The institution was given a land plot with the right of permanent (indefinite) use. How to take this area into account: for

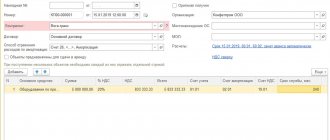

VAT when importing equipment is paid at a rate of 18% (except for cases of exemption from payment

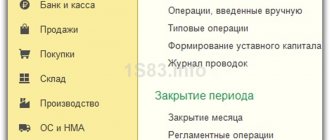

The modernization of fixed assets in 1C 8.3 means a change in their original properties. Usually,

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

In addition to regular reports to the tax service, institutions are required to report to state statistics bodies. WITH

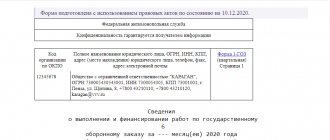

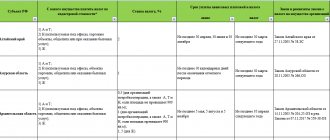

Form for KND 1152028, or calculation of property tax, is a special unified

At the end of the tax period, individual entrepreneurs, as a rule, submit declarations to the tax office. IN

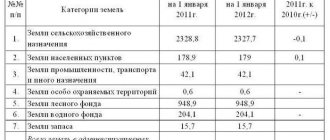

Statistical reporting of an organization: how to correctly fill out Form 11 of statistical reporting, is it necessary to reflect leased

Many large companies have separate divisions. In the process of activity, various situations arise when branches,

How to work as a tutor? Do I need to open an individual entrepreneur and pay taxes? What documents should I fill out? How to use