Returnable (reusable) packaging is used in circulation many times and must be returned to the supplier if

The legislation defines specific deadlines for providing an employee with disability benefits, its calculation, payment, and withholding.

What needs to be attached to the expense report Is it necessary, in principle, to accompany the expense report with any

A company can make tax advances either quarterly or monthly. The specific order depends on:

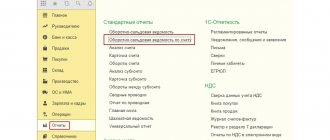

Accounting 2 You can study this section only if you have

More and more organizations and entrepreneurs are working without a cash register. Cashless payments to employees have become commonplace,

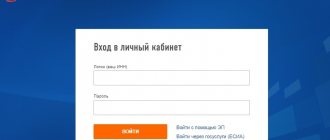

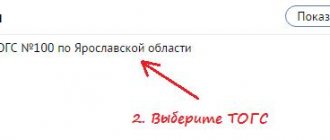

Registration of a taxpayer’s personal account (brief educational program) To submit 3-NDFL via the Internet, the taxpayer must create an account

Employees and you Order of the Federal State Statistics Service No. 387 of 08/04/2016 08/26/2016 Print Rosstat

Accounting The procedure for recording the sale of goods to employees in accounting depends on: the type of property sold (purchased

Which form to use Since 2021, the order of the Social Insurance Fund dated November 17, 2016 No.