What is insurance premium calculation?

The calculation of insurance premiums - ERSV or RSV (the extra letter in the first abbreviation corresponds to the definition of “single”) - is completely different from the reports of the RSV-1 and RSV-2 forms that were submitted to the Pension Fund until 2021.

Why? Because in connection with the introduction of all rules for working with insurance premiums (except for payments for injuries), previously contained in various laws, into the Tax Code of the Russian Federation in 2017, control over their accrual and payment passed to the tax authorities. That is, all reporting on contributions, which was previously submitted to 2 funds (PFR and Social Insurance Fund), began to be submitted to the Federal Tax Service. Since insurance premiums in such a situation turned out to be just part of tax payments, rational actions in relation to the reporting generated on them were:

- creating a summary report form that combines the data that was previously entered into 4 forms:

- RSV-1 - in relation to contributions to the Pension Fund and the Compulsory Medical Insurance Fund accrued by the majority of employers;

- RSV-2 - regarding payments to the same funds, but accrued by the heads of farms;

- RSV-3 - in relation to contributions aimed at additional social security for employees of certain categories;

- 4-FSS - regarding social security contributions for disability and maternity insurance;

There is little new in the content of the consolidated DAM in comparison with the reports made for funds. It has been shortened by excluding:

- the results of settlements with each of the funds at the beginning of the year and at the end of the reporting period;

- data on documents for payment of contributions;

- personal information about the length of service of employees.

That is, the report on contributions submitted to the Federal Tax Service has acquired an appearance close to that of a traditional tax report, while retaining the features inherent in reporting on insurance contributions previously submitted to the funds.

How to fill out the RSV-1 form correctly

Fines for RSV-1 in 2021

If you do not provide a calculation of insurance premiums or violate the deadline, administrative liability and penalties will follow.

If the deadline for submitting the RSV-1 form is violated (for the 3rd quarter - before October 30, 2019), a fine of 1000 rubles or 5% of the calculated insurance premiums in the billing period will be charged for each full or partial month of delay.

If errors or discrepancies are found in the form when filling out, the report will not be provided. Corrections may be made within 5 working days from the date of receipt of the notification from the Federal Tax Service. After making changes, the date of submission of the report is recognized as the day when the form of a single calculation for insurance premiums 2021 was sent for the first time (paragraphs 2 and 3 of paragraph 7 of Article 431 of the Tax Code of the Russian Federation).

Which RSV-1 form to use

The mandatory unified form was approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. KND code - 1151111. The new RSV-1 form for the 3rd quarter of 2021 consists of a title page and three sections, which contain 11 applications. We wrote about this in detail in the article “Unified calculation of insurance premiums.”

Conditions for filling out RSV-1

Let's consider an example of calculating insurance premiums in 2021 for a budget organization. GBOU DOD SDYUSSHOR "ALLUR" uses OSNO. General tax rates are established for the calculation. The average number of employees is 22.

For the reporting 6 months of 2021, payroll accruals amounted to (in rubles):

- July - 253,000.00;

- August - 253,000.00;

- September - 253,000.

We calculate insurance monthly to fill out RSV-1.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

For information on filling out the calculation of insurance premiums: in the 1st half of 2021, wages accrued amounted to 759,300.00 rubles:

- Pension Fund of the Russian Federation: 759,300.00 × 22% = 167,046.00 rubles.

- Compulsory medical insurance: 759,300.00 × 5.1% = 38,724.00 rub.

- Social Insurance Fund: 759,300.00 × 2.9% = 22,019.00 rubles.

Estimated data for the 3rd quarter (in rubles):

- Accrued salary - 759,000.00.

- Contributions to the Pension - 166,980.00.

- Compulsory medical insurance - 38,709.00.

- FSS - 22,011.00.

Final data for filling out the calculation of insurance premiums for 9 months of 2021:

- accruals - 1,518,300.00 rubles;

- contributions to the Pension Fund of the Russian Federation - 334,026.00 rubles;

- Compulsory medical insurance - 77,433.00 rubles;

- FSS - 44,030.00 rubles.

How to fill out the RSV-1 form correctly

The detailed procedure for filling out the calculation of insurance premiums for 2020 is set out in the Order of the Federal Tax Service No. ММВ-7-11/551. Taking into account the provisions of the Order, we will give an example of completing the RSV-1 form for the 3rd quarter of 2020.

Step 1. Title page RSV-1

On the title page of the single calculation we indicate information about the organization: INN and KPP (reflected on all pages of the report), name, economic activity code, full name. manager, phone number. In the “Adjustment number” field we put “0” if we provide a single report for the first time during the reporting period, or we set the next adjustment number. We indicate the Federal Tax Service code and location code.

Step 2. Go to the third section of the RSV-1 calculation

Here you need to fill in personalized information about all insured persons in the organization, for each employee separately. Let's give an example of filling out information in the calculation of insurance premiums for a manager.

We reflect the adjustment number - 0, the period and date of completion.

We indicate personal data in part 3.1: employee’s INN, SNILS, date of birth, gender and citizenship. For Russian citizens, we set the value “643” (line 120), the country code is established by Gosstandart Resolution No. 529-st dated December 14, 2001. We select the document type code (page 140) in accordance with Appendix No. 2 to the Order of the Federal Tax Service dated December 24, 2014 No. MMV-7-11 / [email protected] Passport code for a citizen of the Russian Federation - “21”, indicate the series and number of the passport (or information other document).

We indicate the attribute of the insured person: 1 - insured, 2 - not. Our example of filling out a calculation for insurance premiums 2020 includes code “1”.

Step 3. Completion of the third section of the RSV-1 calculation

We fill out part 2.1 of the third section of the unified insurance calculation: set the “month” field to “07” - July, “08” - August, “09” - September. We write down the category code of the insured person. In accordance with Appendix No. 8 of the Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11 / [email protected] , “hired employee” means “NR”.

Step 4. Fill in the amount of payments and other rewards

The director's salary was 60,000.00 rubles per month. Total for the 3rd quarter - 180,000.00 rubles. Pension insurance contributions (60,000.00 × 22%) amounted to 13,200.00 rubles for each month. We indicate these amounts in special lines of the single calculation for insurance premiums.

If one of the employees exceeds the amount of the maximum base for calculating insurance premiums, we fill out part 3.2.2, guided by the limit values established in Government Decree No. 1378 dated November 15, 2017. For compulsory insurance in 2021 - 1,150,000.00 rubles per employee employee.

Step 5. Go to subsection 1.1 of Appendix No. 1 of Section 1 of the unified calculation of RSV-1

In subsection 1.1 we indicate the payer's tariff code. Information for filling out the calculation of insurance premiums for the 3rd quarter:

Then we indicate the total values of section 3 of the RSV-1.

First, we reflect the number of people:

- general;

- the number of those who received accruals included in the calculation base;

- who has exceeded the maximum base value.

Then the amounts of accruals and insurance premiums are based on the same principle as the number.

In fields 010 (number of individuals) and 020 (number of individuals to whom payments were made and from whom insurance premiums were calculated), set the value to 22 (persons). We do not fill out field 021; it indicates the number of individuals who exceeded the base limit for accrual.

Field 030 is the total amount of accruals, 040 is the amount of non-taxable payments, 050 is the base for calculating insurance premiums, determined by the difference between fields 030 and 040.

Non-taxable payments (p. 040) are established by Art. 422 of the Tax Code of the Russian Federation and include:

- state benefits at the federal, regional and local levels;

- compensation and reimbursement established by the state, within the limits of standards;

- one-time cash payments in the form of material assistance (in the event of the death of a close relative, in case of natural disasters and emergencies);

- financial assistance at the birth of a child up to 50,000.00 rubles; amounts above the specified limit are subject to taxes;

- financial assistance in the amount of 4,000 rubles; the amount exceeding the limit is taxed in accordance with the established procedure;

- the amount of insurance contributions, including for additional insurance;

- other payments.

Field 051 - the amount of accruals exceeding the maximum base value.

Fields 060, 061 and 062 - accrued voluntary pension contributions. 060 - general (total and are the sum of lines 061 and 062), 061 - without exceeding the limit, 062 - with exceeding the limit.

Step 6. Subsection 1.2 of Appendix No. 1 of Section 1

We fill out the data for compulsory medical insurance in the same way as subsection 1.1:

- 010 and 020 - number;

- 030 - total amount of accruals;

- 040 - non-taxable payments (Article 422 of the Tax Code of the Russian Federation);

- 050 - difference between 030 and 040;

- 060 - the amount of calculated insurance premiums for compulsory medical insurance.

Please remember that current legislation does not establish excess limits (limits) under which special conditions apply.

Step 7. Fill out Appendix No. 2 of Section 1. Specify the data for calculating VNiM deductions

Let's analyze line by line what the unified calculation of insurance premiums in Appendix 2 of Section 1 includes. Line 001 (payment indicator): determined in accordance with clause 2 of Government Decree No. 294 dated 04/21/2011 and Federal Tax Service Letter No. BS- dated 02/14/2017 4-11/ [email protected] We indicate “01” if the organization is located in a region that is a participant in the FSS pilot project, “02” for all others:

- 010 - indicate the total number of insured persons;

- 020 - total amount of accruals made during the billing period;

- 030 - non-taxable payments (Article 422 of the Tax Code of the Russian Federation);

- 040 - the amount of charges exceeding the established limit. In 2020 it is equal to 865,000.00 rubles;

- 050 - base for calculating deductions;

- 051–054 - amounts of accruals (under special conditions), if any.

Step 8. We finish filling out Appendix No. 2 of Section 1 of the unified calculation of RSV-1

The fields are for amounts:

- 060 — calculated insurance premiums;

- 070 — expenses incurred for the payment of insurance coverage (sick leave, benefits);

- 080 - expenses reimbursed by the Social Insurance Fund;

- 090 - payable, they are equal to the difference between calculated insurance premiums and actual expenses incurred (060 - (070 - 080)).

We indicate “1” - when paying payments to the budget; “2” - if the expenses incurred exceed the calculated insurance premiums.

If the organization made payments for sick leave or benefits during the reporting period (amounts excluded from the calculation base), you should fill out Appendix No. 3 of Section 1. In our case, there is no data.

Step 9. Fill out section 1 (summary data) of the unified insurance reporting

We indicate the amounts payable for each type of insurance separately.

Fill out OKTMO. For each type of insurance coverage, we indicate the BCC, the amount for the billing period (quarter) and for each month.

Step 10. Specify the budget classification code

We reflect the BCC in the unified contribution report in accordance with Order of the Ministry of Finance No. 132n dated 06/08/2018.

Filling out RSV-1 if there were sick leave and benefits

If during the billing period the company’s employees were sick or other types of benefits were accrued in their favor, reimbursed by the Social Insurance Fund, then additional sheets of the report will have to be filled out. If there are payments from Social Insurance, you will also have to fill out Appendix No. 3 to the first section of the calculation of insurance premiums.

The design of the additional report page follows the general rules. Essentially, the employer provides detailed information on temporary disability. That is, it reveals:

- the number of cases that occurred during the reporting period;

- number of sick days;

- the amount accrued at the expense of the Social Insurance Fund.

Then you must indicate the specific type of benefit that was accrued in the reporting period. If there are several of them, then the employer fills out the corresponding lines of Appendix No. 3 to the first section.

Let's look at a sample of how to fill out the RSV with sick leave using an example: the state budgetary institution "Byudzhetnik" (GBU "Byudzhetnik") employs only two employees, including the director of the institution. Both employees are citizens of the Russian Federation; employment contracts have been concluded with them. During the nine months of 2021, the number of employees of the State Budgetary Institution did not change.

In March, one of the specialists was sick for five days. In the same month, the State Budgetary Institution paid him sickness benefits in the amount of 8,207.95 rubles. (including 3283.18 rubles at the expense of OSS funds in case of VNiM). No other expenses were incurred for the payment of insurance coverage for VNIM at the institution.

The total amount of employee wages was:

- for nine months of 2021 (reporting period) - 900,000 rubles;

- for the last three months of the reporting period: July - RUB 100,000.00;

- August - RUB 100,000.00;

- September — 100,000.00 rub.

The State Budgetary Institution “Budzhetnik” did not make any other payments in favor of individuals for the nine months of 2021. The maximum values for insurance premiums for any of the employees for the reporting period of 2021 were not exceeded. Tariffs for insurance premiums applied by the State Budgetary Institution “Budzhetnik” in 2021:

There was no right to reduced tariffs. There was no basis for the accrual of additional insurance amounts. The amounts of contributions accrued by the State Budgetary Institution “Byudzhetnik” for compulsory health insurance, compulsory medical insurance and VNIM amounted to:

- for nine months of 2021: for OPS - 198,000.00 rubles;

- for compulsory medical insurance - 45,900.00 rubles;

- at VNiM - 26,100.00 rubles;

- for July: for compulsory medical insurance - 22,000.00 rubles, compulsory health insurance - 5100.00 rubles, for VNIM - 2900.00 rubles;

This is what a sample of filling out the RSV-1 form for the Pension Fund of the Russian Federation 2020 looks like, Appendix No. 3 to the first section:

Rules for drawing up and submitting the DAM in 2021

To calculate insurance premiums for 2021, use the form approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] The form is used from the reporting campaign for 2020. The rules for filling it out are contained in the same order of the Federal Tax Service.

ConsultantPlus experts told us what innovations were included in the document. Get free demo access to K+ and go to the review material to find out all the details of the changes.

You will find a detailed description of the principles for filling out each sheet of this document in the article “Unified calculation of insurance premiums - form”.

The DAM is compiled quarterly, including a number of data in the form of incremental figures and taking into account the fact that the calculation of the cumulative total will begin anew with the beginning of the new year. At the same time, the figures that arose only in the last quarter of the reporting period are given with a fairly high degree of detail, which makes it possible to call the DAM (actually compiled on an accrual basis) a calculation for a certain quarter.

You can download a sample of filling out the DAM for 2021 with comments from ConsultantPlus by receiving free trial access to the system using the link below:

Filling out individual lines of the ERSV is discussed in the articles:

- “How to fill out line 040 in the calculation of insurance premiums”;

- “How to fill out line 070 in the calculation of insurance premiums”;

- “Filling out line 030 of the calculation of insurance premiums”;

- “How to fill out line 090 in the calculation of insurance premiums.”

The generated report must be checked for errors.

Sample of filling out the DAM for the 3rd quarter

To help you understand the sequence and procedure for entering accounting data into a single DAM for the 3rd quarter of 2021, our experts filled out a calculation for you based on the following data:

LLC "Quorum" on OSN outsources accounting and tax accounting of small companies. Contribution rates are standard, there are no benefits.

There are 2 specialists on staff with whom employment contracts have been concluded, there are no contractors:

| Employee's full name | Monthly payments in his favor, rub. |

| Vasiliev Alexander Petrovich | 30 000 |

| Smolnikov Andrey Vladimirovich | 20 000 |

When submitting the DAM for the 3rd quarter of 2021, the Quorum accountant will fill out the title page and all mandatory sections, subsections and appendices. In section 3, the legal entity will indicate the personal data of each member of the workforce, as well as payments to them and accrued pension contributions.

Note! Since April 1, 2020, SMEs have been calculating insurance premiums at reduced rates.

EXAMPLE of calculating insurance premiums at reduced rates from ConsultantPlus: In 2021, payments in favor of the employee amounted to: - for January - 17,000 rubles; — for February — 16,000 rubles; — for March — 15,000 rubles…. Read the continuation of the example in K+. Trial access to K+ is free.

We recommend that you familiarize yourself with the ERSV sample for 9 months of 2020 in more detail using the link.

Deadline for filing RSV-2020 for the 4th quarter of 2021

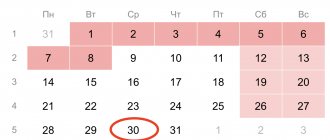

The deadline for submitting the consolidated DAM to the Tax Code of the Russian Federation (clause 7 of Article 431) specifies only one date, defined as the 30th day of the month beginning after the end of the next reporting quarter. There is no specific deadline for annual reporting.

That is, the last day for reporting contributions must fall on the 30th of January, April, July and October, unless this day coincides with a weekend. If this happens, then the deadline is postponed (Clause 7, Article 6.1 of the Tax Code of the Russian Federation) to the next weekday later.

Based on these rules, the deadline for filing the DAM for the 4th quarter of 2021 will correspond to 02/01/2021 (postponed from 01/30/2021, since this day falls on a Saturday).

And reporting for the periods of 2021 will need to be submitted no later than 04/30/2021, 07/30/2021, 11/01/2021 and 01/31/2022 (all dates fall on weekdays, except for the report for 9 months and for the year).

The report can be submitted on paper if the average number of persons whose data appears in the document does not exceed 10 people (clause 10 of Article 431 of the Tax Code of the Russian Federation). When there are 11 employees or more, electronic reporting becomes mandatory.

Deadlines for submitting reports to the Pension Fund

The obligation to submit monthly information about insured persons (SZV-M) to the Pension Fund remains. The form must be submitted no later than the 15th day of the month following the reporting month (clause 2.3 of Article 11 of the Federal Law on Personalized Accounting No. 27-FZ).

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Also in 2021, you must submit the SZV-TD form. Submit a report only for employees who have had personnel changes: hiring, transfer, dismissal, or filing an application to choose an electronic or paper work record book. When hiring and dismissing, the form must be submitted on the next working day after the order is issued. In other cases - until the 15th day of the next month.

If no personnel activities have been carried out in relation to the employee in a month, do not submit the form for him. But if there were no personnel events throughout 2021, submit the SZV-TD before February 15, 2021.

Thus, the SZV-M and SZV-TD forms will need to be submitted no later than:

- January 15, 2021 for December 2021;

- February 15 for January 2021;

- March 15 for February 2021;

- April 15 for March 2021;

- May 17 for April 2021;

- June 15 for May 2021;

- July 15 for June 2021;

- August 16 for July 2021;

- September 15 for August 2021;

- October 15 for September 2021;

- November 15 for October 2021;

- December 15 for November 2021.

And also, policyholders, in accordance with the amendments made to Article 11 of the Federal Law on Personalized Accounting No. 27-FZ, annually no later than March 1 of the year following the reporting year must submit to the Pension Fund information about the length of service for each insured person working for them. The SZV-STAZH must be submitted by 03/01/2021 for 2020.

Results

The report on insurance contributions, which since 2021 has a new curator in the person of the Federal Tax Service, a new form (common for all contributions supervised by the Federal Tax Service) and a new deadline for submission, is drawn up according to the same principles that were in effect during the periods when similar reports were submitted directly to the funds. The report is submitted quarterly. Data is entered into it on a cumulative basis throughout each year.

A report on insurance premiums for 2021 must be submitted to the Federal Tax Service no later than 02/01/2021 in electronic form, if the number of employees on the basis of which the report was generated exceeds 10 people. If the number is smaller, the report may be on paper.

When it is necessary to submit an adjustment to the calculation of insurance premiums, within what time frame and according to what rules, read the articles:

- “Corrective RSV form - how to submit it”;

- "Updated calculation of insurance premiums."

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

DAM for 9 months of 2021: sample and difficult moments

The deadline for submitting reports for 9 months (3rd quarter) of 2020 is approaching. One of the most important is DAM (calculation of insurance premiums). We offer step-by-step instructions for preparing and submitting a single calculation of insurance premiums for the 3rd quarter of 2021. Here you will find a sample of filling out this report.

Step 1. Find out whether you need to submit the DAM for the 3rd quarter of 2020

It must be submitted to the Federal Tax Service:

- everyone who has employees;

- everyone who has formalized other cooperation with individuals (for example, GPC agreements).

In this case, the existence of a contractual relationship involving the payment of money is primary . But the fact of paying money to the “physicists” in the reporting period is secondary. If there is at least one agreement with a citizen - labor, civil process agreement, etc., you must .

If there were no payments during the period, submit a zero ERSV.

Step 2. Design the title page

Start filling out the RSV form with the title page. It is required in this reporting package.

Please note that the Federal Tax Service is preparing draft changes to the DAM form, but the order making the changes has not yet been signed. Therefore, you need to submit the ERSV for 9 months of 2021 on the old form (approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551).

Free RSV, valid in the 3rd quarter of 2021.

Period for the DAM for 9 months: 33. If during this period there was a liquidation or reorganization of the employer, enter the period code not 33, but 53.

OKVED - indicate the main (or first) OKVED, which is indicated in the Unified State Register of Legal Entities (USRIP) extract.

See the table for the presentation location code:

| How does the calculation appear? | Code |

| At the place of residence of an individual who is not an individual entrepreneur | 112 |

| At the place of residence of the individual entrepreneur | 120 |

| At the place of residence of the lawyer who has his own office | 121 |

| At the place of residence of the private notary | 122 |

| At the place of residence of the head of the peasant farm (keep in mind that the heads of the peasant farm do not submit a zero quarterly DAM; only annual) | 124 |

| At the location of the Russian legal entity | 214 |

| At the place of registration of the legal successor of the Russian legal entity | 217 |

| At the location of a separate division of a Russian legal entity | 222 |

| At the location of a separate division of a foreign legal entity | 335 |

| At the place of registration of the international organization | 350 |

Step 3. Decide whether to fill out information about the individual

The personal information sheet is intended for citizens who are not individual entrepreneurs, but are engaged in private practice (activities) and have insured employees.

This sheet is filled out when a person working in this way does not indicate his TIN for some reason. Then, for more complete and correct identification with the tax office, an individual should provide additional information:

- date and place of birth;

- citizenship;

- information about identity documents, etc.

If you are not such a citizen, proceed to the next step.

Step 4. Enter account data

Persucheta data is accumulated in Section 3 of the calculation. For ease of checking and correct filling, we proceed to it after entering the title and identification information.

Fill out the section for each employee: there should be as many Sections 3 as there are individuals who collaborated with you during 9 months of 2021.

In each section, reflect:

- correction number - 0;

- period;

- date of completion.

Provide your personal information in Part 3.1:

- employee tax identification number;

- SNILS;

- date of birth;

- floor;

- citizenship (for Russian citizens, set the code “643” - line 120).

Select the document type code (page 140) in accordance with Appendix No. 2 to the Federal Tax Service order No. ММВ-7-11/671 dated December 24, 2014. The code of the passport of a citizen of the Russian Federation is “21”, indicate its series and number (or information from another document).

Please indicate the characteristics of the insured person:

Fill out part 3.2.1 of Section 3 with numerical data: designate the “month” field “07” - July, “08” - August, “09” - September. Specify the category code of the insured person in accordance with Appendix No. 8 to the order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. Download the code table here.

Fill out Part 3.2.2 if any of the employees exceeded the maximum base for insurance premiums (for 2021 this is income above RUB 1,150,000).

The tax office may not accept the calculation if there are errors in the personal data. The same problems will arise if the final data on accruals and contribution amounts do not match the data shown in Section 1 of the calculation.

Step 5. We draw up Subsection 1.1 of Appendix 1

This is a mandatory subsection that must be completed, even if the report is zero.

First of all, we deal with tariff codes (line 001). Download the full code table here.

If you apply several tariffs under OPS, fill out as many Appendices 1 to Section 1 as the number of codes is applied.

Next, we describe in the columns of Appendix 1 the total values for the base and contributions. If you fill out the calculation manually, it is more convenient to add up the data from Section 3 and transfer it to Appendix 1 to Section 1.

First, transfer the number, then the numerical values.

On line 040, provide information about non-taxable payments during the period.

Fill out line 050. The values in it represent the difference in the corresponding columns of lines 030 and 040. The non-taxable amount must be subtracted from the entire amount of contributions.

Data for lines 061 and 062 are calculated in the same way.

Step 6. Fill out Subsection 1.2 of Appendix 1

This subsection is also a mandatory element of the DAM. We act here exactly the same as in Appendix 1.1, only with regard to contributions to compulsory medical insurance.

There is no limit value after which the conditions for calculating contributions change for compulsory medical insurance in 2021.

Step 7. Fill out Appendix 2 of Section 1

Fill out this mandatory application in the same way as Appendix 1. Pay attention to line 001 “Payment attribute”, which encodes how sick leave payments are made in your region:

- 1 - directly from the Social Insurance Fund (as part of a pilot project);

- 2 - from the employer with a credit (refund) of funds from the Social Insurance Fund.

There is also a distinctive column - “Sign”. Enter “1” in it if you are filling out payments to the budget, and “2” if you are showing the budget debt when expenses for VNiM exceed contributions payable.

Step 8. We draw up the remaining attachments to Section 1

Determine whether you need to complete any other applications besides the required ones. You can skip this step if you are applying for a zero account on the DAM.

Appendix 3

Includes information on VNiM expenses for benefits paid:

- sick leave, taking into account restrictions and exceptions (including external part-time workers);

- for pregnancy and childbirth (also taking into account external part-time workers);

- a one-time benefit for women who registered in the early stages of pregnancy (and again taking into account external part-time workers);

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- the number of additional days off for caring for disabled children and the fees charged for them;

- funeral allowance or reimbursement of the cost of funeral services;

- accrued and unpaid benefits (for reference).

Appendix 4

Fill in with information about expenses made from federal budget funds.

Appendix 5

Dedicated to the application of the reduced tariff of payers specified in subparagraph. 3 p. 1 art. 427 Tax Code of the Russian Federation (IT technologies).

Appendix 6

On the application of a reduced tariff for payers specified in subparagraph. 5 p. 1 art. 427 of the Tax Code of the Russian Federation (simplified).

Appendix 7

On the application of a reduced tariff for payers specified in subparagraph. 7 clause 1 art. 427 of the Tax Code of the Russian Federation (NPOs, except for state employees on the simplified tax system).

Appendix 8

On the application of the reduced tariff under sub. 9 clause 1 art. 427 of the Tax Code of the Russian Federation (IP on a patent).

Appendix 9

On the application of the tariff specified in subparagraph. 2 p. 2 art. 425 of the Tax Code of the Russian Federation (general rates, reduced tariffs).

Appendix 10

About the information for applying subparagraph. 1 clause 3 art. 422 of the Tax Code of the Russian Federation (payments and rewards to participants of student teams included in the register).

Complete those applications that apply to you.

Step 9. Fill out Section 1 of the RSV

In Section 1, combine the data from the completed applications. Here they display a summary of each type of contribution administered by the Federal Tax Service. Contributions are indicated each in its own subsection (refer to their headings).

Section 1 is a mandatory component of the DAM. It comes with 10 applications. The following are required to be submitted:

- Subsections 1.1 and 1.2 of Appendix 1;

- Appendix 2.

If other annexes to this section are completed, transfer data on them to Section 1 as well.

In each subsection, indicate the BCC corresponding to this type of contribution (Order of the Ministry of Finance No. 132n dated 06/08/2018).

In addition, in Section 1 of the calculation of contributions, describe the assessment of contributions during the 3rd quarter of 2021 on a monthly basis.

You can fill out the calculation of insurance premiums for the 3rd quarter of 2020 for free using the direct link here.

Step 10. Check the generated RSV

If you make a paper calculation, you won’t be able to check it with test programs. To do this, you need to use the services of the Federal Tax Service:

But checking in these services is only available for electronic files - either generated in a tax program or downloaded from accounting programs.

As for the control ratios according to the ERSV, there are about 300 of them. When submitting a report on paper, it makes sense to look only at the main ones:

- no errors in lines 210, 220 and 240 of Subsection 3.2.1 - regarding the amount of payments in favor of the insured persons, the “pension” base within the limit and contributions accrued from it;

- absence of errors in lines 280 and 290 of Subsection 3.2.2 - on the amount of payments on which contributions are calculated under the additional tariff and on contributions accrued under it;

- no discrepancies between the summarized indicators for individuals (Section 3) and similar indicators for the enterprise (Subsections 1.1, 1.3);

- absence of unreliable (erroneous) personal data from individuals.

Compliance with these parameters will allow the tax authorities to accept your report. If they subsequently discover any inconsistencies, you will be notified or required to provide explanations. Your DAM for the 3rd quarter of 2021 will be considered submitted - you will either have to provide clarifications or submit an adjustment.

When to report to the FSS

In addition to the unified calculation of insurance contributions, employers are required to submit a report in Form 4-FSS to the Social Insurance Fund. Unlike the Federal Tax Service, representatives of Social Insurance have established individual deadlines for submitting insurance reports, which directly depend on the format for submitting the 4-FSS calculation. Let's look at the dates in the table:

| Reporting period | Submission deadline for paper reports | Deadline for electronic payments |

| Final report for 2021 | 20.01.2020 | 27.01.2020 |

| 1st quarter 2020 | 20.04.2020 | 27.04.2020 |

| Half year | 20.07.2020 | 27.07.2020 |

| 9 months | 20.10.2020 | 26.10.2020 |

| Summary for 2021 | 20.01.2021 | 25.01.2021 |

The 4-FSS calculation form was approved by order of the FSS of Russia dated September 26, 2016 No. 381, and the latest changes to the form were made on June 7, 2017 by order of the FSS of the Russian Federation No. 275. We described in detail the rules for drawing up the form in the article “Filling out the 4-FSS form.”

Procedure for registration of DAM: general requirements

The report consists of 3 sections and 24 sheets, which display information about all insurance premiums, except for “accidental” ones. But you only need to fill out those that are mandatory and for which you have indicators.

Let's consider who should fill out which sheets when preparing reports for 9 months of 2021.

| Sheet | Is it necessary to fill out | Who fills it out |

| Title | Yes | All policyholders |

| Sheet “Information about an individual who is not an individual entrepreneur” | No | Only individuals who are not registered as entrepreneurs |

| Section 1 | Yes | All |

| Annex 1 | Yes | Subsections 1.1 and 1.2 - filled out by all policyholders, Subsections 1.3, 1.3.1., 1.3.2, 1.4 are completed only if there are payments of contributions for additional tariffs |

| Appendix 2 | Yes | All employers indicate information about insurance premiums in case of temporary disability and maternity |

| Annexes 3 and 4 | No | Fill out only those employers who paid sick leave benefits in the reporting period |

| Appendix 5 | No | Filled out by IT firms that have the right to apply reduced tariffs |

| Appendix 6 | No | They are drawn up by simplifiers who have the right to apply reduced tariffs in accordance with paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation |

| Appendix 7 | No | NPOs engaged in activities named in paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation, which allows you to pay contributions at reduced rates |

| Appendix 8 | No | Businessmen apply for a patent, with the exception of those who work in catering, retail or rent out real estate |

| Appendix 9 | No | Designed for those employers who pay income to foreigners and/or persons temporarily staying in the Russian Federation |

| Appendix 10 | No | Issued only in relation to payments to students working in student teams under a GPC or labor agreement |

| Section 2 and Appendix 1 | No | Only heads of peasant farms in relation to contributions for themselves and members of the farm |

| Section 3 | Yes | Employers record pers. information on all hired persons |

Changes in 2021

The procedure for calculating and transferring insurance payments in 2021 has not changed.

Legal features regarding insurance payments are presented in Chapter 34 of the Tax Code of the Russian Federation and in Law No. 125-FZ dated July 24, 1998. In reporting for the 1st quarter of 2021, a new form for calculating insurance coverage is used. You will not be able to submit a discontinued form. The controllers will not accept the report. Details of filling out are in the article “How to correctly fill out the RSV-1 form.”

Algorithm for filling out section 3

Here you should display individual information for each employee:

- FULL NAME;

- SNILS;

- TIN;

- day, month and year of birth;

- country of citizenship code, for Russians - 643;

- floor;

- details of the employee's identity document.

On pages 160-180, enter the value “1” if the employee is insured in the compulsory insurance system, or “2” if he is not insured.

Enter the value “1” even if you calculate insurance premiums at a 0% rate, since employees are insured in the insurance system.

On page 190, write down the month number. In the 3rd quarter it is July - 07, August - 08, September - 09.

On page 200, indicate the code of the insured person by selecting it from Appendix 8 to the procedure for filling out the calculation. For hired workers, this is the value of “HP”.

On pp. 210-240, record the amount of income accrued to the employee and the amount of insurance premiums for mandatory pension insurance.

If you recalculated payments to employees for previous periods, reflect all recalculations in the updated calculation. If you show them in the current calculation and section 3 includes negative values, then the pension fund specialists will not be able to post the information to individual accounts of individuals and the tax authorities will require you to submit an updated calculation.

You can fill out the RSV here .

Methods for sending a report

Applicants have 2 options to submit a report on the DAM: electronically or in paper form. Electronic filing will require a qualified digital signature, without which it is impossible to log in to the tax service website. The second option is more traditional and simpler, but requires the personal presence of the manager (or his trusted representative) and takes more time.

The deadline for submitting RSV-1 is tied to the end of the quarters and year:

- until April 30;

- until July 31;

- until October 30;

- until January 30.

When filling out the DAM, the employer will calculate all amounts of insurance payments of his subordinates

Procedure for filling out the title page

The main fields of the title include “standard” information about the policyholder:

- Name.

- INN/KPP.

Separate divisions that independently pay income to employees indicate their checkpoint.

- Correction number (001, 002, etc.). For the initial calculation, enter 000 in this field.

- The reporting period code is 33 for a 9-month report.

- Federal Tax Service code where the calculation is submitted.

- In the “location” field, enter the code corresponding to where the payment is being submitted. Our table will help with this:

- OKVED code.

- Full name of the person signing the report and date of signing.

- Leave the field “to be filled in by a tax authority employee” blank.