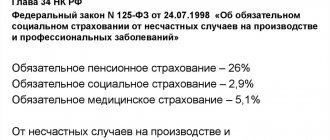

A sample payment order under the simplified tax system is a document confirming the payment of tax by organizations and individual entrepreneurs applying the special tax regime of the simplified tax system, which provides for the payment of three advance payments during the year and payment of the tax at the end of the year.

Taxpayers with the object “income minus expenses” at the end of the year calculate the minimum tax and compare it with the amount of tax in connection with the simplified tax system, calculated at the rate in force in the region. The larger of the two amounts received is paid to the budget.

An important change: from 2021, the minimum tax is paid not on a separate BCC, as before, but on the BCC for the simplified tax system “income minus expenses”.

If the simplified tax system is paid for 2021, the payment order may contain only two BCC values, depending on the selected taxation object.

Payment period

| Period | Deadline |

| 2018 | 04/01/2019 - legal entity, 04/30/2019 - individual entrepreneur |

| I quarter 2019 | 25.04.2019 |

| 1st half of 2019 | 25.07.2019 |

| 9 months 2019 | 25.10.2019 |

| 2019 | 30.04.2020 |

When filling out a payment order to pay tax in connection with the simplified tax system, organizations and individual entrepreneurs use the same tax details with the exception of two fields:

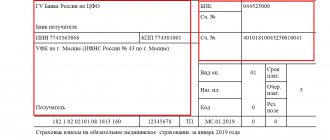

obrazec_pp_usn_dohody_2020_dlya_ip.jpg

Related publications

The single tax according to the simplified tax system is transferred to the budget every quarter. Payments for a quarter, half a year and 9 months are considered advance, and at the end of the year the final tax amount is calculated and paid. It depends on the details indicated in the document whether the amount will be credited to the Federal Tax Service for its intended purpose. The payment under the simplified tax system “6 percent” in 2021 for individual entrepreneurs is filled out in accordance with the rules specified in Order of the Ministry of Finance dated November 12, 2013 No. 107n (as amended on April 5, 2017).

General procedure for processing tax payment orders

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. You can also generate payments using online accounting, such as this one.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2016-2017, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Income minus expenses ↑

When an enterprise fills out an order using a simplified form with the object “income reduced by expenses,” the information in the paragraph will differ to reflect the purpose of the payment.

So, for example, you need to write: the tax that is levied on the taxpayer who chose “income minus expenses” as an object for the 2nd quarter of 2021.

For the rest, you should focus on the general rules for processing a payment order.

New filling rules

If you need to pay a tax or fee, you should use a payment order form.

When registering, you should use the form, number and names of points that are indicated in Appendix 3 to the document, which was approved by the Central Bank of the Russian Federation dated June 19, 2012 “383-P”.

It also contains a list of all necessary details (Appendix 1). You should focus on the rules that were approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

Such features should be taken into account by all payers of taxes and fees who transfer funds to the budget.

In accordance with the new law, the instructions indicate:

| Code | |

| 104 | KBK |

| 105 | The OTKMO code (previously used OKATO), which consists of 8 digits for a municipality and 11 for a populated area. There is a table in which the old OKATOs are listed. The first 2 digits in the codes match |

| 106 – 109 | Enter data in accordance with the rules for filling out paragraphs 104 – 110 |

| 110 | Now you don't need to fill it out, because... tax is transferred |

Previously, they entered 01, 08, 14 in the paragraph to reflect the status. Now they indicate only 08. The indicator of line 21 has changed - they enter 5 instead of 3 (Article 855 of the Civil Code).

This is necessary for the banking institution to process the payment. Paragraph 24 indicates additional information related to the payment of funds to the budget.

So, when paying the insurance premium, you can enter the short name FFS, FFOMS. When transferring a tax, you should indicate its name and the periods for which the funds are paid.

How to calculate the simplified tax system of 6%, see the article: calculation of the simplified tax system.

An example of accounting for the minimum tax under the simplified tax system Income minus expenses.

The number of characters used is a maximum of 210 (in accordance with Appendix 11 of the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P).

Paragraph 22 must contain information about the UIN identifier. They simply write 0 if the payment is made personally by the payer, and not according to requirements (Letter of the Federal Tax Service of Russia dated February 21, 2014 No. 17-03-11/14–2337)

When filling out personal data, you should use the symbol “//”, which will separate the full name, address, etc. In lines 8 and 16, the number of characters should not exceed 160 (PFR letter No. AD-03-26/19355 dated December 5, 2013 .).

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

You can calculate all contributions and prepare payment slips using this service. The first month is free.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Advance payment for the simplified tax system for 2021.

Payer status: Payer status: 01 - for organizations / 09 - for individual entrepreneurs (if paying their own taxes).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Fig. Sample of filling out a payment order for the payment of Income Tax in Business Pack.

Specifics of payment ↑

Despite the general procedure for filling out, there are some differences in the details when filling out orders for advance payments, payment of penalties and fines.

By advance payment

When filling out the “Tax period” line, it is worth noting that for taxes the simplified tax system period is a year, and the billing period is a quarter, six months, 9 months.

But in paragraph 107 you do not need to indicate the period itself, but the frequency of payment. That is, information is reflected on how often the payer must pay tax in accordance with legislative acts.

For simplified taxes, this is a quarter or a specific date. For the quarter, the advance must be transferred by the 25th day of the month following the reporting period. This means that the quarter for which the tax amount was paid should be indicated.

Photo: sample payment order 1

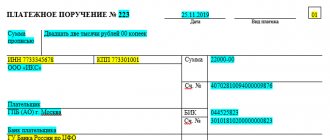

Penya

When transferring penalties for taxes for previous years, it is worth indicating the tax period (year). If the penalty is for the current year's advance, then enter the quarter.

Payers are often in no hurry to pay the penalty this year. If the payment is made on a voluntary basis, then the indication of the TP indicator in the “Basis of Payments” will not be considered erroneous.

But in case of debts, it is recommended to enter the abbreviation ZD (clause 106).

Photo: sample payment order 2

When paying arrears on penalties (USN tax “income”), pay attention to filling out the “Code” column in the payment order.

Photo: sample payment order 3

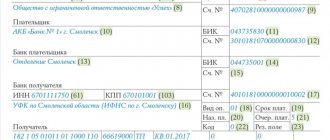

If the Federal Tax Service Inspectorate requires you to pay a penalty, you should refer to the following example of a payment order.

Photo: sample payment order 4

Fine

In case of non-payment or incomplete payment of taxes under the simplified tax system, a fine will be assessed, but only according to the requirements of the tax authority.

If there is a requirement, then find the UIN code in it. In the absence of such information, you should focus on this example of filling out an order:

Photo: sample payment order 5

If the UIN code is specified, then you need to rewrite this value in column 22. The indicator can be reflected in an alphanumeric designation.

Photo: sample payment order 6

Tax debt

There are some features when filling out a payment order form when debts arise.

Find out what restrictions apply to individual entrepreneurs on the simplified tax system from the article: simplified tax system restrictions.

What is it - accounting for materials under the simplified tax system Income minus expenses.

On the purchase of fixed assets under the simplified tax system.

The choice of details will depend on whether the payment is made voluntarily or according to requirements.

At the request of the Federal Tax Service

When drawing up a payment document for the payment of debts of the simplified tax system according to the requirements of the Federal Tax Service, it is worth changing some details.

In addition, if the tax structure indicates the UIN of payments, then this value must be entered in line 22. If there is no UIN:

Photo: sample payment order 7

Paid voluntarily

When transferring debt that was discovered independently, pay attention to such nuances.

In accordance with the general rules, when reflecting a tax period, you must indicate the period for which funds are transferred or additional taxes are paid.

But if you reduce the amount of penalties for late payments from previous years, you will not need to enter the quarter in this paragraph. In column 107, indicate the year in which changes were made to the declaration.

Video: when to use new forms for the simplified tax system

Such examples of preparing a payment order for an individual entrepreneur using the simplified tax system (income) in 2021 will help you correctly enter all the data with a guarantee that the bank will transfer the funds to the recipient. Good luck in preparing your assignment.

Previous article: Calculation of the simplified tax system Next article: Calculation of dividends under the simplified tax system

KBK USN

Current for 2016-2017. In 2021, the BCC was not changed.

| Payment | BCC for tax | KBK for penalties | BCC for fine |

| Single tax with simplified income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Single tax simplified from the difference between income and expenses | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax when simplified (for 2021 this BCC is not applied and is paid on the BCC when simplified from the difference between income and expenses) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Responsibility measures

If filling out electronic forms for the simplified tax system for income and income minus expenses, even using samples, is not a suitable option, you can always do it on paper. However, it is worth remembering that errors, for example, in addresses, account numbers and BCCs can lead to unpleasant consequences.

So, if the document is not received by the Federal Tax Service on time, a delay in the minimum payment may be created. This leads to the accrual of penalties, which amount to a percentage of 1/300 of the refinancing rate of the amount of tax required to be paid. More information about penalties is available in Article 75 of the Tax Code of the Russian Federation.

If the tax is not paid at all, which can also happen due to incorrect filling out of the payment form, the fine will be from 20 to 40% of the unpaid amount - this is regulated by Article 122 of the Tax Code of the Russian Federation.

Considering that there is a service for electronically filling out payment orders under the simplified tax system (income and income minus expenses), it will be quite difficult to encounter errors and fines. However, it is still worth knowing how to fill out this document correctly and what needs to be included in it, since this example may be useful for checking data or in case you have to deal with a sample paper form.

How to correctly calculate an advance payment according to the simplified tax system

So, you’ve worked for some time, the end of the quarter has arrived, and it’s time to calculate your taxes. If you have chosen income under the simplified taxation system, then the base rate for you will be 6%. However, regions can, by their decision, reduce this figure to 1% both for the entire business as a whole and for entrepreneurs engaged in certain areas.

If you were registered no later than two years ago, then you may even be given a tax holiday if the individual entrepreneur meets all the criteria. To find out, just contact the tax office at the place of registration of the individual entrepreneur.

If we take as a basis that the tax rate is 6%, then the calculation is carried out as follows:

- The entire amount of income received by the individual entrepreneur for the quarter is taken (six months, nine months or a year - the tax period for a simplified year is yearly), and advance payments are calculated on an accrual basis. Be careful – income does not include depositing your own funds into the individual entrepreneur’s account.

- The resulting figure is multiplied by six percent. For example, revenue amounted to 140,000 rubles, then the advance payment under the simplified tax system is 140,000 x 6% = 8,400 rubles.

- If you have already paid advance payments this year, then subtract them from the resulting amount.

All that remains is to transfer the money to the treasury. And this must be done before April 25 for 1 quarter, before July 25 for half a year, before October 25 for 9 months and before April 30 of the next year for a year.

Tax payment methods

If the time has come for an entrepreneur to pay taxes, then this can be done in three ways. The first of them is to use the nalog.ru portal, which has a service for creating a payment document.

You will need to fill in the required fields:

The second way is to use bank terminals to pay. However, if you choose it, you should prepare in advance all the same information as when filling out a receipt through the website, since it is better not to blindly trust the data that the terminal automatically enters.

The third - and perhaps the most effective - is to open a bank account if you have not done so before.

Yes, the law does not oblige individual entrepreneurs to have a current account, but this is beneficial for a number of reasons:

- allows you to make payments anytime and anywhere;

- expands the circle of your clients at the expense of organizations that are more convenient and easier to work with non-cash transactions (and these are the majority among medium and large companies);

- allows you to accept absolutely any amount, while there is a limit on cash turnover of 100,000 rubles per agreement. Even if the payment is not made once, but in small parts, as soon as the total amount exceeds the specified threshold, the entrepreneur is obliged to switch to non-cash payments;

- if you plan to keep money in an account, then you can choose a bank that has a tariff plan that charges interest on the account balance;

Many entrepreneurs are deterred from opening a bank account by the fact that it will cause unnecessary costs. But at the moment, the tariff plans offered by various financial institutions are very flexible, and if an individual entrepreneur has a small account turnover, then you can choose a tariff without a subscription fee at all, however, the cost of the transfer for each individual payment will be higher.

If you plan to carry out only a few transactions per month on your account, this turns out to be much more profitable than the usual option with a subscription. fee and low price for money transfer. Moreover, there is no bank commission charged for paying taxes.

General information ↑

When a payment order is used under the simplified tax system, what does it represent? Let's consider the basic laws that you should focus on when filling out the form.

What it is?

The concept of “payment order” is understood as a form of non-cash payment, which is an order from account depositors (payers) to their banking institution to transfer amounts to customers’ accounts.

In this case, an account can be opened in any bank. If a person does not have a bank account (Article 863, paragraph 2 of the Civil Code), then the same rules will apply as to the account holder.

When making payments by payment order, the banking institution must transfer the payer's funds to the account of the person specified in the details.

Payment must be made within the period regulated by legislative acts, unless other terms are specified in the contract.

There are urgent and long-term types of payment orders. Urgent is applicable in this case:

- when transferring advance amounts (before delivery of products, works);

- transfers after the goods have been shipped;

- partial payment for a major transaction.

Payment of the order can be made in full or in part if there are no funds in the payer’s accounts (in this case a special mark is placed in the document).

Orders are issued in electronic format or printed on paper.

According to clause 1.15 of the Regulations of the Central Bank of Russia, at the request of individuals, documentation is generated for the transfer of money by banks from time to time (for a long-term order)

Often a payment order is prepared in 4 copies:

| First | Used in banks to write off the payer’s funds. It will stay in the bank |

| Second and third | Sent to the payee's banking institution. The second, the basis for transferring funds to the recipients’ accounts, remains with the bank. The third will be attached to the recipients' account statements (this is the basis for confirming bank transactions). |

| Fourth | Will be returned to payers with stamps from the banking institution. This is a receipt indicating that the order has been accepted for execution. |

The order can be accepted even if the payer does not have funds in the account. Executed only after the money appears.

Purpose of the document

A payment order is used to transfer funds to recipient accounts:

- for products supplied, services provided - by advance payment or periodic transfers;

- to the budget of any level and to an extra-budgetary fund;

- when repaying a loan, deposit or paying interest on it;

- in other cases described in regulations.

The order form used for registration is form 0401060.

Application for simplification

Enterprises operating under a simplified taxation regime are required to pay advance taxes every quarter (by the 25th of the next month after the reporting period).

If advance payments are made through a bank, then a payment order is used. The form will contain the following information:

- Name of the payment form.

- Code OKUD.

- Purpose of transfer.

- Payer information.

- Name of the bank, its location, BIC, correspondent account, sub-account.

- Information about the recipient of the money.

- Transfer size.

- Listing order.

- The operation that is being carried out.

The order must be filled out in accordance with the requirements described in the legislation. Otherwise, banks refuse to make payments.

You can draw up a document using a special program. Individual entrepreneurs have the opportunity to pay advances in kind.