It is not so easy to distinguish an employment agreement from a form of a civil law nature in practical work.

Especially if, by agreement of the parties, the subordinate was given a standardized task and the condition of his payment based on the final result and the actual completion of the amount of work.

For this reason, employers often make legal mistakes , which can lead to significant material losses.

Analysis of civil agreements leads to the conclusion that they are concluded for the performance of services or specific work , which to a certain extent brings them closer to related employment contracts. Both forms are considered paid , providing for payment for the amount of work performed.

Legislation provides an entrepreneur who uses hired labor with the opportunity to choose between a civil contract and an employment contract. To avoid mistakes and disputes with the tax office , you need to know what their differences are and evaluate their advantages and disadvantages for different situations.

Features of each type of agreement

By signing a civil contract, the Contractor, who undertakes to perform the agreed type of work, does not receive some guarantees that he could count on under the labor form of the agreement. Basic rights :

- Salary payment 2 rubles/month . and more often.

- Salary in the form of vacation pay with reservation of a workplace.

- Payment of travel expenses and leaving the employee in his place when sent on a business trip.

- Providing leave with workplace reservation

- Guarantee after termination of employment in the form of severance pay and the priority right to remain in the company.

- Payment of sick leave.

- Compensation of costs when operating own funds .

Why is it so important to choose the right way to design a performer? Illiterate qualifications can have the most unpredictable consequences for the Employer. For example, if a civil law agreement was drawn up where a labor agreement should be concluded, then the court may intervene to reclassify the agreement.

For the Employer, this means paying a salary no less than the minimum amount approved by the state, including the performer on the staff, compensation for moral damage and payment of legal costs . In addition, tax (FSS and penalties) is also required.

Common mistakes: how to avoid getting fines

Now you can imagine the difference between an employment contract and a GPC contract. What typical mistakes lead to violations, fines, additional charges and other problems?

Most civil law contracts are reclassified as labor contracts, because the employer simply replaces one with the other, without making any distinction:

- Staff salaries and settlements with performers and contractors on the same days.

- Working hours, work standards, and both workers are equally controlled (some manage to give contractors local company regulations to sign - regulations on business trips, for example).

- The employer’s staff voluntarily and forcibly resigns and GPC agreements are immediately concluded with them.

- The tasks of full-time employees and invited employees are the same (for example, the functions specified in the job description are similar to clauses in a contract).

- There are no specifics in the terms of the deal. In the text of the agreement on provision, instead of “preparation of reports for the 3rd quarter of 2021”. This means that it is impossible to submit a specific result.

- Constant re-signing of contracts for the same or similar works/services. For example, an installer works for a month at a site, receives payment, and again a contract is signed with him for the same project, for the same period, and so on throughout the year.

Don’t make these mistakes, be careful about paperwork. When checking, be prepared to clearly answer questions, and employees should also be ready to give their comments. Sometimes employees and performers do not understand the difference between contracts or have incorrect information. Give them explanations and instructions, especially before the upcoming inspection. Some people are intimidated by inspectors and become nervous. Explain that there is nothing wrong with the inspection - this is a normal procedure.

Fundamental differences between forms

In order to decide in time which type of agreement is better to conclude, you need to study the main features by which they can be compared.

According to the labor version of the document, an employee can personally perform the duties of an accountant or electrician, and not the scope of work . A mandatory point is compliance with the labor regulations existing in the company.

Under a civil agreement, the Contractor assumes responsibility for performing the agreed amount of work . He organizes his working time and space himself and is not subject to any other rules. The phrase in the contract “obliged to comply with internal regulations” can have negative consequences .

In the labor form of relations, specialists are considered subordinate to the employer within the framework of their job responsibilities. equal parties works .

The labor option requires the Employer to regularly pay a salary of 2 rubles per month in accordance with the schedule.

The civil law document does not provide for such liability ; the payment procedure is determined by the parties.

In labor relations, a specialist has his own function.

Alternatively , the document assumes obtaining the planned result from the execution of the order. The phrase “performs the functions of an economist in the organization” in this document is incorrect.

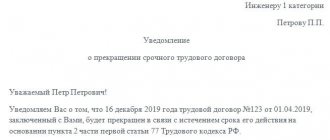

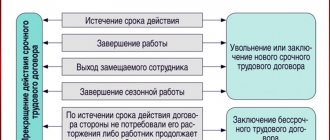

A fixed-term employment contract is only in some cases. Most often, it is indefinite . A civil agreement is concluded for a limited time or until a material result appears.

So, if the Employer intends to choose the civil form of the document, it is worth checking whether it contains any “pitfalls” ─ provisions similar to the wording of the employment contract.

The unclear description of the subject of the agreement must be reformulated, phrases like “payment in accordance with the staffing table” must be replaced with more correct ones . Otherwise, there is a possibility that the contract will be recognized as an employment contract in the courts.

Judicial practice in cases arising from preliminary agreements

So, a sample employment contract. It has already been indicated that there are many disputes regarding this type of transactions in the courts. But something else follows from this: extensive practice in the authorized body regarding decisions made on such disputes. This can also include labor disputes. At the same time, the position of the courts is ambiguous and when concluding a preliminary agreement, it is necessary to pay special attention to the methods of notification in the event of one participant’s refusal to conclude the main document .

In addition, it is worth paying attention to the procedure for terminating the preliminary agreement, as well as the provisions regarding liability in case of failure to fulfill obligations under the preliminary and main agreement.

Disadvantages and advantages of an employment contract

We note the advantages and disadvantages of drawing up an employment contract for the Employer.

Pros:

- The employee complies with labor regulations , otherwise penalties are applied to him, including dismissal.

- When an employment contract is drawn up with, there are options for calculating unified social tax . The position of the tax authorities is that UST payments for individual entrepreneurs are made by the Employer. But according to 235 of the Tax Code of the Russian Federation, an individual entrepreneur is a taxpayer, and the object of taxation here is income from business or other activities, which gives him the right to pay the unified social tax personally.

Minuses:

- The need to pay wages taking into account the minimum wage and the stipulated deadlines for employees who fulfill the labor standard and have worked the specified number of hours.

- Registration of a specialist on the staff of the enterprise with adjustment of the staffing table . Changes must be agreed upon with the trade union body of the team (if there is one in the company).

- The right to severance pay (after dismissal), salary, paid leave (including special leave for employees with children), overtime pay.

- Creating conditions to carry out his functions without distracting him from fulfilling contractual obligations.

- Maintaining documentation about personnel and submitting reports to regulatory authorities (FSS of the Russian Federation, Pension Fund of the Russian Federation, Compulsory Medical Insurance Fund of the Russian Federation, State Statistics Committee of the Russian Federation) with payment of insurance premiums .

For an employee, the specifics of registration under an employment contract are different.

Pros:

- The right to pay wages on time and taking into account the minimum wage prescribed by the Federal Law when fulfilling the plan or functional duties.

- Right to full-time employee status.

- guarantees : payment of benefits upon dismissal, salaries from 2 rubles per month, guarantees for employees with children, payment of vacation pay and overtime, etc.

- Providing the conditions that a subordinate needs to perform functional duties.

- Social insurance law .

- Guarantees of length of service for the transition to a retirement pension.

Minuses:

- Obligation to adhere to internal rules . If it is violated, the employer has the right to discipline or dismissal.

- For the salary amount is not subject to Unified Tax at the rate of 35.6%, existing for the Employer, the individual entrepreneur himself pays Unified Tax (13.2%).

Sample employment contract.

Advantages and disadvantages

Now let's highlight the strengths and weaknesses of each of the agreements. Let's start with the labor document (TD) and see what it looks like from the employer's point of view:

Pros of TD

- Clear legislative regulation . The Labor Code clearly sets out the basic rules for working under a contract, including for various categories of workers. Whatever you specify in the agreement with the employee, if it contradicts the Labor Code, then the provisions of the code will take precedence.

- Consistency . A staff member usually comes with the mindset of long-term cooperation; he is attracted by regular payment, social guarantees, official pension contributions, career growth and other benefits.

- Control . The employer controls the activities of the staff.

- Possibility of planning . Typically, an organization or individual entrepreneur has a clear staffing schedule, which allows you to plan expenses for wages and contributions for a long period (even taking into account salary indexation).

Disadvantages of TD

- Bureaucracy . Accounting and HR departments will never be left without work. Registration of each employee, from hiring to dismissal, is an endless string of papers.

- Employer insecurity . In most cases, according to the law, the employee is right. In disputes, the labor inspectorate and the court take his side. This is despite the fact that some “personnel” abuse their rights, and the employer is the injured party.

- Social Security . For the employer, the burden in the form of social guarantees means additional costs. For example, compensation for travel to a vacation spot for workers in the Far North. The wages themselves are also quite strictly regulated (the minimum wage is established, the contract determines the exact days of payment).

- Reporting . A sore subject for any accountant. Duplicate data, constantly updated forms, changing interpretations of legislation. The latest “favorites” are the monthly SZV-M and the confusing 6-NDFL. Next year we will have another innovation in the form of SZV-TD, which will contain data on personnel movements.

- No sanctions . Or rather, they exist to some extent and are spelled out in Article 192 of the Labor Code of the Russian Federation “Disciplinary sanctions”. There are only three main ones: reprimand, reprimand, dismissal. Did you feel scared? Well, the workers aren’t too scared of them either. No fines can be imposed. Some people think that an employee can be deprived of a bonus, but this is not so. You can not accrue and, accordingly, not pay a premium if some conditions for its calculation are not met. Let's say the required number of hours was not worked, the production standard was not achieved, the sales plan was not successful.

Let's move on to the civil contract. What pitfalls does it hide and why is everything not as rosy as employers imagine?

pros

- Simplicity . It’s easy to draw up the document itself; there are plenty of examples on the Internet. It is necessary to take into account certain nuances; it would be nice if the text was prepared by a lawyer, but this is not necessary. Some specialists come with a ready-made sample contract; the main thing is to read it carefully.

- Flexibility . The Civil Code establishes the basic rules, the foundation for the transaction. You can write down the details in the contract; everything is decided by the will of the parties. Does the performer want to receive Japanese yen as payment? Sure, not a problem!

- Sanctions. Here they can be established - fines, penalties, penalties. For late payment, violation of deadlines for delivery of work, incomplete provision of services, etc.

- Lack of social services . The customer should not pay the performer/contractor for sick leave, vacation, or provide other benefits under the Labor Code.

Note! If the GPC agreement includes a clause on the payment of contributions for injuries, then if a work-related injury occurs, the contractor is entitled to payments from the Social Insurance Fund.

- Documentation . The transfer documentation usually contains only the act. Other documents - plans, diagrams, estimates - are drawn up as necessary.

- Controversy . To resolve conflicts that arise, the parties usually resort to negotiations; if they fail, they go to court. The customer and the contractor are in an equal position before the law.

Minuses

- Lack of versatility . If we are talking about different works and services, then a separate contract will have to be drawn up for each, taking into account the specifics of a particular activity.

- Impermanence . The contractor may fulfill his contract and not continue cooperation, even if you are interested in him. He may decide to stop working, pay the penalty (if he pays) and walk off into the sunset, and you will have to look for another contractor. There are scammers who provide false information - their goal is to get an advance, create the appearance of activity and disappear without a trace. Yes, this also happens.

- Price . The cost is often set not by the customer, but by the contractor/performer himself. We are talking about competition in the market - you don’t have the means to buy the services of a highly qualified specialist, you can pay less, but most likely the work will be done by a non-professional.

Advantages and disadvantages of a civil agreement

Pros:

- The contractor is interested in the result, so he creates the place, time of work, and methods for completing the order himself . If there are no other terms in the contract, he uses his own material.

- UST, in particular, the Social Insurance Fund tax is not charged

- There are no guarantees of the Labor Code of the Russian Federation.

- Salary insurance contributions are not charged unless otherwise indicated in the papers.

- Payment of monetary compensation is carried out upon completion of the work (advance is possible) in accordance with the amount specified in the contract based on the results.

Minuses:

- The contractor cannot be held accountable for ignoring internal regulations, since work regulations are not provided for in this form of contract.

- The risk of recharacterization of the contract if law enforcement agencies can reveal that in fact the relationship is regulated by a related labor analogue (Article 11 of the Labor Code of the Russian Federation).

- If a citizen has not registered as a legal entity, there is a risk of being held accountable before the law for unauthorized activities.

Read more about how a civil contract with a foreign citizen is concluded here.

When does a civil contract become an employment contract? The civil legal form of the document provides for the reduction of unified social tax for a fee. Do tax authorities have the right to re-qualify the agreement? It is impossible to collect tax from a company unconditionally if its payment is conditioned by changes :

- qualifications of transactions concluded with third parties ;

- qualifications of status and nature of activity.

If the tax additional charge is caused by a change in the qualifications of transactions or the status and nature of its activities, the collection of additional amounts from the enterprise can only be carried out in court .

The results of an on-site tax audit, if inspectors require civil documents , are not grounds for making a demand for voluntary payment of tax. Collection is possible only through the court with all formalities. In judicial practice, cases of tax collection when recharacterizing contracts are extremely rare .

Sample civil agreement.

We suggest that you familiarize yourself with the following materials: on the additional agreement to the employment contract, on the collective labor contract, on the quota of jobs for disabled people and on the features of their registration, on the probationary period under the labor code, on the extension of a fixed-term employment contract and the contract with a minor employee.

The legislative framework

To determine the content of the GPC agreement, one should be guided by Chapters 37 and 39 of the Civil Code of the Russian Federation, and not by the Labor Code (Article 57 of the Labor Code of the Russian Federation). Accordingly, terms such as “employee” and “employer” cannot be indicated in the text of the agreement, since they are used in labor law.

Instead of these terms, such terms as “customer”, “performer”, “contractor” should be used. In addition, the contract should not indicate the word “salary” as payment; instead, “remuneration” should be indicated. Also, terms such as "working time", "rest time" or "vacation" cannot be used (

Ratio table

How does an employment contract differ from a civil contract? It is convenient to summarize all the arguments in a table.

| Civil agreement | Employment contract | |

| 1.Sides | ||

| Contractor/Customer | Employee/Employer | |

| 2. Relations of the parties | ||

| Equality between the Contractor and the Customer | Subordination of the hired employee to the rules of the enterprise | |

| 3. Functions | ||

| Work specifically defined in the contract, when the main emphasis is on its result, and not on the process. The contractor manages his own time, without recognizing the employer’s labor regulations (unless the agreement contains other information on this matter). | Responsibilities performed personally by a specialist, taking into account the company’s labor regulations. | |

| 4. Payment terms | ||

| The amount and procedure for receiving financial compensation are determined by the parties by agreement. Typically, funds are paid based on the results of the work done. Issuing an advance does not change the nature of the transaction, since it can be returned. | The employee receives salary at least 2 times a month. Payments must be strictly on schedule, taking into account the minimum wage established by law. | |

| 5. Validity period | ||

| When drawing up a contract, the exact deadline or time until the planned result is achieved | Both fixed-term and permanent agreements are available | |

| 6. Statement of the subject of the agreement | ||

| The subject of the agreement is clearly defined: a specific type of work with a detailed description of the desired result. | Labor function: work in a position in accordance with the staffing table, professional training, specialty and qualifications; a certain type of order. | |

| 7. Social guarantees | ||

| The contractor can count on receiving the guarantees specified in the agreement. | The employee receives all the guarantees provided for by the Labor Code:

| |

| 8. Paying taxes | ||

| If the other party is an individual, the Employer pays the unified social tax for him (contributions to the Pension Fund and the Health Insurance Fund). Payment of contributions to Social Security is stipulated in the contract as a separate clause. | According to tax legislation, the Employer pays the unified social tax to the Social Insurance Fund, the Pension Fund and the Medical Insurance Fund. | |

| 9. Payment of taxes by the Employer for individual entrepreneurs | ||

| If the Contractor is an individual entrepreneur, payment for his work is not subject to unified social tax, unless there is another note in the agreement. | The employee’s status as an individual entrepreneur does not play a role for the Employer: in labor relations he acts as an individual. | |

| Positive aspects for a leader | ||

| 1. There are no UST charges if there are no other conditions in the documents. 2. There is no obligation to comply with the guarantees specified in the ToR. | 1. The employee is obliged to comply with the internal rules of the organization. 2. You can apply penalties, up to and including dismissal, without applying fines. | |

| Negative aspects for a manager | ||

| 1. There is a possibility that the court will recognize the contract as an employment contract if there is evidence that the document actually regulated labor relations. 2. Tax authorities have the opportunity to re-qualify the agreement for payment of unified social tax and recovery of additional charges through the court. | 1. Timely payment of wages, taking into account the minimum wage. 2. Mandatory inclusion of a newcomer on the staff with all clarifications included in the staffing table. 3. Providing guarantees under the Labor Code. 4. Maintaining documentation on personnel and reporting to the FSSRRF, PFRF, FOMSRF, State Statistics Committee. 5. Payment of contributions under the Unified Social Tax. | |

At what point should I apply?

The agreement is concluded in writing. The document is drawn up in two copies, which are signed by the parties. The organization is developing an example of an employment contract, which is filled in with the employee’s data and submitted for signature. One copy remains with the employee, the second - with the employer. The fact that a copy of the document was handed over to the employee must be confirmed by his signature on the copy that belongs to the employer.

If the document is not executed in writing, but the employee is allowed to work, and the employer knows about this, the latter is obliged to prepare the document in writing within three working days from the moment the person is allowed to work.

Use the employment contract designer from ConsultantPlus to avoid mistakes and break the law.

to work with the service.

Indicators

According to the Labor Code of the Russian Federation, agreements between an employee and an employer (legal entities or individual entrepreneurs employing the labor of hired persons) are formalized by an employment contract.

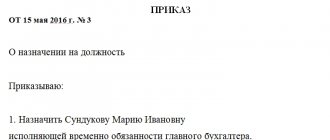

Admission is carried out upon the personal application of the employee, listing his job responsibilities in the order and recording the fact of admission in the work book.

As a rule, they are hired according to the staffing table, but there may be exceptions when an employee is hired for a non-staff position.

Regulatory acts establish working conditions that a manager must create for a subordinate, using his workforce in accordance with his qualifications and position. According to the Labor Code of the Russian Federation, remuneration depends on labor contribution and quality of work. To calculate it, tariff rates .

hire non-employees to perform certain jobs

With their own forces and means, at their own risk, independently choosing ways to implement the subject of the contract , the other party undertakes to produce a certain thing or perform a volume of work. She is responsible for the inadequate quality of the materials and equipment provided to him.

Audit statistics show that partial accrual of contributions to the Payroll Fund (except for the Social Insurance Fund) is explained by the existence of labor agreements with subordinates, believing that these documents can be considered civil contracts . Such contracts, provided for by the Civil Code of the Russian Federation, must be distinguished from labor analogues regulated by the Labor Code of the Russian Federation.

A civil law contract in the sphere of labor is concluded when there is no position in the staffing table to perform the necessary work, it is not typical for a given enterprise, and is not permanent for the employer who needs it. Failure to comply with labor laws can have unpleasant consequences (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- a fine on an official for substitution in the amount of 5-50 minimum wages.

- Disqualification for 1-3 years (for repeated violation of a similar type).

Clarify your relationship with your employer

Do you constantly provide services of any kind in the office for eight working hours? Have you signed an agreement and submitted your work book to the accounting department? This does not mean that an employment contract has been concluded with you.

How to check it:

- Study your copy of the contract, check the title and all terms. If you do not have this document, request it from your employer.

- Ask the accounting or human resources department for a copy of your work record. There should be a record of employment there.

If the contract turns out to be not an employment contract, try to agree on re-issuing the document. If the employer does not agree, contact the labor inspectorate or a lawyer. Be sure to save your job descriptions, training certificates, passes - they will confirm that you really worked for the company and did not provide one-time services.