under Art. 199 of the Criminal Code of the Russian Federation for failure to provide reporting or indicating false information in it.

The maximum fine for the above crime is 500,000 rubles, the maximum prescribed criminal term is 6 years. When the total amount is paid along with penalties after the penalty for late payment of insurance contributions in 2021 to the Pension Fund and other authorities is calculated, criminal liability from the offender is removed, but only on the condition that this was the first violation of this nature.

IMPORTANT!

Higher authorities do not have the right to fine an organization for violating deadlines, provided that the established payment forms are submitted on time (letter of the Ministry of Finance of Russia No. 03-02-07/1/31912 dated May 24, 2017). The inspector's duties include only calculating penalties.

Where should contributions be paid for compulsory health insurance, compulsory medical insurance and compulsory social insurance?

Legislative innovations in insurance premiums, which came into force in 2021, have led to the replacement of the authority that performs the functions of the administrator of these payments. The tax service became such an authority for the majority of contributions, and began to control payments intended for:

- for Social Insurance Fund in terms of sick leave and maternity leave;

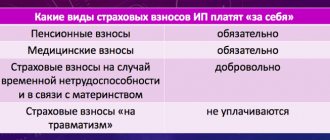

- Pension Fund and Compulsory Medical Insurance Fund, including those paid by individual entrepreneurs for themselves.

Since 2021, all provisions reflecting the specifics of the application of such payments as insurance premiums have been regulated by a special chapter of the Tax Code of the Russian Federation.

Once included in the Tax Code of the Russian Federation, insurance premiums began to obey all its rules, i.e. they turned out to be equivalent to budget payments paid in a special order, which concerns not only the rules for processing payment documents, but also the details for transfer.

To learn how the functions of tax authorities and funds turned out to be differentiated in terms of contributions that came under the control of the Federal Tax Service, read the material “Attention - a memo for payers of contributions from the Federal Tax Service.”

Where are insurance premiums paid in 2021? Contributions regulated by the Tax Code of the Russian Federation should be paid to the budget at the location of the taxpayer, and if he has separate structural units that calculate and pay wages, then at the location of such structural units. Individual entrepreneurs pay contributions for themselves and for employees at their place of residence.

Payment documents, as before, are issued separately for the payment intended for each of the funds, but in accordance with the requirements valid for tax payments.

At the same time, there are contributions that were not affected by the 2017 changes. These are the so-called “accident” premiums associated with occupational injury insurance. They are still subject to the provisions of the Law “On Compulsory Social Insurance” dated July 24, 1998 No. 125-FZ, and the FSS remains their curator. Where should those paying insurance premiums transfer such payments in 2021? The answer is obvious: as before - in social insurance at the place of registration of the policyholder, which may also be its separate division.

We invite you to familiarize yourself with: Types of insurance contracts in private international law

How to calculate the amount

Tax officials calculate sanctions for late payments as 1/300 of the refinancing rate for each day of delay (clause 4 of article 75 of the Tax Code of the Russian Federation).

IMPORTANT!

If an organization is overdue for a monthly payment by 1 calendar day, then no sanctions should follow. Tax inspectors assess penalties from the day following the payment deadline, taking into account that the payment day is not a settlement day (letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 No. 03-02-07/39318).

Here's how to calculate penalties for insurance contributions to the Pension Fund and the Social Insurance Fund using the formula:

P = S × D × SR × 1/300,

Where:

- P - penalty;

- C - the amount of deductions payable;

- D - calendar days of delay;

- CP is the key refinancing rate.

What details should I use to transfer contributions regulated by the Tax Code of the Russian Federation?

Regarding where to transfer insurance premiums in 2021 and how to draw up payment documents, the Federal Tax Service, which received contributions under control, gave many clarifications. The main issues addressed by these clarifications were:

- BCC for payment at the border 2016-2017;

- BCC for contributions 2020, which have become a full-fledged budget payment;

- payer status in the payment document.

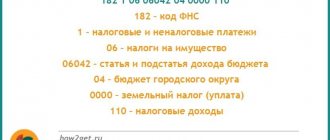

“Limit” contributions (i.e., accrued in 2021 and paid in 2021) are paid by indicating special (interim) BCCs in the payment document. Such BCCs, like any budget payment, begin with the numbers 182, and differ from their final version, corresponding to accruals made starting in 2021, by the value present in the 16th or 17th digit of the code.

The BCCs used for “boundary” contributions for accrued payments to employees are as follows:

- 18210202010061000160 - for payments to the Pension Fund;

- 18210202101081011160 - for payments to the Compulsory Medical Insurance Fund;

- 18210202090071000160 - for payments to the Social Insurance Fund.

Their updated version, used for contributions assessed since the beginning of 2017:

- 18210202010061010160 - for payments to the Pension Fund;

- 18210202101081013160 - for payments to the Compulsory Medical Insurance Fund;

- 18210202090071010160 - for payments to the Social Insurance Fund.

Individual entrepreneurs, when making payments for contributions paid for 2021 in 2017, also use intermediate codes:

- 18210202140061100160 - for payments to the Pension Fund of the Russian Federation with income up to 300,000 rubles;

- 18210202140061200160 - for payments to the Pension Fund for income exceeding 300,000 rubles;

- 18210202103081011160 - for payments to the Compulsory Medical Insurance Fund.

The individual entrepreneur transfers accruals made after 2021 according to the final BCC:

- 18210202140061110160 - for payments to the Pension Fund (this code has become uniform since 2021 for fixed payments and contributions accrued on income over 300,000 rubles);

For details, see the publication “KBK - fixed payment to the Pension Fund in 2021 - 2021 for individual entrepreneurs for themselves.”

- 18210202103081013160 - for payments to the Compulsory Medical Insurance Fund.

The solution to the issue of indicating the payer status turned out to depend on the technical capabilities of the banks. They had difficulties accepting payments with status “14” for execution, which characterizes the person making payments to individuals. Therefore, if technical problems arise with banks, it is recommended that employers-legal entities indicate status “01” in the payment document, and individual entrepreneurs paying contributions for employees are allowed to use status “09”, which is indicated when an individual entrepreneur transfers contributions for himself (letters from the Federal Tax Service of Russia dated 15.02 .2017 No. ZN-3-1/ [email protected] , dated 02/08/2017 No. ZN-4-1/ [email protected] , dated 02/03/2017 No. ZN-4-1/ [email protected] ).

In other aspects, the payment document issued when paying contributions is no different from the one usually generated for the transfer of taxes. The recipient, as with taxes, will be listed as the Federal Tax Service Inspectorate.

In November 2021, the Tax Code of the Russian Federation introduced a provision on the admissibility of paying tax payments for a third party. Since 2021, this possibility has also been applied to the payment of insurance premiums, which have begun to comply with the rules of the Tax Code of the Russian Federation. The payer status indicated for such payment must correspond to the status of the person for whom the payment is made.

Calculation example

Children's and youth sports school SDYUSSHOR "Allur" violated the deadline for payment of CB for January 2021 (02/15/2020 - Saturday, deadline - 02/17) and transferred a sum of money in the amount of 103,420 rubles to the established funds on 02/24/2020.

Breakdown of unpaid amount, in rubles:

- 73,226 - for compulsory pension insurance;

- 22,650 - for compulsory health insurance;

- 7544 - in case of temporary disability and in connection with maternity.

The delay from 02/17/2020 to 02/24/2020 was 7 calendar days - excluding the day of payment. The refinancing rate at the time of funds transfer is 6.0%. Eventually:

- OPS: 73,226 × 7 × 6.0% / 300 = 102.52 rubles;

- Compulsory medical insurance: 22,650 × 7 × 6.0% / 300 = 31.71 rubles;

- VNiM: 7544 × 7 × 6.0% / 300 = 10.56 rubles.

When to pay

The basis for transferring penalties is a notification from the Federal Tax Service. It also stipulates the deadline for paying penalties for late insurance premiums in 2021. There is no legally established period for transferring such a payment.

But there is a statute of limitations. If the taxpayer does not pay the penalty on time, the tax office has the right to sue to recover the penalty amount. The period allotted for filing a lawsuit is the statute of limitations. If representatives of the inspectorate do not begin legal proceedings with the payer, the debt is recognized as uncollectible and written off.

Where to send “unfortunate” contributions

Where should insurance premiums be paid in 2021 if they fall into the “accident” category? Still in social security, indicating its details in the fields of the payment document intended for the recipient’s data. The BCC used for such payment will also remain the same (39310202050071000160).

In addition to the mandatory “unfortunate” contributions paid from employee benefits, voluntary payments can also be made to social insurance. They arise for an individual entrepreneur, who is generally not obliged to make such transfers, but who has independently entered into a voluntary insurance agreement with the fund. BCC for such payments - 39311706020076000180.

https://www.youtube.com/watch?v=upload

Read more about all BCCs applied from 2021 here.

How to pay correctly

The payer has the right to pay the penalty himself (if he knows that he is late in payment) or pay the fine upon request from the tax office. Here's how to pay penalties on insurance premiums in 2020:

- Receive a notification from the Federal Tax Service.

- Check the payment amount - calculate the payment using the formula.

- Fill out the payment order and transfer the required amount to the territorial tax office.

The amount of the penalty must be reflected in the accounting records. In the absence of regulatory documents regulating the type of recording of overdue deductions in accounting, the payer organization has the right to determine the type of accounting entry.

| Postings | Contents of operation | |

| For commercial organizations and non-profits | For budgetary institutions (instructions 157n, 174n) | |

| Dt 99, 91 Kt 68 | Dt 0.401.20.292 Kt 0.303.05.731 | Accrual of penalties and fines on insurance premiums |

| Dt 68 Kt 51 | Dt 0.303.05.831 Kt 0.201.11.610 | Payment of the resulting penalty |

Sanction amount

The exact amount of the fine or penalty depends on the amount of insurance premiums. The company's accountant is responsible for the calculations, so if he makes a serious mistake, he is additionally subject to administrative liability in the form of a fine or disqualification. The employer may take disciplinary action for such errors.

Reference! Entrepreneurs do not need to independently calculate the amount of the sanction, since Federal Tax Service employees send a request that already contains information about the fine or penalty. If the head of the company does not agree with the amount of the fee, he can challenge it in court.

How to fill out a payment form

Payment orders for payment of penalties are practically no different from mutual settlements with counterparties. But there are a number of nuances:

- If sanctions are paid voluntarily, in field 106 we indicate the value of the AP. Payment upon request from the tax office - TR. If the fine is assessed based on the inspection report, we set an AP.

- The situation is similar with field 107 “Tax period”. For self-repayment, 0 is indicated; if payment is made on the basis of a tax warning, then the date specified in the request is indicated.

- Fields 108 and 109 (they contain the number and date of the basis document) are filled in according to the details of the request or verification report from the Federal Tax Service.

Results

https://www.youtube.com/watch?v=ytpressru

Since 2021, most of the insurance premiums have come under the control of the Federal Tax Service and began to be regulated by the provisions of the Tax Code of the Russian Federation. Payment documents for such contributions began to be drawn up in the same way as for tax payments. The Federal Tax Service Inspectorate began to be indicated as the recipient, new BCCs appeared, and the status of the payer changed. An obligation has arisen to pay contributions not only at the location of the taxpayer, but also at the location of its separate structures. At the same time, the type of contributions (“unfortunate”) has been preserved, which are still regulated by social insurance. There were no changes in payments for them.

Which BCCs to indicate in 2021

Now let’s look at where to pay penalties on insurance premiums and what budget classification codes to indicate in the payment order. Payment is made as follows: penalties issued for compulsory medical insurance, compulsory medical insurance and for cases related to temporary disability and maternity are credited to the Federal Tax Service. The resulting penalties for deductions “for injuries” are transferred to the territorial social insurance funds.

And here are the BCCs that should be included in the payment slip for the payment of penalties to the tax office:

- for compulsory pension insurance: 182 1 0210 160;

- for compulsory health insurance: 182 1 0213 160;

- for temporary disability and maternity: 182 1 02 02090 07 2110 160.

Transfer penalties for injuries to the Social Insurance Fund using the following code: 393 1 02 02050 07 2100 160.

The procedure for holding non-payers of insurance premiums accountable

These issues are dealt with by the Federal Tax Service at the place of registration of the individual entrepreneur. Following the established procedure, the tax office has the right to demand that the individual entrepreneur repay the debt, pay penalties, and fines without involving the court. Extrajudicial collection procedures are most often used in the following circumstances:

- Insurance debt is up to 1,500 rubles, and in the Social Insurance Fund - less than 500 rubles. (the cancellation request was made 14 months ago, but not later).

- The debt on contributions is more than 1,500 rubles. and in the Federal Social Insurance Fund of the Russian Federation - exceeds 500 rubles. (at the same time, the fund submitted the demand for repayment 2 months ago, but not later).

The actual collection of debt on contributions is carried out by the Federal Tax Service in the following manner.

| Extrajudicial procedure for collecting non-payment applied by the Federal Tax Service | General explanations for each stage |

| The tax office issues a written request to the individual entrepreneur to make a payment | As is customary, it is issued within 3 months from the date of discovery of non-payment. Options for delivering a written demand: in the hands of the defaulter, by registered mail or through electronic resources |

| Repayment of debt by a defaulter at the request of the Federal Tax Service | As established, after receiving the request from the Federal Tax Service, the individual entrepreneur must repay the debt within 10 days |

| Forced collection of debt by the tax inspectorate | Occurs when, after delivery of the demand, the defaulter does not repay the debt within the due date |

| Repaying debt as funds arrive in the individual entrepreneur’s account | This is carried out when the individual entrepreneur has no money in his account. If this option is not possible, then contributions (penalties, fines) are reimbursed from the property of the defaulter |

As a last resort, the Federal Tax Service may go to court regarding the collection of debts, penalties, and fines from a willful defaulter.

If penalties are accrued and paid with errors

The payer made an incorrect calculation and transferred the wrong amount to the budget. What to do next? Check with the inspector whether you overpaid or underpaid. If there is an overpayment, write a letter about offsetting the excess for a future period. If you have underpaid penalties for late payment of insurance premiums, calculate and pay the balance to the Federal Tax Service.

In case of technical errors (incorrect TIN or checkpoint, fields 104, 106-109 filled in incorrectly), you will not have to do anything. The system will automatically clarify the payment and send it to the correct budget account.

If you have made a mistake in your payment details, payment will not be accepted. Write a letter about canceling the transaction to the bank or about returning the incorrectly paid amount to the Federal Tax Inspectorate. Instead of waiting for a refund, resubmit the correct payment.

Answers to frequently asked questions

Question No. 1: Community pension contributions were transferred on time, but according to an erroneous BCC. Will a sanction be applied in this case?

An error under the KBK is not a violation and not a basis for charging a penalty. As a rule, the payment is updated automatically. In fact, if the payment went through and arrived at the correct account, despite the existing errors, the payment can be specified through the Federal Tax Service.

The policyholder, who independently and promptly noticed an error in the payment document, has the right to clarify the payment by submitting an appropriate application to the Federal Tax Service. The following are also subject to clarification: the status of the payer, the tax period, as well as the basis for payment, etc. in accordance with Art. 45 of the Tax Code of the Russian Federation.

Question No. 2: Penalties on compulsory pension insurance contributions are paid at the request of the tax authorities. How to display this in the “payment”?

You need to write down the details of this requirement in fields “108” and “109”. For your information, when paying voluntarily, zeros are entered here.