Starting from the first quarter of 2015, taxpayers submit VAT returns using a new form

Legal topics are very complex, but in this article we will try to answer the question “Accounting

According to the Federal Law of July 26, 2019 No. 210-FZ, on January 1, 2020, changes to

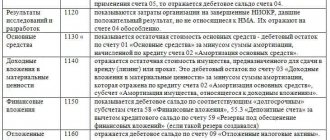

The balance sheet, since it is the main type of accounting reporting, carries the meaning

Separate divisions (branches) are not VAT taxpayers and do not have their own TIN (clause 1

The Federal Tax Service has developed a new declaration form for the simplified tax system, which will be valid from 2021 (reporting

Legal understanding of the object Regardless of what stage of construction the building is at, construction

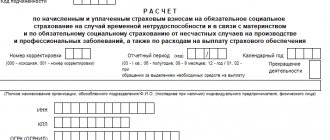

The insurance premium payer code in 2021 was required for all policyholders when filling out the form

Some accounting transactions cannot be documented with primary documents. But according to the rules

Seals and stamps from a legal point of view In ordinary life, a person does not use seals.