Most business entities must submit various reports on their activities to the statistical authorities every year; this obligation is established by Law No. 282-FZ and Resolution No. 620. In accordance with Art. 6 of the Law, there are 2 types of statistical observation: continuous and selective. The first applies to all organizations and individual entrepreneurs, the second is carried out in relation to individual entities. Failure to submit statistical reporting or its untimely submission entails penalties for organizations and officials.

Currently, more than 200 different statistical forms have been approved, but there is not a single regulatory document that would define the list of mandatory reports for certain enterprises.

Therefore, it is not easy for organizations to figure out what information needs to be submitted and when, and the consequences of failing to submit reports. Information about the rules for submitting statistical forms will help you complete them properly and avoid serious fines.

Where can I see the obligation to submit statistical reporting?

Selective statistical observations are carried out by Rosstat of the Russian Federation in the form (clause 1 of the rules for conducting selective statistical observations of the activities of small and medium-sized businesses, approved by Decree of the Government of the Russian Federation of February 16, 2008 No. 79, hereinafter referred to as Rules No. 79):

- monthly and (or) quarterly surveys of small and medium-sized enterprises (except for micro-enterprises);

- annual surveys of micro-enterprise activities.

And if sample observation is carried out, then only those small enterprises that are included in the sampling percentage of Rosstat of the Russian Federation should submit statistical reports (clause 2 of Rules No. 79).

ADVANTAGES OF ACCOUNTING OUTSOURCING

Important!

Lists of companies or individual entrepreneurs that must submit a particular statistical report are posted on regional statistics websites in the section: “Reporting” - “Statistical reporting” - “Lists of reporting business entities”.

Statistical information must be provided to statistics according to approved forms of federal statistical observation on paper (at the location of the respondent) or electronically in the established format using an electronic signature, no later than the submission deadlines indicated on the forms.

REPORTING TO STATISTICS: WHOM AND WHEN TO REPORT (PART 1)

REPORTING TO STATISTICS: TO WHOM AND WHEN TO REPRESENT (PART 2)

What's happened?

The Federal Statistics Service of Russia (Rosstat) reminded all business representatives (organizations and individual entrepreneurs) that in accordance with clause 4 of the Regulations on the conditions for mandatory provision of primary statistical data and administrative data to subjects of official statistical accounting, approved by Decree of the Government of the Russian Federation dated 18 August 2008 No. 620, all of them are respondents to statistical reporting (Rosstat letter dated March 19, 2021 No. 04-04-4/42-SMI, Rosstat letter dated March 15, 2021 No. 04-04-4/40- Media).Those who are late with reports or ignore the obligation to provide them face large administrative fines.

Amount of fines

Punishment for failure to provide primary statistical data or provision of unreliable statistical information is an administrative offense and entails the imposition of an administrative fine under Art. 13.19 Code of Administrative Offenses of the Russian Federation.

EXPRESS AUDIT OF ACCOUNTING STATEMENTS

Important!

Thanks to the Federal Law of December 30, 2015 No. 442-FZ “On Amendments to Article 13.19 of the Administrative Code”, which came into force on December 30, 2015, the liability of companies and individual entrepreneurs for failure to submit (late submission) of statistical information has been tightened.

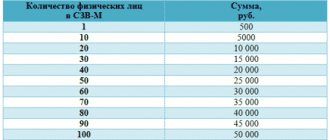

Failure to provide primary statistical data in the prescribed manner or untimely provision of this data will entail fines:

- for officials in the amount of 10 thousand to 20 thousand rubles;

- for legal entities - from 20 thousand to 70 thousand rubles.

Repeated violation is punishable by large fines:

- for officials in the amount of 30 thousand to 50 thousand rubles,

- for legal entities – from 100 thousand to 150 thousand rubles.

Repeated administrative offense means that a company or individual entrepreneur has not previously submitted (or submitted in violation of the established deadline) statistical reporting forms, regardless of its type. That is, we are not talking about cases of failure to submit (or submission in violation of the deadline) of a specific form of statistical reporting (for example, form P-5 (m) “Basic information about the activities of the organization,” approved by order of the State Statistics Committee of the Russian Federation dated August 11, 2016 No. 414 ). An increased fine is applied in the event of repeated failure to submit (or submission in violation of the deadline) any form of statistical reporting.

However, payment of penalties does not negate the need to provide appropriate statistical reporting forms.

ORGANIZATION OF ACCOUNTING IN THE ENTERPRISE

Let us remind you that statistical reporting can be transmitted:

- on paper directly to the territorial statistical office or sent by mail (by registered mail with a list of attachments);

- in electronic form using a specialized electronic reporting operator or on the website of Rosstat of the Russian Federation.

In addition, in accordance with Article 3 of the Law of the Russian Federation dated May 13, 1992 No. 2761-1 “On liability for violation of the procedure for submitting state statistical reporting,” a company or individual entrepreneur that provided reporting in violation of deadlines or inaccurate data, at the request of state authorities statistics compensates for damages incurred due to the need to correct the summary results for these reports.

In practice, this rule does not work, since there are no clear criteria for calculating the damage caused by the respondent.

Obligation to submit reports to statistics

Organizations and individual entrepreneurs are required to send primary statistical data to statistical bodies using approved federal statistical surveillance forms in accordance with the instructions for filling them out at the addresses, within the time limits and with the frequency indicated on the forms of these forms. Some reports are mandatory for everyone, such as the balance sheet and income statement for legal entities. In some forms, selective statistical observation is carried out.

Organizations and individual entrepreneurs can find out what reports must be submitted to Rosstat, including by using a special service on the website on the Internet. If a report needs to be submitted, it must be done on time. Rosstat specialists reminded that the deadlines for submitting statistical reports are set based on the timing of the formation of official statistical information by Rosstat and the time required for data processing.

Reports submitted by the respondent after the established deadline cannot be included in the development of official statistical information due to existing technological limitations. Therefore, if an organization or individual entrepreneur is late in submitting a report, for Rosstat authorities this actually means its failure. Thus, Rosstat authorities have every right to refuse to accept a respondent’s report submitted late. In this case, the organization or individual entrepreneur must bear responsibility.

Challenging fines

When challenging a “statistical” fine, the company must have evidence that all measures within its power to provide statistical reporting have been taken.

Thus, checking the company’s argument that the reporting in Form No. 2-C on paper was sent by registered mail, the courts pointed out that the postal receipt for payment of the corresponding postal item (which contains the unique postal identifier assigned to the postal item, allowing you to track the receipt and delivery of this postal item) the company does not have.

The courts also found that the company had the opportunity to comply with the rules and regulations of the current legislation, but no objective evidence was provided that the company took all measures within its power to comply with the rules and regulations for any independent reasons. This fact indicates the presence of guilt in the actions of the company. In such situations, the courts do not satisfy the company’s demands to cancel the decision to prosecute under Article 19.7.3 of the Code of Administrative Offenses of the Russian Federation for violating the deadline for submitting annual statistical reports (Resolution of the Moscow District AS dated July 13, 2015 No. A40-190349/14).

Basic information ↑

Let's figure out why reporting is submitted to statistical authorities. It is also worth finding out which forms should be provided to representatives of the authorized body.

What do you need to know?

Statistical reporting is documents that are required to be provided by individual entrepreneurs and companies with legal entity status that conduct business activities in Russia.

Such reports differ from those submitted to the tax authority and to the country's extra-budgetary funds. The company must provide to Rosstrat:

- accounting reporting forms;

- statistical reports.

In general, enterprises use about 300 forms of statistical reports. Thanks to this choice, the company can select individual forms that it will use constantly.

When choosing, pay attention to the type of activity and scale of production. All companies, without exception, are obliged to submit reports to Rosstat.

Everyone reports, but at different times and submits different forms. Companies classified as small and medium-sized submit reports using a simplified procedure.

For example, every month and every quarter only those enterprises that are included in the sample will report. We will describe the basic requirements for submitting documentation established by legislative provisions.

| All accounting reports are submitted once a year | But no later than March of the following year after the reporting period |

| If the deadline for submitting documents | Weekend or holiday, reports can be submitted on the next business day |

| Deadline for submitting all forms | Is April 1st |

There are 3 ways to submit reports:

- personally conveyed by representatives of the authorized body;

- by sending it by mail;

- by sending via a communication channel (in this case, you should take care of obtaining an electronic digital signature).

The rules for submitting mandatory forms were approved by Rosstat Order No. 220 dated March 31, 2021.

So, you have 2 options for reporting - on paper or electronic media. The choice is yours, because the legislation regarding this requirement was not established.

The enterprise sends statistical data in established forms free of charge after receiving a written request for their submission (Part 2 of Article 6, 8 of the Federal Law, which was adopted by Russian officials on November 29, 2007 No. 282).

Many new entrepreneurs cannot immediately figure out how to correctly fill out a statistical report, and there are not many recommendations in the legislation of the Russian Federation. This is why businessmen often act at random.

Reports to Rosstat must be submitted by:

- every state authority, local government body;

- a legal entity that operates within the Russian Federation;

- representative office of Russia, which is located outside the state (No. 224-FZ);

- a branch of a foreign enterprise that has business within the Russian Federation;

- individual entrepreneur.

Companies that operate under a simplified tax system are required to submit reports on the same basis as other enterprises.

Documents required by the statistical committee:

- information on the company's balance sheet;

- reporting on the financial performance of the company;

- applications that supplement the accounting - information about what changes in equity capital have occurred, information about the flow of material assets, etc.

For what purpose is it being given up?

To understand why reporting is submitted, let’s consider what the essence of Rosstat’s work is. What kind of service is this?

It was created so that it is possible to generate official statistics in various sectors of life.

How to fill out a report to Rosstat for individual entrepreneurs, see the article: sample report to Rosstat for individual entrepreneurs. How to send a report to statistics electronically, read here.

This is an executive body that has the authority to control statistical activities in the Russian Federation.

The main task of Rosstat is to satisfy the information needs of the government and various companies - the media, commercial enterprises, and scientific societies.

And for this purpose, the service collects reliable and objective information about politics, the social sphere, the demographic situation, and the economy.

Main functions:

- collect statistical information and generate reports based on it;

- develop methods of maintaining statistical records in accordance with international standards;

- provide data to the President and authorities of Russia, citizens of the Russian Federation, the media and other companies;

- create and develop a statistical information system, which should be combined with other systems;

- store statistical data;

- monitor whether citizens and companies comply with laws regarding government statistics.

One of Rosstat’s obligations is to keep records of the activities of entrepreneurs and legal entities and compile statistical codes, which are reflected when registering a company.

And such codes will help the tax service monitor the work of enterprises. They are also needed when opening accounts at a banking institution.

Legal regulation

The need to maintain statistical documents is stated in Federal Law No. 282, which was adopted by the government of the Russian Federation on November 29, 2007.

The procedure for maintaining such documentation and its submission is discussed in Government Resolution No. 620. It is also worth relying on the Law on Accounting.

Statute of limitations

A decision in a case of an administrative offense, by virtue of Article 4.5 of the Code of Administrative Offenses of the Russian Federation, cannot be made after two months (in a case of an administrative offense considered by a judge - after three months) from the date the administrative offense was committed. In practice, this means that the territorial bodies of Rosstat of the Russian Federation will be able to bring companies or individual entrepreneurs to administrative liability under Article 13.19 of the Code of Administrative Offenses of the Russian Federation within 2 months from the expiration of the deadline for submitting statistical reports.

AUDIT'S REPORT ON STATISTICS

Who should report and how?

Clause 2 art. 6 of Law No. 282-FZ defines categories of business entities for which statistical observation is mandatory. These include:

- organizations and enterprises;

- bodies of state power and local self-government;

- representative offices of foreign companies;

- individual entrepreneurs.

A simplified reporting procedure is provided for representatives of small businesses. Continuous observations of their activities by statistical bodies are carried out once every 5 years. Sample observations are carried out quarterly for small enterprises and annually for micro-enterprises. Responsibility for violation of standards for storing archival documents

They provide statistical data using special forms approved by Rosstat. The due date and reporting period are indicated on the title page; there are annual, quarterly and monthly reports. They can be submitted on paper or electronically. Statistical forms and instructions for filling them out must be presented on the official website of Rosstat, and upon request of organizations they must be provided free of charge.

If the last reporting date falls on a weekend or holiday, the deadline is moved to the first working day after the weekend. Depending on the option for submitting reports, the date of their submission is considered to be the date:

- transfer of forms to the statistics body;

- sending a registered letter;

- directions of the email.

Clause 6 of Resolution No. 620 recommends that heads of organizations appoint responsible persons who will monitor the timely provision and correct execution of statistical forms.

It should be noted that responsibility comes not only for failure to submit statistical reports, but also for inaccurate information in it. Arithmetic or logical errors, as well as incorrectly completed forms, are considered invalid data. Instructions for their execution are contained in the orders by which they were approved.

If errors are discovered by a statistical agency, it is obliged to notify the organization that provided the data in writing within three days. He, in turn, provides the corrected forms within 3 days after receiving the notification.

The same should be done if unreliable data is identified independently. You should not neglect correcting errors, as this will lead to a serious fine.

Deadline for submitting P-4

The timing and periods for submitting P-4 are related to the company’s average headcount and annual turnover for the previous 2 years. At the same time, the calculation of the average number includes both the main personnel and part-time workers and employees with whom GPC agreements have been drawn up.

According to these conditions:

- P-4 is submitted every month no later than the 15th day of the month following the reporting month, if the average number of personnel is more than 15 people. and annual turnover is more than 800 million rubles;

- P-4 is submitted every quarter no later than the 15th day of the month following the reporting quarter, if the average number of personnel is no more than 15 people. and annual turnover no more than 800 million rubles.

An exception to this rule are companies with a mining license, as well as those organizations that were created or reorganized in 2021 or 2021. These entities are required to submit P-4 every month no later than the 15th day of the month following the reporting month. They are not subject to conditions regarding headcount and annual turnover.

Attention! Report P-4 for August 2021 is due by September 15.

Rules for filling out form P-4

When filling out the cover page of Form P-4, you must indicate the name of the company, OKPO and its postal address. In addition, if the legal and actual addresses do not match, you must indicate both.

In the document table:

- all indicators are divided by type of economic activity according to OKVED codes;

- the average number of employees per month is the sum of the payroll number of personnel for each calendar day of the month, divided by the number of these days;

- the average number of employees for a quarter is the sum of the average number of employees for each month in the reporting quarter, divided by 3;

- payroll number - the number of all employees according to the working time sheet. Some categories of employees are excluded from this indicator in accordance with clause 78 of Rosstat Order No. 711 dated November 27, 2019, for example, employees undergoing off-the-job training, etc.;

- in gr. 5 and 6 indicate the man-hours worked since the beginning of the year. At this time, all hours actually worked are included, even, for example, overtime. The columns do not include periods of temporary disability, vacations, etc.;

- in gr. 7-10 indicates the accrued wage fund;

- in gr. 11 reflects social payments.

Important! When filling out P-4, you need to take into account that the report is generated even if the employer did not accrue wages or make other payments during the reporting period.

Responsibility for failure to provide

Read: How to submit a petition to the tax office to reduce the fine?

According to Art. 13.19 of the Code of Administrative Offenses applies penalties to organizations and individual entrepreneurs that have not submitted statistical reports, violated deadlines, or provided false information. The amount of the penalty is:

- from 10 to 20 thousand rubles in relation to officials;

- from 20 to 70 thousand rubles for organizations.

If the offense is repeated, the fine will increase:

- from 30 to 50 thousand rubles will have to be paid to the official;

- from 100 to 150 thousand rubles will be collected from the organization.

Important! Penalties apply for each reporting form!

A subject is considered guilty of an offense if it is revealed that he had the opportunity to comply with legal norms, but did not take all measures within his power to comply with them on the basis of Part 2 of Art. 2.1.Administrative Code.

They can be brought to justice within 2 months after the deadline for submitting statistical forms in accordance with clause 1 of Art. 4.5 Code of Administrative Offences. A repeated offense is considered if the subject already has an administrative punishment under this article and a year has not yet elapsed from the date of its appointment.

Moreover, it does not matter which form the subject failed again: the same one or another. The increased fine will apply to the fact of failure to submit a report.

In addition, organizations, enterprises and institutions, on the basis of Law No. 2761-1, when providing distorted information or violating the deadlines for submitting reports, are obliged to compensate the statistical authorities for damage that arises in connection with the need to adjust the summary data.

Since the fines for violating legal requirements for the provision of statistical reporting are significant, business entities need to take this responsibility responsibly.

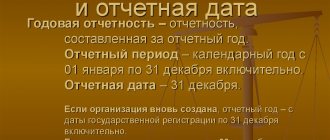

In addition to submitting financial statements to the Federal Tax Service, all companies, including those using special tax regimes, are also required to submit them to the territorial offices of Rosstat. This obligation is enshrined in clause 1 of Art. 18 of Law No. 402-FZ “On Accounting”. This should be done no later than March 31 of the year following the end of the reporting year. Exceptions include enterprises exempted at the legislative level from accounting, as well as public sector organizations and the Central Bank of Russia. The law provides for liability for failure to submit financial statements to statistics.

To whom and how do companies report?

The Federal State Statistics Service accepts two types of reporting from companies - accounting and statistical. If everything is clear with the timing of the first, then the statistics make even experienced accountants think, because:

- each type of enterprise must submit its own set of documents;

- it is difficult to keep track of what kind of research Rosstat is conducting (global or selective);

- larger companies must provide a fairly large package of documents.

Small enterprises have a much easier time submitting statistical reports, since they follow a simplified procedure and submit documents only if they are included in the sample.

In addition to statistics, if your company is subject to audit, you must also submit an audit report, which is carried out by independent services. Such checks are carried out if:

- the company's revenue exceeds 400 million rubles;

- the amount of assets at the end of the year exceeds 60 million rubles;

- the enterprise has the legal form of a joint stock company.

If we talk about limited liability companies, failure to submit an audit report to statistics is equivalent to an accounting violation.