Scope of application

The chart of accounts is a list systematized on the basis of the economic content of each position included in it. The current list is a mandatory basis for drawing up a working chart of accounts for all organizations operating on the territory of the Russian Federation and maintaining accounting using the double entry method. The exception is banks and government agencies.

The double entry method is a registration system that involves simultaneous reflection of a transaction on two accounts: withdrawal ( credit ) of a certain amount of money from one and receipt ( debit ) of the same amount to another account .

Current account transactions and primary documents

The bank carries out non-cash transfers on the basis of special forms. These include payment orders and demands.

A payment order is an administrative document of the account owner, obliging the bank to transfer a certain amount of money to the recipient's account opened in this or another bank.

The article “How to fill out a payment order in 2021 - 2021 - sample?” will help you fill out this document correctly.

With the help of payment orders, orders for funds transfers are issued:

- for goods supplied, work performed, services rendered;

- to pay taxes and contributions to the budget and extra-budgetary funds;

- to repay loans and pay interest on them;

- for processing other expense non-cash transactions.

Payments are made in a certain form and must be accepted by the bank regardless of the availability of funds in the current account of the client transferring them.

For information about what the fields of a payment order mean, see the article “How to decrypt a payment order?”

The purpose of the payment request is somewhat different. It is an administrative document not of the payer of funds (as is the case with a payment order), but of the recipient and contains a requirement to transfer a certain amount from the debtor’s account to the creditor’s account. At the same time, settlements with payment requests may require the prior acceptance of the payer, or may be carried out without it.

Read more about this document and its execution in the article “Procedure for filling out a payment request - sample”.

Structure

The chart of accounts is characterized by a strict structural hierarchy, which is based on:

- synthetic accounts

– designed to record generalized information about transactions, types of property, liabilities; - subaccounts

– used to obtain detailed data.

Subaccounts can be combined or excluded from the organization's working chart of accounts. Company specialists can introduce additional subaccounts. However, changing the names and purposes of synthetic accounts is unacceptable. Based on the division of the balance sheet into assets and liabilities, the following types of accounts are distinguished:

- active

– accounting for the movement of funds at the disposal of the enterprise; - passive

- accounting for sources of funds, displaying information about profits, types of capital, and obligations of the organization; - active-passive

– cumulative accounting of property and sources of its formation.

Documents establishing the use of subaccounts

Rice. 4 Documents regulating the procedure for using accounts and subaccounts

Second-order accounting is used in the activities of all business entities. The procedure is regulated by several legislative acts:

- Accounting plan and instructions on its use, regulated by Order of the Ministry of Finance of the Russian Federation No. 94 of 2000;

- manuals and recommendations for industry accounting.

According to the purpose of the subaccounts, all synthetic accounts in the Plan are adjusted into 3 groups:

- with specific names and numbering;

- divided into several groups according to a specific characteristic;

- presented exclusively in a synthetic version without designation of specific subgroups.

Instructions for using the Plan require:

- specification of synthetic accounts used with subaccounts;

- analysis of accounts without identifying a second-order line;

In addition, there are special Plans (industry), for example, in banks there are documents regulated by separate provisions. Also, some budget organizations have specific activities such that standard documents for accounting regulations are not enough for full-fledged detailed accounting.

Separate provisions of the PBU regulate the use of accounts, as follows:

- clause 9 of the Accounting Regulations approved. Order of the Ministry of Finance No. 125 regulates the accounting of tangible and intangible assets for enterprises extracting minerals;

- in agriculture there is document No. 94n, which defines the use of a special plan, the main difference of which is the composition and numbering of second-line groups;

- Clause 52 of the Methodological Instructions adopted on the basis of Order of the Ministry of Finance 91n indicates the allocation of real estate objects, the rights to which are not registered, to a separate sub-accounting line;

- according to Recommendations R-56/2015-KPT, adopted by the NRBU “BMC” Fund of 2015, the amount of impairment of fixed assets and confirmation of this process after transactions are reflected.

Important: each organization has the right to reduce the number of synthetic accounts used, recommended by the Plan, taking into account the scale and activity of its own activities.

Off-balance sheet accounts

Off-balance sheet accounts are classified as auxiliary accounts. They are used in cases where an accountant needs to systematize information that is not stored on the company’s balance sheet. These accounts record information about the movement of property that does not belong to the organization, but is temporarily in its use, or assets of the enterprise written off as expenses.

Important: Off-balance sheet account data is not reflected in the financial statements.

The chart of accounts provides for 12 off-balance sheet accounts:

- 001 - leased fixed assets (fixed assets);

- 002 - inventory items accepted for safekeeping;

- 003 - materials accepted for processing;

- 004 - goods accepted for commission;

- 005 - equipment accepted for installation;

- 006 - strict reporting forms;

- 007 - debt of insolvent debtors written off at a loss;

- 008 - security for obligations and payments received;

- 009 - security for obligations and payments issued;

- 010 - OS wear;

- 011 - fixed assets leased;

- 012 - land.

Examples of subaccounts

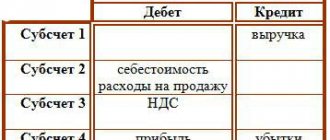

Rice. 5 Examples of subaccounts

Using examples of various sub-accounts, you can clearly see how they are corresponded and used.

Subaccount to account 08

The group for investments in non-current assets has 8 subaccount lines, which not every organization uses in full.

The company uses specific equipment to ensure its own activities. To reflect the purchase of an OS, you can use one of two options:

- 08-4 – purchase of fixed assets, an analytical account will be developed for each individual type of equipment;

- Application of 08 without specification, based on the regulations of paragraph 6 of PBU 1/2008, Recommendation R-100/2019-KpR, adopted by the National Accounting Standards Foundation “BMC” in 2019.

Subaccount to accounts 60 and 62

To account for credit debt by debit 60 on the part of the customer or buyer, a separate line should be opened for each individual person. This way you can quickly determine the amount of each individual buyer and display the total amount of debts.

Instructions for the Chart of Accounts

The instructions help to simplify and systematize work with the Chart of Accounts. Its use allows:

- obtain basic information about the methodological principles of accounting;

- get acquainted with a brief description of synthetic and subaccounts;

- understand the accounting procedures for typical transactions.

Drawing up a working chart of accounts for an organization in accordance with the provisions of the Instructions makes it possible to organize a unified standardized approach to accounting and preparation of financial statements.

Application and features of subaccounts

Rice. 2 Application of subaccount

A sub-account is an intermediate link between a synthetic (main) account and an analytical account of any order, opened in the development of a second-order line. It is used for a more detailed disclosure of the data given in the first position. With its help, the accounting of analytical data is systematized to summarize the information given on synthetic positions. For analytics, the subaccount group is used as a summary group.

Rice. 3 Analytics of subaccounts

All accounts of three orders are interconnected. Their connection is due to the following features:

- all transactions are entered on them according to one primary documentation using one side of the account on which the entry was made at the beginning;

- analytical accounts reflect the same homogeneous accounting objects in the same quality as synthetic ones, but in a more detailed manner;

- all three positions are similar in structure - there is a debit and a credit for recording, as well as a balance as a final point;

- the totals of turnover and balance on the synthetic and analytical sides are equal;

- analytical ones do not have correspondence with other accounts, as happens with synthetic ones.

Data on synthetic accounts and their subgroups are reflected in the General Ledger, while information from analytics is reflected in cards, statements, books and other register instruments.

Important: often information on all accounts of the same order is indicated in one register.

The entries made are monitored using turnover sheets, which contain summaries of accounting data for the past period.

Accounting table

Below is a table with an approved list of accounting accounts. Each position contains a link to a page with reference information that provides answers to the most common questions and allows you to study in detail the specifics of working with a specific account.

| Accounting account | Account name |

| 01. | Fixed assets |

| 02. | Depreciation of fixed assets |

| 03. | Profitable investments in material assets |

| 04. | Intangible assets |

| 05. | Amortization of intangible assets |

| 07. | Equipment for installation |

| 08. | Investments in non-current assets |

| 09. | Deferred tax assets |

| 10. | Materials |

| 11. | Animals being raised and fattened |

| 14. | Reserves for reduction in the value of material assets |

| 15. | Procurement and acquisition of material assets |

| 16. | Deviation in the cost of material assets |

| 19. | Value added tax on purchased assets |

| 20. | Primary production |

| 21. | Semi-finished products of our own production |

| 23. | Auxiliary production |

| 25. | General production expenses |

| 26. | General running costs |

| 28. | Defects in production |

| 29. | Service industries and farms |

| 40. | Release of products (works, services) |

| 41. | Goods |

| 42. | Trade margin |

| 43. | Finished products |

| 44. | Selling expenses |

| 45. | Goods shipped |

| 46. | Completed stages of unfinished work |

| 50. | Cash register |

| 51. | Current accounts |

| 52. | Currency accounts |

| 55. | Special bank accounts |

| 57. | Transfers on the way |

| 58. | Financial investments |

| 59. | Provisions for impairment of financial investments |

| 60. | Settlements with suppliers and contractors |

| 62. | Settlements with buyers and customers |

| 63. | Provisions for doubtful debts |

| 66. | Calculations for short-term loans and borrowings |

| 67. | Calculations for long-term loans and borrowings |

| 68. | Calculations for taxes and fees |

| 69. | Calculations for social insurance and security |

| 70. | Payments to personnel regarding wages |

| 71. | Calculations with accountable persons |

| 73. | Settlements with personnel for other operations |

| 75. | Settlements with founders |

| 76. | Settlements with various debtors and creditors |

| 77. | Deferred tax liabilities |

| 79. | On-farm settlements |

| 80. | Authorized capital |

| 81. | Own shares (shares) |

| 82. | Reserve capital |

| 83. | Extra capital |

| 84. | Retained earnings (uncovered loss) |

| 86. | Special-purpose financing |

| 90. | Sales |

| 91. | Other income and expenses |

| 94. | Shortages and losses from damage to valuables |

| 96. | Reserves for future expenses |

| 97. | Future expenses |

| 98. | revenue of the future periods |

| 99. | Profit and loss |

You can download the table with the chart of accounts here.

The concept and meaning of a subaccount

Rice. 1 Subaccounts are an intermediate group between synthetic (generalized) and analytical (detailed) accounts

A subaccount is a second-order account attached to a synthetic determinant. Essentially, it is part of the analytical order used to systematize data, accounting and control. Translated from Latin, it means being in subordination.

This group can be designated by numbers, letters, or a combination. For example:

When leaving fixed assets from an enterprise, account 01 is used, and subaccount position 02 is applied to it, then the designation following 01 - 02 or the combined value 01 - B.

It should reflect transactions previously made to the account to which it is subordinate. It corresponds with the same accounts as the primary one. The transactions reflected on it are indicated by the same primary documents as on the main one.

Where and how best to get training

to master accounting science on your own , but it is possible if you wish . The choice of learning method depends on the goal. If a person intends to become a professional in this field, he needs to enroll in a specialized educational institution.

You can use short-term courses and consolidate your knowledge in practice. If you have an experienced accountant nearby, he will help you combine theory with practice.

In any case, you need knowledge:

- economic fundamentals;

- accounting;

- standard accounts;

- types of balances.

It is necessary to prepare a chart of accounts with country codes, standards from different fields of activity. One of the important ones for an accountant is the Tax Code. You need to know about the conditions for deductions on profit, pay attention to VAT and all changes in accounting. It is necessary to master the basics of financial transactions. Knowledge is needed not only by a financier, but also by every manager in order to control his subordinates at any time.

How to do accounting in an LLC for a novice accountant

Correct accounting provides a complete picture of the enterprise's activities . The manager must immediately hire a specialist or appoint a responsible person to perform such tasks.

At the initial stage, the accountant determines the tax regime. Then he begins to study the reports that will have to be submitted, and develops and approves accounting, a chart of production accounts - this policy will have to be maintained during the activity.

As an employee of the financial sector, an accountant is obliged to comply with the reporting regime and not miss deadlines, since these violations are accompanied by penalties.

For more explanation of accounting basics for a beginner, watch the video below.