Free legal consultation by phone: 8 The process of applying for sick leave includes a large

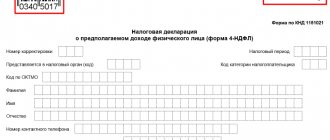

Form 4-NDFL is submitted by individual taxpayers receiving income from business activities or private practice

Information on income tax is reflected by tax agents in 2-NDFL certificates and 6-NDFL calculations. These

Accounting statements of small businesses - what applies to them? The composition of this reporting is for

Employers must withhold personal income tax (PIT) from their employees' paychecks. That's why,

We recommend downloading the 3-NDFL form in 2021 using the links that are given just

Cash documents Cash documents include the following: Receipt order; Withdrawal slip; Journal of registration of papers

Taxes and contributions Natalya Vasilyeva Certified tax consultant Current as of March 9, 2020 Reporting

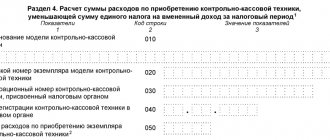

At the end of June, UTII payers submit a declaration and pay tax. However, in 2021

The Federal Tax Service agreed: an entrepreneur using the simplified tax system can take into account expenses when calculating contributions. If an individual entrepreneur uses