How to correctly register the founder's contribution to the cash desk

When a company is created, an authorized capital is formed; it can be its own or borrowed. Authorized capital (hereinafter referred to as the Criminal Code) is a reserve of a company that is created by the founders by contributing to it cash, material assets, property, and intangible rights expressed in monetary terms. It is necessary for the company to start functioning. Legislative acts of the Russian Federation regulate the amount (size) of the authorized capital. Let's look in this article at which account the authorized capital is accounted for, how to register the founder's contribution to the cash desk, and let's look at the accounting entries when registering this operation.

- Payment of wages to employees;

- Rent, for example, office or warehouse space, vehicle rental;

- Acquisition of OS objects that will be used in the future for work, for example, computer equipment, objects in a production workshop, etc.;

- Payment for purchases, transfer of funds to suppliers;

- Other.

Founder's contribution to replenish working capital

The provisions of the founders’ agreement that the share has been paid are most often not taken into account by the courts (see resolutions of the 7th AAS dated October 23, 2014 No. 07AP-9117/14, the 10th AAS dated June 7, 2013 No. 10AP-4385/13 ). How to deposit money into an LLC current account: current procedure Money can be deposited into a current account either in cash at a bank branch or by bank transfer. Methods of non-cash money transfer:

- by payment order, collection order, etc.

(for a participant - a legal entity or individual entrepreneur); - transfer of electronic funds (for citizen participants).

In each case, a column indicating the purpose of payment is filled out in a paper document or electronic form of the bank.

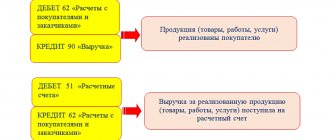

Accounting entries for contributions to the authorized capital

To obtain a license, you need to pay more than half of the authorized capital; 4 months are given to repay the remaining part. The exception is for joint stock companies; they are given 3 months to pay more than 50% of the authorized capital and a year to pay the rest. A joint stock company that has not paid 50% of the authorized capital does not have the right to enter into transactions not related to its establishment, and the decisions of shareholders have no legal force.

First, let’s define what a current account is intended for. It is created by legal entities for the purpose of conducting monetary transactions with other companies and individuals, allowing them to withdraw and store money obtained from cash surpluses. The company itself determines the limit of money stored at the cash register and is obliged to transfer the excess to the current account. The exceptions are paydays, non-working days and holidays.

Tax accounting of gratuitous assistance from the founder of his company

Profit in the form of gratuitous assistance received from a legal entity (or individual) is classified as non-operating income, from which tax is calculated. Contributions made free of charge are not subject to taxation in cases regulated by law (Tax Code of the Russian Federation, Article 38, paragraph 2; 250, paragraph 8; 251, paragraph 1).

| Type of free assistance | Circumstances in which aid is not taxable | Detailing |

| Money, property objects | The share of the “helper” (founder, participant, shareholder) in the authorized capital of the recipient of assistance is more than half | Regarding transferred property (this does not apply to money), these rules apply when it is not transferred to a third party within a year. The countdown starts from the date of its adoption. |

| The recipient (legal entity, organization) of gratuitous assistance owns more than 50% of the authorized capital of the helping party (legal entity, organization) | Situation: a foreign company, which is included in the list of territories providing preferential tax regimes, helps (transfers a property). Then the cost of the accepted property must be included in profit to calculate tax. | |

| Money, property, property and non-property rights | Assistance provided to increase the recipient's net assets | The recipient's constituent documentation (decision) must clearly state the intended purpose of the monetary assistance. |

The above procedure is valid for organizations of all forms of ownership. If the cash contribution made does not increase the tax base, a permanent difference is created. Tax calculations are made from it. The founder's contribution to increase net assets is not taken into account in profits when the company's debt to him is reduced or liquidated.

The preferential category of financial assistance in terms of taxation includes a loan agreement. No interest is charged on the money received. The funds themselves are transferred on a repayable basis. Therefore, profit tax is not calculated on this money.

Regarding VAT, the law provides its own rules for the party providing assistance. Thus, only the sale of goods, services, and works on a free basis is considered subject to VAT. The exception is the circumstances outlined in the Tax Code of the Russian Federation, Art. 146, paragraph 2, paragraphs. 1-5 (for example, gratuitous transfer of kindergartens, sanatoriums, and other social and cultural facilities).

Loan from the founder: postings

A situation may arise when the organization’s own funds are not enough to make capital investments or finance current expenses. One option for raising funds is to ask the founder for help. His assistance can be either free of charge or provided with a refund. We will tell you how to take into account a loan from the founder in our consultation.

In order to understand in which account to account for the loan from the founder, it is necessary to answer the question about the term of the loan. After all, if a loan is provided for a period of up to 12 months inclusive, then it must be taken into account in account 66 “Settlements for short-term loans and borrowings.” And if the loan term exceeds 12 months - on account 67 “Settlements for long-term loans and borrowings”.

Registration of free assistance

The decision to provide financial assistance free of charge requires contractual formalization.

IMPORTANT INFORMATION! The Tax Code of the Russian Federation does not impose income tax on transferred funds if the participant of the legal entity that provided assistance owns half or more of the authorized capital of the organization. In other cases, this amount will become part of non-operating income and is subject to income tax.

The necessary document is the founder's decision to provide gratuitous assistance to the company, where it is necessary to clearly indicate the purposes for which the received finances are planned to be directed.

Accounting accounts 80 and 75

Authorized capital is the initial amount of funds (start-up capital) that the founders are willing to invest to ensure the activities of the enterprise. When registering an organization with the relevant authorities, constituent documents are drawn up, which include the cost of the authorized capital.

First of all, with its help, start-up capital is formed for the subsequent commercial activities of the enterprise. It consists of contributions from the founders, which can be either in the form of tangible property or in cash. Each founder has his own certain share in the capital, depending on its size, he will subsequently receive the corresponding profit from the commercial activities of the enterprise (dividends). The company is responsible for its obligations within the framework of this capital, so for creditors this is a kind of guarantee of satisfaction of their interests.

Free financial assistance to the founder (for registration, posting) in 2021

- Federal Law No. 395-1, which was adopted on December 2, 1990.

- Federal Law No. 129 of August 8, 2001.

- Federal Law No. 14 of February 8, 1998.

- Federal Law No. 208 of December 26, 1995.

- Regulation of the Central Bank No. 302-P dated March 26, 2007 (rules for accounting in a credit institution of the Russian Federation).

- Central Bank Regulation No. 318-P dated April 24, 2008 (rules for conducting cash transactions and storing banknotes).

- Instruction dated September 14, 2006 No. 28-I.

- Methodological recommendations of the Central Bank.

- The best way to cover the deficit of working capital is to replenish the account with the personal sums of the founders. Such a contribution can be made in several ways - increasing the authorized capital, loans and transferring money as gratuitous assistance.

Formation of authorized capital in 1C 8

- Contribution of fixed assets. For example, the founder decided to repay the debt on the authorized capital in the form of equipment that can be immediately put into operation. In this case, two entries will be generated: Dt 08 – Kt 75.01 (repayment of debt on the authorized capital);

- Dt 01 – Kt 08 (commissioning of equipment).

Also read: Payment of fines by Sberbank resolution number online

Please note that if the debt on the authorized capital is repaid not in money, an assessment of this property must be carried out. The founders have the right to produce it themselves if the cost does not exceed 20,000 rubles. Otherwise, an external appraiser must be involved.

How can you replenish working capital?

The registration should be as follows: the participant must receive from the organization a receipt of a cash receipt order for depositing cash into the cash desk indicating the purpose of payment. Then the money is given to him from the cash register according to an expenditure order for depositing in the bank according to an advertisement. How to replenish the current account of an LLC with cash as gratuitous assistance from a participant in the form of a contribution to property. The gratuitous provision of property to the organization by the founder is provided for by law in the form of a contribution to the property of the company (Article 27 of Law No. 14-FZ). The procedure for entering it is as follows:

- The obligation to make contributions must be provided for in the charter.

Cash contribution to the cash desk from the founder of the transaction

Provisions of the Tax Code.

Further, according to paragraph 1 of Article 85 of the Tax Code, the SRS includes all types of income of the taxpayer. Article 96 of the Tax Code determines that the cost of any property, including work and services received by a taxpayer free of charge, is his income. The cost of property received free of charge, including works and services, is determined in accordance with IFRS and the requirements of legislation on accounting and financial reporting.

Normative base.

It may be noted that in paragraph 2 of Article 13 of the Law “On Accounting and Financial Reporting” it is defined that income is an increase in economic benefits during the reporting period in the form of an influx or increase in assets or a decrease in liabilities that lead to an increase in capital other than the increase associated with contributions from persons participating in the capital. And also, paragraph 1 of Article 13 of the Law “On Accounting and Financial Reporting” establishes that an obligation is an existing obligation of an individual entrepreneur or organization arising from past events, the settlement of which will lead to the disposal of resources containing economic benefits.

Types and directions

Currently, several types of contributions are used in practice. The purpose of the operation is the factor included in the classification base. Among the reasons are:

- Increase in the size of the authorized capital. Often preceded by a founding meeting. The operation is carried out only if a large proportion of participants agree with the implementation of the idea. In accordance with the current norms of the law, the fact of a change in size is recorded in the regulatory (tax) services.

- Increase in net assets. As a result of the operation, the size of the authorized capital remains unchanged.

- Replenishment of the reserve part. While depositing money, the founder retains the right to receive funds in the form of dividends. The funds he contributed become the property of the company.

- Replenishment of additional capital. In this case, the object of investment can be not only money, but also property assets allocated for the formation of a DC.

- Securing a repayable loan. The provision of funds is carried out on the basis of an agreement, which includes the terms of the loan and the terms after which it is returned to the founder.

Cash payment

Previously, Law No. 14-FZ implied the fact that the founder must pay at least half of the capital before the company registration procedure. This required opening a temporary savings account with a banking organization.

It does not fall under the influence of the instructions of the Central Bank of the Russian Federation, and the conditions of coverage are determined independently by the banking organization. The basis for such actions is the provision on the rules and regulations of accounting (Order of the Ministry of Finance of Russia No. 34n).

The opening of an account is carried out for a certain period within the balance sheet account, which is used to open a company. Traditionally, a set of papers is provided for this purpose:

- identity card of the founding party;

- protocol indicating the fact of formation of the LLC;

- charter

Funds deposited into the account cannot be spent. If there is an order to one of the participants regarding the deposit of funds into a temporary account, the procedure must be confirmed by a receipt for receipt of funds, otherwise evidence of payment of the share will not be found.

The gratuitous issuance of property to the organization by the founder is provided for within the framework of the current Law No. 14, Art. 27. The procedure for replenishing your account with cash is as follows:

- The obligation to make contributions is provided for in the Charter.

- The decision to make contributions is made by 2/3 of all votes.

- Payment is in cash and strictly in monetary terms.

- The size of the contribution is set disproportionately to the shares.

- The contributed funds do not affect the size of the share.

Loan from the founder

It is necessary to start signing a bilateral loan agreement, as well as ensure the execution of primary documentation, which is able to confirm the fact of the provision of funds, because the loan as a truly valid agreement exists only from this moment.

- During the cash deposit, a cash receipt order is issued from the LLC indicating that the loan has been received.

- In the case of a non-cash transfer, it is necessary to make a record of the online banking system, as well as the order associated with the transfer of money without the need to open an account.

If a controversial situation arises, the banking company that made the transfer provides the necessary information. There is a possibility of submitting a screenshot from the system page within which a detailed reflection of the operation took place.

Often a situation arises when an organization urgently needs funds, but the founder does not have the opportunity to do this in this manner.

The solution is this: an employee of the organization is given a verbal instruction, and he deposits funds into the account within the correct purpose of the payment. In this case, the fact that the funds are not contributed by the founder is taken into account, therefore relations of such a plan must be formalized by means of a receipt. Otherwise, the court will assume that the funds were contributed by the employee

Payment by an individual

The basis for a contribution on the part of an individual is his decision, which is made within the framework of an individual procedure. This aspect is directly related to both individual entrepreneurs and the founders of the LLC.

Features of the procedure include the following aspects:

- a protocol is required;

- registration of the contribution is made for each of the LLC participants, if there are several of them;

- transfer of money through an interest-free loan is not subject to taxation if the founder is the owner of more than ½ of the assets.

The company's property assets are not subject to alienation procedures for a 12-month period. If the founder does not pay for the share on time, it becomes the property of the organization and is subject to further distribution among the remaining participants in accordance with the size of their shares.

Depositing funds by the director

The general director of the organization retains the direct right to transfer funds.

According to Art. 715 clause 1 of the Civil Code of the Russian Federation, one party (director) undertakes to transfer funds or material assets to the company. As for the borrower, the other party, she has an obligation to return these funds in an identical amount. Art. 718 of the Civil Code of the Russian Federation notes the fact that, unless other provisions are provided for by law or contractual provisions, remuneration is paid in predetermined amounts for the use of the loan subject.

Based on Art. 722 of the Civil Code of the Russian Federation, the borrower undertakes to return the subject of the loan within the framework of the procedures and terms provided for by the contractual agreement. As for the subject of the loan, which was provided without an agreed condition on the payment of reward, it can be returned ahead of schedule.

ATM and terminal

ATMs and terminals are a convenient way of interaction between persons wishing to deposit funds and parties seeking to receive them. This only means that representatives of the organization will no longer need to go to a bank branch, since everything can be done in a certain banking structure.

To do this you need to follow the order:

- take an identification code from the organization’s office premises;

- find a suitable self-service terminal;

- click on the item related to payment for services and certain services;

- enter the appropriate code and follow the prompts.

Replenishment from individual entrepreneurs

To deposit the required amount, an entrepreneur should visit a bank branch and top up in cash. This method is considered the most common.

It is worth distinguishing between concepts such as depositing funds and providing money to individual entrepreneurs’ accounts. In the first case, you can deposit funds in cash, through money transfers, using ATMs.

It is best to use account 84. In the process of withdrawing funds, you must use posting Dt 84 Kt 51. The organization goes through the registration procedure without opening current accounts. If the contribution is made to an account, the appropriate basis should be indicated within the bank documentation.

Settlements with founders (account 75)

The obligations and rights of individual LLC participants also apply to legal entities, but there are some restrictions. According to the law, local government bodies and state bodies have the right to be the founders of an LLC, unless this is prohibited by law of the Russian Federation.

In general, the number of LLC founders should not be more than 50 people. They can be citizens who have reached the age of majority and are legally capable; Persons with limited legal capacity also have the opportunity to engage in business, but only with the consent of the trustee. The participants of the LLC are not liable for its obligations, but bear the risk of losses that are associated with the activities of the Company and are within the value of the shares that belong to them, according to the authorized capital of the LLC.

Founder's contribution to replenish working capital - taxation

Important

Cash payments between organizations and citizens who are not engaged in entrepreneurial activities are carried out without limiting the amount (clause 5 of Bank of Russia Directive No. 3073-U dated October 7, 2013). Therefore, if the founder is a citizen, the organization can accept any amount of cash from him as a loan. When receiving or repaying a loan in cash, draw up an outgoing or incoming cash order (forms No. KO-2 and No. KO-1, approved by the Decree of the State Statistics Committee of Russia dated August 18, 1998.

No. 88). 3. From the recommendation of Oleg Khoroshiy, head of the profit tax department of organizations of the department of tax and customs tariff policy of the Ministry of Finance of Russia. Can the founder (participant) of an LLC make an additional contribution to the authorized capital in cash.

Cash contribution to the cash desk from the founder of the transaction

Options are no longer discussed. The founder decided to add and forget about them. He doesn't want to return this money to himself. Moreover, the company is moving to zero for the next couple of years. She is simply =clean= without debts and just after checking, for turnover there is another one, worse. - then regard it as the company’s income, Article 250 of the Tax Code of the Russian Federation, Chapter 25

Oleg Grigoriev. Account 86 does not apply in this situation, this is not financing, because payment of rent is a typical operation of economic activity, and not a targeted event. I have already explained this to the author of the topic via a personal message. Free assistance from the founder is not income only if his share is more than 51%. In all other cases, gratuitous assistance is income and must be carried out through account 91/1. If there are two or more founders, then it is better to show the loan. And it must be interest-bearing, otherwise you will butt heads with the Federal Tax Service for a long time, But the author of the topic has only one founder.

Also read: Where to get your ATV license

Step-by-step instruction

On February 12, decision No. 1 of the meeting of the founders of the Organization approved:

- participant Ivanov A.P., share of participation in the organization is 70%, provides financial assistance to the society in cash in the amount of 580,000 rubles.

On the same day, the funds were transferred to the organization's current account.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection of financial assistance by decision of the meeting of founders | |||||||

| 12th of February | 75.01 | 83.09 | 580 000 | Reflection of financial assistance of the founder | Manual entry - Operation | ||

| Receipt of financial assistance from the founder | |||||||

| 12th of February | 51 | 75.01 | 580 000 | Receipt of financial assistance from the founder | Receipt to current account - Other receipt | ||

Accounting for authorized capital and settlements with founders (account 80 and 75)

The first business transaction for any enterprise is the reflection of the authorized capital. Even before you registered the company, you had to decide on its size; after the company is registered, the amount of the authorized capital will appear in the constituent documents of the enterprise. Now all that remains is to correctly reflect this amount in accounting using entries.

How to contribute authorized capital with property? The property can be assessed by the founders themselves or by engaging a third-party expert. With a property value of up to 20 thousand rubles. the decision on the accounting value is made by the founders of the organization; if the value of the property is more than 20 thousand rubles, then an independent assessment by an expert is required.

Reflection of the contribution in 1C

The procedure for carrying out cash transactions is approved within the framework of the Board of Directors.

A banking institution accepts cash from companies, during which a cash receipt order is issued. To credit ruble units to an account, in practice it is customary to use 51 accounts. The object of analytics is the element from the directory from which the funds are received.

When preparing a document, it is customary to use the posting Dt 51 Kt 50-1. A day later, the bank will provide a corresponding statement.

Statements are used to record transactions within current accounts. The corresponding account is 50-1.

For confirmation purposes, a message will be displayed during the checkout process. If the transaction is completed using documentation, the postings are not duplicated. The main documentation in this case is cash in nature.