Tax returns are filled out and submitted to the tax authorities for various purposes: in order to report on paid tax fees, to receive tax deductions, etc. However, people often have to resort to the help of specialists who know how to correctly fill out a tax return without errors. This especially often applies to a multi-page declaration in form 3-NDFL. However, you can try to design it yourself if you delve into the details.

Technical errors

First on the list is the incorrect attribution of deductions to a particular tax period. Let’s say a citizen paid for medicines in 2014, and in his declaration he asks for a deduction for 2015. This mistake comes from a basic ignorance of the laws. After all, the tax benefit is provided precisely for the year in which the applicant paid for education, medical care or other services.

In second place in the “anti-rating” of errors are violations of the “adjustment number”. Shortcomings of this kind are present in all regions. They are made by people who are filling out and submitting a declaration on their own for the first time. Most often, applicants incorrectly indicate the “adjustment number.” They write the number 1 in this column, although according to the rules they should put 0. “Zero option” is the declaration filed for the first time for the reporting year. If the Federal Tax Service does not accept it and forces you to redo it, then the number 1 is indicated in the column and so on until the tax authority accepts the documents.

The following error is related to the indication of the OKTMO code. There are also some nuances here. When a declaration is filled out in connection with an additional payment to the budget, the citizen must indicate OKTMO at the place of his registration, and if 3-NDFL is submitted to return money from the state, then the applicant indicates the OKTMO code at the location of his employer or other source of payments.

Further, when filing a declaration, applicants often do not fill out the sheets provided for one or another deduction. For example, to receive a deduction for the purchase of residential premises, you need to fill out sheet D1, for social and investment deductions - sheets E1 and E2, etc. If a person fills out a declaration using a program from the Federal Tax Service website, then, as a rule, no problems arise . The program will not allow you to move to the next level if he does not enter information into the appropriate sheet. But when the applicant does this himself in Word or Excell, then he commits such violations.

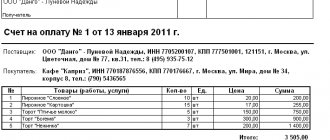

And finally, providing tax deductions is impossible without the appropriate documents. Costs for treatment, training, insurance or purchase of property must be confirmed by contracts, invoices, receipts, and payment orders. However, many applicants do not attach them to the declaration and are denied preferences. Surprisingly, such errors are found everywhere.

Step-by-step instructions on how to correctly fill out form 3-NDFL

Page No. 1 of the 3-NDFL declaration

Title page

This page is dedicated exclusively to the personal data of the individual on whose behalf the declaration is being filled out. It is necessary to indicate your full name, confirm the accuracy and completeness of the data provided, and also certify everything with a personal signature.

In particular, if we look at the page from top to bottom, we will see the following fields to fill out:

- TIN . This information will need to be duplicated on each page of the declaration, so carefully copy the information from your tax registration certificate. If you lose it, you can check your TIN on the Federal Tax Service website at https://service.nalog.ru/static/personal-data.html?svc=inn&from=%2Finn.do. Or open the “ Nalog ru ” website https://www.nalog.ru and find “ Information about the TIN of an individual ” in the list of services.

- Correction number . This field indicates how many times you filed this declaration during the reporting period (that is, per year). If you are submitting a 3-NDFL declaration for the first time, then you need to put “ 0 ”, if the second - “ 1 ”, the third - “ 2 ” and so on.

- Tax period (code) . This field can be filled in by default. If this is not the case, simply enter the number " 34 ". This figure means that the declaration is submitted for the year (this is the code assigned to annual reports).

- Tax period (without the “code” note) . This field indicates the year for which reporting is being submitted. For example, if you submit a declaration before April 30, 2021, then write “2019” in this field.

- Tax authority . This field indicates the number of the tax office to which the 3-NDFL declaration will be sent. You can again check the Federal Tax Service code on the official website of the Federal Tax Service. To do this, follow the link https://service.nalog.ru/addrno.do, indicate who you are (individual or legal entity), select the branch address or use the Federal Tax Service code directory.

- Code of the country . In this case, we are talking about the country of which you are a citizen. For citizens of the Russian Federation this code is “ 643 ”, for citizens of Belarus - “ 112 ”, for citizens of Ukraine - “ 804 ”. Citizens of other states must use the All-Russian Classifier of Countries of the World. To do this, simply follow the link https://classifikators.ru/oksm.

- Taxpayer category code . This field indicates a special code that is assigned to the category of activity of different individuals.

| Individual entrepreneurs | 720 |

| Notaries | 730 |

| Lawyers | 740 |

| Arbitration managers | 750 |

| Individuals | 760 |

| Heads of a peasant (farm) enterprise | 770 |

- Personal data of the taxpayer : last name, first name, patronymic, date of birth, place of birth. Copy the data from your civil passport.

If you don't have a middle name, just put a dash in this column.

- Information about the identity document.

First of all, you need to indicate the document type code: write “ 21 ” if this is a passport of a citizen of the Russian Federation or “ 10 ” if this is a passport of a foreign citizen. For other documents there is the following classification:

| Birth certificate | 03 |

| Military ID | 07 |

| Temporary certificate (which was issued instead of a military ID) | 08 |

| Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on the merits | 11 |

| Residence permit in the Russian Federation | 12 |

| Refugee ID | 13 |

| Temporary identity card of a citizen of the Russian Federation | 14 |

| Temporary residence permit in the Russian Federation | 15 |

| Certificate of provision of temporary asylum on the territory of the Russian Federation | 19 |

| Foreign passport of a citizen of the Russian Federation | 22 |

| Birth certificate issued by a foreign country | 23 |

| Identity card of a Russian military personnel | 24 |

| Reserve officer's military ID | 27 |

If your identification document is not on this list, write a two-digit number "91».

After this, you need to carefully rewrite the data from this document: series and number, who issued the document, date of issue.

- Taxpayer status . If you are a tax resident of the Russian Federation, enter the number “ 1 ”; if not, enter the number “ 2 ”.

- Contact phone number . You can enter either your mobile or landline phone number.

- The declaration is drawn up on “__” pages with supporting documents attached or their copies “__” on sheets. It is recommended to indicate the exact number of pages at the very end, when the tax return is completely completed.

At the last step of filling out the first page of the declaration, you need to confirm the accuracy and completeness of the information provided. This can be done by you yourself (in this case, put the number “ 1 ”, and below - your signature and date) or your representative (in this case, the representative must put the number “ 2 ”, indicate your full name, and also write what document (- s) confirms his authority, and attach a copy of it to the declaration.

The remaining subsection “ Information on submission of the declaration ” does not need to be filled out! It is filled out by a tax official!

Appendix 1 of declaration 3-NDFL

Income from sources in the Russian Federation

In general, according to the chronology of the pages, after the title page there are Section No. 1 and Section No. 2, but when filling out at this stage you need to skip them (they are filled in at the very end). Appendix 1 is intended to indicate information about taxable income, EXCEPT income from business activities. It could be:

- wages of an employee;

- income from the sale of real estate;

- rental income from real estate, etc.

In other words, this sheet indicates the income that you must confirm by law, or if you want to receive a deduction from this income.

To fill out sheet A, duplicate the TIN, surname and initials of the taxpayer, indicate the page number, and then fill in the required fields:

- Tax rate (010) . Indicate the tax rate you need to pay (at the end of 2019, it can range from 9% to 35%). If you do not know its size, follow the link https://www.nalog.ru/rn77/taxation/taxes/ndfl/ and scroll through the article to the section “ Procedure for calculating tax ”. There you will find the current tax rates depending on the source of income and taxpayer category.

- Income type code (020) . Check the table and indicate the code corresponding to your source of income.

| Income from the sale of real estate* | 01 |

| Income from the sale of other property | 02 |

| Income from transactions with securities | 03 |

| Income from rental property | 04 |

| Income received as a gift from third parties (except close relatives) | 05 |

| Income received under an employment contract with personal income tax withholding | 06 |

| Income received under an employment contract without withholding personal income tax | 07 |

| Income in the form of dividends received from equity participation | 08 |

| *In case of sale of real estate based on cadastral value | 09 |

| Other sources of income | 10 |

- TIN of the source of income payment (030) . Here you need to indicate the taxpayer identification number from which you received the income.

- KPP (reason code for registration) (040) . Here you need to indicate the digital code assigned to the organization (legal entity) from which you received income. For individuals and individual entrepreneurs, this code is not needed, and this column can be skipped.

- OKTMO code (050) . The payment source code in accordance with the All-Russian Classifier of Municipal Territories can be viewed on the Federal Tax Service website using a special service - https://fias.nalog.ru/ExtendedSearchPage.aspx.

- Name of source of income payment (060) . Here you indicate the full name of the individual, the official name of the individual entrepreneur or legal entity from which you received the income.

- Amount of income (rub. kop.) (070) . Indicate the exact amount of income, down to kopecks (kopecks are written after the period).

- Amount of taxable income (rub. kop.) (080) . This field indicates income taking into account issued deductions.

- Calculated tax amount (RUB) (090) . In order to calculate it, multiply the amount specified in the “ 080 ” field by the tax rate.

- Amount of tax withheld (RUB) (100) . As a rule, this amount corresponds to “ 080 ”.

If there are several sources of income, similar information about the second and third source is indicated in the fields below.

At the very bottom of Appendix 1 of the 3-NFDL declaration you need to put your signature and date.

Appendix 2 of declaration 3-NDFL

Income from sources outside the Russian Federation

This application must be completed if you receive income from abroad. If this is not the case, then you can immediately proceed to filling out the next page.

Appendix 2 is filled out as follows: first of all, the TIN, surname and initials of the taxpayer are duplicated, the page number and tax rate code (001) . After this, you can proceed to filling out the fields:

- Country code according to the OKSM classifier (numeric) (010) . This is a 3-digit number that is assigned to different countries of the world. You can view the exact code of the country from which you receive income on the OKSM website at https://classifikators.ru/oksm.

- Name of source of income payment (020) . This can be the full name of an individual or individual entrepreneur, or the name of an organization. When filling out this field, you can use Latin letters.

- Currency code (030) . Indicated in numerical form. For American dollars - “ 840 ”, for euros - “ 978 ”, for pounds sterling - “ 826 ”, for Ukrainian hryvnia - “ 980 ”, for Belarusian rubles - “ 933 ”. Other numeric codes can be viewed on the website https://classifikators.ru/okv.

- Income type code (031) . If it is income from a controlled foreign company, write the number " 1 ". If not, then the number “ 2 ”.

- Controlled foreign company number (032) . If this number is not available, then this field can be skipped.

- Date of receipt of income (040) . Filled in with numbers in the following sequence - day, month, year.

- Foreign exchange rate established by the Bank of Russia (050) . It is necessary to indicate the official exchange rate according to the Central Bank of the Russian Federation on the date of RECEIPT of income.

- Amount of income received in foreign currency (060).

- Amount of income received in foreign currency converted to rubles (070).

- The amount of income in the form of the value of property (property rights) received during the liquidation of a foreign organization, exempt from taxation (071) .

- The amount of dividend income received from a controlled foreign company that is exempt from tax (072) .

You can skip paragraphs 071 and 072

- Applicable procedure for determining profit (loss) of a controlled foreign company (073) . Selected by the taxpayer: put “ 1 ” if you want the profit (loss) to be considered according to the financial statements of controlled foreign countries, if you want the calculation to be made according to the rules established for Russian organizations.

- Tax due date (080).

- Foreign exchange rate established by the Bank of Russia on the date of tax payment (090) .

- The amount of tax paid in a foreign country in foreign currency (100) and in terms of rubles (110) .

- Calculated tax amount (120) . Simply multiply the amount of taxable income by the tax rate.

- Estimated tax amount subject to offset (reduction) in the Russian Federation (130) . Indicate the amount paid as tax in another state, so that when recalculating, the tax that must be paid to the Federal Tax Service of the Russian Federation will be reduced by this amount.

Confirm the accuracy of the information provided with your signature and indicate the date the tax return was completed.

Appendix 3 of the 3-NDFL declaration

Income received from business, advocacy and private practice

This application is completed only in one of several cases:

A) You are an individual entrepreneur (in field 010 write “ 1 ”).

B) You are a notary (in field 010 write “ 2 ”).

B) You are a lawyer (in field 010 write “ 3 ”).

D) You are an arbitration manager (in field 010 write “ 4 ”).

E) You are the head of a peasant/farm enterprise (in field 010 write “ 5 ”).

E) Are you engaged in any other private practice (in field 010 write “ 6 ”).

Next, you need to indicate the code of the main type of economic activity (020) , the amount of income for the reporting period (030) and write down all your expenses (040–044) .

After this, the following fields are filled in:

- The total amount of income for all types of activities, if there are several of them (050).

- Tax deduction amount (060).

- Amount of actual advance tax payments paid (070).

Point 080 is filled out only if you are the head of a peasant/farm enterprise. This field indicates the year of registration of the farm.

Points 090 and 100 are filled out only if you decide to independently adjust the tax base and tax, and points 110–150 - only for calculating and processing professional tax deductions.

Appendix 4 of the 3-NDFL declaration

Calculation of the amount of income not subject to taxation

Fill out the header of the 3-NDFL form in the usual way, and then proceed directly to entering the data in the fields 010–120.

Previously, this sheet was filled out in two columns: the left indicated the amounts of income not subject to taxation, and the right indicated the same amounts, but taking into account restrictions on taxation. The updated version of form 3-NDFL provides only one column.

Skip those fields that indicate income that has nothing to do with you!

- One-time payment upon birth/adoption of a child (010) . Limit - 50,000 rubles. for each child.

- Gifts from individual entrepreneurs and organizations (020) . Limit - 4000 rubles.

- Prizes (in cash and in kind) received through participation in contests and competitions (030) . Limit - 4000 rubles.

- Regular payments to employees retired due to age or disability (040) . Limit - 4000 rubles.

- Reimbursement of funds spent on medications prescribed by the attending physician from the employer to the employee, his spouse, children, wards, as well as former employees (050) . Limit - 4000 rubles.

- Income in the form of the value of a win or prize that was received through participation in competitions, games and competitions for the purpose of advertising goods/services (060) . Limit - 4000 rubles.

- Financial assistance to disabled people from public organizations (070) . Limit - 4000 rubles.

- Winnings received by participants in gambling or lotteries are not subject to taxation (080) .

- Assistance and gifts (in cash and in kind) to veterans and disabled people of the Great Patriotic War, widows of military personnel and deceased disabled people of the Second World War, as well as some other categories of persons (090) . Limit - 10,000 rubles.

- Amounts of additional insurance contributions for funded pension that were paid by the employer (100) . Limit - 12,000 rubles.

- Other income not subject to taxation (110) .

At the end, the total amount of income not subject to taxation is recorded (120). To calculate it, you need to add up all the values indicated in the column above.

Appendix 5 of the 3-NDFL declaration

Calculation of standard, social and investment tax deductions

In this application sheet, you need to fill out only those fields for which you need to get a deduction (one or more, depending on the situation), and then sum it up, if necessary. Provides 5 sections:

- The first section contains only data for standard deductions. The standard tax deduction will be accrued until the amount of income for the reporting period exceeds 350,000 rubles. In this regard, the amount of each payment for the declaration must be multiplied by the number of months during which the total amount of income will be less than 350,000 rubles.

- The second describes social deductions that are not subject to the legislative restrictions of paragraph 2 of Article 219 of the Tax Code.

- In the third, you need to indicate social deductions that are subject to legal restrictions. As for the third section, the amount of expenses for which social deductions are issued under one declaration should not exceed 120,000 rubles.

- The fourth sums up all standard and social deductions claimed in the declaration.

- In the fifth, investment tax deductions are calculated.

Appendix 6 of the 3-NDFL declaration

Calculation of property tax deductions for income from the sale of property and property rights

This application details all the taxpayer’s income and then summarizes it. It is important that the amount of the deduction ultimately does not exceed the amount of income.

Appendix 7 of the 3-NDFL declaration

Calculation of property tax deductions for expenses on new construction or acquisition of real estate

It is not necessary to fill out this sheet - it is only necessary for those who want to receive a tax deduction. You can fill out the fields intuitively; the form provides various hints for the filler. There are only a few controversial points that may raise doubts:

- Object name code (010) . Depending on the type of your property, a specific code is indicated.

| Object name | Code |

| House | 1 |

| Apartment | 2 |

| Room | 3 |

| Real estate share | 4 |

| Land plot on which construction will take place | 5 |

| The land plot on which the already acquired property is located | 6 |

| House with land | 7 |

- Taxpayer attribute (020) . Depending on who the taxpayer is in a given situation, a specific code is again assigned

| Taxpayer attribute | Code |

| Property owner | 1 |

| Owner's spouse | 2 |

| Parent of a minor owner | 3 |

| Payer and minor child | 13 |

| Payer, spouse and minor child | 23 |

- Object number (031) . If it is absent, the number “ 4 030 , and field 031 remains blank.

Appendix 8 of the 3-NDFL declaration

Calculation of taxable income from transactions with securities and derivative financial instruments

They rarely fill up. The essence of all fields is described in detail directly on the form, which allows you to fill them out correctly without the help of specialists.

Section 2 of the 3-NDFL declaration

Calculation of the tax base and the amount of tax on income

After filling out the necessary sheets, you can return to section 2 to calculate the total tax base and the amount of all tax deductions. First you need to fill out the page header, and then fill in all the required fields step by step.

Section 1 of the 3-NDFL declaration

Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget

This page is filled in last, since it essentially sums up all the calculations made. After filling out the header, you need to enter the following data sequentially:

- Operation code (010) . Payment - 1, return - 2, no payment or return - 3. If a 3-NDFL certificate is issued to receive a deduction, put the number 2.

- Budget classification code (020) . We discussed how to find out the BCC in our other article.

- OKTMO code (030) . Determined using the Federal Tax Service service.

- Amount of tax to be paid or additionally paid to the budget (040).

- Amount of tax to be refunded from the budget (050).

Section 050 and 040 are 150 and 160. Just rewrite them.

When registering a deduction, the amount of tax to be paid or additionally paid is NOT indicated in either section 1 or section 2!

Inclusion of maternity capital and budget funds in expenses

The inclusion of maternity capital in expenses is considered a significant violation. Young people under the age of 30 make similar mistakes. Using capital when buying an apartment (or when paying interest), they do not hesitate to include it in their expenses, but this is wrong. Maternity capital is not the applicant’s personal income, but is provided to him by the state. The person does not earn this money and does not inherit it. Consequently, these funds cannot be considered income in the literal sense of the word, therefore, including maternity capital in expenses to obtain deductions is a gross violation of the rules for filling out 3-NDFL.

By the way, educational expenses paid from maternity capital are also not taken into account when determining the tax deduction. An attempt to take these amounts into account in 3-NDFL to obtain tax preferences is also considered a violation.

The exact same rule applies to other amounts received from the budgets of the Russian Federation and its constituent entities. Thus, applicants do not have the right to include in expenses funds received under the “Providing Housing for Young Families” program, as well as various types of subsidies to government employees and the military for the purchase of apartments.

When to file an amended return

Conventionally, the following deadlines can be identified for submitting an updated report:

- before the deadline for filing - in the case of 3-NDFL this is the first working day of May;

- before the deadline for tax payment - income tax is paid until July 15 inclusive;

- until the inspection detects errors and incomplete information;

- before the on-site tax audit.

If the adjustment concerns a statement in which there is no amount payable because of deductions, then the adjustment is possible all year round, just like filing the original form. Urgency applies only to cases where there is an amount to be paid to the budget.

The first term is the only one in which you do not fall under Article 119 of the Tax Code of the Russian Federation. In all other cases, you commit a tax offense - untimely submission of reports, however, according to Article 81 of the Tax Code of the Russian Federation, there are circumstances that exempt you from sanctions even in this case.

Adjusting the 3-NDFL declaration takes the same amount of time as a regular report - 3 months. On the day your adjustment is received, the inspecting inspector stops the desk audit of the old report and begins a new one - based on the updated declaration.

Exceeding the maximum amount of deductions

The Federal Tax Service does not provide deductions when their amount exceeds the maximum allowable amount established by law. Such declarations are subject to adjustment. Thus, the maximum amount of social tax deductions (excluding expenses for expensive treatment) cannot exceed 120,000 rubles, and the cost of educating 1 child (for the purpose of filing a deduction) cannot exceed 50,000 rubles. As for property deductions, there are restrictions on them too. Thus, the maximum amount of property deduction for the purchase of housing is 2,000,000 rubles, and the deduction for the cost of paying interest on targeted loans for the purchase of residential premises should not exceed 3,000,000 rubles.

However, applicants often submit documents in which these amounts are clearly inflated.

Penalties for non-payment of tax and errors in the declaration

For non-payment of personal income tax, a fine is provided, which will amount to 5% of the unpaid tax amount for each month from the date of delay, including incomplete ones. For the absence of a report, if it does not contain the amount of personal income tax payable, the fine is minimal - 1,000 rubles. If there is tax to pay, you will have to pay a fine of up to 30% of the accrued tax.

More about personal income tax

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

An attempt to obtain deductions for transactions with related parties

Many Russians buy housing from their relatives: brothers, sisters, fathers, mothers or children. Some of these transactions are made simply for show, but there are also real contracts. However, the law categorically prohibits the provision of property deductions for transactions concluded between interdependent persons (relatives). Accordingly, the cost of paying interest on loans received from related parties for the purchase of housing cannot be included in the declaration. It is also worth noting that, along with relatives, the Tax Code of the Russian Federation classifies the applicant’s employers as interdependent persons, as well as companies that he owns (or in which he has a share).

Results

- If the 3-NDFL declaration is submitted with errors or incomplete information or its absence, then you can submit an updated report with explanations and new documents.

- The corrective declaration must have the same form as the original one and differ in content only in those parts that have been changed.

- For mistakes, you may be subject to tax sanctions, but in the cases specified in Article 81 of the Tax Code of the Russian Federation, the citizen is exempt from liability.

- After adjusting 3-NDFL, you need to wait another 3 months for the completion of a new desk audit.

If you find an error, please highlight a piece of text and press Ctrl Enter.

- Errors in monitoring submitted declarations can be caused either by incorrect completion of the report or by a system failure.

- If you have any questions, we advise you to contact your inspection inspector.

- To minimize typos and calculation errors, take the opportunity to fill out the report online.

Trying to recoup costs for part-time or evening studies

Also a widespread mistake. It is mainly found in regions and rural areas. People are trying to get a deduction for the education of their children (as well as a brother or sister) through correspondence or evening classes. However, in order to receive benefits, it is necessary that children (or wards) study only full-time. According to legislators, correspondence (evening) education implies that the student can work part-time or do business, and therefore the state does not provide tax preferences in this case.

How to submit a declaration?

Providing updated documentation is carried out in the same way as filing a declaration for the first time. The taxpayer can use any method:

- personally contact the territorial authority;

- delegate the responsibility to a representative by proxy;

- send documents by mail;

- make adjustments in your personal account, attaching documents here.

We invite you to read: What happens if you don’t pay microloans, how debtors can communicate with collectors and microfinance organizations

When submitting 3-NDFL via LC, it is necessary to track the status of the shipment - within 3 days the declaration is registered with the inspectorate.

To work with your personal account and fill out the corrective 3-NDFL declaration here, you need to have a digital signature - if it is missing, the documents will be refused.

Brief conclusions

A large number of errors in declarations does not mean that applicants make them intentionally. As a rule, all violations occur due to ignorance of the laws and lack of experience. After all, many Russians submit 3-NDFL for the first time. Subsequently, they no longer make such mistakes. That is why, to fill out the declaration, it is recommended to use the “PC Declaration” program, which is located on the website of the Federal Tax Service of the Russian Federation, or seek help from specialists. They will help you quickly and correctly fill out 3-NDFL and submit it to the Federal Tax Service within the deadlines established by law.

What to do if the report is not sent due to an error in the service part of the exchange file

In addition to contacts and an absentee solution to your problem, you can also go to the nearest tax office to get help regarding your error. If the error has been repeated for some time, the declaration can be submitted in paper form.

Some taxpayers submit reports in the form of a business letter with a list of attachments. The letter does not need to be sealed before sending, as it is necessary to create two more copies of the inventory.

The inventory must contain a list of all documents that are sent by letter. Next to each name there should be a number indicating the number of documents in the attachment. The post office has a special service provided when generating such letters.

If this is your first time submitting a declaration in this form, you can view detailed instructions on the nalog.ru website. It can be downloaded in PDF format or printed.

Code 000000001: there are deductions, but no accrual

Error code 0000000001 in the VAT return indicates the presence of a “tax gap” - when the VAT ASK was unable to match the data in the supplier’s sales book with the data in the buyer’s purchase book. The reason for this gap may be:

- Negligence of the counterparty: he did not submit a VAT return for the same period or reflected in the submitted declaration data that did not allow identifying the invoice and comparing it with the invoices of the counterparty.

- The seller’s dishonesty: instead of actual sales, he reflected zero values in the declaration.

- Buyer's carelessness: mistakes were made when filling out the purchase book.

What are the grounds for refusing a VAT refund, read here.

The figure below shows the possible causes of error code 0000000001 and the procedure for compiling explanations:

In most cases, error code 0000000001 will appear in the tax authorities’ request if you worked with shell companies. They are the ones who most often submit zero VAT returns or do not report to the tax authorities at all.

An example of preparing explanations for a VAT return from ConsultantPlus: Organization "Alpha" received a request from the tax inspectorate to provide explanations for the VAT return for the fourth quarter of 2021. The request was received electronically via TKS. The appendix to the request contains the error code “1” in section. 8 declaration for the purchase of goods from the Beta organization. This means that the inspection found contradictions between the data in the buyer’s purchase book and information from the seller’s sales book. The accountant of the Alpha organization verified the data... You can view the entire example in K+, having received a free trial access.

VAT declaration, which implies the basic requirements

According to tax legislation on the territory of the Russian Federation, VAT rates are 18%, generally, 10% for children's and medical goods and 0% for exports.

All VAT taxpayers pay tax based on the results of each quarter, but are required to make advance payments either quarterly or monthly. The deadline for payment according to the declaration is the 25th day of the month following the month after the end of the quarter.

As with any report, the declaration is no exception; some errors may be made.

Code 000000002: looking for our mistakes

Error code 0000000002 in a VAT return means that there is a discrepancy between the purchase and sales ledger of the reporting company for the same transaction. Here we are not talking about inconsistencies between the declarations of the seller and the buyer, but about discrepancies within the reporting of the company (or individual entrepreneur) itself.

If tax is first assessed and then deducted, the same invoice is recorded in the purchase and sales ledger. How does this happen in practice?

Example 1

Almira LLC (supplier) received an advance payment from Sigma Lux LLC (buyer) and charged VAT on the amount. When shipping products, the supplier declared a deduction of accrued advance VAT (clause 6 of Article 172 of the Tax Code of the Russian Federation). These two operations will compare the VAT ASK.

If there is a deduction in the declaration, but the tax is not charged, the system will generate a request with error code 0000000002. Having received an inspection request with this error code, Almira LLC:

- checks whether the advance invoice is registered in the sales ledger;

- Having identified an advance invoice not reflected in the sales book, he draws up an additional list for the sales book (for the period of receiving the advance payment), pays additional tax and penalties, and also submits an updated declaration.

Almira LLC will receive the same error code if it calculates advance VAT and accepts it for deduction, but at the same time makes errors when registering the invoice in the book of purchases and sales.

Example 2

PJSC KeramzitStroy leases municipal property and acts as a tax agent for VAT. The company issues a monthly invoice and registers it in the sales book, and also pays VAT to the budget. Then PJSC KeramzitStroy declares a deduction for the same amount in the purchase book.

If KeramzitStroy PJSC makes a mistake when reflecting an invoice in the book of purchases and sales, when checking the declaration, the system will indicate an error with code 0000000002. After receiving a request for clarification, the company must follow the algorithm described in example 1.

Clarification of specific issues

There are the most common questions from taxpayers related to filling out and editing a declaration, the answers to which will help you competently and correctly complete this procedure:

- How long does it take to adjust the declaration? The verification period is 3 months from the date of submission;

- Is it necessary to edit the 3-NDFL declaration if the KBK is indicated incorrectly? No, there is no such obligation, but this can be done on personal initiative;

- What sanctions await a taxpayer who makes mistakes? There are no penalties if you paid your tax on time;

- When will the Federal Tax Service return overpaid personal income tax? The decision will be made within 90 days, respectively, the refund will occur after the completion of the desk audit;

- What are the deadlines for submitting clarifications? If errors are detected by the inspection staff, the updated 3-NDFL declaration must be submitted within 5 working days, the review period is the same - 3 months. If you want to increase the social deduction, you must make the adjustment no later than three years from the date when the tax was excessively withheld.

It is the taxpayer's responsibility to file a revised return if errors result in a reduction in the tax paid. Timely clarification of clerical errors and errors allows you to avoid fines from tax authorities.

How to draw up an updated 3-NDFL declaration? The procedure is similar to filling out the primary document, the only exception is that you must indicate the correction number - 01 or 02.