It does not matter what status you are in: an individual entrepreneur or a legal entity. The rules are the same for everyone: you pay income to individuals, calculate salary taxes and transfer them to the budget.

It does not matter how you hired an individual - as a staff member under an employment contract, or under a civil contract for the provision of services or performance of work. In both cases, the employer’s responsibilities regarding income taxation are the same.

Calculate and pay employee contributions online Try for free

Personal income tax and insurance premiums

Let's start with income tax. Its rate for salary payments is 13%. The tax itself is withheld from payments to the employee, so the businessman does not directly bear the fiscal burden.

However, the employer is entrusted with performing the functions of a tax agent, i.e. the obligation to calculate, withhold and transfer personal income tax to the budget. Consequently, for this you need to allocate a specialist (and in large companies, an entire department), equip workplaces, pay salaries and incur other personnel-related expenses.

For errors and violations of deadlines, tax agents are subject to fines, and if large sums are involved, criminal prosecution. Therefore, personal income tax also refers to the tax burden on business, although formally the employer does not spend his funds to pay it.

Compulsory insurance contributions are charged for payments to employees. For this category of payments there are a number of benefits and “special” options, but in general the following rates apply (Article 425 of the Tax Code of the Russian Federation):

- Pension insurance – 22%.

- Compulsory social insurance – 2.9%.

- Compulsory health insurance – 5.1%.

In general, the rate on transferred insurance premiums is 30%.

In addition to them, there is a “specific” type of mandatory contributions - insurance against accidents at work. It is regulated by a separate law dated July 24, 1998 No. 125-FZ. Tariffs of “accident” insurance premiums significantly depend on the type of activity. Depending on how dangerous the production or other processes associated with the business are, the rate can range from 0.2% to 8.5%. But for most industries its value does not exceed 1-2% (law of December 22, 2005 No. 179-FZ).

In further calculations, for simplicity, we will use only the “basic” rate of insurance premiums - 30% of the wage fund (payroll).

Compensation for “client-bank”

With the development of information systems, the use of “client-bank” seems to be a natural process. For operational work, bankers provide similar services. There is no doubt about their economic justification. Art. 346.16 of the Tax Code of the Russian Federation indicates the permissibility of taking banking services into account in the manner specified in Art. 265 Tax Code of the Russian Federation. Subp. 15 paragraph 1 of this article literally indicates the admissibility of accepting bank services as expenses arising from the use of electronic systems for transmitting documents from bankers to the customer and back.

VAT

It would seem – what does VAT have to do with it? After all, the base for this tax is added value, and not payroll. But let's not rush...

Suppose a businessman works “to zero”, i.e. revenue (B) corresponds to costs (C). VAT is generally charged on all income received. And the “input” tax is deductible only from purchased goods, services, etc. for which suppliers have issued invoices.

But the cost consists not only of “external” purchases, it includes payroll and contributions accrued from it. Naturally, no invoices are issued for salaries, so it turns out that the taxable base for VAT is formed precisely at the expense of the payroll and charges on it.

Z = P + FOT x 1.3, where

P – cost of goods (services) purchased from suppliers, subject to VAT

VAT = B x 20% – P x 20%

Because B = Z, then

VAT = (P + payroll x 1.3) x 20% - P x 20%

VAT = payroll x 1.3 x 20% = payroll x 26%

It turns out that VAT can also be considered a payroll tax, and in this case its “rate” is 26%.

Payment of temporary disability benefits

Simplified employees pay temporary disability benefits to their employees in the manner established by Federal Law No. 255-FZ of December 29, 2006.

The benefit for the first three days of illness of the employee is paid at the expense of the employee’s own funds, and from the fourth day - at the expense of the Social Insurance Fund (clause 1, part 2, article 3 of Law No. 255-FZ). For persons who voluntarily pay contributions to the Social Insurance Fund, the fund pays benefits for all days of incapacity for work.

The amount of temporary disability benefits depends on the employee’s insurance length. It is calculated using the formula:

Employee earnings subject to contributions to the Federal Social Insurance Fund of the Russian Federation for two accounting years

Load on payroll under the general system and the simplified tax system “Income minus expenses”

These tax regimes are combined together because The procedure for calculating the “basic” tax is similar. In both cases, costs are deducted from revenue, and tax is taken from the resulting difference.

The fact that under the general system (OSNO) revenue is calculated based on shipment, and under the simplified tax system - based on payment, is not important in this case. If we consider not 1-2 months, but the activity as a whole, then this difference is leveled out.

OSNO provides for the payment of income tax at a rate of 20%.

Payroll and contributions from it are expenses, so they reduce the taxable base and the amount of tax.

Those. income tax will be lower by

Payroll x 1.3 x 20% = Payroll x 26%

Those. we can say that income tax, in the sense of the burden on the payroll, “compensates” for VAT. Therefore, the total “cost” of the accrued salary under OSNO will be equal to 30% plus “accident” insurance premiums, depending on the industry.

Under the simplified tax system “Income minus expenses,” there is no VAT, and the tax rate excluding benefits is 15%.

Therefore, savings from the “simplified” tax will partially offset the burden of insurance premiums.

Payroll x 1.3 x 15% = Payroll * 19.5%

As a result, a businessman in this special mode will pay 10.5% from the accrued payroll

(30% insurance premiums minus 19.5% savings on “simplified” tax)

Collection and cash settlement

Costs arising from the support of ongoing settlements, as well as those associated with the collection and recalculation of received money, their delivery to the bank branch are costs that reduce the base for the simplified tax system. To recognize this type of expense, the cost of collection and settlement services is fixed in an agreement concluded with a banking institution.

The buyer's payment for acquiring is credited to the simplifier's income in full, taking into account the bank commission at the time the funds are credited to the seller's current account. Is it possible to count this commission as an expense for the simplified tax system? Yes, you can. Basis - sub. 24 clause 1 art. 346.16 of the Tax Code of the Russian Federation (as commissions, agency fees).

The list of costs that reduce the base for the “simplified” tax is set out in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses for banking services are given in sub. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation - they are presented in the form of interest paid for loans and credits, or commissions for the services of credit institutions.

The services of bankers who reduce the base for the “simplified” tax are given in Art. 5 of the law of December 2, 1990 No. 395-1. Banking services include them, but in a specific list. Bank commissions under the simplified tax system are included as expenses at the time of actual payment based on the confirming primary receipt.

Example 2

Revenue is 1000 thousand rubles, costs excluding payroll are 500 thousand rubles, payroll is 100 thousand rubles, insurance premiums are 30 thousand rubles.

The “simplified” tax without taking into account the payroll will be equal to

STS1 = (1000 – 500) x 15% = 75 thousand rubles.

Taking into account payroll

STS2= (1000 - 630) x 15% = 55.5 thousand rubles.

Thus, the tax decreased by 75 - 55.5 = 19.5 thousand rubles.

Total additional fiscal burden due to payroll payments

DN = 30 – 19.5 = 10.5 thousand rubles, or 10.5% of the payroll amount.

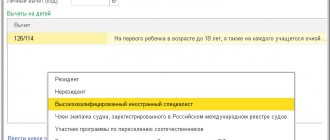

We learn to calculate salaries when combining the simplified tax system and UTII modes (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Salaries and personnel

2017-04-11T14:31:41+00:00

| Is the article outdated and in need of revision? |

Today we will learn how to correctly calculate wages in 1C: Accounting 8.3 (edition 3.0) when combining modes.

Situation. We are on the simplified tax system + UTII.

We have:

- A small shop selling photo accessories. Semyon Semyonich works as a salesman in this store. This company's activities are entirely on UTII. The seller’s salary is 15,000 rubles, let’s attribute these expenses to the sale (account 44):

| Salary 15,000. Fully on UTII. Cost account 44.01. |

- In the same store, photography services are provided by the wonderful Vladimir Petrovich. This company's activities are entirely based on the simplified tax system. The photographer’s salary is 35,000 rubles, let’s attribute these expenses to the main production (account 20):

| Salary 35,000. Fully based on the simplified tax system. Cost account 20.01. |

- And finally, the thunder of the employees, everyone’s favorite director Yuri Viktorovich. His salary is 50,000 rubles and should be distributed equally between the simplified tax system and UTII as general business expenses (account 26):

| Director Yuri Viktorovich | Salary 50,000. 50% on UTII, 50% on simplified tax system. Cost account 26. |

Attention, this is a lesson - you can repeat all my actions in a copy of your database.

So, let's go!

Load on payroll under the simplified tax system “Income”, UTII and the patent system

These three special regimes are similar in that costs are not taken into account when calculating the tax base. Those. There will be no savings from payroll and contributions similar to the options described above. But on the other hand, there is no VAT here either.

However, with the simplified tax system “Income” and “imputation”, you can deduct accrued insurance premiums from the final tax amount within half of it (Articles 346.21, 346.32 of the Tax Code of the Russian Federation). Therefore, under certain conditions, the load on the payroll for these special modes may be completely “zeroed”.

The rate for the simplified tax system “Income” is 6%. Therefore, a deduction for contributions can be applied within 3% of revenue. Those. accrued contributions can be fully used for deduction if

Payroll x 30% <= B x 3%

PHOT <= B x 10%

Thus, if under the simplified tax system “Income” wages are less than 10% of revenue, then the businessman does not bear the fiscal burden on the payroll at all.

Banking transactions expensed

In accordance with the above-mentioned law, the following are related to the costs caused by banking transactions:

In addition to basic banking operations in Art. 5 of Law No. 395-1 provides a list of services of credit institutions, which, according to the same letter from the Ministry of Finance, are allowed to be accepted for expenses:

Accepted costs must be confirmed by the corresponding primary source. They are taken into tax accounting at the time of payment (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

All other expenses that arise during interaction with banks, not mentioned above, cannot be taken into account for calculating the “simplified” tax. Let us dwell on individual services of creditors that raise questions when accepted as costs for the simplified tax system.

Example 3

The amount of revenue is 1000 thousand rubles, payroll is 80 thousand rubles. The total amount of contributions from the payroll will be equal to

VZ = 80 x 30% = 24 thousand rubles.

The “simplified” tax is equal to

STS = 1000 x 6% = 60 thousand rubles.

Because 24 thousand rubles. - this is less than 50% of 60 thousand rubles, then contributions are fully deducted from the tax amount.

A similar calculation can be made for UTII by substituting 7.5% into the formula (since the base rate for UTII is 15%). Instead of revenue, in this case, imputed (i.e., predetermined) income is taken, which greatly simplifies forecasting.

Payroll x 30% <= VD x 7.5%

Payroll <= VD x 25%

So, for UTII, wage contributions are fully “covered” by the benefit if the total payroll does not exceed 25% of imputed income.

Comparison of salary payment methods

If you have registered as an individual entrepreneur and have employees on staff, then you can pay them wages by bank card or in cash. The payment method must be fixed by internal regulations. But even if the employment contract states that the employee receives his salary on the card, the latter has the right to demand payment in cash.

Below in the table we will compare the procedure for paying funds in cash and by card, and also consider the necessary documents and accounting entries.

| Index | Cash payment | Cashless payments |

| Procedure | Based on the calculation made, you can give the employee the amount of salary due to him in cash. If you do not have a cashier on staff, then issue money yourself as the head of an individual entrepreneur. | If you decide to issue salaries to employees in non-cash form, then you must first enter into an agreement with the bank. The credit institution assumes obligations for issuing cards and servicing them. On the day the salary is issued, the bank transfers funds to the employees’ bank account according to the payment documents you provided. |

| Documentation | If you give money to one employee, then you can issue an expense order for this. If several employees receive salaries at the cash desk, then it is advisable to draw up a payroll sheet. When receiving money, the employee is required to sign the payment document as the recipient. | To pay funds to an employee’s card, provide the bank with a payment document. If you are transferring money to several employees, then you will also need a register indicating the full names of the employees, payment card (current account) numbers and amounts to be paid. Documents should be submitted to the bank in advance, but indicating the date of payment. This is due to the fact that banks can transfer money not on the same day, but for example, the next. It is advisable to pay salaries through the bank in which the employees' accounts are opened, this will significantly speed up the payment procedure. |

| Postings | When issuing money from the cash register, make the following entry: Dt 70 Kt 50. If you are issuing a deposited salary, then reflect the transaction as follows: Dt 76.4 Kt 50. | If funds are paid through the bank where employees’ accounts are opened, then reflect the payment as follows: Dt 76 Kt 51 – transfer of money towards salary; Dt 70 Kt 76 – money is credited to the employees’ card accounts. If you transfer your salary through another bank, then reflect the payment as follows: Dt 70 Kt 51. |

Example 4

The amount of imputed income is 1000 thousand rubles, payroll is 300 thousand rubles. The total amount of contributions from the payroll will be equal to

VZ = 300 x 30% = 90 thousand rubles.

The “imputed” tax is equal to

UTII = 1000 x 15% = 150 thousand rubles.

Because 90 thousand rubles. - this is more than 50% of 150 thousand rubles, then contributions are partially deducted from the tax amount, in the amount of 75 thousand rubles.

Thus, the “remaining” fiscal burden on the payroll is 5% of its amount ((90 – 75) / 300).

As for the patent, under this special regime no deductions related to payroll are provided, and VAT is also not paid. Therefore, the fiscal burden on wages will be 30% plus “unfortunate” contributions.

Salaries were included in the expenses of the period of their accrual

If you use the accrual method, you need to recognize wages as an expense in the month in which you made final payments to employees. Even if the specified month does not coincide with the month for which the salary is calculated! This is how the Russian Ministry of Finance interprets the norms of the Tax Code of the Russian Federation. You must take into account the payment for a vacation that began in one month and ended in the next in the expenses of both months in proportion to the number of days of rest falling on each month.

Letter of the Ministry of Finance of Russia dated August 20, 2007 No. 03-03-06/2/156 HOW TO ACCOUNT SALARY

The commented letter will be of interest to those who use the accrual method for profit tax purposes. Firstly, specialists from the Russian Ministry of Finance believe that advances issued to employees* cannot be taken into account in expenses. And, secondly, the salary must be attributed to the expenses of the month in which it was actually accrued. At the same time, the month for which the salary was accrued is not important!