The role and basis for the formation of accounting policies in accounting

All organizations, both large and small, are required to have an Accounting Policy drawn up in accordance with the law. Due to various changes, this is especially important for any business in 2020

Determination of accounting policies

Therefore, we can say that accounting policy is one of the most important components of any enterprise.

The procedure for developing the organization’s accounting policy for 2020 was approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n “On approval of accounting regulations”, the corresponding provision “Accounting Policy of the Organization” (PBU 1/2008).”

The general provisions have not changed much compared to 2021 and 2021. As before, all organizations are required to formulate accounting policies. But if earlier this responsibility was the chief accountant's, now this can be assigned to any person in the enterprise who maintains accounting records.

Changes that need to be taken into account if accounting for 2021 is being formed (item by item)

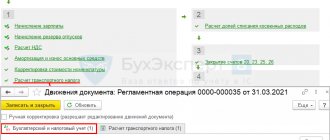

In the proposed example of an enterprise’s accounting policy for 2021, the following have been changed (added):

- Clause 6, 19, 21 - inventory accounting in accordance with the new FSBU 5/2019 “Inventories”.

How to apply the updated FSBU 5/2019 “Inventories” was explained in detail by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

- Paragraph 45 indicates the use of updated financial reporting forms for 2021 and the use of control ratios from the Federal Tax Service.

- Clause 48 - it includes an indication of the approval of mandatory requirements for the preparation of primary accounting documents. Let us remind you that as of June 9, 2019, the chief accountant cannot be fined for errors made in accounting due to the fault of third parties, including due to their incorrect preparation of primary documents. And from July 26, 2019, the Law “On Accounting” introduced an indication of mandatory compliance with the requirements of the chief accountant (another person responsible for accounting) for registration of primary accounts by all employees of the organization. In this regard, it is recommended to draw up such written requirements as an appendix to the accounting policy and familiarize them with all employees involved in working with documentation, against signature.

What should the accounting policy contain in 2021?

The following items must be approved in the accounting policy:

— working chart of accounts of the enterprise;

— forms of primary documents and other registers;

— the procedure for conducting inventory;

— methods for assessing liabilities and assets;

— control over business operations.

The organization also has the right to introduce other items that are important to it.

Elements of accounting policies

[flat_ab id=”11"]

All newly appeared changes must be made to the Accounting Policy no later than December 31, 2021 , independently or using the special “Consultant Plus” program.

The accounting policy comes into force on January 1, 2020 . A newly formed organization must develop and approve its policies within 90 days of being registered.

If the parent organization has subsidiaries and other divisions, then it must use its own accounting policies for all. for each separate division!!!

An enterprise has the right to change its accounting policies if new methods of accounting have been found, if legislation has undergone changes, as well as a reorganization of the enterprise or a change in the type of activity.

The new accounting policy begins to apply in the year following the reporting year, but by law it can also be applied in the current year 2021 under certain conditions.

Cash storage limit at the cash desk

Clause 2 of the “Procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”, approved by Directive of the Bank of Russia dated March 11, 2014 No. 3210-U, stipulates that legal entities must independently determine the limit of cash that can kept in the organization's cash register. Of course, the limit itself should not be indicated in the organization’s accounting policy. Simply because it has nothing to do directly with accounting. And most organizations have no choice in this matter - the Central Bank ordered it, which means there must be a limit.

Since the “majority” was mentioned, does it mean that a minority exists? Of course, where would we be without him? Many regulatory documents written “for everyone” necessarily indicate a certain category that may not do something that is required of the rest. In PBU, this category includes accounting “simplified” ones that are not subject to mandatory audit, taking the place where “small businesses” previously proudly sat. But in the Directive of the Bank of Russia such a replacement did not occur. And therefore, small enterprises and individual entrepreneurs retained the right not to determine the cash limit at the cash desk (see paragraph 10 of paragraph 2 of Bank of Russia Directive No. 3210-U). And it’s worth writing about this in the accounting policy. One of two things – either “we don’t use it because we have the right,” or “we use it because we want to.” The size of the limit, I repeat, does not need to be indicated in the text of the accounting policy. It will still be reviewed periodically. Shouldn’t we issue an order to make changes to the accounting policy every time the limit is changed?

Accounting policy 2021 - sample

1. Accounting policy (common template for all enterprises)

2. Accounting policies of a trading organization

3. Accounting policy of the management company

4. Accounting policy of an agricultural enterprise

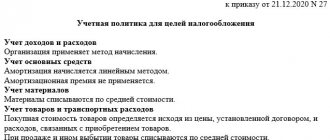

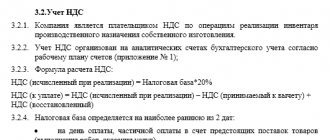

5. Accounting policy for tax accounting purposes

5.

[f[flat_ab id=»5"]p>

The procedure for transferring accountable amounts to employees

Another organizational point related to cash flow should be reflected in the accounting policy. It is related to the procedure for issuing advances for travel, entertainment and business expenses. This situation does not directly relate to accounting of accountable amounts - it is closer, rather, to document flow. But since we are talking about money, why not write about it in the accounting policy?

For a long time, the Ministry of Finance of the Russian Federation in its letters desperately scolded organizations that used the salary cards of their employees to transfer advances for business trips and target amounts for cash expenses of a current nature. But then, apparently, it dawned on the officials that it was useless to fight this, especially since the established practice was quite rational and speeded up the process of employees receiving funds. Resigned, the Ministry of Finance issued several letters (Letter of the Ministry of Finance of the Russian Federation No. 02-03-10/37209 and the Treasury of Russia No. 42-7.4-05/5.2-554 dated September 10, 2013; Letter dated August 25, 2014 No. 03-11-11/42288 ), in which, referring to paragraph 2.5 of Chapter 2 “Regulations on the issuance of payment cards and on transactions performed with their use,” approved by the Bank of Russia on December 24, 2004 No. 266-P, he explained that the organization has the right to transfer funds to employees for travel and other expenses in the interests of the organization on bank cards, because this is rational.

Thus, an organization that wants to disclose in detail the procedure for making payments to its employees for accountable amounts must indicate in its accounting policies (either in the appropriate section or in an appendix drawn up in the form of a special provision - for example, “Regulations on the organization and documentation settlements with accountable persons"), how it will issue money to employees - only in cash from the cash register, only by transfers to a card, or both. Any option is permitted and does not contradict regulatory documents.

Explanatory note and accounting policies of the organization

Organizations that publish their reports, in accordance with PBU 1/2008, must indicate the methods of accounting in an explanatory note . This note should contain the following information:

— methods of calculating depreciation

— methods for assessing inventories, goods, finished products

— methods of recognizing revenue from various types of activities.

If the enterprise has made any amendments to its accounting policies, then in the explanatory note it is obliged to indicate the reason for these changes, their content and reflection of the consequences, as well as the application of new regulations.

Also, the explanatory note must indicate estimated values, which, according to PBU 21/2008, include:

- the amount of valuation reserves that the enterprise has created

- useful life.

It can be noted that changes in PBU are moving accounting and tax accounting further and further away from each other, since the Tax Code of the Russian Federation strictly determines the formation of a reserve for doubtful debts and prohibits changing the useful life.

Results

A ready-made accounting policy has a set of aspects characteristic of the organization for which it was drawn up. Using a ready-made document from another enterprise as a sample for preparing an accounting policy, you should compare and adjust the provisions for each item. And also take into account those provisions that may not be used (not disclosed) in the accounting policies of one enterprise, but should be included in a similar document of another.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Organizational aspects of accounting policies

Information about the reporting year should be reflected here primarily. For all organizations this is the period from January 1 to December 31.

Organizational order of the accounting service. The company establishes this procedure independently.

If the company’s accounting is kept by the chief accountant or an authorized person, then it is this person who is responsible for organizing accounting and maintaining accounting policies.

Mostly, organizations do not take the formation of a chart of accounts seriously, which subsequently leads to serious problems.

If necessary, the company can change the chart of accounts, as well as include or, conversely, remove subaccounts.

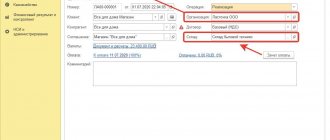

By law, organizations must use primary documents, the forms of which are provided in the albums of unified forms of primary accounting documentation, the development of which requires the availability of the following data:

- Title of the document

- form code

- Date of preparation

- name of the organization that compiled the document

- content of business transactions

- meters of business transactions in monetary and natural meters

- list of officials

- signatures of the parties.

Note. Today it is allowed to create your own forms of primary documents!!!

Also, the organization must approve the accounting registers that are necessary to accumulate information reflected in the primary documents for accounting.

The responsibility to ensure that the registers are compiled correctly lies with the person who compiled and signed them. These persons are required to keep state and commercial secrets.

The document flow schedule is also provided for in the accounting policy. The responsibility for its preparation lies with the chief accountant.

In accordance with clause 33 of the Accounting Regulations, reporting must include performance indicators of branches and divisions of this organization. But the law does not provide for the forms and deadlines for submitting reports of separate divisions, so this must be indicated in the accounting policies of the parent organization.

Among other things, the accounting policy prescribes the methods of reporting. The organization itself chooses how to submit reports to it: electronically or on paper.

Read also: Characteristics of the accounting policy of a trading enterprise

Reserve for reduction in the cost of finished products

The organization incurred some expenses and produced finished products.

The production result is received and sent to the warehouse. Ideally, finished products should not lie in a warehouse for a long time - they were not produced so that they would simply lie around without moving. But anything can happen in life... The buyer let us down, competitors got in the way. Or even completely - the Crisis arrived without an invitation, and no one is particularly eager to buy these products, because there are more pressing needs. Meanwhile, the products lie in the warehouse, deteriorate, losing their purchasing power and slowly becoming cheaper... As we see, finished products are also subject to disturbances, just like ordinary inventories. If this is so, then what prevents the organization from forming a reserve for depreciation of finished products - by analogy with a reserve for depreciation of materials? Nothing gets in the way. Moreover, according to paragraph 2 of Section I of PBU 5/01, finished products also belong to inventories (MP), therefore, the requirement to create a reserve to reduce the cost of MP is also fair for them.

Thus, an organization that produces finished products in material form as a result of production activities is obliged to create a reserve to reduce its value. And when creating such a reserve, the organization will also be obliged to disclose in its accounting policies the procedure for its creation, in which it is necessary to indicate answers to a number of questions:

- frequency of creation and adjustment of the reserve (once a year or several times as of certain, independently selected dates);

- the principle of creating a reserve (by accounting units or by generalized groups);

- the procedure for restoring the amount of the reserve when the market value of products increases (through an increase in income or by reducing expenses)

We have already discussed in detail the procedure for disclosing this information in the accounting policy and the features of the option for choosing the appropriate accounting method by the organization earlier (in the article “Inventory (Inventory)” (October 15, 2015)), so we will not return to this again. Finished products, as we have already found out, are a full-fledged part of the inventories, and the accounting regulations do not provide for any specifics in the procedure for creating a reserve for their depreciation.

For small businesses

Small businesses (SMBs) have the right to use simplified accounting registers and submit simplified financial statements.

If an organization wants to exercise this right, it must be written down in a document.

SMP has the right to refuse to apply 6 accounting standards, such as “Accounting for construction contracts” (PBU 2/2008), “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010) and others.

All accounting standards that are not applied by the entity should be listed in a special section “Application of accounting provisions.”