Input and output VAT Input VAT is the VAT that sellers charge you

Most business entities must submit various reports on their activities to the statistical authorities every year.

Where in 2021 can I download the current form for registering the movement of waybills according to the form?

(5 votes, average rating: 5.00 out of 5) lawyer Labor law Today, almost

If the tax agent does so, then in the situation under consideration there will be sanctions against him for

Accounting for goods in trade A rational system for accounting for goods in conjunction with the efficiency of their sale,

The business transaction “cash withdrawal” can take place in absolutely any organization. In this article we

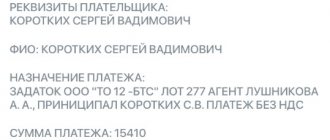

Perhaps almost any company prepares dozens of payment orders every month. Money is transferred to suppliers

You submitted 2-NDFL certificates for all your employees to the inspectorate on time, and the inspection sent

Accounting for ensuring participation in electronic trading In a broad sense, ensuring participation in trading