Source: Magazine “Human Resources Department of a Commercial Organization”

The most common work schedule in organizations is a five-day work week. However, where the production process cannot be interrupted, work is set to a schedule. And under this regime, it is almost impossible to comply with the working hours established by law, not only per day, but also per week. For such cases, a summarized accounting of working time is provided, when the employee must work out his standard working hours for a month, quarter or year. We will talk about how summarized accounting is established and applied in practice in this article.

Working hours - what is it?

Most employers make a mistake when they confuse two concepts - “summary accounting” and “working hours”.

Summarized accounting is not a working time regime, but a method of keeping records of working time, a method of fulfilling the requirement contained in Art. 91 of the Labor Code of the Russian Federation states that the employer is obliged to keep records of the time actually worked by each employee. The concept of working hours is defined in Art. 100 of the Labor Code of the Russian Federation, where you should especially pay attention to the norm, which sounds imperative: “the working hours must provide for...”. The following lists everything that should be specified by the employer in the internal labor regulations or, if the working hours for the employee differ from the established rules (for example, he is a part-time worker or an employee with whom an agreement on part-time work is agreed), in the employment contract:

- length of the working week (five-day with two days off, six-day with one day off, working week with days off on a rotating schedule, part-time work week);

- work with irregular working hours for certain categories of workers;

- duration of daily work (shift), including part-time work (shift);

- start and end times of work;

- time of breaks from work;

- number of shifts per day;

- alternation of working and non-working days, which are established by internal labor regulations and an employment contract.

Flexible working hours

Flexible working hours are the only working hours that eliminate the need to prescribe the duration of daily work and the start and end times of the working day. According to Art. 102 of the Labor Code of the Russian Federation, when working in flexible working hours, the beginning, end or total duration of the working day (shift) is determined by agreement of the parties. The employer ensures that the employee works the total number of working hours during the relevant accounting periods (working day, week, month and others).

The alternation of weekends and working days, the length of the week will be determined in the labor regulations. In this case, it is impossible to change the schedule unilaterally. To change the schedule, you must either ask for the employee’s consent, or justify this by changes in organizational or technological working conditions.

Despite the fact that the Labor Code does not say a word about the fact that with a flexible working time schedule it is necessary to keep summarized records, the concept of a flexible schedule itself presupposes the introduction by the employer of summarized recording of working hours, since he will not be able to ensure that the norm is worked out within a certain day and will set the accounting period - week, month, etc.

Online training on current topics in accounting and tax accounting

To learn more

How to make changes to PVTR

According to Part 1 of Art. 190 of the Labor Code of the Russian Federation PVTR are approved by the employer taking into account the opinion of the representative body of employees. Therefore, when making any changes to the PVTR, this procedure must be followed.

For your information

If the organization does not have a trade union, then employees at a general meeting (conference) can entrust the representation of their interests to a representative (representative body) elected from among the employees (Article 31 of the Labor Code of the Russian Federation).

Before making a decision to amend the PVTR, the employer must send a draft containing the main provisions regarding changes to the local regulatory act, accompanied by justifications to the representative (representative body). The representative, no later than five working days from the date of receipt of the draft PVTR, sends the employer a reasoned opinion on the draft in writing.

If the representative body or representative does not agree with the draft PVTR or proposals have been received to improve the project, the employer may agree with the representative’s opinion or disagree.

Within three days after receiving a reasoned opinion, the employer holds an additional meeting with a representative or representative body in order to reach agreement.

If the parties do not agree, a protocol of disagreement is drawn up. After this, the employer has the right to adopt a local regulation.

In turn, the representative body has the right to appeal the text of the rules approved by the employer in the state labor inspectorate or in court.

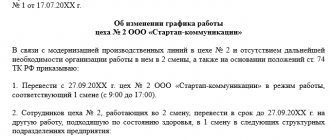

Shift work

In a situation with summarized accounting of working hours, concepts such as “shift work” and “working week with days off on a staggered schedule” are often confused. It is worth keeping in mind that these are two different working hours.

Art. 103 of the Labor Code of the Russian Federation defines shift work as work in two, three or four shifts, which “is introduced in cases where the duration of the production process exceeds the permissible duration of daily work, as well as for the purpose of more efficient use of equipment, increasing the volume of products or services provided” .

The most important condition for shift work is the rotation of workers (one shift/team replaces another). In case of shift work, the employer is obliged to familiarize the employee with the shift schedule no later than one month before it comes into force. Working two shifts in a row is prohibited.

Basic rules of summarized accounting

Non-standard working hours, flexible working hours, staggered days off, shift work require keeping a summary record of working time.

The main document that needs to be relied upon in this case is Art. 104 Labor Code of the Russian Federation. It answers the question in which cases the introduction of summarized accounting is allowed: when the daily or weekly duration established for a given category of workers (including workers engaged in work with harmful and (or) dangerous working conditions) cannot be observed.

The meaning of summarized recording of working time is to select a certain accounting period so that, based on its results, the duration of working time does not exceed the normal number of working hours.

To account for the working time of workers engaged in work with harmful and (or) dangerous working conditions, the Labor Code establishes an accounting period of three months, however, there is a caveat: for workers engaged in work with harmful and (or) dangerous working conditions, due to the peculiarities technological process or for seasonal reasons, it is possible to increase such an accounting period for a period of more than three months, but in the presence of an industry agreement and a collective agreement and to no more than one year.

The normal number of working hours for the accounting period is determined based on the weekly working hours established for this category of workers. For employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is reduced accordingly.

Hassle-free HR records management

Try it

What length of working hours will an employee working on a “every three days” schedule have? In this case, we must proceed from the generally accepted norm: normal working hours do not exceed 40 hours per week. The employer establishes a certain accounting period within which these hours are distributed as desired, the main thing is to reach the standard hourly rate based on the results of the accounting period.

Moreover, if the employer does not take the generally accepted working hours - 40 hours a week, but, for example, a 39-hour work week, then he will have to create his own production calendar.

The Order of the Ministry of Health and Social Development of the Russian Federation dated August 13, 2009 No. 588n states the rules by which the standard working time is determined: “the length of the working week (40, 39, 36, 30, 24, etc. hours) is divided by 5, multiplied by the number of working days according to the calendar of the five-day working week of a particular month and from the resulting number of hours the number of hours in a given month is subtracted by which working hours are reduced on the eve of non-working holidays.”

Judicial practice shows that the essence of the summarized accounting of working time is to adjust the duration of time worked within the accounting period (month, quarter or year), if it deviates from the established norm, that is, overtime on some days is compensated by underwork on others (Resolution of the Federal Antimonopoly Service of the Central District dated 07/03/2006 in case No. A62-5389/2005).

Summarized accounting of working time, according to Art. 104 of the Labor Code of the Russian Federation, is carried out in accordance with established internal labor regulations.

Thus, to introduce summarized accounting it is necessary to follow a certain algorithm:

- determine the duration of the accounting period;

- determine the standard hours for the accounting period based on the weekly working hours established for this category of employees;

- make a schedule;

- establish a procedure for determining overtime hours;

- establish a procedure for paying overtime and work on weekends/non-working holidays.

How to calculate salary based on tariff rate

Often, with a shift work schedule, employees are set a tariff rate. In this case, calculating wages is not complicated: you need to multiply the number of hours worked by the rate per hour. It is necessary to take into account that for work at night, that is, from 22.00 to 6.00, an additional payment of at least 20 percent is required (Article 154 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated July 22, 2008 No. 554).

Example 4

The billing period in the company is one month. In March, the employee worked 7 24-hour shifts. The total time was 168 hours (7 shifts x 24 hours), night work - 56 hours. The hourly rate for this specialist is 285 rubles.

The accountant calculated the salary for March. It is equal to 51,072 rubles ((168 hours x 285 rubles) + (56 hours x 285 rubles x 20%))

Summary accounting: overtime pay

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime work is paid at least one and a half times the rate for the first two hours of work and at least double the rate for subsequent hours. However, the code does not answer more detailed questions: how exactly to pay, that is, where to get one and a half sizes from?

There are other difficulties: in order to figure out how to pay for overtime hours when accounting for working hours together, you need to focus on the chosen wage system - salary or tariff.

So, for example, if an employee has a salary system and the salary is 15,000 rubles, then the employer is guaranteed to pay him this amount. And only at the end of the accounting period, if there is overtime work, he will receive payment in the form of the first two hours at one and a half times the rate, and for subsequent hours at least double the rate.

Example

Payment for January, February and March - 15,000 rubles. for every month. During the accounting period, the employee worked 10 hours overtime. The rate for 1 hour of work is 100 rubles. We calculate how much he needs to pay extra:

2 hours * 1.5 * 100 rub. = 300 rub.

8 hours * 2 * 100 rub. = 1600 rub.

Total: 1900 rub.

Please note that Rostrud experts recommend establishing a tariff system of remuneration for workers for whom summarized working hours are kept - either hourly or daily.

How should overtime be calculated in this case?

Example

The employee has a tariff system of remuneration, the rate for 1 hour is 100 rubles. The accounting period is 1st quarter. Within this period, we notice that in January the employee actually worked 150 hours, which was included in the schedule. Accordingly, at an hourly rate we pay him 15,000 rubles.

In February, instead of 148 hours included in the schedule, the employee actually worked 156 hours (reflected in the report card). It turns out 15,600 rubles. At the same time, 149 hours were planned in March, but in fact it turned out to be 151 hours. You need to pay 15,100 rubles.

Evgenia Konyukhova, an expert in the field of labor legislation and personnel records management, in the webinar “Summary accounting of working time. Registration and payment" draws attention to the fact that with the tariff system of remuneration within the accounting period at a single rate, overtime work has already been paid.

The expert believes that the norm from Art. 152 of the Labor Code of the Russian Federation works well with a salary system of remuneration. As we saw above, in this case, at the end of the accounting period, you need to take 10 hours of overtime work and calculate the amounts: the first 2 hours - at one and a half times, and the remaining 8 hours - at double.

But if the employee has a tariff system of remuneration, then the first 2 hours should be paid only in the amount of 0.5, since the single rate has already been paid. And the remaining hours are not double, but single.

So, based on the fact that we had 10 hours of overtime, we get:

2 hours * 0.5 * 100 rub. = 100 rub.

8 hours *1 * 100 rub. = 800 rub.

Total: 900 rub.

If the employee has a salary system or a monthly wage rate, then you need to figure out how to determine how much to pay for one hour of overtime work. The fact is that the Labor Code does not answer this question. There are several examples of how this can be implemented in practice.

Option 1: The salary is divided by the number of working hours in the month when the employee was involved in overtime work.

So, if the salary is 20,000 rubles, then you need 20,000 / 160 hours = 125 rubles. per hour of work.

Option 2: According to Letter of the Ministry of Health of the Russian Federation dated 07/02/2014 N 16-4/2059436, the salary is divided by the average monthly number of hours per year (for example, for employees with a 40-hour working time in 2021, the average hourly number of working hours is 1979 hours / 12 month = 164.9 hours), respectively, hourly rate = 20,000 rubles. / 164.9 = 121.28 rub.

Option 3: The amount of salaries accrued for the accounting period is divided by the standard working time according to the employee’s schedule for the accounting period in months.

Option 4: The entire salary (including additional payments, allowances) is divided into one of the above options. But the employer is not obliged to calculate the hourly wage rate based on all payments. The Supreme Court believes that only the salary is sufficient.

Often, in addition to salaries, employers also provide a system of additional payments and allowances, which raises the question: should the entire salary in this case be divided by the number of hours in the month when the employee was involved in overtime work or by the average monthly number of hours for the year? Only the employer himself can answer this question in local regulations (Decision of the Supreme Court of the Russian Federation dated June 21, 2007 N GKPI07-516). It is recommended to do this, among other things, to avoid problems with employees and inspectors.

The position of the Ministry of Health and Social Development is that in the case of cumulative accounting of working time, based on the definition of overtime work, the calculation of overtime hours is carried out after the end of the accounting period. In this case, work in excess of the normal number of working hours for the accounting period is paid for the first two hours of work in no less than 1.5 times the amount, and for all other hours - no less than double the amount (Letter of the Ministry of Health and Social Development of the Russian Federation dated August 31, 2009 No. 22- 2-3363).

Depending on the remuneration system - salary or tariff - payment will be either one and a half to double, or 0.5 and single.

But there is another approach, indicated by judicial practice (Review of the Supreme Court of the Russian Federation of the practice of courts considering cases related to the implementation of labor activities by citizens in the regions of the Far North and equivalent areas" (approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014)). There are clarifications according to which overtime pay is taken at one and a half times for the first 2 hours, which falls on average for each working day of the accounting period, and at double the rate for subsequent hours of overtime work. But when using this approach, the amount of payments for overtime work will be less, and therefore conflicts with employees are inevitable.

Calculation example

A.P. Morkovkin’s official salary — 50,000 rubles. In May 2020, the standard working hours was 144. Processing in May was 5.5 hours.

We calculate the additional payment for processing:

- We calculate the hourly salary: 50,000 / 144 hours = 347.22 rubles.

- We calculate the additional payment for the first 2 hours: 347.22 × 1.5 × 2 hours = 1041.66 rubles.

- We calculate the remaining processing time: 5.5 - 2 hours = 3.5 hours.

- Calculation of the allowance for the rest of the time: 347.22 × 2 × 3.5 = 2430.54 rubles.

Total additional payment for processing: 1041.66 + 2430.54 = 3472.20 rubles.

The employee has the right to refuse increased pay and replace it with additional rest time.

IMPORTANT!

Additional payment for work in non-standard conditions from 04/11/2019 cannot be taken into account when comparing earnings with the minimum wage (Decision of the Constitutional Court of the Russian Federation No. 17-P of 04/11/2019). Therefore, additional payment for night, holiday, weekend or overtime work is calculated in excess of the minimum wage.

Payment for holidays or weekends with summarized accounting

If an employee’s working day falls on a non-working holiday, then the code “РВ” is entered in the working time sheet, despite the fact that this working day is included in the employee’s schedule. In this case, the employee is also subject to the provisions of Art. 153 of the Labor Code of the Russian Federation on increased payment for work.

According to the Recommendations of Rostrud dated June 2, 2014, when introducing summarized working time recording, work on holidays must be included in the monthly working time standard.

If an employee was involved in work on his day off or on a non-working holiday in excess of the monthly norm established for him or in excess of the norm in accordance with the accounting period, then such work will be subject to payment in accordance with Art. 153 Labor Code of the Russian Federation. The employee can also take another day of rest.

If within the accounting period the employer has already paid for non-working holidays, then at the end of the accounting period he does not need to pay for them as overtime. The Decision of the Supreme Court of the Russian Federation dated November 30, 2005 N GKPI05-1341 provides an explanation for this case: “Since the legal nature of overtime work and work on weekends and non-working holidays is the same, payment in an increased amount is simultaneously based on Art. 152 of the Labor Code of the Russian Federation, and Art. 153 of the Labor Code of the Russian Federation will be unreasonable and excessive.”

Calculation example

Zaichikov P.B. works in shifts. The duration of 1 shift is 12 hours. The cost of a shift is 2,400 rubles. Night hours are paid at 20% of the rate. In April, the employer engaged Zaichikov to work overtime twice: on April 10 - for 3 hours and on April 15 - for 4 hours. Moreover, the overtime on April 15 fell at night.

We make the calculation:

- We calculate the cost of an hour: 2400 / 12 hours = 200 rubles.

- Additional payment for 04/10/2019: 200 × 1.5 × 2 hours + 200 × 2 × 1 hour = 600 + 400 = 1000 rubles.

- Additional payment for 04/15/2019: 200 × 1.5 × 2 hours + 200 × 2 × 2 hours = 600 + 800 = 1200 rub.

- We calculate the additional payment for night work: 200 × 4 hours × 20% = 160 rubles.

Total: 2360 (1000 + 1200 + 160) rubles.