Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

The main form of accounting is annual, but there are also interim reporting. It is compiled once a month, quarter, six months or nine months, that is, for a period of less than a year. Interim reporting is not mandatory for all organizations, and it is not necessary to submit it to the tax authorities. In this article we will tell you what interim reporting includes, for whom it is mandatory and what is the procedure for its preparation.

General requirements

You may be interested: Limit of the Molodezhnaya card from Sberbank: conditions, how to withdraw and top up

Requirements relating to the preparation of financial (accounting) statements, determination of the reporting date and period are enshrined in Articles 13, 15 402-FZ. In accordance with Art. 13 the reporting must contain reliable information on the basis of which users form an idea of the financial condition of the business entity, as a result of its activities, the availability and flow of funds for the period. All this information will subsequently form the basis for management decisions.

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

The reporting period (in accordance with Article 15 402-FZ) is the period for which the reporting is generated. Reporting date – the day for which the information is summarized. Simply put, this is the last day of the control period.

Preparing for interim reporting

The preparation of interim reporting includes several stages. First of all, you should prepare for its preparation. At the preparation stage, summarize all available data from primary and other documents, study the rules for drawing up forms and prepare the necessary data.

Interim reporting is prepared according to the same rules as annual reporting. It must be compiled in Russian, reflect numerical data in thousands of rubles or millions, negative indicators must be indicated in parentheses. Completed reports must be signed by the manager.

Interim financial statements: terms and conditions of formation

So, when should you create a document? Let's turn to the legislation. As follows from the provisions of 402-FZ, interim accounting (financial) statements are provided for a period not exceeding one year. At the same time, in paragraph 3 of Art. 13 of this normative act provides cases when an economic entity must draw it up. In particular, interim financial statements are prepared if the corresponding obligation is assigned:

- Federal legislation. For example, such a document is necessary for an LLC if net income is distributed between participants every quarter or every six months (this rule is established in paragraph 1 of Article 28 of the Federal Law “On LLC”), or if it is necessary to determine the real value of the share of a participant leaving composition of the company (clause 1 of article 8 and clause 2 of article 23 of the specified Federal Law).

- In contracts, constituent documentation of the enterprise.

- In decisions of the owner of a business company.

- In the regulations of the Central Bank and the Ministry of Finance.

You may be interested in:Addresses of Avangard Bank in Arkhangelsk

The concept of interim reporting

Interim accounting forms are compiled for a period of less than a calendar year; it is necessary to reflect the current activities of the company. The legislation does not define the periods for which indicators are collected in the forms, so the organization independently sets them, this could be:

Interim reporting, depending on which user it is provided to and what information he needs, can be compiled in a condensed form or, on the contrary, added with the necessary lines.

Interim reporting is prepared at the request of the company's managers, for example for:

- For owners (founders), the data may be necessary to make the right decisions aimed at stabilizing the company’s activities;

- Banking institutions, if the company took out a loan secured in the form of collateral, to track the required balance on the pledged property;

- Internal divisions of the company, for drawing up plans;

- For other users.

Submit quarterly accounting forms to regulatory authorities, from the first quarter. 2013 is not necessary, since this provision is not in the law.

Nuances

According to the provisions of paragraph 1 of Art. 30 402-FZ, before state accounting regulatory bodies adopt industry and federal standards, business entities apply the rules for reporting and accounting approved by the Central Bank and authorized federal executive structures. The corresponding rules are today enshrined in PBU 4/99.

Clause 48 of the said PBU establishes that an organization must prepare interim financial statements for a month, a quarter from the beginning of the year on an accrual basis, unless another procedure is provided for by federal legislation. At the same time, in paragraph 52 of the same Regulations there is a clarification that the document we are considering is provided in cases stipulated by law or the constituent documentation of a business entity. And according to paragraph 15 of Art. 21 402-FZ, industry and federal standards cannot contradict the provisions of this law.

Thus, taking into account the content of all the above norms, the payer is not obliged to prepare and provide interim financial statements solely on the grounds provided for by PBU 4/99.

It should also be taken into account that the obligation to send the document to both the Federal Tax Service and the state statistics bodies is not specified in the legislation. Business entities must provide only annual reports (clause 1 of Article 18 402-FZ, Order of Rosstat No. 185 of 08/12/2008, 5 subclause 1 of clause 23 of Article TC).

What requirements must the information reflected in interim reports meet?

The main requirement for the information reflected in the reporting, which is prescribed in the analyzed standard, is its materiality (clause 23). The essence of the requirement is that information for users of reporting must carry an important semantic load. Without reflecting such information, stakeholders will not be able to obtain an objective picture of the company’s business and its interim results. Therefore, all information that is material must be recorded in the interim reports of the company.

PAY ATTENTION! At the same time, if certain events were significant and were reflected in the interim reports, this does not mean that such events will necessarily have to be reflected in the annual reports.

After all, for example, individual significant events may occur in different reporting periods, which in total for the year will not lead to a change (the company took out a large loan in the 1st quarter, but returned it to the bank in full in the 2nd).

Internal documents of the organization

If an enterprise, in the absence of an obligation to prepare and submit interim financial statements on the above grounds, nevertheless recognizes its preparation for management or taxation purposes as necessary, then the decision on the frequency, timing, volume, forms, and procedure for calculating individual indicators should be fixed by local acts.

One of such documents is the accounting policy. The standards state that it is approved by the head of the company. Changes to accounting policies can also be accepted. They are approved by a separate order of the head.

Another local act is the standard of an economic entity - “Regulations on accounting and reporting at an enterprise.” It can be developed separately and approved as a separate document or made an annex to the accounting policies.

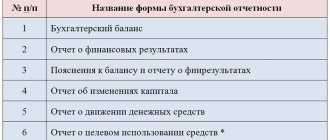

Financial reporting forms

Accounting statements are prepared and presented in accordance with the forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Let's consider the content and procedure for filling out the main forms of the annual financial statements of a commercial organization.

Balance sheet

The balance sheet form is approved by Appendix No. 1 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. It characterizes the financial position of the enterprise.

The balance sheet is divided into two sections - assets and liabilities. The main principle of balance is that equality must be maintained between them.

Assets, in turn, are divided into current and non-current. Current assets include inventories, VAT, accounts receivable, financial investments and cash. Non-current - intangible assets, fixed assets, property for leasing or rental, etc.

Liabilities include three sections: capital and two types of liabilities - less than and more than 12 months. The capital section also includes retained earnings or uncovered losses.

Income statement

It describes the organization's performance for the year. Shows the reasons why the profit or loss occurred. The data in the report is shown for the past and previous year.

Revenue in the report is shown net of VAT, excise taxes and other mandatory payments. By reducing it by the cost of sales, you can get a gross profit. It shows the profit (loss) from sales after reduction by selling and administrative expenses. To identify net profit (loss), interest, other income and expenses, income tax, changes in IT and IT are additionally taken into account.

The net profit indicator should be equal to the final balance in account 99 “Profits and losses”, which, when reforming the balance sheet, is written off to account 84 “Retained earnings (uncovered loss)”.

Statement of changes in equity

Capital is the investments of the owners and the profit accumulated over the entire period of operation of the enterprise. The statement of changes in equity consists of three sections: capital movements, adjustments, and net assets.

The first section contains information about changes in equity capital. It includes authorized, additional and reserve capital, as well as retained earnings.

The second section is filled out if in the reporting year the organization corrected errors of previous years using account 84 or if the accounting policy changed in the reporting year. Amounts for past years need to be adjusted in order to compare the amount of capital of the previous and the year before with the reporting year.

The third section provides information on net assets for three years - December 31 of the reporting year and the two previous ones.

Cash flow statement

This report is a summary of the company's cash and cash equivalents. It reveals data on what amounts the company had at the beginning of the year and how much was left at the end. The report characterizes three types of cash flow: in the context of current, investment and financial activities.

At its core, the cash flow statement is an explanation of line 1250 of the balance sheet. It should indicate its presence.

Explanations for the balance sheet and financial results report

Explanations disclose information that relates to the accounting policies of the organization. They also contain additional information that is not included in the balance sheet and report, but is needed by users of financial statements to understand the processes and state of the organization.

Explanations reveal additional information:

- about intangible assets;

- fixed assets;

- financial investments;

- accounts receivable;

- changes in capital;

- shares issued by a joint stock company;

- reserves for future expenses and payments, estimated reserves;

- accounts payable;

- sales volumes of products, goods, works, services by type of activity and sales markets;

- production costs;

- and other components of the organization’s activities.

This information is presented in the form of separate reporting forms and in the form of an explanatory note. The reporting article to which explanations are given must indicate their presence.

Features of the internal standard

If we consider this document from the point of view of the provisions of paragraphs 1, 11, 12 21 of Article 402-FZ, then it will be considered an act regulating the company’s accounting. In other words, an internal standard will have the force of a normative act in the field of accounting if its content does not contradict industry and federal standards.

You will be interested in: PBU, expenses: types, classification, decoding, name, symbol and rules for filling out financial documents

Taking this into account, the enterprise can establish the procedure necessary for an economic entity to streamline the processes of organizing and maintaining accounting.

Preparation of reports for compliance with the conditions of education (changes) of the group of groups

In accordance with sub. 3 p. 3 art. 252 of the Tax Code, an enterprise party to an agreement on the formation of a consolidated group of payers must meet a number of requirements.

Thus, the amount of net assets calculated in accordance with the financial statements as of the reporting date preceding the day of submission of documents to the Federal Tax Service for registration of the agreement must be greater than the size of the share (authorized) capital.

If the enterprise, in accordance with paragraph 2 of Art. 23 of the Federal Law “On LLC”, must pay the participant the real value of his share in the capital and the company’s accounting policy, then the need to generate quarterly reports is established; the calculation basis is based on information from reporting documents drawn up at a later date preceding the day the participant submitted the relevant requirements.

The legitimacy of this approach is confirmed by the Ministry of Finance. In letter No. 03-03-10/51217, the department explains the following. An enterprise party to an agreement on the formation of a consolidated group of payers may be required to prepare interim financial statements for different periods (on different dates). This depends on the specific act providing for such a requirement. For example, a decision by the owner of a business entity may establish the obligation to generate and submit reports on a monthly basis.

Taking into account the provisions of 402-FZ and sub. 3 p. 3 art. 252 of the Tax Code, the Ministry of Finance came to the conclusion that the amount of net assets should be determined in accordance with accounting documents, the preparation and provision of which is fixed by one of the conditions established by 402-FZ, at a later date. This procedure was included in the letter of the Federal Tax Service dated January 19, 2013 and was sent for familiarization and application in the activities of lower tax services.

The letter of the Ministry of Finance No. 03-03-06/1/47681 dated November 8, 2013 also states that the amount of the organization’s net assets should be calculated based on information from the latest reports generated before the day of submission of documents for registration of the agreement on the creation of the consolidated group of groups.

Results

When preparing interim reporting for its investors/creditors, a company should understand that the frequency of presentation of such reports is best chosen based on the expectations of stakeholders.

The company has the right to generate such reporting either in full or in a truncated form, reflecting only significant business events and showing in the reports current changes for each individual period. In addition, we should not forget that even when choosing the option with abbreviated reports, the standard imposes a number of requirements both on the composition of the report package and on the content. If a complete package is being formed, then you should focus on the standards of IFRS (IAS) 1. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Capitalization rate

It is calculated on the last day of the corresponding period. To determine it, first, the outstanding controlled debt is divided by the amount of equity capital corresponding to the share of indirect or direct participation of a foreign enterprise in the share capital (fund) of a domestic company, and then the resulting indicator is divided by 3 (for banking organizations and entities engaged in leasing activities - by 12.5).

Determining the amount of equity capital

In pursuance of the requirements of paragraph 2 of Art. 269 of the Tax Code are not taken into account when calculating the amount of debt on fees and taxes. We are talking about current arrears, amounts of deferrals and installments, as well as an investment tax credit.

In paragraph 2 of Art. 269 of the Tax Code there is no indication of specific data sources by which an economic entity must determine the amount of equity capital. It follows from this that the enterprise is not obliged to calculate it solely on the basis of information from the financial statements. This means that when calculating the capitalization ratio, the amount of capital can be determined based on accounting data available in any sources.