When a transaction on an account is blocked by the bank's financial monitoring, you must provide documents confirming the integrity of the transaction. If the blocking is not lifted, you should go to court.

Blocking a current account is the suspension of expenditure transactions on it for reasons established by law. In banks, the Financial Monitoring Service has such powers.

Note. The financial monitoring service is a division of the bank whose responsibilities include monitoring customer transactions.

First, it’s worth understanding why financial monitoring blocks current accounts, and what to do in each of the possible options. It is important to understand that blocking an account and refusing to carry out a transaction are different procedures.

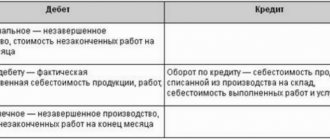

Table 1. Types of sanctions

| Procedure | Peculiarities |

| Refusal to perform an operation | The most common type of restriction is the bank blocking transactions on a current account in accordance with 115-FZ of 08/07/2001. Grounds for refusal:

|

| Account blocking | The bank can block all transactions on the account only if its owner is included in the list of companies and individuals. persons involved in extremist or terrorist activities. The list can be found on the website of the Federal Service for Financial Monitoring. In other cases, only Rosfinmonitoring or a court can completely block an account. Rosfinmonitoring has the right to suspend operations on an account for no more than 30 days, provided that its owner is involved in terrorist and extremist activities. Only a court can block movements on an account for a longer period. In this case, there is no point in arguing with the bank; nothing depends on it. You will have to prove your case by contacting the local branch of Rosfinmonitoring and finding out the essence of the accusations. |

What does it mean

If the current account is blocked, then the activities of the entire enterprise are actually suspended. The owner will not be able to pay the debt, buy goods, pay employees salaries or fulfill other financial obligations. To avoid such a development of events, you need to understand ways to find out whether an organization’s current account is blocked, why this was done, and also how to remove the restrictions.

First, account holders must distinguish between the different types of restrictions that may be imposed by a banking organization. These include:

- Complete blocking.

- Suspension of a specific operation.

- Refusal to implement a certain financial transaction.

Blocking deprives the owner of the ability to make any payments, withdraw funds, pay for goods and services, or transfer funds to another account. This person is not allowed to create other accounts, as well as open deposits in banks.

How to find out why your account is blocked

Before taking any action, you need to find out the reason for the blocking. Typically, notification of restrictions is sent to the client through a remote service system. This is exactly what Modulbank, Uralsib Bank and other credit organizations do. This document contains information about what measures must be taken to unblock the account.

If there is no access to Internet banking or it is also blocked, then you can try contacting your manager at the bank. Usually, specialists from Vozrozhdenie Bank, Promsvyazbank, etc. readily answer questions.

For details, your request will have to be submitted in writing. You will need to prepare a corresponding letter on company letterhead and bring it to the office of the credit institution.

Suspension or complete blocking

Financial monitoring of a bank may block an account if Rosfinmonitoring suspects the account owner of promoting terrorism through its financing or laundering income obtained in violation of the law. In this case, the owner is included in a special list of organizations and individuals, which is publicly available on the Internet.

Such blocking cannot last more than one month. This is stated in the Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” No. 115-FZ, in particular in paragraph. 3 tbsp. 8. The blocking period may be extended by court decision. If such a fact occurs in the absence of an appropriate document, then this is a direct violation of the law.

If an organization is not on the list, funds may be frozen or a certain financial transaction may be suspended until the circumstances are clarified. If financial monitoring blocked the current account of the LLC in this case, then such an action is illegal.

Results

Financial monitoring is a control procedure carried out to check each legal entity or individual for involvement in criminal acts. Including credit structures that conduct transactions with funds also participate in it. The results of this control are reflected in registers posted on the Rosfinmonitoring website. Inclusion in such a list becomes the basis for blocking the accounts of a legal entity or individual by the credit structure. In certain situations (cancellation of the document that led to its inclusion in the list, presence of an error), the blocking can be canceled. To do this, you should contact Rosfinmonitoring with an application.

Sources: Federal Law of August 7, 2001 No. 115-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to check if there is a blockage

To check your account, just try to make any payment or call the financial institution's hotline. But this information can only be provided to the account owner. This data is not disclosed to third parties.

However, on the official virtual resource of the Federal Tax Service there is a service “Bankinform”. Third parties can also use it. Having found this section, you need to select the type of verification, indicate the TIN of the legal entity and the BIC of the banking organization, and also enter the anti-spam security code. As a result, the following information will be obtained:

- Account blocking date.

- Amount of debt.

- Reasons for blocking.

Main reasons for blocking

Banks must supervise transactions carried out by organizations if their amount exceeds RUB 600,000. or is the equivalent amount in foreign currency. This is stated in Art. 6 of the above Law No. 115-FZ. In this case, financial monitoring is carried out in relation to such operations as:

- Receiving money into your account and cashing it out.

- Transfer to foreign bank accounts or receipt of money from them.

- Crediting or debiting funds to a company that has been operating for less than 3 months.

- Opening deposits and crediting funds to them.

According to Art. 7 of Law No. 115-FZ, banks must identify and analyze data on the movement of funds in client accounts in order to highlight transactions that seem dubious. Thus, financial organizations must record the following cases:

- Convoluted deals that make no economic sense.

- Transactions that do not correspond to the purposes provided for by the charter.

- Operations whose purpose may be to evade inspections.

- Refusals of account holders to perform transactions in respect of which bank employees have suspicions of money laundering.

Knowing whether a bank can block a current account and on what grounds, the organization will take a more responsible approach to financial transactions. If they meet at least one of the criteria specified above, then the banking organization may request documents from the account owner that will confirm the legality of its implementation. In the absence of such, blocking is inevitable.

How to prevent refusal of surgery

In order to avoid disagreements with the bank regarding transactions that are subject to mandatory control or are of an unusual nature, you must, upon request, provide the necessary documents to confirm the integrity of the transaction.

The bank itself determines what documents it needs, but, as a rule, these are contracts and invoices for payment. Documents may be requested about the source of funds or the counterparty to whom the transfer is planned.

The client's disagreement with the bank's requirements will result in a refusal to carry out the operation. Practice shows that going to court to force a credit institution to make a transfer will be pointless, because The courts take the side of the bank in such cases.

Additional reasons

There are additional criteria that banks must pay attention to. For example, the methodological recommendations of the Central Bank of the Russian Federation No. 18-MR indicate that banking organizations should pay attention to the following clients:

- Which inflate the amount of payments to 0.9% of turnover and higher.

- Which do not pay salaries to employees or the money paid does not correspond to the available number.

- Which create a wage fund for workers based on the amount of earnings less than the subsistence level established in the region.

- They pay personal income tax, but do not pay insurance premiums.

- They do not have funds in the account or their amount does not correspond to the purposes of accrual.

- The turnover of funds has sharply increased significantly.

- They did not pay for stationery and other household goods, and did not pay current payments.

- VAT was allocated in invoices for the purchase of goods that are not subject to this tax.

Closing an account as a way to remove restrictions

If a company decides to avoid litigation and simply cease cooperation with the bank, it only needs to submit an application by withdrawing the balance of funds by check or indicating the account details for its transfer.

There have been precedents when banks interfered with the procedure for closing and transferring funds, citing the same 115-FZ and the dubiousness of the operation. In such cases, the courts take the client’s side, because After submitting the application, the agreement with the bank is considered terminated, and the bank is deprived of the right to control the operations of an entity that is not its client.

Note. One example of such proceedings is Resolution N A40-182056/2013 of December 23, 2015 of the Moscow Region Arbitration Court.

In such a situation, it is important to check whether the agreement for servicing the bank account does not stipulate an increased commission for withdrawing funds when closing the account due to the bank’s refusal to carry out the operation. In some cases it can reach up to 30%. If such a condition is prescribed by the DBS, it is impossible to do without court intervention, unless the client is ready to sacrifice this amount.

In conclusion, an interesting video about how to establish relations with the bank today and what to do to avoid problems with blocking movements on the account.

The bank requested documents

What to do if financial monitoring has blocked your current account:

- The reasons need to be found out first.

- Next, you should provide the bank with the required documents. The law does not establish information that must be verified. Therefore, banks can request the information they deem necessary. Most often, this includes: payment documents, contracts, payment of taxes, legal sources of funds, and other supporting information.

If, after the account owner has provided the necessary documents and the withdrawal of money is refused, such actions can be appealed as follows:

- At the Central Bank.

- In a court.

Main signs indicating an unusual nature of the transaction

- The confusing or unusual nature of a transaction without obvious economic meaning or legitimate purpose, or its inconsistency with the organization's goals as stated in the founding documents.

- The client’s refusal to provide the bank with documents requested for analysis, unjustified delay of the procedure, provision of information that cannot be verified.

- Unusual client concerns about confidentiality, unusual payment instructions, excessive haste, or changes to an agreed settlement plan.

- Neglect of more favorable payment terms.

- The client is a foreign public person or acts in the interests of such a person.

- Lack of information about the client in official directories, as well as the inability to contact him at the telephone numbers and addresses indicated by him.

A complete list of signs is contained in the appendix to Bank of Russia Regulation No. 375-P dated March 2, 2012.

Note. The law does not establish a threshold value for amounts that have signs of an unusual transaction. The decisive factor here is the transaction’s compliance with these criteria, so any amounts are subject to mandatory control.

Challenging a blocking decision

According to paragraph 3 of Art. 845 of the Civil Code, the bank does not have the right to establish restrictions on the use of the account unless this is provided for by law. He also does not have the right to use funds for his own purposes. It is the provisions of this article that should be followed when drawing up a claim or complaint.

In addition, according to Art. 849 of the Civil Code of the Russian Federation, the bank is obliged to implement a client’s order to issue money within the next day after receiving it. If the client proves that his actions are lawful, the bank refusal is considered illegal.

Based on paragraph 1 of Art. 395 of the Civil Code, the court can not only oblige a banking institution to transfer funds that belong to the account owner, but also charge a percentage for their use.

If the blocking is initiated by the tax service

A banking organization can not only independently block a current account based on financial monitoring, but also perform the same actions at the request of the tax authority. The reasons for freezing the account of a banking organization at the request of the Federal Tax Service are provided for in clause 3 of Art. 76 Tax Code of the Russian Federation. These include the following:

- Failure to submit a tax return within the deadlines established by law.

- Having debt in the form of taxes, fines or penalties.

- Failure to provide a calculation of the tax for individuals, which is withheld from employees.

- Failure to comply with the conditions imposed by the tax service.

The Federal Tax Service is obliged to notify the owner of the decision to block the account. If the notice is not delivered, the account status can be checked by contacting the tax service or using the above-mentioned BANKINFORM service.

How to pay taxes if your account is blocked

The reasons for blocking an account can be very different. If the account is blocked by the tax service due to unpaid taxes, then it is enough to deposit the required amount.

An entrepreneur can send a tax payment from his personal account or pay it in cash at a bank. It is somewhat more difficult for organizations. For a long time, they could pay tax payments exclusively from their current account. But in 2015 the situation changed. Currently, the director of an organization or its representative, acting on the basis of a power of attorney, can pay taxes in cash, for example, at Sberbank or send the corresponding payment from his personal account.

Unlock

If, at the initiative of the tax service, financial monitoring blocked the current account, what should I do? The bank will not be able to help in this case. Therefore, you need to contact the tax service. If there is an error, you must provide documents that confirm the relevant fact. Evidence for this may include:

- Receipts and payments.

- Notes on acceptance of documents, postal notifications.

- Reconciliation acts.

If it becomes known that financial monitoring has rightfully blocked a current account, what should I do? The only way out of the situation is to eliminate the identified violation. After completing the necessary actions, the inspector should provide supporting documents.

Unblocking is carried out in the following periods:

- Within one business day after payment of fines and arrears (if a corresponding bank statement is provided). This is stated in paragraph 8 of Art. 76 Tax Code of the Russian Federation.

- Within one working day after providing documents on sending the declaration or reporting. This is stated in paragraphs. 1 clause 3.1 art. 76 Tax Code of the Russian Federation.

- Within one working day after submitting the necessary documents to the tax service. This is also stated in paragraphs. 1 clause 3.1 art. 76 Tax Code of the Russian Federation.

At the same time, in practice, unblocking can be carried out in a few days if the debt has been paid, and in some cases it can take up to 1 month. In this case, the bank reviews the documents in accordance with internal rules.

Full or partial unlocking

Sometimes the tax and federal financial monitoring service requests the banking organization to completely block the funds in the account. This can be done even if the account balance is much greater than the amount indicated in the decision to temporarily suspend the right to use the account. Then you need to submit an application to the tax service to partially lift the imposed restrictions. If the question is how to pay taxes if the current account is blocked, then it is resolved in the same way. The document is accompanied by a bank statement indicating the funds held in the account.

In accordance with paragraph 4 of Art. 76 of the Tax Code, the service must send to the bank a decision to remove the restriction from the account within one business day from the moment the corresponding decision is made. The procedure is expedited by sending the notification in electronic format. As a result, the company's operations return to normal.

If the deadlines for lifting restrictions are violated, the account owner has the right to receive compensation. In this case, a penalty is established based on the current refinancing rate.

What operations are subject to mandatory control?

In accordance with Law No. 115-FZ, banks must control transactions if the transaction amount exceeds 600 thousand rubles (including transactions in foreign currency), including:

- incoming and outgoing transactions involving cash that are not due to the nature of the company’s business activities, including withdrawals of money by card;

- incoming and outgoing transactions on the account, if the second party to the transaction is registered (resides or is located) in a state that does not comply with FATF recommendations, or the counterparty bank is located on the territory of such a state;

- cash transactions on deposits made to a third party (bearer), as well as transfers outside the Russian Federation to or from anonymous owners;

- movements on the account in the first 3 months from the date of registration, or the first movement on the account;

- leasing operations;

- with precious metals (jewelry, stones, scrap);

- related to the provision of loans, if the company is not a credit institution;

- related to real estate, if the transaction amount is 3 million rubles or more (including in foreign currency);

- transactions of non-profit companies, when one of the parties to the transaction is a foreign company (foreign person or stateless person), and the transaction amount is 100 thousand rubles or more (including in foreign currency);

- for the supply of products under defense orders with a transaction amount of 600 thousand rubles or more (including in foreign currency), and in the case of repeated transactions, transactions worth more than 50 million rubles (including in foreign currency) are subject to control;

- the second party to the transaction is included in the list of companies (persons) involved in extremist and/or terrorist activities.

Account blocking by court

It may also be that, based on a court decision, financial monitoring blocked the current account. What to do in this case? First of all, find out about the reasons for this action. After receiving a court decision, the bank must completely stop carrying out debit transactions, be it cash withdrawals or money transfers.

Usually the reason lies in the presence of a debt to counterparties, government agencies or other financial organizations, which the account owner does not pay voluntarily. This is an interim measure. Thanks to blocking, it becomes possible to satisfy the demands of creditors. The restriction is lifted after the execution of the court decision. If you do not do this yourself, the money will be written off forcibly in the course of enforcement proceedings in the case.

What payments will attract the bank's attention?

Firstly, transit operations. That is, the company receives money from one counterparty and immediately transfers it to another. The Central Bank believes that such transactions are a sign of money laundering.

But according to one criterion, the bank does not block the account, so it will pay attention to other payments to the company that confirm the reality of its existence: whether the client pays rent and utility bills from the account, whether he purchases office supplies, etc.

Secondly, banks control the volume of tax deductions. According to the instructions of the Central Bank, the company must pay taxes of at least 0.5% of the account turnover. The difficulty is that the account turnover and the tax base may not coincide. In this case, the company cannot adhere to the tax burden recommended by the Central Bank. But let us remind you that one criterion is not a reason to block a client’s account and refuse banking services.

Thirdly, payments must comply with the company’s declared OKVED. For example, the bank will pay attention to the discrepancy and take action if money is received for construction materials, but transferred for products. These activities are in no way related to each other.

Fourthly, payments to shell companies. These companies are used to illegally convert non-cash funds into cash. The Central Bank and the Federal Tax Service monitor the accounts of such companies and regularly enter their details into their electronic databases.

Kontur.Bank has a built-in service for express verification of counterparties, Svetofor. You can check the new counterparty even before signing the contract: the service will color dubious companies red or yellow.

Open an account with Kontur.Bank

Includes a corporate card, online accounting and electronic signature.

Fifthly, agency payments and payments under assignment agreements. Banks pay special attention to these transactions, since a number of tax evasion schemes are built on their basis. In addition, financial monitoring will pay attention to cash transactions, currency conversions, and the first operations of a newly opened company.