General concept of inseparable improvements

Inseparable improvements can be considered those changes or transformations of an object that directly improve its capabilities, both functional and technical, but are at the same time inseparable from this object. For example, let’s take rented premises for a company office. Often the company has to invest additional funds in it. For reconstruction, modernization and other improvements. At the same time, when changing office premises, we can take these improvements with us without causing harm to the object.

However, the main question remains: what is the difference between these improvements and ordinary routine repairs? The legislation provides clarification on this matter. Current repairs, as a rule, are necessary to maintain the facility in working condition, and work on modernization, technical re-equipment, and completion of the facility are considered inseparable.

Results

Important points when accounting for OS modernization are the separation of the concepts of “repair” and “modernization” and the organization of convenient analytical accounting. It is also necessary to take into account the differences in accounting and tax accounting for the modernization of fixed assets, which will require the accountant to take action to ensure the correct reflection of temporary differences.

Read more about all the nuances of fixed asset accounting in this article.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

- Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax accounting of inseparable improvements

In cases where all improvements are carried out after agreement with the lessor, and all costs incurred for their creation are not reimbursed, the lessee can charge depreciation. To correctly determine depreciation rates, you can be guided by both the useful life of the leased property and the useful life of improvements. If even at the end of the lease period there remains an unamortized portion of the capital investment, it in any case cannot be taken into account in calculating income tax. This follows from the Tax Code of the Russian Federation, paragraph 16, article 270.

In the case where inseparable improvements are carried out with the consent of the lessor, but with reimbursement of costs, when the property is returned back, the tenant receives income. The tenant can reduce the amount of this income by the amount of expenses that were made for these improvements.

All costs of capital investments, namely inseparable improvements that are made by the tenant to the leased property, are included in the tax base when calculating income tax. Clause 1 of Article 374 of the Tax Code of the Russian Federation states that these costs are included on a general basis. On the date of return of the asset and inseparable improvements to the lessor, the lessee becomes obligated to charge VAT. This obligation arises on the basis that the gratuitous transfer of goods (works or services) is recognized as a sale.

Categories

Tenants of premises, be it offices or industrial space, often have to invest their own funds to bring the property to a condition in which it can be used for its intended purpose. After all, each tenant has his own opinion on what an office, retail space or production space should look like. And here not only the location and footage are important, but also the layout and decoration of the room. Therefore, in practice, tenants often make improvements to the leased property. Planning and accounting for such costs is a difficult area of work for specialists in the economic and financial services of an enterprise.

What amounts of improvement can the tenant take into account as a lump sum in current expenses, and which should be taken into account separately as part of fixed assets? Is it possible to distribute improvement costs systematically over the duration of the contract? Which improvements must the tenant transfer to the owner, and which can he keep for himself? The answers to these and other questions are in this article.

Under a lease agreement, the tenant receives property from the lessor for a fee for temporary possession and use or for temporary use (Article 606 of the Civil Code of the Russian Federation; hereinafter referred to as the Civil Code of the Russian Federation).

The tenant is obliged to promptly pay fees for the use of the property (rent). The procedure, conditions and terms for paying rent are determined by the lease agreement (Clause 1, Article 614 of the Civil Code of the Russian Federation).

Functions of a security deposit when receiving property for rent

The lease agreement may provide that the proper fulfillment of the tenant's financial obligations is ensured by a bank guarantee, a deposit, retention of the debtor's property, a guarantee and other methods provided for by law or agreement (clause 1 of Article 329 of the Civil Code of the Russian Federation).

Payment of a security deposit by the tenant is one of the ways to ensure the fulfillment of obligations under the lease agreement.

Security measures in the form of a guarantee deposit or deposit are not considered an expense for the transferring party and income for the receiving party, since, according to clause 32 of Art. 270 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when determining the tax base, expenses in the form of property or property rights transferred as collateral or a deposit are not taken into account.

This is explained by the fact that initially the guarantee deposit (security deposit) is only in the nature of certifying the party’s intention to complete the transaction. After the contract begins to be performed, the deposit acquires a payment function, and only if the obligations under the contract are violated, the function of the deposit becomes security. If the tenant properly fulfills his obligations under the contract, the security deposit or deposit is usually returned at the end of the lease agreement.

The lease agreement may provide that the tenant pays a security deposit, which is counted towards the fulfillment of obligations to pay rent for a specific month of lease of the property (for the last month, for the last two months of the lease term, etc.) (clause 1 of Art. 329, Article 421 of the Civil Code of the Russian Federation).

The wording of the agreement in this case may be as follows: “The tenant pays a security deposit in the amount of ___________ by ___. The security payment is counted toward the rent for the __________ month of the lease agreement.”

Thus, umma of the security deposit, counted against future rent, performs both security and payment functions . In this case, the security payment is considered as an advance payment (advance payment) under the contract. For example, an organization entered into a lease agreement for industrial premises for a period of one year from 04/01/2014. According to the terms of the agreement, the tenant, until April 10, 2014, transfers a security payment in the amount of the monthly rent - 35,400 rubles, including VAT of 5,400 rubles. This amount will be credited by the landlord towards the rental payment for the last month of renting the premises.

It must be taken into account that when transferring the security payment, the tenant faces certain tax consequences.

When the lessor transfers property to the lessee, the ownership of this property does not pass to the lessee; therefore, such a transfer of property by the lessor and its return by the lessee is not a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Accordingly, upon receipt and return of leased property, no consequences arise in the tax accounting of the tenant.

The amount of the transferred security payment, counted against future rent, is, in fact, an advance payment (advance payment). Consequently, when transferring a security payment when applying the accrual method, the expense is not recognized in tax accounting (clause 14 of Article 270 of the Tax Code of the Russian Federation).

The above equally applies to organizations that apply special taxation regimes, for example, in the form of a simplified taxation system (STS; the object of taxation is “income minus expenses”).

Thus, when using the cash method under the simplified tax system, payment is one of the conditions for recognizing an expense. In this case, payment is recognized as the termination of the tenant’s counter-obligation to the landlord for rent (clause 3 of Article 273 of the Tax Code of the Russian Federation). As of the date of transfer of the security payment, there is no counter-obligation of the lessor to the lessee. Therefore, when transferring a security payment using the cash method, an expense also does not arise in tax accounting.

What is taken into account “off the balance sheet”?

In accordance with paragraph 3 of Art. 607 of the Civil Code of the Russian Federation, the lease agreement must contain data that makes it possible to definitely establish the property to be transferred to the lessee as the object of lease. In the absence of this data in the contract, the condition regarding the object to be leased is considered not agreed upon by the parties, and the corresponding contract is not considered concluded.

An object of fixed assets received by an organization under a lease agreement is accounted for on off-balance sheet account 001 “Leased fixed assets” in the valuation agreed upon by the parties and specified in the lease agreement (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31 .2000 No. 94n (as amended on November 8, 2010)).

Let's assume that the rental property is valued at 1 million rubles. The following entries will be reflected in the accounting records (Table 1).

| Table 1. Accounting for the leased asset in accounting | |||

| Debit | Credit | Amount, rub. | Contents of operation |

| When receiving property for rent | |||

| 001-a | 1 000 000 | The leased object - industrial premises - was accepted for off-balance sheet accounting. | |

| When paying a security deposit | |||

| 76-o | 51 | 30 000 | The security deposit was transferred to the lessor under the lease agreement |

| When the security deposit is applied to the payment of rent | |||

| 20 (26, 44) | 76-o | Current rental payment according to the terms of the agreement | Expenses for the last month of rent are recognized |

Thus, the amount of the security payment transferred by the tenant is not recognized as an expense and is reflected in accounts receivable.

Only upon the arrival of the final reporting period can the tenant offset this security payment against payment for rental services for the last month. In this case, the lessor's receivables are repaid. For information

According to the explanations of the official bodies, in order to document expenses in the form of monthly rent, the signing (execution) of acts on the provision of services under a lease agreement is not required (letter of the Ministry of Finance of Russia dated December 13, 2012 No. 03-11-06/2/145, dated December 1. 2011 No. 03-03-06/1/791, dated November 16, 2011 No. 03-03-06/1/763, letter from the Federal Tax Service of Russia for Moscow dated October 17, 2011 No. 16-15/ [email protected] , dated March 26 .2007 No. 20-12/027737).

Separable and inseparable improvements to property

Improvement of leased property means a change in quality characteristics and, as a rule, a change in the value of the leased property.

Capital investments in the form of improvements must be distinguished from the cost to the tenant of maintaining the leased property in working order. The latter includes all types of repairs and maintenance of leased property.

Thus, in each specific case it is necessary to determine what exactly the tenant has done - repairs of fixed assets or improvements to the leased property. It follows from the norms of civil legislation that repairs of leased property (both current and capital) do not apply to work to improve it. Improvements are new additional properties of property, without which it existed and could be used for its intended purpose. Repair cannot be considered an improvement, since its main goal is to maintain (restore) property in working condition (Articles 616, 623 of the Civil Code of the Russian Federation, clause 3.1 of the Regulations on carrying out scheduled preventative repairs of industrial buildings and structures, approved by the Decree of the USSR State Construction Committee dated December 29. 1973 No. 279). This conclusion is applicable for the purposes of both accounting and taxation (clause 1 of Article 11 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 18, 2009 No. 03-03-06/1/762, dated February 25, 2009 No. 03-03-06 /1/87).

All improvements to leased property are divided into two types - separable and inseparable (Article 623 of the Civil Code of the Russian Federation; distinctive features are shown in the figure). Depending on this, their owner is determined.

As a general rule, separable improvements belong to the tenant. But the agreement may stipulate that they become the property of the lessor (clause 1 of Article 623 of the Civil Code of the Russian Federation). As a rule, the lessor is recognized as the owner of inseparable improvements (with the exception of a special situation when the lessor does not agree and does not accept the improvements made).

Note!

The party on whose balance sheet inseparable improvements are taken into account will be the payer of property tax (clause 1 of Article 374 of the Tax Code of the Russian Federation).

| Leasehold improvements | |

| ↓ | ↓ |

| Separable | Inseparable |

| ↓ | ↓ |

|

|

| ↓ | ↓ |

| movable partitions, hanging air conditioners, removable video surveillance system equipment, a collapsible podium in the exhibition hall and other improvements, if their dismantling does not cause damage to the rented property, etc. | construction of an extension to the building, installation of a fire alarm, ventilation system, redevelopment of premises, finishing work, if they are firmly connected with the leased property and their dismantling leads to its negative changes, etc. |

The owner’s consent may not be obtained if the tenant makes separable improvements (Clause 1 of Article 623 of the Civil Code of the Russian Federation).

The owner's consent to permanent improvements must be obtained. This is explained by the fact that the inseparable improvements made by the tenant to the leased property are the property of the lessor, which he will have to transfer at some point in time.

Tax accounting of separable improvements

To correctly calculate and pay income tax, it is necessary to know the cost and useful life of separable improvements.

If the cost of separable improvements does not exceed 40,000 rubles. or their useful life is 12 months or less, such improvements are taken into account as part of inventories, and the costs of their implementation are written off immediately in full when they are put into operation (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation; subparagraph 4, 5 Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n (as amended on December 24, 2010; hereinafter referred to as PBU 6/01).

If the cost of creating improvements exceeds RUB 40,000. and the useful life is more than 12 months, then the cost of such improvements is written off through depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation, clauses 4, 5 of PBU 6/01).

For your information

If the organization’s accounting policy sets a different limit (less than 40,000 rubles), then this limit should be followed when classifying a separable improvement as depreciable property (clauses 4, 5 of PBU 6/01).

property tax on separable improvements that the tenant included as part of fixed assets, since these improvements relate to movable property (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation).

The tenant has the right to deduct “input” VAT on separable improvements based on the results of the tax period in which goods (work, services) are registered and invoices are received from suppliers and contractors (clause 2 of Article 171, clause 1 Article 172 of the Tax Code of the Russian Federation). Of course, if these goods (works, services), property rights are planned to be used for transactions subject to VAT.

If, at the end of the lease period, the lessor agrees to retain the separable improvements made and reimburse their cost, then for the lessee this will be an ordinary sale subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The tax base for the sale can be determined both on the basis of the residual value of the fixed asset, and in the assessment agreed upon by the parties to the transaction - the lessor and the lessee.

Let's look at the tax consequences of two situations using specific examples:

1) separable improvements remain the property of the tenant;

2) the lessor compensates for the costs of creating separable improvements and retains them.

Example 1

In January 2014, the organization installed a video surveillance system in the rented premises. The cost of installing the system (including the cost of its acquisition) amounted to 250,000 rubles.

The lease agreement did not provide for separable improvements; the lessor does not compensate for their cost.

The computer video surveillance system belongs to the second depreciation group (useful life from two to three years) in accordance with the Classification of fixed assets included in depreciation groups (approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (as amended on December 10, 2010; hereinafter — Classification of fixed assets)). The useful life was set at 25 months.

The monthly depreciation amount (using the straight-line method) in this case is:

250,000 rub. / 25 months = 10,000 rub.

Starting from February 2014, the organization’s accountant includes monthly depreciation charges in tax expenses in the amount of 10,000 rubles.

At the end of the lease agreement, the video surveillance system must be dismantled. The costs of dismantling a separable improvement can be taken into account when calculating income tax if the specified object was used in the organization’s activities aimed at generating income (clause 1 of Article 252, subclauses 8, 9, 20 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

______________________

conclusions

As we can see, in the absence of compensation from the landlord, separable improvements are taken into account as part of the tenant’s own property. In this case, when listing (purchasing or creating) separable improvements as a separate item of property, its value is:

- written off by calculating depreciation if the received object can be recognized as depreciable property (clause 1 of Article 256 of the Tax Code of the Russian Federation);

- the entire amount of expenses is included in material costs if the received object does not meet the characteristics of depreciable property.

Example 2

Let's change the conditions of example 1 and assume that the lease agreement initially stipulates that the parties are obligated to compensate the tenant for the cost of installing a video surveillance system (separable improvements) immediately upon completion of the work.

This means that the following entries will be created in the lessor’s accounting:

Debit of account 08 “Investments in non-current assets” Credit of account 60 “Settlements with suppliers and contractors” - 250,000 rubles. — the costs of installing a video surveillance system (separable improvements) are reflected;

Debit of account 76 “Settlements with various debtors and creditors” Credit of account 08 “Investments in non-current assets” - 250,000 rubles. — separable improvements have been transferred to the lessor’s balance sheet (as of the date of transfer of separable improvements on the basis of a document evidencing the transfer of the object, for example, a transfer and acceptance certificate);

Debit of account 76 “Settlements with various debtors and creditors” Credit of account 68, “Calculations for taxes and fees” subaccount “Calculations for VAT” - 45,000 rubles. (RUB 250,000 × 18%) - VAT is charged on the cost of transferred separable improvements;

Debit of account 51 “Settlement accounts” Credit of account 76 “Settlements with various debtors and creditors” - 295,000 rubles. — compensation for the cost of separable improvements was received from the lessor;

Debit of account 68 “Calculations for taxes and fees” sub-account “Calculations for VAT”, Credit of account 51 “Settlement accounts” - 45,000 rubles. — VAT accrued on the cost of the separable improvement is transferred to the budget.

In this case, it is impossible to include the received object in the tenant’s fixed assets, since the asset in question (video surveillance system) under the terms of the agreement is obviously the property of the lessor (clause 35 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n ( as amended on December 24, 2010; hereinafter referred to as “Methodological guidelines for accounting”), paragraph 1 of Article 623 of the Civil Code of the Russian Federation, paragraphs 4 and 5 of PBU 6/01).

_________________________

conclusions

Thus, the tax treatment of separable improvements depends on the following factors:

- the type to which the improvements are classified (fixed assets, materials);

- the method of making improvements (creation in-house, with the help of a contractor);

- conditions for compensation of separable improvements by the lessor (whether they are compensated or not).

Tax accounting of inseparable improvements

As a general rule, the cost of inseparable improvements made by the tenant must be reimbursed to him by the lessor after the end of the lease agreement (Clause 2 of Article 623 of the Civil Code of the Russian Federation). However, the lease agreement may also provide for other rules, in particular, the procedure for reimbursement of such expenses may be changed (for example, they may be counted against rental payments). In addition, the contract may establish that the cost of inseparable improvements is not reimbursed at all.

In this regard, the right to depreciation belongs to the one who bears the burden of expenses for such improvements (paragraphs 4–6, paragraph 1, article 258 of the Tax Code of the Russian Federation). In a situation where the costs were incurred by the tenant and they are not reimbursed by the landlord, depreciation is charged by the tenant of the property (letter of the Ministry of Finance of Russia dated November 24, 2006 No. 07-05-06/285).

If the costs were paid (reimbursed) by the lessor, then he will depreciate the inseparable improvements. At the same time, it is possible to depreciate inseparable improvements to the property that is rented from an individual (letter of the Federal Tax Service of Russia dated August 17, 2009 No. 3-2-13 / [email protected] ).

Let's analyze the most common situations in practice.

Situation 1

The landlord agrees to the improvements and reimburses their cost

In this situation, work to improve the leased property is carried out for the lessor and transferred to him on the day of signing with the lessor an acceptance certificate for the results of work to create inseparable improvements.

The costs of creating inseparable improvements (the cost of purchased materials, contract work performed, services rendered) can be taken into account by the tenant as expenses when calculating income tax, provided they comply with the requirements of clause 1 of Art. 252 of the Tax Code of the Russian Federation.

For your information

Since the expenses were incurred for the lessor, such expenses should be taken into account not as they arise, but on the date of signing the act of acceptance and transfer of the work results to the lessor.

In other words, expenses must be recognized simultaneously with income. The income in this case will be the amount of compensation due to the tenant, which the tenant recognizes as income from sales (Article 249, paragraph 3 of Article 271 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated January 25, 2010 No. 03-03-06/1/19) .

Thus, if the lease agreement (or an additional agreement to it) stipulates that the lessor will compensate for the cost of inseparable improvements, then the tenant should not include them in his own property.

On the date of transfer of the improvement object to the lessor’s balance sheet, the following entries are formed in the accounting records:

Debit of account 76 “Settlements with various debtors and creditors” (60 “Settlements with suppliers”) Credit of account 08 “Investments in non-current assets” - the improvements made were transferred to the lessor’s balance sheet (the cost of inseparable improvements subject to compensation by the lessor was written off);

Debit of account 76 “Settlements with various debtors and creditors” Credit of account 68 “Calculations for taxes and fees” - VAT is charged (clause 35 of the Accounting Guidelines, clause 1 of Article 623 of the Civil Code of the Russian Federation, clauses 4–5 of PBU 6 /01).

Also, the tenant is obliged to charge VAT, since when transferring inseparable improvements to the lessor, the result of the work is realized (letters of the Ministry of Finance of Russia dated 02/25/2013 No. 03-07-05/5259, dated 07/26/2012 No. 03-07-05/29; letter of the Federal Tax Service of Russia dated 12/30/2010 No. KE-37-3/19032).

It does not matter how the tenant improved the property - on his own or with the involvement of contractors.

On the date of transfer of improvements to the landlord, the tenant must:

- charge VAT on their cost at a rate of 18%;

- draw up an invoice in two copies (for yourself and for the lessor (in the case where the lessor reimburses the cost of inseparable improvements)).

Organizations that apply the simplified tax system (the object of taxation is “income minus expenses”) take into account the amount of compensation in income on the date of its receipt from the lessor (to a current account, to the cash desk) or on the date of offset (for example, to pay off arrears of rental payments), and expenses - after payment and acceptance of purchased materials and work performed.

_________________________

In our opinion, the transfer of inseparable improvements, the cost of which is reimbursed by the lessor, can be considered as the sale of other property, since capital investments are depreciable property for the lessor, but not for the lessee (paragraph 5, 6, 8, 9, clause 1, article 258 of the Tax Code RF). Consequently, the organization has the right to reduce income from the sale of other property by the price of its creation (subclause 2, clause 1, article 268 of the Tax Code of the Russian Federation). An essentially similar conclusion is contained in the Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 5, 2008 No. A58-243/07-F02-1738/08, A58-243/07-F02-1765/08.

Situation 2

The landlord agrees to the improvements, but does not reimburse their cost

Inseparable improvements will still have to be transferred to the lessor, but this can be done on the day the leased property is returned to the lessor.

It must be remembered that inseparable improvements are a separate item of fixed assets, its initial cost is equal to the cost of work to create inseparable improvements, and this cost can be taken into account in expenses through depreciation.

Note!

For income tax purposes, permanent improvements can only be depreciated over the term of the lease. And if by the end of the lease agreement there remains an under-depreciated part of the inseparable improvements, it will not be possible to take it into account in the tenant’s expenses when calculating income tax (letter of the Ministry of Finance of Russia dated May 13, 2013 No. 03-03-06/2/16376, dated August 3, 2012 No. 03-03-06/1/384).

In this case, the following must be kept in mind.

Inseparable improvements are depreciated by the lessee organization during the term of the lease agreement based on depreciation amounts calculated taking into account the useful life of capital investments in the specified objects in accordance with the Classification of fixed assets (clause 1 of Article 258 of the Tax Code of the Russian Federation).

The following solutions are possible here. If an inseparable improvement is named in the Classification of fixed assets (for example, a ventilation system, fire alarm), then its useful life can be determined within the depreciation group to which it belongs.

If the inseparable improvement is not listed in the Classification of Fixed Assets, the tenant must be guided by clause 1 of Art. 258 of the Tax Code of the Russian Federation, and paragraph 6 of this article and determine the useful life of an inseparable improvement in accordance with the technical conditions or recommendations of manufacturers (letter of the Ministry of Finance of Russia dated December 7, 2012 No. 03-03-06/1/638). Finally, the lessee may set the useful life of the permanent improvements to be equal to the useful life of the leased asset (for example, the useful life of the leased building).

Since the tenant has the right to charge depreciation only during the term of the lease agreement, part of the cost of inseparable improvements may not be taken into account in expenses when calculating income tax. For example, if the lease is for 35 months and depreciation is written off based on a useful life of 61 months, then when the lease terminates, some of the costs will remain unaccounted for.

It is important!

If the lease agreement is extended (including more than once), then the tenant can amortize the improvements throughout the entire term of the agreement, taking into account the extension (letter of the Ministry of Finance of Russia dated October 25, 2011 No. 03-03-06/1/689).

We recommend

If, at the end of the lease agreement, you decide to continue renting the property, we recommend prolonging the agreement rather than entering into a new one - this is the only way to take into account the cost of inseparable improvements as much as possible. If a new contract is concluded for a new term, it will not be possible to take into account the part of the inseparable improvements that was under-depreciated by the end of the contract period (letters of the Ministry of Finance of Russia dated 02/04/2013 No. 03-03-06/2/2269, dated 04/04/2012 No. 03- 05-05-01/18).

The procedure for calculating VAT is similar to the previous situation, with the only difference being that on the date of transfer of inseparable improvements to the lessor, the invoice is drawn up in one copy - only for yourself.

Example 3

The tenant, with the consent of the landlord, makes capital expenditures in the leased warehouse building. The improvements made (construction of new partitions) are inseparable, but the lessor does not reimburse their cost.

The cost of erecting new partitions, carried out by a contractor, is 283,200 rubles, including VAT - 43,200 rubles. At the end of the lease term (20 months after the implementation of inseparable improvements), the reconstructed building is transferred to the lessor. The documented market value of the inseparable improvements made as of this date is RUB 210,000. The warehouse building belongs to the fourth depreciation group.

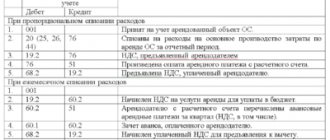

In this situation, inseparable improvements were made with the consent of the lessor, but their cost is not compensated by the lessor. These transactions may be reflected in the lessee's accounting as follows:

Debit of account 08 “Investments in non-current assets” Credit of account 60 “Settlements with suppliers and contractors” - 240,000 rubles. (283,200 rubles - 43,200 rubles) - based on the transfer and acceptance certificate, expenses for the production of inseparable improvements performed by contract are reflected;

Debit of account 19 “Value added tax on purchased assets” Credit of account 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” - 43,200 rubles. — VAT presented by the contractor is reflected (contractor’s invoice);

Debit of account 68 “Calculations for taxes and fees”, sub-account “Calculations for VAT”, Credit of account 19 “Value added tax on purchased assets” - 43,200 rubles. — VAT submitted by the contractor in the presence of an invoice and the corresponding primary documents of the contractor is accepted for deduction;

Debit of account 60 “Settlements with suppliers and contractors” Credit of account 51 “Settlement accounts” - 283,200 rubles. — paid for the work of the contractor;

Debit of account 01 “Fixed assets” Credit of account 08 “Investments in non-current assets” - 240,000 rubles. — inseparable improvements are taken into account as part of fixed assets.

The following entries are made monthly during the rental period:

Debit of account 20 “Main production” (26 “General business expenses”, 44 “Sales expenses”) Credit of account 02 “Depreciation of fixed assets” - 12,000 rubles. (RUB 240,000 / 20 months) - reflects the amount of accrued depreciation.

The return of the leased property to the lessor with inseparable improvements is reflected as follows:

Debit of account 02 “Depreciation of fixed assets” Credit of account 01 “Fixed assets” - 240,000 rubles. (RUB 12,000 × 20 months) - the amount of accrued depreciation is written off;

As a general rule, the residual value of disposed inseparable improvements is recognized as another expense. However, in the situation under consideration, the residual value of inseparable improvements at the date of disposal is zero, therefore, when they are transferred to the lessor, the organization does not recognize other expenses.

VAT accrual is reflected by posting:

Debit of account 91-2 “Other expenses” Credit of account 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” - 37,800 rubles. (RUB 210,000 × 18%) - VAT is charged on the cost of transferred improvements and an invoice is issued.

When calculating income tax, capital investments made by the tenant in the form of inseparable improvements are recognized as depreciable property (Clause 1, Article 256 of the Tax Code of the Russian Federation).

In this case, the leased warehouse building belongs to the fourth depreciation group, therefore the lessee has the right to set the useful life to 61 months. When applying the straight-line method, the monthly depreciation amount for inseparable improvements to the leased warehouse building will be RUB 3,934. ((283,200 rub. - 43,200 rub.) / 61 months), the amount of accrued depreciation until the end of the lease term in tax accounting is 78,680 rub. (RUB 3,934 × 20 months).

The residual value of inseparable improvements is not recognized in the tenant's expenses (Clause 16, Article 270 of the Tax Code of the Russian Federation). VAT amounts accrued upon the transfer of inseparable improvements are also not included in expenses when calculating income tax on the basis of clause 16 of Art. 270 of the Tax Code of the Russian Federation as expenses associated with gratuitous transfer (letter of the Ministry of Finance of Russia dated December 8, 2009 No. 03-03-06/1/792).

In other words, the amount of VAT accrued for payment to the budget when transferring inseparable improvements to the lessor is recognized as another expense in accounting, but in tax accounting, according to clarifications of the Russian Ministry of Finance, is not included in expenses.

__________________________

Situation 3

The lessor agrees to partial reimbursement of the cost of inseparable improvements

In this case, the Ministry of Finance of Russia orders the lessee to include the amount of compensation as part of the income from sales. The tenant can depreciate the unreimbursed cost of capital investments in the general manner (letters from the Ministry of Finance of Russia dated July 30, 2010 No. 03-03-06/2/134, dated January 25, 2010 No. 03-03-06/1/19, dated November 6, 2009 No. 03 -03-06/2/215).

Please note that the tenant has the right to reduce the amount of revenue received as compensation by the cost of expenses incurred in connection with the creation of inseparable improvements. From the point of view of regulatory authorities, the tenant has the right to take into account these expenses as costs associated with performing work for the lessor (letter of the Ministry of Finance of Russia dated December 13, 2012 No. 03-03-06/1/651).

Example 4

The organization, with the consent of the landlord, installed a ventilation system in the premises. It is impossible to dismantle this system without damaging the premises, so it should be considered an inseparable improvement. The cost of installing the ventilation system was 300,000 rubles. By agreement of the parties, the lessor paid compensation in the amount of 200,000 rubles.

In this case, when calculating income tax, the tenant will reflect 200,000 rubles as income from sales. The tenant can also reduce the income from sales by 200,000 rubles.

The unreimbursed cost of capital investments in the amount of RUB 100,000. The lessee will be able to expense it through depreciation over the term of the lease.

________________________

Note!

Only those inseparable improvements that were made with the consent of the lessor can be depreciated (paragraph 5, paragraph 1, article 256 of the Tax Code of the Russian Federation). Otherwise, it is impossible to take into account the costs of them (letter of the Federal Tax Service of Russia for Moscow dated March 24, 2006 No. 20-12/25161).

We recommend

To avoid claims from the tax authorities, we recommend having written confirmation of the landlord’s consent to carry out inseparable improvements. It can be fixed in the main agreement or drawn up as a separate document.

If the landlord agrees to the tenant creating inseparable improvements, the lease agreement or additional agreement to it must indicate:

- what work will be done;

- at whose expense, in whole or in part, inseparable improvements will be made;

- how the costs will be reimbursed - against rent or in another way.

If the tenant does not receive the landlord's consent to create inseparable improvements , then neither one nor the other party will be able to take into account the costs of them for tax purposes. Moreover, the landlord may demand that everything be returned to its original condition (dismantling improvements), which means additional costs for the tenant.

And in conclusion, a few words about who pays property tax if the tenant has made capital expenditures in the form of improvements (separable or inseparable). Obviously, the payer of the property tax will be the one who takes into account the indicated amounts in account 01 “Fixed assets” (clause 1 of Article 374 of the Tax Code of the Russian Federation).

In other words, the procedure for reflecting capital investments as part of fixed assets for the parties to a lease agreement depends on whose ownership they are.

So, if the owner of separable improvements is a tenant, he accounts for them in his account 01 immediately after putting them into operation and from that moment pays property tax.

If the owner is a lessor, then the lessee takes into account the separable improvement as part of its fixed assets until the moment when, in accordance with the lease agreement, it transfers capital investments to the lessor. Until this moment, the property tax is paid by the tenant, after that - by the landlord.

The question of who should pay tax on permanent improvements is more complex. The provisions of the Civil Code of the Russian Federation do not determine who is the owner of inseparable improvements (Article 623 of the Civil Code of the Russian Federation). This means that according to civil law, the tenant and the landlord themselves have the right to determine their fate.

This situation is explained by the Ministry of Finance of Russia (letters dated December 27, 2012 No. 03-05-05-01/80, dated November 3, 2010 No. 03-05-05-01/48). Experts from the financial department indicate that the tax payer is the tenant if, until the disposal of inseparable improvements, he takes them into account on his balance sheet. Let us note that by disposal, Ministry of Finance specialists mean the end of the lease agreement or reimbursement by the lessor of the cost of improvements made, except in the case where reimbursement is made by reducing the rent.

This position is shared by the judges of the Supreme Arbitration Court of the Russian Federation (Decision No. 16291/11 dated January 27, 2012, upheld by the Ruling of the Supreme Arbitration Court of the Russian Federation dated March 26, 2012 No. VAS-2715/12). Similar conclusions are found in the decisions of lower courts (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 16, 2013 No. F05-15687/2013).

Thus, the party on whose balance sheet they are taken into account must pay property tax on the cost of inseparable improvements. If from the moment the improvements are put into operation until they are transferred to the lessor, the balance holder is the lessee, then, accordingly, he is the taxpayer.

Depreciation of permanent improvements

All inseparable improvements that the tenant carries out in agreement with the landlord can be considered depreciable. And in cases where the costs of these improvements are not reimbursable by the lessor, the lessee can independently write off the costs by charging depreciation.

In this case, the tenant determines the useful life of the improvements themselves, and not the property. This period may differ from the one accepted by the lessor; at the same time, it must comply with the OS classifier. Depreciation of inseparable improvements occurs in the general manner, from the 1st day of the month following the month of acceptance of this object for accounting until the last day of the month of full repayment of the cost of this object.

Depreciation of permanent improvements, like any expense, must be documented.

These are standard documents that justify the economic feasibility and calculation of depreciation. The actual receipt of this property and its direct use must also be documented. That is, the following documents must be present:

- lease agreement (or sublease);

- act of transfer of leased assets;

- payment documents that can confirm the fact of payment for the rented property.

So that capital investments in fixed assets (improvements) can be recognized as depreciable property, and depreciation can be taken into account for tax purposes:

- these improvements must be made only with the consent of the landlord;

- the tenant is not compensated for the cost of improvements.

These two conditions must be stated in the lease agreement. The calculation of depreciation of investments in fixed assets (inseparable improvements) is used in the same way as companies use to calculate the depreciation of their own fixed assets. Straight-line depreciation is calculated using the following formula:

A=C*K/12, where

- A – depreciation charges per month;

- C – initial cost;

- K – annual depreciation rate.

Formula for calculating the annual depreciation rate:

Н=1/n*100%, where

- n – useful life of inseparable improvements.

Let us remind you once again that the tenant can set the useful life independently, but taking into account the classifier of fixed assets, which distinguishes several depreciation groups. Calculation of depreciation of improvements in a non-linear way can be done in the same way as if depreciation of fixed assets was calculated, taking into account depreciation groups.

Accounting

The accounting procedure for inseparable improvements received on the lessor’s balance sheet depends on two factors:

- the procedure for accounting for inseparable improvements (as an independent property or as a capital investment in a leased property);

- conditions for the improvements (are they compensated to the tenant or not).

If the lessor has decided to take into account inseparable improvements as an independent piece of property, include it in fixed assets (clause 4 of PBU 6/01, paragraph 2 of clause 42 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

At the same time, if the cost of the work performed is compensated to the tenant, make an entry in the accounting:

Debit 08 Credit 76 (60) – reflects the improvements made by the tenant to the leased property, received on the balance sheet of the lessor on the basis of the act.

If the lessor does not compensate the lessee for the cost of the work performed, reflect the following in your accounting:

Debit 08 Credit 98-2 - reflects improvements made by the tenant to the leased property, received free of charge by the lessor.

This procedure is confirmed by the Instructions for the chart of accounts (accounts 08 and 98-2).

The receipt of an inseparable improvement in the form of a separate fixed asset item on the balance sheet is formalized by an act. For example, according to form No. OS-1 (or form No. OS-1a, form No. OS-1b), approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7. In addition, a separate inventory card must be opened for the new fixed asset, for example , according to form No. OS-6. For more information on preparing primary documents, see How to manage document flow in accounting.

Repay the cost of inseparable improvements in the form of separate fixed assets by calculating depreciation (clause 17 of PBU 6/01).

An example of how inseparable improvements carried out by the tenant with his consent are reflected in the lessor's accounting. Inseparable improvements are taken into account as an independent fixed asset. Improvements are compensated to the tenant

One of the activities of Alpha LLC is the rental of fixed assets. In January, Alpha rented out production space.

In March, the tenant, with the consent of the landlord, replaced the ventilation system in the premises with a newer one. This system cannot be dismantled without damaging the premises, so it should be considered an integral improvement. The cost of replacement was 170,500 rubles.

In accordance with the agreement, inseparable improvements become the property of the lessor on the date of completion of capital work.

Upon completion of the work (in March), Alpha decided to take into account the improvements obtained as a separate fixed asset.

The initial cost of an inseparable improvement in the form of a ventilation system was 170,500 rubles.

The following entries were made in the organization's accounting records.

In March:

Debit 08 Credit 76 – 170,500 rub. – reflects the improvements made by the tenant to the leased property, received on the balance sheet of the lessor;

Debit 19 Credit 76 – 30,690 rub. (RUB 170,500 × 18%) – reflects the input VAT charged by the tenant on the cost of inseparable improvements;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 30,690 rub. – submitted for deduction of input VAT;

Debit 01 Credit 08 – 170,500 rub. – inseparable improvements are taken into account as a separate object of fixed assets;

Debit 76 Credit 51 – 201,190 rub. (RUB 170,500 + RUB 30,690) – the purchased fixed asset item has been paid for.

If the lessor has decided not to take into account inseparable improvements as an independent item of property, then increase the book value of the leased item for the costs associated with their production (for example, as part of the costs of reconstruction or modernization) (clause 27 of PBU 6/01).

If the cost of work performed is compensated to the tenant, make an entry in the accounting:

Debit 08 Credit 76 (60) – inseparable improvements made by the tenant to the leased object are reflected as part of capital investments;

Debit 01 subaccount “Property leased” Credit 08 – the book value of the leased property is increased by the cost of improvements made by the tenant.

If the lessor does not compensate the lessee for the cost of work performed, record the following entries in your accounting:

Debit 08 Credit 98-2 – improvements made free of charge by the tenant are reflected as part of capital investments in the leased object;

Debit 01 Credit 08 – the book value of the leased property was increased by the cost of improvements made free of charge by the tenant.

This procedure is confirmed by the Instructions for the chart of accounts (accounts 08, 01 and 98-2).

Inseparable improvements that relate to the reconstruction or modernization of the leased object, draw up an act, for example, in form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7. In addition, enter data on the reconstruction or modernization of the object into the inventory card . It can be filled out using form No. OS-6.

For more information, see:

- How to manage document flow in accounting;

- How to reflect the reconstruction of fixed assets in accounting;

- How to reflect in accounting the modernization of fixed assets;

- How to reflect the completion (retrofitting) of fixed assets in accounting.

An example of how inseparable improvements carried out by the tenant with his consent are reflected in the lessor's accounting. Inseparable improvements increase the value of the property leased and are compensated to the lessee

One of the activities of Alpha LLC is the rental of fixed assets. In January, Alpha rented out production space.

In March, the tenant, with the consent of the landlord, replaced the ventilation system in the premises with a newer one. This system cannot be dismantled without damaging the premises, so it should be considered an integral improvement. The cost of replacement was 186,000 rubles.

In accordance with the agreement, inseparable improvements become the property of the lessor immediately upon completion of the work. Alpha decided to increase the book value of the premises by the cost of the new system.

The following entries were made in the organization's accounting records.

In March:

Debit 08 Credit 76 – 186,000 rub. – inseparable improvements made by the tenant in the leased object are reflected as part of capital investments;

Debit 19 Credit 76 – 33,480 rub. (RUB 186,000 × 18%) – reflects the input VAT presented by the tenant on the cost of improvements;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 33,480 rub. – submitted for deduction of input VAT;

Debit 01 subaccount “Property leased” Credit 08 – 186,000 rub. – the book value of the premises was increased by the costs associated with the production of inseparable improvements;

Debit 76 Credit 51 – 219,480 rub. (RUB 186,000 + RUB 33,480) – the cost of inseparable improvements was paid to the tenant.

The market value of property received free of charge is recognized as part of other income in account 91-1 as depreciation is calculated.

At the same time, make the following entry in accounting:

Debit 98-2 Credit 91-1 – the market value of property received free of charge is taken into account as other income.

This procedure follows from paragraphs 7, 10.3 of PBU 9/99 and the Instructions for the chart of accounts (accounts 91-1, 98).

For more information about accounting for property received free of charge, see How to reflect the receipt of fixed assets free of charge in accounting.

Answers to common questions

Question No. 1. “Our company and the company from which we rent the OS sign certificates for the provision of these services every month. Are they needed to confirm expenses for improvements to the OS object?”

For your organization, of course, it is better for you to draw up and sign such a document. But to confirm expenses, the tax office does not require this (clause 2, letter of the Federal Tax Service of Russia N02-1-07/81).

Question No. 2. “How to calculate inseparable improvements at original cost?”

Just like you would calculate the primary cost of an OS, that is, you must include the costs of purchase, transportation and installation.

Modernization of depreciated fixed assets

OSes that are already fully depreciated and have a residual value of zero are often upgraded. There is no specific guidance in the regulations on how modernization costs should be taken into account in such a case. So you should proceed similarly to the general principle:

- In accounting, increase the initial cost by the amount of modernization costs. The residual value will be equal to the amount of modernization costs.

- Review the JPI, estimating how much longer the facility will be used, taking into account the work performed.

- Calculate annual depreciation based on new data.

How to take into account the modernization of a fully depreciated operating system in tax accounting, read here .