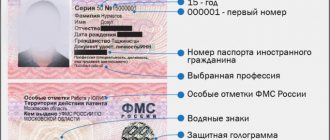

From January 1, 2015, foreign workers from “visa-free” countries temporarily staying in Russia

Accounting In accounting, reflect the amount of debt forgiven to the organization as part of other loan income

Economic disputes and violation of contractual obligations by counterparties may give rise to litigation. Claims from regulatory authorities

Legal entities are required to file a land tax return, with the right of perpetual use or

Good day! Today I have a very useful article for those who are on

It happens that the presence of a seasonal factor has a strong influence on the conduct of business by an entrepreneur. Most

If lending is necessary, the borrower wishes to borrow the required amount without interest or at

According to the Constitution of the Russian Federation, every person has the right to work. And everyone must

When concluding an employment contract with a future employee, the type of activity carried out by the employee at the enterprise is indicated

Is there a tax on currency transactions in the Russian Federation Directly conducting transactions with currency, cash

![Tinkoff Investments [CPS] RU](https://biznes-practic.ru/wp-content/uploads/tinkoff-investicii-cps-ru8-330x140.jpg)