Increasing transport tax coefficient in 2021

The size of the increasing factor depends on the average cost of the car and the year of manufacture. Determination of the average cost of a car is regulated by Order of the Ministry of Industry and Trade of Russia dated February 28, 2014 No. 316 “On approval of the Procedure for calculating the average cost of passenger cars for the purposes of Chapter 28 of the Tax Code of the Russian Federation.”

The Russian Ministry of Industry and Trade regularly publishes a list of cars in order to accurately calculate transport tax. In 2021, this list included more than 900 brands and models of expensive cars. Please note that the increasing factor applies only to passenger cars .

This aspect does not affect owners of expensive cargo vehicles. Vehicle owners will pay transport tax for 2021 already in 2021.

What else do legal entities need to know?

Starting in 2021, legal entities have the opportunity to submit a declaration using a new form. To make calculations easier, several new lines have been added. The new declaration form itself was introduced by the Order of the Federal Tax Service of Russia dated December 5, 2016 .

Attention! The new declaration does not require certification with a seal.

You can use both the old and new forms of declarations , however, the second is more profitable if the taxpayer wants to reduce the tax payable by calculating benefits for a tax such as “Platon”.

Several new lines appeared in the declaration. So, for example, the line for the increasing indicator is line 130. Do not forget that it is calculated based not only on the characteristics of the car, but also on the rate established by the subject of the Russian Federation.

Table of increasing coefficients

The amount of transport tax on expensive cars is calculated taking into account the increasing coefficient (clause 2 of Article 362 of the Tax Code of the Russian Federation):

| Size of the multiplying factor | Average car cost | Vehicle age |

| 1,1 | 3,000,000 – 5,000,000 rubles | 2-3 years |

| 1,3 | 3,000,000 – 5,000,000 rubles | 1 – 2 years |

| 1,5 | 3,000,000 – 5,000,000 rubles | up to 1 year |

| 2 | 5,000,000 – 10,000,000 rubles | up to 5 years |

| 3 | 10,000,000 – 15,000,000 rubles | up to 10 years |

| 3 | from 15,000,000 rubles | up to 20 years |

In accordance with clause 2 of Article 362 of the Tax Code of the Russian Federation, the age of a car is calculated from the year of manufacture, and not from the moment of purchasing the car at a car dealership.

Example 1. Calculation of transport tax for an Audi Q7 quatro diesel passenger car with an engine capacity of 2967 cc. will be carried out taking into account the increasing coefficient:

- from the date of purchase to 1 year – 1.5;

- 1-2 years – 1.3;

- 2-3 years – 1.1.

After three years, the increasing coefficient is not used when calculating the transport tax for this car.

What is subject to tax

To begin with, we note that in addition to passenger cars, other types of transport are also subject to the vehicle tax. These, in particular, may be (Article 358 of the Tax Code of the Russian Federation):

- air Transport;

- motorcycles, scooters, etc.;

- all types of trucks;

- water vehicles: boats, jet skis, yachts, motor ships, sailboats, etc.;

- means for moving through the snow in winter: snowmobiles, sleds, etc.

Also see “What is the tax on water transport in 2017”.

Increasing coefficient in different regions

The increasing coefficient for all regions of the Russian Federation is the same, but the transport tax may differ from region to region. This is due to the fact that transport tax is a regional tax regulated by local governments. Considering the differences between regions in terms of transport tax, the final amount of transport tax, taking into account the increasing coefficient, will also be slightly different.

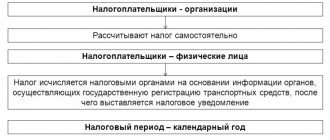

In this regard, before you start calculating the transport tax on an expensive passenger car, you need to contact the local tax authorities to clarify the tax rate and regional benefits. If the Federal Tax Service makes a calculation for individuals and notifies them of payment, then legal entities must independently calculate the transport tax in order to pay advance payments and tax at the end of the tax period.

How to find the tax rate according to the region where the car is registered

In order to find out what the tax rate is for your region, it’s a good idea to know its number. However, if it is unknown, you can find it:

- on vehicle registration numbers;

- in the TIN of an individual or legal entity (first two digits);

- on a map with region numbers.

For example, the number 38 corresponds to the Irkutsk region. Once you have found out the region number, simply enter it on the website nalog.ru and find out the current rate for the current year, or look at the updated Tax Code of the Russian Federation.

Calculation of the average cost of a car

To obtain information about what increasing factor to apply to a passenger car and, as a result, error-free calculation of transport tax, it is necessary to calculate the average cost of the car. The calculation of the average cost is regulated by Order No. 316 of the Ministry of Industry and Trade of Russia dated February 28, 2014. Based on this document, it is possible to calculate the average cost of cars:

- produced in the territory of the Russian Federation (or an authorized person of the manufacturer is present in the territory of the Russian Federation);

- not produced in the territory of the Russian Federation (the authorized person of the manufacturer is not present in the territory of the Russian Federation).

| The car was produced in the Russian Federation | The car was not produced in the Russian Federation |

| average car cost recommended retail price for this vehicle as of July 1 Recommended retail price for this vehicle as of December 1 | average car cost the maximum sales price for a given vehicle as of December 31 of the tax period the minimum sales price of this car as of December 31 of the tax period coefficient of reduction of the catalog price of a car in ruble equivalent the amount of recycling fee and import customs duty for a similar car foreign currency exchange rate to the currency of the Russian Federation as of January 1 of the year of manufacture of the car exchange rate of foreign currency to the currency of the Russian Federation as of December 31 of the year of manufacture of the car |

What cars is it used for?

However, in order to consider the additional fee issued for payment eligible, three conditions must be met:

- the taxable object costs 3,000,000 rubles. and more expensive;

- it is on the list of the Ministry of Industry and Trade;

- its service life from the moment of its release coincides with the period from the list of the Ministry of Industry and Trade.

Everyone knows that it used to be the practice to understate the price of cars in sales contracts in order to avoid a large tax.

Since 2014, the cost of a car from the list of the Ministry of Industry and Trade, specified in the sales contract, is not used when calculating transport tax and is taken exclusively from an official car dealer trading in the Russian Federation, according to Art. 362 of the Tax Code of the Russian Federation.

Calculation of transport tax taking into account the increasing coefficient

Once the average cost of a car has been calculated and an increasing coefficient has been established, you can begin to calculate the transport tax. For this purpose, it is necessary to resort to the following formula:

| Transport tax | = | Engine power (hp) | * | Tax rate | * | Increasing factor | * | Number of months |

It is necessary to understand that, in accordance with clause 3 of Article 362 of the Tax Code of the Russian Federation, there are some features when determining the number of months of car ownership:

- if the car is registered with the traffic police after the 15th day or deregistered before the 15th day, this month is not taken into account when calculating the transport tax;

- if the car is registered with the traffic police before the 15th day or deregistered after the 15th day, this month will be taken into account when calculating the transport tax.

Example 2. Krylov V.V. registered my car on March 18, 2021 - when calculating the transport tax for 2016, March is not taken into account. Vorobyov V.V. deregistered the car on September 17, 2021 - September will be taken into account when calculating the transport tax for 2021.

An example of calculating transport tax with an increasing coefficient

On the balance sheet of ABV LLC there is a passenger car Audi Q7 quatro 2015, diesel, engine capacity 2967 cc, power 233 hp. Transport tax will be calculated for 2021. This car was purchased from an official dealer in the Russian Federation, and therefore the average cost can be calculated as follows:

- 3050000 + 3250000 = 3150000 rubles

- The increasing factor will be 1.3

- Tax rate 7.5

- The amount of transport tax will be 233 * 7.5 * 1.3 * 12 = 27261 rubles

ABC LLC will pay transport tax by transferring advance payments at the end of the reporting periods: 27261 / 4 = 6815.25 rubles

Advance payments

As for the calculation of advance payments for transport tax, it is made taking into account the occurrence of reporting deadlines. Namely - the 1st, 2nd and 3rd quarters.

Also see “Deadline for payment of advance payment for transport tax”.

| AP = 1/4 × NB × NS × Kv × Kp |

- NB – tax base (for a car this is usually the engine power in hp);

- NS – tax rate;

- Kv – ownership coefficient;

- Kp – increasing coefficient.

Errors in using the multiplying factor

If the tax authorities are involved in calculating transport tax for individuals, legal entities carry out this procedure independently. At the same time, it is very important in this case not to make mistakes, so as not to end up among the debtors for unpaid transport tax, because even if the tax is partially paid, the taxpayer’s obligation in this case will still be considered unfulfilled.

Common mistakes include the following:

| Errors | Explanation |

| Incorrect vehicle age | In accordance with clause 2 of Article 362 of the Tax Code of the Russian Federation and letter of the Federal Tax Service of Russia dated 03/02/2015 N BS-4-11/[email protected] The period for calculating the number of years begins with the year of manufacture of the car. For example: a car worth 4,000,000 rubles was produced in 2013. In 2021, the increasing coefficient for transport tax does not apply to this vehicle, because the number of years that have passed since the car was manufactured is 4 years. |

| The car was not found in the List of vehicles of the Ministry of Industry and Trade for which an increasing coefficient was introduced, therefore the increasing coefficient was not calculated | If a car is not found in the List of the Ministry of Industry and Trade, but due to its age and cost it should be subject to an increasing coefficient, failure to apply the coefficient will be considered an error resulting in underpayment of transport tax. The Ministry of Industry and Trade has developed a method for calculating the average cost of a car, using which it is possible to make calculations both for a car whose dealer is located in the Russian Federation, and for a car whose dealer is not present in the Russian Federation. If there is no dealer in the Russian Federation, data on the recommended retail price can be obtained from such catalogs as “Audatex”, “DAT”, “Kelley Blue Book”, “Mitchel”, “Motor”, “Canadien Black Book”, “Schwacke” . |

| The increasing factor does not apply to advance payments for transport tax | In accordance with clause 2.1 of Art. 362 of the Tax Code of the Russian Federation and the Federal Law of November 4, 2014 No. 347-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”, the calculation of the amounts of advance payments by taxpayer organizations must be made taking into account the increasing coefficient. |

Results

An increasing factor for transport tax is applied if the car is indicated in the list of the Ministry of Industry and Trade and the period of use of the car does not exceed the period established in the Tax Code of the Russian Federation for the purposes of applying the increasing factor.

List of expensive cars with an average cost of over 3 million rubles. updated annually on the website of the Ministry of Industry and Trade no later than March 1. If the vehicle is not on this list, the increasing coefficient does not participate in the calculation of transport tax.

Sources:

- Tax Code of the Russian Federation

- letter from the Federal Tax Service dated July 18, 2017 No. BS-4-21/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible not to pay luxury tax?

The increasing coefficient itself does not provide for any preferential categories. The only thing that can get rid of its use is exemption from transport tax in principle. For example, these categories include the following types of vehicles:

- cars with special devices for transporting disabled people;

- cars with power up to 100 hp. pp., at the disposal of social protection authorities;

- stolen cars;

- cars that are the property of federal government bodies or executive authorities.

If the car is not included in any categories, then you will have to pay transport tax, and if the previously stated conditions are met, an increasing coefficient will be applied to it.

Current rates

As mentioned, the tax on vehicles primarily depends on the tax base and rate. So, for cars and trucks, the base is power, which is measured in horsepower.

The general rates are determined by the Tax Code of the Russian Federation (Article 361). However, there is no universal table for calculating transport tax. The fact is that in different areas the rates may be lower or higher. The limit is set to 10 times.

The rates for calculating transport tax in the table for 2017 can be found in our other material here.

| Transport tax rates in Crimea | |

| Vehicle type | Rate (RUB) in 2021 |

| Passenger cars with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 5 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 7 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 15 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 20 |

| over 250 hp (over 183.9 kW) | 50 |

| Motorcycles and scooters with engine power (per horsepower): | |

| up to 20 hp (up to 14.7 kW) inclusive | 2 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 4 |

| over 35 hp (over 25.74 kW) | 10 |

| Buses with engine power (per horsepower): | #colspan# |

| up to 200 hp (up to 147.1 kW) inclusive | 10 |

| over 200 hp (over 147.1 kW) | 20 |

| Trucks with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 12 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 20 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 25 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 30 |

| over 250 hp (over 183.9 kW) | 40 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms (per horsepower) | 5 |

| Snowmobiles, motor sleighs with engine power (per horsepower): | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 20 |

| over 100 hp (over 73.55 kW) | 50 |

| Yachts and other sailing-motor vessels with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 30 |

| over 100 hp (over 73.55 kW) | 100 |

| Jet skis with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 50 |

| over 100 hp (over 73.55 kW) | 100 |

| Non-self-propelled (towed) ships, for which gross tonnage is determined (from each registered ton of gross tonnage) | 30 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 50 |

| Airplanes with jet engines (per kilogram of thrust) | 40 |

| Other water and air vehicles without engines (per vehicle unit) | 400 |