The Federal Tax Service has approved new forms for registering and liquidating a business. Among others, a new form P26001 has been adopted, which is submitted when closing an individual entrepreneur.

Be careful - as of November 25, 2021, the acceptance of previous forms will cease. The tax office will only accept an application for termination of business activity using the new form. Find out how the new form P26001 differs from the old one and how to fill it out.

What to do before writing an application

Before filling out the document, you need to pay the state fee for closing. It is 160 rubles.

If employees work for an individual entrepreneur, then it is necessary to notify them of the closure at least two weeks in advance. Preferably in writing. Otherwise it will be a violation of labor laws.

You also need to decide on how to submit your application. You can submit it to the local authority of the Federal Tax Service in paper form, by mail or electronically. But this cannot currently be done through the Public Services portal. The tax authority has its own website and a corresponding section in it. You can submit an application to close an individual entrepreneur there, but to do this you need to have your own digital signature. If there is no electronic seal, then you will have to do it the old fashioned way, in paper form.

Stages of closing an individual entrepreneur with employees

Let's look at the step-by-step instructions for closing an individual entrepreneur with all the necessary documents and forms that you may need.

Fulfill your duty as an employer - deal with employees if you have them

This means that you need to calculate them, as well as submit reports and pay fees for them.

Employment service notification

According to paragraph 2 of Art. 25 of the Law of the Russian Federation dated April 19, 1991 No. 1032-I, the employment service must be notified in writing about the upcoming reduction of employees - two weeks in advance (at the individual entrepreneur’s place of residence).

There is no established form for such a notification, so it is drawn up in any form. At the same time, there is a whole list of mandatory information about laid-off employees that must be indicated in it:

- job title;

- profession;

- speciality;

- qualification requirements;

- terms and conditions of remuneration for each specific employee.

You can build on this form of notification.

Warning employees about upcoming dismissal

It is important that each employee is familiar with the notice and signed.

Employment contracts with employees may stipulate not only the terms of notice of dismissal, but also the grounds and amounts of severance pay and other compensation payments in the event of termination of the employment contract. If all these points are indicated in the document, then you are obliged to comply with them.

According to Kirill Kuznetsov, managing partner of the EKVI legal agency, if the employment contract does not contain information about notice periods for dismissal, then the individual entrepreneur is not obliged to comply with the two-month notice period for the employee, as is established for employer-organizations.

If specific notice periods are specified in the text of the employment contract, then they must be observed. All employees must be notified, even those who are on vacation, sick leave or on a business trip.

For each employee you need to prepare documents:

- Issue an order to terminate the employment contract. To do this, use form No. T-8. The order must be issued no later than the date of entry on the termination of activities in the Unified State Register of Individual Entrepreneurs, since from that moment the individual entrepreneur is considered to have ceased activities. In the order, indicate that “the employment contract was terminated due to the termination of activities by the individual entrepreneur, clause 1, part 1, art. 81 of the Labor Code of the Russian Federation." Ask employees to read the order and sign it.

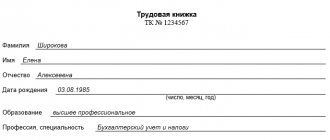

- Make an entry in the work books. It must correspond to the entry you made in the order.

- Make an entry in the employee's personal card. He must also familiarize himself with it and sign it.

- On the day of dismissal, issue each employee with a document on insurance experience (SZV-STAZH), a certificate of income (in the 2-NDFL form), information about work activity in the STD-R form (issued upon the employee’s request), and a work book.

- Pay employees salaries. If they have unused vacations, then compensation for them. If the employment contract provides for other compensation upon dismissal, then you will not be able to save on them - you will have to pay (Review of the judicial practice of the Supreme Court of the Russian Federation No. 4 (2017) (approved by the Presidium of the Supreme Court of the Russian Federation on November 15, 2017)).

Upon written request from the employee, you are obliged to provide him with certified copies of documents related to his work activities.

Report for employees, pay dues for them

To do this, you need to send document forms to the tax office, the Social Insurance Fund and the Pension Fund.

The tax office should receive RSV and 6-NDFL from you. FSS - form 4-FSS. And the Pension Fund of Russia - forms SZV-M, SZV-STAZH and SZV-TD.

After submitting the reports, you must pay the insurance premiums for employees that you calculated in the RSV and 4-FSS within 15 days.

An application for deregistration as an employer is submitted to the FSS only after the last employee is fired (the application form can be downloaded on the FSS website). The withdrawal period is within 14 working days from the date of receipt of the application.

It is important to remember that the fact that the policyholder is deregistered does not exempt him from repaying debt on mandatory payments to the Social Insurance Fund.

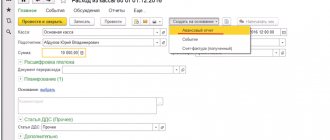

Don't forget to deregister the cash register

To deregister an online cash register when closing an individual entrepreneur, you need to submit an application to the Federal Tax Service (Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 N ММВ-7-20/ [email protected] ). This can be done in person at the tax office, via the Internet on the Federal Tax Service website, as well as in the personal account of the fiscal data operator.

If you are a user of Kontur.OFD, read the detailed instructions on how to deregister a cash register.

Settle all issues with counterparties

Anton Tolmachev, managing partner, draws attention to the fact that before closing an individual entrepreneur, in addition to submitting reports, terminating labor relations with employees and deregistering cash registers, it is imperative to terminate contractual relations with counterparties, pay them their own debts and collect debts from them, which they owe to the individual entrepreneur.

Relations with counterparties are regulated by various agreements, both those stipulating the activities of the entrepreneur, for example, a rental agreement, equipment maintenance agreement, contract for the supply of office supplies, and agreements concluded with counterparties on the direct activities of the entrepreneur.

The expert recommends that all contracts that the individual entrepreneur who is terminating his activities does not want to “take” with him should be terminated before closing the business.

It is necessary to pay your own debts to counterparties and collect from them debts that the individual entrepreneur owes. As you know, after the closure of an individual entrepreneur, all of its debts remain with the individual (former individual entrepreneur). When the lender is willing to wait, it is not necessary to pay off the debt before closing. But at the same time, collecting one’s own debts while still working as an individual entrepreneur is a mandatory measure (if only because in this case most disputes will be considered in an arbitration court, which is much more competent in disputes arising from economic legal relations).

Destroy the seal (if any)

The legislation of the Russian Federation does not oblige individual entrepreneurs to have a seal. Nevertheless, no one forbids an individual entrepreneur to have it.

Just remember that after the closure of the individual entrepreneur, the seal loses its legal force, because the individual entrepreneur indicated on the seal no longer actually exists. Therefore, it is better to destroy the seal to eliminate the risk of its misuse by third parties.

An important point: the destruction of the seal is documented by an act certified by the commission. It can consist of any persons: relatives, acquaintances.

Prepare the necessary package of documents for closing an individual entrepreneur

It will need to be sent to the tax office where the individual entrepreneur was registered.

What documents will be required:

- Download form No. P26001 on the Federal Tax Service website - this is an application for state registration of an individual’s termination of activities as an individual entrepreneur. It needs to be filled out.

Please note that the signature on the application must be certified by a notary. An exception is the case when an entrepreneur submits documents in person and at the same time presents a passport.

- Generate a receipt for payment of the state duty on the Federal Tax Service website. It will cost you 160 rubles. If the application is submitted on the tax office website or at the MFC, then you do not need to pay the state fee.

- Submit information about personalized accounting to the territorial body of the Pension Fund.

If you do not do this, then the territorial authority itself will do this work for you: it will send the tax authorities the necessary information electronically as part of an interdepartmental exchange.

Methods for submitting documents to the Federal Tax Service

There are several methods available now - you can choose any convenient one:

- in person (you will need to have your passport with you);

- through a representative by power of attorney certified by a notary;

- by mail with the declared value and an inventory of the contents (in this case, the signature must be notarized). In the appropriate field of the application you must indicate the notary's TIN. If this is not done, then the closure of the individual entrepreneur may be refused (Letter of the Federal Tax Service dated March 29, 2018 No. GD-4-14 / [email protected] );

- on the Federal Tax Service website;

- in person or by proxy at the MFC;

- through the government services portal.

To generate documents electronically, a qualified electronic signature will be required.

Need an electronic signature? Choose a certificate for your task

The inspection, having accepted the documents, will issue (or send) in response a receipt of their receipt.

What documents will you receive from the Federal Tax Service?

From the moment the documents are received, the tax office has 5 days to close the individual entrepreneur. But this is if everything is in order with your package of documents.

Upon completion of the procedure, you will receive a notice of deregistration and a USRIP entry sheet.

Obligations after loss of individual entrepreneur status

Even having lost the status of an individual entrepreneur, you, as an individual, continue to bear the obligations assumed while running a business, that is, debts continue to hang over you - they should not be left outstanding.

If, when closing an individual entrepreneur, it turns out that there is a debt to the Pension Fund, then it must be paid, since according to the law, the individual entrepreneur is liable for debts even after closure.

In addition, you need to understand that an individual entrepreneur is his own employer, so the responsibility to provide himself with a pension and health insurance falls on him.

An entrepreneur is obliged to pay insurance premiums for himself as long as he has the status of a business entity. Kirill Kuznetsov Managing partner of the legal agency "EKVI"

Understand your reporting

If you use the “simplified” method, then you cannot fail to file a declaration. This must be done no later than the 25th day of the month following the month of deregistration.

Individual entrepreneurs for UTII submit a declaration no later than the 20th day of the first month following the month of closure of the individual entrepreneur.

If you are a user of Elba, then the service will help you submit a declaration under the simplified tax system or UTII and calculate insurance premiums after the closure of the individual entrepreneur.

Individual entrepreneurs on OSN submit 3-NDFL (within 5 days after making a record of the closure of the individual entrepreneur) and a VAT return (by the 25th day of the month following the quarter in which the individual entrepreneur was closed).

Insurance premiums must be reported within 15 days after the business stops. The fixed part of the contributions will decrease in proportion to the days of the individual entrepreneur’s existence - it can be calculated using a contribution calculator. You will need to pay an additional 1% of pension contributions from the amount by which the income received exceeded RUB 300,000.

Close your current account

To deal with your current account, fill out an application on the form issued by the bank that opened the account.

Questions often arise about whether it is possible not to close a current account in connection with the termination of the activities of an individual entrepreneur. Experts mostly agree that it is better to close it in order to avoid claims from the bank and tax authorities.

Requirements for filling

The form will be familiar to those who have applied to open an individual entrepreneur. Requirements for filling:

- All letters must be entered on the form only in printed form.

- All letters must be capitalized.

- It is acceptable to fill only with a black pen, with maximum brightness of the shade. This is due to the fact that the completed document will be processed by machine.

- Each character (including periods, commas, colons, and spaces) needs its own cell.

- The information must completely match the data already available in the system. ID numbers, passports, OGRNIP, TIN and other data must not be distorted. A mismatch of at least one character results in cancellation of the document acceptance.

- Abbreviations and hyphenations are possible only in accordance with the rules of Russian spelling.

- Duplicate information is not welcome.

The machine does not understand and does not accept corrections or illegible written letters.

If you decide to fill out the columns in Word on your computer, then the font size should be 18, and its name should be Courier New.

Basic moments

Individual entrepreneurship is one of the forms of conducting commercial activity. A large number of different benefits are offered.

That is why many citizens who decide to open their own business choose this particular form of doing business.

At the same time, it often happens that an individual entrepreneur has to be closed. It is important to remember that for this you should use a special algorithm established at the legislative level.

There are many different nuances associated with the liquidation of an individual entrepreneur. This concerns primarily the documentation of the procedure itself.

Not only will the funds need to be notified accordingly, but also their own employees, if any. Specialized federal legislation is in effect.

The main issues that will need to be considered in advance today include the following:

- What it is?

- Who does it apply to?

- Where to contact?

What it is

Today, individual entrepreneur is a special form of organization for conducting commercial activities. It is important to remember that there are a number of specific restrictions imposed on working in this way.

They relate to both the profit received, the scale of activity, and the number of employees hired. To open an individual entrepreneur, it is necessary to carry out special registration. This process is determined by law.

The situation is similar with the liquidation of such a form of organization of activity as individual entrepreneurs. To implement the procedure, it is necessary to perform a number of different mandatory actions.

You need to contact special authorities. There are a number of nuances that will need to be dealt with in advance.

A standard set of reasons for terminating the activities of an individual entrepreneur and deregistering it from a special register:

| Indicators | Description |

| Availability of an appropriate decision of the individual entrepreneur himself | — |

| Death of an individual | or his disappearance |

| Lack of actual activity | — |

| There is a corresponding resolution, court decision | regarding termination of activities |

| Late documentary permit | for residence on the territory of the Russian Federation of a specific individual |

| Bankruptcy | insolvency |

The procedure for making an appropriate decision regarding liquidation is established by law. It will be necessary to carry out all actions in accordance with certain standards established by regulatory documents.

Who does it apply to?

Today, the decision to liquidate an entrepreneur can be made:

- An entrepreneur himself.

- Judicial authorities.

Typically, the procedure for terminating the activities of a particular individual entrepreneur is implemented precisely on the basis of his own decision. A special order is drawn up and signed by the individual entrepreneur himself. There are various features to keep in mind.

In some cases, if there are serious violations, liquidation should be carried out on the basis of an appropriate court decision. This procedure involves a trial.

The liquidation algorithm can also be carried out by third parties. A number of different documents are required.

Often, due to lack of time or other reasons, the entrepreneur himself simply cannot carry out all the necessary procedures on his own.

In this case, you can simply use the services of a trusted person. But you will need to draw up a special notarized power of attorney.

At this point in time, there are a large number of different commercial organizations that carry out the process of liquidating individual entrepreneurs on a paid basis.

When contacting them, they undertake all functions and mandatory procedures for carrying out the liquidation process.

This will avoid many different difficulties for the individual entrepreneur himself. The cost of liquidation services is usually relatively low.

When contacting such organizations, it is usually necessary to draw up a special notarized power of attorney. You will also need to certify the liquidation application.

The process of terminating activities involves contacting a fairly large number of different institutions.

The liquidation algorithm will need to be carried out in accordance with special standards. It is determined by law.

Where to contact

The list of authorities to which it will be necessary to apply in the event of liquidation of an individual entrepreneur as such is again established by law.

In 2021 you will need to visit the following institutions:

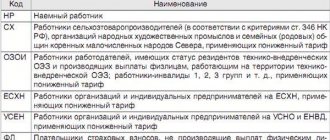

| Indicators | Description |

| Federal Tax Service | — |

| Regardless of the presence or absence of employees |

|

| Bank | to pay state duty |

First of all, you will need to worry about paying the state duty. This procedure is standard.

It is very important not to confuse the payment details. Since if the duty is not paid, it will be quite problematic to close the individual entrepreneur.

In this case, you should definitely keep the paid receipt as confirmation of the payment. Today there is no need to provide it. But often special databases are updated with a significant delay.

Having a paid receipt allows you to avoid many different difficulties.

After the state fee has been paid, you will need to contact the Federal Tax Service with previously prepared documents.

A visit to the Pension Fund and the Social Insurance Fund is also necessary - an alternative is to send documents by mail. Individual entrepreneurs are obliged to make contributions of a certain amount for themselves, as well as their employees.

A separate issue is the closure of individual entrepreneurs with debts. Moreover, both to funds and wages, tax debts.

Before proceeding with the closing, it is important to take into account that the individual entrepreneur is liable for its obligations with its own property.

There are a number of features that will need to be dealt with in advance. If the requirements are not met, there is a high likelihood of legal proceedings.

Closing individual entrepreneurs must be especially careful when dismissing employees.

Before terminating a contract with them due to the termination of business activities, it is mandatory to personally issue a written notification of the completion of the relevant procedure.

Otherwise, the employee has the right to appeal to the labor inspectorate or court to protect his own interests.

Documentation should be approached as responsibly as possible. Since in the future this will allow you to avoid a large number of different difficulties.

If possible, it is worth paying off all existing debts - to various funds, as well as to your own employees, and the tax office. Otherwise, certain difficulties may arise with closing the individual entrepreneur.

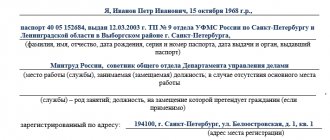

Components of the application

Since 2013, a simplified form has existed. It includes the following fields to fill out:

- OGRNIP number;

- separately - last name, first name, patronymic;

- TIN number;

- to whom and how is the response to the completed paper issued: to the applicant, his authorized representative, in person or by mail;

- telephone;

- E-mail address;

- signature of the applicant or his authorized representative;

- position, signature and its transcript of the employee receiving the application.

If the applicant does not submit the document personally, but prefers to send it by mail, then there is a space on the paper for the notary’s marks. Any authorized person who has the right to certify a notarial act can also perform the functions of confirming a document.

Important point! You only need to sign in the presence of a tax inspector. If the application is sent by mail (and personal presence is not possible), then a notary must be present when signing.

For reliability, the TIN of the person who is the guarantor of the applicant’s authenticity is indicated. The last point is needed for insurance in case of judicial practice on issues of illegal closure of an individual entrepreneur. The entire lower quarter of the application is left for official tax service marks. There is no need to fill it out.

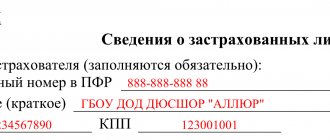

Notification form 26.2-8

To notify the tax inspectorate of the termination of the simplified tax system, a notification has been introduced - a special form 26.2-8. It is submitted to its territorial Federal Tax Service.

The notice of termination of the simplified tax system 2021 (the form can be found below) is applied on the basis of the Federal Tax Service order dated November 2, 2012 No. ММВ-7-3/ [email protected] (Appendix No. 8).

Below we provide a sample of filling out form 26.2-8.

Notice 26.2-8: sample filling

You can submit notification 26.2-8 to the Federal Tax Service in any of the following ways:

— electronically;

- by mail with a valuable letter with an inventory;

— personally (by an authorized person).

Apart from a mark of receipt on the second copy when submitting the form in person, or sending a receipt when sending via the Internet, the Federal Tax Service does not issue any other documents in response. That is, it is understood that the enterprise itself notifies the fiscal authorities about the termination of “simplified” types of activities (notification nature), no preliminary decision of the tax office is required.

Form 26.2-8 can be downloaded below.

Sample of filling out form 26.2-8

What documents will be needed for submission?

If you express a desire to terminate your activities as an individual entrepreneur, you will definitely need a Russian passport and, if available, a passport of a representative (trusted person). The latter can be a relative, friend, or a specialist hired for this purpose: lawyer, attorney, etc. You will also need notarized copies or originals of the TIN, OGRNIP of the legal entity.

Another important point is a fresh (no later than five working days from the date of application) extract from the Unified State Register of Individual Entrepreneurs. Without it, an application to close an individual entrepreneur cannot be accepted by the tax authority.

The cost of obtaining an extract in our country ranges from 200 to 500 rubles.

Payment through Sberbank online

Another convenient option for paying state fees for terminating activities is to contact the Sberbank online service. Payment is also possible through the official website of Sberbank.

To pay the state fee, you will need:

- Login to the site or application.

- Go to the tab with payments and transfers.

- In the name of the recipient structure, indicate the name of the tax department branch.

- Provide passport details and other information about the payer.

- Select the type of state duty.

If funds are transferred by non-cash method, the printed receipt must be certified at the branch of the financial institution.

The document is recognized as valid if it has the employee’s signature and the bank’s seal.

This you need to know: How to pay a debt to bailiffs through Sberbank-Online

If you have debts to the Pension Fund

Previously, until 2013, in order to close, it was necessary to provide a certificate from the Pension Fund stating that the open individual entrepreneur had no debts to it. Now the situation is different. You can also close your debts, but they won’t go away. It’s just that the private applicant will have a debt to the Pension Fund. Thus, there is no need to provide a certificate of no debt along with the paper.

The tax authority to which the application was submitted will independently make a request to the pension fund. With any answer, they will close (if all other parameters are in order), only at the same time they will notify the Pension Fund of this fact.

Payment via MFC

Services for paying the state fee for closing an individual entrepreneur are provided by a network of MFCs opened in Moscow and other cities of the Russian Federation. Pre-registration on the official website will help you avoid wasting time in queues.

On the appointed date and time, you must go to the MFC with your passport and TIN. An employee of the center will perform the operation to pay the state duty. The procedure will take no more than ten minutes.

Documents can be sent to the MFC by mail if the entrepreneur does not have enough time to visit the authorities.

Important nuances

A receipt for payment of the state fee (RUB 160) must be attached to the application (on a paper clip or stapler). If the closure of an individual entrepreneur is carried out in person, and the signature on the completed form is placed in the presence of a tax inspector, then you do not need to use the services of a notary.

The processing time for the application is no more than five working days from the date of application. You can find out about the status of a specific application online through the website of the federal tax service. A valid tax return is required. It is necessary to submit it, even if it is zero. But the legal subtlety of this point is that this can be done both before filing an application to close an individual entrepreneur and after.

When do you need a lawyer’s help in closing an individual entrepreneur?

According to Anton Tolmachev, managing partner, the help of a specialist is especially necessary when closing an individual enterprise with high turnover.

A lawyer can protect you from both banal mistakes, for example, an incorrectly filled out application (in this case, the Federal Tax Service will refuse to close), and from more serious ones - if you do not take the necessary actions to dismiss employees or deregister a cash register before closing.

The expert warns that in this case, the Federal Tax Service will not only refuse to close, but may also organize an inspection of the activities of the individual entrepreneur, and employees with whom the employment relationship was not terminated before the closure in accordance with all the rules of labor legislation will be able to go to court.

What is regulated

The basic rules for registering the termination of individual entrepreneur status are regulated in Federal Law No. 129 of 08.08.2001, in Art. 22.3 there is a list of documents for applying to the tax and registration authority. The form, application P26001 and the requirements for filling it out were approved in the order of the Federal Tax Service No. ММВ-7-6/ dated 01/25/2012. The amounts of the state duty and cases of exemption from it are indicated in Art. 333.35 Tax Code of the Russian Federation.

IMPORTANT!

From November 25, 2021, new forms of registration of individual entrepreneurs and legal entities, approved by order of the Federal Tax Service No. ED-7-14/ dated August 31, 2020, will be in effect. New forms can already be found on legal information portals and in the Consultant databases. The form changes slightly (the “TIN” item has been deleted, information has been added about the method of submission through the MFC or the Federal Tax Service, the ability to receive documents by e-mail), the application form P26001 remains. But if after November 25 the old form is submitted, the Federal Tax Service will refuse to register the termination of the individual entrepreneur.

The individual entrepreneur closed, but the debts remained?

ConsultantPlus experts figured out how to get money from a closed individual entrepreneur.

We are giving free access to this manual. Instructions on how to fill out an application for closing an individual entrepreneur 2021 (the form is only current, from November 25, 2020 - new):

- download the current form;

- find data on OGRNIP and TIN;

- enter details, last name, first name, patronymic;

- enter information about your phone number and method of receipt;

- in compliance with the requirements, fill out all points, except those in which the information is indicated by a notary or tax specialist.

The tax website contains a program that allows you to create an application to terminate the activities of an individual entrepreneur in 2021; it is allowed to print it out and file it manually in compliance with all requirements (large block letters, no omissions, errors or corrections).

Sample of completed form P26001

The completed application for closing an individual entrepreneur in 2021 is as follows:

How the application form for closing an individual entrepreneur, form P26001, is changing from November 25, 2020:

When to write

In Art. Art. 22.1, 22.3, 22.4 Federal Law-129 indicate the reasons for termination of IP:

- a voluntary decision to terminate business activities;

- death of a citizen;

- decision of the court or registration authority;

- cancellation or expiration of the document according to which the citizen resided in the territory of the Russian Federation.

Only in the first case, an application to terminate the individual entrepreneur is filled out and submitted to the Federal Tax Service for registration. In all other cases, information is transferred to the tax office in the manner of interdepartmental interaction. The presence of debt of an individual entrepreneur to the budget or creditors is not a basis for refusal to register termination of status. An individual entrepreneur is liable for debts with all his property even after his exclusion from the Unified State Register of Individual Entrepreneurs.

Where can I get a receipt?

The form can be obtained:

- In banking organizations.

- On the tax service website: the “Payment of state duty” service will allow you to generate a receipt and “direct” the user to a page with a list of partner banks of the Federal Tax Service of Russia in order to pay the duty online, without leaving home. You can also print out the generated receipt and go to the bank to make the payment.

On the sixth working day after the documents have been submitted to the registration authority, the applicant will be provided with a record sheet of the Unified State Register of Individual Entrepreneurs (USRIP).

In case of refusal of state registration, you will receive a document stating the reason for the refusal. The grounds for refusal are listed in paragraph 1 of Art. 23 of the Federal Law of 08.08.2001 No. 129-FZ.