Every person who is officially employed is required to form his own pension. Currently, each person’s total amount is divided into two equal parts, which are replenished by the employer through the payment of taxes and contributions.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

These contributions to the pension fund must be made by each enterprise . Let's consider how you can track your savings, as well as the question of checking them.

basic information

All employers are required to make monthly deductions and contributions for Pension Fund employees. In addition to the Pension Fund, funds are transferred to the departments of the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

This approach is needed in order to insure the employer and his employee if a case arises in the stock organization that is classified as insurance. In this case, a reverse transfer of funds to the employee will be made.

Let’s say that if an employee gets sick, then the Social Insurance Fund handles sick leave payments, which provides funding for a temporarily disabled citizen. The Pension Fund performs the same function - it pays funds to a citizen who has crossed a certain age threshold.

The Social Insurance Fund provides payments to an employee who is temporarily disabled

It is important to note that the employer makes all contributions exclusively from his own finances; borrowing part of an employee’s salary for these purposes is strictly prohibited. If we talk about pension capital, it is divided into two parts: insurance and savings.

Important point! Since 2014, the entire volume of contributions is formed not by the funded pension part, but by the insurance part.

When is it carried out?

Contributions made to increase the pension capital of each citizen must be made on the 15th of each month. During this time period, the employer makes contributions for the previous month.

Simply put, when the employer makes a contribution on November 15, these funds go towards the full month already worked, that is, October.

The employer makes monthly contributions on the 15th

Important ! It is imperative to find out about the timing of contributions so that in the future the organization’s employees do not have disagreements with representatives of the Pension Fund.

Who pays insurance premiums?

Contributions to the Pension Fund must come from the following categories of persons and organizations:

- Enterprises making contributions according to the rules of any agreements in favor of individuals.

- Individual entrepreneur: for citizens in whose favor payments were made for the performance of labor duties or services under contracts of various kinds and for themselves, inclusive.

- Notaries, lawyers and other categories of citizens working for themselves.

- Individuals, if they make deductions based on any agreements, and in cases where they are not individual entrepreneurs.

Insurance contributions should be made by various enterprises, individual entrepreneurs and citizens working “for themselves”

Who is the pension tax payer?

According to the Tax Code, there are two categories of tax payers:

- individuals and legal entities with employees who receive salaries and other types of remuneration;

- individuals who do not have employees and are individual entrepreneurs or are engaged in private practice (lawyers, appraisers, notaries, arbitration managers, patent attorneys, etc.).

Additionally, the law stipulates that in some cases the above categories may be exempt from tax:

- during military service;

- when caring for a child until he is one and a half years old;

- when caring for an elderly person over 80 years old, a disabled child, a disabled person of group 1;

- if the spouse is a military serviceman and in the place where he is serving, it is impossible to get a job in his specialty;

- if the spouse is sent to consular, diplomatic or international organizations.

Tariffing 2021

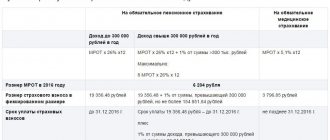

The pension sector quite often undergoes changes, legislative acts change, but the generally accepted tariff for contributions to the Pension Fund remains constant. In 2021, it was equal to 22% of the salary, but only if contributions do not exceed the required limit for the year.

If this level is still higher, then contributions will be equal to 10% of income.

Citizens who make contributions on their own will also pay a fixed amount to the Pension Fund, it is equal to 26% of the minimum wage. In addition, this monetary amount will be multiplied by 12 months.

Important ! It turns out that, knowing the current minimum wage amount of 7,500 rubles, it is easy to calculate that funds in the amount of 23,400 rubles will be deducted during the year.

There is a set percentage that a citizen is obliged to pay to state funds

Calculator for calculating the amount of contributions to the Pension Fund

Enter your salary to find out the amount of contributions to the Pension Fund.

Go to calculations

State co-financing

For persons paying additional contributions to the funded part of the pension, state co-financing is possible for 10 years after the year in which additional contributions began to be paid. But it only applies to those who joined the program before December 31, 2014.

If a person has paid 2,000 rubles or more in a year, the state will add the same amount to the personal account, but not more than 12,000 rubles per year. For persons who have reached retirement age but have not applied to the Fund for an old-age pension, upon payment of an additional contribution from 2,000 to 12,000 rubles, co-financing is possible up to 48,000 rubles per year (Article 13 of Law No. 56-FZ).

Contributions to OPS

Additional tariffs for contributions to pension capital were developed for employers and employees who are involved in industries with hazardous working conditions. It’s different if they make contributions in favor of citizens entitled to receive preferential pension payments.

The tariff must be selected after assessing working conditions and after the procedure for determining the class of danger and harmfulness.

The amount of contributions may vary depending on working conditions

Income that is not taxed

We must not forget that, unlike tax deductions from personal income, which includes taking into account bonuses, salaries and the employee’s regional coefficient, the amount depending on insurance contributions is not included in wages. In another way, an employee of an organization is given a salary with personal income tax deducted.

If we consider contributions to the Pension Fund, they must be made by the payer taking into account income capital; this amount cannot be deducted from the employee’s salary.

The employee's salary is paid after taxes have been deducted.

How can you find out the amount of deductions to the Pension Fund from wages?

The amount of contributions depends on the status of the person making the transfer of funds. For organizations carrying out labor duties under the general tax collection regime, the contribution is equal to 22% of income. It is possible to add another 10%, but only if the profit reaches 800,000 rubles or more.

The amount of payments is calculated individually for each employee, taking into account his earnings.

Important ! Enterprises making payments using the simplified method pay 20%. Employers of private companies also apply the same tariffs for their employees.

The amount of deductions depends on the income of the organization and employees

Contributions to the Pension Fund for an employed citizen in 2018-2019

| Payer categories | Percentage for 2021 |

| Payers using the main tariff | 22% + 10% |

| Enterprises and individual entrepreneurs using the simplified tax system (including charitable ones); performing activities in the field of social services, research, education, cultural education and art, sports, healthcare, as well as having a license confirmation for pharmaceutical activities | 0.2 |

| Enterprises that pay wages to ship crews, with the exception of oil tankers | 0 |

| Business entities organized by budgetary and autonomous organizations for scientific activities | 0.08 |

| SEZ residents, organizations and individual entrepreneurs performing tourism and recreational activities | 0.08 |

| Enterprises performing labor duties in the field of information technology | 0.08 |

| Participating in the Skolkovo project | 0.14 |

| Participants of the free economic zone on the territory of Crimea and Sevastopol | 0.06 |

| Having the status of residents of ASEZ | 0.06 |

| Residents of the free port of Vladivostok | 0.06 |

Insurance premiums for individual entrepreneurs in 2018-2019

The plan and volume of contributions to the Pension Fund were previously governed by the provisions of the legislative act of July 24, 2009 No. 212-FZ, but from the beginning of 2021 this responsibility was assumed by the Federal Tax Service, for this reason the plan of settlement operations in order to determine the deductible amount has been changed.

Control over the plan and volume of contributions to the Pension Fund is controlled by the Federal Tax Service

Until 2021, all “private owners,” regardless of the number of employees, were required to make deductions calculated on the basis of 26% of the minimum wage, which is established at the beginning of the financial year according to the following formula: minimum wage × 0.26 × 12.

Important ! From 2021, the amount of the insurance payment is no longer dependent on the minimum wage; it is now a constant value established by the Tax Code of the Russian Federation.

In 2021, the amount of insurance deductions for self-employed persons is 26,545 rubles. For other time periods: in 2021 - 29,354 rubles, in 2021 - 32,448 rubles.

Article 10 of Federal Law No. 167

In addition to the permanent contribution, the payer must, until April 1, 2019, make contributions to the Pension Fund of an additional payment equal to 1% of earnings for 2021, exceeding the amount of 300,000 rubles.

If an entrepreneur received his status not from the beginning, but from the middle of 2021, then half of the income received will be paid to the Fund.

Due date for payment of fees

The accounting department must make deductions no later than the fifteenth day of each month. The deadline is established by clause 3 of Art.

431 of the Tax Code. When the payment date is a weekend, deductions are made on the next business day. For private entrepreneurs, the last day to make a payment is the thirty-first of December of the current year. The duration of the billing periods is determined by Art. 423 of the Tax Code.

Download for viewing and printing:

Tax Code of the Russian Federation (part two) dated 05.08.2000 N 117-FZ

Separate conditions for other categories of payers

For other categories of payers, modified conditions for deductions of contributions to the Pension Fund have been adopted. It becomes possible for them to use a reduced tariff or complete exemption from making contributions.

Important ! Individual payers may be exempt from depositing funds into the Pension Fund if the required conditions are met and documented.

Article 422 of the Tax Code of the Russian Federation establishes cases in which an entrepreneur has the right not to make contributions.

Excerpt from Article 422 of the Tax Code of the Russian Federation

Procedure for preparation and deadlines for submitting reports

Although tax is no longer paid to the Pension Fund, the organization remains in charge of all issues regarding the calculation of pensions. This means that entrepreneurs or legal entities must report on the length of service of hired workers. Every month after the reporting month, no later than the 15th day, the SZV-M form is provided. When the number of employees is up to 25 people, the report is submitted in paper form, and above – in electronic form.

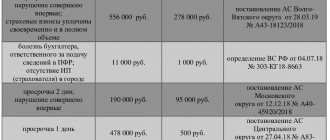

If the deadline for submitting reports is violated, the employer faces a fine:

| Offense | Amount of penalty |

| Failure to submit on time or providing false or incomplete data | 500 rub. for each employee for whom incorrect information was submitted |

| Failure to comply with the procedure for submitting the report (for example, instead of an electronic version, the employer submitted a paper version) | 1,000 rub. |

In what cases can I pay a reduced rate?

After the time period 2011-2017. and the development of reforms regarding the pension sector for certain categories of payers, contributions to the Pension Fund are made at a reduced rate. These include:

- IT organizations, if the income from core employment is at least 90%, has received accreditation from the state, and the number of employees is at least 7 people;

- organizations and individual entrepreneurs performing work on the simplified tax system in the production and social sectors, the type of employment of which is noted in Article 427 of the Tax Code of the Russian Federation, and the income from the main activity is equal to at least 70%;

- agricultural producers paying the unified agricultural tax;

- tribal communities and organizations of folk and artistic crafts of small peoples of the North;

- payers making money transfers to citizens with disabilities and organizations of disabled people;

- organizations implementing innovative technologies;

- organizations and individual entrepreneurs performing labor duties in free or special economic zones;

- those involved in the invention and implementation of information technologies;

- Russian publishing houses and media;

- organizations that pay wages to the crews of Russian ships, with the exception of oil tankers;

- organizations and individual entrepreneurs engaged in pharmaceutical activities with a licensed work permit;

- organizations carrying out charitable activities, using the simplified tax system and registered according to the required plan.

Excerpt from Article 427 of the Tax Code of the Russian Federation

Rates and deductions

Currently, employers withhold personal income tax on all income of their employees at a flat rate. We noted the percentage of the 2021 payroll tax: personal income tax is 13%. Officials have provided a number of tax deductions for working professionals.

Thus, an employee has the right to claim a child deduction - the most common in Russia. Legislators also provided for professional, property, investment and social tax benefits. Read more in the article “How a citizen can get a tax deduction.”

Details for making contributions

It will not be superfluous to know the details of the Pension Fund of the Russian Federation, according to which mandatory cash contributions will be made. If an employer or private entrepreneur makes a mistake and makes a payment to the wrong account, the process of returning funds will be delayed, time will be wasted, making it difficult to prove the timeliness of payments.

Important ! The process of crediting to the correct account will be significantly more complicated.

In order to prevent such an inconvenient situation, we provide a list of details for making various insurance payments.

| Name of insurance payment | KBK | KBK fines | KBK penalties |

| for compulsory pension insurance (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for employees) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| for maternity and sick leave (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

There are certain details to which insurance payments are credited

In order to group items of the state budget, specialized numeric codes are used, which consist of 20 characters, determined by the Ministry of Finance. Each such code is a source of classified information. The budget classification code is divided into four parts:

- “Administrator” - the first three characters indicate the recipient of the finance (PFR - 392);

- “Type of income” - numbers from 4 to 13 inclusive. This part is in turn divided into 4 parts:

- “Group” - the fourth number indicates income (for payment of insurance contributions - 1);

- “Subgroup” - the fifth and sixth digits (in this option, the combination of numbers 02, 09, 16 is usually used);

- “Article” and “Subarticle” - numbers 7 to 11 inclusive are marked taking into account the relevant settlement documentation;

- “Element” - the last two characters of this part (12 and 13) display the budget level (in a particular case, 06 is usually indicated - the budget of the Pension Fund, but 01 and 08 can also be indicated);

- “Program” - signs 14 to 17 inclusive are needed for the purpose of dividing penalties;

- “Economic classification” - the last three digits (for insurance payments, 160 is usually noted, but in some situations 140 may occur).

About KBK codes

A full list of BCCs operating this year and used to deduct insurance premiums, as well as their detailed description, can be found on the official website of the Federal Tax Service.

How to make a transfer

Starting from 2021, funds are deposited into the Federal Tax Service. This feature was recorded in a new section of the Federal Tax Service. Previously, it was necessary to provide funds to each fund separately. To transfer the amount, each region uses its own details.

To transfer funds, you should fill out the following fields on the receipt:

- information about the recipient;

- TIN;

- BIK, KPP, KBK;

- information about the recipient bank;

- information about the purpose of payment.

Information that allows calculations to be made is publicly available. The data can be found on the official website of the Federal Tax Service. There you can also generate a payment order and download a receipt. Then all that remains is to print the document form.

Procedure for deduction of contributions

All deductions are calculated by accountants, thus, all payments intended for a working citizen are multiplied according to the insurance rate. This formula is the same for any organization and does not depend on the tax regime.

Accounting for a specified period of time accrues 22% of the employee’s salary to the Pension Fund. If the income reaches 624 thousand rubles, then the tariff is 10%. For example, when an employed citizen earns 20,000 rubles monthly, the accounting department accrues 4,400 rubles.

Important ! For certain organizations, discounts on insurance premium rates have been established. For example, for the information technology sector this figure is 8%. Regarding the earnings of working citizens, the employer makes contributions at a rate increased by 6%.

Tariffs depend on the nature of the organization and the employee’s earnings

Formation of a future pension

How many points have been accumulated, this will be the payment. The number of points depends on how much the person was paid and how many years they worked. In other words, two parameters play a role: points and experience.

For 2021, the minimum required to earn 16.8 points, in 2021 - 18.6 points.

The state is constantly reforming the pension system. Previously, payments were calculated differently. The rights that citizens previously earned are converted into points. Now there are two types of pensions, and each of them is regulated by separate legal acts.

Insurance pensions are regulated by Federal Law No. 400, and funded pensions by Federal Law No. 424.

Download for viewing and printing:

Federal Law of December 28, 2013 N 400-FZ, as amended. dated 12/19/2016 “On insurance pensions”

Federal Law of December 28, 2013 N 424-FZ, as amended. dated 05/23/2016 “On funded pensions”

The volume of contributions to the Pension Fund for pension payments by employers

It should be immediately noted that, unlike personal income tax, the calculation of which is influenced by the sum of the salary and bonus parts, the regional coefficient of the worker, insurance payments are not included in the salary. In other words, an employed citizen receives a salary with personal income tax already deducted. However, the employer contributes money to the Pension Fund taking into account the earnings of the working person. These funds are not included in the employee's income. It follows from this that it is not deducted from earnings.

The amount of contributions to the Pension Fund depends on the category of payer. For enterprises under the general tax collection regime (of which the majority are), in 2021 this tariff will be 22%. An additional 10% will be applied to those employed persons whose full income is more than 1,150,000 rubles. In 2020, this parameter will be subject to changes.

Important ! Every year the Government of the Russian Federation approves a resolution that notes this size. The base is established individually for each employed citizen for each month from the moment of contributions for him and increasing total.

The amount of payments may vary from year to year.

Additionally, the adopted tariffication of insurance contributions to the Pension Fund was introduced for employers whose workplaces are located in harmful and dangerous production conditions, in other words, in favor of those citizens who are entitled to preferential pension payments.

Important ! The tariff is set after assessing working conditions and determining the hazard class.

How is the pension payment fund formed?

Pensions were paid to Russian citizens before, but the pension payment fund was formed from the state budget. Contributions to social insurance, including pensions, were made by enterprises and were very small, but a significant share of enterprise profits was transferred to the state budget.

Contributions were not taken from employees at all, because our older generation received salaries from the state, since they worked for it; there were no commercial structures. Therefore, there was no point in the state withholding pension contributions. Everything was included in the budget; when assigning a pension, salary and length of service were taken into account.

Now, taking into account the fact that a person can work both in a commercial structure and in the civil service, the employer transfers contributions to the Pension Fund.

It is the employer from the Payroll Fund, and not you personally from your salary, that is the answer to the remark “I’ve been crying all my life!”

Transfers to the Pension Fund of the Russian Federation for individual entrepreneurs and self-employed persons

Self-employed citizens (lawyers, heads of the KHL, etc.) pay a constant amount of contributions to the Pension Fund for themselves. In 2021 it is equal to 29,354 rubles. Income over 300,000 rubles is subject to an additional tax of 1% of this amount. In 2021, the constant amount of deductions is 32,448 rubles. This contribution is made until December 31 by all individual entrepreneurs, without exception, and working citizens who have the status of a lawyer, private notary, etc.

Important ! Self-employed persons can make contributions at a special tax rate - 4% or 6% (an experimental innovation in certain regions). The amount of contributions to the Pension Fund depends solely on their own desire.

Self-employed citizens must contribute a certain fixed amount

SNILS check: how to do it?

Contributions to the Pension Fund made on behalf of the employee must be informatively available on his personal account. You need to take into account and remember that a citizen who has decided to use his accumulated part of the pension capital can find out their size by his SNILS number.

Important ! To carry out this procedure, you will need the help of Pension Fund employees; after providing the necessary information, a request is generated.

You can contact the Pension Fund branch to determine the number of payments according to SNILS

What year was personalized accounting introduced?

The territorial bodies of the Pension Fund monitor the correctness of calculation and provision of accurate information on the length of service and earnings of the insured persons. For violation of deadlines for submitting data on employees to the Pension Fund, penalties are established in accordance with Art. 17 of Law No. 27-FZ.

The structure of personalized accounting, in addition to collecting data on each individual insured person, makes it possible to obtain statistical information on certain categories of citizens, on their average earnings and the total number of the entire working population.

Obtain information on contributions to the Pension Fund using the State Services Internet portal

In order to inform about the insurance portion of their pension, citizens of the Russian Federation have the right to use the State Services Internet portal. In addition, here it is possible to obtain information about the status and funded part of the pension for citizens who are insured by the Pension Fund.

On the website, through your personal account, you need to enter the electronic services section, select the Pension Fund column - the status of the ILS in the OPS system, set the form for receiving notification and obtain information. It will take some time to prepare the report upon request.

Personal account on the State Services website

Important ! This method of providing information is available only to registered users.

Personalized accounting started from what year

During 1996, a pilot project was carried out to introduce a personalized accounting system. It covered only 4 cities of the Russian Federation. The number of user jobs increased to 2000. In 1997, 20 million insured persons were registered. The collection of information about experience and earnings in new regions has begun.

In 1999, personalized accounting system servers were installed in the remaining 26 regions of the Russian Federation. In 1998, another 45 regions were connected, in which regional and district servers were installed. To assign a pension, personalized accounting information is transferred to the bodies providing pensions upon their request.

Checking contributions to the Pension Fund using the Pension Fund website

Insured citizens have the right to provide information on their pension contributions and all savings associated with them on the official website of the Pension Fund. Before you start, you need to register through the “citizen’s personal account” tab using the ESIA system. Then, in the “formation of pension rights” tab, you can familiarize yourself with the status of your personal pension capital account.

Personal account on the website of the Russian Pension Fund

Summarize

Reform in the pension sector, which has been ongoing continuously over the last quarter of a century, has created the situation in such a way that the insurance part of pension payments is formed exclusively from contributions made by employers and individual entrepreneurs to the account of the Pension Fund.

The main purpose of pension contributions is to finance the payment of pension funds. The amount of contributions directly determines the size of future pension payments and even the possibility of taking a well-deserved retirement ahead of schedule.

To ensure that the employee has no doubt about the proper observance of his rights to a pension, the employer needs to timely and in full make contributions to the Pension Fund accepted by law.

From what year of birth was the funded part of the pension accrued and is it currently in effect?

Voluntary saving for old age began back in 90, but the funded pension system became an officially recognized system at the beginning of the 3rd millennium. Since its inception, the funded pension has undergone many changes. Many legislative provisions were

The difference between these funds is that from beginning to end they are regarded as the personal funds of a citizen. If the insurance pension contribution goes as a tax to the state, which in the future will accrue a pension from itself in the form of a fixed part and an insurance one, then the funded one is considered as a long-term bank deposit.