Pension fund for individual entrepreneurs

The formation of future employee pensions is based on the results of previously made insurance contributions. For employees, deduction amounts are calculated based on actual wages.

If we are talking about individual entrepreneurs, then contributions are paid both fixedly within the limits established by law, and based on earnings. So, if the total income during the year exceeded 300,000, then the individual entrepreneur will need to transfer 1% of the amount in excess of the established limit to the Pension Fund.

The general fixed amount of insurance payments for entrepreneurs is the same, the amount is approved annually. As of 2018, according to Art. 430 of the Tax Code of the Russian Federation, contributions must be paid in the following amount:

- FFOMS - 5840 rubles;

- PF - 26545 rubles.

The calculated fixed value during the period is constant and does not change, regardless of other factors (increasing the minimum wage, etc.).

An additional 1% in the Pension Fund is calculated on income over 300,000 rubles. At the same time, the maximum value of the total amount of contributions to the Pension Fund cannot exceed 8 times the amount of the fixed indicator. Thus, the maximum that an entrepreneur can pay to the Pension for himself as of 2021 is 212,360 rubles.

Thinking over a strategy

What strategy should you consider? You must formulate for yourself and, accordingly, for your future employees certain “rules of the game” - let’s call them that. What does this include? There are quite a few points:

- How will the selection and hiring of employees be carried out (interview, registration, probationary period, etc.);

- For what period will the employment contract be concluded (it is good to make a sample contract, having thought through its provisions);

- What duties will each employee perform;

- What type of work schedule to set (strict schedule, flexible schedule, full day, etc.);

- How the remuneration system will be formed (salaries, bonuses, etc.);

- How will the employee motivation system be formed;

- How will the salary be paid (bank cards, cash; within what time frame);

- How will work with personal data be organized?

In fact, at the initial stage, this is most necessary for the individual entrepreneur himself, in order to understand how your future relationships with employees will be organized. The result of this work should be several internal regulations: labor regulations, regulations on the protection of personal data, bonus standards (if required), job descriptions. It is not recommended to compose them “at random”; take this issue seriously. All provisions of these acts should be important to your business (or company).

Registration with the Pension Fund as an employer

When carrying out business activities, an individual entrepreneur has the right to attract the labor of other individuals under an employment contract, acting as an employer. The social rights of employees must be fully respected. Federal legislation obliges employees to charge and pay contributions to the social and health insurance funds of the Russian Federation and make payments to the pension fund.

There is no need to notify the PF of the registration of an individual as an individual entrepreneur.

However, when attracting hired labor under employment or civil contracts, the law on compulsory pension insurance previously provided for the registration of an entrepreneur as an employer with the assignment of a separate registration number.

After the functions of administering insurance premiums were transferred to the tax authorities, the situation changed. Already starting in 2017, the previously existing rule on notifying the fund about the hiring of employees as individual entrepreneurs ceased to apply. You no longer need to register with the fund. The situation has not changed in 2021. No notifications are required to be submitted to the Pension Fund. All information comes automatically from the tax office.

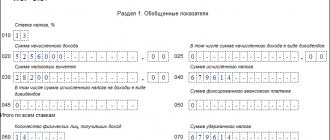

In addition, an additional registration number for an individual entrepreneur as an employer is not assigned. Information about the current number can be found in the Unified State Register of Individual Entrepreneurs (USRIP) extract. The amount of deductions depends on the activities of the entrepreneur. The general rates are as follows:

- Pension Fund - 22%;

- Social Insurance Fund - 2.9% + contributions to the Social Insurance Fund as insurance against industrial accidents from 0.2%;

- FFOMS - 5.1%.

If reduced rates are available, payments may be significantly reduced. For example, if individual entrepreneurs are on the patent taxation system, and their business activities are carried out in the retail trade sector, then contributions in 2021 are equal: PRF - 20%, FSS and FFOMS - 0%.

It is worth considering that the amount of preferential insurance premiums can take on different values every year. More detailed information can be found in chap. 34, art. 426 Tax Code of the Russian Federation.

Content

- What happens if you don’t formally register employees?

- Thinking over a strategy

- Search for colleagues

- We conclude an employment contract

- Register as an employer

- Organization of storage of personnel documents

- Explore information about labor relations

- Selection of a specialist for HR work

When you make a decision to attract hired employees, it is important to understand its consequences - you are moving to a new status as an individual entrepreneur. This entails a bunch of responsibilities and not very pleasant consequences: concluding employment contracts, ensuring personnel records, paying wages, transferring personal income tax and insurance premiums for employees, as well as fines for non-compliance with labor laws and additional communication with government agencies.

Transfer of contributions

Payments to the Pension Fund are required no later than the established deadlines. If we are talking about fixed contributions, then the established amount of 26,545 rubles must be transferred no later than the first working day of the next year, in relation to accruals, calculated as 1% of the amount over 300,000 rubles - until July 1 of the next year inclusive. Otherwise, the order of payment is unimportant. You can transfer contributions in installments or pay the entire amount.

If there are employees, different transfer rules apply. Like other employers, individual entrepreneurs are required to make monthly payments no later than the 15th based on the results of the calculated wages.

Selection of a specialist for HR work

The individual entrepreneur himself is unlikely to be a specialist in personnel and accounting, but here both knowledge is needed! If you have a certain staff of employees, it will be very difficult to cope with everything yourself, especially since legislation changes frequently. Therefore, you should consider adding an accountant to your staff or contact a consulting firm that will provide you with accounting, tax calculations, and personnel records.

What else does a new entrepreneur need to remember? If you use a special taxation regime, then the number of your employees should not exceed a certain number (for example, for UTII - 100 people). If your average number is greater than even by 1 person, then you will simply be thrown out of the special regime. Read more about how to calculate the average number of employees and whether it is possible to conclude a contract for the season.

Reporting to the Pension Fund

Entrepreneurs, as before, must report accrued insurance premiums if they have employees. But you need to submit calculations not to the Pension Fund branches, as before, but directly to the tax office. Reporting is required to be generated quarterly, due by the end of the month following the reporting month.

The contributions declared in the calculation must be transferred on time and in full, otherwise the inspection reserves the right to add additional amounts, as well as penalties and fines.

Despite the fact that the administration of information on insurance premiums has become the responsibility of the tax authorities, we should not forget about the remaining reports to the Pension Fund. Currently, this is reporting on the length of service of employees. Before the 15th of each month, information must be submitted in the SZV-M form, and annually, before March 1 following the reporting period, information on the length of service of employees in the SZV - EXPERIENCE and EDV - 1 forms.

In what case is an individual entrepreneur more profitable than an LLC?

Before making his choice, an individual must weigh all the positive and negative aspects, and after that only make his choice. The entrepreneur can take over the management of the activities without involving additional hired employees.

Attention: many businessmen give preference to individual entrepreneurs - they are attracted by the simple setup procedure and low costs. It is believed that entrepreneurship is also profitable if the number of employees is small.

How to register with the FSS as an individual entrepreneur

After registering the first person for a job, the entity providing it is obliged to contact the Social Insurance Fund to submit an application for the appropriate registration. The procedure must be carried out no later than 30 days from the date of signing the employment contract.

You should prepare documents in advance for registering an individual entrepreneur with the Social Insurance Fund as an employer. The list of papers includes:

- statement;

- document confirming the identity of the policyholder;

- copies of documents confirming the fact of cooperation between the individual entrepreneur and the employee.

Documents are submitted to the FSS office at the place of registration of the individual entrepreneur. All copies must be certified by FSS employees when comparing them with the originals. If papers are sent for registration through the State Services portal, they must be signed electronically. The application is drawn up in a form corresponding to the type of cooperation agreement with the contractor.

Confirmation of registration

Notification of registration

After submitting the documentary package for consideration for registration with the Social Insurance Fund, the applicant is assigned a registration number and subordination code within three days. This information, along with the personal data of the entrepreneur, is entered into the register of policyholders. All registration information is recorded in a notification, which is sent to the applicant in the manner specified in the application.

Additionally, a paper is drawn up that displays information on the amount of contributions to ensure insurance protection against accidents. The value of the parameter depends on the occupational risk class. Documents can be handed over to the applicant personally, by mail or via the Internet by e-mail.

Removal from the register

If a business entity has fired employees, then it must be deregistered with the authorized body.

To do this, you must fill out an appropriate application. The document will become the basis for initiating reconciliation of mutual settlements. If an individual entrepreneur's debt to the budget is identified, it must be repaid. Without carrying out a financial transaction, the entrepreneur will not be deregistered. If during the audit a debt of the Fund to a business entity was revealed, then the amount that was previously overpaid by it will be returned to the current account.

Application for registration

There is no need to deregister if an individual entrepreneur fires employees and plans to hire new employees. However, he will have to submit blank 4-FSS reports to the Fund.

Who are individual entrepreneurs

Any activity that regularly generates income is entrepreneurship. In Russia, its registration is mandatory, otherwise the person will be fined. Its size depends on the industry. An individual entrepreneur is an individual who has registered his activities and carries out them without forming a legal entity.

A citizen who meets certain criteria can obtain the status of an individual entrepreneur:

- legal capacity;

- legal capacity - this means that persons who are capable of independently performing legal actions, owning and disposing of property will be able to register their business activities. In Russia, a citizen becomes fully capable at the age of 18;

- having a place of residence - permanent or temporary.

Attention! In 2021, a new status appeared - “Self-employed”. This category of citizens does not need to go through the standard procedure for registering an individual entrepreneur. They do not need to register with the Federal Tax Service. But this option is more suitable for tutors and home staff.

Any capable citizen of the Russian Federation can register an individual entrepreneur.

Registration of an individual entrepreneur has its advantages:

- simplifies the process of organizing a business;

- the ability to independently manage your income;

- no need to pay tax on property used in business activities;

- simplified reporting option;

- there is no need to hold meetings to make decisions;

- It is possible to use a personal account and a bank card.

But there are also disadvantages that a person should take into account:

- it will not be possible to obtain some licenses, for example, for the sale of alcohol;

- not all organizations agree to cooperate with individual entrepreneurs.

However, the majority of people who receive regular income from business activities prefer to go through the registration procedure. An individual entrepreneur can conduct his business in any region, not necessarily in his place of registration.

Duration of the procedure

The procedure for registering entrepreneurs and legal entities as an employer takes no more than five working days , provided that the employer has provided the necessary package of documents and has not made any mistakes in them.

If an entrepreneur carries out labor activities independently and does not have employees, then he does not need registration as such.

In the case when an entrepreneur or general director of an LLC hires an employee for the first time, he within 30 days and send it to the Pension Fund of the Russian Federation and the Social Insurance Fund, registering as an employer, as well as an insurer.

When sent by mail, all documents must be notarized.

For companies that are any divisions or branches with an already established budget, open accounts and tax payments, registration is not required .

Who can be an employer

According to the concept enshrined in Art. 20 of the Labor Code of the Russian Federation, employers are those persons who, in the process of carrying out labor activities, entered into labor relations with individuals, paid them the wages due for the work, as well as all necessary taxes and contributions to authorized bodies.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Employers , according to Art. 6 Federal Law “On OPS in Russia”, the following may act:

- individual entrepreneurs;

- persons engaged in private practice;

- legal entities;

- citizens who voluntarily completed the registration procedure in the OPS system;

- individuals who have employees under their supervision.

This list is exhaustive and defines all categories of citizens who can act as employers.

Competence of the FSS

Until 2021, the Social Insurance Fund monitored the correctness of the employer’s calculations, submitted reports and payment of insurance premiums, providing insurance coverage for a person’s absence from work due to pregnancy, childbirth, illness and an industrial accident or illness resulting from the influence of production factors. After legislative updating, control over all types of insurance premiums was transferred to the Tax Service. The Social Insurance Fund is responsible only for insurance coverage premiums for episodes of injuries and occupational diseases. The authorized body retained the right to conduct inspections on all other items.

Fines for failure to register employees

The amounts of insurance premiums paid by individual entrepreneurs for their employees are large, and there is often a temptation not to register employees. Administrative liability has been established for committing such an offense:

- a fine of 5,000 – 10,000 rubles for evading the execution of an employment contract (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, hereinafter referred to as the Administrative Offenses Code)

- a fine of 30,000 – 40,000 rubles for a repeated offense (part 5 of article 5.27 of the Administrative Code).

Important! Failure to register employees also leads to non-payment of taxes, fees, and contributions to extra-budgetary funds. Criminal liability is already provided for such acts:

- a fine of 100 - 300 thousand rubles or in the amount of income of an individual entrepreneur for a period of 1 to 2 years, or arrest for up to six months, or imprisonment for up to 1 year for committing a crime on a large scale (large amounts are taxes, fees, insurance premiums amounting to the last 3 years more than 900 thousand rubles, provided that the unpaid share exceeds 10% of what was payable or exceeds 2.7 million rubles);

- a fine of 200 - 500 thousand rubles or in the amount of income of an individual entrepreneur for a period of 1.5 to 3 years, or forced labor for up to 3 years, or imprisonment for up to 3 years for committing a crime on an especially large scale (the amount of taxes and fees for the last 3 years amounts to more than 4.5 million rubles, with the unpaid share exceeding 20% or 13.5 million rubles).

Note! Individual entrepreneurs will be accrued additional amounts of unpaid taxes and fines will be issued for their late payment within the framework of tax legislation.

Rights and obligations under this legal form

All persons who have officially registered their activities have the following rights:

- Selecting an industry permitted by the legislation of the Russian Federation.

- Reception of employees.

- Selection of partners and market. Each entrepreneur can independently decide in which industry he will develop his business.

- Has the right to independently regulate the cost of its goods/services and wages to employees.

- Can manage profits based on personal interests.

- Can appear at court hearings as both plaintiff and defendant.

But in addition to rights, an individual entrepreneur has a number of responsibilities that he must comply with:

- adhere to Russian legislation;

- document all financial transactions;

- To implement licensed types of activities, it is necessary to obtain the appropriate state permit;

- all employees hired by individual entrepreneurs must be officially employed;

- if a business harms the environment, the entrepreneur must take measures to reduce the negative impact on the environment. If it is not possible to reproduce them on his own, he should contact the environmental service;

- Individual entrepreneurs must pay taxes on time.

Reference! An individual entrepreneur is a participant in market relations, so he must treat the consumer with respect. If you comply with all rights and fulfill obligations, then there will be no difficulties in doing business, and timely payment of taxes will help you avoid fines. Therefore, more and more people are registering their business officially.

How much does it cost to open an individual entrepreneur in 2018?

Let us summarize in the form of a table how much it costs to open an individual entrepreneur:

| Registration | Duty amount | other expenses | Total |

| Independently through the Federal Tax Service | 800 | – | 800 |

| Independently through the MFC | 800 | – | 800 |

| Independently through State Services | 560 | Digital signature from 1000 rubles Programs from 900 rubles. | 2460 |

| On your own via Mail | 800 | Notary from 1500 rubles Postal services from 200 rubles | 2700 |

| Through the Nalog.ru service | 800 | Digital signature from 1000 rubles Programs from 900 rubles. | 2700 |

| Through banks | 800 | Digital signature from 1000 rubles Bank services from 2000 rubles | 3800 |

| Through an intermediary (law firm) | 800 | Registration services from RUB 2,500 | 3300 |

Attention: from January 1, 2021, the state fee for registering individual entrepreneurs will not be charged, provided that documents are submitted electronically, for example, through the State Services website.

What types of activities do not fall under individual entrepreneurs in 2021

Regulatory acts regulating certain areas of activity in the economic sphere establish what types an entrepreneur cannot carry out. For this area it will be necessary to open an LLC.

These include:

- Creation and wholesale and retail sale of finished products containing alcohol.

- Production and sale of products containing narcotic and psychotropic substances.

- Production of medicinal products.

- Air transportation.

- Production and repair of aviation equipment.

- Activities related to space.

- Manufacturing, sales and other activities related to the handling and use of weapons and ammunition.

- Notarial activities.

- Operation of investment funds.

- Lending activities.

- Insurance activities.

- Private security services.

- Production of pyrotechnic products.

- Works on industrial safety.

- Sales of electricity.

- Search for work for citizens outside of Russia.