Regional Chamber of Lawyers

Contents of the article: what is the income code in certificate 2 personal income tax sick leave for pregnancy and childbirth and what is the deduction code for the amount of this sick leave? thank you The question relates to the city of Meleuz Bashkortostan In accordance with paragraph.

1 tbsp. 217 of the Tax Code of the Russian Federation, state benefits are not subject to personal income tax, with the exception of temporary disability benefits, as well as other payments and compensation paid in accordance with current legislation.

At the same time, benefits that are not subject to taxation include unemployment benefits, maternity benefits. Therefore, for such types of income (such as maternity benefits, one-time benefits for the birth of a child), an income code is not provided.

Letter of the Ministry of Finance of the Russian Federation dated April 18, 2012 N 03-04-06/8-118 The Department of Tax and Customs Tariff Policy reviewed the letter on the issue of providing a standard tax deduction and filling out certificates of income for individuals and in accordance with Art. 34.2 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) explains the following.

1. Established paragraphs. 4 paragraphs 1 art. 218 of the Code, standard tax deductions are provided to the taxpayer for each month of the tax period by reducing the tax base in each month of the tax period by the corresponding established deduction amount.

The tax base is reduced from the month of birth of the child (children) or from the month in which the adoption took place, guardianship (trusteeship) was established, or from the month of entry into force of the agreement on the transfer of the child (children) to be raised in a family until the end of that year, in in which the child (children) has reached the age specified in paragraph. 12 of the specified subparagraph, or the agreement on the transfer of the child (children) to be raised in a family has expired or been terminated early, or the death of the child (children). Clause 3 of Art. 218 of the Code provides that standard tax deductions are provided to the taxpayer by one of the tax agents who are the source of payment of income, at the taxpayer’s choice based on his written application and documents confirming the right to such tax deductions.

If the taxpayer has the right to receive a standard tax deduction, in particular, has been working for a tax agent since the beginning of the year and has a child in his care, then the tax agent has the right to provide a tax deduction from the beginning of the year, regardless of the month in which the taxpayer filed an application for the deduction, with the necessary documents attached. 2. The list of income not subject to personal income tax is established by Art. 217 of the Code. Since the income referred to in Art.

217 of the Code are exempt from personal income tax, then there are no grounds for reflecting the specified income in the certificate in Form N 2-NDFL. By Order of the Federal Tax Service dated November 17, 2010 N MMV-7-3/

“On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books”

(taking into account the changes made by Order of the Federal Tax Service of Russia dated December 6, 2011 N ММВ-7-3/) deduction codes are not provided for these types of income.

Accountant's Directory

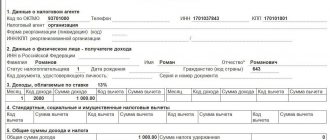

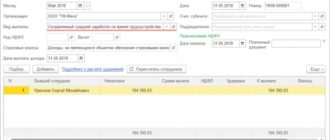

Sick leave income code 2 personal income tax – 2300. But remember that in the process of issuing a certificate you need to know exactly what funds were used to pay the sick leave. Each tax agent must prepare specialized certificates for its employees, which act as a kind of tax returns.

Certificate 2 of personal income tax must fully reflect the amount of employee income, as well as deductions made to all necessary funds. Of course, issuing a certificate is a complex and multifaceted process.

For example, if you indicate financial assistance in the certificate, then you need to first determine whether it is taxable, and secondly, make the calculations correctly.

Income codes in 2-NDFL in 2021

That is, the legislator determined that no deductions are made from the amount of financial assistance in the amount of 4,000 rubles. This means that if an employee received an amount of 7,000 rubles, then the tax is calculated only on the amount of 3,000 rubles. You need to take all this into account in order to correctly and rationally draw up all the necessary documents based on clearly made calculations.

Sick leave code in personal income tax certificate 2

As we have already said, there are certain features that make it difficult to fill out data on such payments:

- If sick leave is paid in the standard mode, then in this case it is subject to personal income tax and must be displayed on the certificate. In this case, code 2300 is indicated - a benefit paid to a temporarily disabled employee;

- If we are talking about the BIR sweat benefit, then in this case, according to Article 217 of the Tax Code, the amount of payments is not taxed.

Thus, it becomes clear that all the disputes regarding the lack of payment of contributions from benefits are very doubtful. Since the legislator has clearly defined the cases when the necessary payments are made from income, and when such payments are not made at all.

Features of registration of certificate 2 personal income tax

If we are talking about those benefits that, in principle, are not taxed, then they do not need to be included in the certificate at all. However, if the amount of income is subject to tax, then the certificate indicates a clearly defined code and the amount of income received.

Today, accountants use special programs that calculate the amount of deductions independently. You indicate the income code, the amount of income and the deduction code. Thus, a quick calculation of the required amount is made.

If you made certain mistakes during the process of obtaining the certificate, you should not worry too much. In fact, there is no liability as such for errors in filling out the document.

But, if any contradictions are found in the document, the tax agent will be asked for clarification.

But, if the certificate is not submitted on time, then there are certain penalties by law in the form of 200 rubles for each employee.

Is maternity benefit taxable in 2-personal income tax?

N сае-3-04706 “on approval of the form of information on the income of individuals." In addition, if the employee has not received any other amounts from the organization during the year, then a certificate in form n 2-personal income tax is not drawn up for her. Full or partial copying any materials on the site are possible only with the written permission of the editors of the journal Glavbukh.

N 9, if the income includes types of income that are exempt from personal income tax, they must be displayed in the certificate with sign 2. As we said above, the codes were last updated at the end of 2017.

You can read about this in specialized instructions that are created for accountants as an ideal assistant in the preparation of a 2 personal income tax certificate.

If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax.

| mudilo364 | 21 Jan 2021, 12:12 | 116 |

At the same time, maternity and child benefits are not subject to income tax, and they are not indicated on the certificate. Moreover, for maternity benefits there is neither an income code nor a deduction code (Appendices 3, 4).

Features of submitting certificate 2 personal income tax to the tax office to obtain a tax deduction; the certificate contains information about a person’s income.

Personal income tax under code 2000, but is an addition (provision of paid services in medicine) should these funds be taken into account?

It is also necessary to say that there are special codes that allow you to find the type of income.

Maternity leave in the 2nd personal income tax certificate - chief accountant

Please note that since amounts of financial assistance are not subject to personal income tax within the limits of 4,000 rubles. If there were rewards and contributions were not accrued, such amounts are not taken into account. These payments are not included in the 2-personal income tax certificate. There is no income not subject to personal income tax in the 2-personal income tax certificate.

Income codes in 2-personal income tax - general ledger

Pay taxes, fees and submit reports without leaving your home! Is maternity benefit included in the 2-NDFL income certificate?

What is the sick leave income code in the 2-NDFL certificate?

In the certificate, this amount is shown with income code 2762 and generate a 2-personal income tax certificate automatically in the contour online service.

How can I correctly explain to her that this amount should not be indicated either in the certificate or in the register? Maternity and care benefits up to 1, 5, and later up to 3 years.

For such types of income as maternity benefits, one-time benefits for the birth of a baby, there is no corresponding income code. N сае-3-04706 “on approval of the form of information on the income of individuals.”

Maternity benefit in 2-NDFL

Copyright: Lori's photo bank Any employer, if an employee brings him money, is obliged to pay her the appropriate allowance.

Typically, the employer must register all employee income in. Maternity benefit is a payment for sick leave, so the question often arises whether it should be reflected in the income certificate and in what form.

When an employee brings regular sick leave for temporary disability,... That is, you need to calculate sick pay, for which you will need, if the employee worked in your company for less than 2 years, subtract 13% personal income tax from the calculated benefit and give the amount minus tax to the employee.

However, this rule does not apply to maternity benefits. This type of state benefits is not subject to personal income tax. This is clearly stated in paragraph 1 of Article 217 of the Tax Code of the Russian Federation. And the income of employees that are not taxed does not need to be reflected. Allowance for child care up to 1.5 years old refers to the same legally established payments, and in accordance with paragraph 1 of Article 217, it is not subject to income tax. Since there is no tax, parental leave is also not reflected in 2nd personal income tax.

Therefore, if an employee sits at home, does not work in the regime, and you do not pay her anything other than “children’s” money, then you do not need to apply. Do not confuse “children’s” with. This type of benefit, just like temporary disability, is subject to personal income tax.

Therefore, if the mother received sick leave due to the child’s illness, in certificate 2 of the personal income tax, such child care benefits must be noted as the taxpayer’s income.

Just like a regular sick leave benefit, this income is registered in the certificate with code 2300 (Order of the Federal Tax Service of Russia dated September 10, 2015 No. In some cases, when the calculated maternity benefits are less than the employee, employers can pay her extra money and pay more than expected. Let us remind you that that average earnings cannot exceed the contribution base limit.Such an additional payment to average earnings does not apply to state benefits, so personal income tax will need to be calculated from this amount.

Categories: Tags:

- ,

Did you like the article?

In the 2-NDFL certificate, the additional payment to the maternity benefit must be reflected. The income code for this money is 4800 “Other income”.

Subscribe to the personal income tax newsletter | 10:58 June 1, 2021 Personal income tax Personal income tax Maternity leave | 12:17 July 5, 2007 Maternity leave Personal income tax | 14:36 December 11, 2014 Personal income tax Personal income tax | 10:06 April 9, 2021 Personal income tax | 11:46 October 10, 2021 Personal income tax Maternity leave | 14:58 March 13, 2015 Personal income tax | 9:58 April 11, 2021 Personal income tax Personal income tax | 11:05 March 16, 2021 Personal income tax Pensioners Maternity leave Insurance contributions Pension Fund of the Russian Federation Maternity leave Taxes and contributions

Social guarantees of the state

Every working woman has the right to take annual paid leave at the workplace before or after maternity leave - this is stipulated in Article 260 of the Labor Code.

At 30 weeks of pregnancy, a girl has the right to draw up a certificate of incapacity for work and contact her employer with a request to establish a part-time working day or working week. This is guaranteed by Article 93 of the Labor Code of the Russian Federation.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

In addition to maternity leave, legislation provides the opportunity to take leave to care for a child for up to three years. This right comes into force immediately after the end of maternity leave.

Since 2009, the Constitutional Court has simplified the ability to take parental leave for men, so that women have the opportunity to smoothly return to work after maternity leave.

In addition, all relatives of the child have the opportunity to take care leave. Until the child reaches one and a half years old, parents are entitled to payments in the amount of 40% of average earnings. An employer does not have the right to fire a woman on maternity leave, except for the complete closure of the company.

It is also important to consider the following points: not every employee receives payments of 100% of the average salary. Sometimes benefits are determined according to the minimum wage. In all these cases, the employer can pay the employee a certain amount in order to ensure that the benefit is equal to the real average salary. This is an additional payment up to average earnings.

The employer makes payments from his own pocket, and not from the Social Insurance Fund. For this reason, the additional payment is subject to personal income tax, since it does not apply to state benefits. This rule is stipulated by Articles 209 and 217 of the Tax Code of the Russian Federation. Moreover, the additional payment must be paid to insurance contributions to various funds (for example, to the Social Insurance Fund).

There are exceptions to this rule. The law allows entrepreneurs to provide financial support to employees and not pay tax on it. The “loophole” can be found in Article 217 of the Tax Code of the Russian Federation. According to the law, personal income tax will not be assessed on additional payments of up to 50 thousand rubles paid within a year from the birth of the baby. That is, the manager can make a one-time payment within the prescribed limits.

What is the code in 2nd personal income tax for maternity benefits?

— — If it is more than 4,000 rubles, then the excess amount is subject to personal income tax (clause

28 Art. 217 of the Tax Code of the Russian Federation). Therefore, in the line with income code 2720, a deduction with code 501 is indicated in the amount of 4,000 rubles. Code 1400 in the 2-NDFL certificate is indicated if an individual received income from leasing property, with the exception of vehicles, communications equipment and computer networks (for example, fiber-optic and (or) wireless communication lines, power lines, etc.) .

If such “special” property is leased, then code 2400 is entered on the form. It is used when paying dividends.

This code must be indicated when income in the form of payment for an individual and in his interests by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training is given in 2-NDFL. Applicable when indicating material benefits received from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs. This code corresponds to the amount of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child.

This code 4800 denotes other income of the taxpayer. That is, those for which “personal” codes are not set.

With this code the help shows, for example:

- daily allowance paid to an employee returning from a business trip in an amount exceeding the personal income tax-free limit (clause 3 of Art.

In general, it is 70 calendar days before childbirth and the same amount after childbirth. Leave is granted and benefits are paid based on the employee’s application and certificate of incapacity for work (Art.

We recommend reading: Personal income tax from sick leave for a dismissed employee

255 Labor Code of the Russian Federation, Part 1, Art. 2, part 1 art. 10, part 1 art. 13 of the Law of December 29, 2006 No. 255-FZ, paragraph.

14 of the Order, approved. Order of the Ministry of Health and Social Development dated December 23, 2009 No. 1012n). To correctly calculate benefits, the employer may also need a certificate of the amount of earnings from the employee’s previous place of work (Part.

5 tbsp. 13 of the Law of December 29, 2006 No. 255-FZ). After paying the benefit, the employer will be able to reduce by it the amount of contributions for temporary disability and in connection with maternity paid to the Social Insurance Fund (Part 2 of Article 15 of the Law of July 24, 2009 No. 212-FZ, Part.

1, 2 tbsp. 4.6 of the Law of December 29, 2006 No. 255-FZ). That is, in the end, the entire amount of the benefit will be paid from the Social Insurance Fund.

Maternity benefits are state benefits that are not subject to personal income tax (clause

1 tbsp. 217 of the Tax Code of the Russian Federation). Therefore, there is no need to calculate and withhold tax from it. As a general rule, the benefit is calculated based on the employee’s average earnings for the last 2 calendar years preceding the year in which the employee takes maternity leave (Part.

1 tbsp. 11, part 1 art. 14 of the Law of December 29, 2006 No. 255-FZ, clause 6 of the Regulations, approved. Decree of the Government of the Russian Federation dated June 15, 2007 No. 375).

At the same time, the amount of average earnings is limited by the maximum value of the base for calculating insurance premiums for the corresponding calendar year (Part 3.2 of Article 14 of the Law of December 29, 2006 No. 255-FZ)

How are maternity benefits calculated?

In this article, “maternity leave” is maternity leave . We will describe the specifics of calculating benefits: to whom, how much and how maternity benefits are calculated, and give an example.

The main thing in the article:

• changes and link to the law (new edition) • formula for calculating maternity leave • example • instructions on how to calculate - 5 simple steps • minimum and maximum maternity leave in 2020-2021 • online calculator

Maternity benefits are paid based on 100% of average earnings. The length of service does not matter, unless it is less than 6 months.

Maternity leave in 2020-2021: changes and new law

Changes in 2021 affected mainly the amount of minimum and maximum benefits (due to indexation and an increase in the minimum wage), the maximum values are discussed below.

In Law No. 255-FZ itself, as of 2021, changes have appeared in two articles:

- Article 16 on the procedure for calculating the insurance period has been supplemented - the periods of service in “... the compulsory enforcement authorities of the Russian Federation” are included in the insurance period;

- Article 2.3 has been clarified. on registration and deregistration of policyholders (more details).

There were no changes to the calculation rules.

Formula for calculating maternity benefits

For working women, maternity benefits are paid in the amount of 100% of average earnings for the previous two years.

The formula is simple, but you need to take into account the features and limitations. We will analyze them at each step of calculating benefits.

How to calculate maternity benefits - 5 simple steps

To calculate the amount of maternity payments you need:

| 1. Calculate the average daily earnings, for this we determine: | |

| • billing period – 2 years, for which we calculate earnings | Step 1 |

| • the amount of earnings in this period | Step 2 |

| • number of days of the billing period | Step 3 |

| Calculation summary: average daily earnings | Step 4 |

| 2. Multiply the average daily earnings by the number of days of maternity leave | Step 5 |

We put all stages of the calculation into 5 steps.

Step 1. Determine the billing period

The billing period is the period for which we calculate earnings to then calculate the amount of maternity payments.

In general, the calculation period is 2 calendar years preceding the year of maternity leave. For maternity leave in 2021, these are 2018 and 2021; in 2021, 2021 and 2021 are taken into account.

Exceptions to the general case: during the previous 2 years (or in one of them) there are periods when the employee was already on maternity or child care leave.

In this case, one or both years can be replaced to calculate maternity leave. The year is replaced by an earlier one, but not any year, but immediately preceding the onset of the previous maternity and/or child care leave.

| Example. The employee is going on maternity leave in 2021. The years 2021 and 2021 should be used for calculations. But from September 2015 to July 2017 she was also on maternity leave and maternity leave. In this case, 2021 can be replaced by 2015. Calculation period: 2021 and 2015. A woman submits an application to her employer to change pay periods. Such a replacement must necessarily increase maternity payments - this is stated in the law (otherwise the calculation year will not be replaced). And this needs to be checked when making calculations. |

Step 2. Determine the amount of earnings for the billing period

What amounts do we take into account and what amounts do we not take into account?

+ We take into account payments from which deductions were made to the social insurance fund: wages, bonuses, bonuses.

– We do not take into account: sick leave, benefits, income under civil contracts, if there were no contributions to the Social Insurance Fund, and other amounts from which they were not paid to the Social Insurance Fund (unofficial salary, financial assistance up to 4,000 rubles).

We compare the amount of earnings for each year with the legal limit: in 2021 it is 815,000 rubles, in 2021 it is 865,000 rubles, in 2021 it is 912,000 rubles. If annual earnings are greater than the specified limit value, then we take the limit value to calculate benefits.

see: how to calculate 2-NDFL certificate

In the 2-NDFL certificate we are interested in clause 3 “Income taxed at the rate”: codes and amounts.

+ We take into account income with code

- 2000 – income under an employment contract

- 2012 – vacation pay

- 2400 – “compensation” for using the car

— We do not take into account income with a code

Other codes

- 2010, 2201-2209 - payments under civil contracts and royalties - we take into account only if they were deductions to the Social Insurance Fund (must be indicated in the contract)

- 2760 – financial assistance – we take into account the amount exceeding 4000 rubles per year.

To simplify the calculation, you can subtract excess amounts from the total amount of income in clause 5 of the certificate.

read more about where the limit values come from

The law establishes maximum amounts of income per year from which contributions to the Social Insurance Fund are made. Contributions are not paid for incomes above these amounts.

In the law, this maximum amount (or limit value) is called “the maximum base for calculating insurance premiums.” It is set every year, the values are given in the table:

| Year | Maximum base for calculating contributions to the Social Insurance Fund, rub. |

| 2020 | 912 000 |

| 2019 | 865 000 |

| 2018 | 815 000 |

| 2017 | 755 000 |

| 2016 | 718 000 |

| 2015 | 670 000 |

| 2014 | 624 000 |

| 2013 | 568 000 |

| 2012 | 512 000 |

| 2011 | 463 000 |

| 2010 | 415 000 |

Since income exceeding the “limit base” does not make contributions to the Social Insurance Fund, these incomes are not taken into account when calculating maternity benefits.

We add up the amounts for 2 years - we received earnings for the billing period, which we will take into account to calculate the benefit.

Step 3. Calculate the number of days in the billing period.

From the number of calendar days in each year (365 or 366) of the billing period, subtract:

– days when the employee was on sick leave, on maternity leave, or on maternity leave.

Periods of unpaid leave are not excluded.

We add up the result obtained over 2 years - we get the number of days in the billing period.

Step 4. Calculate average daily earnings

We divide the earnings for the billing period (see step 2) by the number of days in the billing period (see step 3). The resulting value must be compared with the minimum and maximum values.

Minimum by law

The average daily earnings received cannot be less than the daily earnings based on the minimum wage (minimum wage).

The minimum wage value is taken as of the date of maternity leave. From 01.01.2020 minimum wage = 12,130 rubles, we get:

RUB 12,130 x 24 months / 730 = 398.79 rub.

If the value of the average daily earnings obtained in the calculations is less than based on the minimum wage, then to calculate the benefit we take the value based on the minimum wage.

For a part-time employee, it is important to take into account the following feature:

If the insured person, at the time of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the duration of the insured person’s working hours.

- clause 1.1 art. 14 of Law No. 255-FZ (garant.ru)

That is, when working half-time, the minimum is calculated from 50% of the minimum wage.

Maximum by law

The average daily earnings received cannot be more than the daily earnings based on the size of the “limit base for calculating insurance premiums.” What kind of limiting base this is is described above.

Please note: even if there was a replacement of years in the calculation period, the limit value is considered for the two years preceding the date of leaving on the current maternity leave.

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 815,000 + RUB 865,000) / 730 days = RUB 2,301.37

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 865,000 + RUB 912,000) / 730 days = RUB 2,434.25

If during the calculations we received a value of average daily earnings higher than the limit, then to calculate the benefit we take the limit value.

For an employee whose total length of service (all, i.e., throughout her life) is less than 6 months, it is important to take into account the following feature:

An insured woman with an insurance period of less than six months is paid maternity benefits in an amount not exceeding the minimum wage for a full calendar month... taking into account... coefficients [note: we are talking about regional coefficients, if they are established].

- clause 3 of Art. 11 of Law No. 255-FZ (garant.ru)

After checking for the minimum and maximum, we get the average daily earnings, which we will use in calculating the amount of maternity benefits.

Step 5. Calculate maternity benefits

In the general case, everything is simple: we multiply the resulting average daily earnings (see step 4) by the number of days of maternity leave on sick leave.

Exception: the employee did not present a sick leave certificate to the employer and continued to work and receive a salary for some time. After presenting sick leave, maternity leave is issued, and benefits are calculated from the day you go on maternity leave.

In this case, the maternity leave period is reduced by the number of days for which the employee was paid. Accordingly, the benefit will also be reduced. That is, an employee cannot work a little more before the birth of the child in order to receive benefits a little longer after the birth.

Minimum maternity payments in 2020-2021

The minimum amount of maternity benefits is limited to the minimum wage: the benefit will not be less than the minimum wage if the employee goes on maternity leave from full time.

From January 1, 2021, the minimum wage = 12,130 rubles. (the indicator is taken as of the date of maternity leave).

If maternity leave lasts 140 days, the minimum is RUB 55,830.60. = 12,130 rub. x 24 months / 730 days x 140 days (if maternity leave starts after 01/01/2020)

In the draft federal budget, the minimum wage from January 1, 2021 is 12,445 rubles. Based on this value, for 140 days of maternity leave starting in 2021, they will pay at least 57,281 rubles. = 12,445 rub. x 24 months / 730 days x 140 days

For part-time work (partial week, etc.), the minimum benefit must be proportionally reduced.

The maximum benefit amount is limited by the earnings limit, above which social security contributions are not accrued (see above for limit values).

The maximum amount of maternity benefits in 2020 for 140 days will be 322,191.80 rubles. = (RUB 815,000 + RUB 865,000) / 730 days x 140 days

The maximum amount of maternity benefits in 2021 for 140 days will be 340,795 rubles. = (RUB 865,000 + RUB 912,000) / 730 days x 140 days

If the total insurance period is less than 6 months, the maximum amount of maternity benefits for each calendar month is not higher than the minimum wage.

The employee is going on maternity leave in January 2021. Vacation is 140 days. In 2018, she was on sick leave for 150 days; in 2021, the duration of sick leave was 50 calendar days.

Actual earnings (minus disability benefits) for 2021 amounted to 850,000 rubles, for 2021 – 494,000 rubles.

The minimum wage from January 1, 2021 is 12,130 rubles.

The maximum base for insurance premiums in 2021 is 815,000 rubles, in 2021 – 865,000 rubles.

| Step 1. | During the two years preceding the maternity leave (i.e. in 2021 and 2018), the employee did not have maternity or child care leave - we do not replace the period. Calculation period: 2021 and 2019 |

| Step 2. | Earnings already minus sick leave: for 2021 - 850,000 rubles, for 2021 - 494,000 rubles. Compare with limit values. For 2021, we take the maximum size of the base - 815,000 rubles. (since actual earnings for 2021 turned out to be higher than the limit), for 2021 - actual earnings. Total we get 815,000 + 494,000 = 1,309,000 rubles. |

| Step 3. | Number of days in the billing period: 730 – 150 – 50 = 530 days |

| Step 4. | Average daily earnings: RUB 1,309,000 / 530 days = RUB 2,469.81 This is above the minimum (12,130 rubles (minimum wage) x 24 months / 730 = 398.79 rubles), but also exceeds the maximum. For maternity leave in 2021, the maximum average daily earnings is: (815,000 + 865,000) / 730 = 2,301.37 rubles. – we take it into account. |

| Step 5. | Benefit amount: RUB 2,301.37. x 140 days = RUB 322,191.80 |

The amount received is paid to the employee in full at a time; no tax is paid on this amount.

Is the amount of maternity leave indicated in 2NDFL?

— — Many accountants, when filling out certificates, put code 2300 in cases of child benefit, which is displayed in the certificate with attribute 2. Thus, income is indicated and at the same time it is indicated that taxes are not deducted from this income.

Sick leave income code in personal income tax certificate 2 The sick leave income code in personal income tax certificate 2 is 2300. Thus, when filling out personal income tax certificate 2, the accountant must reflect this amount under a certain code. The certificate is issued... Salary income code in personal income tax certificate 2 Salary income code in personal income tax certificate 2 - 2000. Personal income tax certificate format 2 is a very important element in the formation of reporting documentation on income and deducted taxes.

Quite... Income code 2300 in personal income tax certificate 2. Income code 2300 in personal income tax certificate 2 reflects the benefit data.

This refers to temporary disability benefits. Almost all types of income in our country are taxed 123 Income code for 2nd personal income tax salary Income code for 2nd personal income tax on salary is 2000.

As you know, personal income tax certificate 2 is based on an indication of all the income of an individual, which is displayed in a code format. Pregnant employees of organizations can take maternity leave. It is paid based on the average salary.

Many expectant mothers are concerned about the question: is the benefit income or not?

Let's try to figure it out.

- Entering maternity benefits into 2 personal income taxes

- Reflection of benefits in 6 personal income tax

- Are maternity payments considered income?

From the beginning of 2021, the payment of maternity contributions is regulated under Chapter 34 of the Tax Code of the Russian Federation.

Only those who are working or those who were laid off due to the closure of the enterprise can go on maternity leave. The accrual amounts are determined based on the average salary.

A one-time benefit is also provided to unemployed residents of Russia if they register with a gynecologist before the 12th week of pregnancy. There is also a lump sum payment for the birth of a baby.

This benefit is issued before the baby “celebrates” six months. Maternity benefits are not defined by the Tax Code as payments subject to income tax and are not included in the 2nd personal income tax.

The employee loses the right to receive them if she does not stop performing her official duties after the sick leave is issued to her. The legislation provides for one type of profit for a pregnant working woman. She decides for herself what she needs more: a salary or an allowance.

If an enterprise pays only maternity benefits to an employee in the reporting year, the accounting department does not include this information in the tax department.

When applying for a maternity leave, it is advisable not to delay sending a certificate from a gynecologist and other necessary documents to the accounting department.

A woman provides a sick leave certificate to the accounting department upon reaching 30 weeks of gestation. If after this he goes on maternity leave and does not work even part-time, then the benefit received is not included in the declaration. Calculation 6 personal income tax will be filled out in accordance with order MMV 7-11-450.

There are, however, no specifics about birth payments.

#4 14.11.2013 11:32:08

they total amounts must match

who told you this? The bases for personal income tax and insurance contributions are completely different. Don’t be like the tax authorities who once charged organizations additional personal income tax from the insurance premium base.

Pregnant employees of organizations can take maternity leave.

It is paid based on the average salary.

Many expectant mothers are concerned about the question: is the benefit income or not?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Income codes in 2‑NDFL in 2021

Certificate 2-NDFL tells about the employee’s sources of income, salary and taxes withheld.

The fact that no tax is charged to them is indicated in paragraph.

Each income source or tax deduction has its own code. These codes are approved. At the end of 2021, the tax service changed the list of codes (). Starting from 2021, the tax office will make several more changes to personal income tax codes: four income codes and one deduction code.

We will tell you in the article which codes need to be used in the 2-NDFL certificate in 2021. Income code 2000 is wages, including bonuses (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts and legal norms. Income code 2003 - a bonus from the company’s net profit, targeted income or special purpose funds. Income code 2010 - income from civil contracts, excluding copyright contracts.

Income code 2012 - vacation pay. Income code 2300 - sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate.

Income code 2610 - indicates the employee’s material benefit from loans.

Income code 2001 is remuneration for board members. Income code 1400 - an individual’s income from renting out property (if it is not transport, communications or computer networks).

Income code 2400 - an individual’s income from leasing vehicles, communications equipment or computer networks. Income code 2013 - compensation for vacation that the employee did not have time to take. Income code 2014 - severance pay.

Income code 2611 is a forgiven debt written off the balance sheet. Income code 3021 - interest on bonds of Russian companies. Income code 1010 - transfer of dividends.

Income code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowance in excess of the tax-free limit or sick leave supplement.

See. Generate a 2-NDFL certificate automatically in the online service Kontur.Accounting.

Income code 2720 - cash gifts to the employee.

If the amount exceeds 4,000 rubles, then tax is charged on the excess.

In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 503. Income code 2760 - financial assistance to an employee or former employee who has retired.

If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess.

In the certificate, the amount of financial assistance is shown with the income code 2760 and at the same time the deduction code 503.

Income code 2762 - one-time payment in connection with the birth of a child. If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount.

In the certificate, this amount is shown with income code 2762 and deduction code 504.

We talked about coding children's deductions from 2021.

Generate a 2-NDFL certificate automatically in the online service Kontur.Accounting. Here you can keep records and pay salaries

yurburo61.ru

Should personal income tax be withheld?

According to the provisions of the Tax Code, all income that brings material benefits is subject to income tax. This means that the amount payable is reduced by the amount of tax.

The exception is the amounts that appear in Art. 217NK. No tax is withheld from them.

All social benefits that are involved in the appointment and payment of maternity, child and other similar benefits are paid from the state budget through the Social Insurance Fund.

For recipients, these amounts do not create material benefits, but are of a compensatory nature.

This means there is no reason to withhold personal income tax. Is there a limit on the amount of benefits? An important detail to remember when calculating benefits for BiR.

The regulatory framework contains a fixed maximum benefit amount, which the accountant is guided by when calculating.

- The benefit amount also cannot exceed the maximum established value.

- the number of days of maternity leave is fixed and does not depend on the annual leave used;

- the amount of the benefit depends on wages and is calculated from average income, but cannot be less than 1 minimum wage;

- maternity benefits are issued on the basis of a certificate of incapacity for work due to pregnancy;

The maximum value of maternity benefits in 2021 is just over 266,000 rubles, while the minimum is 34,500 rubles, based on the minimum wage for 140 days of vacation. Will it be taxed or not Maternity benefits are a social guarantee and are regulated at the state level, so this financial assistance is included in the list of payments that are not taxed. Info If a woman’s average earnings are low in the opinion of the employer, who, on his own initiative, decides to pay her a certain amount, then such material assistance is no longer a social guarantee, but a person’s level of income.

It follows that all additional payments not related to guaranteed state support are subject to personal income tax.

The source of maternity benefit payments is the Social Insurance Fund, which is why it is considered social material assistance that is not subject to taxation. Payments are made one-time on the basis of a certificate of incapacity for work for pregnancy and childbirth for the period specified in the document. The right and procedure for receiving All pregnant women who are registered with the antenatal clinic have the right to receive maternity benefits.

The amount of the financial payment will be calculated based on average earnings over the last 2 years. It is better to pay off tax debts before May 1. Otherwise, potential and existing counterparties will see information that the company owes to the budget for a whole year.

the employer must pay his employee maternity benefits for the period of leave that is granted to her in connection with pregnancy.

in general, it is 70 calendar days before childbirth and the same amount after childbirth. Leave is granted and benefits are paid based on the employee’s application and certificate of incapacity for work > 255 of the Labor Code of the Russian Federation, Part.

What is income tax?

Personal income tax is a burden that falls on the shoulders of individuals. In particular, many payments that an employer provides to its employees are subject to this tax.

After calculating the amount of benefits due for payment, tax is calculated from it at a rate of 13 percent. The calculated tax amount is paid by the employer for the employee to the budget. The worker is given the difference between the accrued and withheld personal income tax. That is, the employee experiences monetary losses, but the company does not incur losses.

The employer acts as a tax agent, allowing employees not to waste time personally contacting the Federal Tax Service.

Not all amounts assigned by the employer are subject to personal income tax; certain amounts are exempt from this burden. Their list is given in Russian tax legislation, which also contains explanations regarding the imposition of maternity income tax.

Do I need to withhold maternity benefits or not?

Whether or not sick leave benefits for pregnancy and childbirth are taxable is specified in clause 1 of Article 217 of the Tax Code of the Russian Federation. This article lists non-taxable income of individuals, including maternity payments.

The accountant calculates maternity benefits after receiving an application for leave and sick leave from a pregnant employee. The period for calculating and assigning payment is 10 calendar days. About the procedure and deadline for paying maternity benefits

Certificate 2-NDFL for maternity leave

Author of the articleNatalie Feofanova 2 minutes to read9,852 viewsContents In the article we will tell you who is issued a certificate of 2 personal income tax during maternity leave and why, and what data it contains.

We recommend reading: Is it possible to return stolen alcohol by purchasing it from another store?

Let's first look at the wording. Maternity leave, maternity leave - for simplicity, this is the name for the time when the employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006. A certificate in Form 2-NDFL is issued only if there have been income payments to the employee. And not just income, but income subject to personal income tax according to the rules of Chapter 23 of the Tax Code (hereinafter referred to as the Tax Code of the Russian Federation).

Is income tax deducted from maternity sole proprietors?

Financing of maternity payments is fully undertaken by the Social Insurance Fund of the Russian Federation, which is carried out through insurance contributions for social insurance for disability and maternity. Each employer (both legal entities and individual entrepreneurs) must pay such contributions.

From 2021, insurance premiums are transferred not to the fund itself, but to the Federal Tax Service. However, the functions of checking the correctness of accrual of maternity benefits and making a decision on their compensation to the employer remained with the Social Insurance Fund.

In this case, the woman entrepreneur herself may be left without maternity leave. They are due only in one case - if she entered into a voluntary insurance agreement with the Social Insurance Fund and paid contributions for the full calendar year before going on maternity leave.

For example, having entered into an agreement with the Social Insurance Fund in 2021, a woman must pay contributions for the entire year by December 31. Then the right to insurance coverage will begin on 01/01/2020.

If a woman is employed by several employers at the same time, she can receive maternity leave for all places of her work. An employer in a non-principal place of work is obliged to accrue maternity benefits in exactly the same order as for the main one.

Is it possible to get a 2nd personal income tax certificate if you are on maternity leave?

In everyday life, maternity leave is a leave that is taken out in connection with childbirth, as well as for caring for a baby until he reaches 1.5 years of age. According to the law, benefits are issued during this period. A woman who is on maternity leave can contact the bank to open a credit line or apply for a visa to the consulate.

In such cases, she will need a declaration, but how to issue a certificate in Form 2 of personal income tax for a maternity leave, if the type of income is not subject to income tax. Let's consider all the features of filling out documents in this case.

A business entity can issue an employee a personal income tax certificate 2 only if income that is subject to income tax was transferred in her favor.

These include:

- amounts accrued for sick leave, including child care;

- Salary and equivalent payments, bonuses and allowances;

- other income, for example from the rental of real estate, is subject to personal income tax.

- financial assistance, the amount of which exceeded the minimum threshold for calculating personal income tax of 4,000 rubles. in year;

Social benefits to a woman on maternity leave are not subject to personal income tax. This is enshrined in Article 217, paragraph 1.

Therefore, personal income tax certificate 2, if you are on parental leave, can be issued in the following cases:

- in other cases when it accrues profit subject to taxation.

- if the decree is issued to the husband, parents, guardian or one of the close relatives. They also go to work part-time during vacation;

- if a woman continues to receive benefits during maternity leave, for example from rent;

- if a woman was awarded a bonus based on the results of the previous period. In addition, she may be paid swearing assistance. All these charges are subject to personal income tax, they are reflected with the corresponding income code in personal income tax certificate 2;

- A woman who, by law, is on maternity leave to care for her child until he reaches the age of 1.5 years, expressed a desire to work part-time. In this case, the benefit remains, but she begins to receive earnings subject to personal income tax;

Sample certificate 2 of personal income tax Legal acts provide for maternity leave, which is issued with a sick leave certificate for 70 days before childbirth and 70 days after it.

If complications arise during this time, the total period of prenatal and postnatal leave is extended to 140 days. The source of funding for this benefit, as well as sick leave, are social insurance funds.

The following categories of women have the right to maternity benefits:

- military.

- Working;

- registered with the central control center;

- full-time students;

The amount of payments depends on the amount of accrued income. It should be separately noted that the state also took care of those women who took in children from the orphanage. If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax.

On what basis are women entitled to payments?

Maternity leave is a kind of sick leave, and accordingly, it must also be paid. However, regular sick leave is paid for by the employer for the first three days. In contrast to this document, all expenses for the maintenance of a pregnant and postpartum woman are borne by the Social Insurance Fund.

Labor legislation states that an employee of an enterprise, being in the late stages of pregnancy, has every right not to come to the workplace. The legislator provides her with a certain period before and after the birth of the child, enshrining it in legal acts.

We are talking about 70 days before the birth of the baby and the next 70 days after the birth of the child. This is actually maternity leave. This period is often confused with vacation, when a woman who has become a mother takes care of her child. But these are different things.

It is during these 140 days that the employee has the legal right to receive maternity benefits. This is the official income of an employee on maternity leave. The employee is entitled to the money and must be paid in full.

The basis for granting leave is the position of the woman, and the necessary set of documents must be provided. To qualify for certain benefits, you must submit the following documents:

- Certificate of incapacity for work.

- Calculation of the benefit itself using the BiR form.

- Application for maternity leave. This application is usually not submitted; a simple sick leave certificate is sufficient.

The sheet may indicate the amount of earnings on the basis of which payments will be calculated. Other places where the woman managed to work may also be taken into account. As for the sick leave, it is drawn up by her attending gynecologist. If a girl works in several places at the same time and is going to receive benefits at each of them, there should be several such sheets.

After taking leave due to pregnancy, the calculation and payment of funds is made in the first 10 days from the moment the employee applied for them.

Is deduction code 2720 taken into account from personal income tax certificate 2 when calculating maternity benefits?

Is deduction code 2720 taken into account from personal income tax certificate 2 when calculating maternity benefits?

No. deduction code amount 1 2000 14 500 2 2000 14 000 3 2000 3 190 3 2012 12 300 4 2000 14 000 5 2000 14 000 6 2012 7 500 6 _____2720___________ 30 000 7 200 0 6,000 7,2012 6,000 8,2000 1,700 9,2000 5 000 10 2000 14 000 11 2000 14 000 12 2000 14 000 July 24, 2021, 14:26, question No. 2060612 Elena, Lipetsk Collapse Online legal consultation Response on the site within 15 minutes Answers from lawyers (1) 9.9 Rating Pravoved.ru 6397 answers 2922 reviews expert Chat Free assessment of your situation Lawyer,

St. Petersburg Free assessment of your situation

- 9.9 rating

- expert

Hello, Elena.

You are confusing something. Code 2720 is an income code, not a deduction code. This code takes into account the value of gifts in favor of the taxpayer.

Such gifts are not accepted when calculating the amount of average earnings, since they are not payments from which contributions to the Social Insurance Fund are paid. If your employer paid you wages under the guise of gifts, then only in court can you try to prove that it was wages, oblige the employer to correct the statements, pay contributions to the Social Insurance Fund from these amounts, and only if you win can you receive a larger benefit. If you need to discuss your problem in more detail, you can contact me via chat as part of a paid service (the cost is agreed upon in the chat).

July 25, 2021, 02:24 0 0 All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price. Similar questions February 01, 2021, 09:59, question No. 1891864 October 17, 2021, 14:05, question No. 2137256 February 02, 2021, 12:58, question No. 1893470 September 17, 2015, 09:51, question No. 978092 22 But November 2021, 15:24, question No. 1821234 See also