eBay's money-back guarantee turned out to be an advertising ploy Online stores are acquiring everything every year

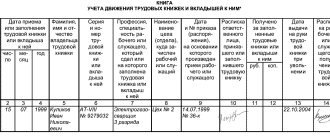

Each document must necessarily belong to a specific archive or file cabinet. Strict forms

Methodology for calculating average earnings Let's say there was a case at your enterprise in which

From the beginning of 2021, the minimum wage (minimum wage) in Russia is 11,280

Absolutely all enterprises, of any form of ownership, use account 51 “Current Account”. It is necessary

Containers are a material asset of an enterprise used for storing, moving and packaging goods. Depending

Who is required to provide the Certificate When to submit the Certificate For whom the Certificate must be provided

Income and expenses under assignment agreements should be accounted for separately from income and expenses under

The UTII regime will cease to apply at the beginning of 2021, so now is the time to think about

Simplified and assignment agreement: we understand the concepts A simplified person is a taxpayer who has chosen for tax purposes