Absolutely all enterprises, of any form of ownership, use account 51 “Current Account”.

It is necessary to display the status of the organization’s accounts that are opened in banks. The number of current accounts can be any; the number of banking institutions for storing funds of legal entities is also not limited.

After reading this article, you will learn what a balance sheet for account 51 is - what it is needed for and when it is used.

- 1 Characteristics

- 2 Postings of 51 accounts in accounting 2.1 For a loan

- 2.2 Analysis of 51 accounts

What it is

Settlements with suppliers of goods or raw materials, customers of these goods or personnel are one of the most important transactions in the life of every legal entity. 51 accounts in the accounting department is the “Settlement Accounts” register, designed to collect information about the availability of material assets in the national currency of the Russian Federation (in Russian rubles) and about their movement through the payment accounts of an organization or enterprise. Accounts, in turn, must be opened in financial and credit institutions. Register 51 is active, since the opening and closing balances for it can only be debit

Position 51 reflects the movement of all funds in current accounts

The nature of credit turnover

As already mentioned, credit turnover on a current account is the totality of all expense transactions. Their list and content can be judged based on the chart of accounts. The following actions are displayed for the credit of the active account 51 r/s:

- receipt of money from the account to the cash desk;

- payment to suppliers for products, contractors for work;

- tax contributions to the state budget;

- repayment of loan debts;

- transfer of money to social security and insurance authorities;

- repayment of debts to creditors;

- payment of interest on loans from credit institutions;

- financial investments.

What is it used for?

Account 51 was created in order to keep records, control and analyze data on the material funds of a legal entity that are located in banking organizations. This register reflects only payment and acceptance in the national currency of Russia.

Cash received by 51 registers will be accounted for as a Debit, and the amounts of all write-offs will be recorded as a Credit, which is obvious. One of the grounds for displaying receipts from this account is bank statements, and the amounts of all money transfers are carried out on the basis of instructions to make a payment.

Important! Analytical accounting for 51 accounts is carried out in the context of individual suppliers and customers who perform payment and receipt transactions with the company, as well as in the context of types of operations, for example, settlements with counterparties, payment of wages to personnel or payment of debt.

It is better to carry out analytics by dividing into counterparties and types of operations

Accounting for goods at sales prices

Firms that sell goods in retail trade can keep records of goods in the form of sales prices. For example, a company purchased 34 kg. sausages of one type and gave 300 rubles. per 1 kg, including VAT of 18%. Display is carried out at sales prices. Selling price - 400 rubles. per 1 kg., including VAT of 18%. There were no leftover sausages at the beginning of the month.

Dt. 41.1 Kt. 60 – 10,200 – payment for products at the purchase price.

Dt. 19 Kt. 60 – 1555.93 – amount of VAT paid.

Dt. 41.2 Kt. 41.1 – 10,200 – the product has entered retail sales.

Dt. 41.2 Kt. 42 – 3400 (13 600 – 10 200) – trade margin.

Within a month, all the goods were sold out.

Dt. 50 Kt. 90.1 – 13,600 – revenue.

Dt. 90.3 Kt. 68 – 2074.57 – VAT on sales.

Dt. 90.2 Kt. 41.2 – 13,600 - write-off of cost of sales at sales prices.

Dt. 90.2 Kt. 42 – 3400 — markup write-off.

Account characteristics

The debit (Dt) of the account reflects the receipt of funds to the organization's current accounts in the banks in which it is a client. That is, all money that was credited to the name of a legal entity passes through Debit 51 of the register. It is worth remembering that for a financial institution these funds are credit funds, therefore they will be located in the “Credit” item on the statement.

Examples of basic receipt operations:

- Receipt of funds from the buyer Dt 51.01, Kt 62.01 Bank statement or client payment order (primary document);

- Crediting collection revenue Dt 51.01, Kt 57.01. Bank statement or transmittal statement;

- Receipt of money under a loan or credit Dt 51.01, Kt 66 Bank statement, loan agreement, loan agreement;

- Contribution of the founder of a legal entity Dt 51.01, Kt 75.01 Bank statement or bank order.

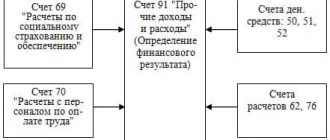

The operation diagram of register 51

Credit (Kt) also shows the debiting of money from the organization’s bank accounts. It displays all transactions in descending order of funds.

Posting examples:

- Receipt of funds in cash, Dt 50.01 Kt 51.01, Bank statement or check for cash;

- Payment to the counterparty for goods or services, Dt 60.01 Kt 51.01, Bank statement, payment order;

- Repayment of borrowed funds, Dt 66 Kt 51.01, Bank statement or loan agreement;

- Transfer of salaries to staff on a card, Dt 76.05 Kt 51.01, Bank statement, letter for refund.

Example of filling out a chess sheet

During the current period the following transactions were performed:

- Payment received from the buyer (D51 K62) – 20,000

- The sale of goods to the buyer was made (D62 K41) – 15000

- Wages transferred to employees (D70 K51) - 5000

In work, a larger number of accounts are used, so this statement is rarely filled out manually, but it is convenient when using 1C.

Existing subaccounts

There are no official sub-accounts for 51 items. In accounting software like 1C: Enterprise or 1C: Accounting, you can create your own sub-accounts and even accounts. This is often used, but mistakes also happen often. By adding 51.01, 51.02 and other subaccounts, you can find that the ending balance for Debit and Credit will be the same at the end of one month, and then will be different.

Many people are accustomed to adding subaccounts to simplify work or to separate costs and profits for different types of activities. In new versions of 1C: Accounting 8, adding subaccounts may not end in the best way.

Important! Problems especially often appear at the end of the month, when it needs to be closed. The amounts in the subaccounts simply freeze, which requires additional modifications and procedures for closing the month.

The desire to add your own subaccounts and accounts in new versions of 1C may end badly

Closing procedure

At the end of the month, the sales result is formed.

A balance is calculated for each individual subaccount. The financial result is displayed using account 90.9 and debited to account 99. Profit is displayed - Dt. 90.9 Kt. 99.1, and loss - Dt. 99.1 Kt. 90.9.

At the end of the month, each subaccount 90 has a balance, except for synthetic ones. At the end of the year the account is closed. 90.x to 90.9. Debit accounts - Dt. 90.9 Kt. 90.x. Credit - Dt. 90.x Kt. 90.9.

At the end of the year, the balance will be reset to zero, and the new year will start at 0.

Correspondence with other accounts

Register 51 corresponds with other accounts for Debit and Credit. List of interactions by Debit:

- 50 - Cash desk;

- 51 — Settlement registers;

- 52 — Currency registers;

- 55 – Special bank accounts;

- 57 — Transfers on the way;

- 58 - Financial investments;

- 60 — Settlements with suppliers and contractors;

- 62 — Settlements with buyers and customers;

- 66 — Calculations for short-term loans and borrowings;

- 67 — Calculations for long-term loans and borrowings;

- 68 — Calculations for taxes and fees;

- 69 — Calculations for social insurance and security;

- 71 - Settlements with accountable persons;

- 73 — Settlements with personnel for other operations;

- 75 — Settlements with founders;

- 76 - Settlements with various debtors and creditors;

- 79 — On-farm calculations;

- 80 — Authorized capital;

- 86 - Targeted financing;

- 90 - Sales;

- 91 — Other income and expenses;

- 98 - Deferred income;

- 99 - Profits and losses.

The current account position corresponds with a large number of other accounting positions for debit and credit.

Correspondence regarding the Loan occurs with:

- 04 - Intangible assets;

- 50 - Cashier;

- 51 — Current accounts;

- 52 — Foreign currency accounts;

- 55 – Special bank accounts;

- 57 — Transfers on the way;

- 58 — Financial investments;

- 60 — Settlements with suppliers and contractors;

- 62 — Settlements with buyers and customers;

- 66 — Settlements on short-term loans and borrowings;

- 67 — Settlements on long-term loans and borrowings;

- 68 – Payment of taxes and fees;

- 69 — Calculations for social insurance and security;

- 70 — Remuneration of personnel;

- 71 — Settlements with accountable persons;

- 73 — Settlements with personnel for other operations;

- 75 — Settlements with founders;

- 76 – Payment to various debtors and creditors;

- 79 — Intra-economic calculations;

- 80 — Authorized capital;

- 81 — Own shares (shares);

- 84 — Retained earnings (uncovered loss);

- 96 — Reserves for future expenses;

- 99 - Profit and loss.

Register analysis table for the accounting period in the 1C: Accounting program

Accounting entries

The main item of transactions that can be carried out under 51 items are settlements with counterparties, who are suppliers of goods or raw materials, customers when performing services, and buyers. All these actions are carried out in accordance with previously concluded agreements. Typical transactions for such operations are as follows:

- Debit 51 Credit 62 - Receipt of funds from customers for goods or services (both as an advance payment and as a full final payment);

- Debit 51 Credit 60 - Returns by suppliers of goods or services before they are paid for;

- Debit 51 Credit 43 - Receipt of money for the provision of goods transportation services;

- Debit 51 Credit 76 - Receipt of money under concluded agreements with counterparties;

- Debit 60 Credit 51 - Payment to suppliers or contractors for services, goods or work rendered, both in the form of an advance payment and in the form of final payment;

- Debit 62 Credit 51 - Return to customers or buyers of funds that were credited by mistake earlier;

- Debit 76 Credit 51 - Accrual of money to other organizations and persons for other types of transactions;

- Debit 51 Credit 90 - Receiving revenue from the sale of products or performance of work (rendering services);

- Debit 51 Credit 91 - Receiving income from sales and other disposals, as well as reflecting non-operating income.

Important! Account assignments about changes in the state of accounted objects, described above, are not comprehensive for 51 registers, since it corresponds with a large number of positions, both for Debit and Credit. More wiring can be done.

Form of the Turnover balance sheet for 51 registers

Net figures

Cleared turnover on the current account is:

- an indicator of the financial well-being and performance of the enterprise;

- a word from accounting slang that is not used either in legislation or in contracts.

Without delving into terminology and financial intricacies, we can assume that turnover on the account is an indicator of activity, and net turnover is an indicator of the success of the enterprise. For this reason, the last category is actively used:

- auditors to analyze the work of the institution;

- bodies of the Federal Tax Service for the purpose of control over the payment of taxes;

- banks to establish the applicant’s solvency when receiving a loan.

Account turnover is defined as the difference between receipts and expenses for the period of interest to the analyst (from one day to several years). In turn, when calculating cleared turnover, not all receipts are taken into account, but only those that are directly related to operational business activities. Not subject to accounting:

- receipts to the account of any borrowed funds: loans, financial assistance, both repayable and non-repayable;

- proceeds from the sale of shares, bills and other proprietary securities;

- return of erroneously transferred money;

- replenishment of current accounts from accounts opened by the company in other financial institutions.

Net turnover on an organization’s current account reflects its gross income and allows you to:

- carry out an in-depth analysis of economic activities;

- compare reported data on revenues from sales of goods with actual revenue;

- establish the segment occupied by a business entity in a specific market.

Requirements for providing an overdraft

This indicator is important for providing an overdraft. Regarding it, most banks put forward the following requirements:

- the account has been open and active for 3 months or more;

- the overdraft amount is less than or equal to 30% of the cleared average monthly debit turnover on the current account for the last 3 months;

- The financial position of the owner of the settlement is no worse than average.

Account Analysis

The analytics process involves deciphering the turnover and balance in the context of financial institutions for all of the accounts opened with them. Most often, in accounting and accounting systems, analytical accounting for 51 accounts is organized in the form of the following reports:

- The balance sheet for this register;

- Account Analysis 51;

- Account card 51.

Thanks to the formation of these documents, it is possible to control the movement of material assets at least every day and realize the possibilities for disposing of assets within the framework of the final balance. The analysis represents the correct formation of the balance at the end of the reporting period of any length. To calculate the balance, you need to add up the opening balance and debit turnover, and then subtract from this the total volume of cash movements on the loan in a given reporting period.

The balance sheet of register 51 is the balance for this register, which is displayed at the end of the month to close it. It should contain the beginning and ending balances, the total amounts of turnover for Dt and Kt. Also, SALT 51 is formed on the basis of a section of subaccounts.

Sample analysis card for 51 accounts, which is filled in automatically

Thus, 51 accounting registers are an accounting position that summarizes data on settlements of a legal entity with counterparties, customers and employees. It reflects the receipt of money into the organization’s accounts under Debit and its write-off under Credit. To analyze it, there is a card and OSV 51, which can provide the necessary data on a monthly basis.

https://www.youtube.com/watch?v=h5Q2PfrU45k

The essence of SALT

The balance sheet is a report on the main performance indicators of the company. It generates data on movements in the enterprise, grouped by accounting accounts and sub-accounts for any arbitrarily selected period. As a rule, a complete accounting statement is created before closing the year to form a balance sheet. Purpose and main goals of creating a balance sheet

- Analysis of the financial and economic activities of the enterprise for making timely management decisions.

- Checking the double entry method (all transactions in accounting are reflected in the debit of one account and the credit of another in the same amount). Example: Payment of VAT is reflected in debit 68 of account and credit 51.

- Identifying arithmetic errors and inaccuracies.

- Control over the correct distribution of amounts between accounting accounts.