Any business involves certain types of costs. Among them, a significant place is occupied by the so-called commercial expenses. The efficiency of the entire economic and production system of the enterprise depends on their formation and management.

Let's consider what an organization's commercial expenses are, what influences their distribution and analysis, how to correctly reflect them in financial accounting, and also give specific examples of calculations regarding commercial expenses.

sales expenses (commercial expenses) in the accounting of a production organization if the accounting policy for accounting purposes provides for the complete write-off of such expenses to the cost of sales?

Let's decipher the term business expenses

If an organization is engaged in the production and sale of goods and/or services, it will certainly incur costs directly related to its direct activities. Costs directly for production are taken into account separately, the rest are called commercial, otherwise non-productive.

What expenses are included in business expenses ?

These types of expenses include:

- costs associated with the shipment of goods sold;

- expenses associated with the implementation process;

- the cost of packaging or containers, if it is not produced but purchased from another organization;

- payment to third-party packers if their services are used;

- costs of delivering goods to the destination specified in the contract;

- advertising and marketing expenses;

- commissions and deductions to intermediaries;

- rental of warehouses, shops, etc.;

- ensuring storage of goods;

- representation expenses;

- licensing and/or certification costs;

- wages for distributors;

- other expenses close to their intended purpose.

NOTE! It is allowed to include in business expenses costs not only for sales, but also for the purchase of goods.

Such costs are called transport and procurement costs (TPP). They are distributed between goods already sold and goods not yet sold.

The role of commercial expenses in the economic mechanism of the organization

Only those business activities that effectively record and manage their financial results, which include business expenses, will be successful. The factors of their influence on the economic mechanism are very significant and diverse.

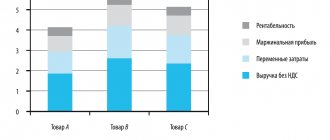

- A direct connection with the profitability of production - an analysis of the dynamics of business expenses and ways to manage them shows ways to increase the efficiency of business, as well as “weaknesses” that should be given increased attention.

- Determination of reserves for reducing production costs . The rise or fall of business costs clearly shows the financial potential for different types of activities and types of goods produced.

- Pricing policy – accounting for business expenses allows you to correctly set prices for the company’s products.

- Calculation of economic efficiency in case of technology changes, modernization, acquisition of new equipment, etc.

- Formation of a product range - justification for making decisions on the removal of any products from production or the introduction of new ones.

- Dominant position in the financial accounting of the organization - it is commercial indicators that are the main accounting reporting units.

- Impact on national income throughout the state.

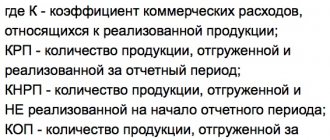

What accounting data is used when filling out line 2210 “Business expenses” ?

What are management costs?

Administrative expenses include amounts generated on account 26 and associated with the maintenance of the company’s common property and the organization of its activities. A distinctive feature of such expenses is that they are not directly related to production, provision of services or trade. An example of management expenses would be the following expenses:

- on guard;

- payment for the Internet, housing and communal services and communications;

- entertainment expenses;

- salaries of accountants, lawyers, personnel officers and other administrative and management personnel;

- labor protection and seminars for workers;

- stationery.

Administrative expenses can be included in the cost of production as products are sold. Then the accountant must write them off by posting to the debit of account 20 (23 or 29) and the credit of account 26.

The second way to account for administrative expenses is to attribute them in full to the cost of the reporting period in which they arose. In this case, the accountant will post Dt 90 Kt 26.

The chosen procedure for accounting for management expenses must be specified in the company’s accounting policy (clause 20 of PBU 10/99).

Learn more about account 26 from the publication “Account 26 in accounting (nuances).”

How are business expenses calculated?

One of the key commercial characteristics of a product is its cost. It can only be determined during the production process, since it consists of the amount of funds spent on the production itself (production costs) and on sales (commercial costs).

The organization's accounting must take into account such costs in account 43 “Business expenses”. The debit shows the costs of selling products for the reporting month, the credit shows the amounts that were written off for products sold in the reporting month, and the balance shows the costs of shipped products that have not yet been paid for at the beginning dates of the month.

The debit of account 43 “Business expenses” allows you to take into account this type of cost, which passes through the credits of the following accounts:

- costs for containers and packaging – account 10 “Materials”;

- expenses for transport delivery of sold products to the buyer’s warehouse or to the point of further departure (airport, port, railway station) - account 23 “Auxiliary means”;

- payment for delivery to the buyer, if it is carried out by a third party - account 60 “Settlements with suppliers and contractors”;

- salaries for employees accompanying products, sellers, etc. – account 70 “settlements with personnel for wages”.

Statement 15 for accounting for general business expenses, future and non-production, reflects the result of analytical accounting of business expenses.

When the accounting month ends, these types of expenses are written off to cost of goods sold. You can use a direct route for this (for specific types of products), and it is permissible to distribute costs in proportion to the cost and number of goods sold (if it is difficult to classify products into one group or another). To do this, the following accounting entry is used:

- debit 46 “Sales of products, works, services”;

- credit 43 “Business expenses”.

FOR YOUR INFORMATION! If during the reporting month not all of the planned products were sold, but only some part of them, then it is advisable to distribute commercial expenses for the sold and unsold part of the products, for example, according to the cost of goods or in another acceptable way.

New chart of accounts and business expenses

One of the accounting innovations provides for the posting of commercial expenses in account 44 “Sales expenses”. The debit of this account accumulates the amounts of funds spent on the sale of goods, services, and work performed. The assets in this account are written off as a debit to account 90 “Sales”.

Selling expenses on the balance sheet

The balance sheet does not provide a special item for business expenses. When drawing up a balance, the balance of funds in account 43 “Business expenses” is added to the balances accumulated in account 45 “Shipped goods”.

Rules for maintaining accounting records in trade

Attention

Write-off of expenses in full In accordance with paragraph 9 of PBU 10/99, commercial and administrative expenses can be fully included in the cost of products sold if they are recognized as expenses for ordinary activities. If a company has switched to this write-off procedure since the beginning of the year, then it must write off the unwritten-off balance of business expenses for the previous reporting period to account 84 “retained earnings (uncovered loss)” (clause 15 of PBU 1/2008). Example Passive LLC produces products. According to the accounting policy for the reporting year, selling expenses are recognized as expenses for ordinary activities and are fully taken into account in the cost of products sold.

At the beginning of the year, the balance of business expenses in the amount of 6,000 rubles is recorded in the “Liability” account. The Liability accountant will write off this amount by posting: DEBIT 84 CREDIT 44 - 6000 rubles.

Business expenses and taxation

The difficulty is that it is necessary to separate the costs of selling products and advertising costs, which are also non-sales, but are standardized according to another article of the Tax Code (clause 4 of Article 264 of the Tax Code of the Russian Federation).

In the income tax, the share of advertising tax will be no more than 1% of revenue, which will make the difference in tax and accounting.

FOR EXAMPLE. For the reporting period, Primavera LLC received incremental revenue in the amount of RUB 6,500,000. excluding value added tax. Advertising expenses according to accounting data amounted to 70,000 rubles. Let's calculate how much advertising costs can be used to calculate income tax.

According to the rate of advertising costs given in paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, advertising expenses cannot exceed 1% of revenue: 6,500,000 x 1% = 65,000 rubles. This percentage is less than the funds actually spent on advertising - 70,000 rubles. Consequently, income tax will be calculated only on 65,000 rubles, and the difference in tax and accounting will be 5 thousand rubles.

Drawing conclusions

Considering that the organization we are interested in is engaged exclusively in trading operations, all expenses, except for the cost of purchasing goods, should be considered related to the purchase and sale of goods and must be taken into account in accounting on account 44. Such an organization will use account 26 only if it begins to carry out other activities related to the production process.

At the same time, this does not mean that all these expenses should be indicated as business expenses in the income statement. An enterprise may well decide to reflect both commercial and administrative expenses in this form if this information is important to users of the statements (to be more precise, relevant). Where does this come from?

In accordance with clause 6.1 of the Concept of Accounting in the Market Economy of Russia <2> the information generated in accounting should be useful to users. Information is considered useful if it is relevant, reliable and comparable. From the point of view of interested users, information is relevant if its presence or absence has or is capable of influencing the decisions (including management) of these users, helping them evaluate past, present or future events, confirming or changing previously made assessments. In turn, the relevance of information is influenced by its content and materiality.

<2> Approved by the Methodological Council on Accounting under the Ministry of Finance of Russia, the Presidential Council of the IPB RF on December 29, 1997.

Since Russian accounting legislation is rapidly moving closer to the requirements of IFRS, we consider it appropriate to look at IAS 1 “Presentation of Financial Statements” <3>, in which we are interested in the section “Information to be presented in the statement of comprehensive income or in the notes”. In accordance with paragraph 99 of this Standard, an entity must present an analysis of expenses recognized in profit or loss using a classification based on either the nature of the costs or their function within the entity, whichever provides reliable and more relevant information . That is, we find the same requirement - relevance.

<3> Put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated November 25, 2011 N 160n.

In IAS 1, enterprises are offered a choice of one of two options for disclosing information about expenses in the statement of comprehensive income for the period (for us this is the profit and loss statement) (company management chooses the most appropriate and reliable way of presenting information).

The first form of analysis is the “cost nature” method. It aggregates expenses based on their nature (for example, depreciation of fixed assets, purchases of materials, transportation costs, employee benefits, and advertising costs).

Optimization of business expenses

Effectively reducing sales costs is a direct path to increased profitability and profitability. The following ways to optimize this type of expense can be identified:

- cost reduction should not be an end in itself; it is much more important to organize effective management;

- any unit of spending should bring the most effective result;

- it should be remembered that expenses are the result of both actions and inactions;

- cost reduction is impossible without corresponding costs invested in it;

- maintaining the level of spending at an optimal level is already considered successful from the point of view of economic efficiency;

- one should not skimp on expenses that will help insure against more significant costs;

- Analytical work to optimize commercial costs must be ongoing.