Accounting for ensuring participation in electronic trading

In a broad sense, ensuring participation in bidding on electronic platforms is not limited only to the security payment as such. The company bears the necessary costs, without which participation in the auction is impossible. They must be reflected correctly in accounting, also guided by the norms of the Tax Code of the Russian Federation.

- Dt 76 Kt 51 - security payment transferred.

- Dt 009 - the amount of security is fixed.

- Dt 51 Kt 76 - security deposit returned.

- Dt 009 - the security amount has been written off.

Accounting for provision of applications for participation in procurement

The organization’s funds on the personal account of the electronic trading platform are accounted for in account 55 “Special accounts in banks” in accordance with the Instructions for using the chart of accounts. Sub-accounts can be opened for account 55 to reflect free and blocked funds. In addition, it is advisable to open sub-accounts for each platform (Roseltorg, Sberbank-AST, RTS, etc.), since each electronic platform opens its own personal account.

If you are unwilling or unable to use your own funds to secure an application, a participant in a competition or closed auction may use a bank guarantee. Under the terms of the bank guarantee, the bank assumes the obligation to secure the participant’s application (Article 368 of the Civil Code of the Russian Federation). If the participant is found to have evaded concluding the contract, the bank, at the request of the customer, will transfer to the latter the amount of the application security. Naturally, the bank’s services for providing a bank guarantee are paid for the procurement participant and are reflected in accounting as part of other expenses in account 91-2.

What should I write in the payment instructions?

In the purpose of payment indicate:

- debtor's name

- lot number

- lot name

- from whom

- period

for example: 9938-OAOF, lot No. 1 car UAZ-36223. From Sergei Korotkikh 01/12/2015 - 01/19/2015

It is better to make payment in advance (3-5 days) so that by the time you submit your application, the money will already be in your account.

Participation in electronic trading and recording in accounting

The provision of a security payment involves stimulating the debtor to fulfill its obligations in a proper manner. In addition, such a payment prevents (reduces) the risk of negative consequences associated with non-fulfillment or improper fulfillment of obligations.

Then, in the month the result is announced, the credit balance on account 76 is written off either as expenses for ordinary activities (accounts 41 “Goods”, 44 “Sales expenses”) (in case of winning), or to the debit of account 91 “Other income and expenses” "(sub-account "Other expenses") (in case of loss).

Bidding: how to take into account the costs of holding or participating

The winning bidder's accounting after signing the contract will depend on what exactly was won. If this is the right to enter into a lease, then you will subsequently record lease transactions. If you win a construction contract, then you will have “construction” transactions.

The fact of bidding, the form in which and when it will be held, what the starting (auction) or maximum (competition) price is, must be announced in an advertisement placed in a newspaper, on television or simply in a visible place, at least than 30 days before the start of trading in clause 2 of Art. 448 Civil Code of the Russian Federation.

Documenting

Receipt of the deposit must be formalized in writing in the form of a deposit agreement (clause 2 of Article 380 of the Civil Code of the Russian Federation). Draw up this document taking into account the requirements for primary accounting documentation. In this case, indicate in it the details of the agreement under which the deposit was received, its amount, as well as the responsibility that the parties must bear for failure to fulfill their obligations under the agreement. This procedure follows from Articles 380, 381 of the Civil Code of the Russian Federation and Article 9 of the Law of December 6, 2011 No. 402-FZ.

Failure to comply with the established procedure may entail recognition of the received deposit as an advance payment received to pay for future deliveries (clause 3 of Article 380 of the Civil Code of the Russian Federation). And this, in turn, may affect the taxation procedure for the amount of the deposit received.

Expenses for participation in open electronic auctions

Note that an electronic signature is a requisite of an electronic document, intended to protect this electronic document from forgery, obtained as a result of cryptographic transformation of information using the private key of an electronic digital signature and allowing to identify the owner of the signature key certificate, as well as to establish the absence of distortion of information in the electronic document ( Article 3 of the Federal Law of January 10, 2021 N 1-FZ “On Electronic Digital Signature”).

Participation in trading transactions

• The Ministry of Finance in its letters dated 12/07/2021 N 03-11-05/317, dated 08/08/2021 N 03-11-11/39673 indicates that the costs of the electronic signature key for bidding, the security payment for the application, the costs associated with information support for bidding, for an electronic digital signature certificate for bidding, cannot be taken into account as part of expenses under the simplified tax system. Since these costs are not included in the list approved by paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, which is closed.

The amount of money contributed by a participant in placing an order to secure an application for participation in the auction (it must be returned by the customer in certain cases specified by law) from an accounting point of view is not an expense of the organization, as follows from clause 2 of PBU 10/99, therefore For this amount, an entry is made Dt 76 Kt51. At the same time, in the context of trading, an entry is made to the off-balance sheet account 009

Trade accounting

Let's consider accounting for transactions involving tendering and participation in them for each of the parties.

Accounting with the auction organizer

The organizer’s accounting largely depends on what the result will be and what exactly is sold at the auction:

- <or> property;

- <or> the right to conclude an agreement (for example, to rent premises).

Depending on this, the organizer will make the following transactions. 3 PBU 9/99 “Income of the organization”, approved. By Order of the Ministry of Finance of Russia dated 06.05.99 No. 32n; pp. 4, 11 PBU 10/99 “Expenses of the organization”, approved. By Order of the Ministry of Finance of Russia dated 05/06/99 No. 33n; Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations, approved. By Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

| Dt | CT | |

| On the date of receipt of the deposit | ||

| Received a deposit for participation in the auction (competition) | 51 “Current accounts” | 76 “Settlements with various debtors and creditors” |

| On the date of preparation for trading | ||

| Goods (work, services) were purchased for further bidding | 91 “Other income and expenses”, subaccount 2 “Other expenses” | 60 “Settlements with suppliers and contractors” or 76 “Settlements with various debtors and creditors” |

| VAT is reflected on purchased goods (works, services) | 19 “VAT on purchased assets” | 60 “Settlements with suppliers and contractors” or 76 “Settlements with various debtors and creditors” |

| Accepted for deduction of VAT on purchased goods (works, services) | 68 “Calculations for taxes and fees” | 19 “VAT on purchased assets” |

| On the date of announcement of auction results, if property was sold at auction | ||

| Deposits returned to losers | 76 “Settlements with various debtors and creditors” | 51 “Current accounts” |

| On the date of signing the contract | ||

| The winner's deposit is taken into account as an advance payment | 76 “Settlements with various debtors and creditors” | 62 “Settlements with buyers and customers” |

| VAT charged on prepayment | 76 “Settlements with various debtors and creditors” | 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” |

If you held a competition for the subsequent conclusion of an agreement under which you would have to supply goods, lease property, etc., then the deposit from the winner will not be considered an advance payment, but a payment for the right to participate in the competition. Then you will need to make a posting: debit account 76 “Settlements with various debtors and creditors” – credit account 60 “Settlements with suppliers and contractors”. In the future, you will have “regular” transactions under the concluded agreement.

Accounting with the bidder

If you yourself participate in the auction, then accounting will largely depend on whether you manage to win it. And also on whether you will purchase or create something to participate in them.

The main transactions and their reflection in accounting will be as follows: Instructions for using the Chart of Accounts.

| Dt | CT | |

| On the date of payment of the deposit | ||

| A deposit has been paid to participate in the auction (competition) | 76 “Settlements with various debtors and creditors” | 51 “Current accounts” |

| In preparation for the auction | ||

| Project creation services purchased if you participate in the competition | 76 “Settlements with various debtors and creditors”, sub-account “Trading” | 60 “Settlements with suppliers and contractors” or 76 “Settlements with various debtors and creditors” |

| VAT reflected on purchased | 60 “Settlements with suppliers and contractors” or 76 “Settlements with various debtors and creditors” | |

| Accepted for deduction of VAT on purchased services (as services are provided and if the necessary primary material is available) | 68, subaccount “VAT calculations” | 19 “VAT on purchased assets” |

| A project has been created to participate in the competition | 76, sub-account “Trading” | 10 “Materials” (41 “Goods”, 43 “Finished products”, 70 “Settlements with personnel for wages”) |

| On the date of announcement of the bidding results, if the bidding is lost | ||

| Returned deposit received | 51 “Current accounts” | 76 “Settlements with various debtors and creditors” |

| Expenses for preparing for bidding have been written off | 91, subaccount 2 “Other expenses” | 76, sub-account “Trading” |

| On the date of announcement of the bidding results, if the bidding is won | ||

| The previously paid deposit is taken into account as an advance payment (payment for participation in the competition) excluding VAT | 60 “Settlements with suppliers and contractors” | 76 “Settlements with various debtors and creditors” |

| VAT charged on prepayment | 19 “VAT on purchased assets” | 76 “Settlements with various debtors and creditors” |

| The costs of preparing for the auction were written off if a fixed asset was purchased* | 08 “Investments in non-current assets” | 76, sub-account “Trading” |

| * If instead of a fixed asset, materials or goods were purchased at the auction, then instead of this posting you will have the following posting: debit of account 10 (41) - credit of account 76, subaccount “Tenders” If, as a result of the auction, you won the right to conclude an agreement (for example, supply of goods, rental of property, etc.), then instead of this posting you will make the following posting: debit of account 91-2 - credit of account 76, subaccount “Trading” | ||

| On the date of signing the contract and receiving the invoice | ||

| Accepted for deduction of VAT on prepayment | 68, subaccount “VAT calculations” | 19 “VAT on purchased assets” |

The winning bidder's accounting after signing the contract will depend on what exactly was won. If this is the right to enter into a lease, then you will subsequently record lease transactions. If you win a construction contract, then you will have “construction” transactions.

***

As we have seen, there are no difficulties in accounting for trades. In addition, selling or purchasing property at auction is a sure way to avoid questions from inspectors regarding the transaction price. After all, check it for “marketability” Art. 40 of the Tax Code of the Russian Federation is already useless - the price was formed as a result of trading, in competition.

Other articles from the magazine "MAIN BOOK" on the topic "Expenses":

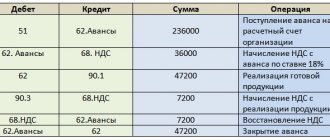

Accounting entries for participation in electronic trading

! Please note: a bank guarantee issued as security for participation in the procurement must comply with the requirements established by Art. 45 of Law No. 44-FZ. The bank that provided the guarantee must be included in the approved list, which can be found on the website of the Ministry of Finance of the Russian Federation.

• At the same time, there is a Resolution of the AS SZO dated 10.08.2021 in case No. A13-9590/2021 with a completely opposite opinion, according to which all costs, including ensuring participation in auctions, purchasing digital signatures for bidding for individual entrepreneurs and organizations can be accepted for tax accounting. In this case, the court refers to paragraphs. 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation, which allows simplifiers to reduce income by the amount of material costs determined in accordance with the provisions of Art. 254 Tax Code of the Russian Federation.

Legal basis for changes

In accordance with Part 18 of Art. 44 of the Federal Law of 04/05/2013 No. 44-FZ (hereinafter referred to as Law No. 44-FZ), the application can be secured by:

- blocking funds in a special account of the procurement participant;

- provision of a bank guarantee.

At the same time, there is no possibility of securing applications by providing a bank guarantee until July 1, 2019 (Part 52, Article 112 of Law No. 44-FZ).

The list of banks in which special accounts can be opened to secure applications was approved by Order of the Government of the Russian Federation dated July 13, 2018 No. 1451-r.

We also note that according to Letter No. 24-03-07/60842 of the Ministry of Finance of Russia dated August 27, 2018, the obligation of budgetary institutions to provide security for procurement applications may be excluded in the future.

How to take into account payment for participation in electronic trading under the simplified tax system

Expert recommendation For profit tax purposes, the economic feasibility of expenses for participation in tenders is obvious not only to entrepreneurs, but also to tax authorities. Therefore, they recognize that, regardless of the results, the organization’s expenses associated with participation in competitive bidding that are lost can be recognized for profit tax purposes as part of non-operating expenses if they are incurred in connection with the fulfillment of the requirements imposed by the bidding organizers on the bidding participants, and are not returned to them if they lose. In the event that the auction organizers return the amounts paid by the bidders for participation in the tender, such amounts from the participant are included in non-operating income (Letters of the Ministry of Finance of Russia dated January 16, 2021 N 03-03-06/1/7, dated November 7, 2021 N 03- 11-04/2/109, dated 10/31/2021 N 03-03-02/121).

However, this position is relevant only for income tax payers. For organizations using the simplified tax system, the tax authorities refuse to take into account these expenses, due to the fact that the list of expenses taken into account when calculating the tax base for the tax paid under the simplified tax system is presented in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation and is closed, and this type of expenses, such as expenses associated with participation in auctions, is not provided for by current legislation. This opinion is presented, in particular, in Letters of the Ministry of Finance dated 07/02/2021 N 03-11-04/2/173 and dated 05/13/2021 N 03-11-06/2/85.

We calculate taxes

We have summarized the costs of the organizer and bidders in a table.

| Operation | At the auction organizer | From bidders | ||

| VAT | Income tax | VAT | Income tax | |

| Participants paid a deposit to participate in the auction | Not subject to sub. 2 p. 1 art. 167 Tax Code of the Russian Federation; Resolution of the FAS VSO dated December 16, 2004 No. A33-9886/04-S3-F02-5196/04-S1; FAS MO dated May 23, 2006 No. KA-A40/4283-06; FAS UO dated December 1, 2005 No. Ф09-5394/05-С2 | Is not income m subp. 2 p. 1 art. 251 Tax Code of the Russian Federation | Not taken into account | It is not an expense under paragraph 32 of Art. 270 Tax Code of the Russian Federation |

| Losing bidders will have their deposit returned after the bidding results are announced. | Not taken into account | Is not an expense m art. 252 Tax Code of the Russian Federation | Is not a subject to a tax | Is not income m Art. 41 Tax Code of the Russian Federation |

| The deposit from the winning bidder is credited after the results are announced | It becomes an advance payment, clause 1 of Art. 167 Tax Code of the Russian Federation; Resolutions of the Federal Antimonopoly Service dated January 25, 2011 No. A65-7593/2010, dated May 14, 2010 No. A55-11869/2009; FAS UO dated December 1, 2005 No. Ф09-5394/05-С2 or, if the right to conclude a contract was exercised at the auction, by payment for participation in the competition. Then he is subject to payment of income tax from clause 1 of Art. 167 Tax Code of the Russian Federation | Is not income m subp. 1 clause 1 art. 251 Tax Code of the Russian Federation. If the right to conclude a contract was sold at the auction, payment for participation in the competition relates to non-operating income under Art. 250 Tax Code of the Russian Federation | You can deduct VAT from a deposit that has become an advance payment (payment for participation in a competition), if there is an invoice, payment slips and an agreement with the condition that the deposit is counted as an advance payment (payment) clause 12 of Art. 171, paragraphs. 1, 9 tbsp. 172 Tax Code of the Russian Federation | Is not an expense m art. 252, paragraph 1, art. 272 Tax Code of the Russian Federation. If the right to conclude an agreement was exercised at the auction, payment for participation in the competition is classified as non-operating expenses (m subp. 20 clause 1 art. 265 Tax Code of the Russian Federation |

| Costs incurred for preparation of tenders | VAT on expenses is deductible if there is an invoice and all other conditions of clause 1 of Art. 172 Tax Code of the Russian Federation | Refers to other expenses depending on their type and sub. 10, sub. 15, sub. 25, sub. 41, sub. 49 clause 1 art. 264 Tax Code of the Russian Federation | VAT on expenses is deductible if there is an invoice and all other conditions of clause 1 of Art. 172 Tax Code of the Russian Federation | For the losers - refer to non-operating expenses and sub-clause. 20 clause 1 art. 265 Tax Code of the Russian Federation. For the winner, the value of the property purchased at the auction is determined x clause 1 of Art. 254, paragraph 1, art. 257 Tax Code of the Russian Federation |

Payment for winning the auction under 44-FZ

In 2021, many changes were made to Federal Law 44, which also affected payment by potential suppliers for their participation in the tender. This is how clause 4 of Article 24.1 appeared in it, according to which ETPs acquire the right to set fees for companies’ participation in procurement. The resolution specifies the maximum possible amount of such remuneration; exceeding it is not allowed.

In situations where the contract will be concluded with the participant who took second place according to the results of the procurement procedure, the site operator does not have the right to charge him a fee. This is indicated by paragraph 3 of resolution No. 564.

How to take into account the costs of an auction, including digital signature for state bidding

• The Ministry of Finance in its letters dated 12/07/2021 N 03-11-05/317, dated 08/08/2021 N 03-11-11/39673 indicates that the costs of the electronic signature key for bidding, the security payment for the application, the costs associated with information support for bidding, for an electronic digital signature certificate for bidding, cannot be taken into account as part of expenses under the simplified tax system. Since these costs are not included in the list approved by paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, which is closed.

All of these expenses are taken into account when calculating income tax (Letter of the Ministry of Finance of the Russian Federation dated January 16, 2021 N 03-03-06/1/7). At the same time, they are accepted as expenses at a time, and therefore a deferred tax liability arises in relation to the amount of security under the contract.

Topic: Postings for provision in competitions

We mainly do repairs and maintenance. We mainly use 20 counts. Can it be transferred to it? Money was withdrawn from the additional account for signing the contract. (AST Sberbank - 3000.00). If I understand correctly, then should I attribute their act to the 20th count? Thanks for understanding.

Dt 55 - Kt 51 ... 100000 :: money transferred to the electronic platform Dt 76 - Kt 55 ... 60000 :: part of the money was reserved as a security payment to the customer (deposit) Dt 91 - Kt 55 ... 3000 :: commission for the electronic platform was removed

Postings to secure the contract

Further, regardless of whether the participant lost or won the tender, according to the rules established by Federal Law No. 44, the customer is obliged to return the funds of the financial collateral within the prescribed period. And here, again, we are faced with the fact that this receipt cannot be considered the income of the enterprise, because it is simply a return of the security deposit. Therefore, the posting must be appropriate, the reverse of what was made earlier when making a deposit - D 51 K 76 of the subaccount “Settlements for the transferred deposit” (return of the deposit payment).

At first glance, in addition to the labor resources required to carry out accounting entries, the participating organization does not lose anything - the same funds that were deposited as direct collateral are returned back after some time. But we should not forget that high inflation rates daily eat up finances that are frozen and not working in deposit accounts. From this point of view, losses can be quite obvious, especially if we talk about large government contracts with large sums.

Accounting: failure to fulfill an obligation due to a deposit

Failure to fulfill the contract through the fault of the counterparty who issued the deposit entails the following consequences:

- the received deposit remains with the organization;

- the counterparty who issued the deposit is obliged to compensate the organization for any losses incurred by it, offset by the amount of the deposit (unless otherwise provided by the agreement). In this case, losses are compensated only to the extent that exceeds the previously transferred deposit amount.

This conclusion follows from the provisions of paragraph 2 of Article 381 of the Civil Code of the Russian Federation.

Reflect the amounts due as part of other income on the date of refusal to fulfill obligations under the agreement (clause 7, 10.2, 16 PBU 9/99). If the organization has not incurred losses, make the following entry:

Debit 62 (76) subaccount “Settlements on deposits received” Credit 91-1 - income is reflected in the amount of the deposit received.

If the amount of losses compensated in connection with non-fulfillment of obligations under the contract exceeds the amount of the deposit received earlier, then the amount of income will be equal to the amount of losses compensated in connection with non-fulfillment of obligations under the contract.

If the amount of losses does not exceed the amount of the deposit, then the amount of income will be equal to the amount of the deposit received to fulfill the obligations under the contract.

Reflect the reimbursement of the amount of loss by the counterparty using the following entry:

Debit 62 (76) subaccount “Calculations for claims” Credit 91-1 - income is reflected in the amount of the reimbursable loss.

How much will you have to pay to participate in auctions under 44-FZ?

This is the maximum that ETPs cannot exceed. But operators have the right to set a lower price at their own discretion. Moreover, if the site first set a maximum fee and then introduced a lower one, it has the right to do this “retroactively.”

The resolution in question deals with charging a fee from the winner of the purchase. Moreover, only the supplier who initially won the competition, auction or other procedure will pay for ETP services. The fee will be charged to him even if he did not enter into a government contract, that is, he evaded signing it. But the participant with whom the contract was ultimately concluded will not pay the site in this case.

The company is a competitor at the auction: accounting and taxes

In order to correctly reflect transactions related to participation in tenders for a competing company, it is necessary to clearly differentiate all arising payments and obligations. After all, they have a different nature and, accordingly, should be reflected differently.

Most often, companies become bidders in the form of a competition or auction if they want to become participants in the placement of orders within the framework of the requirements of the Federal Law of July 21, 2021 N 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for government and municipal needs” with the aim of subsequently concluding a state or municipal contract (with state bodies, management bodies of state extra-budgetary funds, with local governments or with government institutions and other recipients of budgetary funds) or a civil contract with a budgetary institution. In accordance with Law No. 94-FZ, customers do not have the right to charge participants a fee for participation in competitions and auctions, with the exception of fees for providing tender documentation in established cases. In particular, customers do not have any obligations to pay the cost of services for placing orders of a specialized organization, which it provides to a state or municipal customer on a contractual basis (Letter of the Ministry of Economic Development of Russia dated September 15, 2021 N D28-376). However, the customer and the authorized body may establish a requirement to deposit funds as security for an application for participation in a tender or auction, and then such a requirement applies equally to all participants in the placement of the relevant order and is indicated in the tender documentation or in the auction documentation. The participant can independently choose one of the following security methods: - irrevocable bank guarantee issued by a bank or other credit institution; — guarantee agreement; — transfer of funds to the customer as collateral (including in the form of a contribution or deposit). Security is not required to be provided only if the winner of the competition or auction - or the participant with whom the contract is concluded - is a budgetary institution. If the winner of a competition or auction (as well as the “second in line” participant in the event of the winner’s refusal) avoids concluding a contract, the funds contributed by him as security for the application for participation in the competition are not returned. In other cases, for example, if the customer refused to hold a competition or auction, if the application was received late (after the end of their acceptance), if the participant was not allowed to participate in the competition or auction or did not become a winner, the security amount must be returned to him. Refunds are also made after concluding a contract with the winning participant (or, if he refused, with the participant who was assigned the second number following the results of the competition or who made the penultimate offer on the contract price at the auction).

Accounting records in a budgetary (autonomous) institution

The transfer by a budgetary (autonomous) institution of funds to secure an application to a special bank account and their blocking can be reflected as follows:

- Debit 0 201 26 510 (increase 17, KOSGU 510) Credit 0 201 11 610 (increase 18, KOSGU 610) - funds were transferred to secure the application to a special bank account;

- Debit 0 210 05 560 Credit 0 201 26 610 (increase 18, KOSGU 610) - the blocking of collateral funds in a special bank account is reflected;

- Debit 0 201 26 510 (increase 17, KOSGU 510) Credit 0 210 05 660 - the removal of the blocking of collateral funds in a special bank account is reflected;

- Debit 0 201 11 510 (increase 17, KOSGU 510) Credit 0 201 26 610 (increase 18, KOSGU 610) - reflects the return of collateral from a special account in the bank.

Bidding: costs of participation in them

Even if there is one seller and one buyer, during bargaining there is a kind of competition between them to establish a favorable price or other conditions for the sale of goods. Moreover, as noted above, the obligation to conduct public auctions in certain cases is provided for by law (for example, #M12291 901941785 Federal Law of July 21, 2021 N 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs " #S ).

But the fact is that the List of expenses taken into account when determining the tax base by taxpayers applying the simplified tax system and choosing income reduced by the amount of expenses as an object of taxation is established #M12293 0 901765862 0 0 0 0 0 0 0 398263088 clause 1 of Art. 346.16 Tax Code of the Russian Federation #S.

Accounting entries for writing off funds for remuneration of the operator of the electronic platform

When holding tenders and closed auctions, the application security for participation in the procurement can be transferred to a special account of the customer, according to the details specified in the notice. In this case, the funds transferred as security for the application are reflected in accounting on account 76 “Settlements with other debtors and creditors” as part of accounts receivable until they are returned to the settlement account of the procurement participant.

- 1% of NMCC, but not more than 5,000 rubles excluding value added tax, when making regular purchases.

- 1% of the NMCC, but not more than 2021 rubles, if the purchase is carried out among small and medium-sized businesses.

Auction or competition

Purchase and sale agreements, contract agreements, provision of services, lease agreements can be concluded at the auction. 1 tbsp. 447 of the Civil Code of the Russian Federation. Anyone can become an auction organizer.

If you decide to do this, first decide what exactly you will hold: a competition or an auction. 4 tbsp. 447 Civil Code of the Russian Federation.

The auction will be won by the one who offers the highest price, the competition is won by the one who offers the most favorable conditions. 4 tbsp. 447 Civil Code of the Russian Federation. But if you decide to hold a competition, then you will also need to appoint a competition committee - from among your employees or with the involvement of outsiders.

If you are holding an auction, in the announcement of the auction you must indicate the starting price; if there is a competition, the maximum price.

The auction participant must be prepared to raise the price, and the competition participant must develop some special project, for which it may be necessary to attract new workers and purchase additional materials.

All bidders must first pay the deposit specified in the notice of bidding, which will be returned. 4 tbsp. 448 Civil Code of the Russian Federation:

- to everyone if the auction did not take place;

- to the losing participants.

Let's see how all this affects taxes.