One of the forms of remuneration that an employer can establish at an enterprise is time-based.

The time-based form of remuneration, together with piecework, is one of the main wage systems used by employers. But unlike the piecework form of remuneration, time-based wages are accrued to the employee taking into account the time actually worked, regardless of performance. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

What is a time wage?

Each enterprise has its own specific form of remuneration. This is due to the specifics of production. For example, in one company employees are paid for the quantity of products they produce, and in another - for the time actually worked.

The manager himself determines what kind of salary he will have in production. But nevertheless, this issue is coordinated with the trade union organization. Every employee who gets a job can find out about his salary in advance. The type and form of monthly payments is prescribed in the employment contract.

In the Russian Federation, only 30% of enterprises have time-based wages, although, for example, in the USA this figure has exceeded 70%. Now let’s decipher the concept itself.

Time wages are a type of salary where the amount of employee payments directly depends on the hours, days or months actually worked. This takes into account special working conditions and qualifications of specialists.

Simply put, a time-based form of remuneration is when wages are paid not for the quantity (volume) of work performed, but for the time it is performed. That is, the hours of work that were spent on completing a particular task are paid.

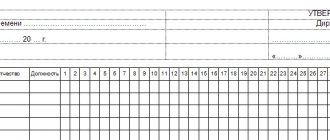

Salaries are calculated based on the completed working time sheet. There, the standard keeper indicates how many hours or days the employee worked.

Normative base

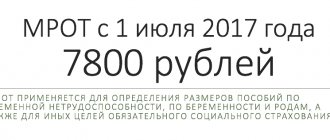

Federal Law of December 25, 2018 N 481-FZ “On Amendments to Article 1 of the Federal Law on the Minimum Wage”

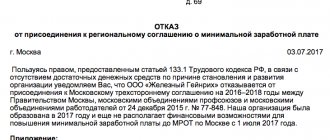

Regional agreement on the minimum wage in St. Petersburg for 2019

A time-based remuneration system is a form in which an employee’s salary is calculated from a salary or tariff rate, taking into account the time actually worked.

Salary is the established amount of remuneration for the performance of labor duties, accrued for a fully worked month.

Daily or hourly rate is a fixed amount paid per day or hour worked.

Where are time wages most often used?

Time wages are paid in industries where the quality of work, rather than quantity, is valued. It is this type of salary that encourages employees to constantly improve and raise their skill level. Time-based wages are used in the following cases:

- If the employee’s activities are regulated by a certain rhythm or he works on assembly lines;

- If the work involves maintenance and repair of equipment;

- If the qualitative indicator of work is valued higher than the quantitative one;

- When it is impossible to determine a quantitative indicator of labor, or this procedure is difficult or irrational;

- When the result of an employee’s work is not the main indicator of his work;

- If an employee, with all his desire, cannot influence an increase in the volume of products produced, due to the low productivity of the equipment.

This salary is most often paid to accountants, medical personnel, teachers, lawyers, government officials, managers, etc. For example, it is very difficult and pointless to calculate how well the teacher worked this month and how much information the students learned.

Registration of labor relations

When a person is hired, the company management needs to draw up an employment contract. Working conditions are to be reflected in this act. The document must be prepared in two copies. The salary amount and the tariff applied when calculating earnings are subject to mandatory reflection.

Type of time salary

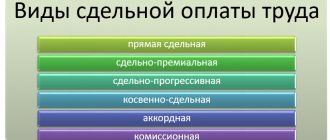

There are several types of time wages.

Simple time wages - paid to employees whose responsibilities include maintaining the functioning of production. The employee does not in any way influence the final result of the product produced or service provided. The employee receives a fixed salary for the time worked in production. However, he cannot count on any additional payments.

Salaries can be calculated by period. Hours, days or months can be taken into account.

Example. The employee has a tariff rate of 60 rubles/hour, he worked 50 hours, therefore his salary will be 60 * 50 = 3000 rubles.

If an employee works for a month (works out a monthly standard of hours) and has a fixed salary, then his salary will correspond to the size of his salary.

The advantage of a simple time-based salary is its stability, but the disadvantage is the lack of motivation for the employee (everyone receives the same salary, regardless of work results). A simple time wage is very rare.

A time-based bonus salary is when an employee, in addition to his salary, receives additional payments in the form of bonuses for fulfilling certain conditions. For example, the absence of disruptions in work, no emergency situations were allowed, exceeding the plan, manufacturing products without defects, saving raw materials and energy resources, etc.

When calculating this type of remuneration, not only qualitative indicators are taken into account, but also quantitative ones.

The conditions for payment of bonuses and their amount are specified in the employment contract. Bonuses include the following payments: 13th salary, additional payments for length of service, holiday bonuses, etc.

Calculated as follows:

Basic salary + Bonus = Time-based bonus salary

The basic salary means the salary or tariff rate multiplied by the number of hours actually worked per month.

The bonus amount is a percentage of the basic salary.

Example. The employee has worked out the standard hours and his salary is 10 thousand rubles. For a job well done, he is entitled to a 10% bonus. We make calculations:

10,000 + 10,000*0.1 = 11,000 rubles.

With time-based bonus wages, the employee is interested in quickly and efficiently completing the task. Awards are a great way to stimulate and motivate the team.

Time-based bonus with a specific task - at enterprises where this form of wages is in effect, monthly payments to employees consist of payment for hours actually worked and additional payments (in the form of bonuses) for completing assigned tasks.

This is a type of time-based bonus salary. With this type of remuneration, the manager can count on a guaranteed result in completing the task, because the amount of the employee’s salary depends on this. And this is the main motivator for fast and high-quality work.

Piece-time wages - sometimes it is called mixed, because it combines piece-rate and time-based wages.

This salary is most often received by people whose activities are related to trade. For example, sellers, in addition to payment for actually being at the workplace, are accrued interest on products sold.

This condition interests employees, and they strive to increase the level of sales.

Documentary basis for accrual

Legislative evidence justifying the use of this salary system at the enterprise is contained in a number of internal documents. To calculate wages using the time-bonus model, the following sample documentation is required.

- Working time sheet - this accounting document is needed for any type of time-based salary distribution, because on its basis the main indicator for calculating the salary of the main salary part - the time part - is calculated.

- A tariff schedule or staffing table that sets the salary or rate.

- Relevant provisions in a collective agreement, an individual employment contract or an additional agreement to it . The labor remuneration system is an essential condition for the interaction between the employer and the employee, therefore it must be contained in the title documentation.

- Regulations on bonuses (separately or as part of an employment contract). The additional payment part of the salary is regulated by the conditions specified in a special local act - a regulation that clearly establishes:

- the conditions under which the premium is calculated;

- factors influencing its size;

- the procedure for calculating the increase (percentage of the tariff rate or salary, fixed amount, share of income received, etc.);

- reasons that deprive an employee of the right to receive an additional (bonus) part of the salary.

NOTE! If the situation at the enterprise has changed, which requires a change in the bonus policy, management can make separate changes to the existing Regulations, both on increasing and decreasing points. Such changes must be formalized by a special order for the enterprise. The procedure for carrying out the order and familiarizing staff with it is standard.

Comparative characteristics of time and piecework wages

Each form of salary has its pros and cons. It is impossible to say unequivocally which one is better and which one is worse. Each company has its own type of salary.

Nevertheless, we provide a comparative description of different types of remuneration for workers.

| Criteria for evaluation | Forms of remuneration | |

| Piece wages | Time salary | |

| Where is it used? | In enterprises where any product is produced, or where quantitative indicators are valued | In the service sector, services, in the case of project orders. That is, where the quality of the work performed is valued |

| Dependence of wages on labor productivity | Salary directly depends on the volume of work performed. The higher the labor productivity, the more the employee will earn | There is no dependence, or it is indirect. The employee receives the salary due to him, even if he works at half capacity (unless a bonus is provided) |

| Who benefits? | Beneficial for the employer, because he pays only for the product produced | Beneficial for the employee. He doesn’t have to try, because he’ll still get his salary |

| Salary stability | Unstable. If an employee is absent from work (even for a good reason), he will still not receive wages for the days missed | Stable, i.e. guaranteed |

| Availability of motivation | Present. Employees always strive to do more to get a higher salary | If bonuses are not provided, then the employee has no motivation. After all, he is guaranteed to receive a salary |

| Quality of work performed | Often quality wants to be better, because workers strive to do more without thinking about the quality of the work performed | If an employee receives a bonus for quality work, then he will try his best to get an increased salary. Accordingly, the quality of the work performed will be high |

Which enterprises benefit from using time-based wages (area of use)

Most often, this form of payment is used for irregular work or if the operations performed are very difficult to account for. For example, in organizations that provide minor repair services to the public. This also includes public sector employees who can conduct business activities.

“Time work” can be set for part-time workers, temporary and permanent workers. This is how you pay for your work:

- administrative and management personnel;

- workers of servicing households, auxiliary production.

These could be, for example, doctors, engineers and other highly qualified specialists. We can say that today time-based payment is optimal for most organizations and is gradually replacing piece-rate payment.

Least of all, time-based work is used by commercial structures that seek to increase profits by increasing labor productivity. But if they use non-economic methods of motivation, then this form is used by them as a dominant one.