How to fill out 2-NDFL for 2021?

The 2-NDFL sample is a document filled out in accordance with the Recommendations for filling out the 2-NDFL form, approved by Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] (hereinafter referred to as the 2-NDFL Form Recommendations) .

At the same time, the Federal Tax Service has its own form, and for issuing it to the employee, its own. IMPORTANT! From 2021, the deadline for submitting 2-NDFL certificates has been postponed from April 1 to March 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation as amended by Law No. 325-FZ of September 29, 2019). 03/01/2021 - working Monday. This means there will be no transfers.

Certificate 2-NDFL - see sample below - is filled out separately for each person receiving income from a tax agent. At the same time, sample 2-NDFL certificate simultaneously contains information on all tax rates, if in a given reporting period the taxpayer received income taxed at different rates. Sections must be completed sequentially for each bet.

From 2021, the 2-NDFL certificate, as an independent report, has been cancelled. For reporting for the 1st quarter of 2021, information from the certificate is submitted as an appendix to Form 6-NDFL (Federal Tax Service order No. ED-7-11 dated October 15, 2020 / [email protected] ).

This application will be submitted both as information about the income of individuals and personal income tax withheld from them, and as a message about the impossibility of withholding tax (that is, instead of 2-personal income tax with sign 2).

Important! For the first time, you will need to submit 2-NDFL as part of the 6-NDFL calculation at the end of 2021. For 2021, we submit 2-NDFL certificates in the same old way - separately from 6-NDFL on the form from the Federal Tax Service order dated 10/02/2018 No. ММВ-7-11/ [email protected] This will help you fill out and submit 2-NDFL certificates for 2020 Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Also read the material “Where you can get (get) a 2-NDFL certificate .

Section 5

In section 5, reflect the total amount of income and tax at the end of the year.

Please complete this section separately for each tax rate. The order of filling in the relevant fields is given in the table.

| Field names | What to indicate | |

| Help with sign 1 | Certificate with sign 2 (message about the impossibility of withholding tax) | |

| "Total Income" | The total amount of income at the end of the tax period. To do this, add up all the income specified in section 3. Do not include tax deductions specified in sections 3 and 4 in this indicator | The total amount of income from which tax was not withheld |

| "The tax base" | The tax base from which the tax is calculated. To do this, you need to subtract from the indicator reflected in the “Total amount of income” field the amount of all tax deductions that are reflected in sections 3 and 4 of the 2-NDFL certificate | Tax base for tax calculation (if the total amount of accrued income is subject to reduction by the amount of deductions) |

| "Tax amount calculated" | The amount of tax calculated. To do this, multiply the tax base by the rate specified in section 3 | The amount of tax that you calculated but did not withhold |

| “Amount of fixed advance payments” | The amount of fixed advance payments by which the tax should be reduced | 0 |

| "Tax amount withheld" | The amount of tax you withheld from the employee's income | 0 |

| “Tax amount transferred” | The amount of tax you paid for the year | 0 |

| “Amount of tax over-withheld by the tax agent” | The amount of tax withheld in excess not returned by the tax agent, as well as the amount of overpayment of tax that arose in connection with a change in tax status | 0 |

| “The amount of tax not withheld by the tax agent” | The calculated amount of tax that the tax agent did not withhold in the tax period | |

If there are foreign employees who work under a patent, fill out the field “Notification confirming the right to reduce tax on fixed advance payments.” Indicate the details of the notification received and the code of the Federal Tax Service that issued this document. If you do not have such a notification, you do not need to fill out this field.

Situation: how to fill out a 2-NDFL certificate if wages were accrued in the reporting period but not paid?

This salary should be reflected in the 2-NFDL certificate according to the general rules. Only section 5 needs to be completed in a special way.

Whether the salary was paid or not does not matter for the 2-NDFL certificate. In any case, wages become income on the last day of the month for which they are accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, in form 2-NDFL, reflect:

- the month for which the salary was accrued, the code and amount of such income - in section 3;

- deductions - in section 4.

In section 5, accrued but unpaid wages must be reflected only in the lines “Total amount of income”, “Tax base”, “Calculated tax amount”. And fill in the lines “Amount of tax withheld” and “Amount of tax transferred” depending on whether you managed to pay the salary before submitting the certificate or not. This is due to the fact that the amounts of withheld tax are reflected in the tax period for which the tax was calculated. Such clarifications are contained in letters of the Federal Tax Service of Russia dated March 2, 2015 No. BS-4-11/3283 and dated January 12, 2012 No. ED-4-3/74.

The salary was issued before the certificates were submitted. If the salary was issued before submitting the 2-NDFL certificate, then include the amount of tax transferred to the budget after the end of the reporting year in the lines “Amount of tax withheld” and “Amount of tax transferred” of the 2-NDFL certificate for that year.

For example, the company paid wages for December only on January 10 of the following year. The withheld tax was transferred to the budget the next day - January 11. In the 2-NDFL certificates, the accountant indicated this amount in section 5, including in the lines “Amount of tax withheld” and “Amount of tax transferred.” Although the tax was actually paid after the end of the reporting year.

The salary was paid after the certificates were submitted. If the salary was paid after the organization submitted 2-NDFL certificates for the reporting year to the inspectorate, you will have to draw up and submit updated certificates.

For example, as of the date of filing 2-NFDL, the company still had not paid wages for November of the reporting year. Therefore, in section 5 of the certificate, the accountant showed the amount of income and the tax calculated on it. But I did not include this tax in the lines “Amount of tax withheld” and “Amount of tax transferred”. Salaries were paid in June. The accountant submitted updated certificates to the tax office, adding the amount of withheld and transferred tax to the appropriate lines.

All indicators in the certificate (except for the personal income tax amount) should be reflected in rubles and kopecks. Show the tax amount in full rubles (discard amounts up to 50 kopecks, round up amounts of 50 kopecks or more). This procedure follows from the provisions of paragraph 6 of Article 52 of the Tax Code of the Russian Federation and is confirmed by letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-3-11/4997.

If the certificate cannot be placed on one page, fill out the required number of pages. On the next page at the top of the certificate, indicate the serial number of the page and the duplicate heading “Certificate of income of an individual for the year 20__ No. ___ from ________.”

In this case, the “Tax Agent” field must be filled in on each help page.

This is stated in the Procedure approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485.

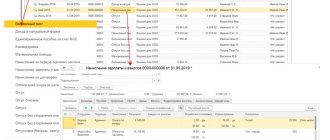

An example of a certificate of income in form 2-NDFL

A.S. Kondratyev works as an economist in the organization. His details: Alexander Sergeevich Kondratyev, citizen of the Russian Federation, date of birth - April 15, 1978, passport series 46 00 No. 462135 issued by the Voikovsky police department of Moscow on November 23, 2000, registered at the address: 125127, Moscow, st. 2-ya Radiatorskaya, 5, building 1, apt. 40, TIN 703254479214.

The organization is registered for tax purposes with the Federal Tax Service No. 43 for the Northern Administrative District of Moscow (Koptevo municipal district). OKTMO code – 453410000. INN 7708123456, checkpoint 770801001. Head of the organization – Alexander Vladimirovich Lvov, tel..

In 2015, Kondratiev’s monthly salary was 19,200 rubles. In July 2015, Kondratiev took annual paid leave and was paid vacation pay in the amount of 17,300 rubles. (and the salary for the time actually worked in July is 1800 rubles).

Kondratiev is married and has a five-year-old son. In this regard, throughout 2015 he was provided with a standard tax deduction of 1,400 rubles. per month (subclause 4, clause 1, clause 2, article 218 of the Tax Code of the Russian Federation). Kondratiev has no rights to other standard deductions.

In October 2015, Kondratiev bought an apartment in Kolomna, Moscow Region, worth RUB 1,340,000.

In November, Kondratyev submitted to the organization’s accounting department:

- an application requesting a property tax deduction in connection with the purchase of an apartment;

- notification No. 3752/07 dated October 30, 2015, issued by Interdistrict Inspectorate of the Federal Tax Service No. 7 of Kolomna, Moscow Region, confirming the right to a property tax deduction in the amount of RUB 1,340,000. (in the amount of the actual cost of the apartment, but not more than 2,000,000 rubles) (subclause 2, clause 1, article 220 of the Tax Code of the Russian Federation).

Based on these documents, the organization provided the employee with a property deduction for income received by him since November 2015. At the same time, the organization did not return the personal income tax withheld before receiving an application for a property deduction from the employee.

Until the end of the tax period (for November and December), the organization provided Kondratyev with a property tax deduction (including standard deductions) in the amount of 35,600 rubles. (19,200 rubles – 1400 rubles + 19,200 rubles – 1400 rubles) (clause 3 of article 220 of the Tax Code of the Russian Federation).

Thus, Kondratiev’s total tax base for 2015 amounted to 177,900 rubles. (19,200 rubles × 11 months + 1800 rubles + 17,300 rubles – 1400 rubles × 12 months – 35,600 rubles). The amount of tax withheld was RUB 23,127.

On March 27, 2021, the accountant submitted a certificate of Kondratiev’s income for 2015 to the inspectorate.

Situation: how to reflect in the 2-NDFL certificate the refund of the amount of tax that was excessively withheld in the expired tax period from the income of a dismissed employee? The amount of the overpayment was returned to the employee in the current year at the expense of personal income tax withheld from the income of other employees.

The return of the excessively withheld amount of personal income tax is not reflected in the 2-NDFL certificate. It is enough for the tax agent to clarify the tax obligations of the dismissed employee. To do this, you must submit an updated 2-NDFL certificate to the inspectorate for the expired tax period.

If an employee’s tax obligations decrease, the information reflected in the previously submitted Form 2-NDFL distorts the real state of settlements with the budget. Therefore, in the updated certificate, correct the necessary data (for example, the amount of income or tax base).

Please provide information about the correct tax amount:

- on the line “Calculated tax amount”;

- on the line “Amount of tax withheld”;

- on the line “Tax amount transferred”.

In this case, in the line “Amount of tax transferred” it is necessary to reflect not the actual amount of personal income tax transferred, but the amount of tax to be paid to the budget after the employee’s tax obligations have been clarified.

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated September 13, 2012 No. AS-4-3/15317.

As a result of the corrections made in the personal account card of the organization (tax agent), an overpayment of personal income tax will be generated. However, this overpayment will be compensated by personal income tax, withheld from the income of other employees, but not transferred to the budget in connection with the return to the dismissed employee.

An example of filling out an updated 2-NDFL certificate when returning tax that was excessively withheld from the income of a dismissed employee in the expired tax period

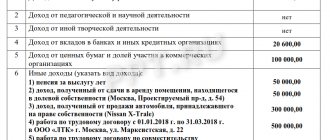

Seller N.I. Korovina left the organization in November 2015. For the period of work in 2015, she accrued income in the amount of 125,000 rubles, from which personal income tax was withheld in the amount of 16,250 rubles.

In 2021 (after submitting information on form 2-NDFL), the Hermes accountant discovered that when calculating personal income tax, the standard tax deduction for a child was not taken into account (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation), which was due to Korovina in 2015 . The overstatement of the tax base amounted to 16,800 rubles. (RUB 1,400 × 12 months), the amount of excess tax withheld is RUB 2,184.

According to Korovina, this amount was transferred to her account at Sberbank. The source for the refund was the personal income tax amounts withheld in 2016 from the income of other employees of the organization.

The organization's accountant recalculated Korovina's tax liabilities and submitted an updated certificate 2-NDFL for 2015 to the tax office.

In section 4 of Korovina’s updated income statement for 2015, the accountant indicated:

- deduction code – 114;

- deduction amount – 16,800 rubles.

In section 5, the accountant reflected the following data:

- on the line “Total amount of income” - 125,000 rubles;

- on the line “Tax base” – 108,200 rubles;

- on the line “Calculated tax amount” – 14,066 rubles;

- on the line “Amount of tax withheld” – 14,066 rubles;

- on the line “Tax amount transferred” – 14,066 rubles.

In the lines “Amount of tax excessively withheld by the tax agent” and “Amount of tax not withheld by the tax agent,” the accountant entered zeros.

Situation: how to fill out section 5 of the certificate in form 2-NDFL if the calculated amount of tax was not fully withheld from the employee?

Fill out this section, guided by the Procedure approved by Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485, and clarifications of regulatory agencies.

If during the tax period the tax agent was unable to fully withhold personal income tax from the income paid, he must transfer the amount of the taxpayer’s debt for collection to the tax office. To do this, within one month from the end of the tax period (before March 1 of the next year), you need to send a written notification to the taxpayer and to the tax office at the place of registration of the tax agent (clause 5 of Article 226 of the Tax Code of the Russian Federation).

As a notification, use form 2-NDFL (clause 2 of the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485). When filling out the form, in the “Attribute” field, indicate the number 2 (clause 5 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 27, 2011 No. 03-04-06/8-290). Enter the amount of debt in the line “Amount of tax not withheld by the tax agent” of form 2-NDFL.

If a tax agent has provided information about the impossibility of withholding personal income tax, this does not relieve him of the obligation to submit certificates in Form 2-NDFL at the end of the tax period (letters of the Federal Tax Service of Russia dated October 29, 2008 No. 3-5-04/652 and dated September 18 2008 No. 3-5-03/513). Therefore, the amounts of income and calculated tax (including unwithheld tax), which were previously reflected in certificate 2-NDFL with sign 2, should be indicated in annual certificates with sign 1 (letter of the Ministry of Finance of Russia dated October 27, 2011 No. 03-04- 06/8-290).

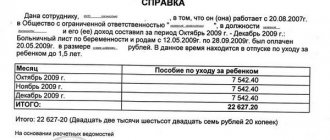

An example of filling out section 5 of the certificate on form 2-NDFL. The organization transfers the incompletely withheld amount of personal income tax for collection to the tax office

The total amount of salary accrued to economist A.S. Kondratyev in 2015, amounted to 144,000 rubles. In December 2015, at the employee’s request, the organization paid for his tourist trip. Kondratyev’s additional income received in kind amounted to 60,000 rubles.

Kondratyev is a disabled person of group II, so in 2015 he was entitled to a standard tax deduction in the amount of 500 rubles. per month. Thus, the total amount of personal income tax calculated from Kondratiev’s income for 2015 is equal to: (144,000 rubles – 500 rubles × 12 months + 60,000 rubles) × 13% = 25,740 rubles.

As of January 1, 2021, the organization was able to withhold personal income tax from Kondratiev’s salary only in the amount of 17,940 rubles. On January 1, 2016, Kondratiev resigned. The organization submitted the difference between the calculated and withheld tax amount to the tax office for collection.

In section 5 of Kondratyev’s income certificate for 2015, which the organization submitted to the inspectorate by March 1, 2021, the accountant reflected the following data:

- on the line “Total amount of income” – 60,000 rubles;

- on the line “Tax base” – 60,000 rubles;

- on the line “Calculated tax amount” - 7800 rubles;

- on the line “Amount of tax not withheld by the tax agent” - 7800 rubles.

In the “Sign” field of Section 1 of the income certificate, the accountant indicated the number “2”, since the tax agent reports the impossibility of withholding personal income tax.

The same data was included in the indicators of the 2-NDFL certificate, which the organization submitted to the tax office by April 1 with attribute 1. Section 5 of this certificate for Kondratiev reflects the following data:

- on the line “Total amount of income” - 204,000 rubles;

- on the line “Tax base” – 198,000 rubles;

- on the line “Calculated tax amount” - 25,740 rubles;

- on the line “Amount of tax withheld” – 17,940 rubles;

- on the line “Tax amount transferred” – 17,940 rubles;

- on the line “Amount of tax not withheld by the tax agent” - 7800 rubles.

Situation: how to fill out section 5 of the 2-NDFL certificate for a foreign employee working under a patent?

Fill out Section 5 of the 2-NDFL certificate in the general manner. Indicate the amount of fixed advances on the patent by which you are reducing the tax in the line of the same name. If its value exceeds the amount of calculated personal income tax, then enter zeros in the lines “Amount of tax withheld” and “Amount of tax transferred.”

This follows from the 2-NDFL form itself and the Procedure for filling it out, which were approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485.

An example of how to fill out a 2-NDFL certificate for a foreign employee working under a patent

Citizen of Moldova A.S. Kondratyev paid for a patent to conduct labor activities in Moscow in the period from January 1 to December 31, 2015. The amount of the fixed advance payment for personal income tax was 48,000 rubles. (4000 rubles × 12 months).

On January 15, 2015, Kondratyev got a job under an employment contract at Alpha LLC. His salary is 30,000 rubles. For the time actually worked in January, Kondratiev was accrued 22,000 rubles. Kondratiev does not have the right to standard tax deductions.

On the day of employment, Kondratiev wrote an application to reduce personal income tax by the amount of fixed payments paid and presented a receipt confirming payment of the tax. On the same day, Alpha sent an application to the tax office to issue a notice confirming the right to a tax reduction. On January 20 we received a notification.

Starting in January, Alpha’s accountant reduces personal income tax from Kondratiev’s salary by the amount of fixed advance payments.

The total amount of personal income tax on Kondratiev’s income for the year was 45,760 rubles. The amount of advance payments exceeds this amount, but is not accepted for offset or refund (Clause 7, Article 227.1 of the Tax Code of the Russian Federation). Therefore, when calculating the personal income tax to be withheld, the Alpha accountant reduced the tax amount by only 45,760 rubles. Rights to return or offset the difference RUB 2,240. (48,000 rubles - 45,760 rubles) Kondratiev does not have.

Monthly calculations of the tax base and the amount of personal income tax to be withheld are in the table.

| Month | Income | Personal income tax accrued from monthly salary | Personal income tax accrued from wages on an accrual basis | Personal income tax to be withheld (taking into account the fixed payment paid) |

| January | 22,000 rub. | 2860 rub. (RUB 22,000 × 13%) | 2860 rub. | 0 rub. (RUB 2,860 – RUB 48,000) |

| February | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | 6760 rub. (2860 rub. + 3900 rub.) | 0 rub. (RUB 6,760 – RUB 48,000 – RUB 2,860) |

| March | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 10,660 (6760 rub. + 3900 rub.) | 0 rub. (RUB 10,660 – RUB 48,000 – RUB 6,760) |

| April | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 14,560 (RUB 10,660 + RUB 3,900) | 0 rub. (RUB 14,560 – RUB 48,000 – RUB 10,660) |

| May | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 18,460 (RUB 14,560 + RUB 3,900) | 0 rub. (RUB 18,460 – RUB 48,000 – RUB 14,560) |

| June | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 22,360 (RUB 18,460 + RUB 3,900) | 0 rub. (RUB 22,360 – RUB 48,000 – RUB 18,460) |

| July | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 26,260 (RUB 22,360 + RUB 3,900) | 0 rub. (RUB 26,260 – RUB 48,000 – RUB 22,360) |

| August | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 30,160 (RUB 26,260 + RUB 3,900) | 0 rub. (RUB 30,160 – RUB 48,000 – RUB 26,260) |

| September | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 34,060 (RUB 30,160 + RUB 3,900) | 0 rub. (RUB 34,060 – RUB 48,000 – RUB 30,160) |

| October | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 37,960 (RUB 34,060 + RUB 3,900) | 0 rub. (RUB 37,960 – RUB 48,000 – RUB 34,060) |

| November | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 41,860 (RUB 37,960 + RUB 3,900) | 0 rub. (RUB 41,860 – RUB 48,000 – RUB 37,960) |

| December | 30,000 rub. | 3900 rub. (RUB 30,000 × 13%) | RUB 45,760 (RUB 41,860 + RUB 3,900) | 0 rub. (RUB 45,760 – RUB 48,000 – RUB 41,860) |

| Total for the year | RUB 352,000 | RUB 45,760 | X | 0 rub. (RUB 45,760 – RUB 48,000) |

The accountant filled out Form 2-NDFL according to Kondratiev according to the general rules.

In section 2 of Kondratyev’s income statement for 2015, the accountant indicated:

- taxpayer status – 6;

- citizenship (country code) – 498.

In section 5, the accountant reflected the following data:

- on the line “Total amount of income” – 352,000 rubles;

- on the line “Tax base” – 352,00 rubles;

- on the line “Calculated tax amount” – 45,760 rubles;

- on the line “Amount of fixed advance payments” – 45,760 rubles;

- on the line “Amount of tax withheld” – 0 rub.;

- on the line “Tax amount transferred” – 0 rub.

On January 25, 2021, the accountant submitted a certificate of Kondratiev’s income for 2015 to the inspectorate.

The procedure for filling out 2-NDFL - 2021 in 2021

A sample 2-NDFL certificate can be downloaded to clearly see the procedure for filling it out. Tax agents are required to fill out all sections of the certificate for which they have information. Section 3 may remain blank if there are no tax deductions. An example of a 2-NDFL certificate for the Federal Tax Service contains the following information that makes up the structure of the document:

- title page;

- sections 1-3;

- application.

At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

IMPORTANT! There is no need to provide standard, property and social deductions in the application (clause 6.4 of the Recommendations for Form 2-NDFL).

For more information about deductions, see this material.

ConsultantPlus experts explained how to reflect various payments in the 2-NDFL certificate. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Rules for issuing a certificate

This document does not have a unified template that is mandatory for use, so it can be drawn up in free form or according to a template specially developed and approved by the company. The main thing is that the certificate contains the following information:

- Business name,

- information about the employee,

- average monthly salary,

- the amount of salary actually accrued and received by the employee for a certain period of time.

The amount of deductions for taxes and insurance contributions to extra-budgetary funds does not need to be written, provided that the certificate indicates a “net” salary. In addition, it is advisable to indicate the amount of debt the organization owes to the employee as of the date of issue of the certificate, if any.

All data entered into the income certificate must be reliable, and there should be no errors or corrections in the document. For providing incorrect information (which today can be easily verified by supervisory authorities), the administration of the enterprise, represented by the chief accountant and manager, may be punished with a large fine.

The certificate can be written either on a regular A4 sheet or on the company’s letterhead; the law allows both printed and handwritten versions. There can be as many copies of the certificate as the employee requests in his application. The document must be signed by the chief accountant of the enterprise and the director.

If the document is issued by a commercial organization, then the stamp may not be affixed, since individual entrepreneurs and legal entities (from 2021) are not required to use seals and stamps in their activities (but it is worth keeping in mind that sometimes representatives of government and credit institutions may require a stamp on the document).

Results

The 2-NDFL certificate must be submitted to the Federal Tax Service by tax agents on a special form. In 2021, this must be done in a shorter period than before - no later than March 1 of the year following the reporting year.

Sources:

- Tax Code of the Russian Federation

- Federal Law of September 29, 2019 No. 325-FZ

- Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who issues the certificate

Remember: the law does not require you to indicate for what purpose you needed an income certificate.

This document is issued by the employer at the request of the subordinate. The certificate is usually issued by a specialist in the accounting department, who then passes it on to the head of the enterprise for signature. In order to receive it, an interested employee just needs to contact the company management with a written application - management has no right to refuse. Within three days of the request, the employee must receive the required document. The validity period of the certificate may vary significantly depending on the organization to which it must be submitted, but usually this period does not exceed one month.

Answers to common questions

Question: What should an entrepreneur who uses PSN or Unified Agricultural Tax do? Can he count on receiving a tax deduction when buying an apartment?

Answer: No, the use of tax regimes such as a patent or unified agricultural tax exempts an entrepreneur from paying income tax. This means that an entrepreneur will not be able to receive a tax deduction when buying an apartment. Such a right arises only when an entrepreneur has income subject to income tax at a rate of 13% as an individual. Also, the wife of an individual entrepreneur can take advantage of the right to deduction, and she must also have income subject to personal income tax.

Who can sign

The rules clearly state that the following persons have the right to sign this official document:

- Directly the tax agent himself.

- An officially authorized representative.

The certificate must indicate exactly who signed it. This is done by indicating the corresponding code digit:

- for a tax agent – “1”;

- The official representative identifies himself/herself when endorsing the certificate with the number “2”.

If the representative has been instructed to submit a certificate to the territorial bodies of the Federal Tax Service of Russia, then he should additionally indicate the specific name of the document that will confirm such powers and the legality of the actions of this person.

General rules for filling out income certificate 2-NDFL

The document is filled out for the tax period. This is a calendar year. Data is taken from tax registers.

Unacceptable:

- correcting errors by corrective or other similar means;

- double-sided printing and binding of sheets, leading to damage to the certificate;

- specifying negative numeric values.

Use black, purple or blue ink.

Each reference indicator corresponds to one field, consisting of a certain number of familiar places. Only one indicator is indicated in each field. The exception is the date (DD.MM.YYYY) or decimal fraction (two fields separated by a dot).

Fill out the help fields from left to right from the first (left) familiarity.

When filling out on a computer, the values of numerical indicators are aligned to the right (last) familiarity. It is acceptable to have no frames for familiar places and no dashes for empty familiar places.

Fill in CAPITAL PRINTED characters in Courier New font with a height of 16-18 points.

| SITUATION | SOLUTION |

| There is no indicator | In all familiar places in the corresponding field there is a dash. |

| To indicate any indicator, you do not need to fill out all the fields | In empty spaces there is a dash on the right side of the field. |

| No value for total indicators | Indicate zero (0) |

| Help cannot be completed on one page | Fill out the required number of pages located before the Application |

Continuous numbering. For example, for the first page - 001, for the twelfth - 012.

How to give it to an employee

There are no established ways to transfer a 2-NDFL certificate with sign 2 to an employee. The main thing here is that you have evidence of fulfilling such a duty. Thus, you can transfer information to him personally against signature or by registered mail with notification.

So that the employee understands what such a message means, it would not be amiss to explain to him in the covering letter that (letter of the Ministry of Finance dated March 12, 2013 No. 03-04-06/7337):

- no later than 05/02/2017 he needs to submit to his Federal Tax Service a personal income tax declaration for 2016 (clause 1 of article 229, article 6.1 of the Tax Code of the Russian Federation);

- no later than July 17, 2017, he needs to pay to the budget the amount of tax indicated in the 2-NDFL certificate received from you (clause 4 of article 228, article 6.1 of the Tax Code of the Russian Federation).

Who forms?

Usually the accounting department at the enterprise is responsible for issuing the certificate.

At the request of the employee, the organization is obliged to issue a certificate within up to 3 working days.

There are companies throughout the country that offer certificates for a fee.

Before turning to the services of such companies, it is important to know that even the slightest mistakes can lead to the document being rejected, for example, when submitted to a bank for a loan, or when contacting social authorities.

Filling out section 1 of the income certificate

| FIELD | HOW TO FILL OUT |

| TIN in the Russian Federation | Identification number of an individual confirming his registration with the tax authority of the Russian Federation. If the tax agent does not have information about the TIN of the income recipient, they do not fill it out. |

| Surname Name Surname | Without abbreviations in accordance with the identity document. The middle name may be missing if it is not indicated in the identity document. For foreign citizens, it is permissible to indicate the last name, first name and patronymic in letters of the Latin alphabet. |

| Taxpayer status | Taxpayer status code:

As you can see, in relation to a non-resident foreigner, you also need to fill out certificates in form 2-NDFL. of how to do this in ConsultantPlus: In October 2021, the organization hired a citizen of Tajikistan, a non-resident of the Russian Federation, under an employment contract with a salary of 45,000 rubles. |

| Date of Birth | Date, serial number of month, year - by sequential writing in Arabic numerals. |

| Citizenship (country code) | Numerical code of the country of which the individual is a citizen. According to the All-Russian Classifier of Countries of the World (OKSM) (approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). If you do not have citizenship, indicate the code of the country that issued the identity document. |

| Identity document code | Taken from Appendix No. 1 to the Procedure:

|

| Series and number | Details of the taxpayer’s identity document – series and number, respectively. The “No” sign is not placed. |

Sources for workers

To exercise your rights, it is not enough to know them; you need to rely on the legislative framework and insist on the implementation of the legal order.

The following acts apply to the issue of requiring and issuing certificates of employment:

- 255 law, adopted in 2006 on December 29, on insurance for social cases (temporary disability and childbirth); the law contains rules for the provision of certificates of employment and the calculation of benefits;

- Labor Code of Russia; Article 62 of the code specifies the period for issuing certificates and any other documents by the employer - 3 working days;

- 182 order of the Ministry of Labor of Russia, adopted in 2013 on April 30, which provides a standard form of a salary certificate and instructions for its formation;

- 512 government decree adopted in 2003 on August 20.

At the regional and municipal level, there is a separate regulatory framework that also needs to be taken into account.

Substance of the document

The document is a reporting form that displays the income received by the employee and the amount of taxes paid for him.

Typically, 2-NDFL is formed for the reporting year, for six months, or upon dismissal. But every employee has the right to receive it upon request at any time.

The form is filled out on a model approved by the legislation of the Russian Federation, which changes periodically, so before making a certificate you should make sure that the form is up to date.

Certificate form 2-NDFL