By the Decree of the Supreme Court of the Russian Federation dated July 13, 2006 No. GKPI06-637, changes were made to the “Regulations on the specifics of the procedure for calculating average wages” in terms of calculating payment for vacation time provided to employees for whom summarized working time recording is established. A.V. talks about how this change in legislation is implemented in the “Salary and Personnel Management” configuration for “1C:Enterprise 8”. Yarvelyan, Sea Data CJSC.

The procedure for calculating accruals paid on average earnings is regulated by the Labor Code of the Russian Federation, local regulations, as well as the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of April 11, 2003 No. 213 “On the specifics of the procedure for calculating the average salary” (hereinafter referred to as "Position").

In particular, paragraph 4 of clause 13 of the Regulations determines the procedure for calculating average earnings for employees who have established a summarized accounting of working hours: “The average earnings of an employee for vacation pay are determined by multiplying the average hourly earnings by the amount of working time (in hours) per week, depending on the established the length of the working week and the number of calendar weeks of vacation.”

At the same time, part 4 of Article 139 of the Labor Code of the Russian Federation states: “The average daily earnings for paying vacations and paying compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days) "

Paragraph 4 of clause 13 of the Regulations has already been considered by the Supreme Court of the Russian Federation and was declared invalid and not subject to application from the date of its adoption in terms of its application to medical workers by decision of the Supreme Court of the Russian Federation of November 18, 2003 No. GKPI 03-1049.

Last summer, the Supreme Court considered another civil case to invalidate paragraph 4 of paragraph 13 of the Regulations. The application was submitted by an employee of a motor transport enterprise, which has established a summarized recording of working hours. The applicant was granted leave, the amount of payment for which was calculated in accordance with paragraph 4 of clause 13 of the Regulations. Meanwhile, when calculating average earnings to pay for vacation on the basis of Part 4 of Article 139 of the Labor Code of the Russian Federation, the applicant would have received a significantly larger amount for the same vacation period. The applicant believed that the contested order of the Regulations violated his labor rights and contradicted Articles 114, 120, 132 and Part 4 of Article 139 of the Labor Code of the Russian Federation.

As a result of considering this case, the Supreme Court found that:

| By decision of the Supreme Court of the Russian Federation dated July 13, 2006 No. GKPI06-637, paragraph 4 of paragraph 13 of the Regulations was declared invalid. Since the contested prescription of the Regulations concerns the calculation of average earnings to pay for vacations of all employees for whom a summarized recording of working time is established, and not just motor transport workers, it is subject to recognition as invalid in full. In fact, the Regulations were declared ineffective from the moment of its adoption, that is, from April 11, 2003. Thus, there is a need to recalculate the amounts of payment for all vacations calculated in the period from 04/11/2003. However, the decision of the Supreme Court does not directly stipulate the need to recalculate vacation pay. Thus, whether or not to recalculate holidays calculated “in the old way” remains at the discretion of the enterprise. However, it should be noted that when recalculating vacations, it is necessary to take into account changes in the Labor Code of the Russian Federation, that is, for vacations granted in the period from 04/11/2003 to 10/06/2006, the period for calculating average earnings should be the last 3 months. |

Basic moments

An enterprise whose product output requires continuity of the production process switches to a shift work schedule using summarized accounting. The duration of the time period under consideration is twelve months:

- The production will operate in four shifts.

- When drawing up the work schedule, management took into account the standard working hours.

- The standard working time for 12 months is 1986 hours.

- Employees are notified by signature that they will work according to the new schedule.

At the end of the twelve-month working period, it was time for the employees to take vacations.

How to calculate average daily earnings

To calculate average daily earnings, you need:

First, determine the billing period.

Secondly, the amount of payments that the employee received in the pay period.

The calculation period for vacation pay is 12 months preceding the month in which the employee goes on vacation.

You need to take the calendar month into account:

January: 1st to 30th of the month inclusive.

February: from the 1st to the 28th of the month inclusive.

March: from the 1st to the 31st of the month inclusive.

… and so on.

EXAMPLE 1. HOW TO DETERMINE THE BILLING PERIOD

An employee of the organization goes on vacation from July 10, 2021. The billing period includes: - July-December 2021 - January-June 2019

How are employee vacations reflected?

The Labor Code regulates work on summary accounting (Article 104 of the Labor Code of the Russian Federation), namely, it prohibits exceeding the normal amount of working time for the period under consideration (month, quarter, year). The normal working hours are assigned to employees by the Labor Code of the Russian Federation, based on the categories to which they belong. For certain categories of workers, the standard working hours differs: for example, a miner (who works in particularly harmful and dangerous conditions) and a seamstress.

Any work schedule is guided by the fact that the duration of the labor process per working week cannot exceed 40 hours.

Order of the Ministry of Health and Social Development of Russia dated August 13, 2009 No. 588n determines working hours:

- Like a five-day week with an eight-hour working day and two days off (Saturday and Sunday).

- The working day on pre-holiday days is seven hours.

- The work shift on the day before the holiday is also reduced by an hour (Article 95 of the Labor Code of the Russian Federation).

- A shift taking place at night is reduced by 1 hour (Article 96 of the Labor Code of the Russian Federation).

- It is prohibited to work for two shifts in a row (Article 103 of the Labor Code of the Russian Federation).

- One shift can last up to 12 hours.

- The lunch break does not count towards working hours (from 30 minutes to two hours).

Article 114 of the Labor Code of the Russian Federation guarantees workers an annual leave, during which the employee retains his job and is paid an average salary. The Labor Code provides for the procedure by which citizens receive vacations. Annual leave is required to be paid. Vacation is provided for the year worked and the countdown begins from the date the employee is hired by the enterprise. Art. 123 of the Labor Code of the Russian Federation provides for the approval of the vacation schedule for the enterprise no later than 14 days before the start of the new calendar year.

Average daily earnings in 2021

The general procedure for calculating average earnings is regulated by Article 139 of the Labor Code.

More detailed rules that must be followed when calculating vacation pay were approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

For vacation pay, average daily earnings are calculated for the 12 calendar months preceding the month the vacation starts.

For each fully worked month, 29.3 days are taken into account. This is the average monthly number of days ((365 days - 14 holidays per year) / 12 months).

Compensation for unused vacation is calculated in the same manner.

Use the online calculator to calculate vacation pay

Does vacation count towards working hours?

It is clear that under any working regime, a worker cannot work the hours that he was on legal leave. Accordingly, the norm of working hours for the year for an employee will be less by the number of hours that fell on any type of leave (annual, educational, at one’s own expense, sick leave or leave taken to fulfill civic duty). Vacation time during working hours must be deducted from the employee's total vacation period.

That is, the standard working hours for a certain period are initially determined without subtracting missed working days. Next, the total number of working hours attributable to vacation is subtracted from this standard. The Labor Code does not prohibit employers from drawing up shift work schedules taking into account all types of employee leave. Moreover, these vacations are planned in advance and their time frames are known.

The Labor Code does not prohibit employers from drawing up shift work schedules taking into account all types of employee leave.

Upon careful study of Art. 123 of the Labor Code of the Russian Federation, it becomes clear that a vacation schedule for an enterprise can be formed and signed long before the two-week limit at the end of the year. This will help the organization’s management to combine the vacation schedule with a shift work schedule, which means it is possible to reduce the accounting working time in the shift schedule during the employee’s vacation.

Nuances of summarized accounting: question - answer

Above we examined the general rules for maintaining summarized records of working time and their payment. Now let’s briefly answer the questions that most often arise when using CS in practice.

How to pay for night hours if they fall on a shift?

Night hours (and this, remember, is the time from 22.00 to 6.00) must be taken into account separately and paid additionally - according to the rules established for payment for work at night. article explains exactly how .

What if the shifts fall on weekends or holidays?

Shift workers have their own days off. Therefore, the general rules about increased pay for work on days off do not apply here. But there are some nuances when it comes to changing holidays. Read about them in this article .

What to do if, at the end of the accounting period, there is a rework?

Overtime based on the results of the accounting period is overtime. For them, the Labor Code of the Russian Federation also has its own rules, which also apply to shift workers. Read about these rules here .

What to do if an employee has not worked the entire accounting period?

If an employee did not fully work the accounting period (for example, was sick, was on vacation, quit), a reduced standard is calculated for him. To do this, the missed time is subtracted from the general norm. If this truncated standard is exceeded at the end of the period, overtime ; if, on the contrary, less time was worked, the work is paid after the fact. The employee is not required to work hours/days missed for valid reasons.

How are vacation pay calculated?

Calculation of vacation pay for cumulative accounting of working hours is carried out in exactly the same way as for people working in normal working hours. To calculate the amount of vacation pay, the calculated numerical value of the average daily salary is used. To calculate the average salary for a vacationer (any mode of work), the actual accrued payments, including bonuses, and the time actually worked by him for the previous year from the start of the current vacation are summed up. You can take no more than one type of payment in one month. For example, one bonus if there were two. The concept of “calendar year” includes the concept of “calendar month”. “Calendar month” is the period from the 1st day of the month to the last day of the month. The totality of twelve “calendar months” constitutes a “calendar year.”

If the employee has worked in full for the previous “calendar year”, then payment for vacation during the summarized accounting of working hours is made in the following order: the total amount of all accruals for the period is divided by the number of calendar days for the period and multiplied by the vacation time (in calendar days).

For example:

- The employee received a salary of 420,000 rubles + 18,000 rubles for the year preceding the vacation. bonus + 5,000 rub. monetary incentives for innovation proposals. Total, 443,000 rubles.

- Worked 363 working days per year.

- We determine the average annual salary for 1 day: 443,000 rubles. divide by 363 days (calendar year) = 1220.00 rubles.

- We calculate the amount of vacation pay: multiply the number of vacation days by 1220.00 rubles. (average salary per day).

The procedure for calculating vacation pay

Based on the Labor Code of the Russian Federation, the employer is obliged to pay the employee not only working hours, but also the period of annual leave.

The amount of vacation pay is calculated for each calendar day during which the employee was on vacation, taking into account the amount of average daily earnings:

Vacation pay = AvgDnZ * KolDn,

where Average daily earnings determined for the billing period; KolDn – vacation period by order (in calendar days).

The calculation period for determining the amount of vacation pay is 12 months preceding the month of vacation. For example, for an employee who goes on vacation from September 20, 2021, the billing period will be September 1, 2017 – August 31, 2021.

Determination of average earnings with summarized accounting of working hours

The summary recording of working time is introduced by the employer in order to comply with the established normal working hours during the accounting period (month, quarter, etc.). The accounting period cannot exceed one year (Article 104 of the Labor Code of the Russian Federation).

When accounting for working time in aggregate, payment for working hours according to the schedule is made based on the established salary (tariff daily or hourly rate). For hours worked overtime, the employee is entitled to additional pay.

In organizations that use summarized working time tracking, average hourly earnings are used to calculate the average earnings of a specific employee. It is calculated by dividing the amount of wages actually accrued for the pay period by the number of hours actually worked during this period. The average earnings of a particular employee are determined by multiplying the average hourly earnings by the number of working hours in the period subject to payment.

The procedure for calculating average wages is established by Art. 139 Labor Code of the Russian Federation. The specifics of the procedure for calculating average wages are determined by the Government of the Russian Federation. Currently, they are approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages” (hereinafter referred to as Resolution No. 922).

Resolution No. 922, in addition to the general rules for calculating average earnings, defines the specifics of calculating average earnings when recording working hours in aggregate.

Article 104 of the Labor Code of the Russian Federation determines in which cases an employee can be provided with a summarized recording of working time. If, due to the conditions of production (work) for an individual entrepreneur, in an organization as a whole, or when performing certain types of work, the daily or weekly working hours established for a given category of workers cannot be observed, then it is permissible to introduce summarized recording of working hours so that the working hours time during the accounting period (month, quarter and other periods) did not exceed the normal number of working hours. The accounting period should not exceed one year.

The normal number of working hours for the accounting period is determined based on the weekly working hours established for this category of workers (example 1).

Example 1

Ivanov works as a watchman, shift work - every other day, so the organization has established a summarized recording of working hours, the accounting period is a quarter.

In the second quarter of 2008, the normal number of working hours for a 40-hour work week is 493 hours.

Thus, the organization's employees must work no more than 493 hours in the second quarter of 2008. If employees work more than 493 hours, then the hours worked in excess of the specified amount of time will be considered overtime work (Article 99 of the Labor Code of the Russian Federation).

For employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is reduced accordingly. The procedure for introducing summarized recording of working time is determined by the internal labor regulations.

According to paragraph 13 of Resolution No. 922, when determining the average earnings of an employee for whom a summarized recording of working time is established, except in cases of determining the average earnings for vacation pay and payment of compensation for unused vacations, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of Resolution No. 922, by the number of hours actually worked during this period.

Paragraph 15 of Resolution No. 922 determines that bonuses and remunerations are taken into account in the following order:

- monthly bonuses and rewards actually accrued in the billing period, but not more than one payment for each indicator for each month of the billing period;

- bonuses and remunerations for a period of work exceeding one month, actually accrued in the billing period for each indicator, if the duration of the period for which they are accrued does not exceed the duration of the billing period, and in the amount of the monthly part for each month of the billing period, if the duration of the period for which they are accrued exceeds the duration of the billing period;

- remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event - regardless of the time the remuneration was accrued.

If the time falling within the billing period was not fully worked by the employee or time was excluded from it in accordance with clause 5 of Resolution No. 922, then bonuses and remunerations are taken into account when determining average earnings in proportion to the time worked in the billing period, with the exception of bonuses accrued for actually worked time in the billing period (monthly, quarterly, etc.).

If an employee has worked an incomplete working period for which bonuses and remunerations are accrued, and they were accrued in proportion to the time worked, then they are taken into account when determining average earnings based on the amounts actually accrued in the manner established by clause 15 of Resolution No. 922.

The average earnings that are retained by the employee are determined by multiplying the average hourly earnings by the number of working hours according to the employee’s schedule in the period that is subject to payment (example 2).

Example 2

An employee of the organization, who was assigned a summarized recording of working time, was on a business trip for 14 days (from May 12 to May 25, 2008).

According to Art. 167 of the Labor Code of the Russian Federation, when an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with the business trip.

Clause 9 of the Instruction of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions dated April 7, 1988 No. 62 “On business trips within the USSR” (applied to the extent that does not contradict the Labor Code of the Russian Federation) it is determined that the average earnings during the time an employee is on a business trip are retained for all working days of the week according to the schedule established at the place of permanent work.

In this example, according to the employee’s work schedule, during his business trip there are four 24-hour shifts.

Let’s assume that for the billing period (from May 1, 2007 to April 31, 2008), an employee received a salary in the amount of 120,000 rubles; in the billing period, the employee worked 1,500 hours.

Let's determine the average hourly earnings:

120,000 rub. / 1,500 hours = 80 rub.

Let's calculate the average salary that an organization is obliged to pay to an employee while on a business trip:

80 rub. × 24 hours × 4 shifts = 7,680 rub.

Let us note that previously, for the calculation of vacation pay and the amount of compensation for unused vacation for employees who have a summarized accounting of working time, the Government of the Russian Federation established a special procedure (paragraph 4 of clause 13 of the Regulations on the specifics of the procedure for calculating average wages (approved by a resolution of the Government of the Russian Federation dated April 11 2003 No. 213 “On the peculiarities of the procedure for calculating average wages”).

According to the Regulations on the specifics of the procedure for calculating average wages, vacation pay was required to be calculated based on average hourly earnings. To determine it, it was necessary to divide the wages actually accrued for the billing period by the number of hours actually worked during this period (including overtime). The result obtained should have been multiplied by the established number of hours in the working week and by the number of calendar weeks of vacation.

Based on the calculations, it turned out that the average hourly earnings of an employee who worked overtime and received increased wages for this were the same as the average hourly earnings of an employee who did not work overtime and received a much lower salary. In other words, an employee who worked more hours than established by law was deprived of part of the average earnings saved for the period of annual paid leave. Therefore, the Supreme Court of the Russian Federation recognized paragraph 4 of clause 13 of the Regulations on the specifics of the procedure for calculating average wages as ineffective from the date of its adoption (decision of the Supreme Court of the Russian Federation of July 13, 2006 No. GKPI06-637).

Article 139 of the Labor Code of the Russian Federation defines the following: currently, payment of vacations and payment of compensation for unused vacations to employees for whom summarized recording of working time is established is carried out in the general manner. According to this article, the average daily earnings are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days). Explanations on the procedure for paying vacations and paying compensation for unused vacations to employees for whom summarized working time recording is established are given in the letter of the Ministry of Health and Social Development of Russia dated August 27, 2007 No. 2608-17 (example 3).

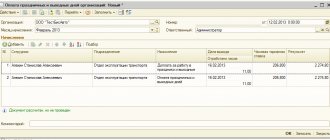

Example 3

From June 16, 2008, an employee of an organization who has a summarized recording of working time is granted leave of 28 calendar days. The employee worked out the billing period in full (from June 1, 2007 to May 31, 2008). Let’s assume that for the billing period the employee received a salary in the amount of 204,000 rubles. In the billing period, the employee worked 1,800 hours.

Let's determine the average daily earnings of an employee:

204,000 rub. / 12 / 29.4 = 578.23 rub.

Let's calculate the amount of vacation pay:

RUB 578.23 × 28 days = 16,190.44 rubles.

According to Art. 139 of the Labor Code of the Russian Federation, the employer has the right to calculate the average salary using not only the 12 calendar months preceding the period during which the employee retains the average salary, but also other periods. This provision must be reflected in the collective agreement or local regulatory act. However, if the employer uses this right, then each time when calculating average earnings, the organization’s accountant will need to check whether the employee’s situation has worsened, that is, make two calculations: taking into account a different period established by the employer’s document, and in the generally established manner. The employee of the organization is paid the greater of the calculated amounts.

Magazine “Personnel Solutions” No. 10 2008 #2081

V.V. Avdeev Source: Personnel Solutions Magazine

Payment for holidays with total accounting

According to Art. 153 of the Labor Code of the Russian Federation, work on a day off or a non-working holiday is paid at least double the amount.

Note!

When accounting for working hours in total, work on weekends and holidays is included in the monthly working time standard.

In order to correctly process wages on holidays and weekends, you need to determine whether the holiday is a working day according to the employee’s schedule or whether he should rest on this day. If this is a scheduled working day for an employee and he worked this day, as indicated by the mark “I” on the time sheet, then the additional payment for this day should be made in a single amount, since there are no special deviations for summarized accounting in Art. 153 of the Labor Code of the Russian Federation no.

That is, an employee, subject to a full work schedule, will receive wages calculated based on the hourly tariff rate or salary and an additional payment in the amount of a single rate for a holiday.

If a holiday is not a working day according to the schedule, but it is reflected in the timesheet as “RV” - the duration of work on weekends and non-working days, then the additional payment for this day should be made in double the amount in the current month.

In this case, the employee will receive wages calculated at the salary or hourly rate, and an additional payment in the amount of double the rate for a holiday.

Note!

When calculating overtime hours at the end of the accounting period, work performed on holidays in excess of the norm should not be taken into account, since it has already been paid in double amount (clause 4 of Explanation No. 13/P-21 “On compensation for work on holidays”).

Payment for night hours with total accounting

Night hours (from 22:00 to 6:00) must be taken into account separately and paid at an increased rate (Article 154 of the Labor Code of the Russian Federation). The minimum bonus for night work is 20% of the hourly tariff rate (official salary), calculated for each hour of night work.

The number of night hours worked is determined by the working time sheet (form T-12 or T-13). To reflect the hours worked at night on the timesheet, use the letter code “H” or the numeric “02” indicating the number of hours worked at night.

Example 4

The company has established a summarized recording of working hours for all employees. The billing period is one month. The working hours for individual employees (security guards, dispatchers, storekeepers) are every three days.

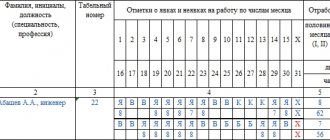

The working time sheet for April is presented in table. 4.

Let's calculate the salary of dispatcher V. G. Sokolov for April according to the work time sheet.

From the timesheet data it follows that in April the dispatcher worked 7 shifts of 24 hours each. The total time was 168 hours (7 shifts × 24 hours), including 56 hours of night work.

Work within normal limits. We pay extra for night work.

The hourly tariff rate for this specialist is 300 rubles. Night time surcharge - 20% of the hourly tariff rate.

Wages for April will be equal to:

168 hours × 300 rub. + (56 hours × 300 rub. × 20%) = 53,760 rub.

For your information

If during the accounting period both overtime and night work took place, then both overtime work and night hours are subject to payment at an increased rate, since this work is performed under conditions deviating from normal ones.

SCOPE OF APPLICATION

Summarized accounting can be established both for employees working under normal working hours, and for employees working part-time (shift) and (or) part-time, as well as for employees who have reduced working hours. As a rule, summarized accounting is used for shift work or flexible working hours.

It should be taken into account that, without fail, the summarized recording of working time is applied only when working on a rotational basis (Article 300 of the Labor Code of the Russian Federation).

How to calculate vacation pay if an employee was sick, studied or was on vacation at his own expense

In practice, you rarely encounter textbook situations when you only need to know your salary to calculate vacation pay.

For vacation pay, the calculation period is 12 months preceding the vacation. At this time, the employee could take sick leave, go on study leave, or take a few days at his own expense.

In these cases, the time the employee was away from work must be subtracted from the billing period. And from the total amount of payments you need to subtract payments for the time of absence.

In Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages” you can see the list of payments that are excluded. These are periods when an employee:

- was on annual main, additional or study leave;

- received sick leave benefits;

- received maternity benefits;

- was on vacation at his own expense;

- received additional paid days off or days off to care for disabled children and people with disabilities since childhood;

- did not work due to downtime due to the fault of the employer;

- received time off, etc.