You will find the 2021 reporting schedule broken down by quarter below. The information will be useful to companies and individual entrepreneurs on OSNO, simplified tax system and UTII.

This chart will help you include approximate tax amounts in your cost estimate. In the 2021 tax calendar you will find important deadlines for submitting reports to the Federal Tax Service. The 2021 reporting calendar is divided into quarters, and quarters into months. Here you will find an accountant calendar for January 2021, February, July, etc.

The 2021 accounting calendar describes the exact due dates, names of forms and persons who are required to report.

The reporting schedule for 2021 is presented in table form for the convenience of those who better perceive information in the form of tables.

In the first and second quarters, companies and individual entrepreneurs will submit annual reports in addition to quarterly reports.

Reporting changes in 2018

This year the reporting company will be carried out using many declarations in new forms.

Updated 4-FSS reports, tax return for transport tax, tax return for income tax. A new form of property tax reporting, 3-NDFL, and land tax declaration has been introduced.

There are no serious innovations in these reports. Most of the innovations are related to clarifications and innovations in tax legislation. Therefore, in most cases, declarations are supplemented with new lines.

In addition, new reporting forms have been developed that will need to be used starting in 2021, these are primarily:

- New calculation of insurance premiums.

- Help 2-NDFL.

- Declaration 6-NDFL.

- Declaration on UTII and others.

Important!

For the first time this year, companies and entrepreneurs acting as employers will need to submit a new SZV-STAZH form to the Pension Fund. Many accountants have already received notification letters from representatives of the Pension Fund of the Russian Federation about the need to submit a new report and the deadline for its submission. Letters arrived both electronically and by post. This is due to the fact that the previously existing report is now divided into two - one needs to be sent to the Federal Tax Service, the other to the Pension Fund.

Many statistical reporting forms have also been updated. New this year was the impossibility of submitting a zero report to Rosstat.

Therefore, if a report is included in the list of mandatory forms for a company, but the company does not have the data to fill it out, then it is necessary to send letters to statistics explaining the reason for the impossibility of submitting certain reporting forms (for example, due to the lack of objects of statistical observation).

Postponement of deadlines on weekends and holidays

Currently, most regulations establish that if the day the report is sent falls on weekends and holidays, then it is transferred to the next working day after non-working periods.

That is, if the form “Information on the average headcount” must be submitted to the Federal Tax Service by January 20, then in 2021, due to this date falling on a Saturday, the day of sending is postponed to January 22.

Reporting forms submitted to the Social Insurance Fund previously had to be sent to the fund only on time, without taking into account postponements due to weekends and holidays.

Attention! As of 2021, social insurance has also revised its position regarding the transfer. Therefore, when determining the days for sending forms to the FSS, you must also adjust them, and if these days fall on weekends, use the following working days as such.

Deadlines for submitting reports to the Social Insurance Fund: table

Currently, only one form is sent to the FSS. However, its end date is determined based on how the form is sent - in paper form or electronically.

Attention! In addition, to set the rate of transfers for injuries, you need to confirm the main activity for 2021 in the Social Insurance Fund. This must be completed by April 16, 2021.

| Reporting type | Submission period | Due dates | Tax system | ||

| BASIC | simplified tax system | UTII | |||

| 4-FSS in paper format | Quarter | 2017 - 01/22/2018 Q1 2021 – 04/20/2018 1st half of 2021 - 07/20/2018 9 months 2021 – 10/22/2018 | + | + | + |

| 4-FSS in electronic format | Quarter | 2017 - 01/25/2018 Q1 2021 – 04/25/2018 1st half of 2021 - 07/25/2018 9 months 2021 – 10/25/2018 | + | + | + |

What does a patent system report include?

Within a few years of the introduction of patents as a form of payment of taxes, a whole list of changes occurred in the system. Therefore, the 2021 Patent Tax Reports require careful attention. In some cases, a company may lose the right to apply this regime, so when preparing the 2021 annual patent tax report, it is worth paying attention to the existing restrictions.

The main thing in the report is the presence of a book of income and expenses (KUDiR). It is on its basis that it is determined that an individual entrepreneur has met the limits on total revenue/profit. To comply with the deadline for submitting documents to the Federal Tax Service, it is recommended to use the reporting calendar of the 2021 taxation system. The following rules apply to accounting books:

- Russian language is used;

- each business transaction is entered on a separate line;

- It is not allowed to use a proofreader (to correct errors);

- Previously submitted KUDiR books are stored for at least 4 years.

In Moscow, reporting of the 2021 patent tax system is submitted in the same ways as in the regions.

Deadlines for submitting financial statements

Accounting statements consist of:

- Balance sheet according to form-1.

- Profit and loss statement according to form-2.

All companies that are required to carry out accounting must submit a balance sheet and other accounting forms in 2018. For example, this includes absolutely all companies, regardless of the tax system they use - OSNO, simplified tax system, UTII or unified agricultural tax.

The organizational form of the organization is also not taken into account - they must be sent by LLC, JSC, cooperatives and other companies of private or commercial ownership.

Entrepreneurs and branches of foreign companies may not send balances in 2021. They are exempt from mandatory accounting.

The sending day is set to the same for all business entities that are required to report - until March 31, 2021. However, since this day is marked as a holiday, the final day for sending the balance is moved to April 2, 2021. For transferring the form after the specified date, a fine will be imposed on the company.

Attention! This deadline does not apply to new companies that were registered on or after October 1, 2021. For them, by law, the reporting period is set from the date of registration to December 31 of the following year. This means that they will have to send the balance for the first time in 2021.

When a company is liquidated in 2021, its final reporting period is set to be from January 1, 2021 to the date of entry in the Unified State Register of Legal Entities. Next, the closing balance must be prepared and submitted within 3 months from the closing date.

Transition to OSNO in 2021

In order to start working on OSNO immediately after registering a business, you do not need to submit a notification about the application of OSNO to the Federal Tax Service. All organizations and individual entrepreneurs are automatically transferred to this regime if they did not choose a different taxation regime during registration or within 30 days after it.

Note! Starting from 2021, companies and individual entrepreneurs cannot use the UTII system - it has been cancelled. All payers who have not switched to other modes were automatically transferred to OSNO from January 1. Additionally, they do not need to take any action to switch.

Transition from simplified tax system to OSNO

To switch to the OSNO with the simplified tax system, you must, before January 15 of the year from which the transition to the general regime is planned, submit to the tax office at the place of registration a notice of refusal to use the simplified tax system in form No. 26.2-3.

If the notification is not submitted by January 15, it will be possible to switch to OSNO only starting next year.

A voluntary transition to OSNO is possible only from the next calendar year, but if an organization or individual entrepreneur loses the right to use the simplified tax system, they are automatically considered transferred to OSNO from the quarter in which non-compliance with the conditions for applying the simplified tax system was committed.

Transition from Unified Agricultural Tax to OSNO

To switch to OSNO with Unified Agricultural Tax, it is necessary, before January 15 of the year from which the transition to the general regime is planned, to submit to the tax authority at the place of registration an application for refusal to use Unified Agricultural Tax in form No. 26.1-3.

A voluntary transition to OSNO is possible only from the next calendar year, but if an organization and individual entrepreneur lose the right to use the Unified Agricultural Tax, they are automatically considered transferred to the OSNO from the beginning of the reporting (six-month) or tax (year) period in which non-compliance with the conditions of application was committed Unified Agricultural Sciences.

You can switch to the unified agricultural tax again only one year after losing the right to use the unified agricultural tax.

Transition from Patent to OSNO

The transfer to the OSN from the PSN is carried out after 5 days from the date of submission to the tax authority of the application for termination of activities on the patent. If the right to use a patent is lost, the entrepreneur is transferred to the general system from the beginning of the period for which the patent was received.

Reporting to statistics

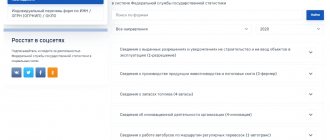

In 2021, Rosstat has expanded the number of forms that must be submitted. It is also necessary to remember that it is prohibited to submit zero reports.

Which business entities must submit one form or another depends on the status (microenterprise, small, etc.), what kind of activity the company is engaged in, etc.

All registered companies, regardless of status, must submit financial statements by March 31, 2021. Entrepreneurs do not submit them, since they are allowed not to conduct accounting.

Firms that have above-average business status must submit:

| Form name | Term |

| P-1 | Rented every month until the 4th day of the following month |

| P-5(M) | Sent for each quarter, before the 30th day of the month following the end of the quarter |

| 1-Enterprise | Dispatched every year, until April 1 of the new year |

| P-4 | Can be rented either monthly or quarterly. In each case, the deadline for submission is until the 15th day of the month following the reporting period |

| P-2 | Annual form - until February 8 after the end of the year, quarterly - until the 20th day of the month after the end of the quarter |

If the business entity is a micro, small or medium-sized enterprise, then they are not included in the mandatory delivery. In relation to them, Rosstat conducts random observations. You can find out what forms an organization must submit in a given year on the Rosstat website https://statreg.gks.ru/.

Subjects included in the sample usually send:

| Form name | Term |

| 1-IP (for entrepreneurs) | Until March 2, 2021 |

| PM (micro) (for micro enterprises) | Until February 5, 2021 |

| PM (all other enterprises) | Until January 29, 2021 |

Penalty for failure to provide

The amount of fines does not change in 2021. However, there is a change in how the total amount of unpaid tax is calculated. Previously, a criminal case could be opened against a company when the amount of untransferred taxes reached the maximum level. However, this amount did not take into account the amount of unpaid amounts to the funds. Now, both taxes and contributions to social funds are involved in achieving the upper limit.

In addition to the general punishment for failure to provide a report, certain types of punishment are defined in some forms:

| Report title | Amount of fine |

| All tax returns | For any tax - 5% of the amount of tax not transferred on time according to this declaration for each full or partial month of delay. The maximum fine is set at 30% of the tax amount according to the declaration. The minimum amount is 1000 rubles (for example, this is paid for failure to submit a zero declaration) |

| Income tax and property tax | 200 rubles for an unsubmitted declaration or calculation of advance transfers |

| Report 2-NDFL | 200 rubles for each certificate that was sent in violation of the deadlines |

| 6-NDFL | 1000 rubles for each whole or partial month of delay |

| Calculation of insurance premiums | 5% of the amount of contributions for the previous 3 months according to the unsubmitted calculation for each whole or partial month of delay. The maximum fine amount is 30%. The minimum amount is 1000 rubles. |

| SZV-M | 500 rubles for each employee whose information was included in the report submitted late |

| SZV-STAZH | 500 rubles for each employee whose information was indicated in the late submitted report |

| 4-FSS | 5% of the amount of contributions for injuries for the previous 3 months according to the unsubmitted calculation for each whole or partial month of delay. The maximum fine is 30%. The smallest amount is 1000 rubles. |

| Accounting forms | 200 rubles for each form that needed to be submitted to the Federal Tax Service. 3000-5000 rubles for each form that needed to be sent to statistics. |

What taxes must be paid under the general taxation system in 2021

Basic taxes OSNO

Note! In 2021, tax payment and reporting deadlines for some individual entrepreneurs and organizations were postponed due to the coronavirus epidemic. However, all delays are now over. Read the article for details about transfer deadlines.

The table below shows all the main taxes that must be paid on OSNO:

| Type of tax | Tax rate | Payment deadline | Who pays |

| Corporate income tax | 20% | Advance payments (for organizations that meet the criteria of clause 3 of Article 286 of the Tax Code of the Russian Federation) - within 28 days from the end of the reporting period (quarter) Monthly advance payments – by the 28th of each month Tax at the end of the year - until March 28 of the year following the reporting year | Organizations |

| Personal income tax | 13%, 15%, 30% | Advance payments until April 25, July 25, October 25 Tax at the end of the year - until July 15 of the year following the reporting year | IP |

| VAT | 0%, 10%, 20% | No later than the 25th day of each month following the expired tax period (quarter) 1/3 of the amount each month or a single amount until the 25th day of the month following the previous quarter | Organizations and individual entrepreneurs |

| Organizational property tax | not > 2.2% (set by local authorities) | Tax and advance payments are paid according to the deadlines established by the regulations of the constituent entities of the Russian Federation | Organizations |

| Property tax for individuals | from 0.1% to 2% (set by local authorities) | Tax for the year is due by December 1 of the year following the reporting year. | IP |

Taxes and payments for employees

Individual entrepreneurs and organizations on OSNO are required to withhold personal income tax on all income paid to their employees (including those working on a civil basis), as well as transfer insurance contributions to extra-budgetary funds.

Learn more about taxes and payments for employees.

Fixed contributions for individual entrepreneurs

All individual entrepreneurs, regardless of the chosen taxation system and the presence of employees, are required to pay fixed insurance premiums “for themselves” every year.

In 2021, their size remained unchanged and amounted to RUB 40,874.

Learn more about fixed individual entrepreneur contributions.